- IRS forms

- Form 1040

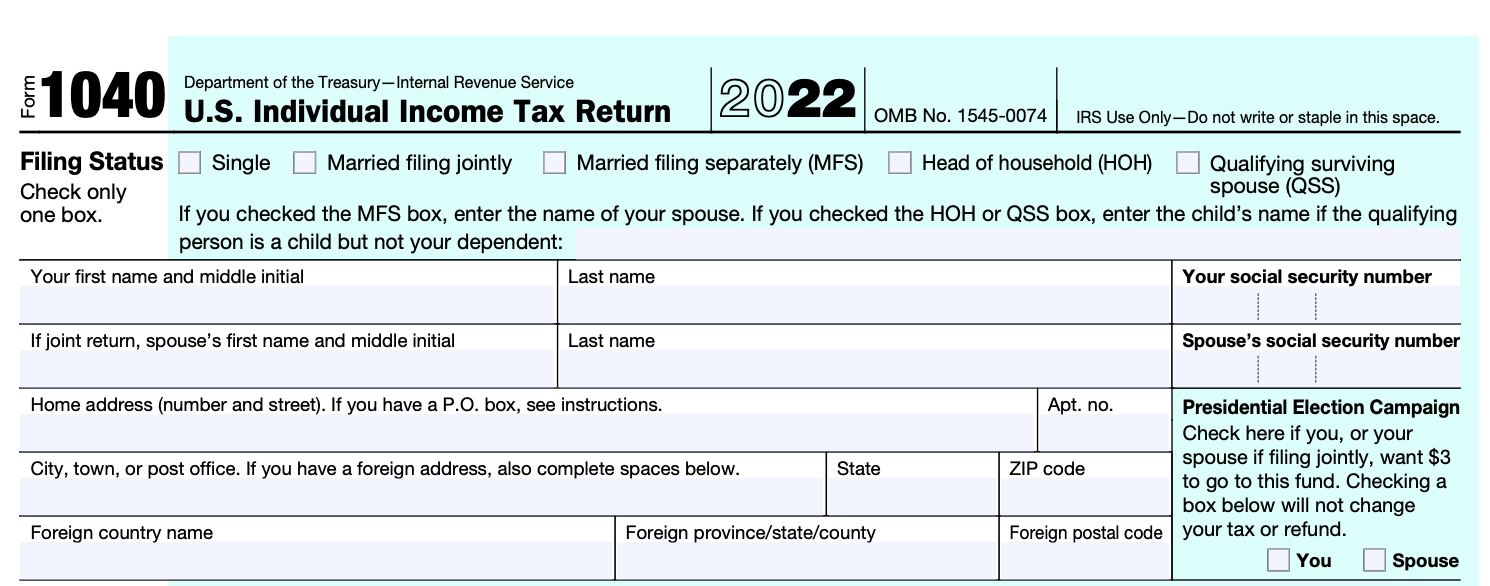

Form 1040, U.S. Individual Income Tax Return

Download Form 1040The U.S. Individual Income Tax Return, commonly known as Form 1040, is the primary document for individual taxpayers to report annual income to the Internal Revenue Service (IRS). It captures essential financial details, deductions, and credits, influencing the calculation of owed taxes or refunds. Accurate completion is crucial for compliance, making it a cornerstone in the annual tax-filing process.

What Is IRS Form 1040?

The IRS 1040 form, or the mother of all tax filing forms, is one of the official documents that US taxpayers are required to use to file their annual tax returns.

The 1040 form is segmented into sections where you categorically input your income and deductions. This will automatically determine the amount of tax you owe or the tax refund you can expect to receive.

Form 1040 is less than two pages long, but you need to attach additional forms (also known as schedules) if you have certain types of income, credits, or deductions.

Before we explore the various types of Form 1040 and the entire filing process, let's look at the new changes made to the form in 2020.

Purpose of Form 1040

Income reporting: IRS Form 1040, also known as the U.S. Individual Income Tax Return, serves as the comprehensive document for reporting various types of income earned by individual taxpayers.

Tax liability calculation: It is the key tool for calculating the total tax liability owed to the IRS based on the reported income, deductions, and tax credits.

Deductions and credits: Allows taxpayers to itemize deductions or claim standard deductions, influencing the taxable income and, consequently, the amount of tax owed.

Filing status determination: Captures information on the taxpayer's filing status, such as single, married, or head of household, affecting the tax rates and deductions applicable.

Credits and payments: Facilitates the claiming of tax credits, reducing the overall tax liability. Additionally, it accounts for any pre-paid taxes through withholding or estimated tax payments.

Income adjustments: Provides sections for reporting adjustments to income, such as student loan interest, IRA contributions, or self-employed health insurance—impacting the final taxable income.

Comprehensive financial overview: Offers a holistic view of an individual's financial situation, aiding in financial planning and budgeting.

Tax compliance: The form ensures taxpayers comply with tax laws, allowing the IRS to assess and collect the correct amount of tax revenue.

Data verification: The IRS utilizes the information provided on Form 1040 to verify the accuracy of reported income against other documents, such as W-2s and 1099s.

Record-keeping: After filing, the completed Form 1040 serves as a record of the individual's financial transactions for the tax year, valuable for future reference and potential audits.

Who Files Form 1040?

The IRS Form 1040 is filed by individual taxpayers in the United States to report their annual income and calculate the income tax they owe or the refund they are entitled to receive. It is the primary form used by U.S. residents, including citizens, residents, and certain non-residents who meet specific criteria, to fulfill their income tax obligations. Different variations of Form 1040, such as 1040A or 1040EZ, were previously available for simpler tax situations, but as of tax year 2018, these have been consolidated into the revised Form 1040.

Do you have to file?

Use Chart A, B, or C to see if you must file a return. U.S. citizens who lived in or had income from a U.S. possession should see Pub. 570. Residents of Puerto Rico can use Tax Topic 901 to see if they must file.

Even if you do not otherwise have to file a return, you should file one to get a refund of any federal income tax withheld. You should also file if you are eligible for any of the following credits.

- Earned income credit

- Additional child tax credit

- American opportunity credit

- Credit for federal tax on fuels

- Premium tax credit

- Credits for sick and family leave

How To Complete Form 1040: Step-by-Step Instructions

Form 1040 can be completed with the steps mentioned below.

Step 1: Gather all of your tax documents

Before you file Form 1040 for your income tax return, you first need to gather all of your tax documents, which include:

- Form W-2, which is used to report wages paid to employees and the taxes withheld from them.

- Form 1099, which is used to record income you received as an independent contractor or through some other source.

Step 2: Provide personal information

This section is where you enter personal details such as your name, address, Social Security number (SSN), and tax filing status. If you have one, you can mention your Individual Taxpayer Identification Number (ITIN) on the SSN line. If you are filing a joint return, you can also include your spouse’s information.

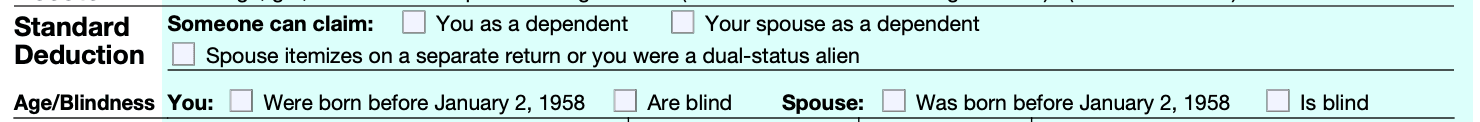

Step 3: Add details of standard deductions applicable

Standard deductions entail the expenses you can subtract from your annual income. This section has seven boxes to help determine the amount of your standard deduction. Check the ones that apply to you.

Step 4: Fill in the “Dependents” portion

Step 4: Fill in the “Dependents” portion

This section is to add your dependents and has room for each of their SSNs, their relationship to you, and a box you can check if the dependent qualifies you for the child tax credit.

Step 5: Calculate your total income

Step 5: Calculate your total income

Lines 1 through 9 are for calculating your total taxable income. Here, you need to input the amount from each type of income line by line. Lines that are not applicable should be left blank.

Lines 10 to 15 ask for additional information as per any actions taken by you or any situations that are applicable to you.

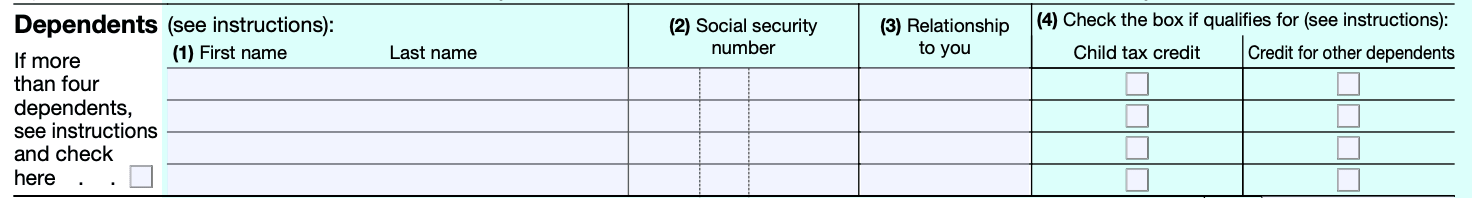

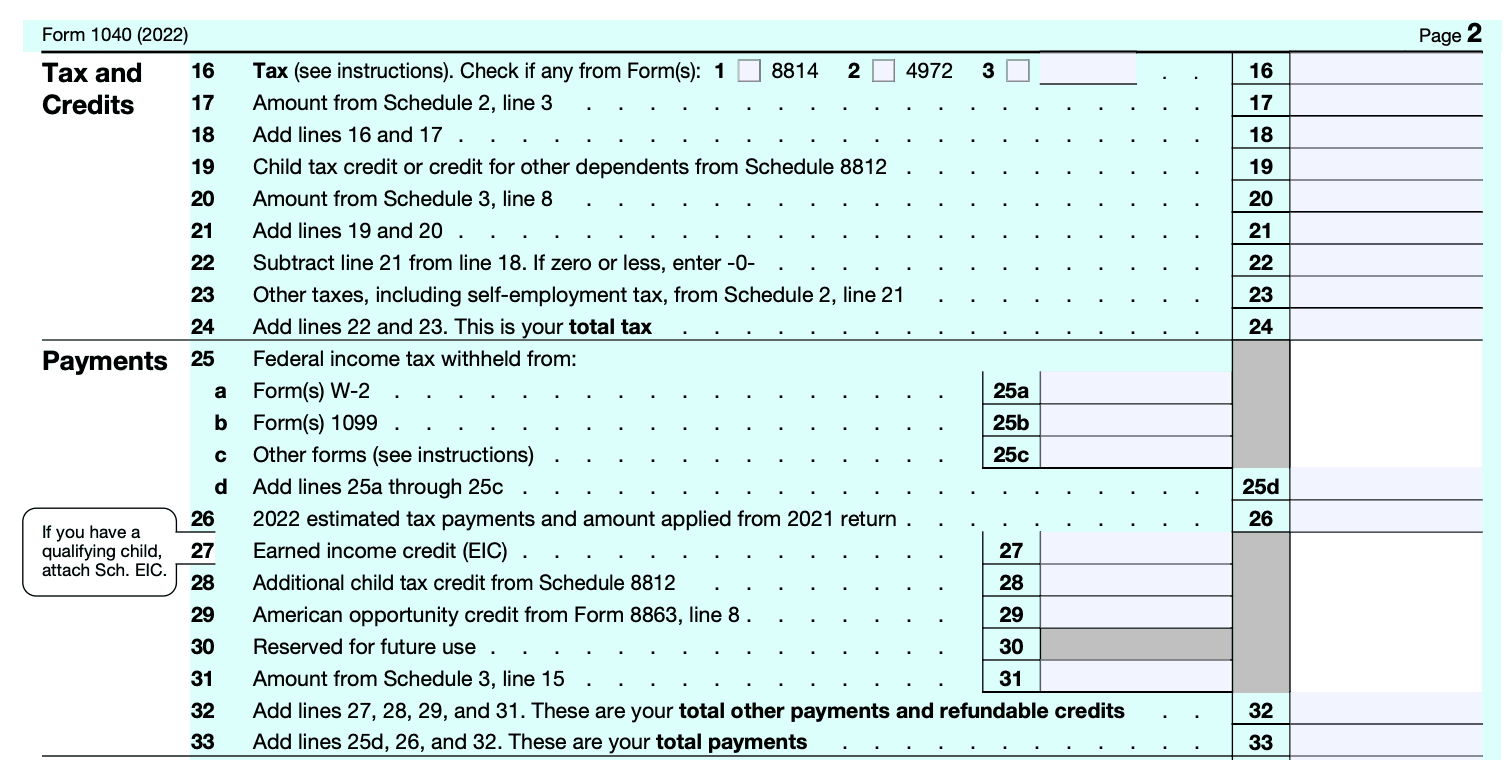

Step 6: Calculating your annual tax bill

Lines 16 through 24 help you calculate your total tax, i.e., the amount you owe in taxes before factoring in certain tax credits. Lines 25 to 33 ask for additional information.

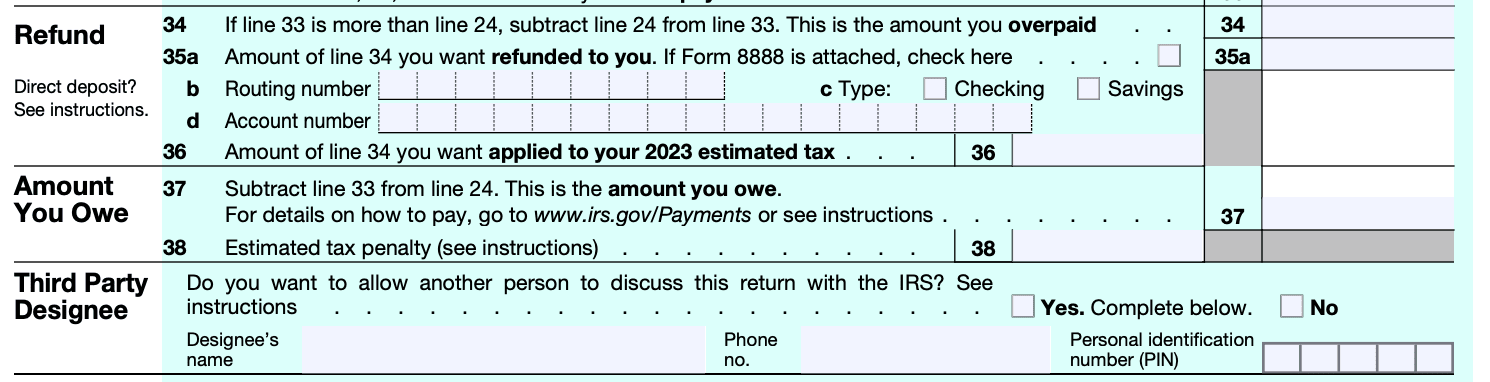

Step 7: Calculating your tax refund or bill

Step 7: Calculating your tax refund or bill

The next five lines are where you calculate the total amount of your refund or tax bill. You will get a refund if line 33 (total tax paid) is more than line 24 (total tax owed).

On line 35, you will input the direct deposit of your refund. Here, you should mention:

- The bank account number

- The bank routing number

- The type of account (checking or saving)

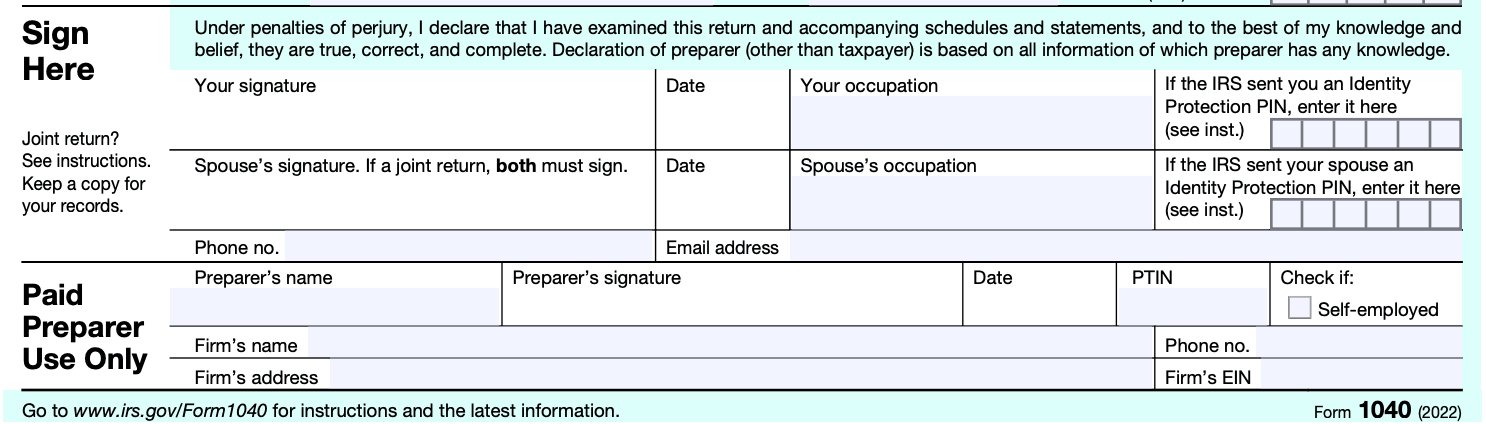

Step 8: Sign and file the form

Understanding the Various Schedules

Lettered schedules

The lettered 1040 schedules you may need to file as a small business owner or self-employed person are:

Numbered schedules

There are three numbered schedules associated with Form 1040.

You’ll attach each schedule with Form 1040 and send them to the IRS. You should file Form 1040 and other tax forms within the tax deadline itself.

The deadline for filing Form 1040 for your tax returns has been extended to May 17, 2021. The quarterly estimated tax payments are still due on April 15, 2021.

Making Corrections After Submitting Form 1040

If you notice any mistakes on the form after you've already submitted it, you can amend your return by filing Form 1040X. It's a quick process where you only update the boxes that will change on the corrected form.

Once Form 1040X has been dispatched, you can check the status of your amended return here.

Conclusion

Form 1040, the U.S. Individual Income Tax Return, is the linchpin of annual tax filings, capturing vital financial details that shape tax obligations. Its purpose spans income reporting, tax liability calculation, and providing a comprehensive financial overview. As taxpayers navigate its sections, understanding deductions, credits, and filing statuses, meticulous completion becomes paramount. Whether you're owed a refund or have a tax bill, the form's meticulous completion ensures compliance.

As tax regulations evolve, staying informed and using resources like Form 1040X for corrections ensures a seamless tax-filing experience.