- IRS forms

- Form 966

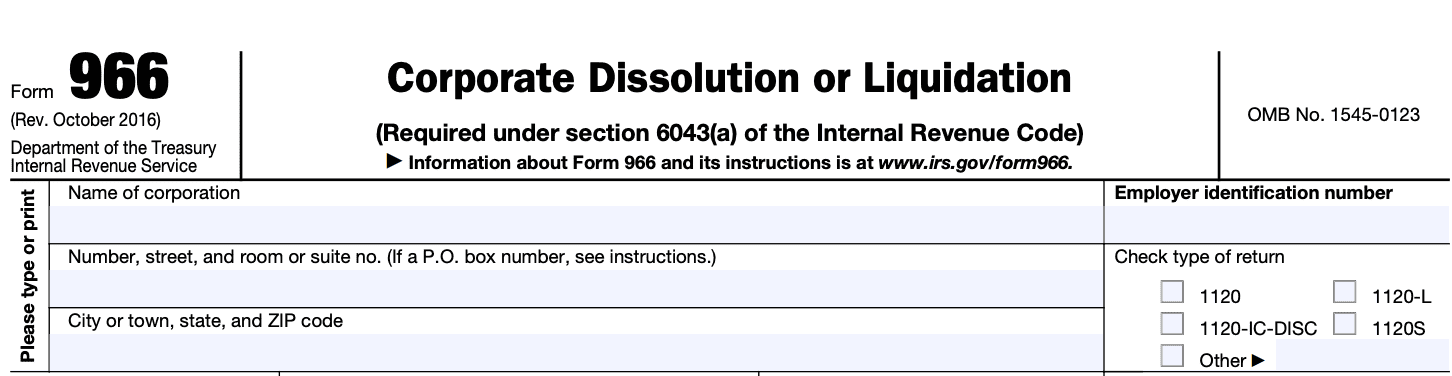

Form 966: Understanding Corporate Dissolution or Liquidation

Download Form 966The life cycle of a business is dynamic and often subject to change. Sometimes, companies may need to dissolve or liquidate due to various reasons, such as financial difficulties, strategic restructuring, or the end of the business's life cycle. When a corporation decides to dissolve or liquidate, it is required to file a Form 966 with the Internal Revenue Service (IRS) in the United States.

Form 966, officially known as "Corporate Dissolution or Liquidation," is a document filed with the IRS to notify them about a corporation's decision to dissolve or liquidate. The IRS requires this form to be filed within 30 days of the corporation adopting a resolution or plan to dissolve or liquidate its affairs.

In this blog post, we will explore Form 966, its purpose, and the key information required to complete it accurately.

Purpose of Form 966

Form 966 serves several purposes, both for the IRS and the corporation:

IRS notification: By filing Form 966, the corporation notifies the IRS of its intention to dissolve or liquidate. This enables the IRS to update its records and ensure compliance with tax regulations.

**Tax clearance: **Filing Form 966 helps the corporation obtain tax clearance from the IRS. This means that the corporation has fulfilled its tax obligations before dissolving or liquidating, reducing the risk of future tax liabilities.

Final tax returns: Form 966 prompts the IRS to process the corporation's final tax returns, including the final income tax return and, if applicable, the final employment tax return (Form 941).

Benefits of Form 966

While there are certain requirements and obligations associated with filing Form 966, there are several benefits that corporations can derive from completing this form. Some of the benefits of Form 966 include:

Finalizing the winding down process: Filing Form 966 is an essential step in formally closing down a corporation. By submitting this form, the corporation notifies the IRS about its intention to dissolve or liquidate, allowing for the finalization of the winding down process.

Termination of tax obligations: When a corporation files Form 966, it serves as a notification to the IRS that the company will no longer conduct business. This helps to terminate various tax obligations, including the need to file future tax returns and pay corporate taxes.

**Stopping the accrual of penalties and interest: **By filing Form 966 and initiating the dissolution or liquidation process, a corporation can halt the accrual of penalties and interest on any outstanding tax liabilities. This can provide financial relief and prevent additional costs from accumulating.

Establishing a final tax year: Form 966 helps establish the final tax year for the corporation. Once the form is filed, the corporation's tax year is deemed to have closed, simplifying the tax reporting process and ensuring clarity regarding tax obligations for both the corporation and its shareholders.

Providing legal protection: Filing Form 966 helps protect the corporation and its officers from potential legal issues that may arise after dissolution or liquidation. It provides evidence that the corporation has followed the proper procedures and complied with IRS requirements, which can be important in case of any future disputes or claims.

Who Is Eligible To File Form 966?

Form 966 is typically filed by C corporations (including S corporations that were previously C corporations) that have made the decision to terminate their existence and wind up their affairs.

Here are some key points regarding eligibility to file Form 966:

C corporations: The primary category of corporations eligible to file Form 966 is C corporations. C corporations are the standard type of corporations, and they must file Form 966 if they choose to dissolve or liquidate.

S corporations: S corporations that were previously C corporations and have converted to S corporation status can also use Form 966 to report their dissolution or liquidation. If an S corporation has always been an S corporation and has not been a C corporation at any point, it does not need to file Form 966.

Limited liability companies (LLCs): By default, LLCs are not required to file Form 966 when they dissolve or liquidate. However, if an LLC elected to be taxed as a C corporation at any time, it would need to file Form 966 if it decides to dissolve or liquidate.

Foreign corporations: Foreign corporations, which are corporations formed outside of the United States, are not eligible to file Form 966.

How To Complete Form 966: A Step-by-Step Guide

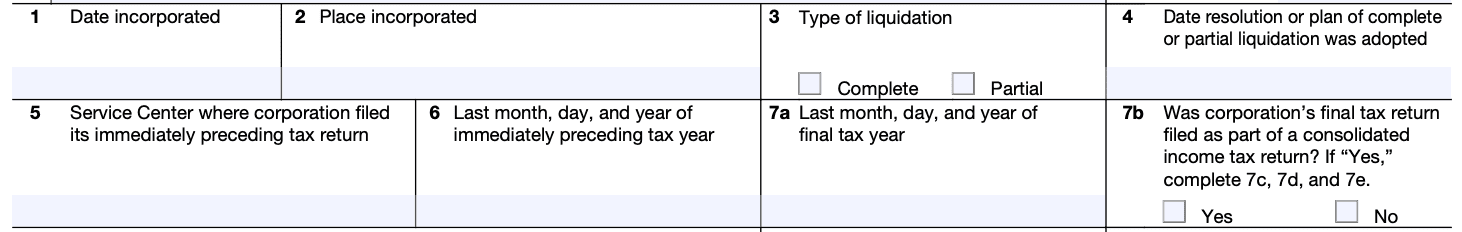

Here's a step-by-step guide on how to complete Form 966:

Step 1: Obtain the form

Download Form 966 from the official website of the Internal Revenue Service (IRS). Ensure that you have the most recent version of the form.

Step 2: Provide basic information

Fill in the basic information about the corporation, including its name, address, Employer Identification Number (EIN), and the state or country where it is incorporated.

Step 3: Choose the applicable election

Indicate whether the corporation is electing to be treated as an S corporation from the beginning of the tax year or from a specific date during the tax year. Check the appropriate box to indicate your choice.

Step 4: Provide shareholder details

List the names, addresses, and Social Security Numbers (SSNs) or EINs of all shareholders who own stock in the corporation as of the date of the election. Include both individual shareholders and other entities, such as trusts or estates, and provide the percentage of stock owned by each shareholder.

Step 5: Sign and date the form

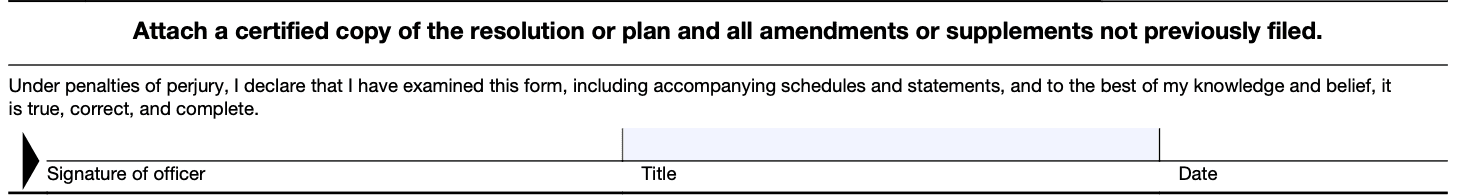

The form must be signed and dated by an authorized officer of the corporation. Ensure that the person signing the form has the authority to do so.

Step 6: Retain a copy

Make a copy of the completed Form 966 for your records. It is important to keep a copy of all forms and documents submitted to the IRS.

Step 7: Submit the form

Mail the completed Form 966 to the appropriate address as specified in the instructions for the form. Ensure that you send the form to the correct IRS office based on the corporation's location.

It is recommended to consult with a tax professional or an attorney familiar with corporate tax matters to ensure accurate completion of the form and to address any specific questions or concerns related to your corporation's situation.

Special Considerations When Filing Form 966

When filing Form 966, there are several special considerations to keep in mind. Here are some important points:

**Purpose: **Form 966 is filed by a corporation to initiate the process of dissolving and liquidating the corporation's assets. It serves as notice to the Internal Revenue Service (IRS) that the corporation intends to terminate its existence.

Timing: The form should be filed within 30 days of adopting a resolution or plan to dissolve the corporation or within 30 days of the final distribution of assets if the dissolution has already occurred.

**Final tax return: **Prior to filing Form 966, the corporation must file its final federal income tax return (Form 1120) and pay any remaining taxes due.

**Tax liabilities: **The corporation should ensure that all tax liabilities, including federal, state, and local taxes, have been addressed before filing Form 966. This includes income taxes, payroll taxes, and any other outstanding obligations.

Shareholder approval: The decision to dissolve the corporation and file Form 966 typically requires the approval of the corporation's shareholders. The specific requirements for shareholder approval may vary depending on the state where the corporation is incorporated.

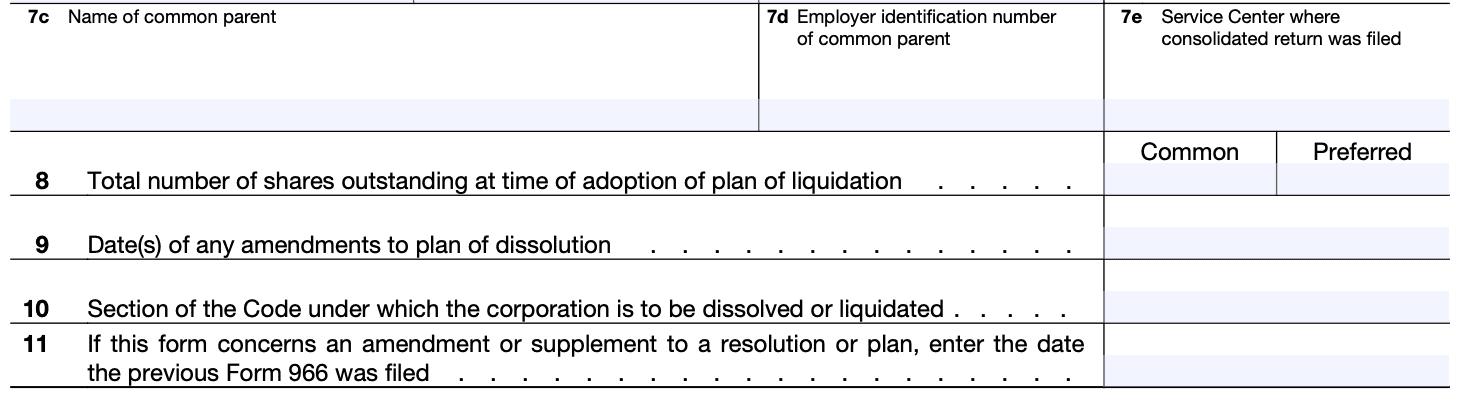

Supporting documentation: Form 966 generally does not require any attachments or supporting documents. However, if the corporation is being liquidated under IRC Section 332, 337, or 338, additional information may be required. It's important to review the instructions for Form 966 and any applicable IRS guidance to determine if any additional documentation is needed.

**Mailing address: **The completed Form 966 should be mailed to the appropriate IRS service center based on the corporation's location. The current mailing address can be found in the instructions for Form 966.

**State requirements: **In addition to filing Form 966 with the IRS, the corporation may also need to comply with state-specific requirements for dissolution and liquidation. This may include filing similar forms with the state's secretary of state or other regulatory agencies.

How To File Form 966: Offline/Online/E-filing

As of September 2021, you can file Form 966 offline by mail or online through the Electronic Federal Tax Payment System (EFTPS).

Offline filing (mail)

To file Form 966 offline by mail, follow these steps:

a. Obtain the form: Download Form 966 from the official IRS website (www.irs.gov) or request a copy by calling the IRS forms hotline at 1-800-TAX-FORM (1-800-829-3676).

b. Fill out the form: Complete all the required information on Form 966, including the corporation's name, address, employer identification number (EIN), the reason for dissolution/liquidation, and other relevant details.

c. Attach additional documentation: If required, attach any necessary supporting documents, such as resolutions authorizing the dissolution/liquidation.

**d. Sign and date: **Ensure that the form is signed and dated by an authorized individual on behalf of the corporation.

e. Mail the form: Send the completed Form 966 and any attachments to the appropriate IRS mailing address. The address can be found in the instructions accompanying the form or on the IRS website.

Online filing (e-filing)

You can use the Electronic Federal Tax Payment System (EFTPS) to submit Form 966 electronically. Here's how:

a. Enroll with EFTPS: If you haven't already, enroll with EFTPS by visiting their website at www.eftps.gov. Provide the required information to set up an account.

b. Access EFTPS: Log in to your EFTPS account using your credentials.

c. Select "Business" and "Form 966": Once logged in, select the "Business" tab, then locate and select "Form 966" from the available options.

d. Fill out the form online: Follow the prompts to complete the Form 966 electronically. Provide all the necessary information as requested.

**e. Submit the form: **After completing the form, review the information for accuracy, and submit it electronically through the EFTPS platform.

Common Mistakes To Avoid While Filing Form 966

When filing Form 966, there are several common mistakes that you should avoid. Here are some of them:

**Incorrect or incomplete information: **Ensure that all the information provided on Form 966 is accurate, complete, and matches the information on other relevant documents. Double-check names, addresses, and other details to avoid errors.

Missing signatures: Form 966 requires the signature of an authorized individual, such as an officer or director of the corporation. Failure to sign the form can lead to its rejection. Make sure the form is properly signed and dated before submitting it.

Incorrect filing status: Verify the correct filing status for your corporation before submitting Form 966. The options include "A corporation adopting a plan of complete liquidation under Section 331," "A corporation merging into a statutory merger under Section 332," and others. Choose the appropriate status based on your situation.

Failure to attach supporting documents: Depending on the circumstances of the corporate dissolution, you may need to attach additional documents, such as a plan of liquidation or a merger agreement. Ensure that you include all the necessary supporting documentation as required by the Internal Revenue Service (IRS).

Missing or incorrect Tax Identification Number (TIN): Provide the correct Tax Identification Number (TIN) of the corporation on Form 966. This is typically the Employer Identification Number (EIN) assigned to the corporation by the IRS. Double-check the TIN to avoid any errors.

Late filing: Be mindful of the filing deadline for Form 966. Generally, it should be filed within 30 days after the adoption of the plan of liquidation or the merger. Failing to meet the deadline may result in penalties or other complications.

Failure to notify state authorities: Remember that filing Form 966 with the IRS does not automatically dissolve your corporation at the state level. Ensure that you comply with the requirements of your state's Secretary of State or other relevant authorities to properly dissolve the corporation in your state.

Conclusion

Form 966 plays a crucial role in the dissolution or liquidation process of a corporation. By filing this form with the IRS, corporations can properly notify the authorities of their intent to dissolve or liquidate, obtain tax clearance, and ensure compliance with tax regulations. It is important to complete the form accurately and within the specified timeframe to avoid penalties and legal complications. If you are considering dissolving or liquidating your corporation, consult with a tax professional or legal advisor to ensure a smooth and compliant process.