- IRS forms

- IRS Federal Form 3115

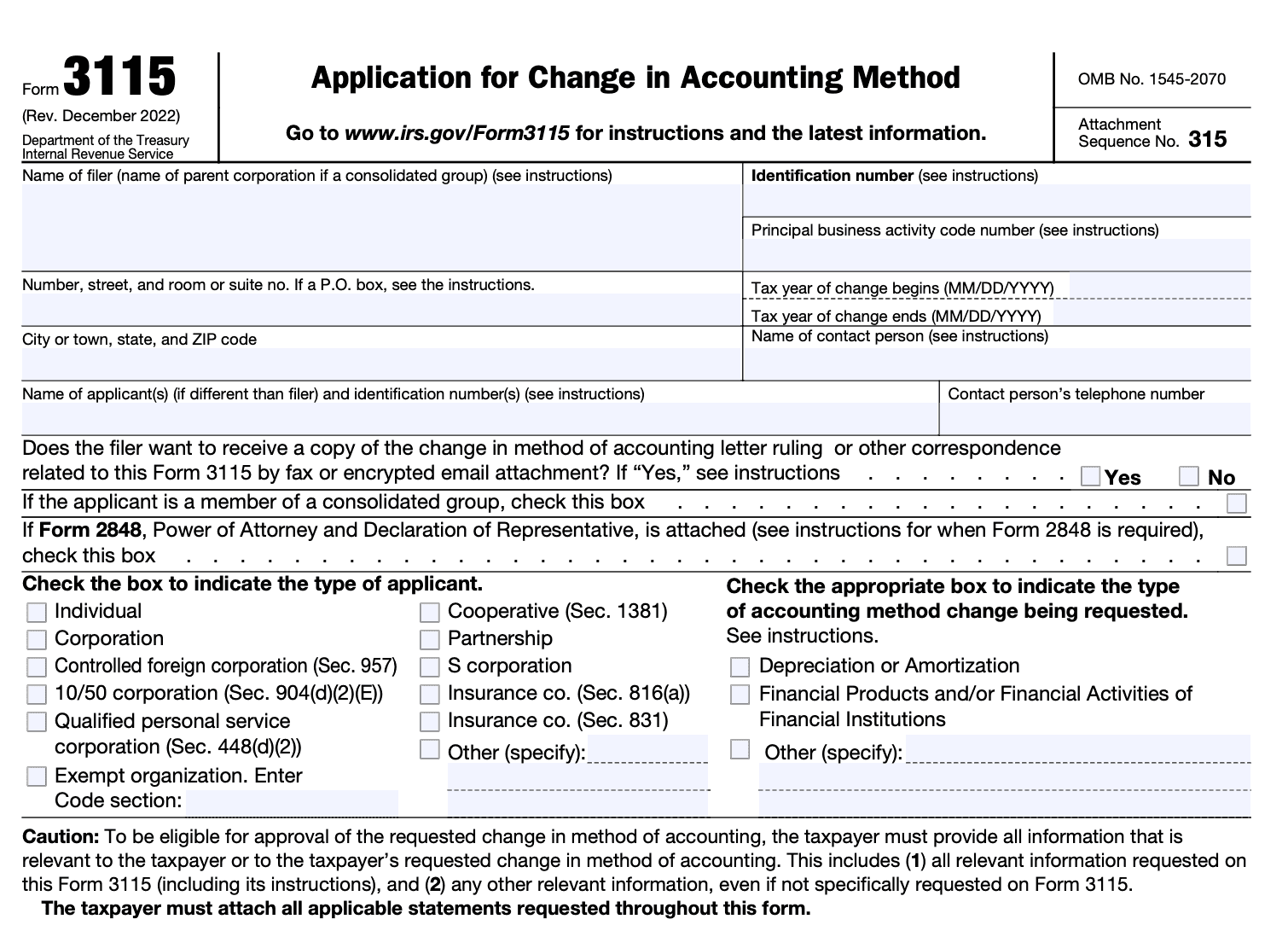

IRS Tax Form 3115: Application for Change in Accounting Method

Download Form 3115In the world of accounting, businesses often find themselves needing to change their accounting methods for various reasons. Whether it's to comply with new tax regulations, improve financial reporting accuracy, or align with industry standards, the process of changing accounting methods requires a formal application. Form 3115, also known as the Application for Change in Accounting Method, is the IRS document that businesses use to request approval for such changes.

Federal Form 3115 is an important tool for businesses seeking to change their accounting methods. It allows them to request approval from the Internal Revenue Service (IRS) to make a change in their overall method of accounting, including a change in accounting treatment for specific items or a change in the timing of recognizing income or expenses.

In this post, we will delve into the details of Form 3115 and discuss what businesses should know when navigating this complex process.

Purpose of Form 3115

The purpose of Form 3115 is to notify the IRS about the change and provide the necessary information and documentation to support the request.

Changing an accounting method involves adopting a new way of reporting income, expenses, and other financial transactions. There are various reasons why a taxpayer might want to change their accounting method, such as complying with new tax laws or regulations, improving the accuracy of financial reporting, or aligning their accounting practices with their business operations.

Form 3115 is typically filed by businesses, partnerships, S corporations, and individuals with a business or rental activity. It is important to note that certain changes in accounting methods require IRS approval, while others can be made without obtaining permission.

The form itself requires detailed information about the taxpayer, the current accounting method, the proposed accounting method, and the reason for the change. It also requires a description of the adjustment that needs to be made to properly account for the change in the taxpayer's tax liability.

Accounting Methods and Changes in Accounting Methods

Accounting methods serve as the foundation for how a business reports its financial transactions. They determine when income and expenses are recognized for tax purposes, which can significantly impact a company's financial statements and tax liabilities. The most common accounting methods used by businesses are the cash method, accrual method, and modified cash-basis accounting. Each method has specific rules and regulations that govern its usage and application.

Cash Method of Accounting

The (link: https://fincent.com/glossary/cash-accounting text: cash method of accounting) is a straightforward approach where income and expenses are recorded when cash is received or paid. It is popular among small businesses due to its simplicity. However, the IRS imposes certain limitations on its use to prevent potential misuse and ensure accurate financial reporting.

- Limitations on Use of Cash Method of Accounting: Businesses with gross receipts over a certain threshold and those maintaining inventory typically cannot use the cash method.

- Accounting for Income and Deductions Under the Cash Method: Income is recognized when payment is received, and expenses are recorded when they are paid.

IRS Form 3115 helps businesses utilizing the cash method of accounting to document and report any changes in accounting practices to the IRS. This is particularly crucial when transitioning to or from the cash method, as it ensures that the change is properly documented and approved.

Accrual Method of Accounting

The (link: https://fincent.com/glossary/accrual-accounting text: accrual method of accounting) recognizes income when it is earned and expenses when they are incurred, regardless of when cash is actually received or paid. This method provides a more comprehensive view of a company's financial health but can be more complex to maintain.

- Accounting for Income Under the Accrual Method: Income is recorded when it is earned, irrespective of when the payment is received.

- Accounting for Advance Payments in Income Under the Accrual Method: Advance payments are recognized as income when the rights or services are provided.

- Accounting for Deductions Under the Accrual Method: Expenses are recognized when they are incurred, regardless of when they are paid.

For businesses using the accrual method of accounting, IRS Form 3115 serves as a means to inform the IRS about any changes in accounting practices that might affect the timing of income or expenses recognition. It helps maintain transparency and consistency in the financial reporting process.

Modified Cash-Basis Accounting

Modified cash-basis accounting is a hybrid method that incorporates elements of both cash and accrual accounting. It allows certain businesses to use the cash method for most transactions but requires the accrual method for specific items.

- Limitations: Specific guidelines determine which businesses can use the modified cash-basis accounting method.

- Deductions: Expenses are recorded when they are paid, while income might be recognized either when it is received or when it is earned, depending on the circumstances.

Form 3115 plays a vital role in modified cash-basis accounting by enabling businesses to request permission from the IRS for any necessary changes in accounting methods. This helps maintain accuracy and compliance with IRS regulations while accommodating the specific requirements of the modified cash-basis accounting method.

A change in accounting method occurs when a business decides to adopt a different accounting method from the one it has been using. This change can have significant implications for tax reporting and may necessitate approval from the IRS. For more indetailed information around how to change accounting methods using IRS form 3115 - read this post.

IRS Reconstruction of Taxable Income

Benefits of Form 3115

Here are some benefits of filing Form 3115:

- Compliance with IRS regulations: By filing Form 3115, businesses ensure that they are compliant with the IRS rules and regulations regarding accounting method changes. It allows them to make changes in their accounting methods while following the proper procedures and obtaining approval from the IRS.

- Timing of income recognition: Changing accounting methods can sometimes result in a more favorable timing of income recognition. For example, a business may want to switch from the cash method to the accrual method, which could allow them to recognize income when it is earned rather than when it is received. This can be beneficial for matching revenues and expenses accurately, especially for businesses with long-term projects or contracts.

- Tax planning and optimization: Form 3115 provides an opportunity for tax planning and optimization. Businesses can analyze their current accounting methods and assess whether changing to a different method would be advantageous for their tax situation. It allows them to evaluate different methods and choose the one that minimizes their tax liability or provides other tax benefits.

- Correction of errors: In some cases, a business may identify errors in their accounting methods or inconsistencies in the way they have been reporting income or expenses. Form 3115 can be used to correct these errors and bring the accounting records in line with the appropriate accounting standards. By doing so, businesses can avoid potential penalties or disputes with the IRS.

- Consistency with financial reporting: Changing accounting methods through Form 3115 can help align a business's financial reporting with its tax reporting. Consistency between these two aspects is essential to ensure accurate and transparent financial statements and tax returns. It allows businesses to present a more cohesive and understandable financial picture to stakeholders, including investors, lenders, and regulatory bodies.

Who Is Eligible To File Form 3115?

Various entities and individuals can be eligible to file Form 3115, including:

Individuals: Individual taxpayers, such as sole proprietors, may file Form 3115 if they want to change their accounting method.

Partnerships: Partnerships, including general partnerships, limited partnerships, and limited liability partnerships, can file Form 3115 to request a change in their accounting method.

Corporations: Both C corporations and S corporations can file Form 3115 to initiate a change in their accounting method.

Trusts and estates: Trusts and estates that have income reportable on Form 1041 may file Form 3115 to request an accounting method change.

It's worth noting that certain limitations and restrictions apply to different entities and circumstances. Additionally, some taxpayers may need to comply with specific rules and regulations related to their industry or specific tax provisions.

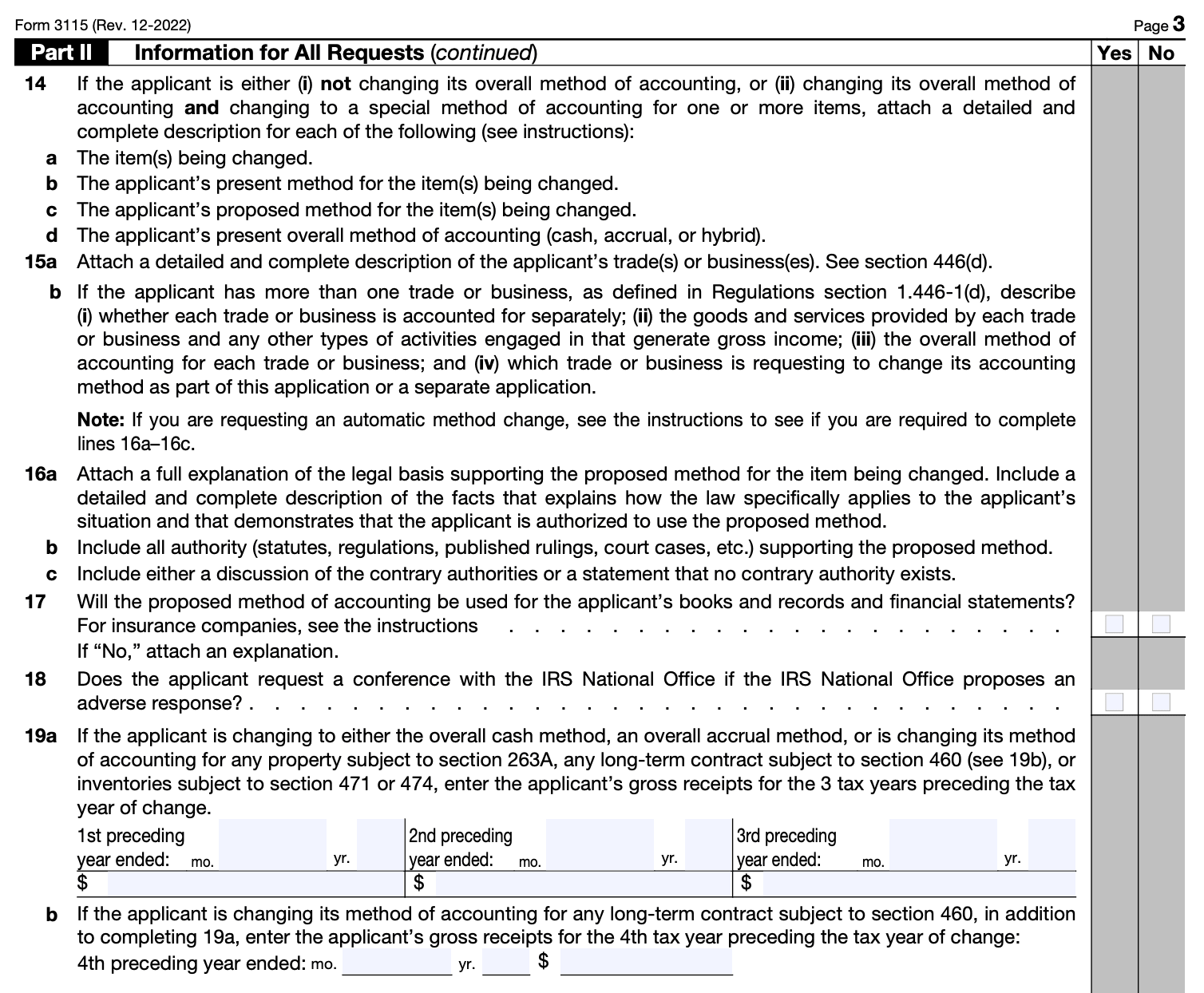

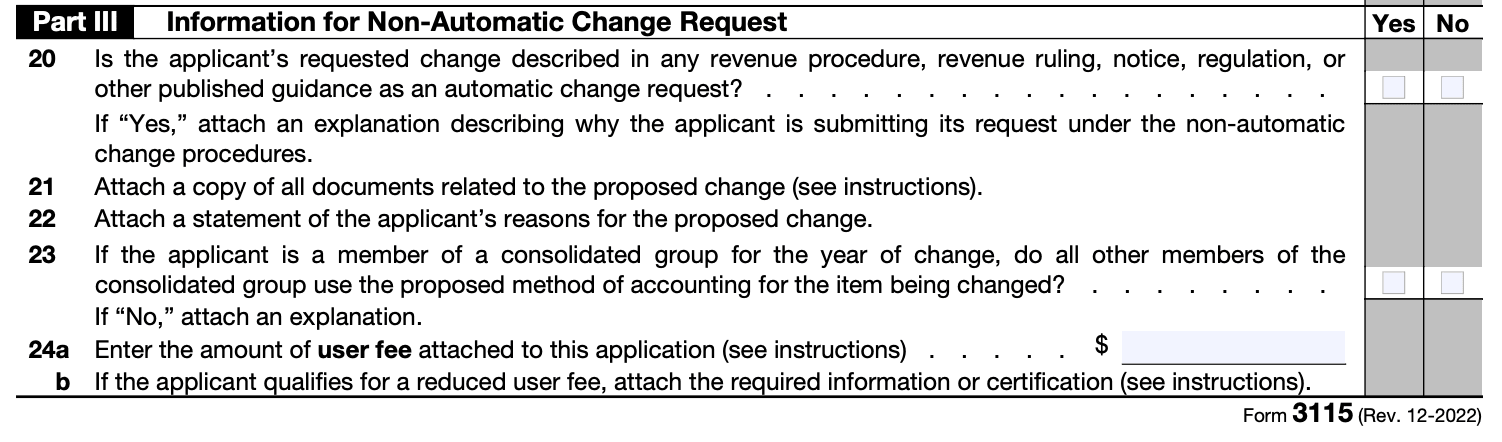

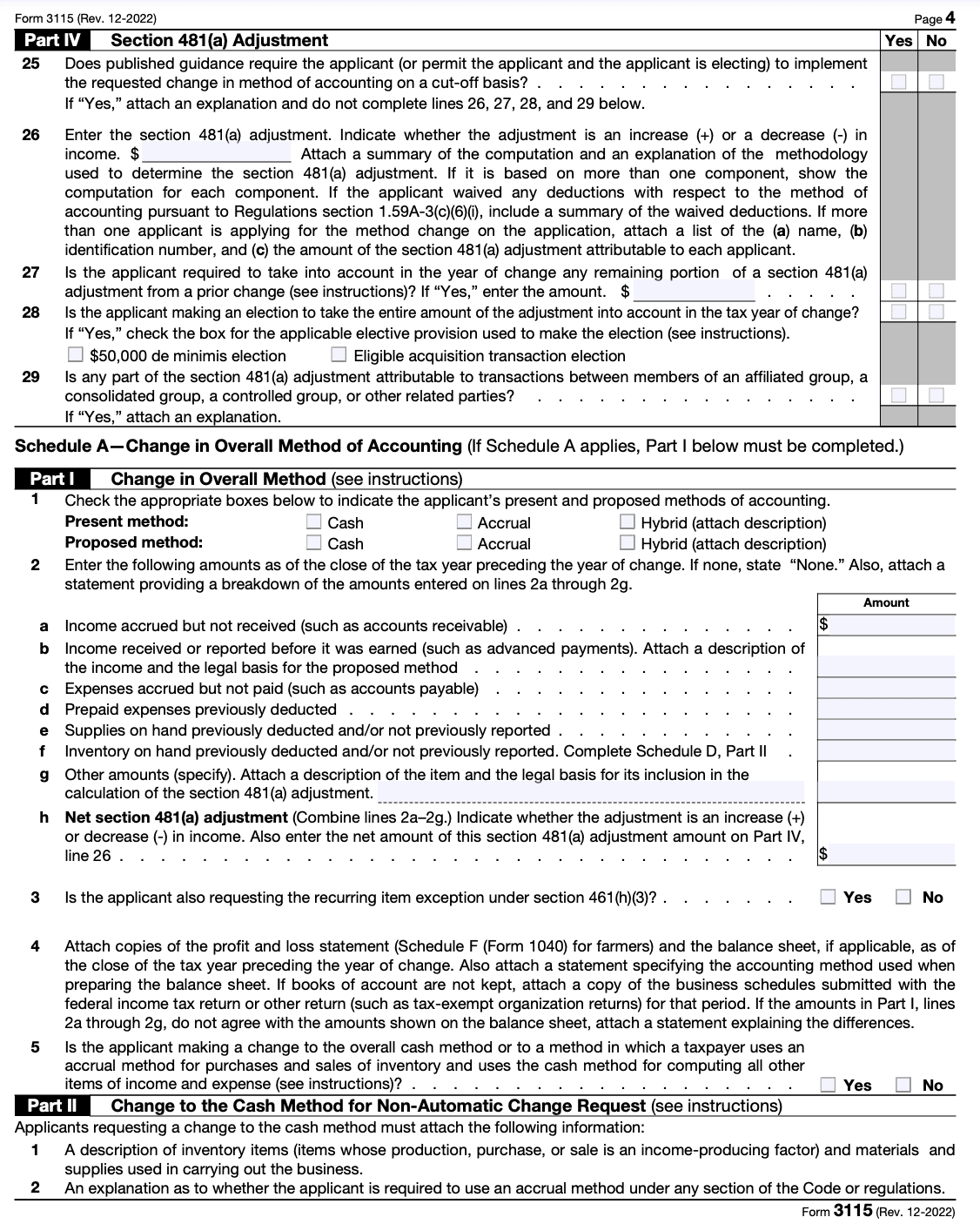

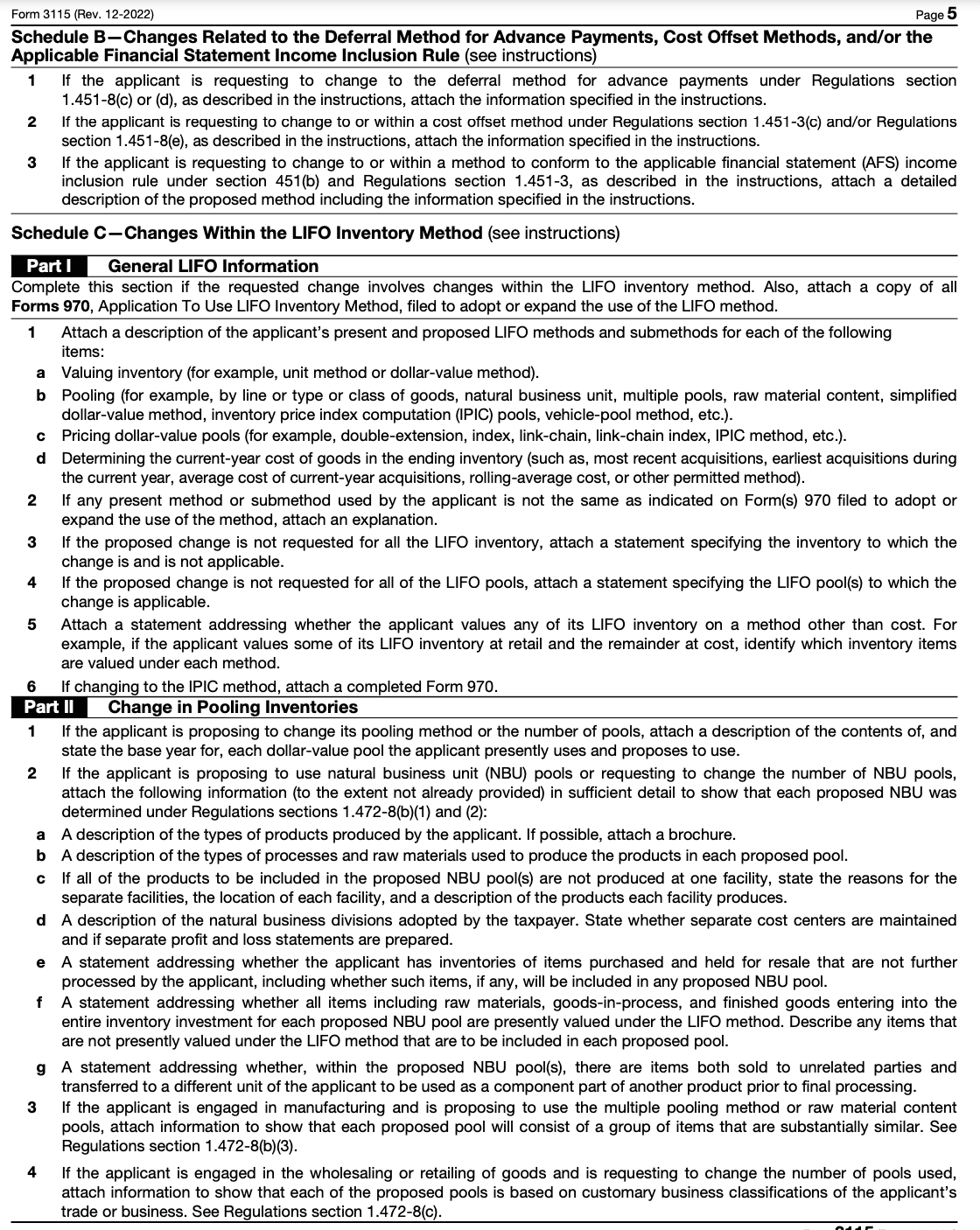

How To Complete Form 3115: A Step-by-Step Guide and Instructions

Here's a step-by-step guide with detailed instructions on completing IRS Tax Form 3115:

Step 1: Obtain the form

Download Form 3115 from the official IRS website (www.irs.gov) or request a copy from the IRS.

Step 2: Understand the instructions

Read the instructions accompanying Form 3115 carefully. They provide important information regarding eligibility, required attachments, and specific details on completing the form.

Step 3: Provide general information

Enter your name, address, taxpayer identification number (such as Social Security Number or Employer Identification Number), and other identifying information at the top of the form.

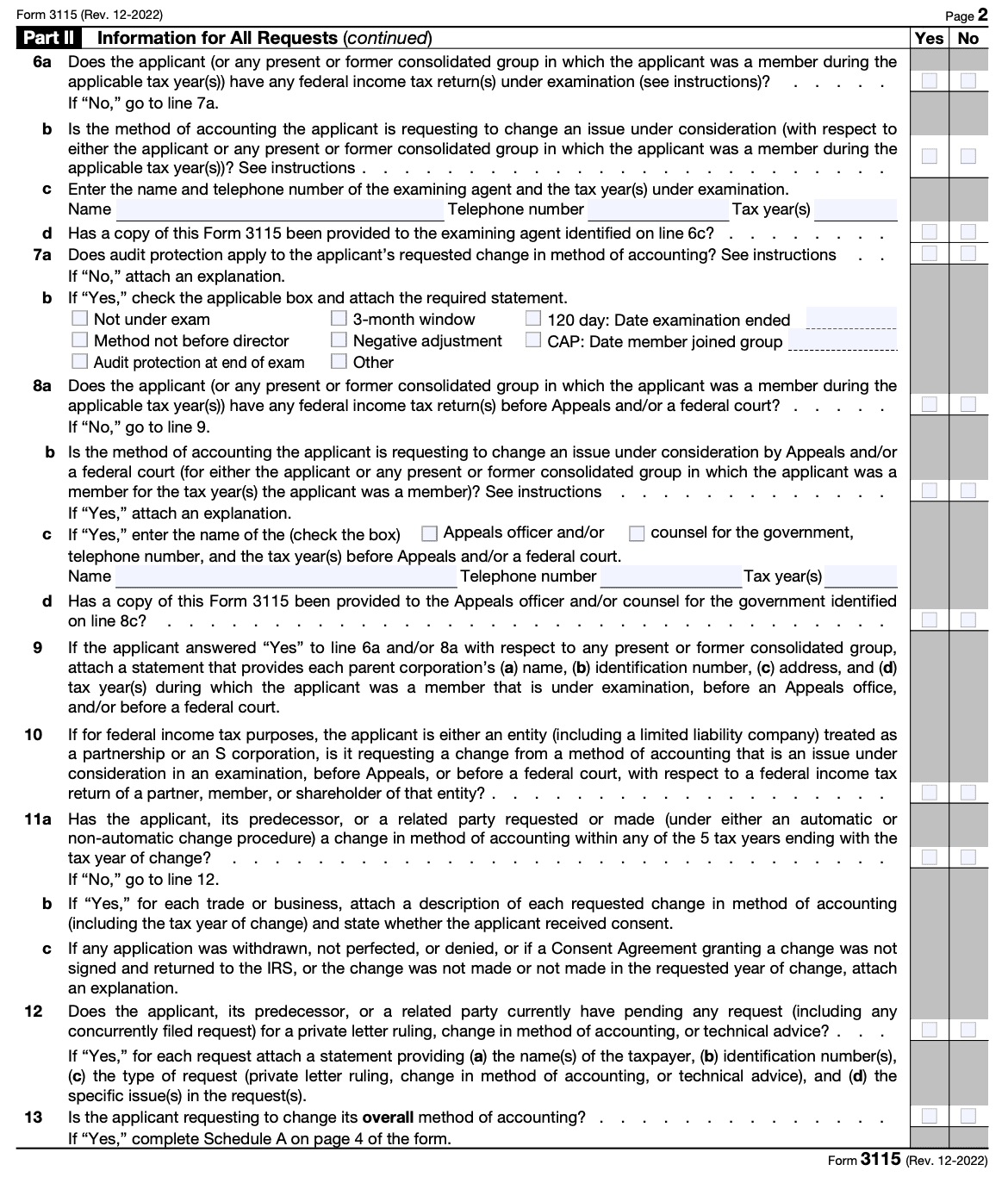

Step 4: Complete Section A: Information about the filer

Answer the questions in Section A that pertain to your filing status, tax year, and accounting method you want to change.

Step 5: Complete Section B: General information about the accounting method

Provide details about your current and proposed accounting methods in Section B. This includes information such as the name of the method, a description of the method, and the primary books and records used.

Step 6: Complete Section C: Additional information

Answer any additional questions in Section C that apply to your specific situation. This may include details about prior changes in accounting methods or any related transactions.

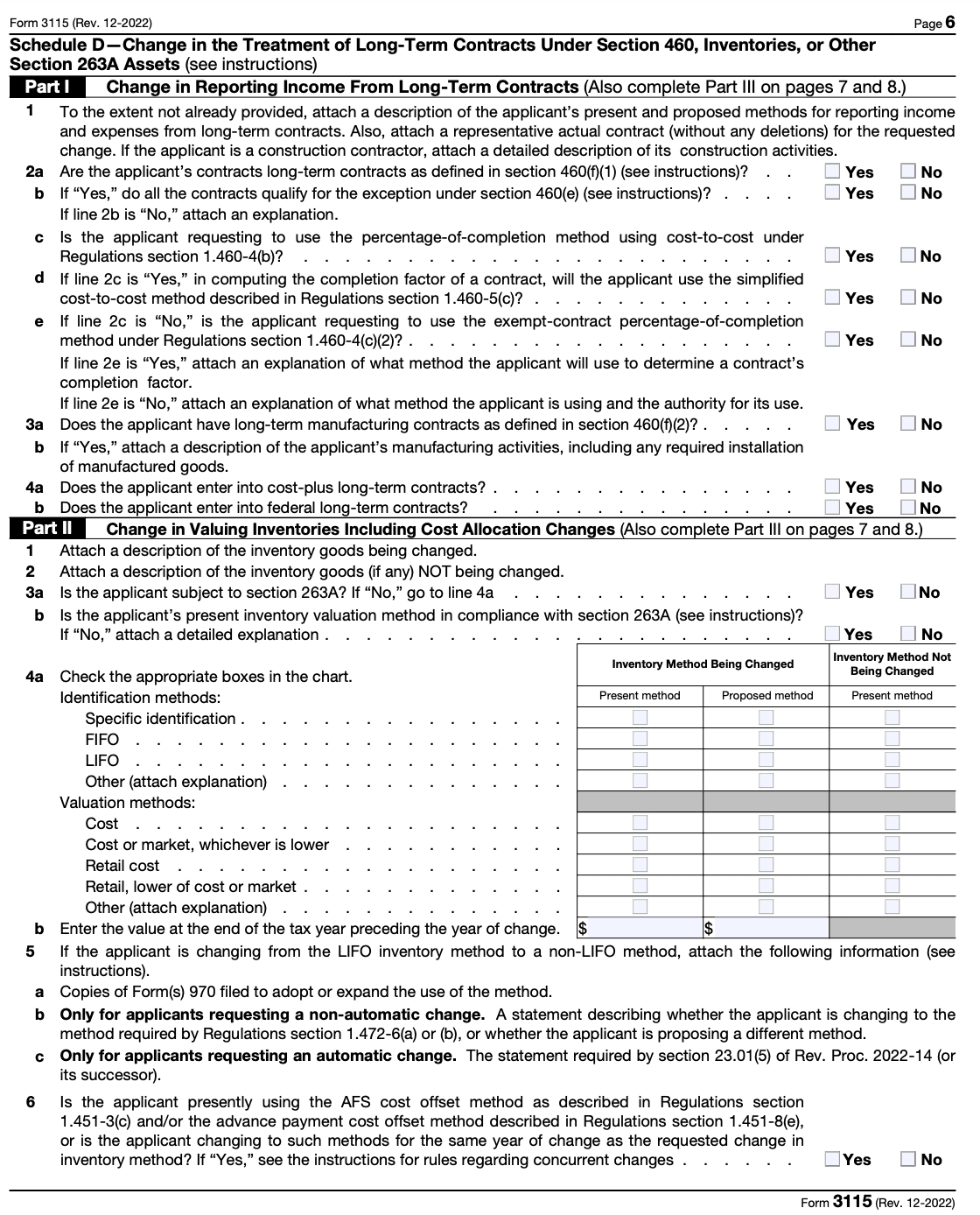

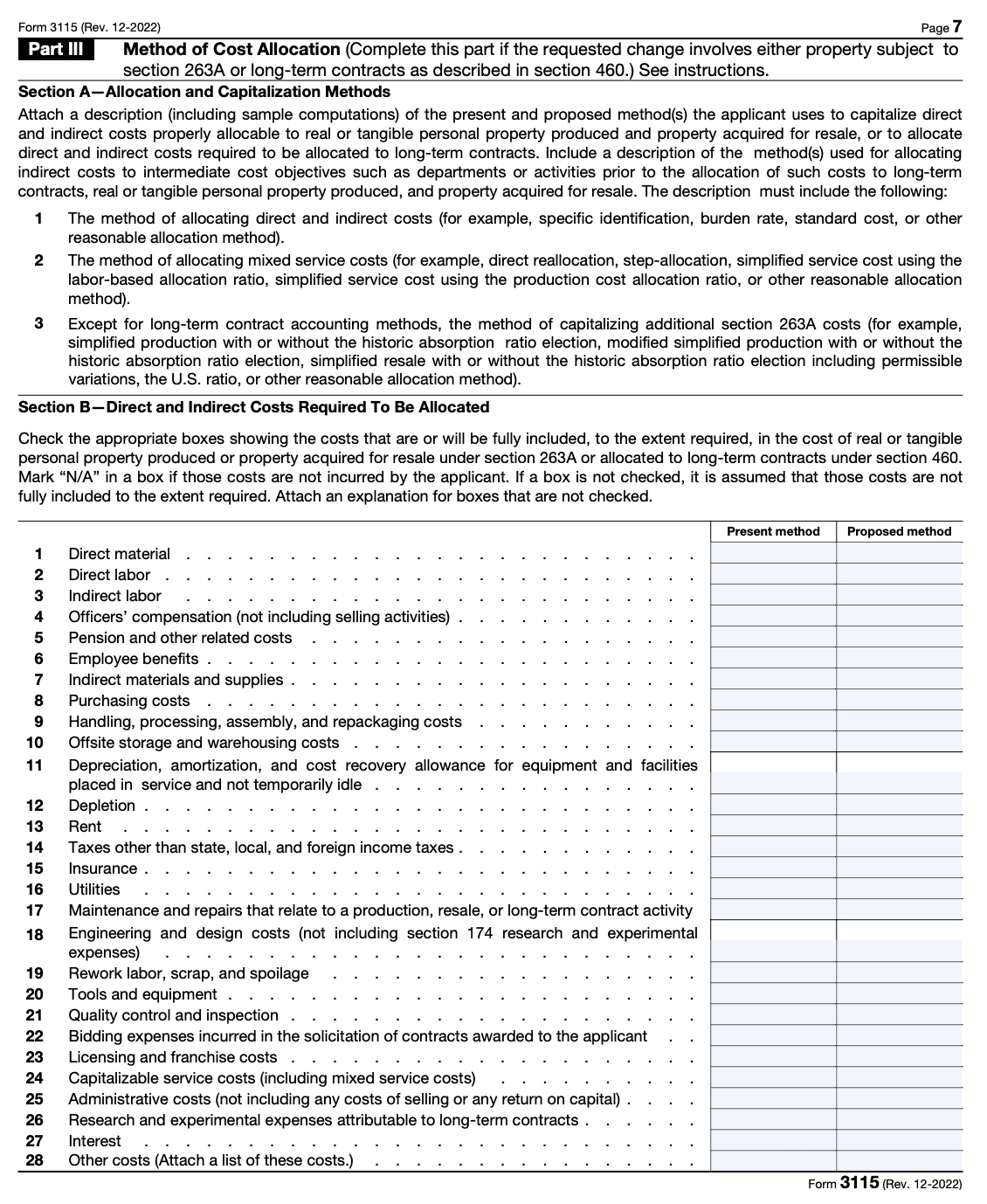

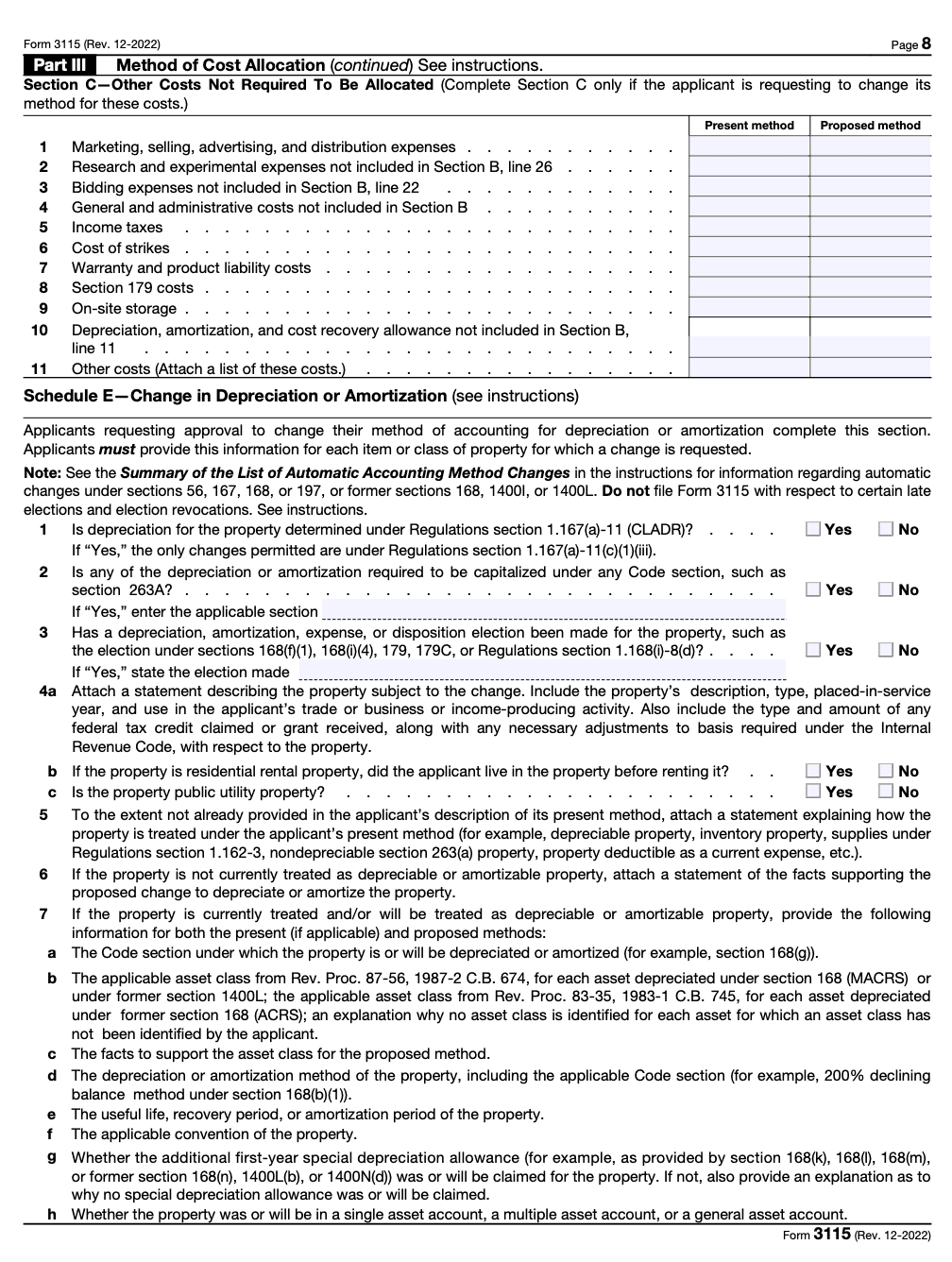

Step 7: Complete Section D: Statements and explanations

Attach any required statements, explanations, or computations that support your request for a change in accounting method. These might include schedules, calculations, or other supporting documents. Make sure to reference these attachments in the appropriate sections of the form.

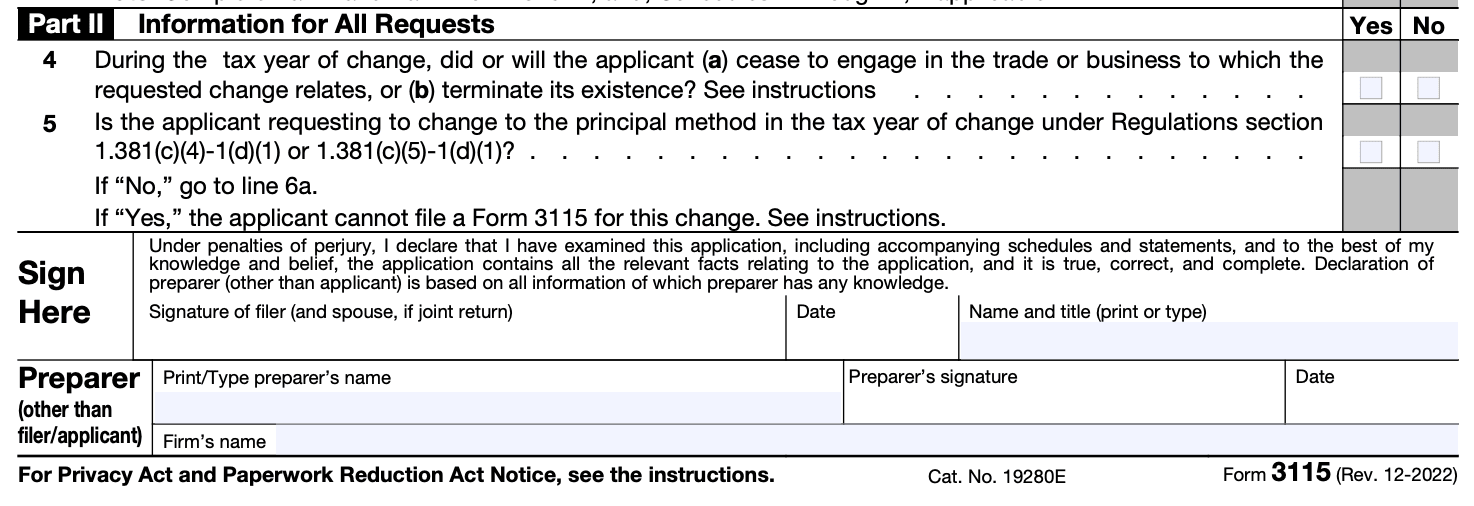

Step 8: Complete Section E: Signature and consent

Sign and date the form in Section E. If you are submitting the form on behalf of a partnership or corporation, include the authorized person's signature.

Step 9: Retain copies and file the form

Make copies of the completed Form 3115 and all attachments for your records. File the original form with the appropriate IRS office as instructed in the form's instructions.

Step 10: Keep track of the status

Monitor the status of your application using the IRS tracking system or by following up with the IRS if necessary.

Remember, this is a general guide, and the specific requirements for completing Form 3115 may vary depending on your unique circumstances. Consulting with a tax professional will ensure that you accurately complete the form and provide all necessary supporting documentation.

Section 481(a) Adjustments After an Accounting Method Change

When a business changes its accounting method, it may result in a section 481(a) adjustment. This adjustment is necessary to account for the difference between the income or deductions reported under the old method and what would have been reported under the new method.

Limits on Tax Increase from Section 481(a) Adjustment:

The IRS imposes certain limitations on the tax increase resulting from a section 481(a) adjustment to mitigate the potential financial burden on the business.

When and Where To File Tax Form 3115?

For automatic change requests: Form 3115 is filed with the tax return for the year of the change.

For non-automatic change requests: Form 3115 must be filed before the year of change, typically with the tax return for the year preceding the change.

Do You Attach Form 3115 To a Tax Return?

Form 3115 is generally attached to the taxpayer's timely filed original tax return for the year of the change. However, if the change is made in a subsequent year, the form is attached to the return for that year.

Special Considerations When Filing Form 3115

When filing Form 3115, there are several special considerations to keep in mind. Here are some:

Adequate disclosure: Ensure that the form provides adequate disclosure of the requested accounting method change. Include all relevant information, such as the current method, the proposed method, the reason for the change, and the impact on taxable income.

Timeliness: File Form 3115 in a timely manner. Generally, the form must be filed before the tax return for the year of the change is due, including extensions. However, there are certain exceptions and transition rules that may allow filing in subsequent years. Consult the instructions for Form 3115 and any applicable IRS guidance for specific deadlines and exceptions.

Consent requirements: In some cases, you may need to obtain the consent of the IRS to change your accounting method. The form includes a section where you can request this consent. Be aware that certain changes, such as changes from the cash to accrual method, generally require consent.

User fee: As of my knowledge cutoff date in September 2021, filing Form 3115 requires payment of a user fee. The fee amount depends on the taxpayer's average annual gross receipts. Confirm the current user fee amount by referring to the instructions for Form 3115 or consulting the latest IRS guidance.

Attachments: Include all required attachments with the form. This may include a statement of the proposed adjustment to taxable income, a statement of the section 481(a) adjustment, and any other supporting documentation as specified in the instructions.

Consult a tax professional: Filing Form 3115 can be complex, and the tax implications of changing accounting methods can be significant. It's advisable to consult with a qualified tax professional who can assist you in accurately completing the form and navigating the process.

Filing Deadlines & Extensions of IRS Tax Form 3115

Typically, the deadline for filing Form 3115 depends on the type of accounting method change being requested.

The general rule is that Form 3115 should be filed with the taxpayer's timely filed federal income tax return for the year of change. However, there are a few exceptions and special cases to consider:

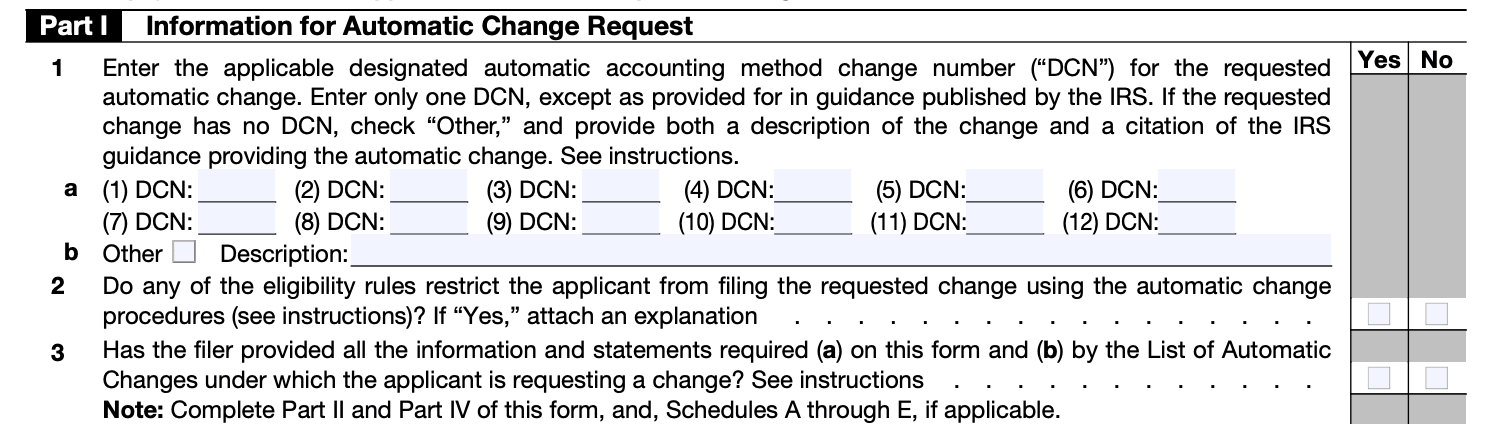

Automatic changes

Certain accounting method changes are considered automatic, which means they don't require IRS consent. In these cases, the taxpayer generally files Form 3115 with their federal income tax return for the year of change. The due date for filing the tax return, including extensions, applies.

Non-automatic changes

If the accounting method change is not eligible for automatic consent, the taxpayer must file Form 3115 under the non-automatic procedures. In this case, the taxpayer generally files Form 3115 before the first day of the tax year of change. Extensions are not available for non-automatic changes.

Extensions

For the general rule mentioned earlier, if a taxpayer requests an extension to file their federal income tax return, the extension also applies to the filing of Form 3115. Therefore, if you have received an extension for filing your tax return, you typically have until the extended due date to file Form 3115 as well.

Common Mistakes To Avoid While Filing Form 3115

When filing Form 3115, it's important to be thorough and accurate to avoid any potential mistakes or issues. Here are some common mistakes to avoid while filing Form 3115:

Incomplete or missing information: Ensure that all the required fields on the form are completed accurately. Double-check that you've included all necessary attachments and schedules as specified in the instructions.

Incorrect accounting method description: Provide a clear and accurate description of your current and proposed accounting methods. Clearly explain the changes you are requesting and how they comply with the tax regulations.

Improper or missing documentation: Supporting documentation is crucial when filing Form 3115. Provide all relevant documents, such as financial statements, calculations, and schedules, to support your requested accounting method change.

Failure to follow the correct procedure: Make sure you follow the proper procedure for filing Form 3115, including timely filing, appropriate submission to the correct IRS office, and adhering to any specific instructions or requirements outlined in the form instructions or other guidance.

Incorrect or inconsistent numbers: Double-check all numerical figures, such as amounts, percentages, and calculations, to ensure they are accurate and consistent throughout the form and supporting documentation. Any inconsistencies or errors may raise red flags with the IRS.

Missing or outdated form version: Always use the most current version of Form 3115 provided by the IRS. Using an outdated form could result in your application being rejected or delayed.

Failure to consult a tax professional: Filing Form 3115 can be complex, especially if you have multiple accounting method changes or unique circumstances. Consulting with a tax professional or accountant experienced in tax compliance can help ensure you're completing the form correctly and maximizing your chances of approval.

Remember, filing Form 3115 involves navigating specific tax regulations, and any mistakes or omissions could lead to delays, penalties, or even audits. It's crucial to carefully review your submission and seek professional guidance if needed.

Conclusion

Form 3115 plays a crucial role in facilitating changes in accounting methods for businesses. While the process of filing this form can be complex, understanding its purpose and following the necessary steps is essential for maintaining compliance and accuracy in financial reporting.

When considering a change in accounting method, businesses should carefully assess the impact on their financial statements and tax obligations, seek professional advice if needed, and ensure the proper completion of Form 3115.

By navigating this process successfully, businesses can make informed accounting decisions and align their financial reporting practices with their evolving needs and regulatory requirements.

FAQs:

What types of accounting method changes require Form 3115?

Common changes that require Form 3115 include:

- Switching from cash to accrual accounting or vice versa

- Changing inventory valuation methods

- Modifying depreciation methods

- Adjusting the timing of recognizing income and expenses

What is an automatic accounting method change?

An automatic accounting method change is one that does not require advance consent from the IRS. These changes follow specific procedures outlined by the IRS and are typically less complex. Form 3115 must still be filed, but the IRS pre-approves these changes under Rev. Proc. 2015-13.

What is a non-automatic accounting method change?

A non-automatic accounting method change requires advance written consent from the IRS. This involves a more detailed review process, and the taxpayer must file Form 3115 and pay a user fee. Approval is not guaranteed, and additional documentation may be required.

What is the Section 481(a) adjustment?

The Section 481(a) adjustment accounts for any income or deductions that would have been recognized under the old accounting method but need to be adjusted under the new method. This adjustment prevents duplication or omission of income or expenses due to the change in accounting method.

Can I make multiple accounting method changes on one Form 3115?

Generally, a separate Form 3115 is required for each accounting method change. However, the IRS may allow multiple changes in certain circumstances, provided they are related and can be clearly documented on one form.

What is catch-up depreciation on Form 3115 and When do I need to report?

Catch-up depreciation is an adjustment on Form 3115 to correct accumulated depreciation when changing accounting methods, ensuring total depreciation is accurately reflected.

You need to report catch-up depreciation when you change your accounting method and need to adjust previously reported depreciation to match the new method.

What is Code 88 on Form 3115 and How do I use it?

Form 3115 Code 88 refers to changes in the method of accounting for depreciation or amortization, typically involving adjustments to the recovery period or method used.

You use Code 88 on Form 3115 to indicate a change in your depreciation method, recovery period, or convention for depreciable assets.

What is a statement in lieu of Form 3115 and Who can use it?

A statement in lieu of Form 3115 allows certain small taxpayers to make accounting method changes without filing the full form, provided they meet specific IRS criteria.

Small taxpayers with average annual gross receipts of $10 million or less over the prior three years can use a statement in lieu of Form 3115 for certain changes.

Can I correct an error in my catch-up depreciation?

Yes, if an error is discovered in your catch-up depreciation, you should file a corrected Form 3115 as soon as possible.

What happens if I fail to report catch-up depreciation?

Failing to report catch-up depreciation can result in inaccurate tax filings and potential penalties or audits from the IRS.

Is there a fee for filing Form 3115?

There is no fee for filing an automatic change request on Form 3115, but a user fee is required for non-automatic changes.

How long does it take to get approval for Code 88 changes?

Approval for non-automatic changes under Code 88 can take several months, as the IRS must review and approve the request.