Roth 401(k) vs. 401(k): Choosing the Right Option

The decision between choosing to invest in a Roth 401(k) account and a traditional 401(k) account depends largely on financial objectives, risk tolerance (with respect to potential tax brackets), and individual circumstances. Financial situations and goals are never set in stone. They change and evolve over time. Thus, a periodic reassessment of your choice between a Roth 401(k) and a traditional 401(k) can help you stay on the right track and remain aligned with your retirement strategy.

Planning for retirement begins early on in your career as it must. When you’re at it, choosing between contributing to a Roth 401(k) and a traditional 401(k) is one of the key decisions that you will face. Both these retirement savings vehicles come with their own set of distinct considerations and benefits. Which is best suited for you depends entirely on your financial goals.

Before you make a decision, it’s imperative that you learn all about the nature of these options—the similarities, key differences, nuances, and the criteria that you must take into consideration. This article will help you do exactly that.

What Does “Roth” Mean?

In the context of retirement savings accounts, the term “Roth” in Roth 401(k) and Roth IRA refers to the name of its legislative sponsor, Senator William Roth. Hailing from Delaware, Senator Roth advocated the idea of introducing a new type of retirement savings account in 1997. He proposed a kind of retirement savings account that would offer unique tax advantages that the traditional retirement accounts lacked. The Roth IRA, short for Roth Individual Retirement Account, was then introduced in the USA.

Roth retirement accounts are known for the way tax on contributions and withdrawals is treated. Contributions to a Roth account are made after the amount has been taxed. In this sense, it differs from traditional retirement accounts, where contributions to the account are made before the amount is taxed and withdrawal amounts come with tax deductions.

Introducing the Roth retirement accounts in the system provided an alternate to the traditional way of saving for retirement life. It reduced the tax burden that individuals would have to bear at the time of retirement.

What is a Roth 401(k)?

A Roth 401(k) account is a type of retirement savings account that gives you the best of both worlds by combining the benefits of the traditional 401(k) and the Roth IRA.

It was introduced to provide an alternate to the traditional options for retirement savings in the USA in 2006 as part of the Pension Protection Act. The Roth 401(k) is offered by employers as part of the employee benefits package.

Tax benefits

A Roth 401(k) allows employees to make contributions from their salary to their retirement savings account on a post-tax basis, i.e., after the salary is taxed. This means that the money that employees contribute has already been subject to income taxes and will prevent the burden of paying any tax at the time of withdrawal.

This makes a Roth 401(k) an easier option for any retired employee, as the earnings that are withdrawn at a time when you’re no longer part of the workforce and are in your retirement phase are tax-free. You won’t owe any taxes on the contributed amount or the earnings that have steadily accumulated over the years.

This can make things easy for you, particularly if you expect your tax rate to be higher at the time of retirement, as you won’t have to pay heavy taxes on your withdrawals.

Contribution limits

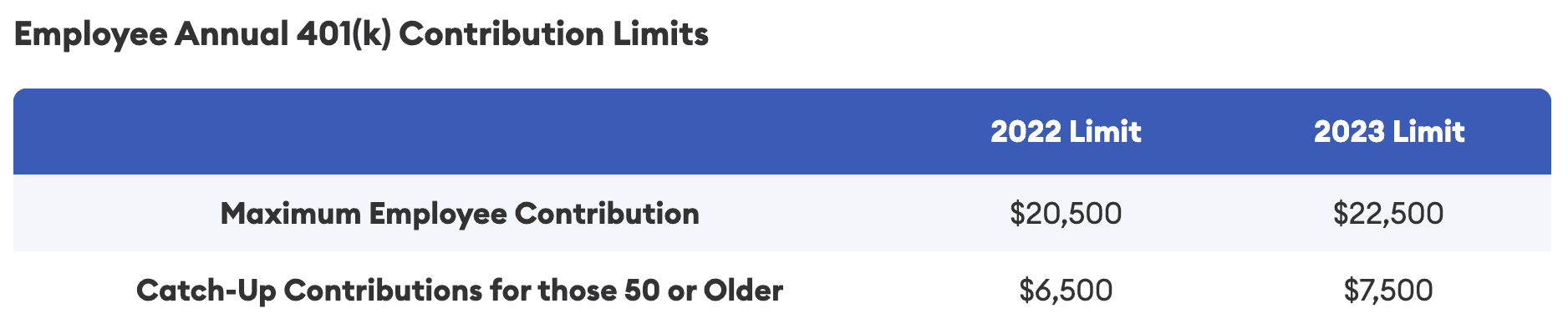

Similar to a traditional 401(k), the Roth 401(k) has contribution limits that have been set by the Internal Revenue Service (IRS) every year. As of 2023, the annual contribution limit for both retirement savings accounts is USD 22,500. There’s an additional catch-up contribution limit of USD 6,500 for individuals aged 50 and above. These limits, of course, aren’t permanent and are subject to change based on IRS regulations.

Rules around withdrawals

The Roth 401(k) comes with its set of rules around the time of withdrawal of funds without penalties, just like the traditional 401(k).

In general, you can start withdrawing funds from your Roth 401(k) account without penalties under two circumstances:

- You are 59½ years or older in age

- Your account has been open for a minimum duration of 5 years

The Roth 401(k) can be an intelligent tool of investment for those who anticipate being in higher tax brackets at the time of retirement and hence want to mitigate their tax liability.

What is a Traditional 401(k)?

A traditional 401(k) is also a type of retirement savings plan sponsored by the employer that allows eligible employees to make contributions from their salary toward their retirement. As opposed to the Roth 401(k), the portion of the salary that’s contributed to the traditional 401(k) is not taxed at the time of deposit. In other words, the contributions are made on a pre-tax basis.

As the contributions are made on a pre-tax basis, the taxable income of the employee for the year that remains after making the contribution goes down. This means that choosing to contribute to the traditional 401(k) can cause an immediate reduction in the amount of income that’s subject to taxes.

Tax benefits

The primary benefit of contributing to a traditional 401(k) is that the contributions are tax-deferred. The money that you contribute to your 401(k) account continues to grow tax-free—you won’t owe any taxes on the amount of the contributions as well as the gains within the amount—until the amount is withdrawn at the time of retirement.

Contribution limits

As of 2023, the maximum employee contribution to a traditional 401(k) account is USD 22,500; up from USD 20,500 in 2022. As is the case with the Roth 401(k) account, there’s an additional catch-up contribution limit of USD 7,500 for individuals aged 50 and above. The retirement plan contributions are adjusted by the IRS annually to account for inflation.

Rules around withdrawals

The withdrawals from a traditional 401(k) account at the time of retirement are taxable. This means that you owe income taxes on the amount that you withdraw, which can have an impact on the overall tax liability at the time of retirement.

This makes the traditional 401(k) account apt for those individuals who potentially see themselves being in a lower tax bracket during retirement. This factor makes the taxation at the withdrawal stage favorable for these individuals.

An important note to be made here is that traditional 401(k)s are subject to RMDs, short for Required Minimum Distributions, starting at age 72. On reaching this age, you need to start drawing out a minimum amount out of your traditional 401(k) each year. As is the case with 401(k)s, these withdrawals, too, are subject to taxes.

Common Similarities Between a Roth 401(k) and a Traditional 401(k)

Despite distinct tax treatments, Roth 401(k) and traditional 401(k) share several key similarities. These are as follows:

- Employee-sponsored: Both retirement savings accounts are sponsored by the employer in the sense that the employer offers these options as part of your employment benefits package. The workplace-based approach allows employees to make contributions toward their retirement savings directly from their salaries.

- **Matching contributions: **Several employers are willing to match your contributions as the policy that’s part of their retirement benefits package. Employer matches are typically made to a traditional 401(k) account, regardless of the type of account that you’ve chosen for your retirement savings.

- Limitations to contributions: Both accounts have limitations when it comes to contributions. These are decided by the IRS and are adjusted annually as per the inflation rates in that year.

- **Withdrawal rules: **Generally in most cases, withdrawals from both Roth 401(k)s and traditional 401(k)s are restricted if the individual is below 59½ years of age. This is done to avoid early withdrawal penalties.

- **Required Minimum Distributions (RMDs): **Both accounts are subject to RMDs, but different rules apply. While the traditional 401(k)s mandate RMDs starting from the age of 72, the Roth 401(k)s do not need the account holders to take RMDs during their lifetime.

- **Portability: **Both accounts are transferable to new employers. In case of a job change or leaving your employer, you are allowed to roll over your 401(k) funds into the 401(k) plan that’s offered by your new employer or into an IRA. This ensures that your retirement savings aren’t impacted by a change of job and that they continue to grow.

- Investment options: A range of investment options are provided under both accounts, including various funds and assets for building a solid and diversified portfolio based on your retirement goals and risk tolerance.

Roth 401(k) vs. 401(k): Key Differences

Both the options can be segregated based on their key differences. These differences mostly have to do with the tax treatment, rules around withdrawals, and the overall financial strategy.

To make the right choice, understanding these differences is paramount.

| Roth 401(k) | Traditional 401(k) | |

| Tax treatment: Contributions | Contributions are made with after-tax dollars i.e., you pay tax on your contributions. | Contributions are made with pre-tax dollars i.e., there is no income tax levied on the contributions. |

| Tax treatment: Withdrawals | Qualified withdrawals, including the contributions and gains, are tax-free at the time of retirement as long as you are at least 59½ years old.. | Withdrawals are taxed and are subject to the latest income tax rates. This can potentially result in higher tax liability during retirement. |

| Employer Contributions | While employees contribute after-tax dollars, employer contributions, by way of matching funds, are made on a pre-tax basis and are subject to tax upon withdrawal. | Employer contributions are made on a pre-tax basis, just like employee contributions. These are taxable upon withdrawal. |

| Required Minimum Distributions (RMDs) | Unlike traditional 401(k)s, Roth 401(k)s do not mandate account holders to take RMDs during their lifetime. This offers greater flexibility in managing your retirement withdrawals. | Traditional 401(k)s mandate RMDs starting from the age of 72. This can potentially increase your taxable income in later years. |

| Flexibility in Withdrawals | Roth 401(k) accounts allow access to your contributions (not earnings) before retirement if needed without any penalty. This offers better flexibility in withdrawals. | Early withdrawals from a traditional 401(k) account can result in taxes and penalties. |

| Current vs. Future Tax Considerations | Roth 401(k) makes for a better choice if you anticipate being in a higher tax bracket during retirement. A Roth 401(k) account can help you avoid higher tax payments on your withdrawals. | A traditional 401(k) is a good choice if you believe your current tax rate is higher than you foresee during retirement. This way, you get to benefit from the immediate tax deduction. |

Criteria for Choosing Between Roth 401(k) and 401(k)

Keeping into mind the key similarities and differences between a Roth 401(k) and a traditional 401(k) account, you can use the following criteria to arrive at a fail-solution:

- The timing of when taxes are applied

- Current and future tax considerations

- Flexibility on withdrawals

- Required Minimum Distributions (RMDs)

- Employer contributions

- Expected income at the time of retirement

- Tax diversification

- Long-term vs. short-term gains

- Levels of tolerance and aversion to risk

- Tax implications for beneficiaries inheriting the account

- Overall retirement strategy.

It may seem like there are too many things to consider but each one is a crucial point. In case of confusion, you always have the option of consulting with a financial advisor for their expertise.

Making The Right Choice: Roth 401(k) vs. Traditional 401(k)

The decision between choosing to invest in a Roth 401(k) account and a traditional 401(k) account depends largely on financial objectives, risk tolerance (with respect to potential tax brackets), and individual circumstances.

While Roth 401(k) warrants post-tax contributions and offers tax-free withdrawals, the traditional 401(k) does the opposite. The final call boils down to the tax liabilities that you foresee being subject to at the time of withdrawal.

The good news is that there is the option of choosing both instead of one. However, this can be done as long as the contributions don't exceed the annual maximum limit of USD 22,500 or $30,000 for those aged 50 and older (as of 2023). A well-balanced retirement portfolio can include both options, thus giving you the advantages of flexibility and the diversification of your portfolio. Simply put, it gives you some wiggle room and enables you to remain adaptable in the face of changing tax landscapes.

An important thing to remember is that financial situations and goals are never set in stone. They change and evolve over time. Thus, a periodic reassessment of your choice between a Roth 401(k) and a traditional 401(k) can help you stay on the right track and remain aligned with your retirement strategy.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more