- IRS forms

- Form 5498

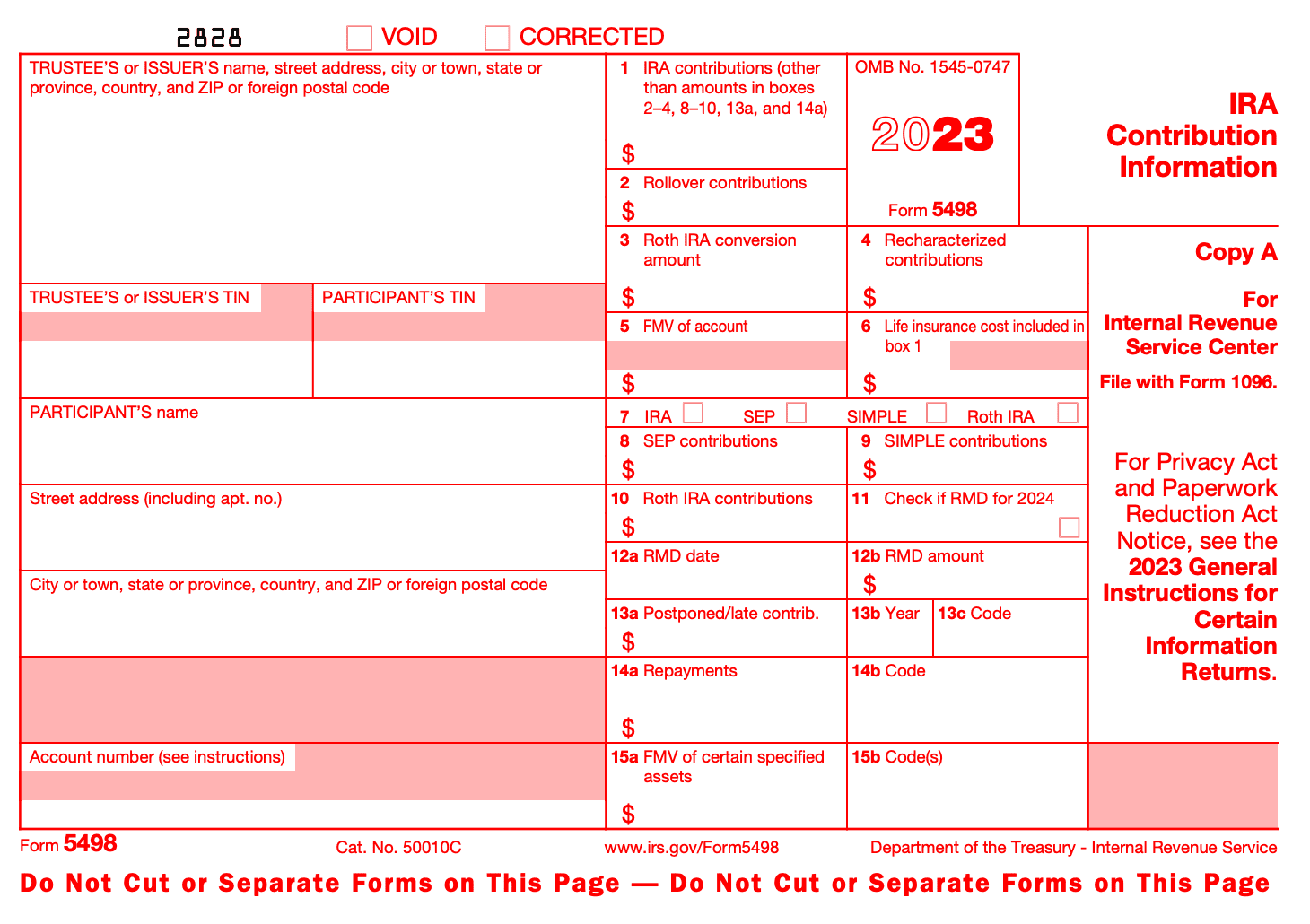

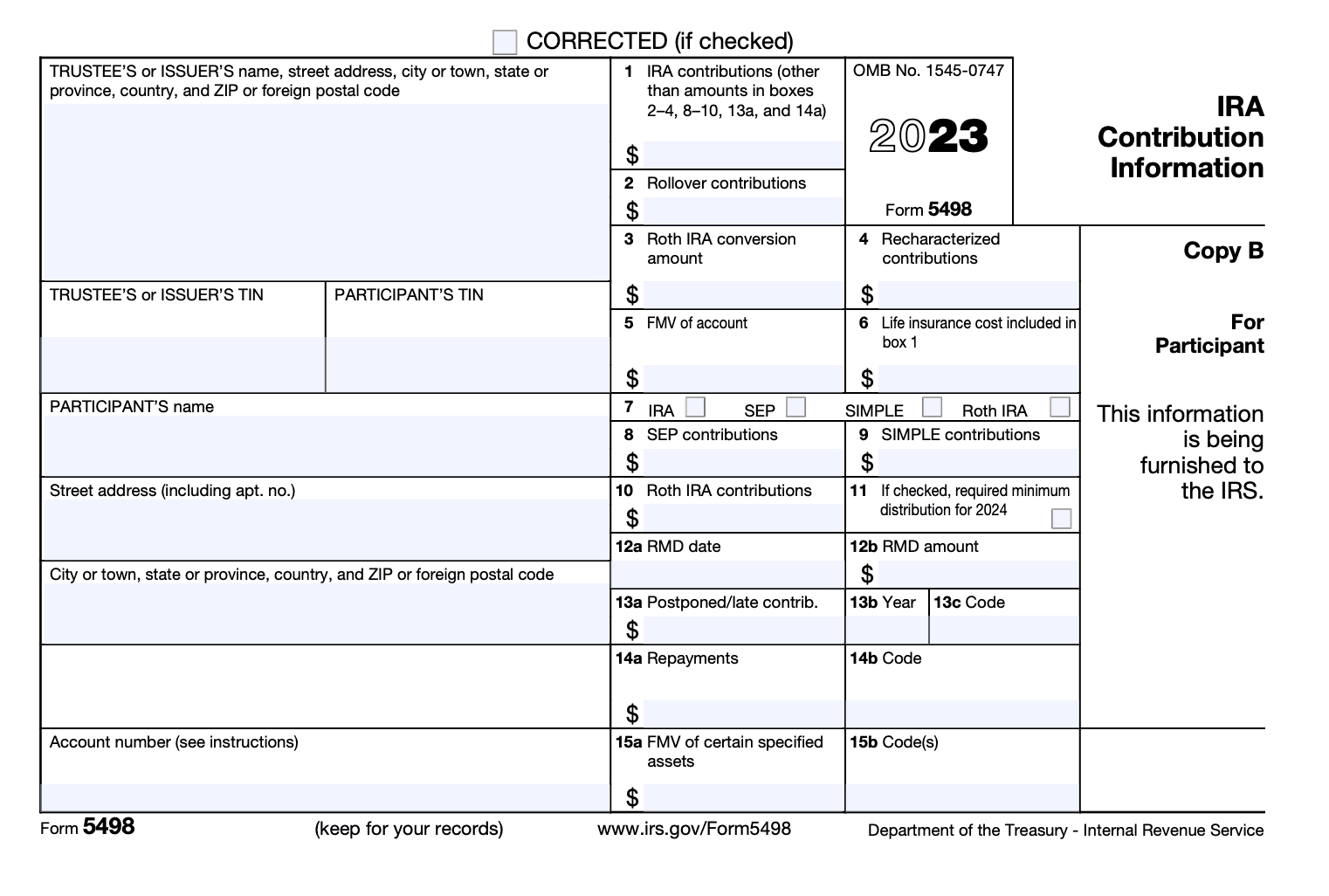

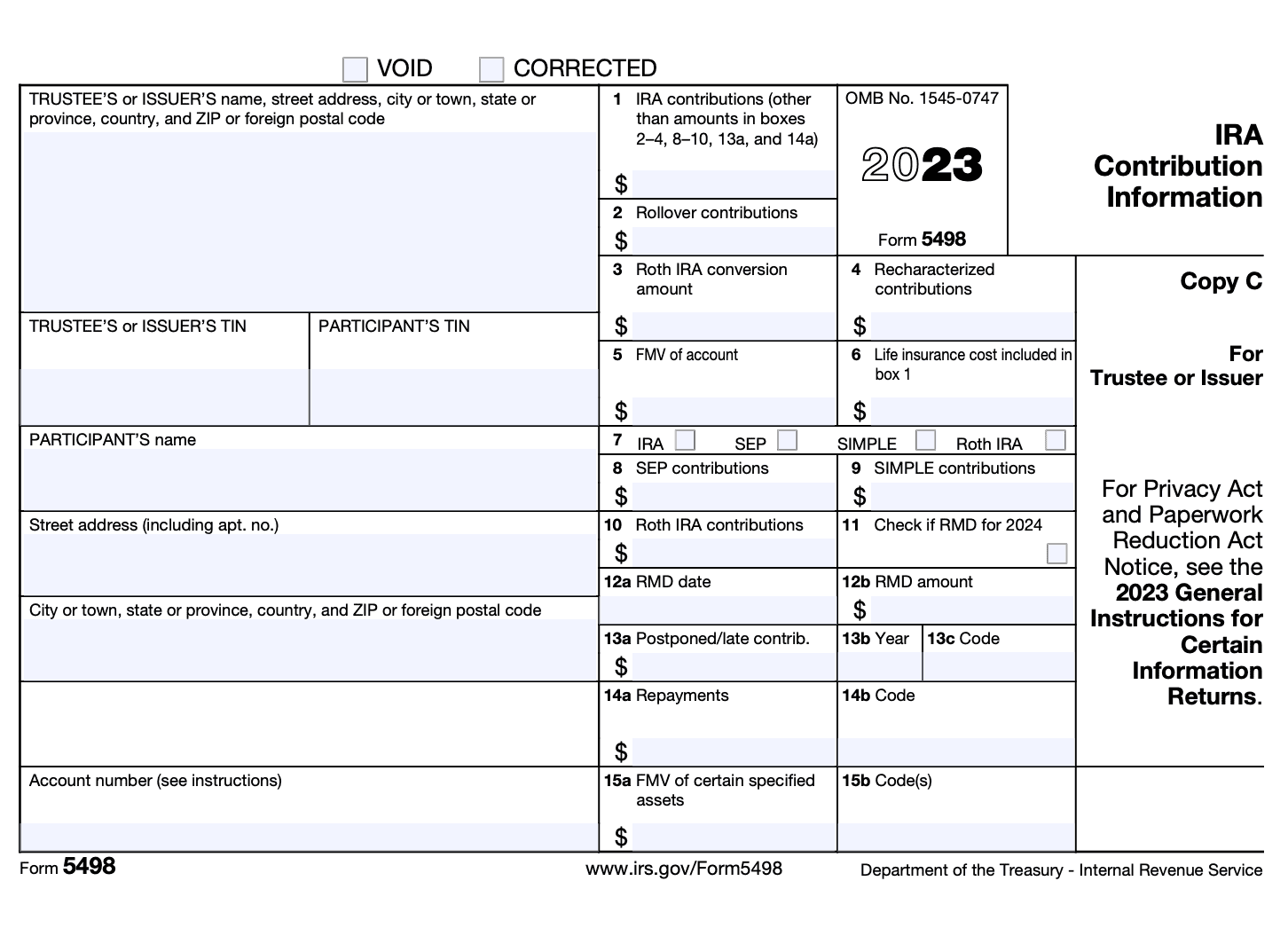

Form 5498: IRA Contribution Information

Download Form 5498When it comes to Individual Retirement Accounts (IRAs), staying informed about your contributions and transactions is crucial for effective retirement planning. One essential document in this process is Form 5498, IRA Contribution Information.

Form 5498 is an information return filed by financial institutions that act as custodians or trustees for IRAs. It serves as a summary of the contributions made to your IRA during a particular tax year. Generally, financial institutions must send Form 5498 to account holders by May 31 of the following year. This form is also submitted to the Internal Revenue Service (IRS).

In this blog post, we will explore the significance of Form 5498, its purpose, and the key information it provides to help you navigate your IRA contributions effectively.

Purpose of Form 5498

The purpose of Form 5498 is to provide information to the IRS about the contributions made to an IRA during a specific tax year. It includes details such as the amount contributed, the type of IRA (traditional, Roth, SEP, or SIMPLE), and the individual's identifying information. The form also reports any rollovers, recharacterizations, or conversions that occurred during the year.

For taxpayers, Form 5498 serves as a record of their IRA contributions. It is important to keep this form for future reference and to compare it with their own records of IRA contributions.

Additionally, the IRS uses the information reported on Form 5498 to ensure compliance with IRA contribution limits and to verify the accuracy of tax returns. It helps the IRS match the contributions reported on the form with the amounts claimed as deductions or credits on the taxpayer's tax return.

Overall, Form 5498 plays a crucial role in reporting IRA contributions accurately and providing essential information to both taxpayers and the IRS.

Benefits of Form 5498

While the primary purpose of Form 5498 is informational, it provides several benefits to both individuals and the IRS. Here are some of the benefits of Form 5498:

Contribution verification: Form 5498 helps individuals verify the amount they contributed to their IRAs during the tax year. This information is crucial for accurately reporting deductible and non-deductible IRA contributions on their tax returns.

Tax planning: The form provides individuals with a record of their IRA contributions, enabling them to assess their retirement savings and plan for future contributions. It helps individuals track their progress toward annual contribution limits and make informed decisions about their retirement savings strategies.

Retirement account monitoring: Form 5498 helps individuals monitor the activity in their IRA accounts. It includes information on rollovers, conversions, recharacterizations, and fair market valuations of the account. This allows individuals to stay updated on any changes or transactions related to their IRAs.

Compliance with IRS requirements: Financial institutions are required to file Form 5498 with the IRS, ensuring compliance with tax regulations and providing the IRS with an accurate picture of IRA activity. The form helps the IRS cross-reference the information reported by individuals on their tax returns with the data reported by financial institutions.

Taxpayer protection: Form 5498 helps protect taxpayers from potential errors or discrepancies in their tax reporting. By receiving a copy of the form, individuals can compare the information reported by the financial institution to ensure accuracy and rectify any discrepancies before filing their tax returns.

Audit trail: The form creates an audit trail for both individuals and the IRS. If there are any questions or disputes regarding IRA contributions, conversions, or other transactions, Form 5498 serves as a documentation source that can be referenced to resolve issues and provide evidence of compliance.

Who Must File Form 5498?

Form 5498 is filed by various entities to report contributions made to Individual Retirement Arrangements (IRAs). The entities required to file Form 5498 include:

**Financial institutions: **Banks, credit unions, brokerage firms, and other financial institutions that serve as IRA trustees or custodians are responsible for filing Form 5498. They report contributions made to IRAs held by individuals, including traditional IRAs, Roth IRAs, SEP-IRAs, and SIMPLE IRAs.

Employers: Employers who maintain Simplified Employee Pension (SEP) IRAs for their employees need to file Form 5498 to report employer contributions to these IRAs.

Trustee-to-trustee transfers: If a trustee or custodian receives a transfer of funds from one IRA to another directly (trustee-to-trustee transfer), they must file Form 5498 to report the amount transferred.

Inherited IRAs: In the case of an inherited IRA, the trustee or custodian of the IRA is responsible for filing Form 5498 to report the required information.

It's important to note that as an individual taxpayer, you may receive a copy of Form 5498 from the entity that filed it on your behalf. However, you, as an individual, are not required to file Form 5498 with the IRS.

How To Complete Form 5498: A Step-by-Step Guide

Form 5498 is an IRS form used to report contributions made to an individual retirement arrangement (IRA). Here's a step-by-step guide to help you complete Form 5498:

Step 1: Obtain a copy of Form 5498

You can download the most recent version of Form 5498 from the IRS website (www.irs.gov) or request a copy from the IRS.

Step 2: Provide your identifying information

Enter your name, address, and Social Security number (SSN) or taxpayer identification number (TIN) in the appropriate sections of the form. If you're filing the form on behalf of a business or organization, provide the employer identification number (EIN) instead.

Step 3: Fill in the IRA information

In Part I of Form 5498, you'll need to provide information about the IRA for which you're filing the form. This includes the name of the trustee or custodian, their address, and their EIN or SSN.

Step 4: Report contributions

In Part II, you'll report the total contributions made to the IRA during the tax year for which you're filing the form. This includes both regular contributions and rollover contributions. If you're reporting a rollover contribution, you'll need to indicate the type of rollover (e.g., direct rollover, 60-day rollover) and provide additional details.

Step 5: Report fair market value (FMV)

In Part III, you'll report the FMV of the IRA assets at the end of the tax year. If the IRA holds alternative investments, such as real estate or privately held companies, you may need to provide additional information about the value of those assets.

Step 6: Indicate the type of IRA

In Part IV, you'll indicate the type of IRA for which you're filing the form. Check the appropriate box to indicate whether it's a traditional IRA, Roth IRA, SIMPLE IRA, SEP IRA, or other type of IRA.

Step 7: Check applicable boxes

In Part V, there are several checkboxes that you may need to mark to indicate certain circumstances related to the IRA. For example, if you're reporting excess contributions, recharacterizations, or conversions, you'll need to check the appropriate boxes and provide additional details if required.

Step 8: Sign and date the form

At the bottom of the form, you'll need to sign and date it to certify that the information provided is accurate and complete.

Step 9: Retain a copy

Make a copy of the completed Form 5498 for your records before submitting it to the IRS. This will help you keep track of your tax-related documentation.

Step 10: Submit the form

Send the completed Form 5498 to the IRS address specified in the instructions for the form. Be sure to review the instructions to ensure you're mailing it to the correct location based on your state of residence.

Types/Schedules/Deductions on Form 5498

Form 5498 provides information to the IRS about the contributions made by the taxpayer during the tax year. Here are the key components of Form 5498:

Types of IRAs: Form 5498 covers different types of IRAs, including traditional IRAs, Roth IRAs, SEP IRAs (Simplified Employee Pension), and SIMPLE IRAs (Savings Incentive Match Plan for Employees). The form will indicate the specific type of IRA to which the contributions were made.

Contribution schedules: The form may include multiple schedules to report different types of contributions. For example:

- Regular contributions: This schedule reports the total amount of regular contributions made by the taxpayer to their IRA(s) during the tax year.

- Catch-up contributions: If the taxpayer is age 50 or older, they may be eligible to make additional catch-up contributions to their IRA(s). This schedule reports the total amount of catch-up contributions made.

- Rollover contributions: If the taxpayer rolled over funds from another retirement account into their IRA(s), this schedule reports the total amount of rollover contributions made.

**Deductible contributions: **For traditional IRAs, taxpayers may be eligible to deduct their contributions from their taxable income. This section of Form 5498 reports the total amount of contributions that are deductible for the tax year.

Fair market value (FMV): Form 5498 may also include the fair market value of the IRA account(s) as of the end of the tax year. This is important for tracking the growth and value of the retirement account.

It's important to note that Form 5498 is an informational form that is typically not filed by the taxpayer when submitting their tax return. Instead, it serves as a record for the taxpayer and is filed by the financial institution with the IRS.

Filing Deadlines & Extensions for Form 5498

As of September 2021, the filing deadline for Form 5498, "IRA Contribution Information," depends on whether you are an IRA trustee, custodian, or issuer. Here are the general guidelines:

IRA trustees and custodians

Deadline: The deadline for furnishing Form 5498 to the IRA owner is May 31 of the year following the calendar year to which the form relates. For example, if you are reporting contributions made in 2022, the deadline for providing Form 5498 to the IRA owner would be May 31, 2023.

Extension: If you need additional time to furnish the form, you can request a one-time 30-day extension by filing Form 8809, "Application for Extension of Time To File Information Returns."

IRA issuers

Deadline: The deadline for filing Form 5498 with the IRS is June 30 of the year following the calendar year to which the form relates. Using the same example as above, if you are reporting contributions made in 2022, the deadline for filing Form 5498 with the IRS would be June 30, 2023.

Extension: You can request an automatic 30-day extension by filing Form 8809 with the IRS before the original due date of June 30.

Common Mistakes To Avoid While Filing Form 5498

When filing Form 5498, which is used to report contributions to individual retirement arrangements (IRAs), it's important to avoid certain common mistakes to ensure accurate and error-free reporting. Here are some mistakes to avoid:

Incorrect or missing taxpayer identification number (TIN): Make sure to provide the correct TIN for the account holder. Double-check the number to ensure accuracy and avoid any typos.

Missing or incorrect contribution amounts: Ensure that the contribution amounts reported on Form 5498 match the actual contributions made during the tax year. Double-check the numbers to avoid any discrepancies.

Failing to report rollovers or transfers: If there were any rollovers or transfers from other retirement accounts, such as 401(k)s or other IRAs, make sure to report them accurately on Form 5498. Failing to report these transactions can lead to discrepancies and potential tax issues.

**Incorrect account type or code: **Each type of retirement account has a specific code associated with it. Make sure to use the correct account type and code on Form 5498 to accurately reflect the type of IRA being reported.

Late filing or missed deadline: Form 5498 should generally be filed by the trustee or issuer of the IRA by May 31 of the following tax year. Failing to file on time or missing the deadline can result in penalties or other complications.

Not retaining copies or failing to provide copies to account holders: It's important to retain copies of Form 5498 for your records. Additionally, provide copies to the account holders, as they may need them for their tax filings or future reference.

Failing to reconcile with Form 1099-R: If there were any distributions from the IRA during the tax year, ensure that the information reported on Form 5498 reconciles with the corresponding Form 1099-R. Inconsistencies between the two forms can trigger IRS inquiries or audits.

Failing to report required minimum distributions (RMDs): If the account holder reached the age for RMDs during the tax year, make sure to report the distribution amount correctly on Form 5498. Failing to report RMDs can result in penalties and additional taxes for the account holder.

To avoid these mistakes, it's recommended to carefully review the instructions provided by the IRS for Form 5498 and double-check all the information before filing.

Conclusion

Form 5498 plays a crucial role in understanding and managing your IRA contributions. By demystifying its purpose and significance, this blog post aimed to empower you to make informed decisions about your retirement savings.

Remember to review Form 5498 carefully, cross-reference it with your records, and seek professional assistance if you encounter any discrepancies. With a clear understanding of Form 5498, you can confidently navigate the intricacies of your IRA and take control of your financial future.