- IRS forms

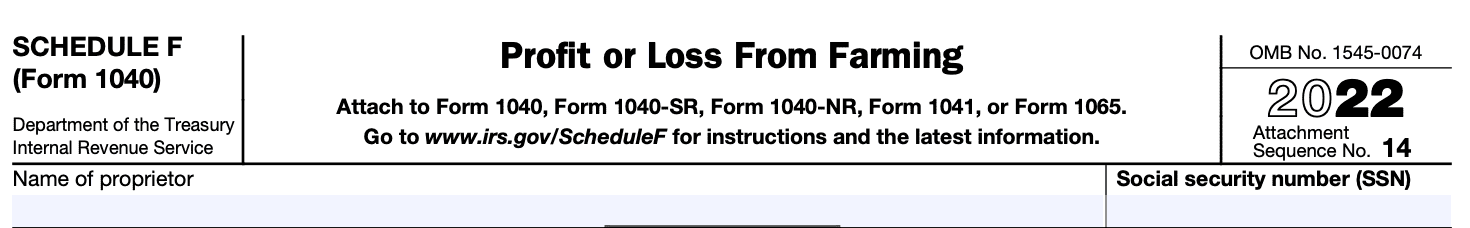

- Schedule F (Form 1040)

Schedule F (Form 1040): Profit or Loss From Farming

Download Schedule F (Form 1040)If you're engaged in farming or agricultural activities as a primary occupation or as a source of income, it's essential to understand the tax implications associated with your agricultural endeavors. The Internal Revenue Service (IRS) requires individuals involved in farming operations to report their profit or loss on Schedule F (Form 1040).

Schedule F is an IRS form that allows farmers to report their income and expenses related to farming operations. It is used by individuals, partnerships, estates, and trusts engaged in farming activities. The purpose of Schedule F is to calculate the net profit or loss from farming, which is then reported on the taxpayer's individual tax return (Form 1040).

This comprehensive guide will walk you through the basics of Schedule F, providing a clear understanding of the form and its significance for farmers.

Purpose of Schedule F (Form 1040)

Typically, Schedule F is used for reporting farm income and expenses. It is an attachment to Form 1040, which is the U.S. Individual Income Tax Return. If you are engaged in farming activities as a sole proprietor, a partnership, or a shareholder in an S corporation, you may need to file Schedule F to report your farming income or loss.

Schedule F allows you to report various aspects of your farming operations, including the sale of livestock, crops, and other products, as well as the expenses associated with farming such as feed, seeds, equipment, and labor costs. The purpose of this schedule is to calculate the net farm profit or loss, which is then included on your Form 1040 to determine your overall taxable income.

Benefits of Schedule F (Form 1040)

The benefits of filing Schedule F include:

Simplicity: Schedule F allows farmers to report their income and expenses in a straightforward manner. It consolidates all relevant information regarding farming activities, making it easier to calculate taxable income.

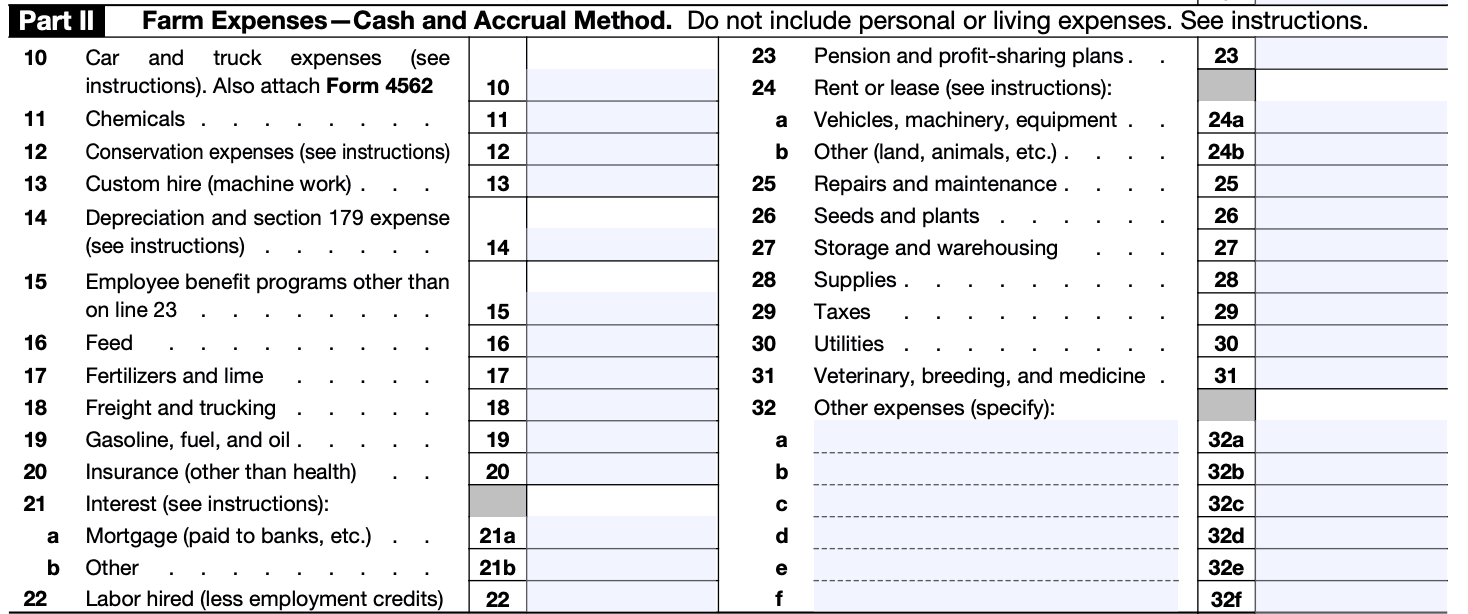

Deductions: Schedule F enables farmers to claim various deductions related to their farming operations. These deductions can include expenses such as seed and fertilizer costs, livestock feed, farm equipment, repairs, fuel, insurance premiums, and other expenses directly associated with the farming business. By claiming these deductions, farmers can potentially reduce their taxable income and lower their overall tax liability.

Net operating losses: If a farmer's expenses exceed their income for the tax year, they may incur a net operating loss (NOL). Schedule F allows farmers to carry back NOLs for up to two years and carry them forward for up to 20 years. This provision provides farmers with flexibility in managing their tax obligations during periods of financial difficulty.

Self-employment tax: By filing Schedule F, farmers can calculate their self-employment tax liability. Self-employment tax covers Social Security and Medicare taxes for individuals who are self-employed. This tax is based on the net income from farming activities and is calculated separately from income tax.

Agricultural credits: Certain agricultural credits are available to farmers, such as the agricultural chemicals security credit and the biodiesel and renewable diesel fuels credit. By filing Schedule F, farmers can claim these credits if they meet the eligibility requirements, potentially reducing their overall tax liability.

Who Is Eligible To File Schedule F (Form 1040)?

The following individuals or entities are typically eligible to file Schedule F:

Farmers: Individuals who engage in the business of farming or agricultural activities can file Schedule F. This includes individuals who cultivate land, raise livestock, operate a ranch, or engage in other agricultural pursuits.

Sole proprietors: If you operate a farming business as a sole proprietorship, you are eligible to file Schedule F. As a sole proprietor, you report your farm income and expenses on Schedule F, which is then included with your personal income tax return (Form 1040).

Partnerships and LLCs: If you are a partner in a farming partnership or a member of a farming Limited Liability Company (LLC), your share of the partnership or LLC income and expenses is reported on Schedule F. The partnership or LLC itself does not file Schedule F; instead, it provides a Schedule K-1 to each partner or member, who then includes that information on their Schedule F.

It's important to note that certain criteria must be met to qualify as a farm for tax purposes. The IRS provides guidelines regarding the definition of a farm, including minimum income thresholds and factors such as the amount of time and effort spent on farming activities.

How To Complete Form Schedule F (Form 1040) : A Step-by-Step Guide

Schedule F (Form 1040) is used to report income and expenses related to farming or agricultural activities. Here's a step-by-step guide to help you complete it:

Step 1: Gather necessary documents

Collect all the relevant documents such as income statements, expense receipts, and records related to your farming activities. This may include sales receipts, invoices, and bank statements.

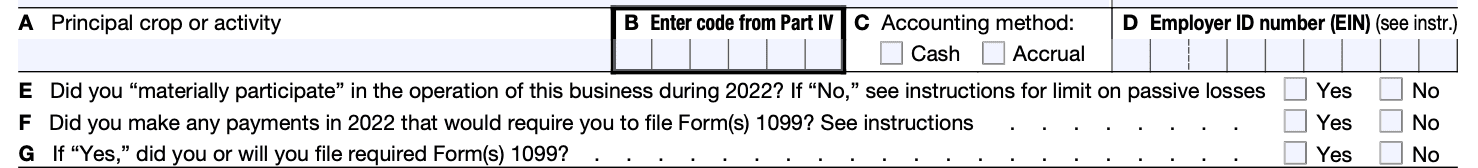

Step 2: Provide personal information

At the top of Schedule F, enter your name, Social Security number, and the tax year you are filing for.

Step 3: Describe your farming activity

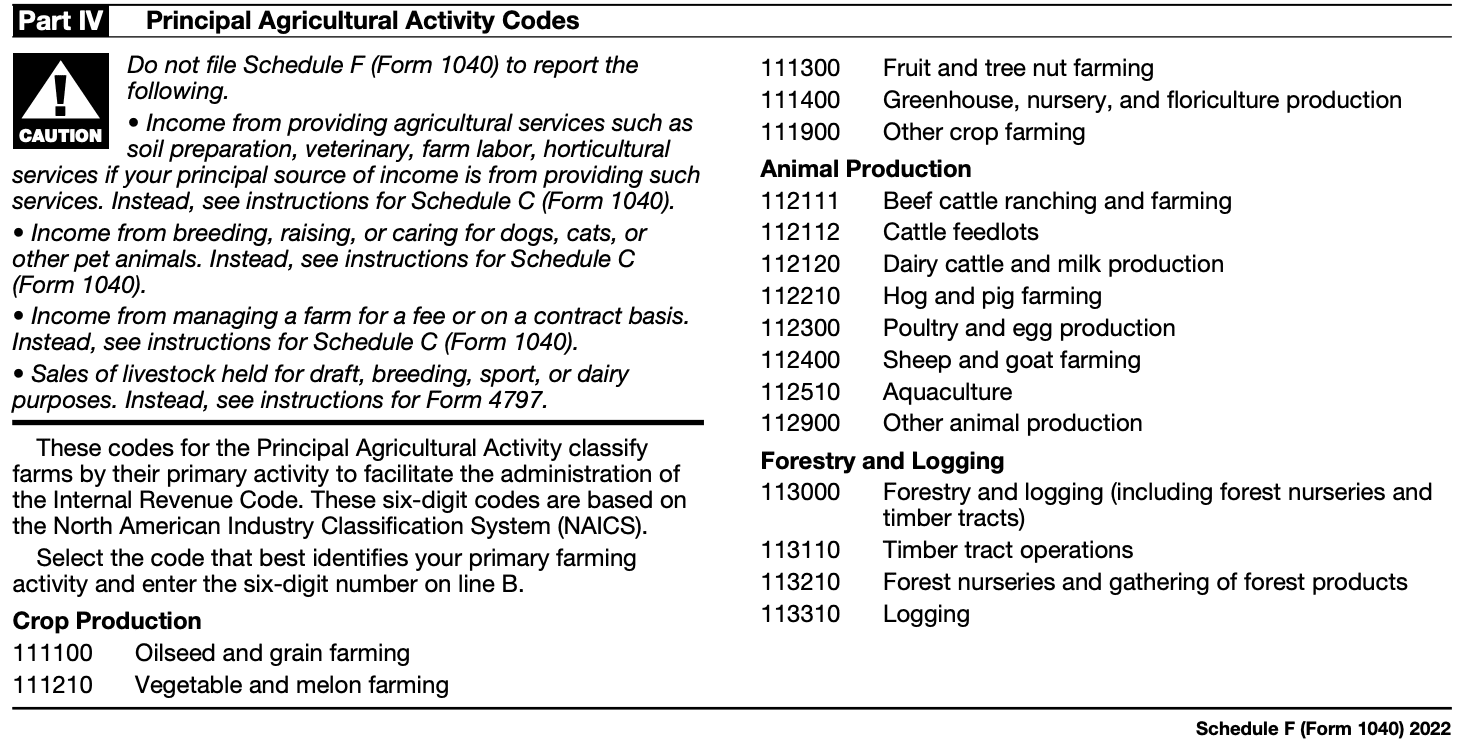

On line 1, describe the type of farming or agricultural activity you are engaged in (e.g., crop farming, livestock production).

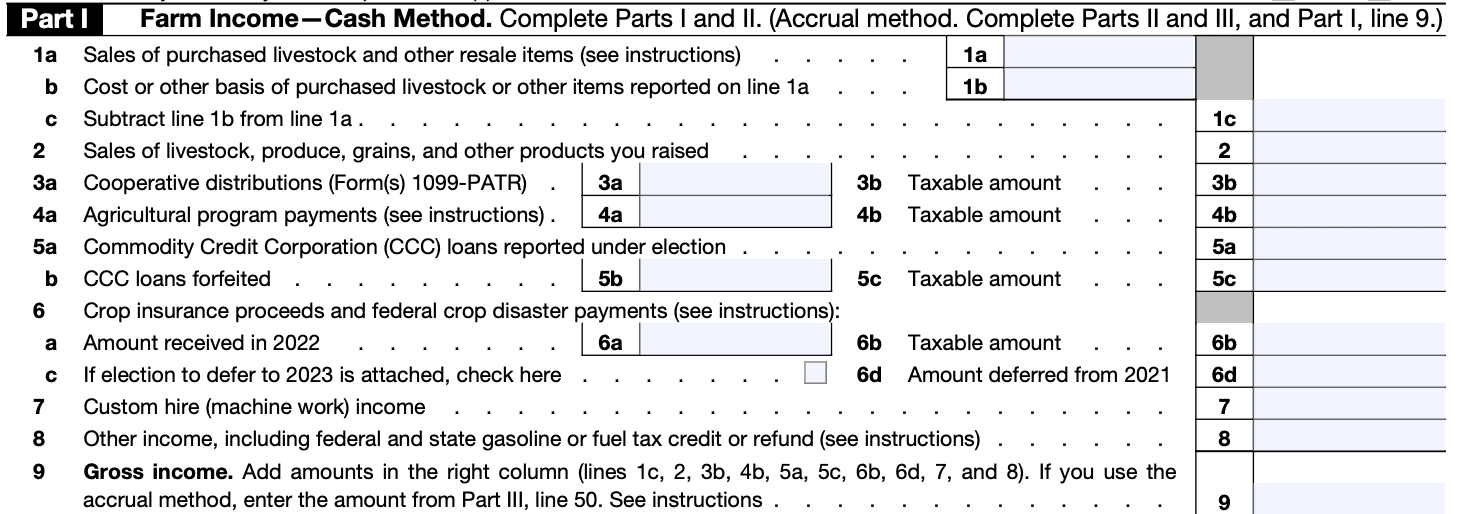

Step 4: Calculate gross farm income

Report your total income from farming activities on line 2. This includes all sales of farm products, government program payments, and other income sources related to farming.

Step 5: Deduct farm-related expenses

List your deductible farm expenses on lines 3 to 33. Common expenses may include seed and fertilizer costs, equipment maintenance, rent or lease payments for land or equipment, livestock feed, and fuel expenses.

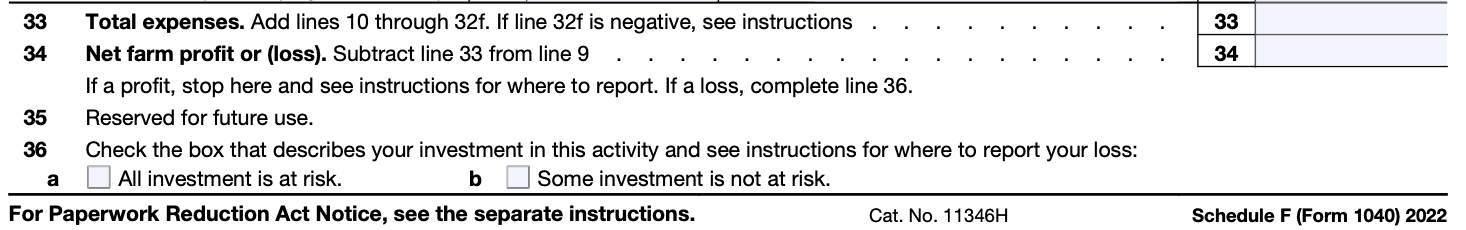

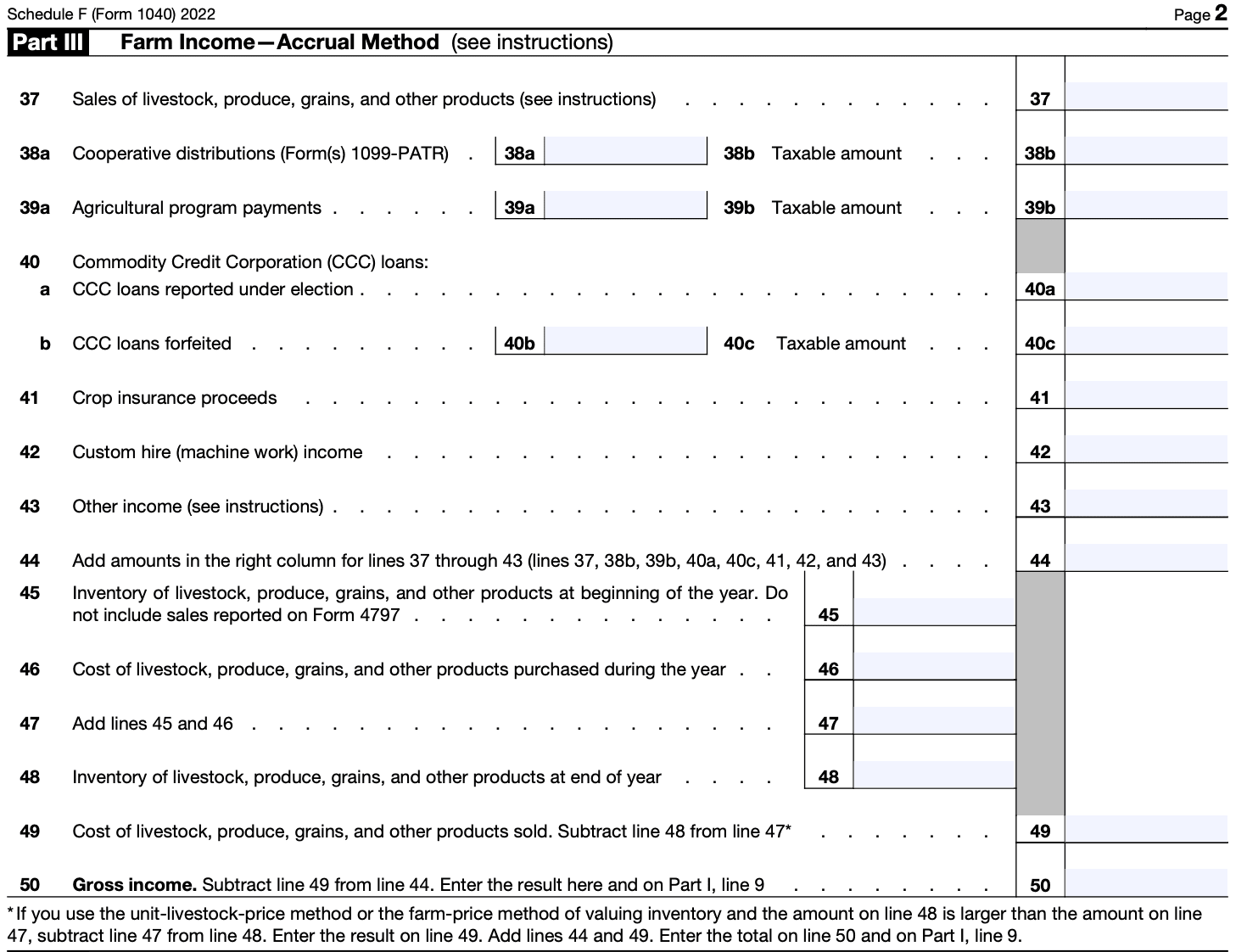

Step 6: Calculate net farm profit or loss

Subtract your total farm expenses (line 34) from your gross farm income (line 2) to determine your net farm profit or loss (line 35).

Step 7: Report other farm income or deductions

If you have any other farm income sources or deductions not included in the previous sections, report them on lines 36 to 42.

Step 8: Calculate taxable income

Add or subtract the amounts from lines 35, 40, and 42 to determine your farm's taxable income on line 43.

Step 9: Complete the rest of your tax return

Transfer the taxable income from Schedule F to the appropriate section of Form 1040. Complete the rest of your Form 1040 as instructed, including other income, deductions, and credits.

Step 10: Sign and file your tax return

Review your entire tax return for accuracy and completeness. Sign and date your return. If filing electronically, follow the instructions provided by your tax preparation software or online filing service. If filing by mail, attach Schedule F to your Form 1040 and send it to the address specified in the tax instructions.

Special Considerations When Filing Schedule F (Form 1040)

When filing Schedule F (Form 1040), there are several special considerations to keep in mind. Here are some important points to consider:

Qualifying as a farmer: To file Schedule F, you must engage in farming activities with the intent of making a profit. The IRS considers farming to include the cultivation of land for the production of crops, raising livestock, and other agricultural activities. It is important to meet the criteria to be classified as a farmer for tax purposes.

Reporting income and expenses: Schedule F is used to report both income and expenses related to farming activities. Income from farming includes proceeds from the sale of livestock, crops, and other products, as well as income from agricultural services you provide. It is important to accurately report all sources of farming income and keep detailed records to support your figures.

Depreciation and capital assets: If you purchase or use capital assets such as machinery, equipment, or buildings for your farming activities, you may be eligible to claim depreciation deductions. Depreciation allows you to deduct the cost of these assets over their useful lives. Different rules apply to different types of assets, so it's important to understand the IRS guidelines and keep proper records.

Farm income averaging: Farmers have the option to use income averaging to reduce their tax liability. This allows you to average your current year's farming income with the income from the previous three years, which can help reduce your tax burden. However, there are specific rules and limitations associated with income averaging, so consult the IRS guidelines or a tax professional to see if it applies to your situation.

Farm household expenses: Schedule F allows you to deduct certain household expenses that are directly related to your farming activities. These may include utilities, repairs, insurance, and property taxes for your farm residence. However, the IRS has specific rules regarding the allocation of expenses between personal and business use, so it's essential to keep accurate records and consult the guidelines.

Self-employment tax: As a farmer, you are generally subject to self-employment tax, which covers your Social Security and Medicare tax obligations. The self-employment tax is calculated on Schedule SE, and the amount owed is based on your net farm income reported on Schedule F. Make sure to consider this additional tax liability when estimating your overall tax obligation.

Special rules for certain agricultural activities: Some farming activities have specific tax rules associated with them. For example, there are special provisions for timber, fisheries, and certain livestock-related activities. If you engage in these activities, familiarize yourself with the specific guidelines and reporting requirements for accurate tax filing.

How To File Schedule F (Form 1040): Offline/Online/E-filing

To file Schedule F (Form 1040), you have several options: filing offline, filing online, or e-filing. Let's go through each method:

Offline filing

a. Obtain a copy of Form 1040 and Schedule F: You can download the forms from the official IRS website (www.irs.gov), order them by mail, or pick them up at your local IRS office.

b. Fill out the forms manually: Follow the instructions provided with the forms to accurately complete all the required sections. Make sure to include all relevant information about your farming activities, income, and expenses.

c. Calculate your taxes: Use the information from Schedule F to calculate your total tax liability.

d. Attach Schedule F to your Form 1040: Once you have completed Schedule F, attach it to your Form 1040. Make sure all other required schedules and forms are included as well.

e. Mail your tax return: Send your completed tax return, including Schedule F and any supporting documents, to the appropriate IRS address based on your location. Remember to keep a copy of your tax return for your records.

Online filing

a. Use tax preparation software: Online tax preparation softwares can guide you through the process of filing your taxes. These platforms typically have a step-by-step interview-style interface that helps you enter your information accurately.

b. Enter your farming income and expenses: When prompted by the software, provide all the necessary details about your farming activities, income, and expenses. The software will typically have a section dedicated to Schedule F.

c. Review and verify your return: Once you have entered all the required information, review your tax return to ensure its accuracy. Check for any errors or missing information.

d. Pay any taxes owed or claim a refund: If you owe taxes, you will need to arrange for payment. If you're due a refund, you can choose to have it directly deposited into your bank account.

e. Submit your return: Follow the instructions provided by the tax software to electronically submit your tax return. The software will transmit your return securely to the IRS.

E-filing

a. Use IRS-approved tax software or a tax professional: To e-file Schedule F, you need to use IRS-approved tax software or work with a tax professional who is authorized to e-file returns on your behalf.

b. Enter your farming income and expenses: Provide all the necessary details about your farming activities, income, and expenses as prompted by the tax software or your tax professional.

c. Review and verify your return: Review your tax return carefully to ensure its accuracy and completeness. Make any necessary corrections or additions before proceeding.

d. Pay any taxes owed or claim a refund: If you have a tax liability, make arrangements for payment. If you're eligible for a refund, indicate your preferred method of receiving it.

e. Transmit your return electronically: With e-filing, the tax software or your tax professional will securely transmit your tax return to the IRS on your behalf.

Common Mistakes To Avoid While Filing Schedule F (Form 1040)

When filing Schedule F (Form 1040), it's important to avoid certain common mistakes. Here are some errors to watch out for:

Misclassifying activities: Ensure that you correctly classify your activities as farming for Schedule F purposes. Not all rural or agricultural activities qualify, so make sure you meet the criteria outlined by the IRS.

Failure to report all income: It's crucial to report all income from your farming operations, including cash, checks, credit card payments, and the fair market value of goods or services received through bartering.

Neglecting to report crop insurance and government payments: Crop insurance proceeds and government payments such as disaster assistance or conservation program payments should be reported as income on Schedule F.

Not keeping accurate records: Maintain detailed records of your farming activities, including income, expenses, purchases, sales, and inventory. Good record-keeping is essential for accurate reporting and can help support your deductions if audited.

**Overlooking deductible expenses: **Ensure you are aware of the deductible expenses related to your farming activities. These may include seeds, fertilizer, livestock feed, veterinary services, fuel, machinery repairs, farm insurance, property taxes, and interest on farm loans.

Failing to depreciate assets correctly: If you have depreciable assets like machinery or buildings, it's important to depreciate them properly over their useful lives. Utilize the appropriate depreciation methods and recovery periods as prescribed by the IRS.

Not understanding special provisions: Familiarize yourself with any special provisions that may apply to your farming activities, such as the farm income averaging option or the NOL (Net Operating Loss) carryback and carryforward rules.

Ignoring estimated tax requirements: If you anticipate owing a significant amount of tax on your farming income, remember to pay estimated taxes throughout the year to avoid underpayment penalties. Familiarize yourself with the rules and due dates for estimated tax payments.

Failing to sign and date the return: Make sure you sign and date your tax return. For joint returns, both spouses must sign, even if only one spouse operates the farm.

Not seeking professional advice when necessary: If you're uncertain about any aspect of filing Schedule F or have complex farming operations, don't hesitate to consult a tax professional who specializes in agricultural tax matters. They can provide guidance tailored to your situation and help you avoid costly mistakes.

Remember, accuracy and attention to detail are crucial when filing Schedule F. Taking the time to ensure your return is correct can help prevent IRS audits and potential penalties.

Conclusion

As a farmer, it is crucial to understand the tax obligations associated with your farming activities. Schedule F provides a structured way to report your farming income and expenses, enabling you to determine your net farming profit or loss. By accurately completing Schedule F, you can ensure compliance with IRS regulations while maximizing tax benefits.

It's recommended to consult with a tax professional or accountant who specializes in agricultural taxation to ensure you fully understand the requirements and optimize your tax return. By staying informed and organized, you can navigate the tax aspects of farming and keep your agricultural business on track.