- IRS forms

- Form 8038-CP

Form 8038-CP: Credit for Qualified Bonds Allowed to Issuer

Download Form 8038-CPIn the world of finance, bonds play a pivotal role in raising capital for various projects, initiatives, and infrastructure developments. To incentivize the issuance of certain types of bonds that contribute to specific community-oriented projects, the United States government offers tax credits to issuers. Among these credits is the Credit for Qualified Bonds allowed to Issuers, a powerful tool that can significantly reduce an issuer's tax burden.

Form 8038-CP is a tax form used by issuers of certain qualified bonds to claim the credit for the federal subsidy paid to them. When governmental entities issue bonds to finance public projects, such as schools, highways, or infrastructure, the federal government may provide them with a subsidy in the form of a tax credit. This tax credit is designed to reduce the issuer's borrowing costs, making it more attractive for them to raise funds for public initiatives.

In this blog, we will delve into the details of Form 8038-CP, the form used to claim this credit, and explore how it benefits issuers while promoting public welfare.

Purpose of Form 8038-CP

The purpose of Form 8038-CP is to provide the Internal Revenue Service (IRS) with information about bond issues that are subject to a compliance check. It helps ensure that issuers of tax-exempt bonds are in compliance with the relevant tax laws and regulations.

When a state or local government issues tax-exempt bonds, they are subject to various rules and restrictions to maintain their tax-exempt status. The IRS may conduct compliance checks to ensure that the bonds meet the necessary requirements and that the proceeds are used for qualified purposes, such as funding public infrastructure projects like schools, hospitals, highways, etc.

Form 8038-CP is used by issuers to respond to the IRS when they are contacted for a compliance check. The form requests detailed information about the bond issue, including the purposes for which the proceeds were used, the types of bonds issued, the amount of interest paid to bondholders, and other relevant details.

Benefits of Form 8038-CP

Form 8038-CP and the associated tax credit offer significant benefits to issuers of qualified tax credit bonds. Here are a few:

-

Compliance with IRS regulations: Filing Form 8038-CP ensures that issuers of tax-exempt private activity bonds comply with IRS reporting requirements. Meeting these obligations helps avoid potential penalties and interest on underreported or late-filed returns.

-

Accurate record-keeping: The form requires detailed information about the bonds, such as the issue date, maturity date, and use of proceeds. Completing this form facilitates accurate record-keeping for both the issuer and the IRS.

-

Transparency and accountability: Form 8038-CP provides transparency regarding the issuance of tax-exempt private activity bonds. This information is useful for government agencies, investors, and the public to track the use of funds and ensure that the bonds are being utilized for the intended tax-exempt purposes.

-

IRS oversight: By submitting Form 8038-CP, issuers provide the IRS with the necessary data to monitor the issuance of tax-exempt private activity bonds. This oversight helps the IRS ensure compliance with applicable tax laws and regulations.

-

Validating tax-exempt status: Filing Form 8038-CP is necessary to validate the tax-exempt status of the bonds. Failure to file or incomplete filing can jeopardize the tax-exempt status of the bonds and may result in adverse tax consequences for bondholders.

-

Eligibility for certain tax incentives: For certain types of bonds, compliance with IRS filing requirements may be a prerequisite for the bonds to qualify for tax incentives or benefits. Filing Form 8038-CP ensures that the bonds meet the necessary criteria to enjoy these benefits.

Who Is Eligible To File Form 8038-CP?

The form is filed by the qualified issuer of these bonds to claim the tax credits to which they are entitled.

The eligible entities that can file Form 8038-CP include:

State or local governments: This includes cities, counties, states, and other political subdivisions that issued the tax-credit or direct-pay bonds.

Authorized issuers: Entities that have been authorized by the state or local government to issue the bonds on their behalf.

Certain non-profit organizations: In some cases, certain nonprofit organizations may be eligible to issue tax-credit bonds.

Other qualifying entities: Depending on the specific type of tax-credit bond or direct-pay bond, other entities may also be eligible to file Form 8038-CP.

How To Complete Form 8038-CP: A Step-by-Step Guide

This form is typically submitted by issuers of qualified tax credit bonds or direct-pay bonds to claim the credit payments from the federal government. Given below is a step-by-step guide to completing Form 8038-CP:

Step 1: Obtain the form

You can download Form 8038-CP from the official website of the Internal Revenue Service (IRS). Make sure to use the most recent version of the form.

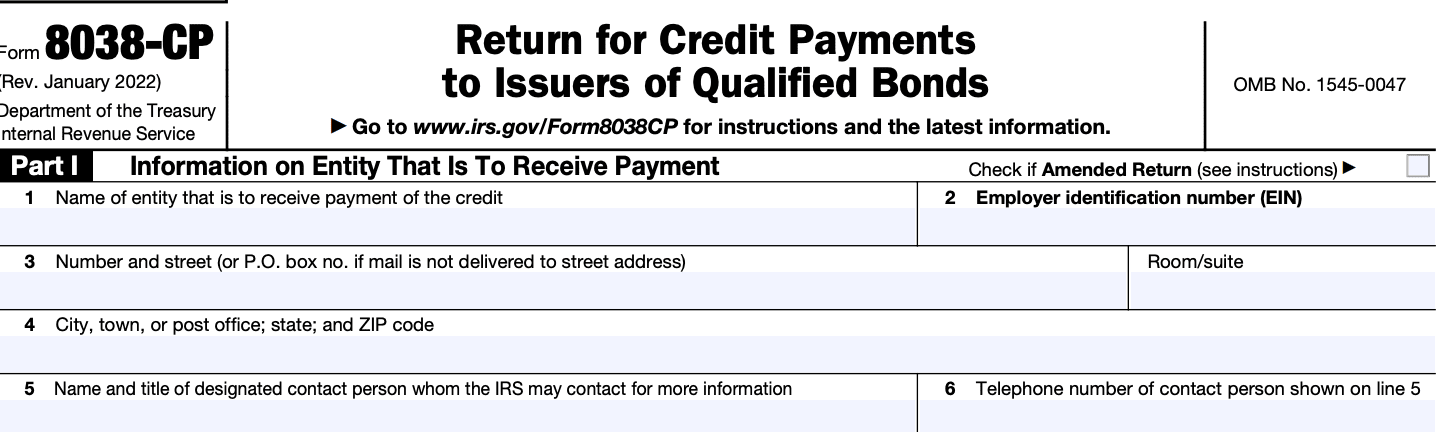

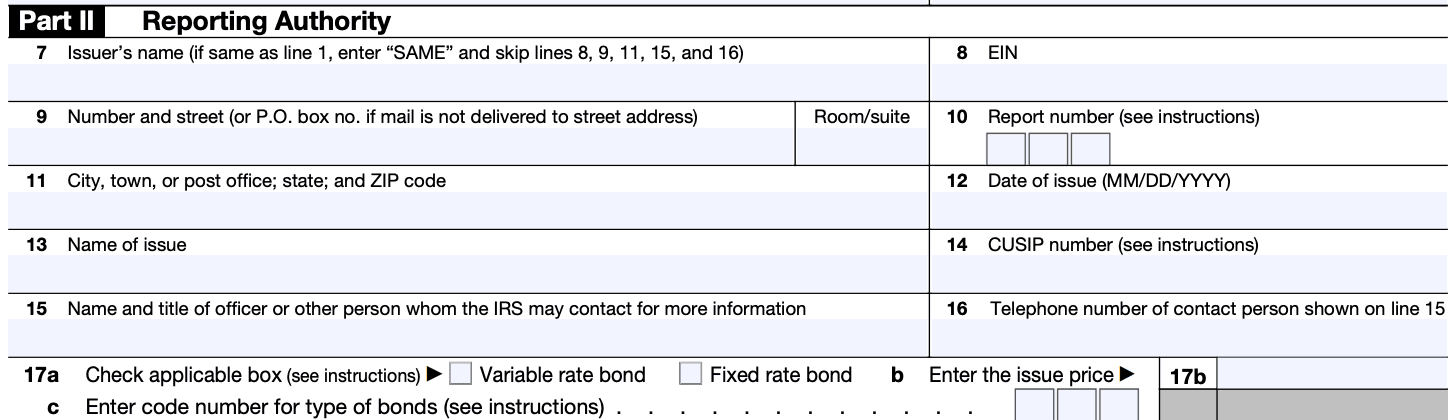

Step 2: Provide general information

At the top of the form, you will find fields where you need to enter basic information, including the name and address of the issuer, employer identification number (EIN), the type of bond, and the credit payment amount being claimed.

Step 3: Complete Part I - Credit payment information

In Part I of Form 8038-CP, you will need to provide detailed information about the qualified tax credit bonds or direct-pay bonds that you issued, including:

- The series and CUSIP number of the bond

- The date the bond was issued

- The total principal amount of the bond

- The credit payment amount for each bond

- The credit payment election can be either "Direct payment to issuer" or "Credit allowed to holders"

Step 4: Complete Part II - Direct payment election

If you chose "Direct payment to issuer" in Part I, you need to complete Part II. In this section, you must provide the information required to receive direct payments from the federal government.

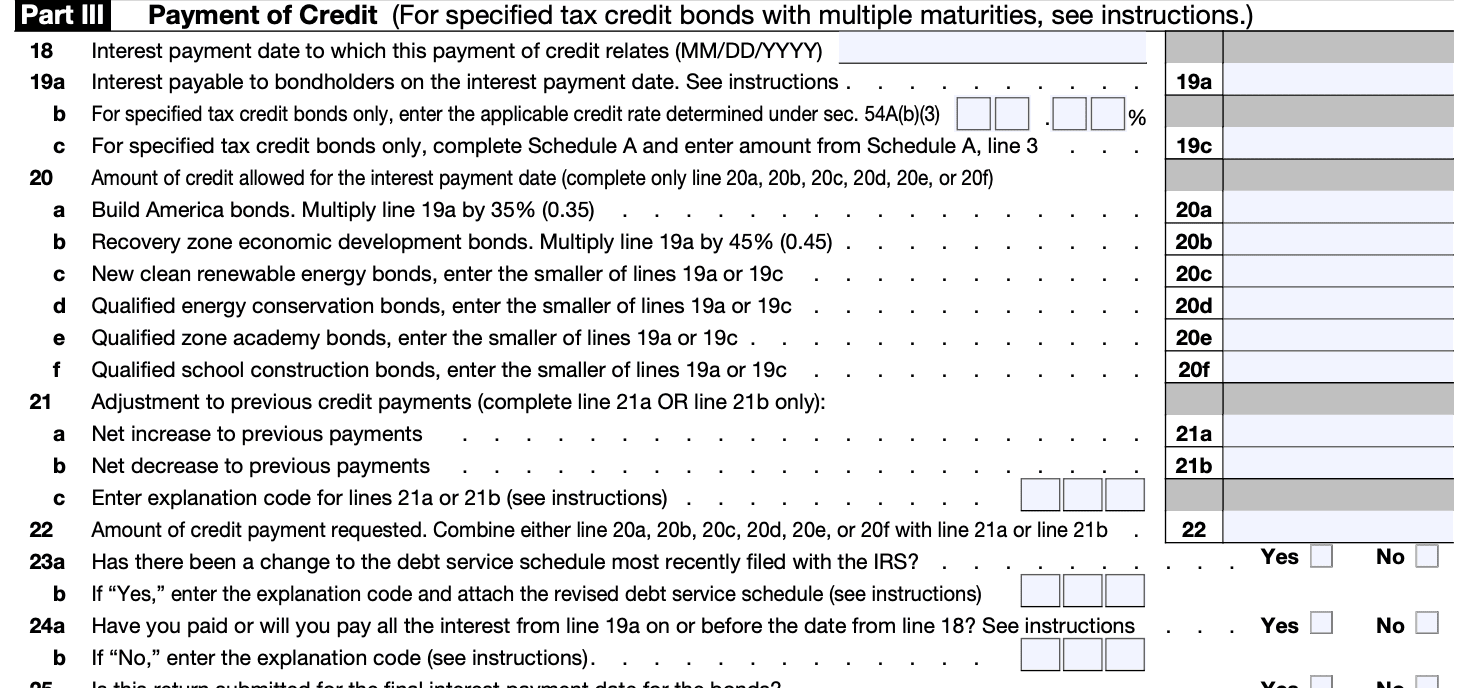

Step 5: Complete Part III - Payment of credit

Enter details of payment of credit for specified tax credit bonds with multiple maturities.

Step 6: Complete Part IV - Claimant information

Part III is used to provide information about the claimant who will receive the credit payment. This could be the issuer or another person authorized to receive the payment on behalf of the issuer.

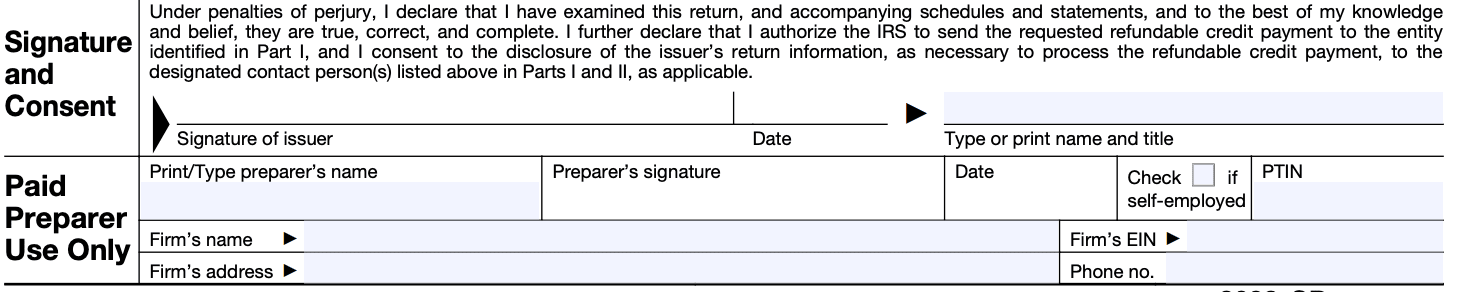

Step 7: Sign and date the form

Ensure that the form is signed and dated by an authorized person from the issuer or the claimant if applicable.

Step 8: Attach required documents

Depending on your specific situation, you may need to attach supporting documents, such as a copy of the issuance document or any other documentation that the IRS requests.

Step 9: Submit the form

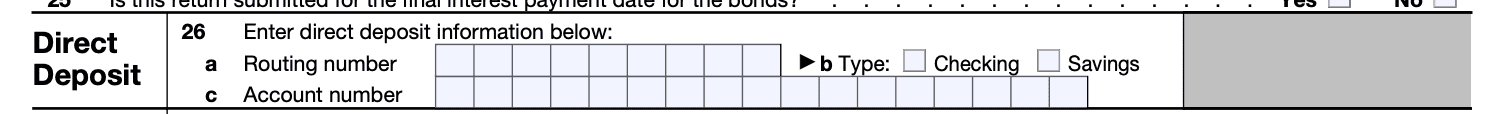

Once the form is completed and all necessary attachments are included, mail the Form 8038-CP to the address specified in the instructions of the form. It is essential to use the correct address to ensure timely processing.

Special Considerations When Filing 8038-CP

When filing Form 8038-CP, there are several special considerations you should keep in mind:

Accurate and timely filing: It is essential to file the Form 8038-CP accurately and on time. Missing the filing deadline or providing incorrect information can result in penalties and interest.

Gather required information: Before starting the filing process, gather all the necessary information, including the issuer's name, address, taxpayer identification number (TIN), and other details related to the bond issuance.

Understand the purpose: Form 8038-CP serves as an informational return for tax credit bonds. The form provides the IRS with essential details about the bond issuance, such as the issue date, issue price, and credit amounts.

Familiarize with the instructions: The IRS provides specific instructions for filling out Form 8038-CP. Make sure to review these instructions carefully to ensure accurate completion of the form.

Electronic filing: In most cases, the IRS requires electronic filing for Form 8038-CP. Check the IRS guidelines for electronic filing requirements and follow the designated procedures.

File separate forms for each issue: If multiple tax credit bond issues exist, file a separate Form 8038-CP for each issue.

**Understand compliance rules: **Qualified tax credit bonds come with specific compliance rules and requirements. Ensure that you are familiar with these regulations to avoid potential issues during the filing process.

Consult a professional: Filing Form 8038-CP can be complex, especially for first-time filers. If you are unsure about any aspect of the filing, consider consulting a tax professional or financial advisor with experience in tax-exempt bond filings.

How To File 8038-CP: Offline/Online/E-filing

As of September 2021, here's how you can file Form 8038-CP:

Offline filing

To file offline, you would need to obtain a physical copy of Form 8038-CP and fill it out manually. You can get the form from the Internal Revenue Service (IRS) by either:

a. Downloading it from the IRS website (www.irs.gov) and printing a hard copy, or

b. Requesting the form by mail by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

Once you've filled out the form, mail it to the appropriate address provided in the instructions for Form 8038-CP.

Online filing

The IRS didn't originally offer a specific online fillable version of Form 8038-CP like they do for some other forms. However, the IRS continuously updates their services and offerings, so it's possible that an online option may have become available.

To find out if online filing is now an option for Form 8038-CP, you should visit the IRS website and search for the most up-to-date information.

E-filing

The IRS supports electronic filing (e-filing) of Form 8038-CP through the FIRE (Filing Information Returns Electronically) System. If you have 250 or more forms to file, you must e-file the returns using the FIRE System. To e-file, you need to:

a. Register with the FIRE System on the IRS website.

b. Obtain the appropriate software or work with a qualified e-file provider that supports Form 8038-CP.

c. Follow the instructions provided by the IRS to submit your e-filed forms.

Common Mistakes To Avoid When Filing Form 8038-CP

When filing this form, it's essential to avoid common mistakes that could lead to delays in processing or potential penalties. Here are some common mistakes to avoid:

Incorrect or missing taxpayer identification number (TIN): Ensure that you provide the correct TIN for the issuer and the recipient of the tax credit or refund. Incorrect TINs can lead to processing errors and delays.

Incomplete or missing information: Double-check that you have filled out all the required fields on Form 8038-CP. Missing information can cause the form to be rejected or sent back for corrections.

Wrong tax period: Make sure you are filing for the correct tax period. If you are unsure, review the applicable tax year and verify the dates before submitting the form.

Calculation errors: Check all calculations on the form, including the amount of the tax credit or refund requested. Errors in calculations can result in incorrect refund amounts or cause the form to be rejected.

Failure to attach required documentation: Form 8038-CP may require additional documentation to support your claim for a tax credit or refund. Be sure to include all necessary attachments as specified in the instructions.

Late filing: Ensure that you file Form 8038-CP by the due date to avoid potential penalties for late filing.

Using outdated or incorrect forms: Always use the most current version of Form 8038-CP available from the IRS website. Using outdated forms may lead to processing delays or rejections.

Inaccurate mailing address: Verify the correct mailing address for submitting Form 8038-CP. Using the wrong address can cause delays in processing your request.

Lack of signature: The form must be signed and dated by an authorized person. Double-check that the signature is included before submitting the form.

Failure to retain copies: Keep a copy of the filed Form 8038-CP and all supporting documentation for your records. This will be essential for future reference or in case of any inquiries from the IRS.

Conclusion

Form 8038-CP plays a significant role in the municipal bond landscape, enabling issuers of qualified bonds to benefit from tax credits and, in turn, reduce borrowing costs and promote public initiatives. By filing this form correctly and on time, state and local governments can maximize the advantages of issuing qualified bonds and make a positive impact on their communities.

As with any tax-related matters, it's essential to stay informed about the latest IRS regulations and seek professional advice to ensure compliance and optimize the benefits of tax credits associated with qualified bonds. Form 8038-CP may be just one piece of the puzzle, but it is a vital tool in facilitating essential public projects and contributing to the betterment of society.