- IRS forms

- Form 4868

Form 4868: Guide to File a Tax Extension

Download Form 4868If you need more time to file your federal income tax return, you may be able to get an automatic six-month extension by filing Form 4868. This guide will walk you through everything you need to know about Form 4868, including who can use it, how to fill it out, and what to do after you file it.

What is Form 4868 and Who Can Use It?

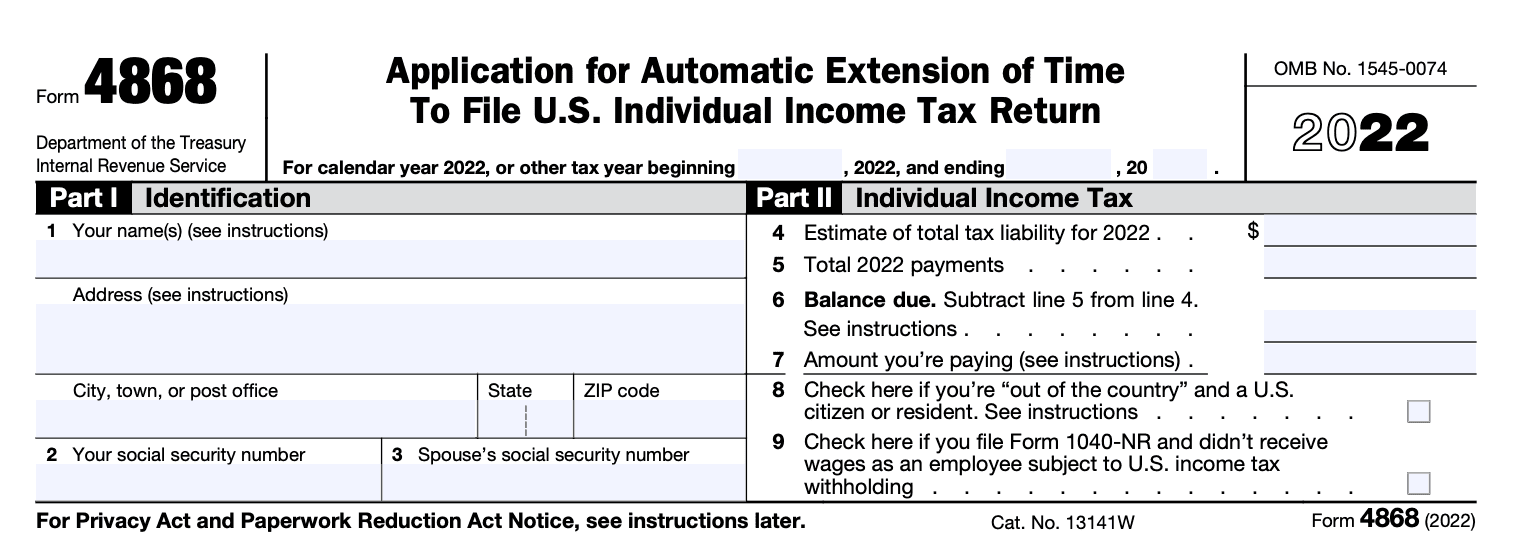

Form 4868, also known as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, is a form that allows individuals to request an extension to file their federal income tax return. Any individual who needs more time to file their income tax return can use Form 4868, including those who are self-employed, those who owe taxes, and those who are not able to file their taxes by the original due date.

Form 4868 serves the following purposes:

- To request an additional six months (four months for taxpayers who are "out of the country") to file the following tax forms: Form 1040, 1040-SR, 1040-NR, 1040-PR, or 1040-SS.

- To extend the time to file the Gift and generation-skipping transfer (GST) tax return (Form 709) for the 2022 calendar year income tax return.

- However, it does not extend the time to pay any gift and GST tax due for 2022. Taxpayers should use Form 8892 to make the payment.

- Failure to pay the amount due by the regular due date for Form 709 will result in interest charges and potential penalties.

- If the donor passed away during 2022, taxpayers should refer to the instructions for Forms 709 and 8892.

When To File Form 4868?

Form 4868 must be filed by the original due date of your tax return, which is typically April 15th for most taxpayers. If the due date falls on a weekend or a holiday, the due date is typically extended to the next business day. If you cannot file your tax return by the original due date, you can request an extension by filing Form 4868.

How to Fill Out Form 4868: Step-by-Step Instructions

Filling out Form 4868 is a relatively simple process. Here are the step-by-step instructions:

- Provide your personal information, including your name, address, and Social Security number.

- Estimate your total tax liability for the year.

- Enter any payments you have already made toward your tax liability.

- Calculate your balance due, if any.

- Determine the amount you want to pay with your extension request.

- Sign and date the form.

Form 4868 is an application for an automatic extension of time to file individual income tax returns. In this guide, we will take you through the process of completing Form 4868.

Part I – Identification:

The first part of Form 4868 requires you to provide your identification details. Here's what you need to do:

- Provide your name(s) and address.

- For joint returns, list both spouses' names in the order they will appear on the return.

- If you have changed your mailing address since your last return, inform the IRS of the change by using Form 8822.

- When filing a joint return, enter the Social Security Number (SSN) of the spouse listed first on the return.

- If you're filing Form 1040-NR as an estate or trust, enter the Employer Identification Number (EIN) on line 2 instead of an SSN.

- If you're a nonresident or resident alien without an SSN or ineligible for one, obtain an Individual Taxpayer Identification Number (ITIN).

- Instructions on how to apply for an ITIN can be found on Form W-7.

Part II – Individual Income Tax:

The second part of Form 4868 is about estimating your total tax liability and payments. Here's what you need to do:

- **Round off dollars **to whole dollars on Form 4868.

- Enter the estimated total tax liability you'll report on your 2022 return on Line 4. If you expect this amount to be zero, enter -0-.

- Enter the estimated total payments you'll report on your 2022 return on Line 5.

- Subtract Line 5 from Line 4 to calculate your balance due on Line 6. If Line 5 is more than Line 4, enter -0-.

- If you can't pay the amount on Line 6, you can still get the extension, but pay as much as you can to minimize interest owed and report the amount you're paying on Line 7.

- If you're out of the country on the regular due date of your return, check the box on Line 8.

- If you're a Form 1040-NR filer who didn't receive wages subject to U.S. income tax withholding and your return is due June 15, 2023, check the box on Line 9.

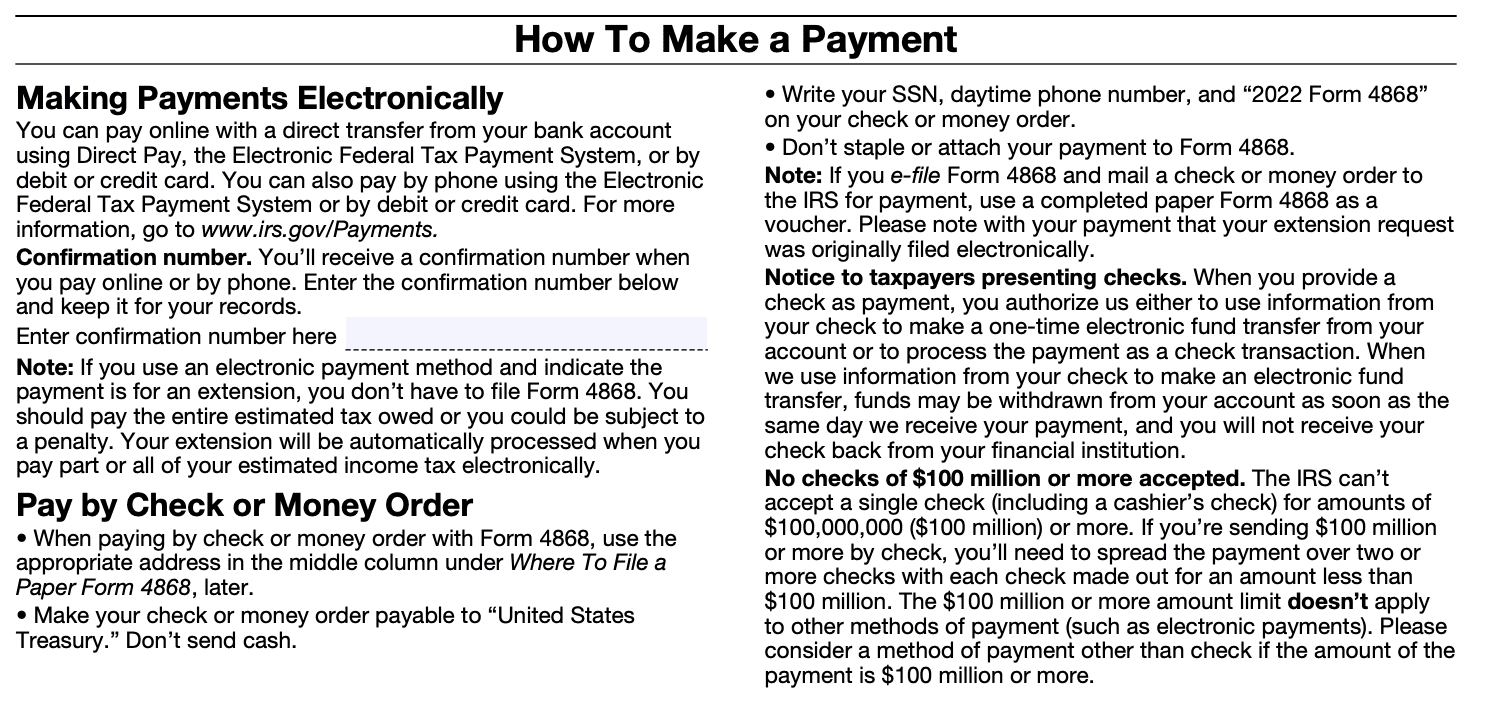

How To Make a Payment

If you owe taxes, you should pay as much as you can with your extension request to minimize interest and penalties. You can make a payment by mailing a check or money order with your Form 4868 or by using the IRS's Electronic Federal Tax Payment System (EFTPS). You can also make a payment by credit or debit card, but keep in mind that there may be a processing fee.

How to Pay by Check or Money Order for Form 4868:

- Use the appropriate address in the middle column under "Where to File a Paper Form 4868" to mail your form.

- Make your check or money order payable to "United States Treasury."

- Write your Social Security Number (SSN), daytime phone number, and "2022 Form 4868" on your check or money order.

- Don't staple or attach your payment to Form 4868.

- If you e-file Form 4868 and mail a check or money order to the IRS, use a completed paper Form 4868 as a voucher and indicate that your extension request was filed electronically.

- Note that when you provide a check as payment, you authorize the IRS to use information from your check to make a one-time electronic fund transfer or process the payment as a check transaction.

- The IRS can't accept a single check (including a cashier's check) for amounts of $100 million or more. If you're sending $100 million or more by check, spread the payment over two or more checks, with each check made out for an amount less than $100 million. The $100 million or more limit doesn't apply to electronic payments. Consider another method of payment if your payment is $100 million or more.

Deadline to File Form 4868 and Request an Extension

Form 4868 must be filed by the original due date of your tax return, which is typically April 15th for most taxpayers. If you cannot file your tax return by the original due date, you can request an extension by filing Form 4868. The deadline to request an extension is also April 15th.

Benefits of Filing Form 4868 and Extending Your Tax Deadline

Filing Form 4868 and requesting an extension has several benefits.

- More time to prepare and file your tax return

- Reduced risk of errors and mistakes due to rushing

- Avoidance of the failure-to-file penalty

- Avoidance of the failure-to-pay penalty if you owe taxes

- Opportunity to review tax-saving strategies and ensure accuracy in your tax return.

Common Mistakes to Avoid When Filing Form 4868

When filing Form 4868, there are several common mistakes to avoid, including:

- Failing to sign and date the form.

- Not estimating your tax liability accurately.

- Not making a payment or underestimating the payment amount.

- Not submitting the form by the due date.

What Happens After You File Form 4868?

After you file Form 4868, you will receive a six-month extension to file your federal income tax return. Keep in mind that filing Form 4868 does not give you an extension to pay your taxes. If you owe taxes, you must make a payment with your extension request to minimize interest and penalties. You will also receive a confirmation notice from the IRS acknowledging that they have received your extension request.

- Extension granted: If your Form 4868 is accepted by the IRS, you will be granted an automatic extension of time to file your tax return. This gives you an additional six months to complete and file your tax return.

- No response: If you don't hear back from the IRS after filing Form 4868, it likely means that your extension has been approved. However, it's always a good idea to double-check with the IRS or your tax professional to confirm.

- Need to pay estimated taxes: Filing Form 4868 does not grant an extension of time to pay any taxes owed. If you owe taxes, you will need to estimate your tax liability and make a payment by the original tax deadline to avoid interest and penalties.

- Late payment penalties: If you owe taxes and do not make a payment by the original tax deadline, you may be subject to a failure-to-pay penalty, which can be as high as 0.5% per month of the unpaid tax amount.

- Amended return: If you discover errors or omissions on your tax return after filing Form 4868, you can still file an amended return before the extended deadline.

How to File Your Tax Return After Requesting an Extension

Once you have filed Form 4868 and received an extension, you have until October 15th to file your federal income tax return. To file your tax return, you will need to gather all of the necessary documents, including W-2s, 1099s, and other income and deduction information. Then, you can file your tax return online using tax preparation software or by mailing a paper return to the IRS.

How To Claim Credit for Payment Made With This Form

If you made a payment with your Form 4868 extension request, you can claim a credit for that payment on your tax return. To claim the credit, you will need to include the payment amount on your tax return and complete the appropriate section of the form.

Other Tax Extension Options for Individuals

In addition to Form 4868, there are other tax extension options for individuals. For example, taxpayers living abroad may be eligible for an automatic two-month extension without filing a form. Military personnel serving in a combat zone may also be eligible for an extension.

IRS Penalties and Interest for Late Tax Filings

If you do not file your tax return by the extended due date, you may be subject to penalties and interest. The failure-to-file penalty is usually 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25%. The failure-to-pay penalty is usually 0.5% of the unpaid taxes for each month or part of a month that the taxes are not paid, up to a maximum of 25%.

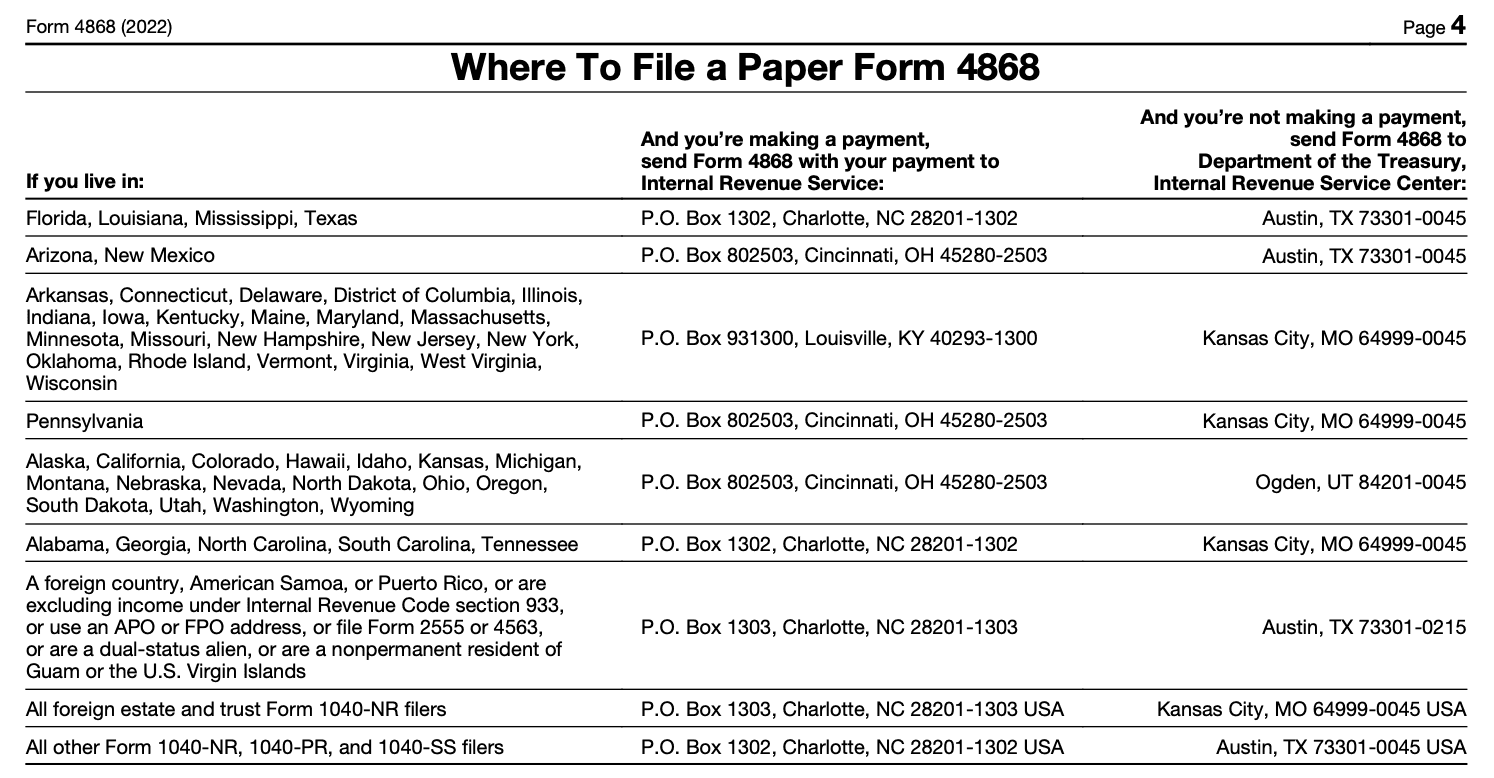

Where To File a Paper Form 4868

If you choose to file a paper Form 4868, you should mail it to the appropriate address based on your location and payment method.

The IRS provides a list of private delivery services on their website.

FAQs about Form 4868 and Tax Extensions

Q: Can I get an extension if I owe taxes?

A: Yes, you can still request an extension even if you owe taxes. However, you must make a payment with your extension request to minimize interest and penalties.

Q: How do I know if my extension request was approved?

A: You will receive a confirmation notice from the IRS acknowledging that they have received your extension request.

Q: Can I still e-file my tax return after requesting an extension?

A: Yes, you can still e-file your tax return after requesting an extension. However, you must file your tax return by the extended due date.

Q: What happens if I don't file my tax return by the extended due date?

A: If you don't file your tax return by the extended due date, you may be subject to penalties and interest.