- IRS forms

- Form 1098-F

IRS Form 1098-F Guide: Reporting Fines & Penalties

Download Form 1098-FThe IRS Form 1098-F is used to report fines, penalties, and other amounts paid to the government for violating the law. If you're a business or individual that has paid these types of fees during the year, you may be required to file this form. In this guide, we'll walk you through everything you need to know about the IRS Form 1098-F, including who needs to file it, how to fill it out, and common mistakes to avoid.

Who Needs to File Form 1098-F?

Form 1098-F (Fines & Penalties) must be filed by a government or governmental entity, including a non-governmental entity treated as a governmental entity, that receives payments for fines or penalties that are deductible under the Internal Revenue Code. This includes entities such as government agencies and courts that collect fines and penalties for violations of the law.

The entity that collects the fine or penalty is required to file Form 1098-F if:

- The payment amount is $600 or more; and

- The payment is deductible under the Internal Revenue Code.

- If the payment is not deductible, then the entity is not required to file Form 1098-F.

It's important to note that only deductible fines and penalties need to be reported on Form 1098-F. Non-deductible fines and penalties do not need to be reported on this form. Additionally, a separate Form 1098-F must be filed for each payer that is a party to the suit, order, or agreement.

**Statements to be furnished to payers: **If you need to file Form 1098-F, you must produce a statement to the payer. This statement should include the amount of the fine or penalty paid and any other relevant information. The statement must be furnished to the payer no later than January 31st of the year following the calendar year in which the payment was received.

**Truncating payer's TIN on statements to payers: **Additionally, filers of Form 1098-F are permitted to truncate the payer's Taxpayer Identification Number (TIN) on the statement furnished to the payer. Truncating means that the filer may only show the last four digits of the TIN. This is done to protect the payer's sensitive information from potential identity theft.

However, it's important to note that truncating the TIN is only allowed on the statement furnished to the payer. The full TIN must be provided on the copy of Form 1098-F that is filed with the IRS. Filers must also include their own TIN on Form 1098-F, and this cannot be truncated.

When to File IRS Form 1098-F?

| Filing Deadline | January 31st of the year following the calendar year in which the fines, penalties, or other amounts were paid |

| Recipient Copy | Must be provided to the recipient by January 31st |

| Paper Filing | February 28th |

| Electronic Filing Deadline

(if more than 250 forms filed) | January 31st of the year following the calendar year in which the fines, penalties, or other amounts were paid |

How to Fill Out Form 1098-F

Filling out Form 1098-F (Rev. 1-2022) can seem daunting, but it's a relatively straightforward process. Here are the 3 steps you need to follow:

Step 1: Gather Information

Before you can fill out Form 1098-F, you'll need to gather some information. This includes the name and address of the recipient (the person or organization that received the fines or penalties), as well as their taxpayer identification number (TIN).

Step 2: 1098-F Copy Versions

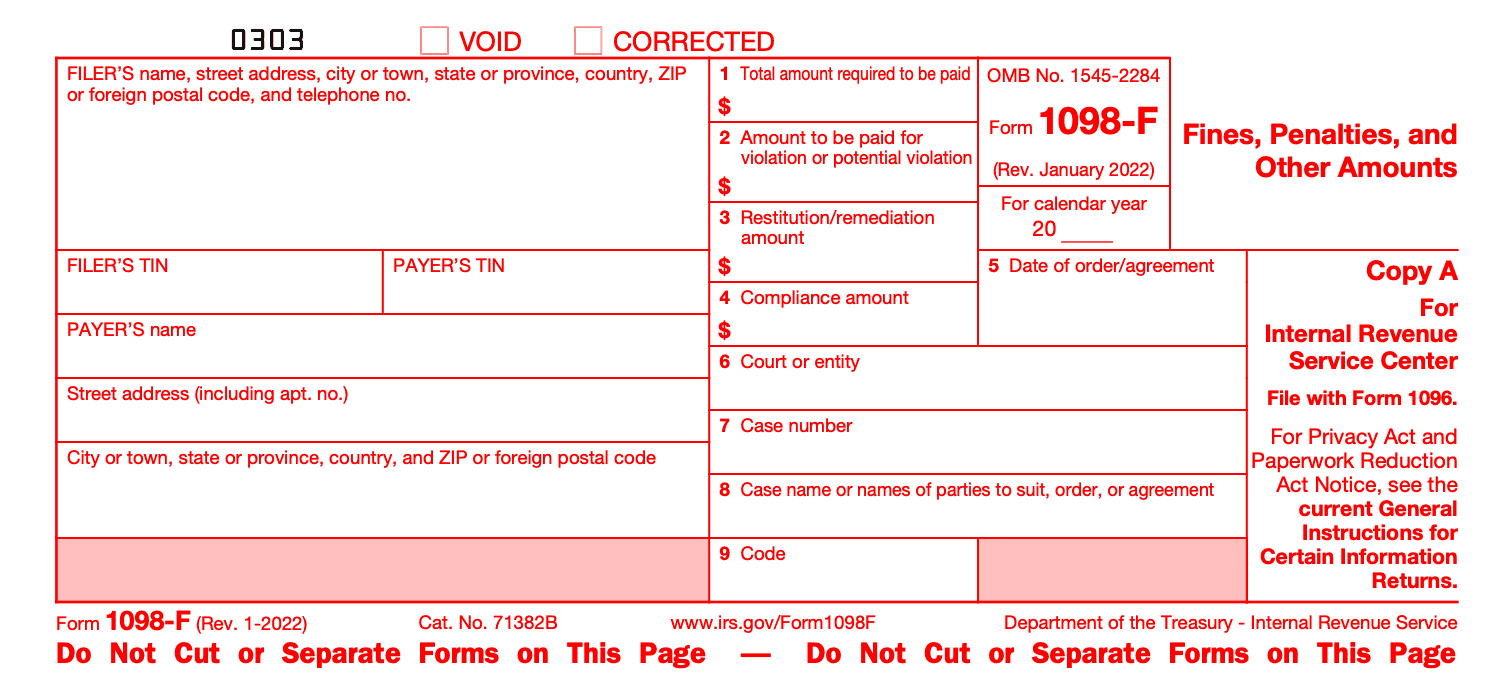

There are actually three versions of Form 1098-F: Copy A, Copy B, and Copy C. Each version is used for a different purpose, such as filing with the IRS, providing to the payer, or keeping for the filer's records.

Copy A for IRS

Copy A is sent to the IRS and is used to report the total amount of fines and penalties assessed and collected during the year. The IRS uses this information to ensure that the correct amount of tax is being paid on these fines and penalties.

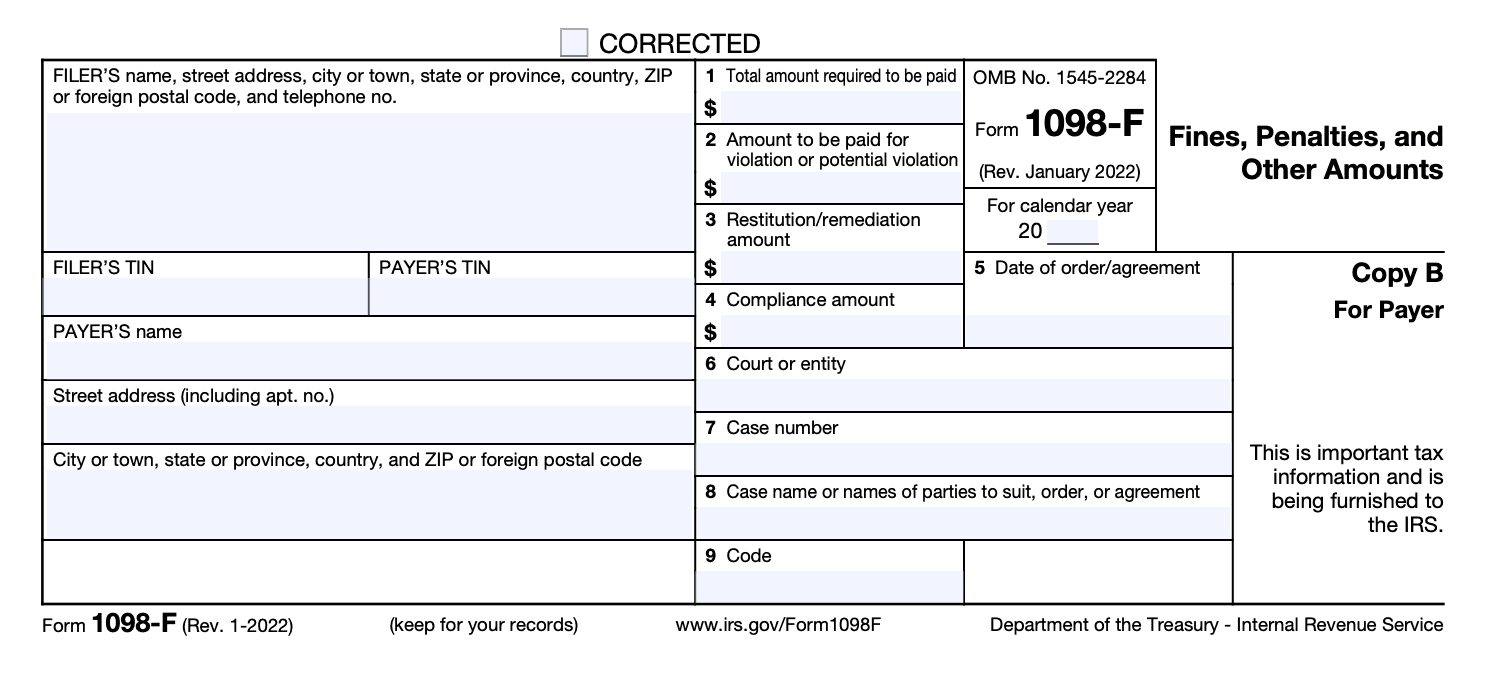

Copy B for payer

Copy B is sent to the person or entity that paid the fine or penalty. It includes the same information as Copy A and is used by the payer to determine if the fine or penalty is deductible on their tax return.

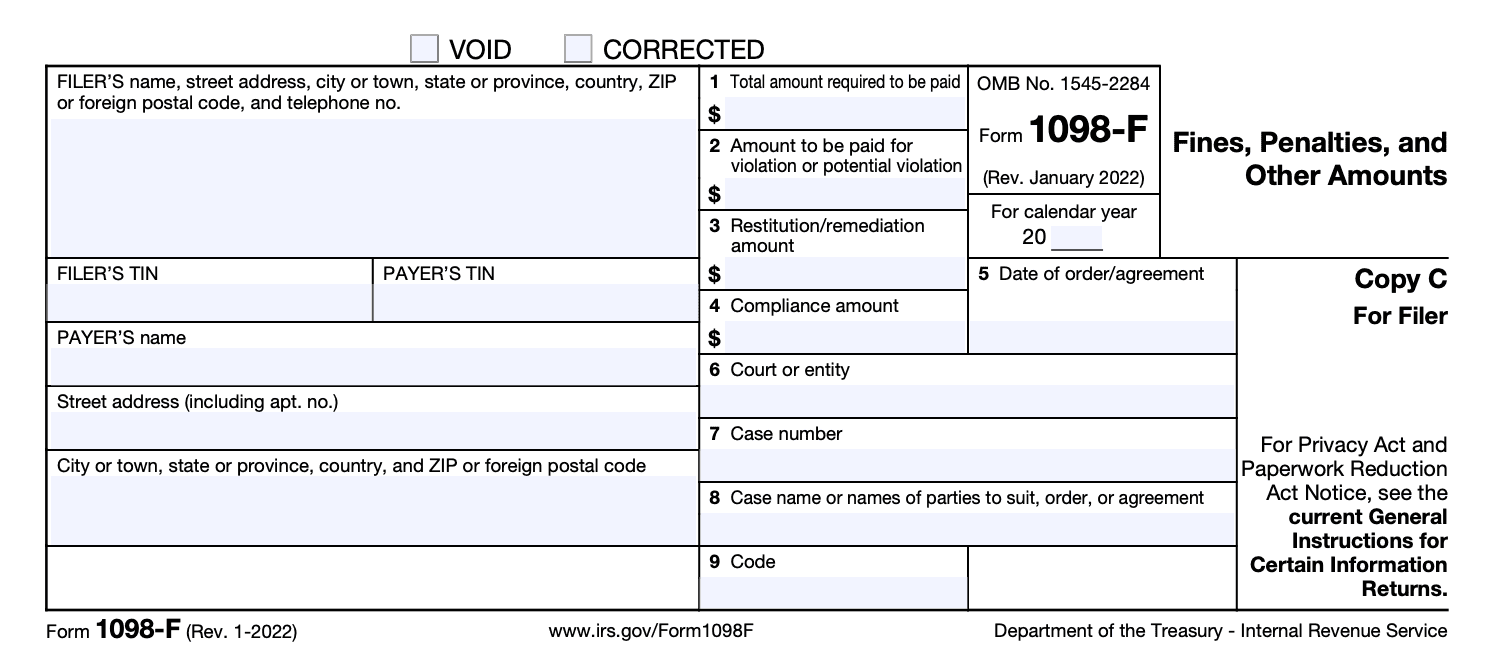

Copy C for Filers

Copy C is kept by the entity that assessed the fine or penalty for their records.

In the above copies there are 16 boxes which are used to report various information related to fines and penalties. The boxes include the date of payment, address, FATCA filing requirement indicator and more. Here we listed some of them in detail:

Box 1: Total amount need to be paid

Box 1 is where you report the total amount of fines, penalties, and other amounts paid to the government during the year. This includes any interest or penalties that were assessed on these amounts.

Box 2: Amount to be paid for violation or potential violation

You should report the type of fine or penalty that was paid. This can include things like traffic fines, environmental fines, labor fines, and more.

Box 3: Restitution / remediation amount

Where you report the date that the fines or penalties were paid. This should be the date that the payment was actually made, not the date that the violation occurred.

Box 4: Compliance amount

Here you report the taxpayer identification number (TIN) of the recipient. This can be either a Social Security number (SSN) or an employer identification number (EIN).

Box 5: Date of order/agreement

Box 5 is where you report the name and address of the recipient.

Box 6: Court or entity

Box 6 is where you enter the name of the court, or any other entity, which entered the order or approved the agreement, that is relevant to the payment.

Box 7: Case number

Box 7 is where you report any account number or other identifying information that is relevant to the payment.

Box 8: Case name or names of parties to suit, order, or agreement

Box 8 is where you provide sase name or names of parties to suit, order, or agreement

Box 9: Code

Box 9 of Form 1098-F provides codes that indicate the nature of the payment. The codes are as follows:

- A: Indicates multiple payments made by the payer

- B: Indicates multiple payers who contributed to the payment

- C: Indicates multiple payees who received the payment

- D: Indicates that the payment was made for the provision of services or property as required by law

- E: Indicates that the payment amount was not identified or could not be determined.

Step 3: Review and Submit Your Form

Before you submit your Form 1098-F, it's important to review it carefully to ensure that all the information is correct. Double-check the spelling of the recipient's name, address, and TIN, as well as the amounts you entered in the boxes.

Once you have reviewed your form, you can submit it to the IRS. If you are filing on paper, mail Copy A to the IRS along with a Form 1096, which is a summary of all the Forms 1098 you are filing. If you are filing electronically, you can submit your form through the IRS's Filing Information Returns Electronically (FIRE) system.

Common Mistakes to Avoid

Filing Form 1098-F correctly is important to avoid penalties and ensure that your tax reporting is accurate. Here are some common mistakes to avoid:

- Failing to report all fines and penalties paid during the year

- Using the wrong TIN for the recipient

- Entering incorrect amounts in the boxes

- Failing to include all required information, such as the recipient's name and address

- Failing to file by the deadline

To avoid these mistakes, make sure to carefully review your Form 1098-F before submitting it. If you are unsure about any aspect of the form, consult with a tax professional or the IRS for guidance.

Hidden things to know about Form 1098-F:

Here are some hidden things about Form 1098-F (Form 1098-F for Fines & Penalties) that you may not know:

- Limited Deductibility: While some fines and penalties are tax-deductible, not all of them are. It's important to consult with a tax professional to determine which fines and penalties are eligible for deduction.

- Non-FATCA Filing: The FATCA Filing Requirement Indicator on the form is only relevant for entities that are subject to the Foreign Account Tax Compliance Act. If the entity is not subject to FATCA, the box can be left blank.

- Penalties for Late Filing: The penalties for late filing can be significant, so it's important to file the form on time to avoid these penalties.

- Legal Actions: If the fine or penalty is the result of a legal action, such as a lawsuit or settlement, the court name (box 6) and case number (box 7) must be reported on the form.

- Changes of Address: The form includes a box for indicating whether the payer's address has changed since the last time they received a Form 1098-F. This information can be important for ensuring that future forms are sent to the correct address.

- Assistance: The IRS provides resources and assistance for individuals and businesses who need help with filing Form 1098-F, including instructions, publications, and online tools.

Conclusion

The IRS Form 1098-F is an important form for businesses and individuals who have paid fines, penalties, and other amounts to the government for violating the law. By understanding who needs to file the form, how to fill it out correctly, and common mistakes to avoid, you can ensure that your tax reporting is accurate and avoid penalties.