- IRS forms

- Form 965-B

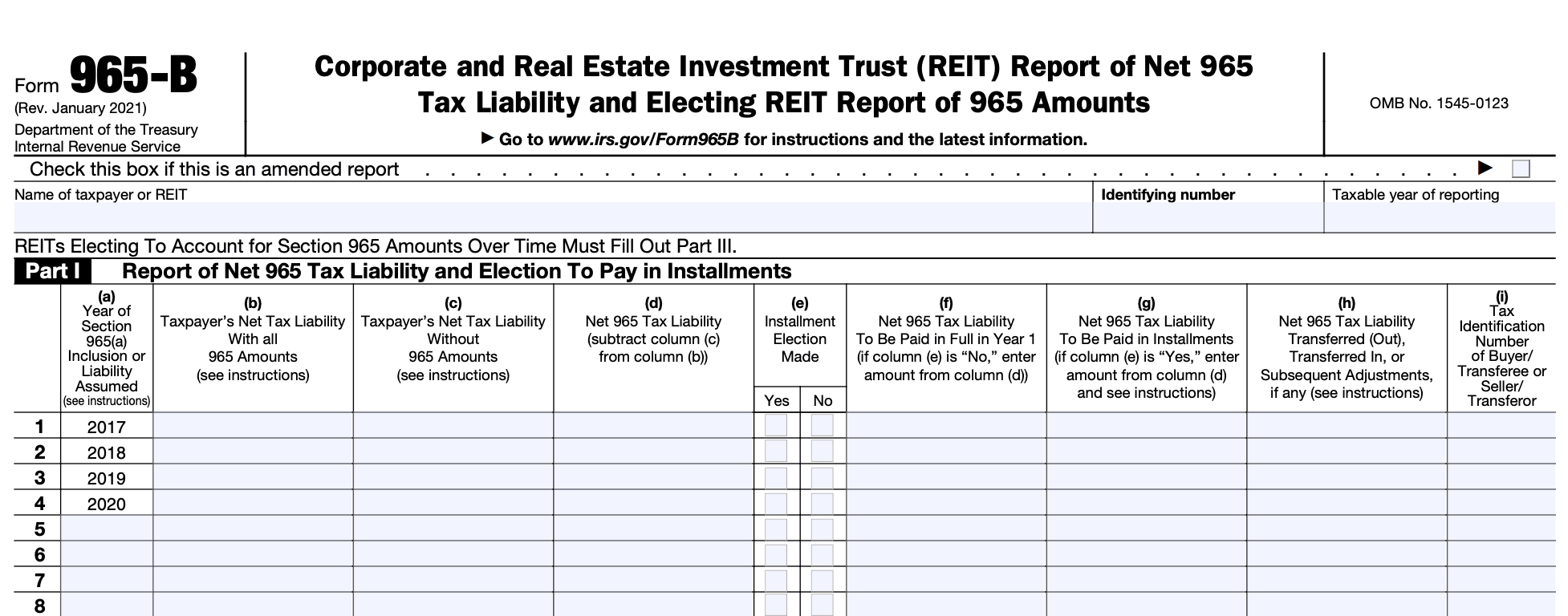

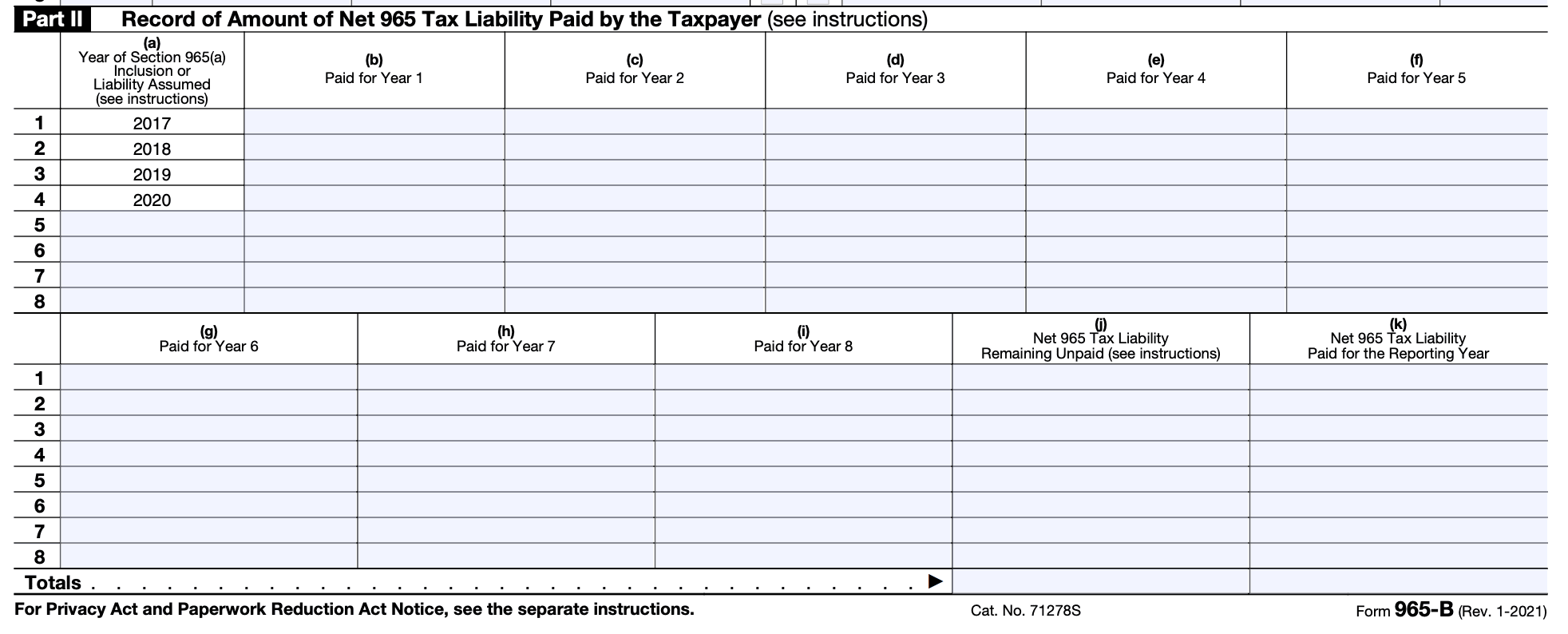

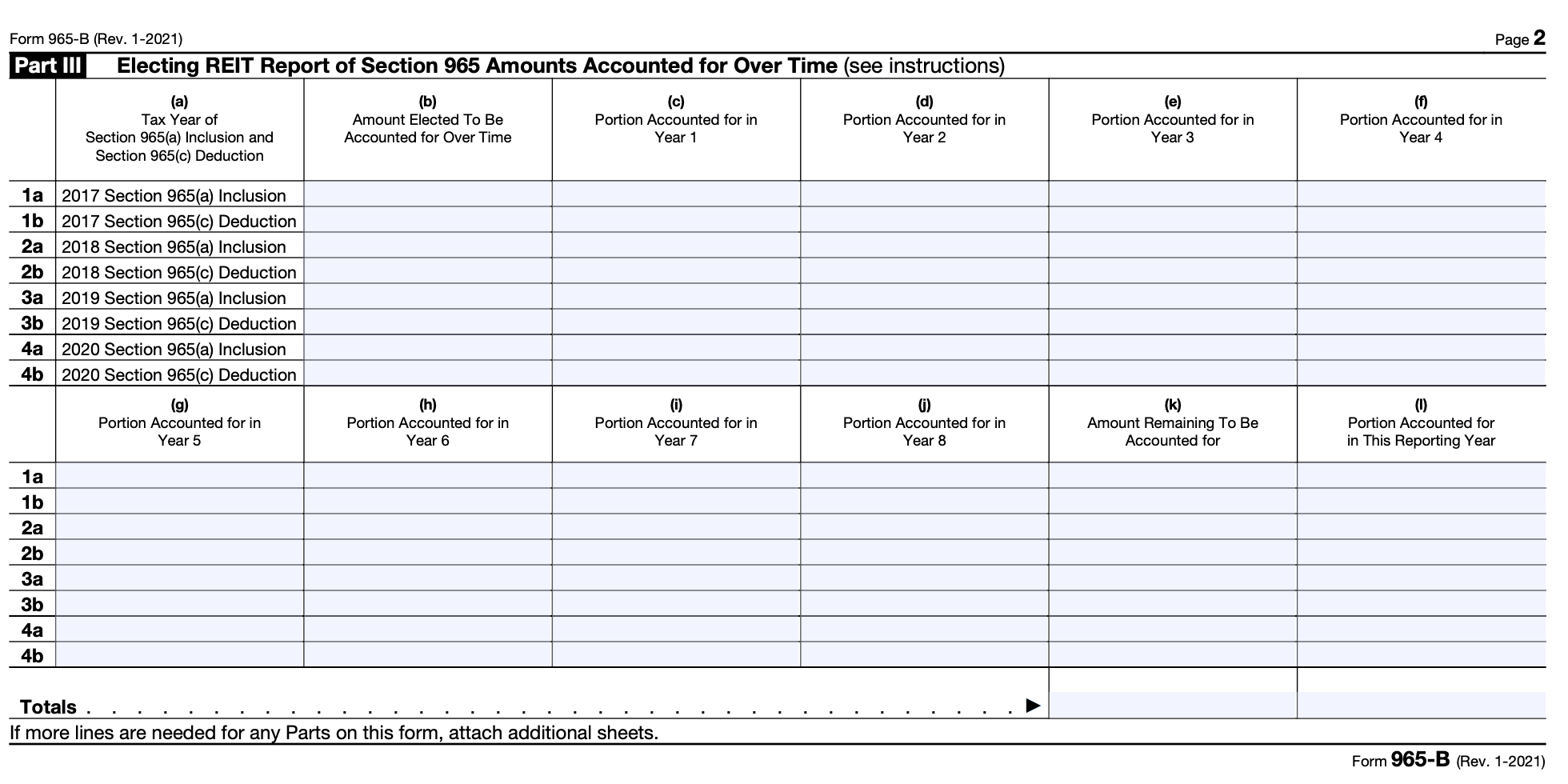

Form 965-B: Corporate and Real Estate Investment Trust (REIT) Report of Net 965 Tax Liability and Electing REIT Report of 965 Amounts

Download Form 965-BIn an effort to revamp the U.S. international tax system, the Tax Cuts and Jobs Act (TCJA) of 2017 introduced several provisions aimed at taxing deferred foreign income. One of these provisions is Form 965-B, also known as the "Transition Tax Statement for the Section 965 Deferred Foreign Income Transition Tax."

The transition tax, as mandated by section 965 of the Internal Revenue Code, targets accumulated earnings and profits (E&P) held by specified foreign corporations (SFCs) as of certain designated dates. It aims to tax the previously untaxed foreign income of these corporations at a reduced rate. The transition tax is a one-time mandatory inclusion that seeks to transition the U.S. international tax system to a territorial regime.

In this blog post, we will delve into the details of Form 965-B, explaining its purpose, requirements, and implications for U.S. taxpayers with certain foreign investments.

Purpose of Form 965-B

The purpose of Form 965-B is to calculate and report the net tax liability of the corporation or REIT under Section 965. The form provides specific instructions and worksheets to determine the amount of income subject to the transition tax, the deductions, and the resulting tax liability.

Additionally, the form also serves as the Electing REIT Report of 965 Amounts. REITs have the option to make an election under Section 965 to pay the transition tax over an eight-year period instead of a one-time payment. Form 965-B is used to report the amounts elected by the REIT for inclusion in their taxable income and the corresponding tax liability for each year of the eight-year period.

In summary, Form 965-B is used to calculate and report the net tax liability under Section 965 for corporations and REITs and to report the amounts elected by REITs for inclusion in their taxable income over an eight-year period. It helps ensure compliance with the tax provisions related to the transition tax on accumulated foreign income.

Benefits of Form 965-B

The benefits of Form 965-B include:

**Transition to a territorial tax system: **The TCJA aims to move the U.S. tax system from a worldwide taxation approach to a territorial system. This means that U.S. corporations will generally only be taxed on their domestic income, and foreign income will not be subject to U.S. taxation. Form 965-B helps facilitate this transition by allowing corporations to pay the transition tax on accumulated foreign earnings.

**Lower tax rate on repatriated earnings: **Under the TCJA, U.S. corporations are required to pay a one-time transition tax on their accumulated foreign earnings. Form 965-B provides a mechanism for calculating and reporting this tax liability. The tax rate for this transition tax is generally lower than the regular corporate tax rate, resulting in potential tax savings for corporations bringing back their foreign earnings to the U.S.

Repatriation of overseas earnings: By completing Form 965-B and paying the transition tax, U.S. corporations can repatriate their previously untaxed foreign earnings to the United States. This allows corporations to access and utilize those funds for various purposes such as investment, research and development, expansion, dividends to shareholders, or debt reduction.

Simplified reporting and compliance: Form 965-B provides a structured and standardized format for reporting and calculating the transition tax liability. By following the guidelines outlined in the form, corporations can ensure compliance with the TCJA provisions and reduce the risk of errors or omissions in their tax filings.

It is important to note that the specific benefits of Form 965-B may vary depending on the individual circumstances of each corporation

Who Is Eligible To File Form 965-B?

The transition tax applies to certain U.S. shareholders of specified foreign corporations.

Eligibility to file Form 965-B depends on the following criteria:

-

U.S. shareholder: You must be a U.S. person, such as a citizen, resident alien, domestic partnership, domestic corporation, or domestic estate or trust.

-

Ownership of specified foreign corporations (SFCs): You must be a U.S. shareholder who owns stock in one or more specified foreign corporations. A specified foreign corporation generally includes any foreign corporation in which a U.S. person owns 10% or more of the total voting power or total value of the corporation's stock.

-

Earnings and profits (E&P): The specified foreign corporation(s) must have accumulated post-1986 deferred foreign income (E&P) that was not previously subject to U.S. tax.

How To Complete Form 965-B: A Step-by-Step Guide

Step 1: Gather the necessary information

Before starting to fill out Form 965-B, make sure you have all the relevant information handy. This may include:

- Deferred foreign income and foreign income taxes related to section 965 previously reported on Form 965-A

- Section 965(c) previously taxed earnings and profits (E&P)

- Net section 965(a) inclusion amount

- Amounts previously paid as section 965(h) installment payments or election to pay in installments

Step 2: Fill out Part I - Election to Pay Net Tax Liability in Installments

If you have elected to pay your net tax liability in installments under section 965(h), you will need to complete Part I of Form 965-B. This section requires information such as the election statement filing year, the amount of net tax liability, and the installment payment schedule.

Step 3: Fill out Part II - Net Tax Liability Under Section 965(b)

Part II of Form 965-B is used to calculate the net tax liability under section 965(b). You will need to provide the necessary information and perform the calculations based on the instructions provided on the form.

Step 4: Fill out Part III - Installment Payment Calculation

If you have elected to pay your net tax liability in installments under section 965(h), you will need to complete Part III. This section requires you to calculate the installment payment amounts based on the information provided in Part II.

Step 5: Fill out Part IV - Reporting of Installment Payments and Election Statement

Part IV is used to report any installment payments made and to provide the election statement information. You will need to enter the details of each payment made and the corresponding amounts.

Step 6: Complete any other required sections and signatures

Make sure to review the form and complete any other necessary sections based on your specific situation. Also, ensure that the form is signed and dated appropriately.

Step 7: Retain a copy for your records and submit the form

After completing the form, make a copy for your records and submit the original form as instructed by the IRS. Keep a record of the submission for future reference.

Special Considerations When Filing Form 965-B

When filing Form 965-B, there are several special considerations to keep in mind:

Eligibility: Form 965-B is generally filed by U.S. shareholders of specified foreign corporations who have a net E&P deficit in the relevant specified foreign corporations' first tax year that includes November 2, 2017.

**E&P deficit calculation: **The form requires the calculation of the E&P deficit for each specified foreign corporation. The deficit is determined by subtracting the aggregate amount of deficits from the aggregate amount of E&P.

**Tax calculation: **The transition tax is calculated based on the E&P deficit of each specified foreign corporation. The tax rate varies depending on whether the E&P is held in cash or other assets. Careful calculations and referencing the instructions are essential to determine the correct tax liability.

Reporting method: The form provides two options for reporting the transition tax liability. U.S. shareholders can choose either the aggregate foreign E&P deficit calculation or the net foreign E&P deficit calculation. Consult the instructions and determine the most appropriate reporting method for your situation.

Record-keeping: It is crucial to maintain accurate records of the E&P calculations, foreign taxes paid or accrued, and any relevant supporting documentation. These records will help support the figures reported on Form 965-B and may be needed for future audits or inquiries.

Deadline and extensions: The deadline for filing Form 965-B is generally the same as the due date for the U.S. shareholder's federal income tax return (including extensions). Ensure you are aware of the specific filing deadlines and any available extensions to avoid penalties for late filing.

Professional assistance: Form 965-B involves complex calculations and requires a thorough understanding of international tax laws. Consider consulting with a qualified tax professional or accountant who specializes in international tax matters to ensure accurate and compliant filing.

How To File Form 965-B: Offline/Online/E-filing

Here's a general overview of filing options:

Offline filing

a. Obtain the physical copy of Form 965-B from the Internal Revenue Service (IRS) website or by requesting it through mail.

b. Fill out the form manually using a pen or typewriter, following the instructions provided.

c. Double-check all the information for accuracy and completeness.

d. Make copies of the completed form for your records.

e. Mail the original form to the appropriate IRS address provided in the form's instructions. It is recommended to send it via certified mail or with a return receipt to have proof of mailing.

Online filing

a. Visit the official IRS website and navigate to the appropriate section for filing Form 965-B online.

b. Depending on the tax software you use, you may need to log in to your tax software account or create a new one.

c. Follow the step-by-step instructions provided by the tax software to complete the form electronically.

d. Review all the information before submitting to ensure accuracy.

e. Submit the form electronically through the tax software platform.

f. Keep a copy of the confirmation or any electronic receipt provided for your records.

E-filing

E-filing generally refers to electronic filing using specialized tax software or online tax service providers. The steps for e-filing Form 965-B are similar to online filing as described above. Ensure that you choose a tax software or service provider that supports the specific form you need to file.

Common Mistakes To Avoid While Filing Form 965-B

When filing Form 965-B, which is used to report deferred foreign income on the transition tax, it's important to be aware of common mistakes to avoid. Here are some key errors to watch out for:

- Incorrect calculations: Double-check all calculations and ensure that you have accurately determined the transition tax liability. Errors in calculations can lead to incorrect reporting and potential penalties.

- Missing or incomplete information: Ensure that you provide all the necessary information required on Form 965-B. This includes details such as taxpayer identification numbers, amounts of deferred foreign income, and any relevant adjustments.

- Incorrect classification of earnings and profits (E&P): It's crucial to properly classify and report the E&P of each specified foreign corporation. Be diligent in determining whether the E&P is previously taxed income (PTI), non-previously taxed income (non-PTI), or any other relevant category.

- **Failure to attach required schedules: **Depending on the specifics of your situation, additional schedules or statements may need to be attached to Form 965-B. Review the instructions thoroughly to ensure you include all the necessary supporting documents.

- **Late or missed filing: **Form 965-B has specific deadlines for filing, and failure to submit it on time can result in penalties and interest. Stay aware of the due dates and make sure to file the form within the prescribed time frame.

- Inaccurate reporting of foreign income: Ensure that the amounts of deferred foreign income reported on Form 965-B are accurate. Use reliable and up-to-date financial records to support the figures reported.

- **Ignoring relevant guidance and updates: **Tax laws and regulations are subject to change. Stay informed about any updates or guidance provided by the Internal Revenue Service (IRS) regarding Form 965-B to avoid potential errors resulting from outdated information.

- Relying solely on this response: While this information provides a general overview, it's essential to consult the official instructions for Form 965-B provided by the IRS. The instructions provide detailed guidance specific to your circumstances, and it's crucial to follow them carefully.

Conclusion

Form 965-B plays a significant role in the reporting and calculation of the transition tax on accumulated foreign earnings for U.S. shareholders. It requires careful consideration of the U.S. shareholder's share of the specified foreign corporation's accumulated earnings and profits. Compliance with the reporting requirements and accurate calculation of the inclusion amount are crucial to avoid penalties and ensure adherence.