- IRS forms

- Form 1040-ES

Guide to Form 1040-ES: Paying Estimated Taxes for Individuals

Download Form 1040-ESWhat is IRS Form 1040-ES?

Form 1040-ES, also called as “Estimated tax for individuals” is an IRS tax form used by individuals who are required to pay estimated taxes on income that is not subject to withholding. This includes self-employment income, interest, dividends, capital gains, and rental income, among others. Estimated taxes are typically paid on a quarterly basis and are used to cover the taxpayer's tax liability for the current year.

Why is Form 1040-ES important?

Filing and paying estimated taxes on time is important for several reasons. First, it helps taxpayers avoid penalties for underpayment of taxes. Second, it ensures that taxpayers are making timely payments toward their tax liability throughout the year, rather than waiting until the end of the year to pay a large tax bill. Finally, it helps taxpayers manage their cash flow by spreading out their tax payments over the year.

Who needs to file Form 1040-ES?

Generally, individuals who expect to owe $1,000 or more in tax for the current year, after subtracting withholding and refundable credits, are required to pay estimated taxes. This includes self-employed individuals, freelancers, independent contractors, and those with significant investment income.

However, there are some exceptions to this rule. For example, taxpayers who had no tax liability in the previous year or who meet certain criteria for agricultural or fishing income may not need to pay estimated taxes.

Household employers

When estimating the tax on your 2023 tax return, include your household employment taxes if you will have federal income tax withheld from wages, pensions, annuities, gambling winnings, or other income, or if you would be required to make estimated tax payments to avoid a penalty even if you didn't include household employment taxes when figuring your estimated tax.

Higher income taxpayers

If your adjusted gross income (AGI) for 2022 was more than $150,000 ($75,000 if your filing status for 2023 is married filing separately), substitute 110% for 100% in (2b) under the General Rule. This rule does not apply to farmers or fishermen.

Note: If you receive salaries and wages, you may be able to avoid making estimated tax payments on your other income by asking your employer to take more tax out of your earnings. To do this, file a new Form W-4, Employee's Withholding Certificate, with your employer.

What Is Included in Form 1040-ES?

Form 1040-ES includes four quarterly payment vouchers and instructions for calculating estimated taxes. The vouchers can be used to make payments online, by phone, or by mail. Taxpayers can also make payments electronically through the Electronic Federal Tax Payment System (EFTPS). The instructions for Form 1040-ES provide information on how to calculate estimated taxes, when to make payments, and how to avoid penalties for underpayment.

How To Calculate Estimated Taxes?

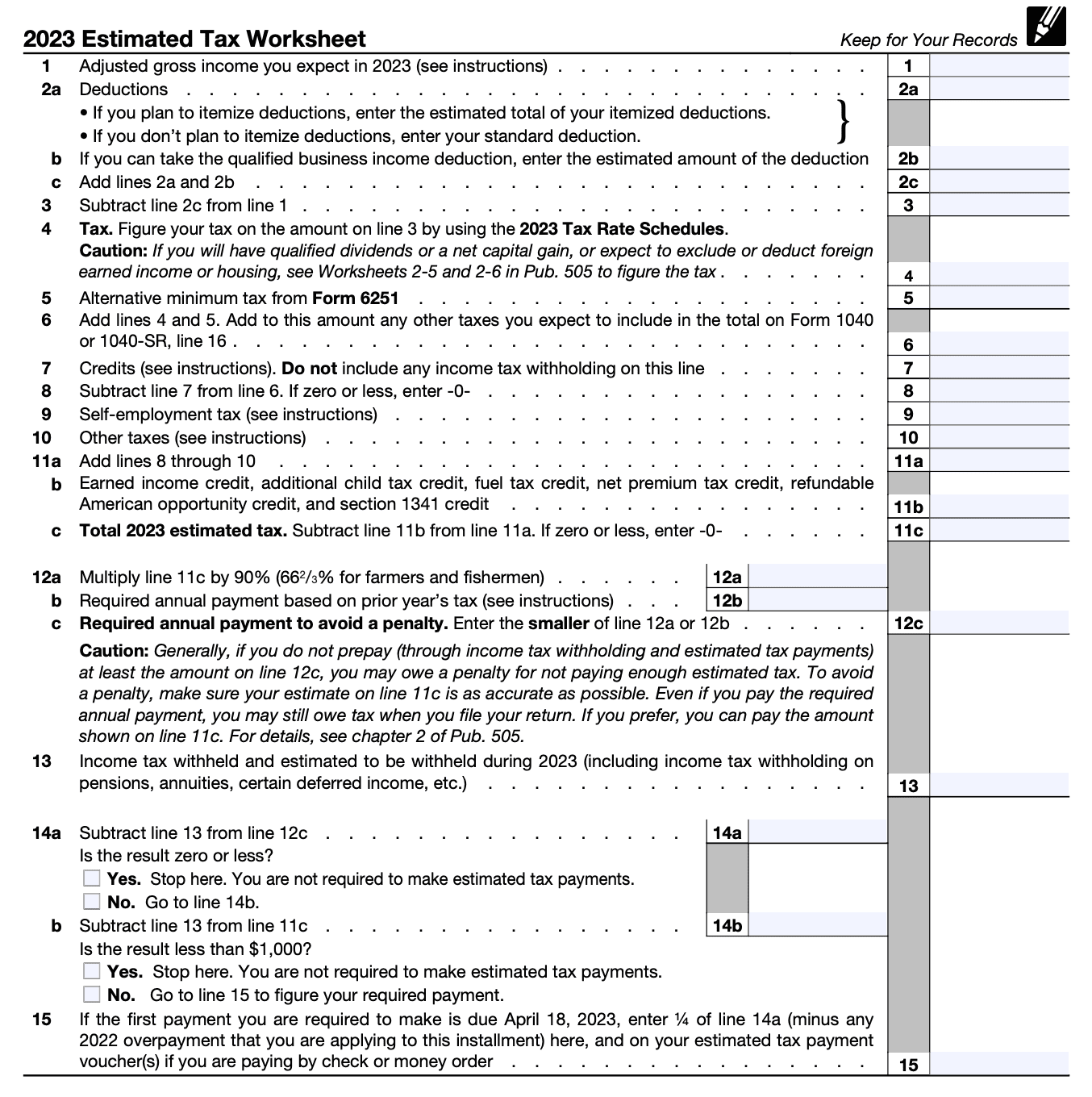

- To calculate estimated taxes, start by estimating your total income for the year, then determine your adjusted gross income (AGI) by deducting applicable adjustments.

- Next, subtract deductions and exemptions to arrive at your taxable income. Use the current tax brackets and rates to calculate your estimated tax liability based on this income.

- Factor in any expected withholding and tax credits throughout the year. Divide your total estimated tax for the year by four to determine the quarterly payments, adjusting if your income changes.

- Consider using Form 1040-ES to assist in these calculations and ensure accuracy in your estimated tax payments, preventing potential penalties and interest for underpayment.

Exceptions to the IRS Form 1040 ES

If you were a U.S. citizen or resident alien throughout 2022 and had no tax liability for the entire 12-month tax year, you are not required to pay estimated taxes for 2023. No tax liability for 2022 means either your total tax amounted to zero or you were not obligated to file an income tax return.

As a U.S. citizen or resident alien with no tax liability in the previous year, you're not required to pay estimated taxes for the current year if you didn't owe any taxes or didn't meet the filing requirement.

Deadlines and Penalties

The deadlines for filing Form 1040-ES and paying estimated taxes are as follows:

| Tax Deadline | Date |

| First quarterly estimated payment | April 17, 2023 |

| Second quarterly estimated payment | June 15, 2023 |

| Third quarterly estimated payment | September 15, 2023 |

| Fourth quarterly estimated payment | January 16, 2024 |

| Form 1040-ES payment deadline | January 16, 2024 |

| Form 1040 filing deadline | April 17, 2024 (May 15, 2024 for residents of Maine and Massachusetts) |

| Form 1040 extension deadline | October 15, 2024 |

It's important to note that if the due date falls on a weekend or a holiday, the deadline is moved to the next business day. Additionally, the estimated tax payments must be made on a quarterly basis. Failure to make these payments on time can result in penalties.

How To Avoid Penalties For Underpayment

- Meet Safe Harbor Rules: Ensure you meet the IRS "safe harbor" rules: a. 90% Rule: Pay at least 90% of the current year’s tax liability. b. 100%/110% Rule: Pay 100% of the previous year’s tax liability (110% if your AGI exceeds $150,000 married filing jointly or $75,000 for other filers).

- Adjust withholding: Increase withholding from your paycheck to cover any underpayment. This might be simpler than making estimated tax payments.

- Pay quarterly: Make estimated tax payments on time and in the correct amounts for each quarterly deadline to avoid penalties.

- Use Form 2210: If you underpaid due to an unexpected situation, like a sudden increase in income late in the year, you might be able to request a waiver or reduce penalties by filing Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts.

How To File Form 1040-ES?

To fill out Form 1040-ES, taxpayers will need to estimate their income and deductions for the current year. This can be done by reviewing previous tax returns and considering any changes in income or expenses. The estimated tax liability is then calculated based on the estimated taxable income, deductions, and tax credits for the year. The instructions for Form 1040-ES provide a worksheet to help taxpayers calculate their estimated tax liability.

Step 1: Gather your financial records

Before you begin filling out Form 1040-ES, make sure you have all the necessary financial records for the year. This includes income statements, expense receipts, and any other financial documents that may be relevant to your tax situation.

Step 2: Determine your estimated income and taxes

Using your financial records, estimate your total income for the year and your total tax liability. This will help you determine the amount of estimated tax you need to pay throughout the year.

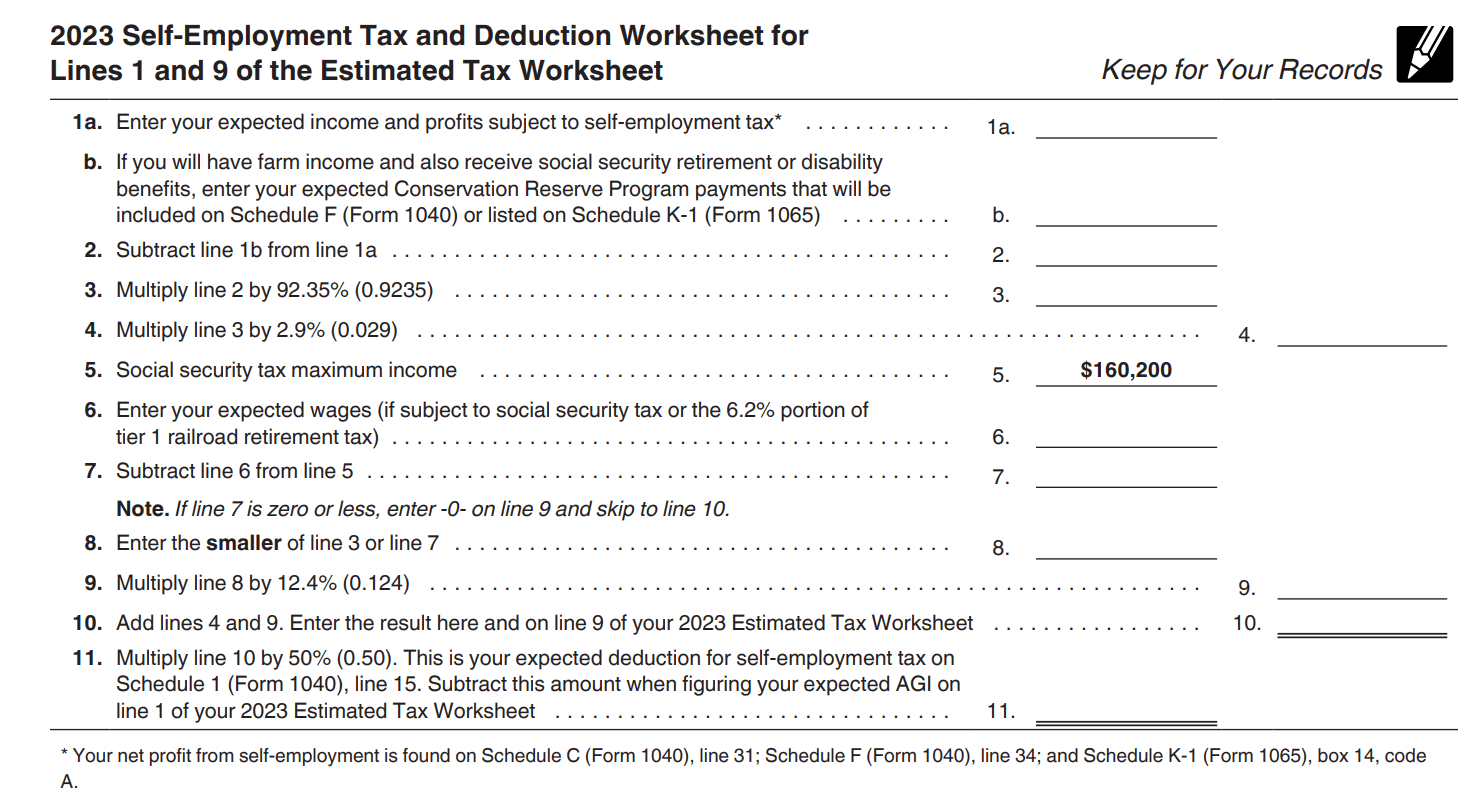

Step 3: Fill out the 2023 Self-Employment Tax and Deduction Worksheet

If you are self-employed, you will need to fill out the Self-Employment Tax and Deduction Worksheet to determine your estimated self-employment tax liability. This worksheet is used to calculate the amount of Social Security and Medicare taxes you will owe on your self-employment income.

Line 1: Adjusted gross income

To find your adjusted gross income for 2023, check out the "What's New" section and look at Pub. 505, chapter 2 for more help on Expected AGI—Line 1. If you work for yourself, remember to take out the self-employment tax deduction and use the 2023 Self-Employment Tax and Deduction Worksheet for Lines 1 and 9 of the Estimated Tax Worksheet. This worksheet also tells you what to enter on line 9 of your estimated tax worksheet.

**Line 7: Credits **

Refer to the 2022 Form 1040 or 1040-SR, line 19, and Schedule 3 (Form 1040), lines 1 through 6z, and the related instructions for the types of credits allowed.

Line 9: Self-employment tax

If you and your spouse want to make joint estimated tax payments and both of you have self-employment income, then figure the self-employment tax for each of you separately. Enter the total on line 9. When estimating your 2023 net earnings from self-employment, use only 92.35% (0.9235) of your total net profit from self-employment.

Step 4: Fill out the 2023 Estimated Tax Worksheet

Next, you will need to fill out the Estimated Tax Worksheet. This worksheet will help you determine your estimated tax liability for the year, taking into account your total income, deductions, and credits.

Keep track of your estimated tax payments using the Record of Estimated Tax Payments form. This form is particularly important for farmers, fishermen, and fiscal year taxpayers, as they may have different payment due dates.

Step 5: Record your estimated tax payments

After calculating your estimated tax liability, you will need to record your estimated tax payments. If you are a farmer, fisherman, or have a fiscal year tax return, see the Payment Due Dates section on the Form 1040-ES for additional information on how to record your estimated tax payments.

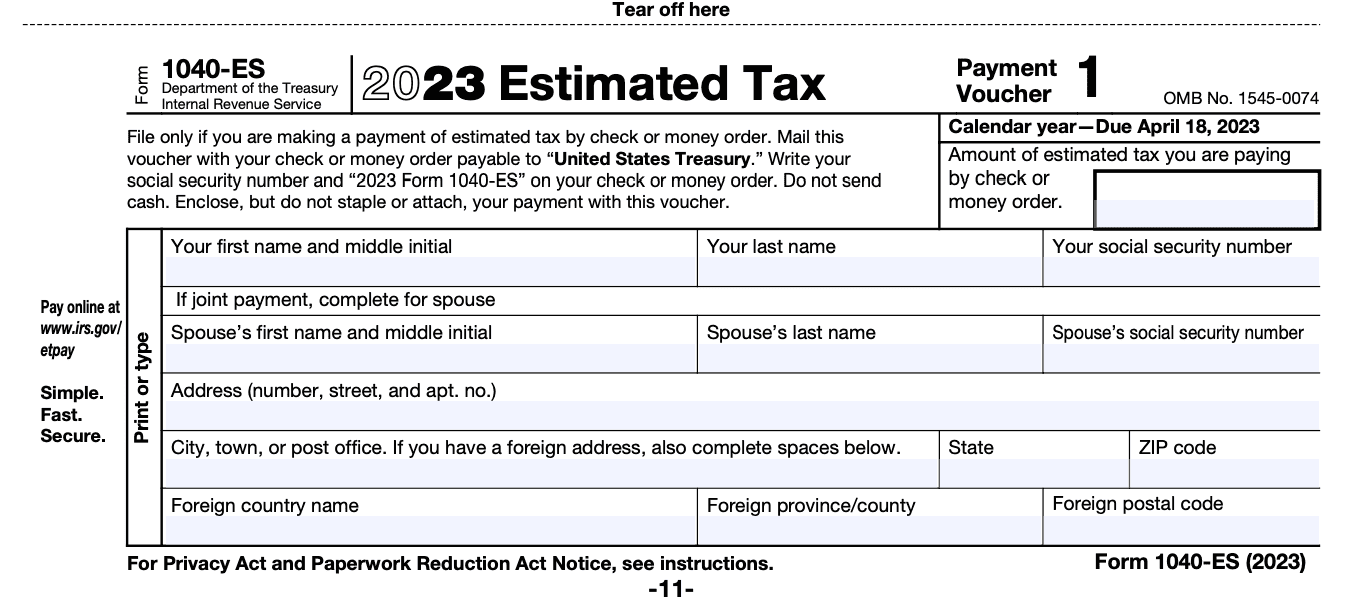

Step 6: Fill out the payment voucher

If you need to make a payment, you can use the Payment Voucher included in Form 1040-ES. There are four payment due dates throughout the year: April 18, 2023, June 15, 2023, September 15, 2023, and January 16, 2024. Be sure to indicate the correct payment due date and the amount you are paying on the Payment Voucher

Please check the IRS form for other payment vouchers.

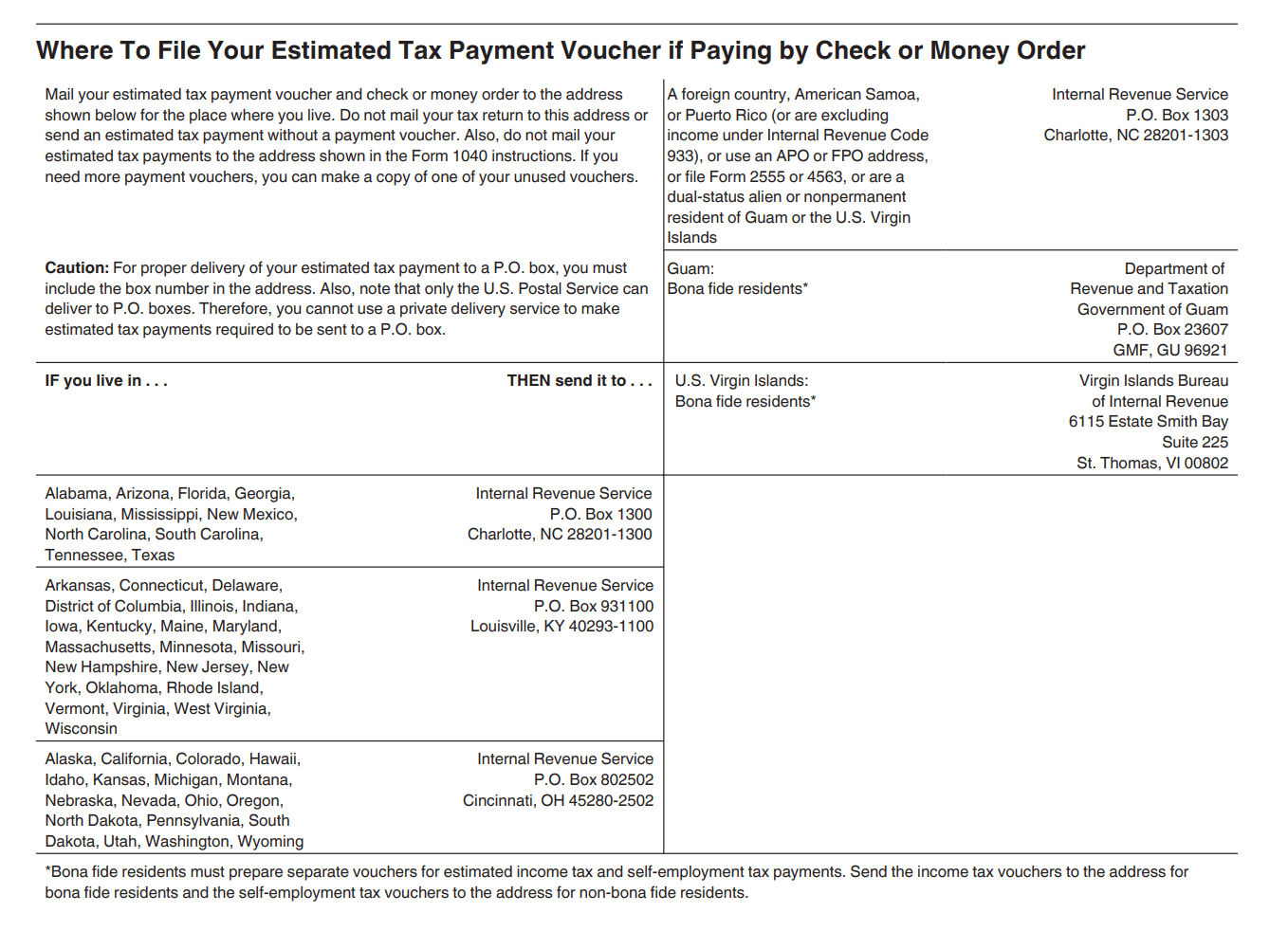

Step 7: Mail your payment and Payment Voucher

Once you have filled out the Payment Voucher and enclosed your payment, mail it to the appropriate address listed on the Form 1040-ES. Be sure to allow enough time for your payment to be received and processed before the due date.

Note: Bona fide residents must prepare separate vouchers for estimated income tax and self-employment tax payments. Send the income tax vouchers to the address for bona fide residents and the self-employment tax vouchers to the address for non-bona fide residents.

How To Make Estimated Tax Payments Using Form 1040-ES

Payment options

Taxpayers have several options for making estimated tax payments. These include:

Online payments: Taxpayers can make payments online using the IRS's Electronic Federal Tax Payment System (EFTPS). To use this system, taxpayers must register online and have a bank account to make payments from.

Phone payments: Taxpayers can also make payments by phone using EFTPS. This option is available 24/7.

Mail payments: Taxpayers can mail in their payment vouchers with a check or money order made payable to the United States Treasury. The payment vouchers include a mailing address for each payment.

Credit or debit card payments: Taxpayers can make payments using a credit or debit card, but they will be charged a convenience fee by the processing company.

Estimated tax payments are due on a quarterly basis, typically on April 15, June 15, September 15, and January 15 of the following year. Taxpayers can choose to make payments more frequently if they prefer. It's important to note that estimated tax payments are based on the taxpayer's income and expenses for the current year, so taxpayers should update their estimated tax payments if their income or expenses change during the year.

General rules to follow while filling out IRS Form 1040 ES:

- Determine if you need to pay estimated tax for 2023. In most cases, you will need to pay estimated tax if you expect to owe at least $1,000 in tax for 2023 after subtracting your withholding and refundable credits, and if you expect your withholding and refundable credits to be less than the smaller of 90% of the tax to be shown on your 2023 tax return or 100% of the tax shown on your 2022 tax return.

- Use the 2023 Self-Employment Tax and Deduction Worksheet for Lines 1 and 9 of the Estimated Tax Worksheet if you are self-employed.

Conclusion

Form 1040-ES is an important tax form for individuals who are required to pay estimated taxes on income that is not subject to withholding. It's important to file and pay estimated taxes on time to avoid penalties for underpayment and manage cash flow throughout the year. Taxpayers can use Form 1040-ES to estimate their tax liability and make quarterly payments using a variety of payment options.

Frequently Asked Questions

Who needs to file Form 1040-ES? Anyone who expects to owe at least $1,000 in federal income tax for the year, after subtracting their withholding and refundable credits, should file Form 1040-ES.

How do I calculate my estimated tax liability? To calculate your estimated tax liability, you will need to estimate your total taxable income for the year and subtract any deductions and credits you expect to claim. You can use the worksheet provided in Form 1040-ES to help calculate your estimated tax liability.

How often do I need to file Form 1040-ES? Form 1040-ES is filed quarterly, with deadlines in April, June, September, and January of the following year.

Can I make estimated tax payments online? Yes, you can make estimated tax payments online through the IRS website using their Electronic Federal Tax Payment System (EFTPS).

Can I adjust my estimated tax payments during the year? Yes, if your circumstances change during the year, you can adjust your estimated tax payments. You can do this by filing a new Form 1040-ES with updated estimated tax payments.

Do I need to file Form 1040-ES if I'm self-employed? Yes, self-employed individuals typically need to file Form 1040-ES. However, there are some exceptions. For example, if you expect to owe less than $1,000 in federal income tax for the year, you may not need to file Form 1040-ES.

Can I use last year's tax return to estimate my estimated tax payments? Yes, you can use last year's tax return to estimate your estimated tax payments.

Do I need to file Form 1040-ES if I have taxes withheld from my paycheck? If you have enough taxes withheld from your paycheck to cover your tax liability for the year, you may not need to file Form 1040-ES. However, if you have additional sources of income or expect to owe more than what is being withheld from your paycheck, you may still need to file Form 1040-ES.

What happens if I don't file Form 1040-ES? If you are required to file Form 1040-ES and fail to do so, you may be subject to penalties and interest on the amount you underpaid.