- IRS forms

- Form 1095-A

ABCs of Form 1095-A: Health Insurance Marketplace Statement

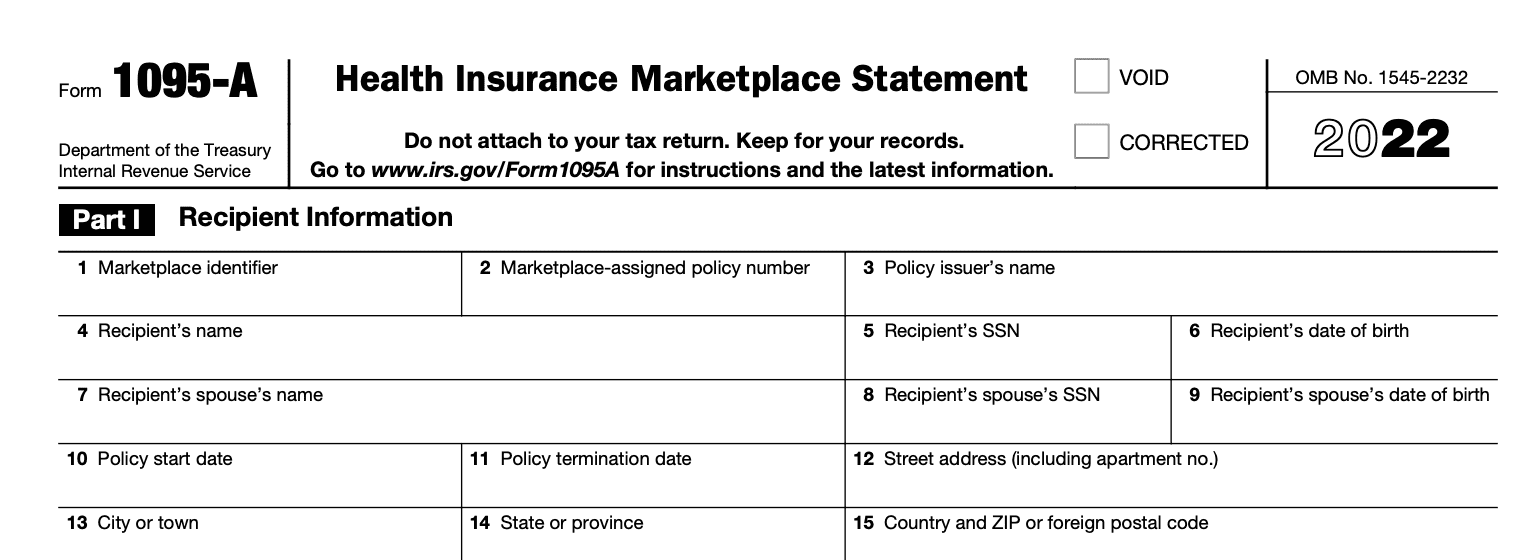

Download Form 1095-AForm 1095-A is a Health Insurance Marketplace Statement that provides important information about your health insurance coverage for the tax year. If you or your family members enrolled in a health insurance plan through the Health Insurance Marketplace, you may receive Form 1095-A. This form is used to report information about your coverage, including the amount of any advance premium tax credits received. It is important to understand how to read and use Form 1095-A when filing your taxes, as it can affect your tax liability.

What is Form 1095-A?

Form 1095-A is a statement that provides information about an individual's health insurance coverage, including the amount of any advance premium tax credits received. This form is issued to individuals who purchased their health insurance through the Health Insurance Marketplace.

Who Needs to File Form 1095-A?

Individuals who enrolled in a health insurance plan through the Health Insurance Marketplace are required to file Form 1095-A. This includes individuals who received advance premium tax credits to help pay for their insurance premiums. Even if you did not receive any tax credits, you still need to file Form 1095-A to report your health insurance coverage to the IRS.

Who will send me my Form 1095-A?

Your 1095-A will be sent to you by the Marketplace, but only if you bought your health insurance through them and received a government subsidy. The IRS will also receive a copy.

**Pro Tip: **If you haven't received your 1095-A by mid-March, you can log in to your Marketplace account or request a copy from them to access a digital version and any other relevant tax forms.

How to file Form 1095-A?

Step 1: Review the Form 1095-A for accuracy

Upon receiving Form 1095-A, the individual should review it for accuracy. Check that the name, address, and social security number of the individual and any covered dependents are correct.

**Part 1: Recipients Information **

This section contains information about the person who enrolled in the Marketplace plan. It includes the name, address, and Social Security number of the individual who received the form. It also includes the name and contact information of the Marketplace where the plan was purchased, as well as the policy number.

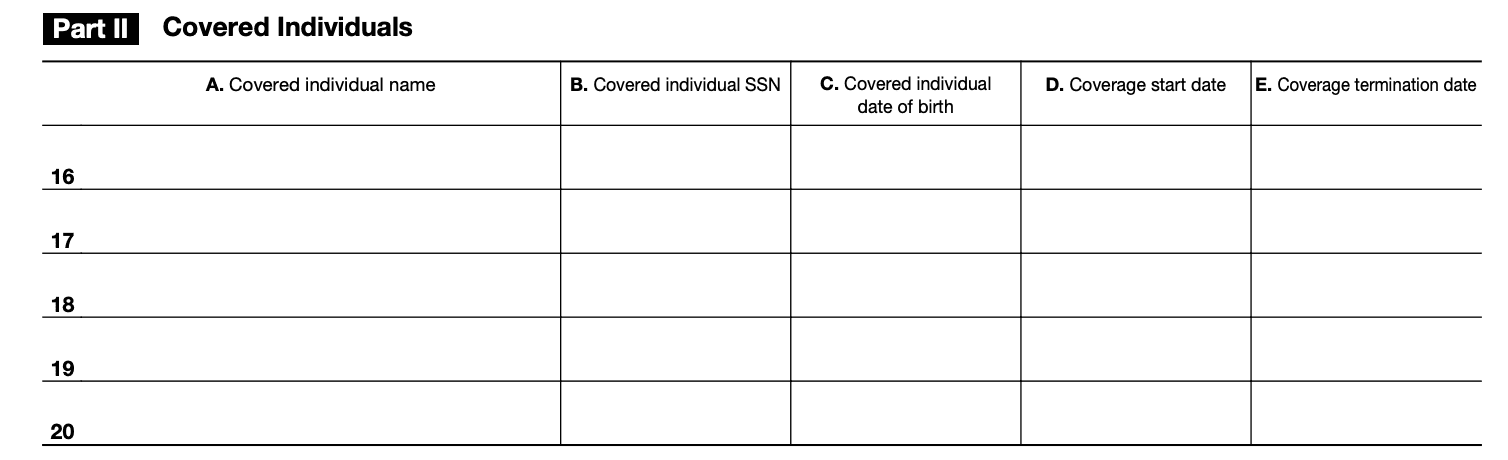

Part 2: Covered Individuals

This section contains information about the individuals covered by the Marketplace plan. It includes the name, Social Security number, and birthdate of each person covered under the policy, as well as the months during which they were covered.

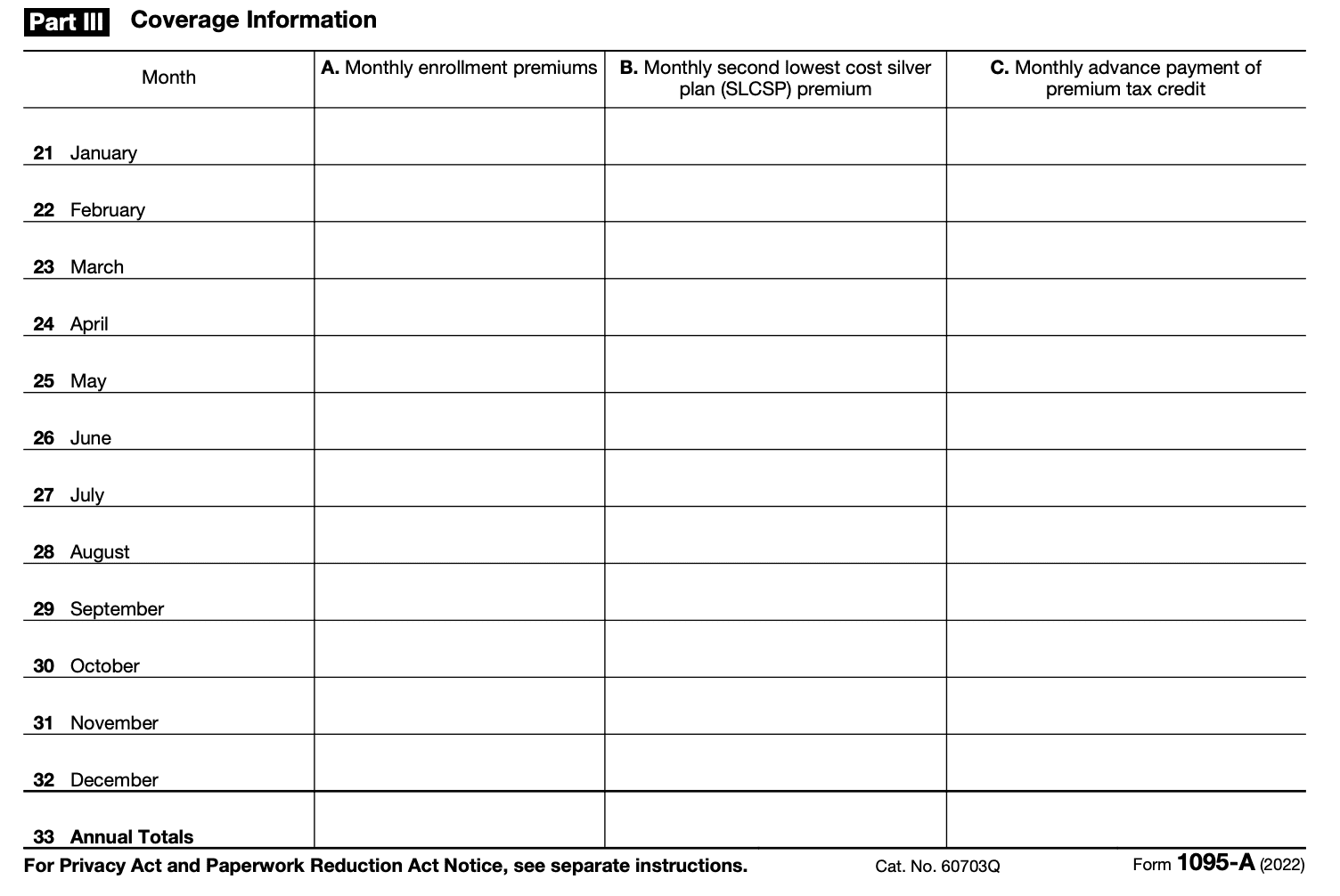

Part 3: Coverage Information

This section contains information about the coverage and premium amounts. It includes the start and end dates of coverage, the monthly premium amount, the amount of any advance premium tax credits received, and the amount of any premium paid by the individual.

Step 2: Determine if the individual is eligible for the premium tax credit

The individual should determine if they are eligible for the premium tax credit. If eligible, the individual can choose to take the credit in advance or claim it on their tax return.

Step 3: Complete Form 8962

If the individual received advance premium tax credits, they must complete Form 8962, Premium Tax Credit (PTC). This form is used to reconcile the advance payments with the actual premium tax credit the individual is eligible for.

Step 4: File Form 1095-A and Form 8962 with the tax return

The individual should file Form 1095-A and Form 8962 with their tax return.

When to file Form 1095-A?

Form 1095-A must be issued to individuals by January 31st of the year following the tax year. The individual must then file Form 1095-A with their tax return.

Correction on Information Reported

If you find out that the information reported on Form 1095-A is incorrect, you should report the corrected information to both the IRS and the recipient as soon as possible. To indicate that the form has been corrected, mark the "CORRECTED" box located at the top of the form.

What is a Void Statement?

A void statement in Form 1095-A refers to a statement that was sent in error for a policy that is not required to be reported on it, such as a standalone dental plan or a catastrophic health plan.

If such an error is discovered, it is important to provide corrected information to both the recipient and the IRS as soon as possible. This can be done by sending a duplicate of Form 1095-A with the VOID box checked at the top of the form.

In simpler terms, a void statement is a Form 1095-A sent by mistake and should be corrected by submitting a new Form 1095-A with the VOID box checked.

What happens if I don't have Form 1095-A when I file my taxes?

If you purchased health insurance through the Marketplace and received a government subsidy, you must have Form 1095-A to file your taxes. If you don't have your Form 1095-A when it's time to file your taxes, you should contact the Marketplace where you purchased your insurance to request a copy.

You can also log in to your Marketplace account and download a digital copy of the form. It's important to note that you cannot file your taxes without this form if you received a government subsidy for your Marketplace insurance plan.

If you are unable to obtain your Form 1095-A before the tax filing deadline, you should file for an extension to avoid penalties for late filing.

How do I reconcile advance premium tax credits on Form 1095-A?

To reconcile advanced premium tax credits on Form 1095-A, you need to complete Form 8962. The purpose of this form is to determine if you received the correct amount of premium tax credits. If the advanced premium tax credit you received was less than the amount you are eligible for, you will receive the difference as a tax refund. However, if the advanced premium tax credit you received was more than the amount you are eligible for, you may have to pay back the excess amount when you file your tax return. Make sure to carefully review the instructions for Form 8962 and seek assistance from a tax professional if you need help with the reconciliation process.

Common mistakes to avoid when filing IRS Form 1095-A:

- Failing to review the form for accuracy: Individuals should review Form 1095-A for accuracy to ensure that all information is correct.

- Not determining eligibility for the premium tax credit: Individuals must determine if they are eligible for the premium tax credit and take appropriate action.

- Not reconciling advance premium tax credits: Individuals who received advance premium tax credits must reconcile them with the actual premium tax credit they are eligible for using Form 8962.

- Failing to file Form 1095-A with tax return: Individuals must file Form 1095-A with their tax return to avoid penalties.

Conclusion:

In conclusion, Form 1095-A is an essential document for individuals who enrolled in a health insurance plan through the Health Insurance Marketplace. This form provides important information about your coverage, including the amount of any advance premium tax credits received. It is important to understand how to read and use Form 1095-A when filing your taxes, as it can affect your tax liability. By following the steps outlined in this blog and avoiding common mistakes, you can ensure that you file Form 1095-A correctly and accurately report your health insurance coverage to the IRS.