- IRS forms

- Form 4562

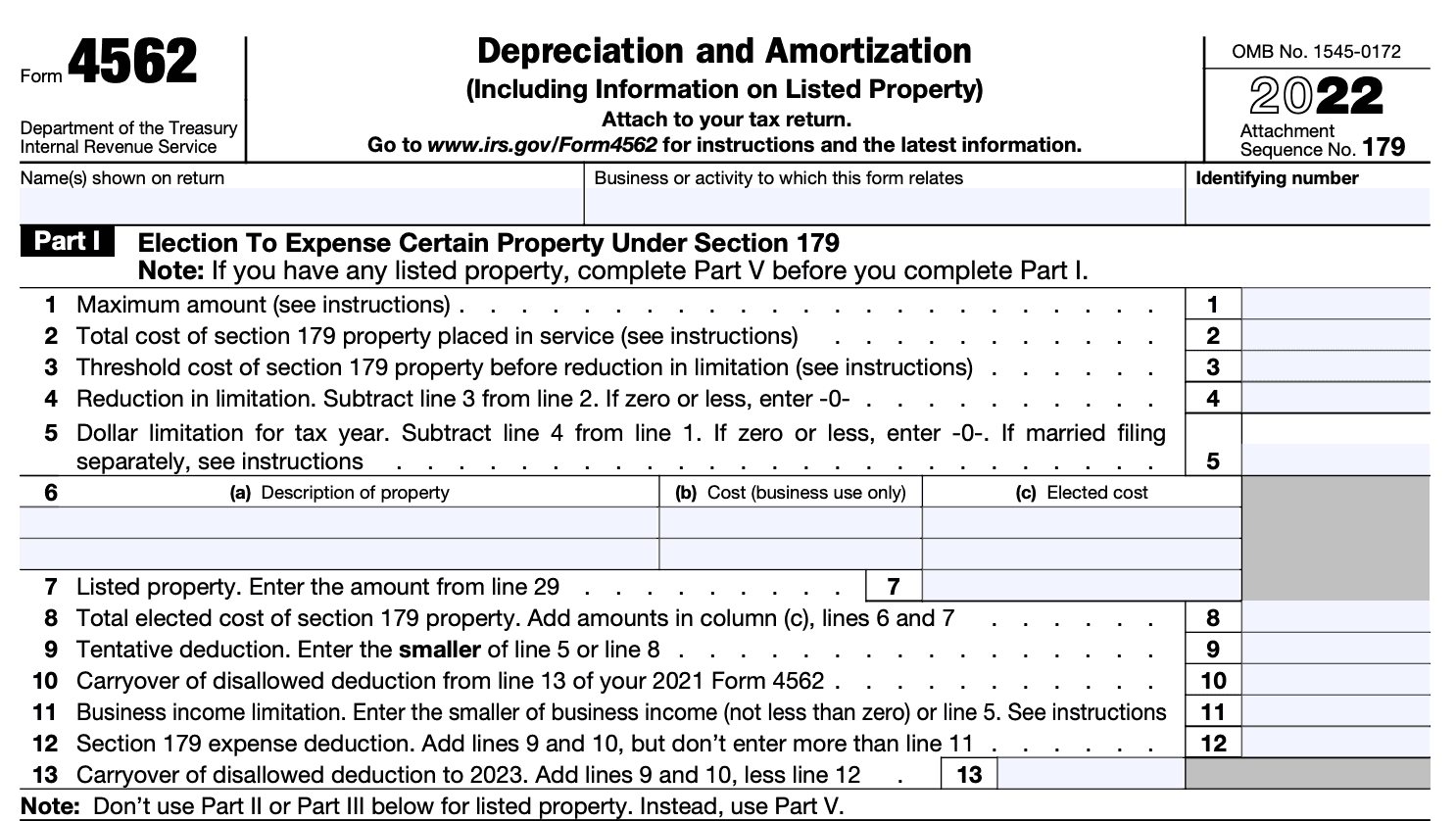

Form 4562: Depreciation and Amortization (Including Information on Listed Property)

Download Form 4562Setting up a new business can cost you a fair bit of money. You're likely to spend on office space, equipment, and utilities, which can quickly add to your expenditure. Thankfully, it is possible to recoup some of the money you've spent by deducting expenses on your federal tax return.

However, it is generally not allowed to claim the full cost as a deduction in the first year. Instead, you can deduct a part of your costs each year by claiming a depreciation deduction, which you must report on IRS Form 4562.

What Is IRS Form 4562?

Form 4562, Depreciation and Amortization (Including Information on Listed Property) is an Internal Revenue Service (IRS) form used to claim deductions for the depreciation or amortization of an asset for tax filing purposes. It is submitted along with your federal income tax return every year that you claim this deduction.

Let's say you are an architect and recently spent some money on upgrading your website and purchasing new laptops. You also purchased an office space to accommodate your growing team. Now, you want to write off the costs for buying the property and new equipment as a business expense.

However, you won't be allowed by the IRS to deduct the entire cost in one year. Instead, you can deduct a small portion of the expenses for multiple years by claiming a depreciation deduction on IRS Form 4562.

What Are Depreciation and Amortization?

Several benefits are provided to small business owners to encourage entrepreneurs and creatives, including deductions for business expenses to reduce their tax burden. IRS Form 4562 allows business owners to claim a deduction for both depreciation and amortization.

The IRS defines depreciation as follows:

"Depreciation is the annual deduction that allows you to recover the cost or other basis of your business or investment property over a certain number of years. Depreciation starts when you first use the property in your business or for the production of income. It ends when you either take the property out of service, deduct all your depreciable cost or basis, or no longer use the property in your business or for the production of income."

Depreciation deals with tangible property, something you can touch, like a car, a laptop, or a building. Amortization is also similar to depreciation, but it is used to depreciate the value of intangible assets, such as your goodwill, intellectual property, and the cost of starting a business.

Purpose of IRS Tax Form 4562

The IRS Form 4562, titled "Depreciation and Amortization," is used to report depreciation, amortization, and certain business expenses.

Asset depreciation reporting: Form 4562 is primarily used to report the depreciation of assets used in a business. Depreciation is the gradual allocation of the cost of tangible assets (such as machinery or equipment) over their useful life.

Amortization reporting: The form is also used to report amortization, which is the gradual write-off of certain intangible assets' costs, like patents or copyrights, over a specific time period.

Section 179 expense deduction: Form 4562 allows businesses to claim a Section 179 expense deduction. This provision allows for the immediate deduction of the cost of qualifying property (like equipment or machinery) rather than depreciating it over time.

List of property placed in service: The form requires businesses to list the details of the property (both tangible and intangible) that they placed in service during the tax year, along with their associated costs.

Vehicle depreciation: Businesses that use vehicles for business purposes can use Form 4562 to report the depreciation of these vehicles. This includes information on the vehicle's cost, date of acquisition, and the method used for depreciation.

Computational details for various depreciation methods: The form provides space for businesses to compute depreciation using different methods such as MACRS (Modified Accelerated Cost Recovery System), straight-line, or other permissible methods.

Bonus depreciation reporting: If a business qualifies for bonus depreciation, it can be reported on Form 4562. Bonus depreciation allows for an additional deduction for certain qualifying property in the year it is placed in service.

Calculation of total depreciation deduction: The form calculates the total depreciation deduction for the tax year, considering all eligible assets and methods used.

Pass-through entity reporting: For businesses structured as pass-through entities (such as partnerships or S corporations), Form 4562 is used to report depreciation and amortization, and the resulting deductions flow through to individual shareholders or partners.

Compliance and recordkeeping: By completing Form 4562, businesses ensure compliance with IRS regulations regarding the reporting of depreciation and amortization. It also serves as a record for both the business and the IRS.

Support for tax audits: In the event of a tax audit, having accurate and complete Form 4562 documentation supports the business's claims for depreciation deductions, helping to substantiate the reported expenses.

Tax planning tool: Form 4562 serves as a tool for tax planning, allowing businesses to optimize their depreciation deductions and manage their tax liability strategically.

Who Must File IRS Form 4562?

You only have to file IRS Form 4562 if you deduct a depreciable asset on your income tax return. You are also required to file Form 4562 for every year that you continue to depreciate the asset. Usually, you need to file IRS Form 4562 to claim any of the following:

-

Depreciation for an asset placed in service in the tax year for which you'll be filing.

-

A section 179 expense deduction (which could include a carryover from a previous year).

-

Depreciation on any vehicle or another listed property (regardless of when it was placed in service).

-

A deduction for a vehicle reported on a form other than Schedule C: Profit or Loss From Business.

-

Any depreciation on corporate income tax returns other than (link: https://fincent.com/irs-tax-forms/form-1120-s text: Form 1120-S).

-

Amortization of costs that began in the tax year for which you'll be filing.

Once you have filled up your IRS Form 4562, you need to file it as part of your annual business tax return in the same year you purchased the asset you want to depreciate or amortize.

How To Complete IRS Form 4562: A Step-by-Step Guide

IRS Form 4562 is divided into six parts, and we will discuss each part in this step-by-step guide. You can clarify any further doubts by checking out the IRS instructions for Form 4562.

We also recommend you keep the following information handy before you start filling out the form:

-

The price and date of service of the asset you're depreciating

-

The total income you're reporting in the year

Step 1: Complete Part I - Section 179 Election

(link: https://fincent.com/blog/guide-to-section-179-deductions text: Section 179) of the IRC allows you to take an immediate deduction for business expenses related to depreciable assets, including equipment, vehicles, and software. Suppose you have qualified property eligible for deduction under Section 179. In that case, you need to make an election for the same in Part I Form 4562. Here's the information you need to fill up in this part.

In Line 1, you have to enter the deduction you are claiming. Typically, you can deduct a maximum of $1 million in a year. This limit reduces if the asset costs more than $2.5 million. If the latter holds, the reduction will be applied in Lines 4 and 5 of the form.

Line 6 is where you will list the assets you are depreciating. If you use the asset solely for business purposes, list the price. If you aren't depreciating the full value, you will list the amount under elected cost.

Suppose you wrote off a portion of a listed asset in the previous year, and the rest of its value was carried over and is depreciating this year. In that case, you will enter that amount in line 10. The next line, Line 11, is the maximum amount you can write off in the tax year. It would either be your net earnings/profits for the year or the amount in Line 1, after considering any reduction limits in Lines 4 and 5.

Line 12 is where you enter the total amount you are deducting. If it is higher than the limit on Line 11, simply enter the value from Line 11. The last line, Line 13, tells you how much carryover depreciation you will have in the subsequent year. To get this figure, subtract Line 11 from the total amount you are writing off.

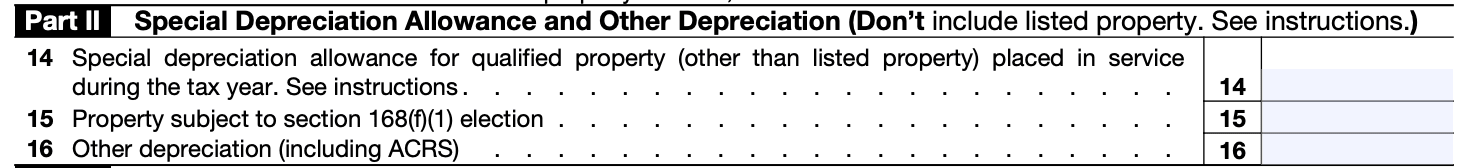

Step 2: Part II - Special Depreciation Allowance

In this second part of Form 4562, you will list any type of special depreciation you're claiming, including bonus depreciation. This type of depreciation only applies to certain qualified property, and it's best to meet an expert to get your status right regarding special deduction. You can read the instructions for this section on the IRS site if you think you may qualify.

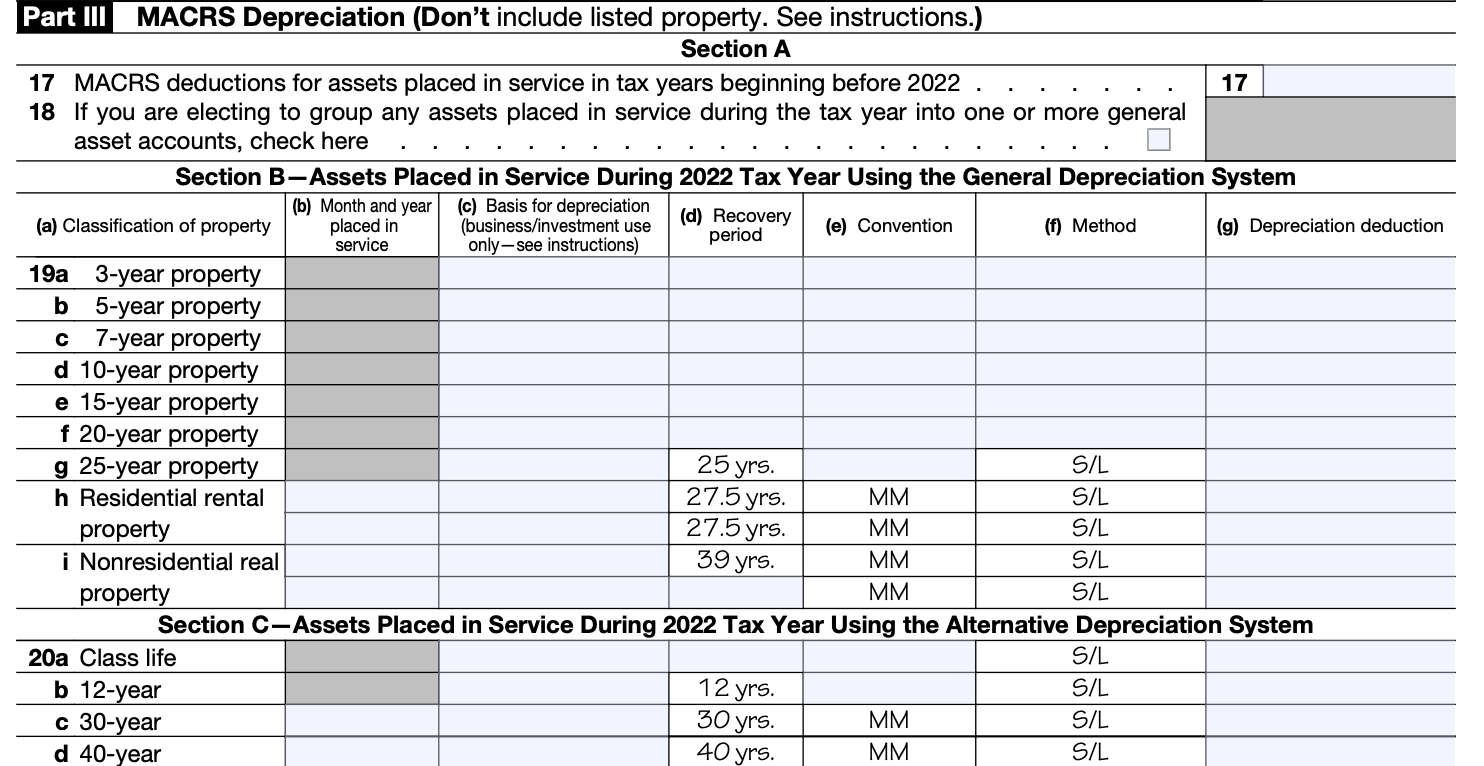

Step 3: Part III - MACRS Depreciation

Part III of Form 4562 is meant for listing Modified Accelerated Cost Recovery System deductions (MACRS). This section is relevant if you plan to depreciate the property over multiple years instead of writing off as much as possible with Section 179.

This is also the section where business and income-producing real estate are listed. The period for which you can depreciate property is determined by the Modified Accelerated Cost Recovery System (MACRS) guidance issued by IRS.

While filling up this section, in Line 17, you must enter the deduction for assets that were placed in service during the year for which you're filing. The details about the assets go on lines 19(a) through 19(i).

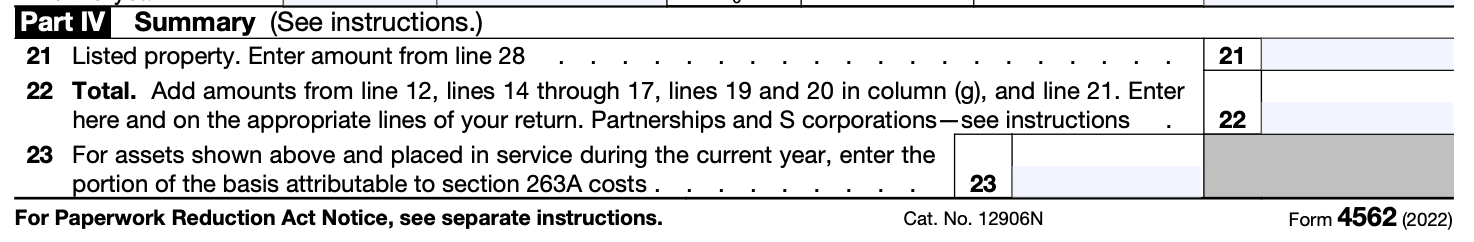

Step 4: Part IV - Summary

Part IV of Form 4562 is where you will add the total amount of depreciation from each part of the form. You will enter this amount on Line 13 of Schedule C for Form 1040.

Unfortunately, this part where the IRS wants you to summarize your deductions falls right in the middle of the form. Generally, you're better off skipping this section and completing Part V of IRS Form 4562 before returning to Part IV. That's because Line 21 requires you to enter the value of your listed property that's also used for personal use (which will be listed in Part V).

The next line, Line 22, will list your total deduction. You needn't fill this up if you're filing for a partnership or S corporation.

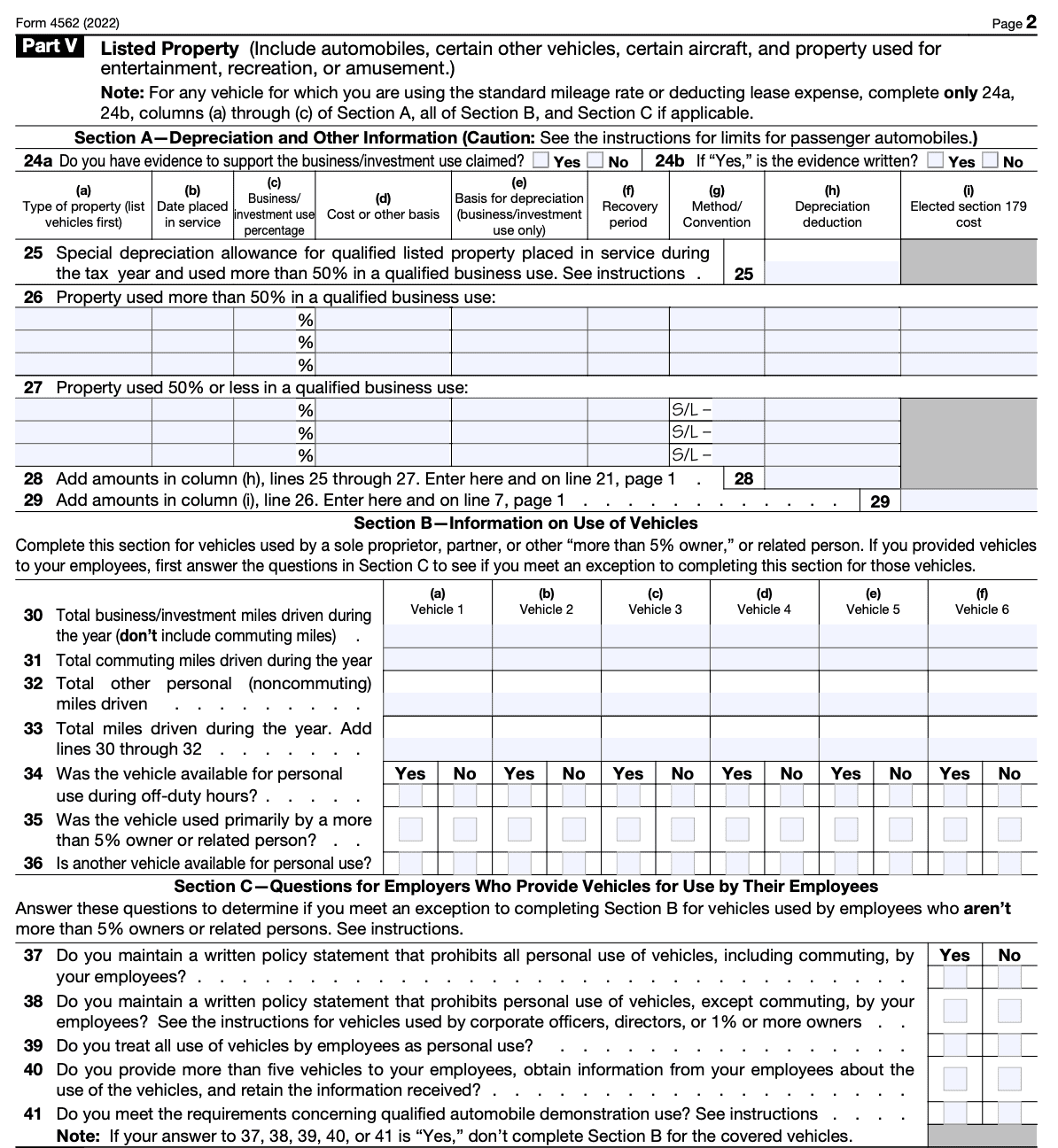

Step 5: Part V - Listed Property

This part of IRS Form 4562 is used for depreciating listed property, which refers to the business property also employed for personal use. For instance, a vehicle that you use for your business and dropping your kids at school.

Part V of IRS Form 4562 is divided into three sections.

In Section A, you will enter the depreciation allowance for listed property, but you must have evidence to support the deductions you are claiming.

Section B is meant to be filled by sole proprietors and partners to provide additional information on vehicles used for business purposes.

Section C is filled up by employers to provide information on the vehicles provided to their employees. It comprises five yes-or-no questions. You needn't fill it up if you don't have any employees.

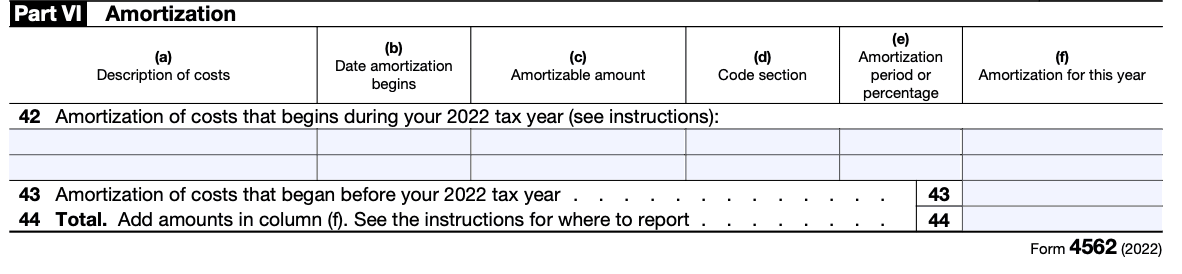

Step 6: Part VI - Amortization

Part VI of Form 4562 deals with the amortization of intangible business expenses. These costs are not related to any purchase of physical assets. Instead, these are expenses for intangible assets such as goodwill and trademarks. To fill out this section, you need to include a description of the amortized costs and other details.

Part VI of Form 4562 deals with the amortization of intangible business expenses. These costs are not related to any purchase of physical assets. Instead, these are expenses for intangible assets such as goodwill and trademarks. To fill out this section, you need to include a description of the amortized costs and other details.

However, filling up Part VI is often tricky because it is hard to ascertain the value of intangible goods. For example, how do you put a price on your goodwill, and how do you justify it? It's best to consult a CPA or a tax advisor if you're going to amortize assets than simply guess the worth of your intangible assets.

Conclusion

Taking care of your business' bookkeeping can be stressful, especially if you're a small business that's just starting out. At Fincent, we ensure that your bookkeeping needs are taken care of, giving you the benefit of being able to focus on growing your business.

FAQs:

Can I file Form 4562 separately from my tax return? No, Form 4562 should be completed and attached to your tax return. It is not a standalone form and must be filed in conjunction with your business or individual tax return.

**Is there a limit to how much I can deduct using Section 179? **Yes, there are limits to how much you can deduct using Section 179, which are subject to change each year. For the current year's limits, refer to the IRS guidelines or consult with a tax professional.

**Can I claim bonus depreciation on Form 4562? **Yes, you can claim bonus depreciation for qualifying property on Form 4562, which allows you to take an additional depreciation deduction in the year the property is placed in service.

**What types of property are eligible for depreciation? **Most types of tangible property like buildings, machinery, vehicles, furniture, and equipment used in a business or income-producing activity are eligible for depreciation.

**How do I determine the useful life of a property for depreciation purposes? **The IRS provides guidelines and charts, such as the Modified Accelerated Cost Recovery System (MACRS), to determine the class life of different types of property for depreciation purposes.

**If I make an error on Form 4562, how can I correct it? **If you make an error on Form 4562 after filing it with your tax return, you may need to file an amended tax return using Form 1040X (for individuals) or Form 1120X (for corporations) and attach a corrected Form 4562.

How does the mid-quarter convention affect depreciation on Form 4562? If you placed more than 40% of your property in service during the last quarter of the tax year, the mid-quarter convention may apply. It affects the depreciation calculation, and Form 4562 will guide you through applying this convention.

What happens if I sell or dispose of property listed on Form 4562? When you sell or dispose of property for which you've claimed depreciation, you need to report the sale on Form 4797, "Sales of Business Property," and may need to recapture some of the depreciation deductions as ordinary income.

Do I need to file Form 4562 every year for the same property? Yes, you must file Form 4562 each year to report depreciation for an asset until its recovery period is over or until you no longer own the asset.