- IRS forms

- Form 1098-C

Demystifying Form 1098-C for Vehicle Donations

Download Form 1098-CIntroduction:

Donating a motor vehicle, boat, or airplane to a charitable organization is an act of generosity that benefits both the donor and the charity. In addition to the positive impact of your donation, there are tax benefits that come with making charitable contributions. To claim these benefits, you need to file Form 1098-C: Contributions of Motor Vehicles, Boats, and Airplanes. In this blog, we'll explore what this form is, who needs to file it, how to file it, and common mistakes to avoid.

What is Form 1098-C?

Form 1098-C is used to report donations of motor vehicles, boats, and airplanes to qualified charitable organizations. The form provides information about the donor, the recipient charity, and the donated property. It also includes the fair market value of the donated property and any tax deductions that the donor may claim.

Who Needs to File Form 1098-C?

If you are a charitable organization that received a donated motor vehicle, boat, or airplane, you must file Form 1098-C with the IRS and provide a copy to the donor. If you are the donor, you do not need to file the form, but you should receive a copy of it from the charity. The form is required for donations of vehicles, boats, or airplanes that have a claimed value of more than $500.

Contents of Form 1098-C

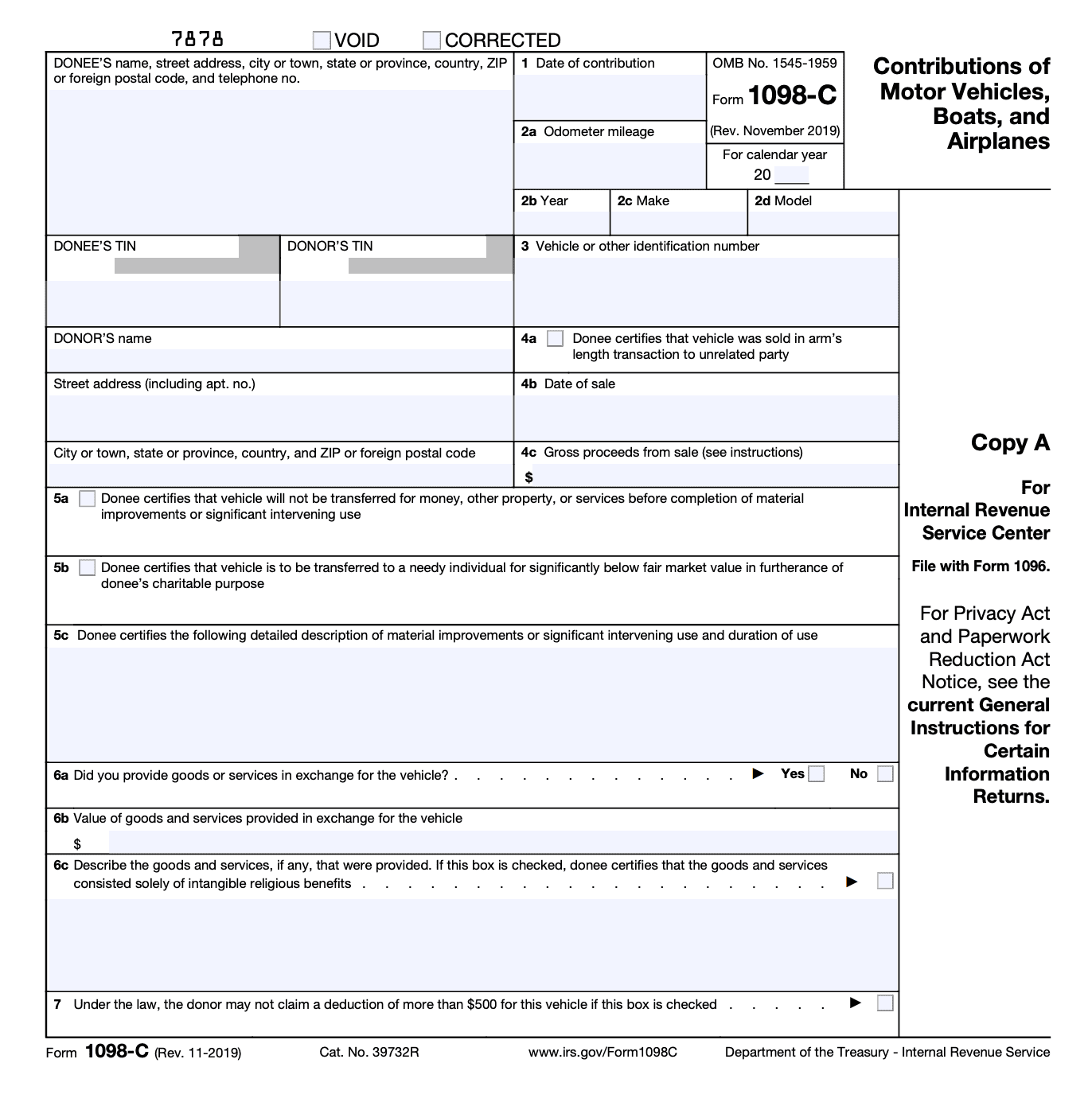

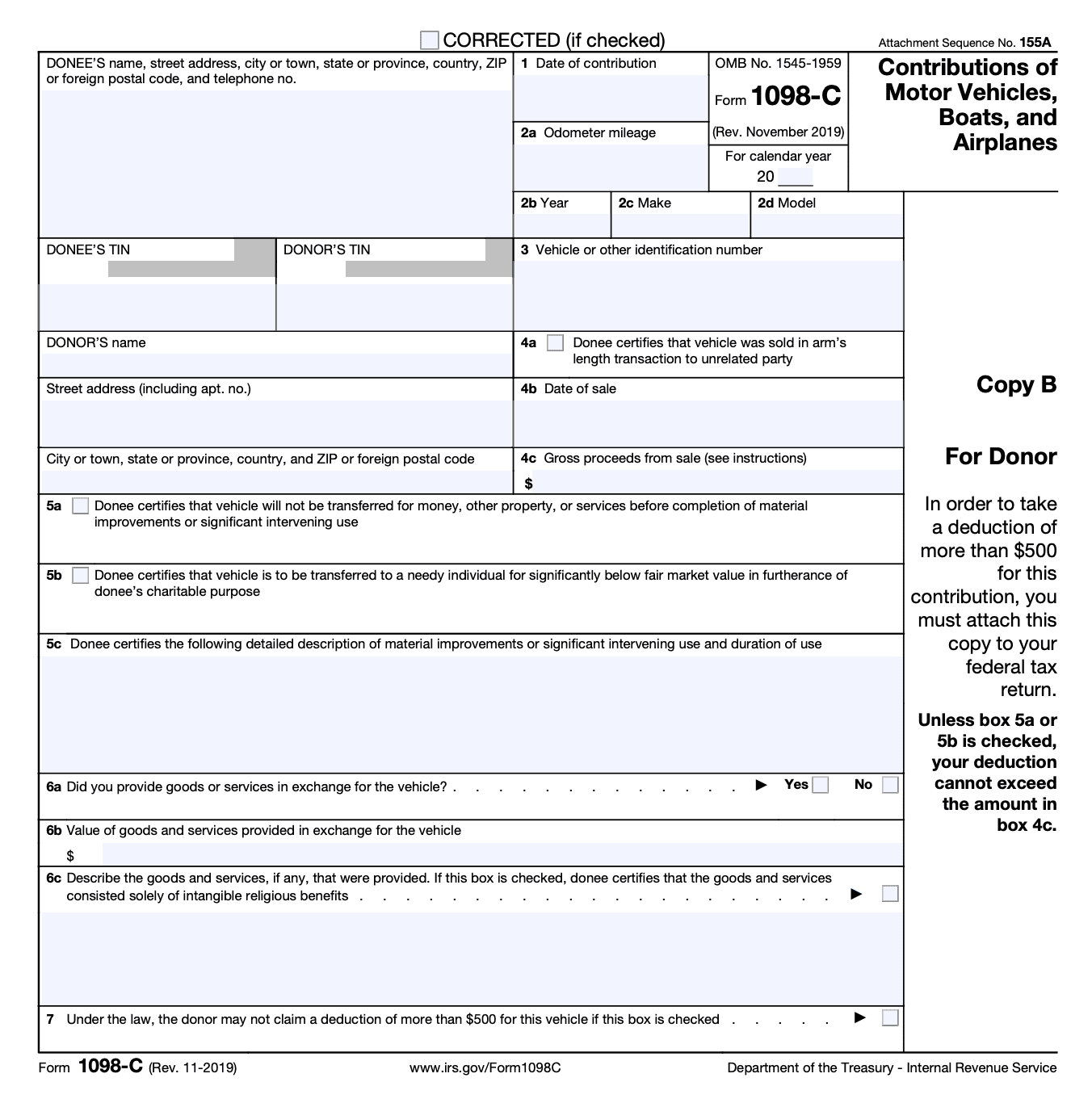

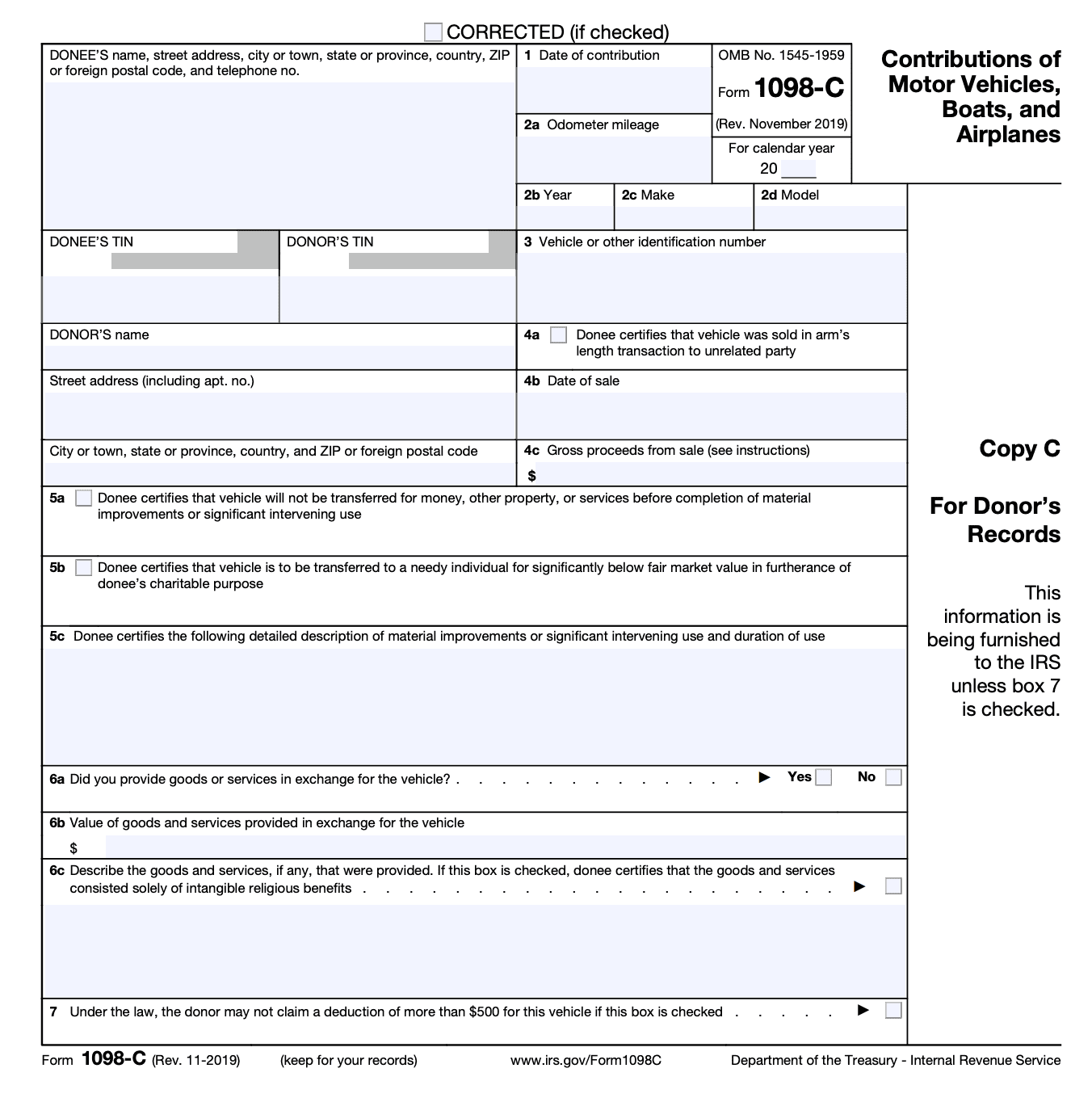

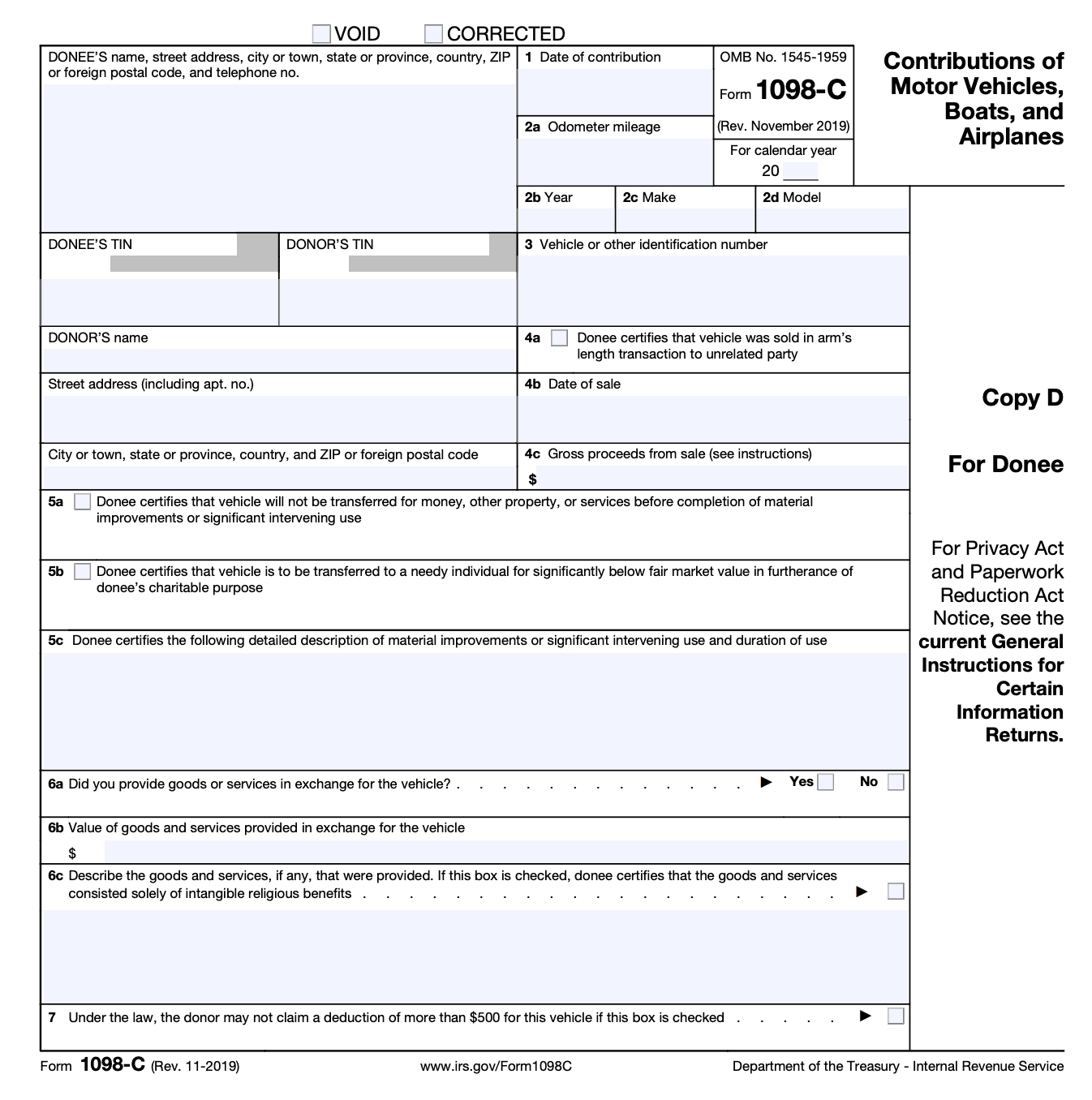

Form 1098-C contains four copies: Copy A, Copy B, Copy C, and Copy D. Here is a breakdown of the information contained in each copy of Form 1098-C:

Copy A (For IRS Centre): Of Form 1098-C is filed with the Internal Revenue Service (IRS). It includes information such as the donor's name, address, and tax identification number, as well as the recipient organization's name, address, and tax identification number. The IRS uses this information to verify the donation and ensure that the donor is eligible to claim a tax deduction.

Copy B (For Donor): Of Form 1098-C is provided to the donor. It includes the same information as Copy A, along with the date of the donation, a description of the donated property, and the fair market value of the property at the time of the donation. The donor will use this information to calculate their tax deduction.

Box 1: This box is used to report the donor's name, address, and tax identification number. The donor's tax identification number is required to ensure that they are eligible to claim a tax deduction for the donation.

Box 2: This box is used to report the year of the donation. The year must be entered in the format YYYY.

Box 3: This box is used to report whether the donor received any goods or services in exchange for the donation. If the donor did receive any goods or services, the value of those goods or services must be subtracted from the fair market value of the donated property to determine the tax deduction.

Box 4a: This box is used to report the date of the donation. The date must be entered in the format MM/DD/YYYY.

Box 4b: This box is used to report whether the donation was made in cash or property. If the donation was made on property, a description of the property must be provided.

Box 5a: This box is used to report the name and address of the recipient organization. The recipient organization must be a qualified charitable organization in order for the donor to be eligible for a tax deduction.

Box 5b: This box is used to report the recipient organization's tax identification number.

Box 6: This box is used to report the gross proceeds from the sale of the donated property by the recipient organization. This information is used to determine the donor's tax deduction if the property is sold by the recipient organization.

Box 7: This box is used to report whether the donated property was sold in an arm's length transaction between unrelated parties. If the property was sold in an arm's length transaction, the donor's tax deduction is limited to the gross proceeds from the sale. If the property was not sold in an arm's length transaction, the donor's tax deduction is limited to the fair market value of the property at the time of the donation.

Copy C (For Donor’s Record): Of Form 1098-C is provided to the recipient organization. It includes the same information as Copy A, as well as the information contained in Copy B. The recipient organization will use this information to acknowledge the donation and provide the donor with a receipt for their records.

Copy D (For Donee): Of Form 1098-C is for the donor's records. It includes the same information as Copy B, and serves as a reminder of the donor's contribution and the fair market value of the donated property.

Steps on How to File Form 1098-C?

To file Form 1098-C, the charitable organization must follow these steps:

- Obtain the donor's name, address, and social security or tax identification number.

- Obtain a description of the donated property, including the make, model, and year of the vehicle or boat, or the make and model of the airplane.

- Obtain the date of the contribution and the date of the sale, if applicable.

- Determine the fair market value of the donated property.

- Complete Form 1098-C with the required information.

- File the form with the IRS and provide a copy to the donor by January 31st of the year following the donation.

When to File Form 1098-C

Charitable organizations must file Form 1098-C with the IRS by February 28th if filing on paper or March 31st if filing electronically. Donors should receive a copy of the form by January 31st of the year following the donation.

Common Mistakes to Avoid When Filing

One common mistake when filing Form 1098-C is reporting the gross proceeds from the sale of the donated property instead of the fair market value. Another mistake is failing to include the donor's correct name, address, and social security or tax identification number. Additionally, charities should ensure that they are filing the correct version of the form, as there have been updates to the form over the years.

FAQs on Form 1098-C

Do I need to file Form 1098-C if I donated a vehicle to a charity?

No, as the donor, you are not required to file Form 1098-C. The charity or organization that received your donation will file the form and provide you with a copy.

How does the IRS determine the value of my donation?

The IRS considers the fair market value of the donated property at the time of the donation. In some cases, an appraisal may be required to determine the value of the property.

How long should I keep a copy of Form 1098-C?

As a donor, you should keep a copy of Form 1098-C with your tax records for at least three years after the due date of your tax return or the date you filed your tax return, whichever is later.

What to Do If You Encounter an Issue

If you encounter an issue when filing Form 1098-C, such as an incorrect social security or tax identification number for the donor, you should contact the IRS immediately. The IRS has a toll-free hotline for organizations filing information returns, and they can provide guidance on how to correct any errors.

Conclusion

Form 1098-C is an important form for charitable organizations and donors to understand when making donations of motor vehicles, boats, or airplanes. By following the proper steps and avoiding common mistakes, both the charitable organization and the donor can ensure that they receive the tax benefits they are entitled to. If you have any questions or concerns about filing Form 1098-C, don't hesitate to seek guidance from the IRS or a tax professional.