- IRS forms

- Form 720

IRS Tax Form 720: Quarterly Federal Excise Tax Return (Rev. June 2023)

Download Form 720Form 720 is a quarterly tax return filed with the Internal Revenue Service (IRS) to report and pay federal excise taxes. Excise taxes are levied on specific goods, activities, or services and are separate from income taxes. These taxes are often imposed on items such as gasoline, tobacco products, alcohol, firearms, and certain transportation-related services.

In this blog post, we will explore what Form 720 entails, who needs to file it, and provide an overview of the key aspects associated with this tax return.

Purpose of Form 720

The purpose of Tax Form 720 is to provide information about the excise taxes owed by a business for various goods, services, or activities. These excise taxes are often levied on specific goods or services that are considered to be potentially harmful to public health or the environment, or on activities that are subject to special federal regulation.

Some common examples of excise taxes reported on Form 720 include:

- Environmental taxes: These taxes are imposed on activities or products that may have an adverse impact on the environment. Examples include taxes on the sale or use of certain chemicals, petroleum products, or hazardous materials.

- Communications taxes: These taxes are imposed on certain communication services, such as telephone service, local telephone service, and Voice over Internet Protocol (VoIP) services.

- Air transportation taxes: These taxes are imposed on commercial air transportation, including passenger ticket taxes, fuel taxes, and segment fees.

- Fuel taxes: These taxes are imposed on the sale or use of specific fuels, such as gasoline, diesel fuel, and aviation fuel.

- Indoor tanning taxes: This tax is imposed on businesses that provide indoor tanning services.

Form 720 is typically filed quarterly, and businesses are required to report their excise tax liability and remit the taxes owed to the Internal Revenue Service (IRS) accordingly. It is important for businesses to accurately complete and file Form 720 to ensure compliance with federal tax laws and regulations.

Benefits of Form 720

While there are specific requirements and conditions for filing Form 720, it does offer several potential benefits. Here are some of the benefits associated with Form 720:

Compliance with tax obligations: Filing Form 720 ensures compliance with federal tax obligations related to the specific excise taxes it covers. By accurately reporting and paying these taxes, individuals and businesses avoid penalties and potential legal issues.

Avoiding penalties: Failure to file Form 720 or underpayment of excise taxes can result in penalties imposed by the Internal Revenue Service (IRS). By timely filing and paying the appropriate taxes, individuals and businesses can avoid these penalties.

Contribution to public services: The federal excise taxes reported on Form 720 contribute to funding various public services and programs. These taxes are often levied on specific goods, services, or activities, such as the sale of tobacco, firearms, or indoor tanning services. By fulfilling tax obligations through Form 720, individuals and businesses contribute to the functioning of important public services.

Eligibility for tax credits or deductions: In some cases, filing Form 720 may make individuals or businesses eligible for certain tax credits or deductions. These incentives can help reduce overall tax liability. For example, the IRS may offer credits or deductions related to the payment of certain fuel-related taxes.

Streamlined tax management: Form 720 helps consolidate the reporting and payment of various excise taxes into a single form. This simplifies the tax management process for businesses or individuals who engage in activities subject to multiple excise taxes. By using Form 720, taxpayers can streamline their tax reporting and payment procedures.

Demonstrating compliance to stakeholders: In certain industries or situations, such as when applying for licenses or permits, providing evidence of compliance with federal excise tax requirements may be necessary. By filing Form 720, businesses can demonstrate their adherence to tax regulations, which can enhance their credibility with stakeholders.

Who Is Eligible To File Form 720?

The following entities or individuals may be eligible to file Form 720:

- Businesses: Most businesses that engage in activities subject to federal excise taxes are required to file Form 720. This includes manufacturers, importers, producers, and sellers of various goods and services that are subject to excise taxes.

- Manufacturers and producers: If you manufacture or produce goods such as alcohol, tobacco, firearms, or fuel, you may be required to file Form 720 and pay the appropriate excise taxes.

- Importers: If you import goods into the United States that are subject to federal excise taxes, you are generally responsible for filing Form 720 and paying the applicable taxes.

- Retailers and sellers: Certain goods and services, such as indoor tanning services, heavy truck tires, gasoline, and certain chemicals, are subject to excise taxes at the retail level. If you are a retailer or seller of such goods or services, you may need to file Form 720.

- Medical device manufacturers and importers: Medical device manufacturers and importers are required to report and pay the excise tax on certain medical devices by filing Form 720.

It's important to note that the eligibility to file Form 720 may vary based on specific circumstances and the types of goods or services involved.

How To Complete Form 720: A Step-by-Step Guide and Instructions

Here's a general outline of the steps involved in completing Form 720 with detailed instructions:

Step 1: Gather necessary information

Collect all the relevant information and documentation needed to complete IRS Tax Form 720. This may include details about the business, the type of excise taxes being reported, and any applicable exemptions or credits.

Step 2: Obtain the latest version of Form 720

Visit the IRS website and download the most recent version of Form 720 and its instructions. Ensure that you have the correct version to avoid any discrepancies or outdated information.

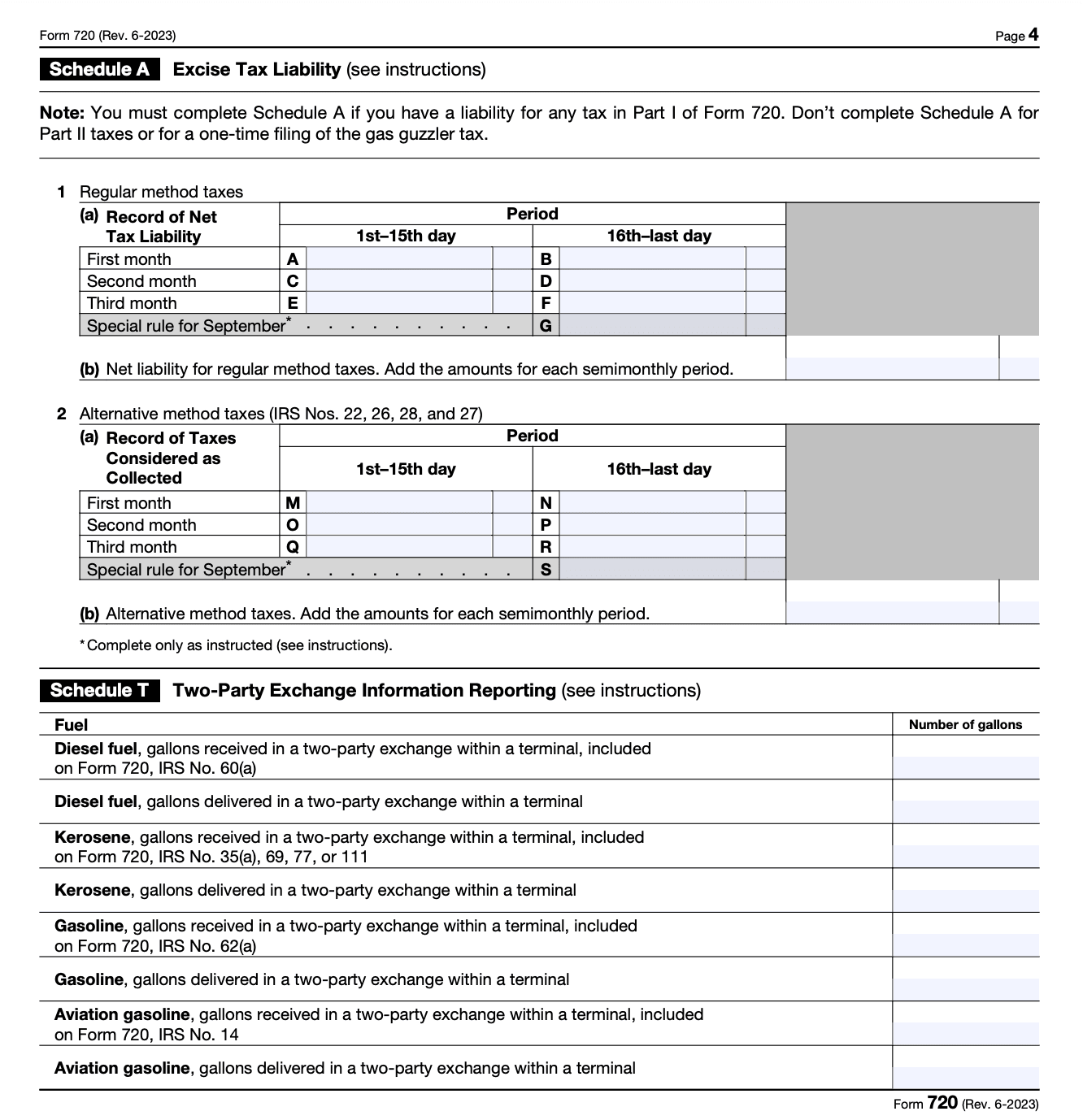

Step 3: Identify the applicable tax schedules

Form 720 consists of several tax schedules that cover different categories of excise taxes. Determine which tax schedules are relevant to your business based on the activities and products/services you engage in. Common tax schedules include Schedule A for environmental taxes, Schedule C for communication taxes, and Schedule T for tobacco taxes, among others.

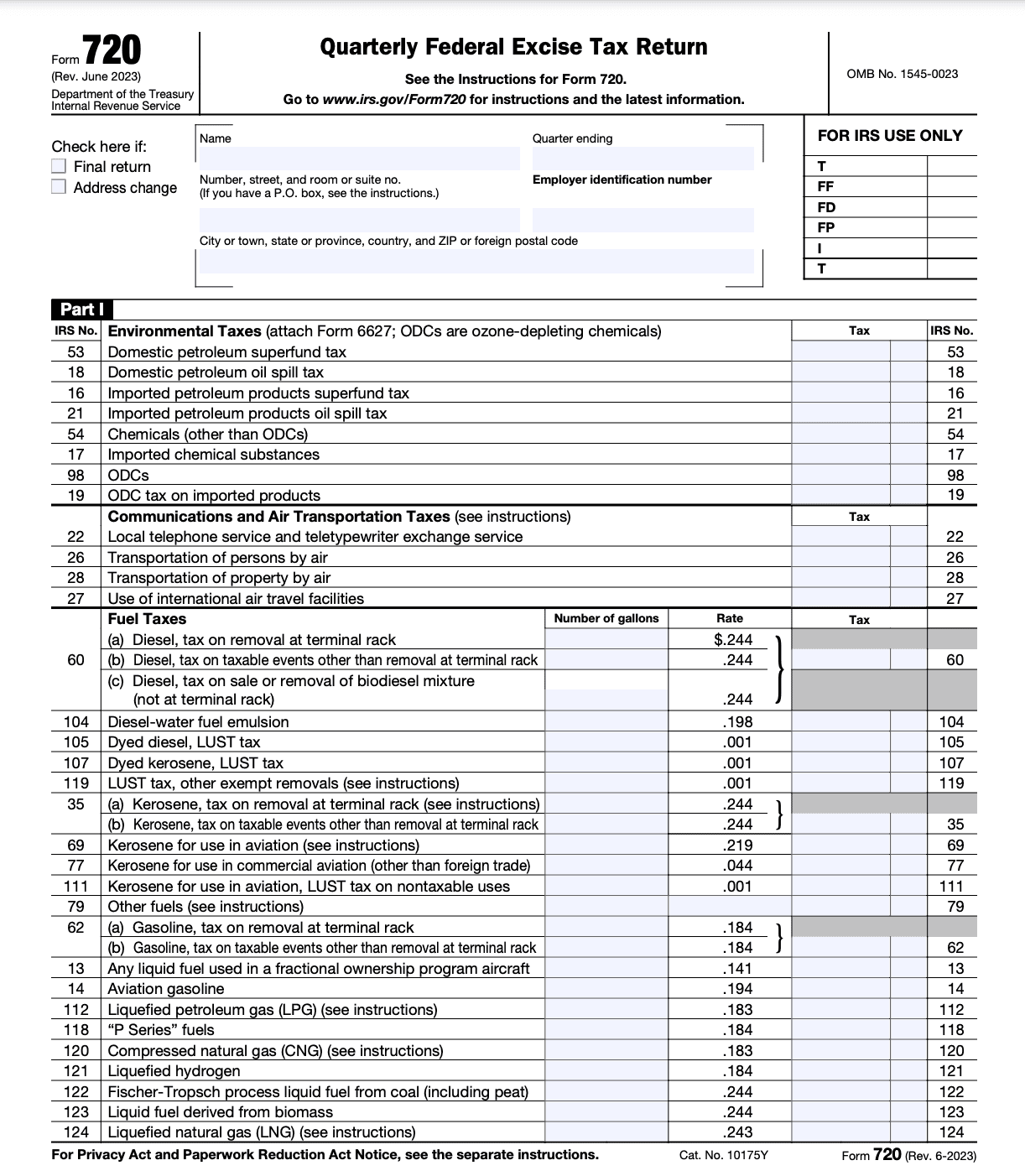

Step 4: Complete the general information section (Part I)

Start by providing basic information about your business, such as the name, address, Employer Identification Number (EIN), and tax period. Make sure to accurately enter all the required details.

(image: form-720-i_i.png)

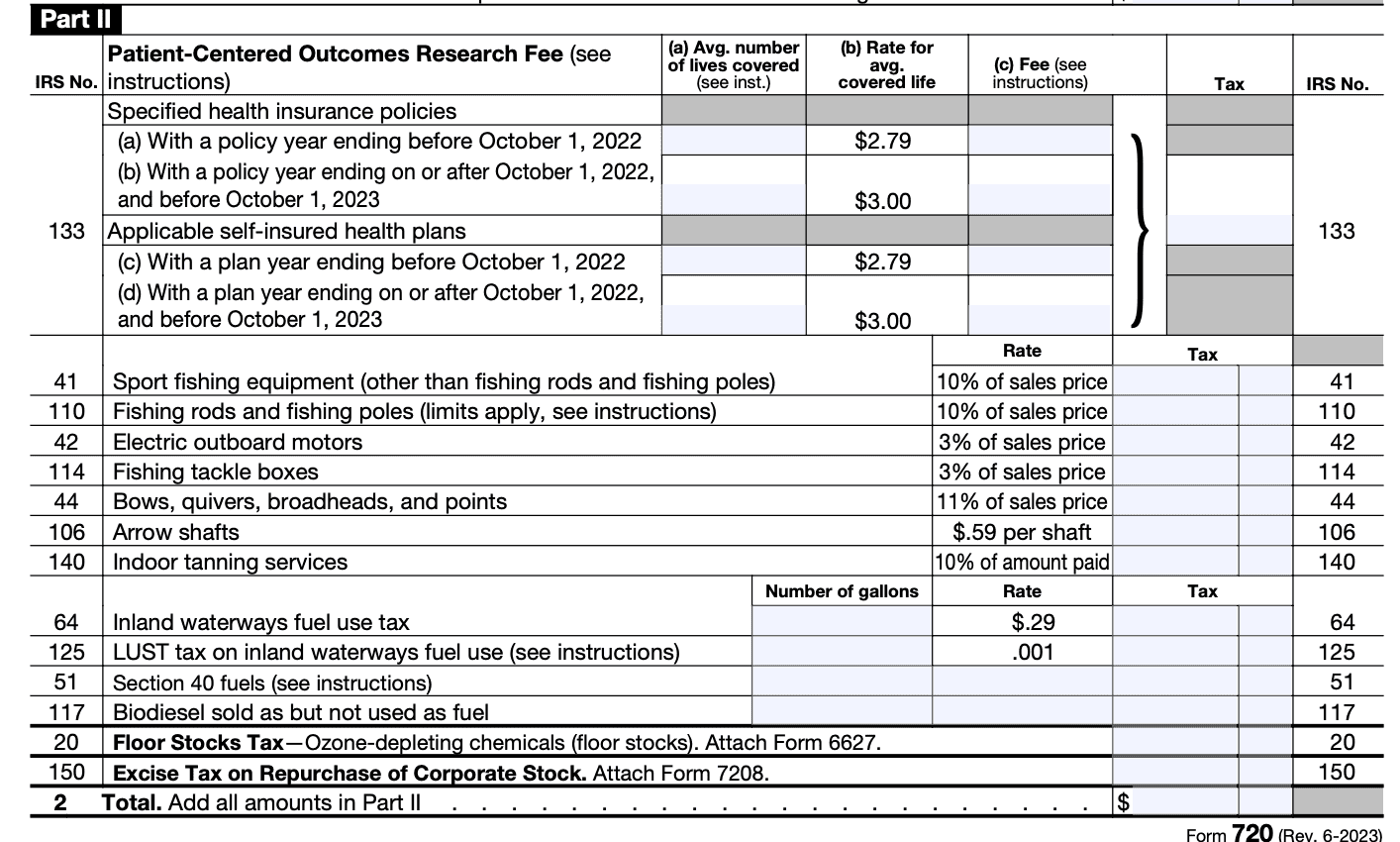

Step 5: Complete the applicable tax schedules (Parts II to VIII)

For each tax schedule applicable to your business, complete the corresponding sections. This typically involves reporting the tax liability for the specific category of excise tax, calculating the owed amount, and providing any necessary supporting information.

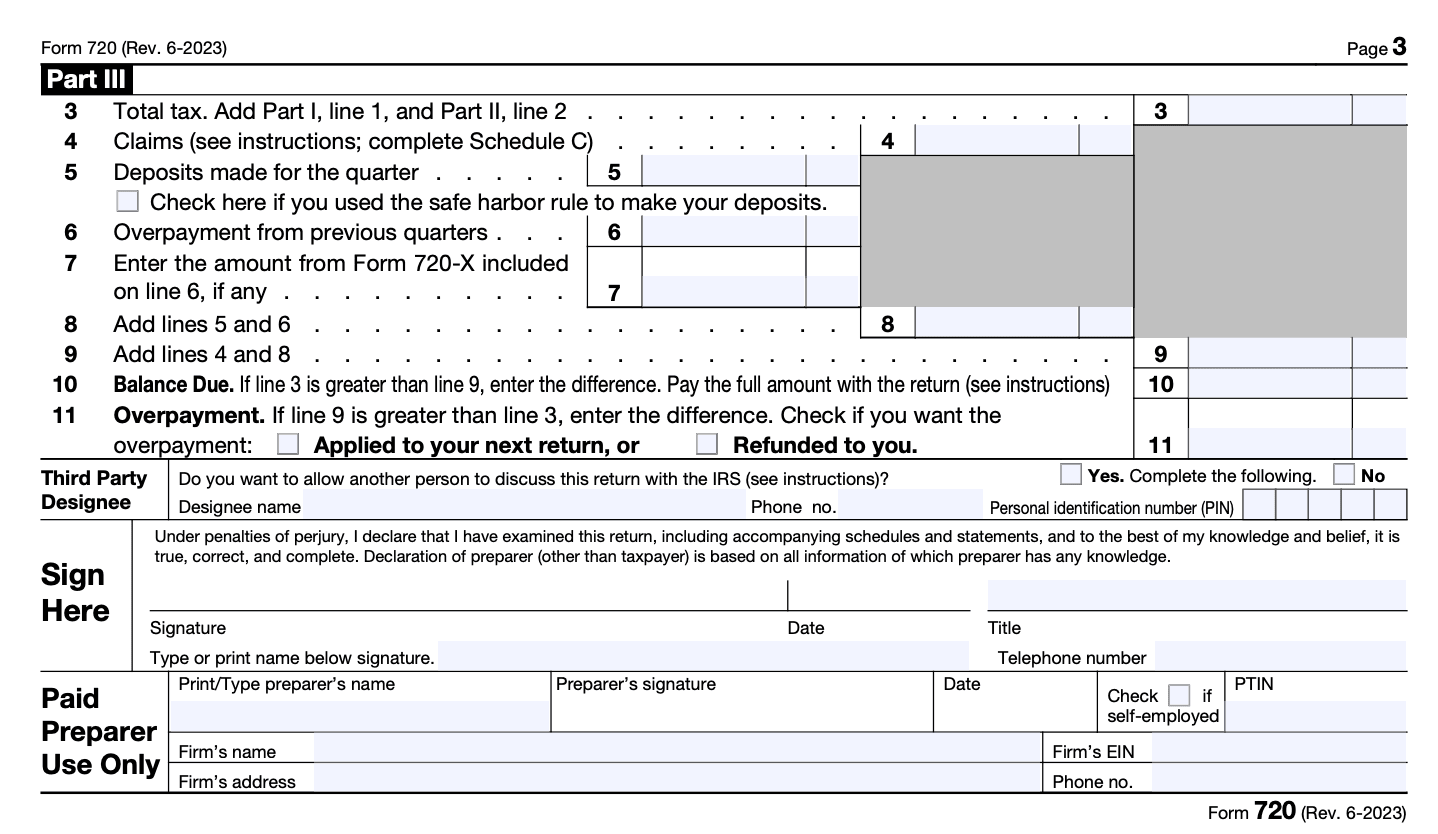

Step 6: Calculate the total tax liability

Once you've completed all the relevant tax schedules, transfer the total tax liability from each schedule to Part I, Line 10. Add up all the amounts to arrive at the total tax liability for Form 720.

Step 7: Complete other sections and check for errors

Review all the information you've entered to ensure accuracy and completeness. Complete any other sections of Form 720 that may apply to your business, such as the Payment Voucher (if making a payment) or Schedule C-1 (if claiming a credit). Double-check for any errors or omissions.

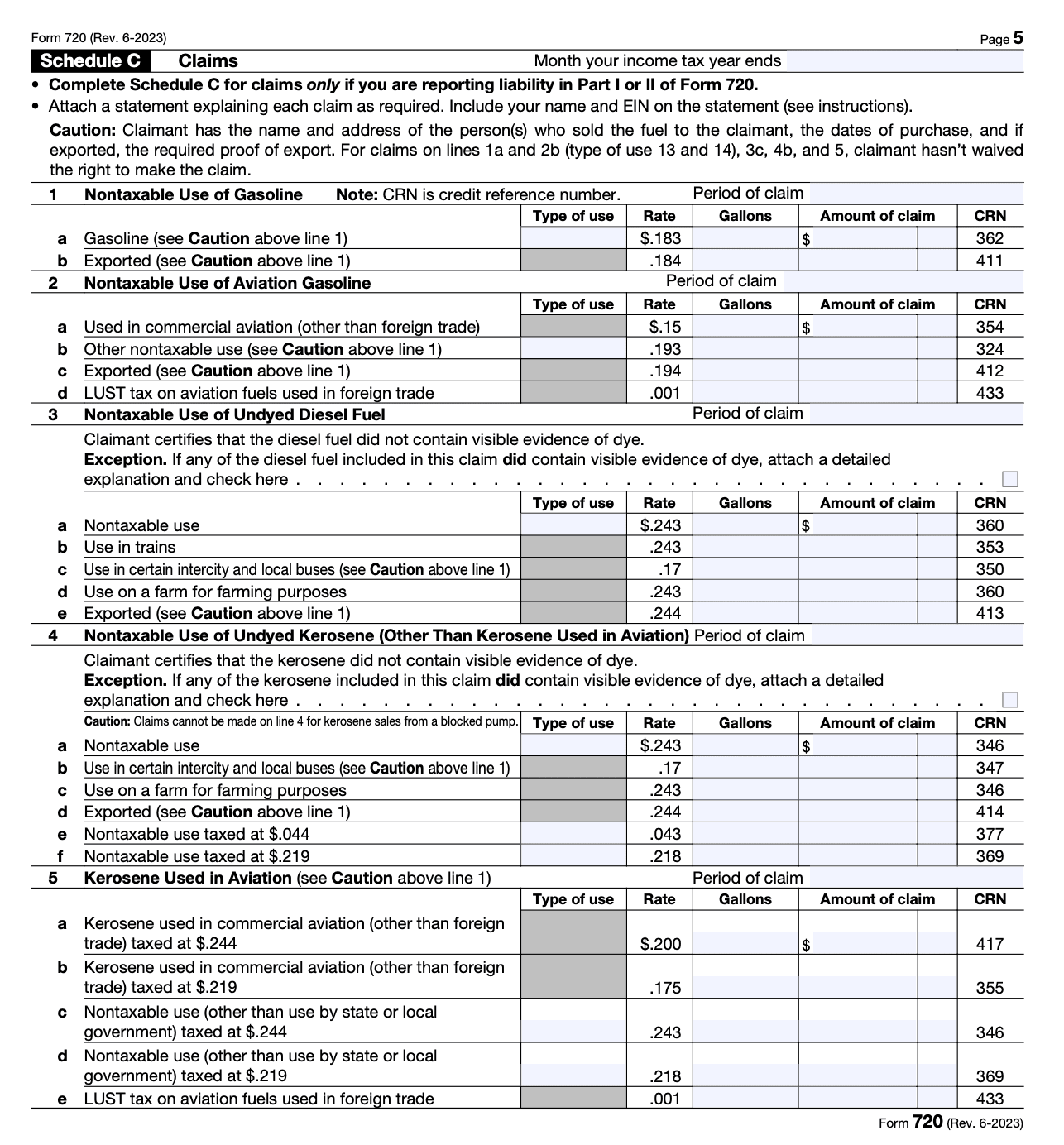

(image: form-720-schedule-c_1.png)

(image: form-720-schedule-c_2.png)

Step 8: Sign and submit Form 720

Sign and date the completed form. Keep a copy for your records and submit the original form to the address provided in the instructions.

Special Considerations When Filing Form 720

When filing Form 720, there are several special considerations you should keep in mind. Here are some important points to consider:

Filing frequency

Form 720 is filed quarterly, and the due dates for each quarter are as follows:

- Quarter 1 (January - March): April 30

- Quarter 2 (April - June): July 31

- Quarter 3 (July - September): October 31

- Quarter 4 (October - December): January 31 of the following year

Electronic filing requirement

If you have an excise tax liability exceeding $2,500 for a quarter, you are generally required to file Form 720 electronically using the IRS e-file system. Electronic filing is also convenient and helps in reducing errors.

Tax payment

When filing Form 720, you are required to pay the excise taxes owed for the quarter being reported. You can make the payment electronically through the Electronic Federal Tax Payment System (EFTPS) or by mail using a payment voucher (Form 720-V).

Line-by-line considerations

Form 720 consists of multiple parts and lines, each representing different types of excise taxes. Ensure that you accurately report the taxes applicable to your business activities in the appropriate sections of the form. Carefully review the instructions provided by the IRS for each line to understand the reporting requirements.

Exemptions and credits

There may be exemptions or credits available for certain activities or situations. Make sure to review the instructions and check whether you qualify for any exemptions or credits that could reduce your tax liability. If applicable, provide the necessary documentation or explanations when filing.

Recordkeeping

It's essential to maintain accurate and organized records related to your excise tax liabilities and activities. Retain supporting documents, such as invoices, receipts, and other relevant records, as they may be required for future reference or in case of an audit.

Penalties for non-compliance

Failure to file Form 720 or pay the required excise taxes on time can result in penalties imposed by the IRS. Make sure to meet the filing and payment deadlines to avoid penalties and any associated interest charges.

Common Mistakes To Avoid While Filing Form 720

When filing Form 720, it's important to be aware of potential mistakes to avoid errors and penalties. Here are some common mistakes to watch out for while filing Form 720:

Incorrect reporting: Ensure that you accurately report the required information for each line item. Double-check the details to avoid any errors, such as transposing numbers or entering incorrect amounts.

Missing or late filing: File your Form 720 on time to avoid penalties. The form is due quarterly, with the deadlines falling on April 30, July 31, October 31, and January 31 of each year. Failure to file or filing late can result in penalties and interest charges.

Incomplete information: Provide all the necessary information on the form. Ensure that you fill out all relevant sections, including your business details, tax period, tax liability calculations, and any supporting schedules or forms required.

Wrong tax rates: Use the correct tax rates for each category of excise tax you are reporting. The rates can vary depending on the type of goods or services involved, so refer to the instructions or consult the relevant IRS publications to ensure accurate calculations.

Failure to reconcile previous payments: If you're filing Form 720 for a subsequent quarter, make sure to reconcile any tax liabilities from previous quarters. Include any carryovers or adjustments to ensure the correct calculation of taxes owed or refunds due.

Failure to report all taxable activities: Be thorough in identifying all taxable activities applicable to your business. Common areas where excise taxes may apply include air transportation, fuel-related activities, indoor tanning services, certain environmental taxes, and more. Review the instructions carefully to ensure you are reporting all relevant activities.

Ignoring changes in tax laws or regulations: Stay updated with any changes in excise tax laws, rates, or reporting requirements. The IRS may issue updates or revisions that can affect how you complete Form 720. Regularly check the IRS website or consult with a tax professional to ensure compliance.

Poor record-keeping: Maintain accurate and organized records to support the information reported on Form 720. Keep copies of filed forms, supporting schedules, and any other relevant documentation for future reference or potential audits.

How To File Form 720: Offline/Online/E-filing

The process of filing Form 720 can be done offline, online, or through e-filing. Here's an overview of each method:

Offline filing

a. Obtain a physical copy of Form 720: You can download the form from the official website of the Internal Revenue Service (IRS) or request a copy by mail.

b. Fill out the form manually: Complete the form by providing the required information, including your personal details, the type of excise tax being reported, and the amount owed.

c. Calculate the tax liability: Use the instructions provided with the form to calculate the amount of excise tax you owe.

d. Prepare supporting documents: Gather any necessary supporting documentation, such as schedules or additional forms, depending on the nature of the excise tax being reported.

e. Mail the form and payment: Once you have completed the form, mail it along with a check or money order for the amount owed to the address specified in the instructions.

Online filing

a. Visit the IRS website: Go to the official IRS website and navigate to the section for e-filing.

b. Choose the e-file option: Select the option for Form 720 and follow the instructions to start the e-filing process.

c. Provide the required information: Enter all the necessary information, including your personal details, tax information, and payment details.

d. Calculate the tax liability: The online system will automatically calculate the amount of excise tax owed based on the information you provide.

e. Submit the form and payment: Once you have reviewed the information and ensured its accuracy, submit the form electronically and pay the amount owed using a credit card or electronic funds withdrawal.

E-filing through a tax professional or software

a. Use tax preparation software: Utilize tax preparation software that supports e-filing of Form 720. These software packages often guide you through the process, ensuring you provide all the necessary information.

b. Work with a tax professional: If you prefer assistance, consult with a tax professional who can help you prepare and e-file Form 720 on your behalf. They will ensure the accuracy of the form and handle the submission process.

Remember to consult the official IRS resources, such as their website and instructions for Form 720, to ensure you have the most up-to-date and accurate information regarding the filing process.

Conclusion

Form 720 serves as a means for businesses to report and pay federal excise taxes on a quarterly basis. Understanding the intricacies of this tax return is crucial for businesses operating in industries subject to excise taxes. Familiarizing yourself with the various schedules and payment requirements will help ensure compliance with IRS regulations.

While this blog post provides a general overview, it's essential to consult with a tax professional or review the latest IRS guidelines for detailed instructions tailored to your specific circumstances. Adhering to your tax obligations and staying up-to-date with changes in tax laws will help your business maintain financial stability and avoid potential penalties.

FAQs About Filing IRS Tax Form 720

What types of taxes are reported on Form 720?

Taxes on environmental products, communications, air transportation, fuel, retail, ship passengers, foreign insurance, and other specified goods and services.

How can I pay the taxes reported on Form 720?

Payments can be made via EFTPS, check, or money order.

What happens if I file Form 720 late?

Late filings may result in penalties and interest. It’s important to file and pay on time to avoid these charges.

Are there any exemptions from excise taxes?

Certain exemptions may apply based on specific criteria outlined by the IRS. Check the instructions for Form 720 for details.

How do I handle adjustments and credits on Form 720?

Report any adjustments or credits in the appropriate section of Part III to calculate your total tax liability for the quarter.

Can I amend a previously filed Form 720?

Yes, you can amend a previously filed Form 720 by filing a new Form 720 with corrected information. Indicate at the top of the form that it is an "Amended Return."

What happens if I overpay my excise tax?

If you overpay your excise tax, you can claim a credit on your next Form 720 or request a refund by filing Form 8849, Claim for Refund of Excise Taxes.

Are there penalties for underpayment of excise taxes?

Yes, the IRS may impose penalties and interest for underpayment of excise taxes. It’s important to accurately calculate and timely pay your taxes to avoid these charges.

Can I file Form 720 if my business is seasonal and I don’t have sales every quarter?

Yes, you must file Form 720 for each quarter even if there were no sales or activities subject to excise tax. You should indicate zero liability if applicable.

Do I need to file Form 720 if I only sell a few items subject to excise tax?

Yes, any business or individual selling items or services subject to federal excise tax must file Form 720, regardless of the volume of sales.

What is the IRS No. column on Form 720?

The IRS No. column lists specific numbers that correspond to different types of excise taxes. Match the appropriate IRS number to the tax you are reporting in Part I.

What if I discover an error after submitting Form 720?

If you discover an error after submitting Form 720, file an amended return with the corrected information and indicate that it is an "Amended Return" at the top of the form.

How does the IRS handle credits for overpayment of excise taxes?

Credits for overpayments can be carried forward to future quarters or refunded by filing Form 8849. Ensure you maintain accurate records to support your claim.

How do environmental taxes differ from other excise taxes on Form 720?

Environmental taxes are imposed on products that have an impact on the environment, such as ozone-depleting chemicals, while other excise taxes may apply to goods and services like fuel or air transportation.

Can non-profit organizations be subject to excise taxes?

Yes, non-profit organizations may be subject to excise taxes if they engage in activities or sell products that fall under the excise tax regulations.