- IRS forms

- Schedule D (Form 1040)

Schedule D (Form 1040): Track Your Capital Gains and Losses

Download Schedule D FormIf you have sold any assets such as stocks, bonds, real estate or mutual funds, you may be subject to capital gains tax. The IRS requires you to report your capital gains and losses on Schedule D of Form 1040. Filing Schedule D tax form may seem daunting, but it doesn't have to be. In this guide, we'll take a closer look at what Schedule D is, why you need to file it, and how to do it correctly.

Key Highlights:

- (link: #what-is-schedule-d-tax-form text: What is Schedule D tax form?)

- (link: #why-do-i-need-to-file-schedule-d text: Why do I need to file Schedule D?)

- (link: #what-information-do-i-need-to-complete-schedule-d text: What information do I need to complete Schedule D?)

- (link: #how-to-complete-schedule-d text: What are required documentation for filing Schedule D form)

- (link: #how-to-fill-the-schedule-d-form-1040-step-by-step-guide-and-instructions text: How to fill the Schedule D (Form 1040)-Step by Step Guide and Instructions)

- (link: #tips-for-filling-out-schedule-d text: Tips for filling out Schedule D)

- (link: #how-schedule-d-income-is-taxed text: How Schedule D Income is Taxed?)

- (link: #deadline-for-filing-schedule-d text: Deadline for Filing Schedule D)

- (link: #faqs-for-schedule-d-form-1040: FAQs for Schedule D (Form 1040))

What is Schedule D tax form?

Schedule D is a form used by taxpayers to report their capital gains and losses as part of their annual federal income tax return ((link: https://fincent.com/irs-tax-forms/form-1040 text: Form 1040)) filed with the IRS. Capital gains refer to profits made from the sale of an asset for a price higher than its original purchase cost. Capital losses, on the other hand, happen when an asset is sold for a price lower than its original purchase cost. The IRS Schedule D form is used to report both short-term and long-term capital gains and losses.

Why do I need to file Schedule D?

You need to file Schedule D tax form if you sold any assets during the tax year and realized a capital gain or loss. The Schedule D tax form (Form 1040) is utilized for reporting the following during the tax year:

- Schedule D (Form 1040) is a tax form used to report financial transactions.

- The form is used to report capital gains or losses resulting from the sale of assets in the current tax year.

- Schedule D is also used to report gains from the involuntary conversion of capital assets that are not held for business or profit.

- (link: https://fincent.com/glossary/capital-gains text: Capital gain distributions) not reported directly on Form 1040, or effectively connected capital gain distributions not reported directly on Form 1040-NR, can also be reported on Schedule D tax form.

- Non-business bad debts may also be reported on this form.

The purpose of reporting your capital gains and losses to the IRS is to determine your (link: https://fincent.com/blog/what-is-income-tax-liability-and-how-do-you-calculate-it text: tax liability).

If you have made a (link: https://fincent.com/glossary/profit text: profit) on the sale of an asset, you may owe capital gains tax. Conversely, if you lost money on the sale of an asset, you may be able to deduct that loss from your taxable income, thereby reducing your tax liability.

What information do I need to complete Schedule-D ?

To complete Schedule D, you'll need to gather the following information:

- The date you acquired the asset

- The date you sold the asset

- The sales price of the asset

- The cost or basis of the asset

- Any expenses incurred to sell the asset, such as brokerage fees or commissions

- Any adjustments to the basis of the asset, such as depreciation or amortization

- Any other relevant information, such as whether the asset was inherited or gifted

How to complete Schedule D

- **Determine your gains and losses: **To determine your gains and losses, you'll need to subtract the basis of the asset from the sales price. If the result is a positive number, you have a capital gain. If the result is a negative number, you have a capital loss.

- **Calculate your net capital gain or loss: **If you have multiple capital gains and losses, you'll need to calculate your net capital gain or loss. To do this, you'll need to add up all of your capital gains and subtract all of your capital losses. If the result is a positive number, you have a net capital gain. If the result is a negative number, you have a net capital loss.

- **Determine your tax rate: **Your tax rate will depend on the type of asset you sold and how long you held it. If you held the asset for more than one year, it is considered a long-term capital gain or loss. If you held the asset for one year or less, it is considered a short-term capital gain or loss. Long-term capital gains are taxed at a lower rate than short-term capital gains.

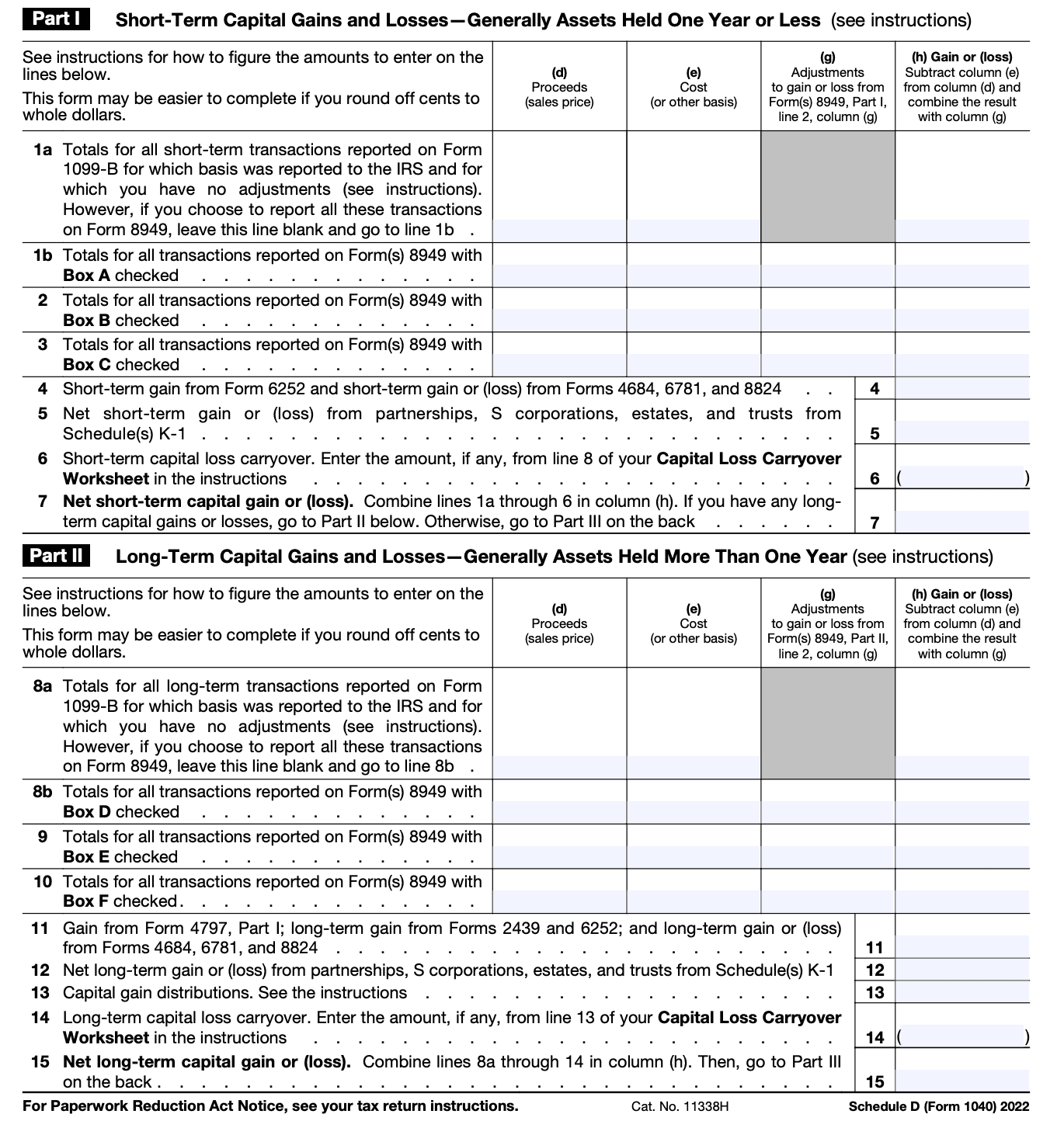

- **Complete Schedule D: **Once you have all of the information you need, you can complete Schedule D. The form is divided into two sections. The first section is for short-term IRS capital gains and losses, and the second section is for long-term capital gains and losses. You'll need to fill out the appropriate section based on the type of gain or loss you have.

How to fill the Schedule D (Form 1040): Step by Step Guide and Instructions

Filling out Schedule D (Form 1040) requires you to report your capital gains and losses from the sale of assets. Here's a step-by-step guide on how to fill out the Schedule-D tax form:

Step-1: Gather all relevant documents

Before you start filling out the form, make sure you have all the necessary documents, including your investment statements, 1099-B forms, and other tax documents that show your capital gains and losses.

Step-2: Complete Parts I and II

Part I is for reporting short-term capital gains and losses, while Part II is for reporting long-term capital gains and losses. You will need to report the date of acquisition, date of sale, proceeds from the sale, and the cost basis for each asset sold.

- **Calculate your total capital gains and losses: **Add up your total capital gains and losses from Parts I and II on Line 6.

- Calculate your net short-term and long-term capital gains and losses: On Lines 7 and 15, calculate your net short-term and long-term capital gains and losses by subtracting your total short-term losses from your total short-term gains, and your total long-term losses from your total long-term gains.

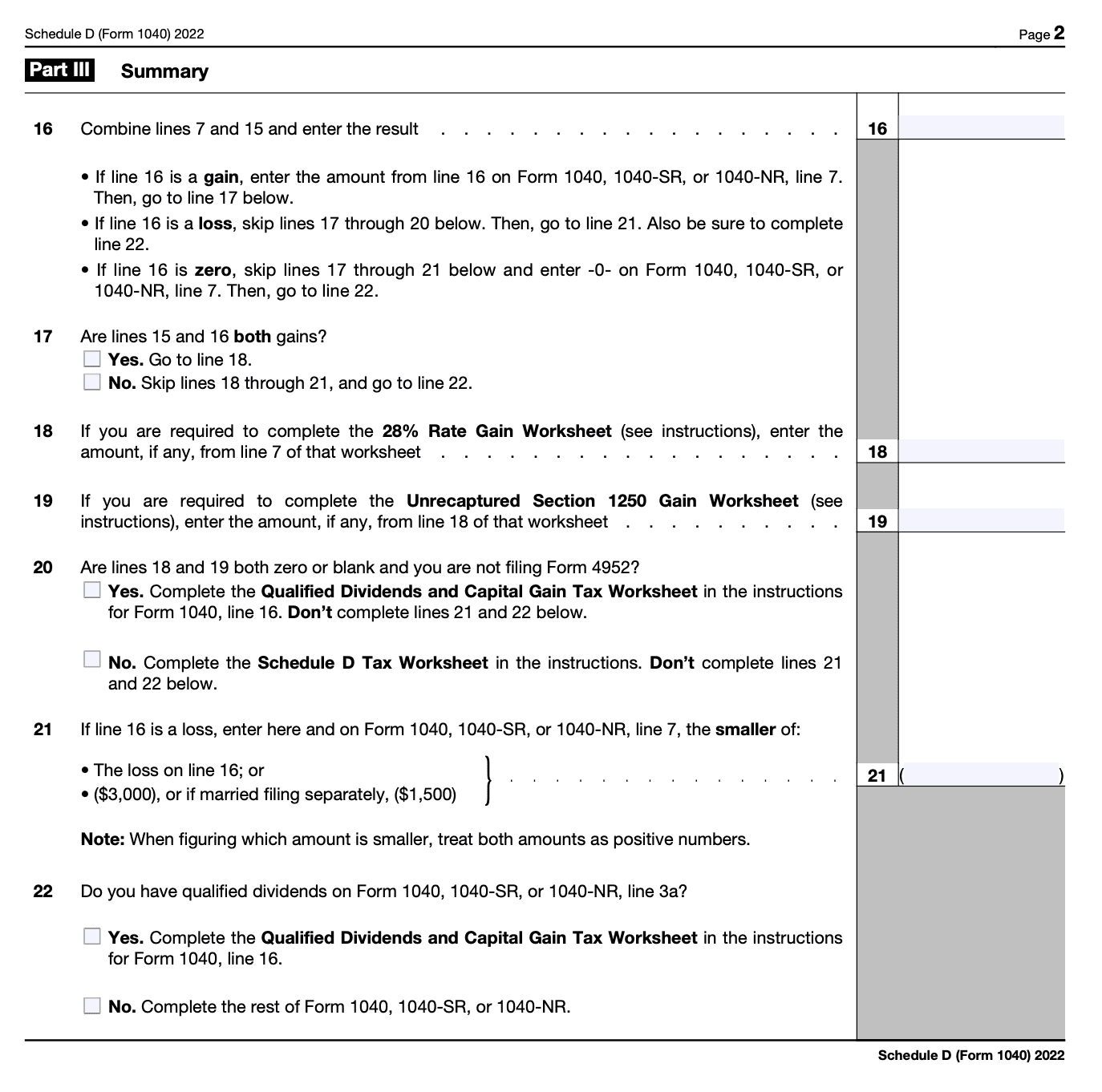

- Calculate your total net capital gain or loss: On Line 16, calculate your total net capital gain or loss by adding your net short-term capital gains or losses to your net long-term capital gains or losses.

Step-3: Complete Part III

Part III is a summary of Parts I and II. Transfer your totals from Line 6, 13, and 16 to the appropriate lines.

- **Check for accuracy: **Review your completed form to ensure accuracy, and double-check all calculations.

- Attach to Form 1040: Once you've completed Schedule D, attach it to your Form 1040 tax return.

Tips for filling out Schedule D

- Keep accurate records: Keep all of your records related to the sale of assets, including purchase and sale receipts, brokerage statements, and other relevant documents. This will make it easier to fill out Schedule D accurately and ensure that you report all of your gains and losses.

- Be aware of wash sales: A wash sale occurs when you sell a security at a loss and then purchase the same or a substantially identical security within 30 days before or after the sale. If you have a wash sale, you cannot deduct the loss on your taxes. Be sure to account for any wash sales when filling out Schedule D.

- Use tax software: Tax software can make it easier to fill out Schedule D and ensure that you don't make any errors. Most tax software will automatically import your investment information and calculate your gains and losses for you.

- **Understand the rules for basis adjustments: **Basis adjustments can affect your capital gains and losses. For example, if you sell a rental property that you've owned for several years, you may need to adjust the basis of the property to account for depreciation. Make sure you understand the rules for basis adjustments so that you can accurately calculate your gains and losses.

How Schedule D Income is Taxed?

- Short-term capital gains are taxed as ordinary income, subject to graduated tax rates.

- Long-term capital gains are taxed at the capital gains tax rate set by the IRS.

- For the tax year 2023, the capital gains tax rate is 15% if your taxable income falls between $44,625 and $492,300 for single filers or between $89,250 and $553,850 for married filers who file jointly.

Deadline for Filing Schedule D

Schedule D must be filed along with your IRS Form 1040 by the tax filing deadline, which is typically April 15th of each year. If you need more time to file, you can request an extension using (link: https://fincent.com/irs-tax-forms/form-4868 text: IRS Form 4868).

Conclusion

Filing Schedule D may seem daunting, but it doesn't have to be. By following the tips outlined in this guide and keeping accurate records, you can ensure that you file Schedule D correctly and avoid any penalties from the IRS. Remember that tax laws can change, so it's always a good idea to consult with a tax professional if you have any questions or concerns. With a little bit of effort, you can successfully navigate Schedule D and take control of your tax liability.

FAQs for Schedule D (Form 1040)

Q: What types of gains and losses are reported on Schedule D?

A: Schedule D is used to report gains or losses from the sale of capital assets, such as stocks, bonds, real estate, and other investments.

Q: How are short-term and long-term capital gains taxed?

A: Short-term capital gains are taxed as ordinary income at graduated tax rates. Long-term capital gains are taxed at the capital gains tax rate set by the IRS, which is generally lower than the tax rate for ordinary income.

Q: Can I deduct capital losses on my tax return?

A: Yes, you may be able to deduct capital losses from your taxable income, subject to certain limitations. If your total capital losses exceed your capital gains for the year, you can deduct up to $3,000 of the excess loss from your taxable income. Any remaining capital losses can be carried over to future tax years.

**Q: Do I need to attach any supporting documents to Schedule D? ** A: You may need to attach certain supporting documents to Schedule D, such as (link: https://fincent.com/irs-tax-forms/form-1099-b text: Form 1099-B), which reports your sales of securities, or Form 8949, which lists the details of each individual sale. It's important to keep accurate records of all your capital gains and losses throughout the year to make filing your tax return easier.

Q: Do I Need to Report Cryptocurrency Transactions on Schedule D?

A: If you trade or use cryptocurrency, you need to report it to the IRS as they consider it like property. To do this, you'll use Form 1040 Schedule D to show any profit or loss you made from buying or selling cryptocurrency.