- IRS forms

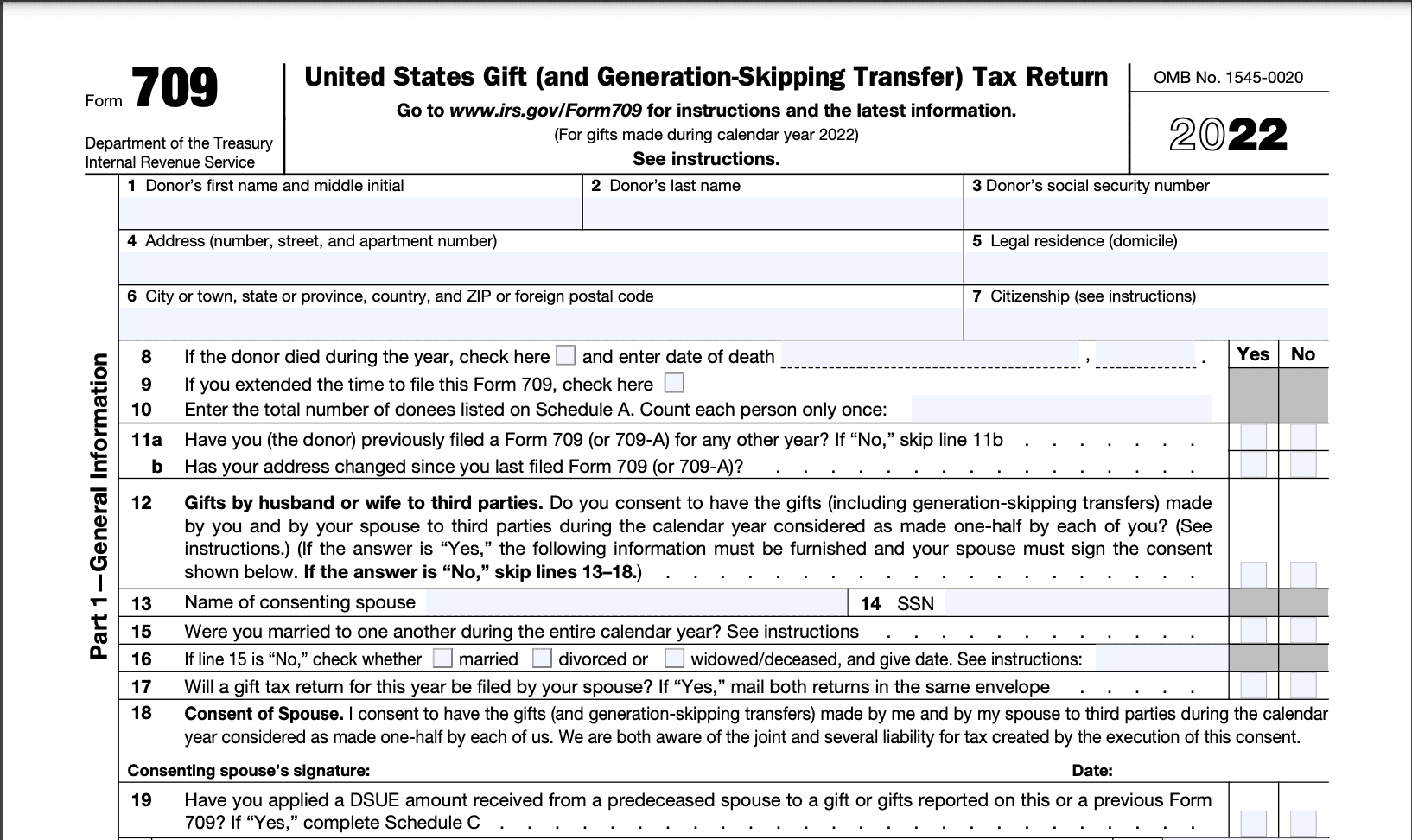

- Form 709

IRS Tax Form 709: Gift Tax

Download Form 709What is IRS Tax Form 709?

Form 709 is a tax form used in the United States to report gifts that exceed the annual gift tax exclusion. The gift tax is a tax imposed on the transfer of property by one individual to another, where the transfer is made as a gift and not as compensation for goods or services.

The purpose of Form 709 is to provide information to the Internal Revenue Service (IRS) about gifts that exceed the annual exclusion amount and to calculate any potential gift tax liability. The annual exclusion is the amount of money or property that an individual can gift to another person each year without incurring any gift tax liability. As per the US law, cutoff in September 2021, the annual exclusion amount was $15,000 per recipient.

Form 709, also known as the "United States Gift (and Generation-Skipping Transfer) Tax Return," is a tax form used to report gifts that exceed the annual gift tax exclusion and to calculate any potential gift tax liability. Let's dive deeper into the key aspects of Form 709 and the gift tax.

Understanding Gift Tax (IRS Tax Form 709)

The gift tax is a tax imposed on the transfer of property by one individual (the donor) to another person (the recipient). Given below are a few aspects of gift tax for better understanding.

Gift tax basics: The gift tax is imposed on the transfer of property by one individual (the donor) to another person (the recipient) when the transfer is made as a gift and not as compensation. The tax is typically paid by the donor, not the recipient.

Annual exclusion: The annual exclusion is the amount of money or property that an individual can give to another person each year without incurring any gift tax liability. As per the US law, cutoff in September 2021, the annual exclusion amount was $15,000 per recipient. This means that you can give up to $15,000 to any individual in a calendar year without needing to file Form 709 or owing gift tax.

Reporting requirements: If you make gifts to any one individual during a calendar year that exceed the annual exclusion amount, you are required to file Form 709 to report those gifts to the IRS. For example, if you give someone $20,000 in a year, you would need to file Form 709 to report the $5,000 that exceeds the annual exclusion.

Lifetime exemption: In addition to the annual exclusion, the gift tax system allows for a lifetime exemption, which is the total amount of taxable gifts an individual can make over their lifetime without owing gift tax. As on September 2021, the lifetime exemption was $11.7 million per individual. This means that if your total taxable gifts, including those that exceed the annual exclusion, are below the lifetime exemption amount, you generally won't owe any gift tax.

Importance/Benefits of Form 709: Gift Tax

While the payment of gift tax is typically not required for most individuals due to the annual gift tax exclusion and the lifetime gift tax exemption, filing Form 709 is still necessary for several reasons. Here are some of the importance and benefits of Form 709:

Tracking gift tax exemption: Filing Form 709 helps individuals keep track of their use of the lifetime gift tax exemption. The IRS imposes a limit on the total amount of taxable gifts an individual can make over their lifetime without incurring gift tax. By filing Form 709, individuals can monitor their gift-giving activities and ensure they stay within the limits set by the IRS.

Allocation of gift splitting: Married couples may choose to split gifts they make jointly. Form 709 allows them to allocate the gift tax exemption between spouses if they wish to do so. By splitting gifts, couples can effectively maximize their use of the gift tax exemption and minimize potential gift tax liabilities.

Documentation and record-keeping: Form 709 serves as documentation of the gifts made during a tax year. It requires individuals to provide detailed information about the gifts, including the value, recipient's information, and relationship to the recipient. By filing the form, individuals establish a clear record of their gift-giving activities, which can be helpful for future reference or in the event of an audit.

Clarifying valuation: The value of certain gifts, such as property or assets, may need to be determined for gift tax purposes. Filing Form 709 requires individuals to disclose the value of the gifts made, providing clarity on the valuation process. This helps ensure accurate reporting and prevents potential disputes with the IRS regarding the value of the gifts.

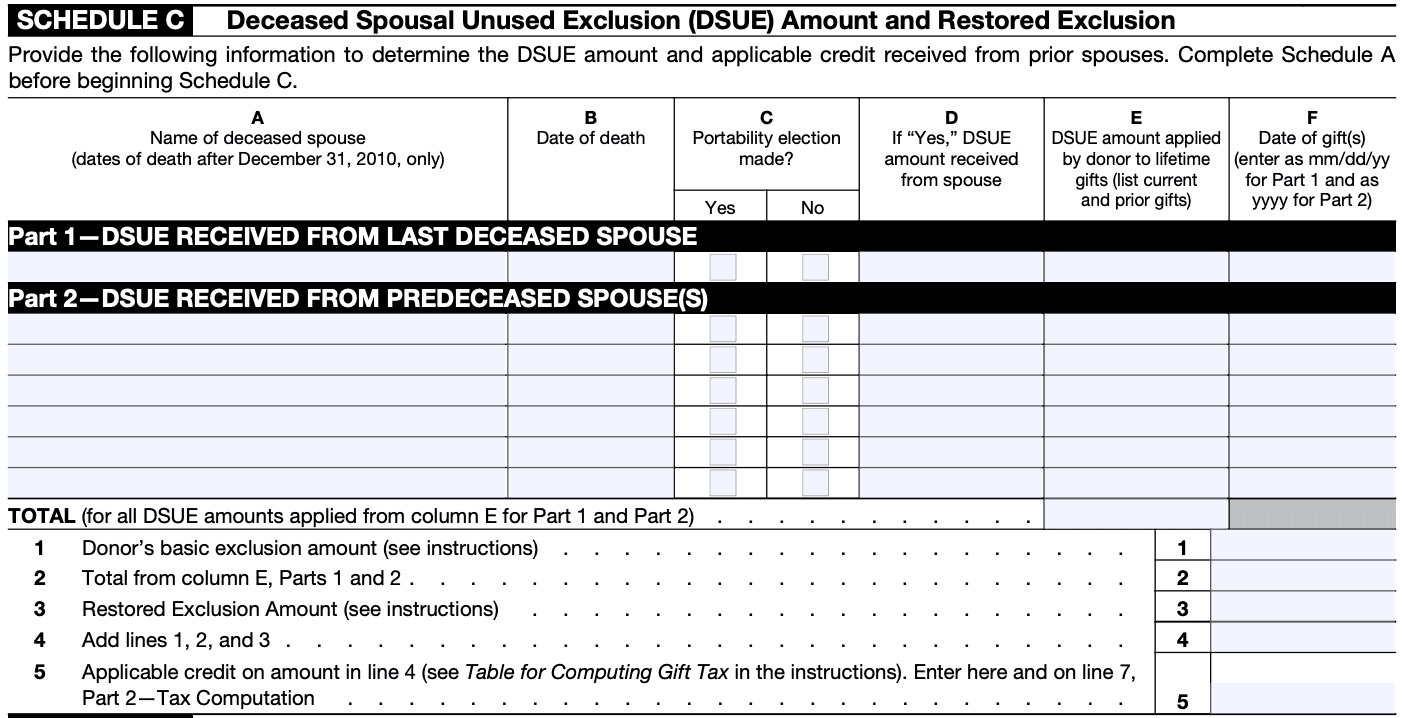

Portability of unused exemption: Form 709 is necessary for electing portability of any unused gift tax exemption to a surviving spouse. Portability allows the surviving spouse to utilize the unused portion of the deceased spouse's lifetime gift and estate tax exemption. By filing Form 709, individuals can ensure that the unused exemption amount is properly calculated and transferred to their spouse.

**Compliance with tax laws: **Filing Form 709 is a legal requirement for individuals who exceed the annual gift tax exclusion or have made taxable gifts during a tax year. By fulfilling their obligations and submitting the form, individuals demonstrate compliance with the gift tax laws and avoid potential penalties or future complications with the IRS.

Who Must File Form 709: Gift Tax?

The following individuals are generally required to file Form 709:

Donors who have made gifts exceeding the annual exclusion limit: If you have given gifts to any one individual that total more than the annual exclusion limit for the tax year, you must file Form 709.

Donors who have made split gifts with a spouse: If you and your spouse made a gift splitting election and you contributed to a gift that is considered made by your spouse under the gift-splitting rules, you may need to file Form 709.

**Donors who have made gifts of future interests or other special gifts: **Certain gifts, such as gifts of future interests, gifts in trust, or gifts with certain conditions or restrictions, may require the filing of Form 709.

Donors who wish to apply the lifetime gift tax exemption: If you want to apply any of your lifetime gift tax exemption amount towards the gifts you made during the tax year, you need to file Form 709.

It's important to note that even if you are not required to file Form 709, you may still choose to do so in order to establish the basis of the gifted property and keep a record of your gifts for future reference.

How To Complete Form 709: Gift Tax - A Step-by-Step Guide and Instructions

Learn how to navigate and complete IRS Form 709 with comprehensive instructions for smooth gift tax reporting.

Step 1: Gather the necessary information

Collect all relevant information related to the gifts you made during the tax year, including:

- Your personal information: name, address, social security number (SSN), and date of birth

- Information about the recipients (donees): name, SSN, and relationship to you

- Description of the gifted property or assets

- Date of the gift(s)

- Fair market value (FMV) of the gifted property or assets at the time of the gift(s)

Step 2: Determine whether you need to file

You must file Form 709 if any of the following situations apply to you:

- You made gifts to individuals exceeding the annual exclusion amount (currently $15,000 per recipient in 2023).

- You and your spouse are "splitting gifts" (gifts made by one spouse are treated as made equally by both).

- You made gifts of future interests or gifts to a trust.

- You made gifts to a non-U.S. citizen spouse exceeding the annual exclusion for gifts to non-citizen spouses (currently $159,000 in 2023).

- You want to elect gift-splitting with your spouse for gifts made in a prior year.

Step 3: Obtain the necessary forms

Download the latest version of Form 709 and its instructions from the IRS website. Make sure you have the correct year's form, as they may change annually.

Step 4: Complete the taxpayer and preparer sections

Enter your personal information, including your name, address, SSN, and date of birth, in the taxpayer section. If someone else is preparing the return on your behalf, provide their information in the preparer section.

Step 5: Fill out Part 1 - General information

Provide the required information, including the tax year, date of the gift(s), and relationship to the donee(s).

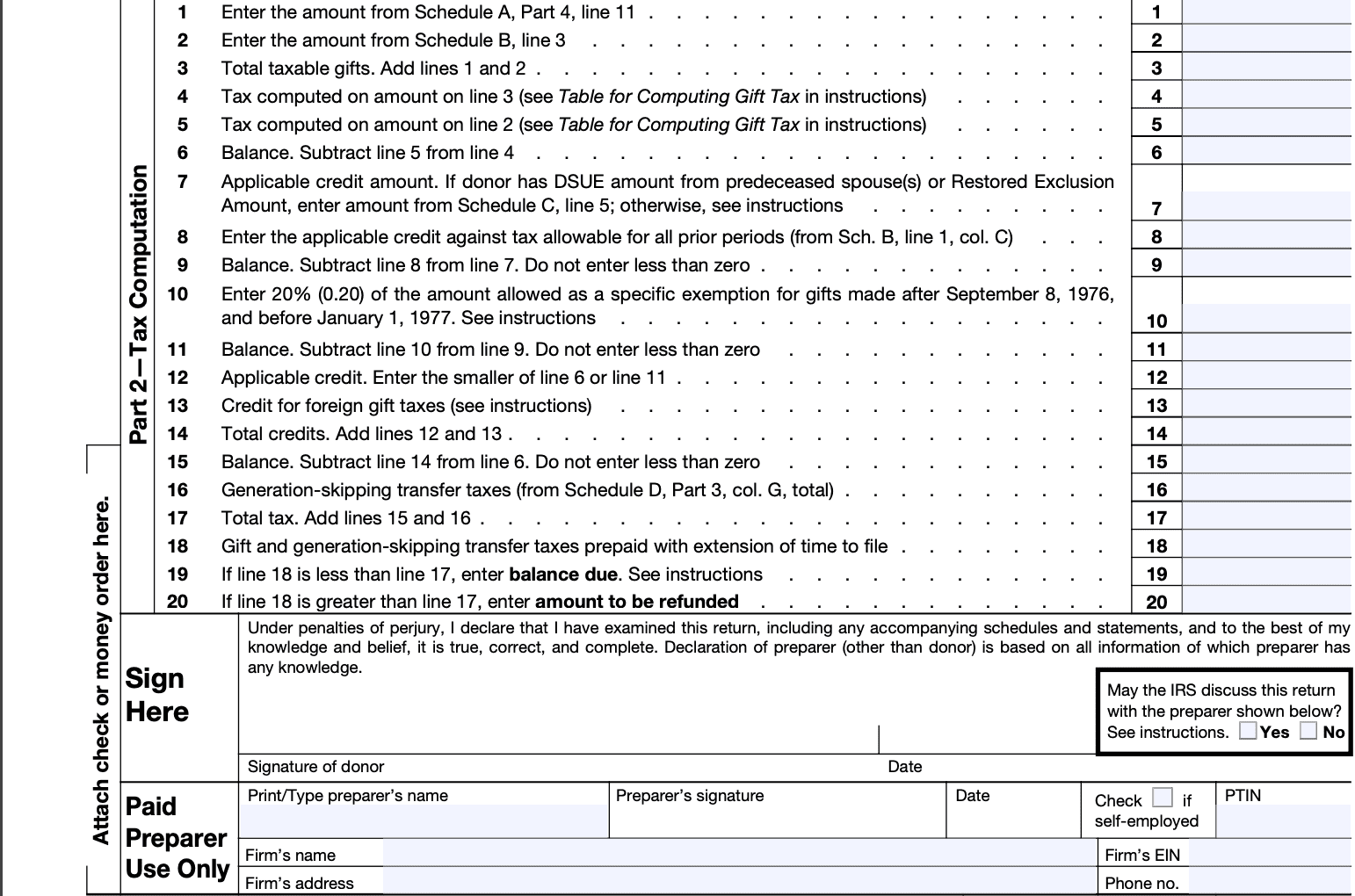

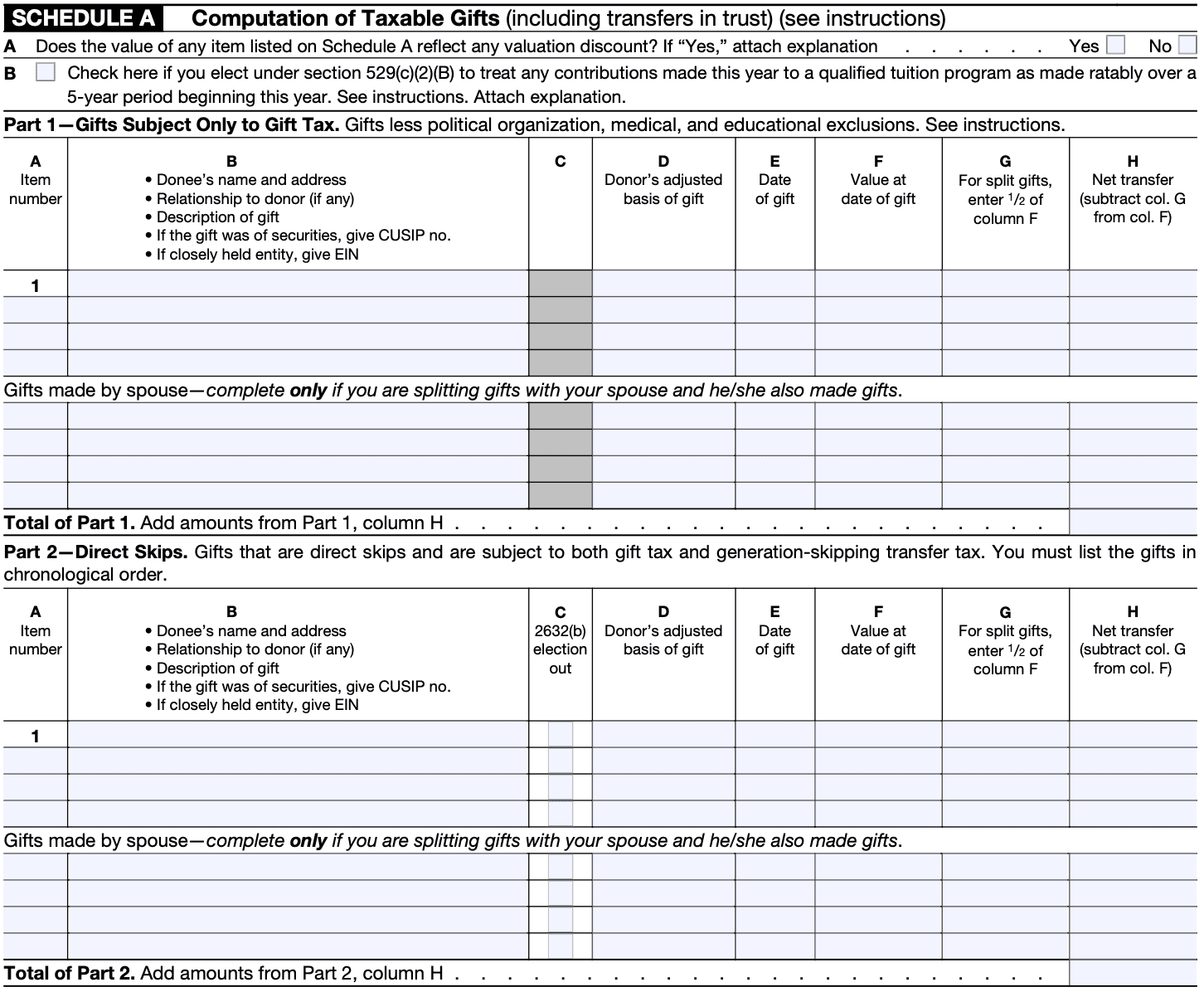

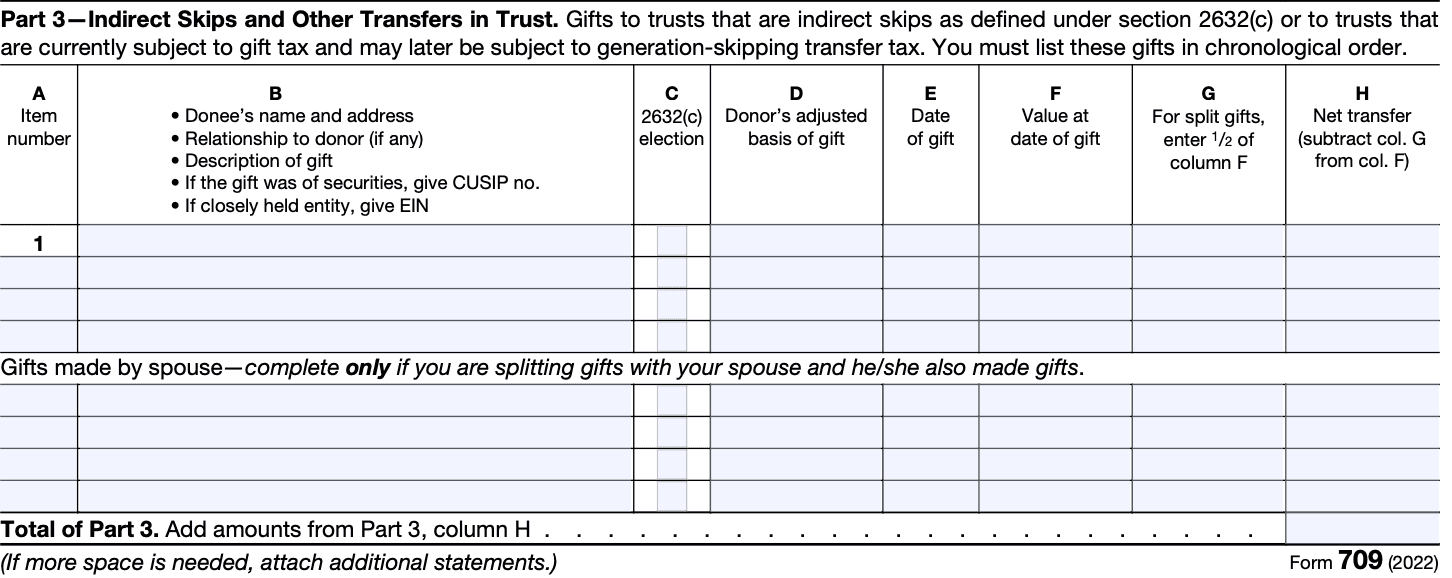

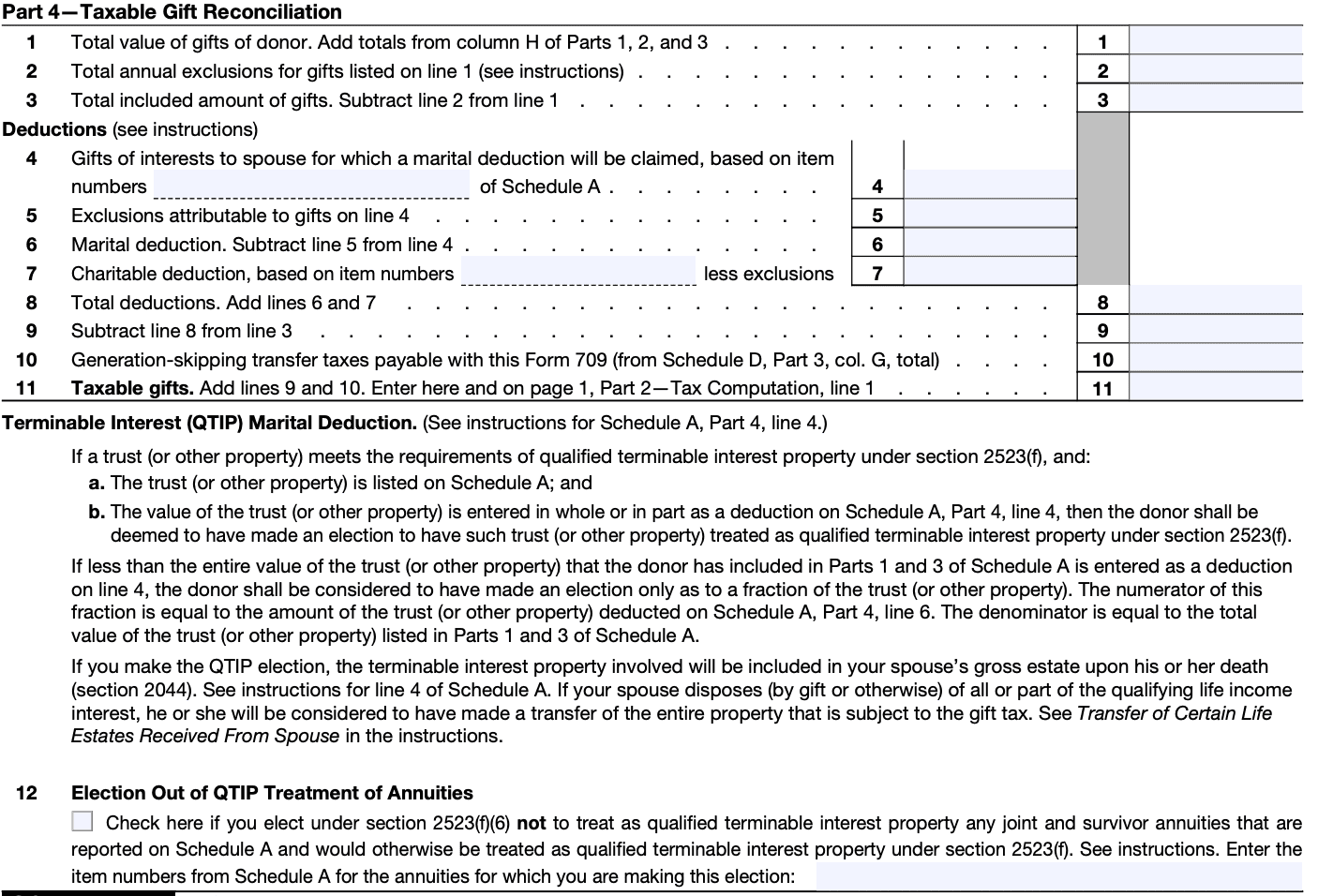

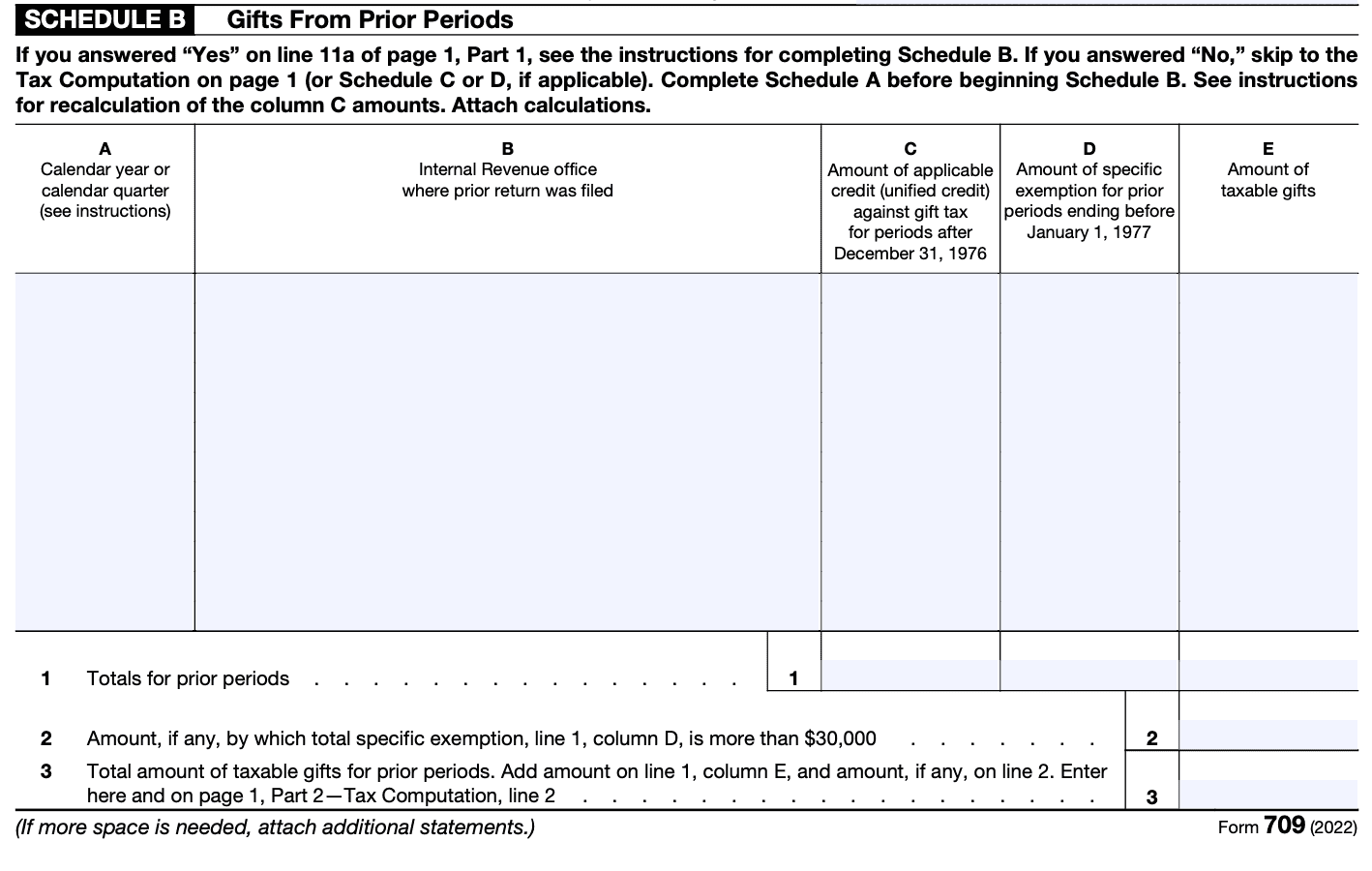

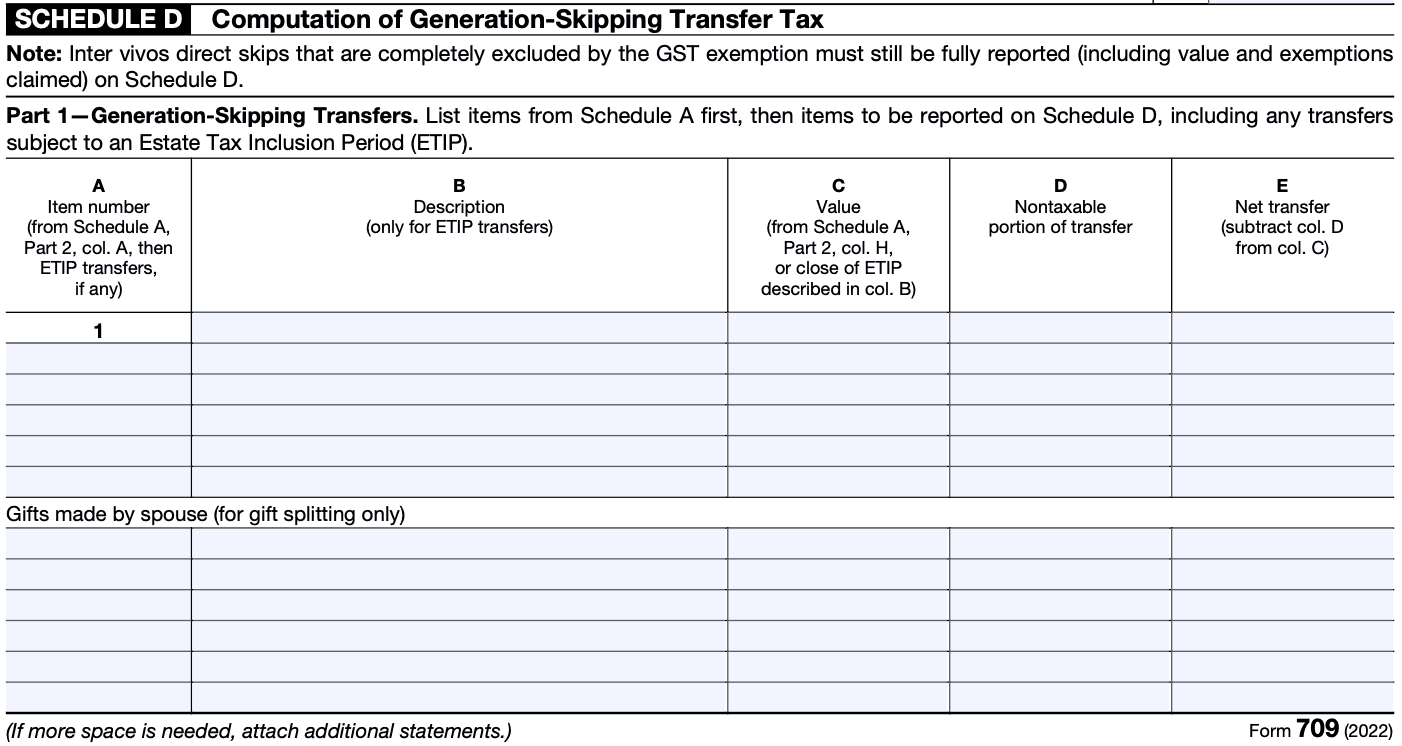

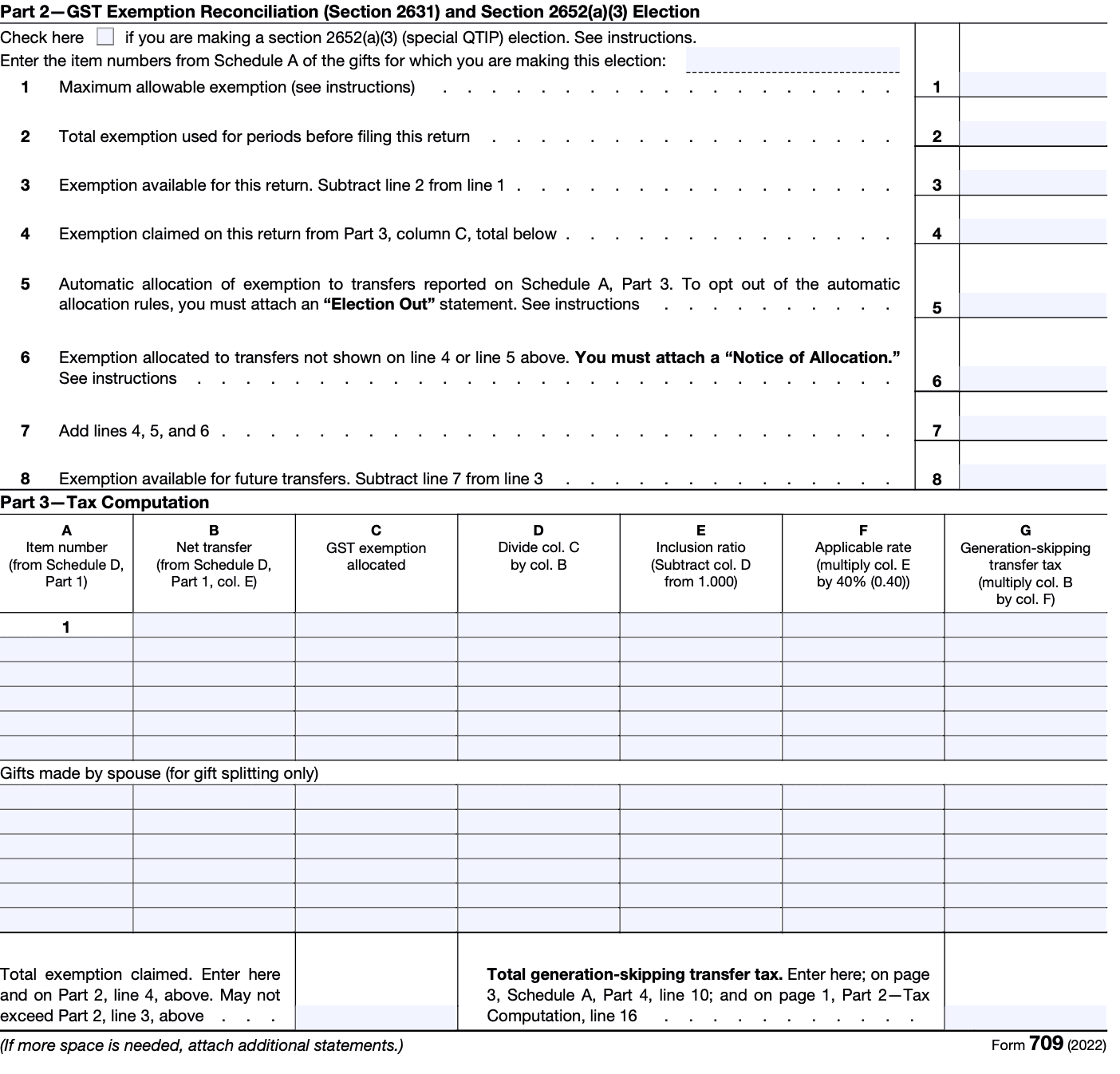

Step 6: Complete Part 2 - Calculation of taxable gifts

In this section, you'll report the gifts made during the tax year that exceed the annual exclusion amount. Calculate the total taxable gifts and enter them accordingly.

Step 7: Determine any applicable deductions and exclusions

Certain deductions and exclusions may reduce the taxable value of your gifts. Review the instructions to determine whether any apply to your situation, such as the marital deduction or charitable deductions.

Step 8: Calculate the gift tax

Use the appropriate tax rate table or the unified credit to calculate the gift tax owed. The unified credit exempts a certain amount of taxable gifts from tax liability. Consult the instructions to ensure you're using the correct rates and credits for the tax year in question.

Step 9: Sign and file the form

Review the completed Form 709 for accuracy and completeness. Sign and date the form, and keep a copy for your records. Depending on your circumstances, you may need to file the form electronically or mail it to the appropriate IRS address provided in the instructions.

It's important to note that this step-by-step guide is a general overview, and individual circumstances may vary. Consulting with a tax professional or using tax software can provide additional guidance and ensure accurate completion of Form 709 based on your specific situation.

Exclusions for Form 709: Gift Tax

When filing Form 709 for gift tax purposes, there are several exclusions that can help reduce or eliminate the gift tax liability. Here are some common exclusions:

Annual exclusion

As mentioned earlier, the annual exclusion allows you to give a certain amount of money or property to each recipient each year without incurring any gift tax.

For 2023, the annual exclusion amount is $16,000 per recipient.This means you can gift up to $16,000 to an individual without it being subject to gift tax. If you are married, you and your spouse can each give $16,000, totaling $32,000 per recipient.

Medical and educational exclusions

Payments made directly to medical providers or educational institutions for someone's medical expenses or tuition are generally excluded from gift tax. These payments must be made directly to the provider and cover eligible medical expenses or tuition costs.

Charitable deductions

Gifts made to qualified charitable organizations are generally deductible for gift tax purposes.

If you make a gift to a qualified charity, it will not be subject to gift tax.

Marital deduction

Gifts made to a spouse who is a U.S. citizen are generally eligible for the marital deduction.

The marital deduction allows for unlimited tax-free gifts between spouses.

However, if the recipient spouse is not a U.S. citizen, there are certain limitations and requirements for the gift to qualify for the marital deduction.

Political organization exclusion

Gifts made to qualified political organizations for their use are excluded from gift tax.

The organization must be recognized by the IRS as a political organization eligible to receive tax-deductible contributions.

These exclusions can help minimize the taxable amount of gifts and potentially reduce or eliminate gift tax liability. It's important to note that specific requirements and limitations apply to each exclusion, so consulting with a tax professional or referring to the IRS instructions for Form 709 is advisable to ensure compliance with the applicable rules.

Filing Deadlines & Extensions for Form 709: Gift Tax

Typically, Form 709 is used to report gifts that exceed the annual exclusion amount set by the IRS. The annual exclusion amount determines the maximum value of gifts that an individual can give to another person each year without incurring any gift tax. For the year 2021, the annual exclusion amount is $15,000 per recipient.

Regarding the filing deadlines for Form 709, here are some general guidelines:

Calendar year filing: If you follow the calendar year for tax purposes (most individuals do), the deadline for filing Form 709 is April 15 of the year following the year in which the gift was made. For example, if you made a taxable gift during the year 2021, the deadline for filing Form 709 would be April 15, 2022.

Fiscal year filing: If you operate on a (link: https://fincent.com/glossary/the-fiscal-year text: fiscal year) instead of a calendar year, the due date for Form 709 is the 15th day of the fourth month following the close of your fiscal year.

It's important to note that if you need additional time to file Form 709, you can request an extension. However, an extension only grants you more time to file the form, not to pay any gift tax owed

Common Mistakes To Avoid While Filing Form 709: Gift Tax

When filing Form 709 for gift tax purposes, there are several common mistakes that you should avoid. Here are some of them:

Failing to file the form: One of the most common mistakes is simply not filing Form 709 when required. If you make gifts that exceed the annual exclusion amount or the lifetime exemption, you are required to file the form. Failure to do so can result in penalties and potential complications in the future.

Incorrect valuation of gifts: It's essential to properly value the gifts you make on Form 709. Gifts should be valued at their fair market value at the time of the gift. Failing to accurately determine the value can lead to underreporting and potential issues with the IRS.

Forgetting to report joint gifts: If you and your spouse jointly make a gift, both of you must file separate Forms 709 to report your respective portions of the gift. Each spouse can take advantage of their annual exclusion and lifetime exemption amounts.

Neglecting to include all necessary information: Form 709 requires you to provide detailed information about the gifts, including the recipient's name, relationship to you, and the value of the gift. Failing to provide complete and accurate information can lead to errors and potential audits.

Missing the filing deadline: Form 709 must be filed by April 15 of the year following the gift. Failing to meet the deadline can result in penalties and interest charges. If you need more time to file, you can request an extension, but remember that an extension only applies to the filing deadline, not the payment of any gift tax owed.

**Overlooking gift splitting: **Spouses can choose to split gifts, which allows them to combine their annual exclusion amounts and double the tax-free gift amount. If you decide to split gifts, you must indicate it on both of your Form 709 filings. Failing to do so may result in a missed opportunity to minimize your gift tax liability.

**Misunderstanding the annual exclusion: **The annual exclusion allows you to give a certain amount to each recipient without incurring gift tax or needing to file Form 709. However, it's important to note that the exclusion applies per recipient. If you give more than the annual exclusion amount to a single recipient, you need to file Form 709.

Conclusion

Form 709 is an essential tax form that allows the IRS to monitor and tax significant gifts made during an individual's lifetime. Understanding the basics of Form 709, including (link: https://fincent.com/blog/tax-filing-extention-deadlines-everything-you-should-know text: filing requirements, deadlines), and exemptions, is crucial for individuals who wish to make sizable gifts while managing their tax liabilities effectively. By complying with the gift tax regulations and properly reporting gifts, individuals can ensure a smooth transfer of assets while staying in line with the IRS guidelines.

It is always advisable to consult with a qualified tax professional or estate planning attorney to ensure accurate compliance with the gift tax laws and to make informed decisions regarding gift-giving strategies. Gift tax rules can be complex, and professional guidance can help individuals navigate the intricacies of Form 709 and optimize their tax planning strategies.