- IRS forms

- Form 8849

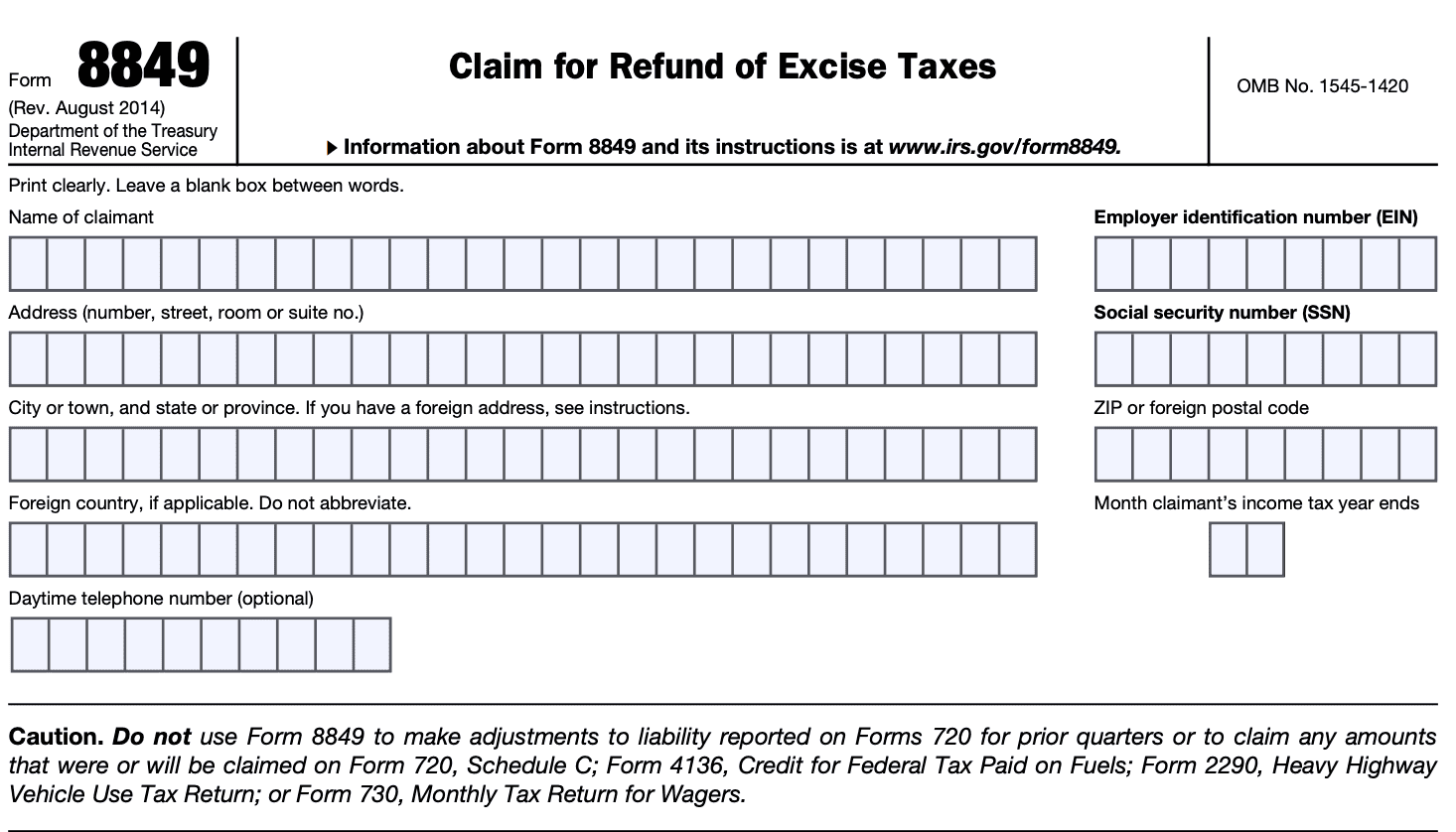

Form 8849: Claim for Refund of Excise Taxes

Download Form 8849When it comes to taxes, many people associate them with income or sales tax. However, there is another category of tax known as excise tax, which is levied on specific goods, activities, or services. If you have paid excise taxes and believe you are eligible for a refund, Form 8849 can be your solution.

Form 8849, also known as the "Claim for Refund of Excise Taxes," is a document issued by the Internal Revenue Service (IRS) of the United States. The form is specifically designed for individuals, businesses, and organizations that want to claim a refund of excise taxes paid on certain goods or activities. The form allows taxpayers to request a refund or credit for various types of excise taxes paid on fuels, such as gasoline, diesel fuel, kerosene, and alternative fuels.

In this blog post, we will explore Form 8849, its purpose, eligibility criteria, and the process to claim a refund of excise taxes.

Purpose of Form 8849

Some common reasons for filing Form 8849 include:

Fuel used in nontaxable situations: If you used taxed fuel in a nontaxable manner, such as for farming purposes, off-highway business use, or for certain types of machinery or equipment, you can claim a refund for the excise taxes paid on that fuel.

Fuels used in government or exempt purposes: Certain government entities or exempt organizations can claim refunds for the excise taxes paid on fuels used for their operations.

Fuel used for exports: If you exported taxed fuel or used it in international aviation or shipping, you may be eligible for a refund of the excise taxes paid on those fuels.

Alternative fuel credits: Form 8849 allows you to claim credits for using certain types of alternative fuels, such as biodiesel, ethanol, or compressed natural gas.

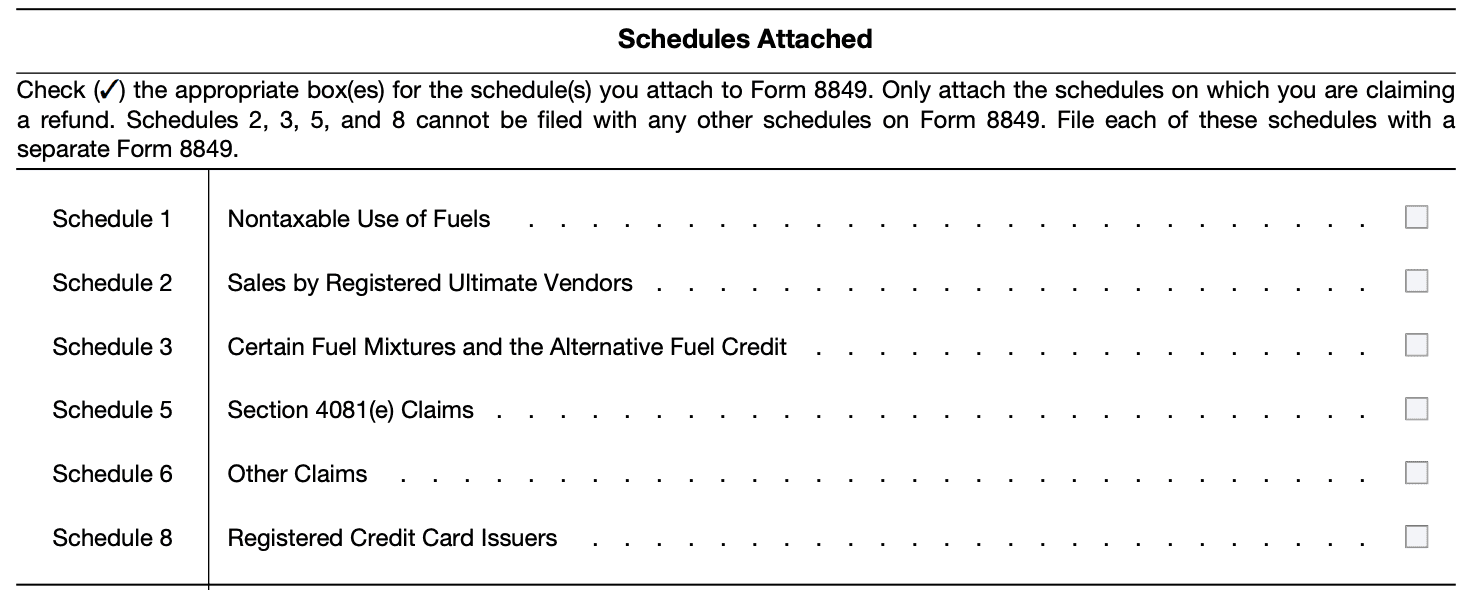

It's important to note that Form 8849 has various schedules and sections, each corresponding to a specific type of refund or credit. Depending on the specific circumstances, you may need to complete different sections of the form to claim the appropriate refund or credit.

Benefits of Form 8849

Here are some of the benefits of filing Form 8849:

Refund of overpaid taxes: If you have overpaid excise taxes, either due to an error or a change in circumstances, Form 8849 allows you to claim a refund for the excess amount. This can help you recoup the money you paid unnecessarily.

Correction of errors: If you made a mistake in paying excise taxes, such as paying for the wrong type of tax or miscalculating the amount, Form 8849 enables you to correct those errors and request a refund. It allows you to rectify any inadvertent errors in tax payments.

Reduction of tax liability: Form 8849 can also be used to claim credits or exemptions that may reduce your overall excise tax liability. By properly documenting eligible claims, you can lower the amount of excise tax you owe, resulting in cost savings for your business.

Compliance with tax regulations: Filing Form 8849 ensures that you are in compliance with the IRS regulations regarding excise taxes. By promptly submitting the form to claim refunds or correct errors, you demonstrate your commitment to fulfilling your tax obligations accurately and in a timely manner.

Potential for future tax planning: By carefully reviewing the excise taxes you have paid and analyzing the reasons for overpayments or errors, you can identify patterns or areas for improvement in your tax planning processes. This can help you minimize future mistakes and optimize your tax strategies.

Who Is Eligible To File Form 8849?

The following entities are generally eligible to file Form 8849:

**Businesses: **Any business entity, including corporations, partnerships, limited liability companies (LLCs), sole proprietorships, and other types of businesses, can file Form 8849 if they have paid excise taxes in excess or erroneously.

**Trucking and transportation companies: **Businesses involved in the trucking and transportation industry may file Form 8849 to claim refunds for certain excise taxes related to fuel used in qualified vehicles, such as heavy trucks and buses.

Fuel producers and blenders: Companies engaged in the production, blending, or sale of various types of fuels, including gasoline, diesel, and alternative fuels, may file Form 8849 to claim refunds for excise taxes paid on these fuels.

Certain nonprofit organizations: Qualified nonprofit organizations, such as schools, colleges, universities, and government entities, may be eligible to file Form 8849 to claim refunds for certain excise taxes paid on fuels used for their exempt purposes.

How To Complete Form 8849: A Step-by-Step Guide

Step 1: Gather necessary information

Collect all the information and documentation you'll need to complete the form, including your taxpayer identification number, tax period, and details of the tax you are claiming a refund or credit for.

Step 2: Download Form 8849

Visit the official website of the Internal Revenue Service (IRS) and locate Form 8849. You can download the form from the IRS website in PDF format.

Step 3: Provide general information

Fill in your name, address, and other general identifying information at the top of the form. Make sure to use your current and correct information.

Step 4: Determine the schedule(s) to include

Form 8849 consists of several schedules, each associated with a different type of tax credit or refund. Review the schedules provided and select the one(s) that apply to your situation. The most commonly used schedules include (link: https://fincent.com/irs-tax-forms/schedule-1-form-8849 text: Schedule 1) (Non-taxable Use of Fuels), (link: https://fincent.com/irs-tax-forms/schedule-2-form-8849 text: Schedule 2) (Sales by Registered Ultimate Vendors), Schedule 3 (Certain Fuel Mixtures and the Alternative Fuel Credit), and Schedule 6 (Other Claims).

Step 5: Complete the selected schedule(s)

For each schedule you selected, fill in the required information. This typically includes details such as the type and amount of tax, the tax period, and the reason for claiming the refund or credit. Provide accurate and detailed information to support your claim.

Step 6: Calculate the refund or credit amount

Using the instructions provided with each schedule, calculate the refund or credit amount you are eligible for. Double-check your calculations to ensure accuracy.

Step 7: Attach supporting documentation

Include any necessary supporting documentation along with your completed Form 8849. This may include invoices, receipts, or other relevant documents that substantiate your claim.

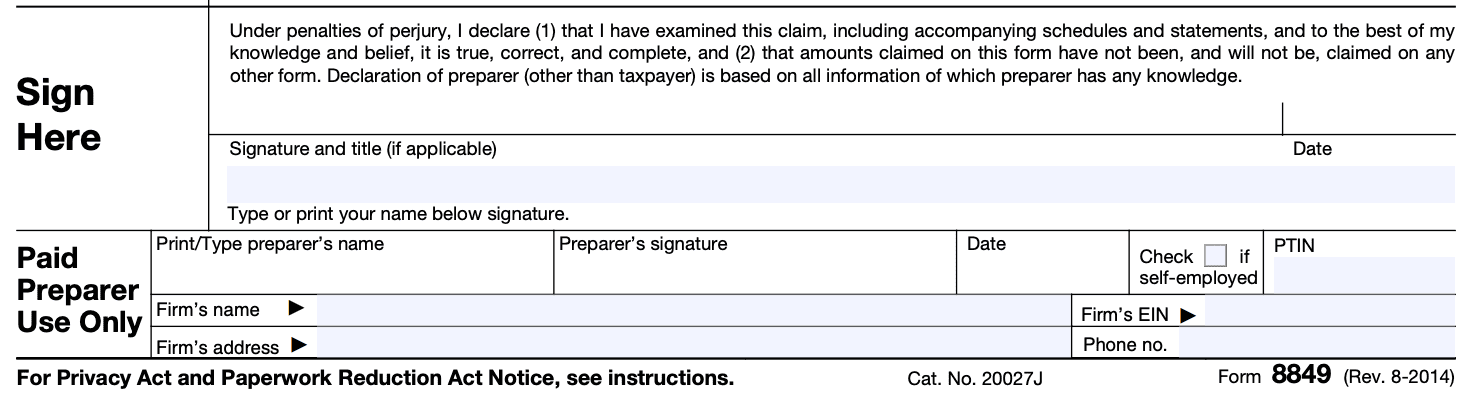

Step 8: Sign and date the form

Ensure you sign and date the form in the designated spaces. Unsigned forms may not be accepted by the IRS.

Step 9: Make a copy for your records

Before submitting the form, make a copy of the completed Form 8849 and all accompanying documents for your personal records.

Step 10: Submit the form

Mail the original Form 8849 and supporting documents to the address provided in the instructions. Alternatively, if electronic filing is available, you may be able to submit your form online through the IRS website.

Special Considerations When Filing Form 8849

Here are some important points to consider:

Eligibility: Form 8849 is used to claim a refund for certain excise taxes, such as those related to fuel, highway use, heavy vehicle use, environmental taxes, etc. Ensure that you are eligible to claim a refund for the specific tax you are seeking a refund for.

**Time limits: **There are specific time limits for filing Form 8849. Generally, the form must be filed within the later of either three years from the date the tax was paid or two years from the date the tax was reported on a quarterly or annual return. Make sure you file within the prescribed time limits.

Correct form: Ensure that you are using the correct version of Form 8849, as the form may have been updated since my knowledge cutoff date in September 2021. Check the official IRS website or consult with a tax professional to obtain the most recent version of the form.

Supporting documentation: Depending on the type of refund being claimed, you may need to attach supporting documentation to substantiate your claim. This could include invoices, receipts, mileage records, or any other relevant documents. Make sure you have the necessary documentation ready before filing.

Identification numbers: Provide accurate identification numbers, such as your Employer Identification Number (EIN) or Social Security Number (SSN), to ensure proper identification and processing of your claim.

Filing method: Determine the appropriate method of filing Form 8849 based on your circumstances. You can file electronically using the IRS e-file system or file a paper return by mail. Note that certain types of claims may require electronic filing.

Schedule 6: Most refund claims on Form 8849 require completion of (link: https://fincent.com/irs-tax-forms/schedule-6-form-8849 text: Schedule 6), Other Claims. Provide accurate and detailed information on this schedule, including the type of tax, the amount claimed, and any supporting details.

**Review and double-check: **Before submitting your Form 8849, review all the information provided to ensure accuracy and completeness. Mistakes or omissions can lead to delays or denials of your refund claim.

Contact the IRS: If you have any specific questions or concerns about filing Form 8849, consider contacting the IRS directly or consulting a tax professional. They can provide guidance based on the most up-to-date information and address any queries you may have.

Filing Deadlines & Extensions on Form 8849

**Filing deadline: **Generally, Form 8849 must be filed by the last day of the quarter following the quarter in which the tax liability arose. The quarters and their corresponding filing deadlines are as follows:

- Quarter 1 (January 1 - March 31): Deadline - April 30

- Quarter 2 (April 1 - June 30): Deadline - July 31

- Quarter 3 (July 1 - September 30): Deadline - October 31

- Quarter 4 (October 1 - December 31): Deadline - January 31 (of the following year)

Form 8849 Tax Extensions: By default, there is no extension available for filing Form 8849. It must be filed by the respective deadline mentioned above. However, there are certain exceptions for certain excise taxes. For example, if you are claiming a refund for the gasoline or diesel fuel used on a farm for farming purposes, you may be eligible for an extension. The extension deadline is six months after the regular due date.

Common Mistakes To Avoid While Filing Form 8849

Here are some mistakes to avoid while filing Form 8849:

Incorrect or outdated form version: Make sure you are using the most current version of Form 8849. The IRS regularly updates forms, so check the IRS website or consult with a tax professional to ensure you have the correct form.

**Incorrect taxpayer identification number (TIN): **Enter your TIN (typically your Social Security number or Employer Identification Number) accurately on the form. Double-check the digits to avoid any errors that could cause processing issues.

Filing the wrong form: Form 8849 is used for specific types of excise tax refunds. Ensure that you are using the correct form for the specific tax you are claiming a refund for. Using the wrong form can lead to delays or rejection of your claim.

Incomplete or missing information: Provide all required information on the form, including your name, address, tax period, and the specific excise tax being claimed. Failing to complete all necessary fields can result in delays or rejection of your claim.

Incorrect calculations: Double-check all calculations to ensure accuracy. Incorrect calculations can lead to inaccurate refund amounts or trigger IRS inquiries. Use the appropriate schedules and worksheets provided with the form to calculate the refund accurately.

**Missing supporting documentation: **Depending on the type of excise tax refund you're claiming, you may need to include supporting documentation with your Form 8849. Review the instructions for the form to determine which documents are required and ensure you include them with your submission.

Late filing: File your Form 8849 by the due date specified by the IRS. Filing late can result in penalties and interest charges, and it may also affect the processing time of your claim.

**Failure to sign the form: **Sign and date the form where indicated. Unsigned forms will not be processed by the IRS. If filing electronically, follow the instructions for electronic signatures.

**Using illegible or incorrect information: **Write or type legibly on the form to ensure that all information is clear and readable. Illegible or incorrect information can cause processing delays or errors.

**Not keeping a copy of the form: **Make a copy of your completed Form 8849 and any supporting documentation for your records. This will help you in case of any inquiries or if you need to reference the information later.

Conclusion

Form 8849, the Claim for Refund of Excise Taxes, offers individuals, businesses, and organizations the opportunity to recoup overpaid excise taxes. By understanding the eligibility criteria, completing the necessary schedules accurately, and providing supporting documentation, you can increase your chances of a successful refund claim.

Remember to stay informed about the IRS guidelines, deadlines, and any updates related to excise tax refunds. If you're uncertain about the process, don't hesitate to consult a tax professional who can provide personalized assistance and ensure compliance with IRS regulations.