- IRS forms

- Form 56

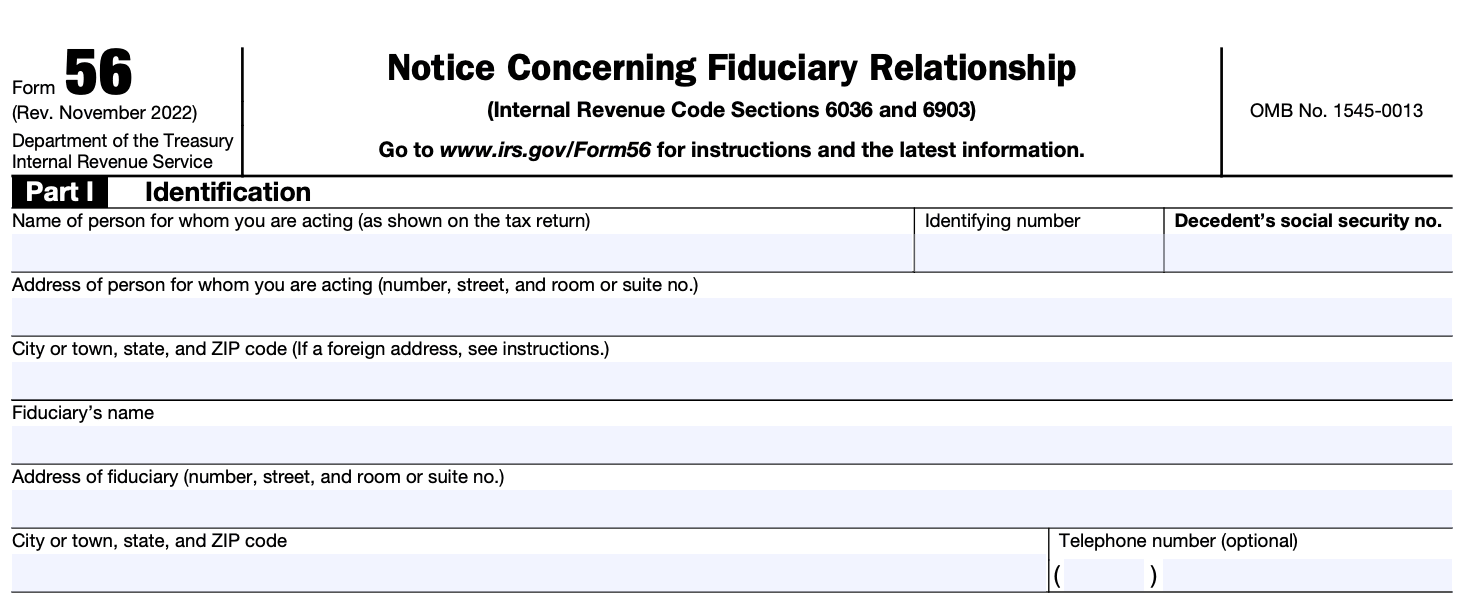

IRS Tax Form 56: Notice Concerning Fiduciary Relationship

Download Form 56In the world of taxes and financial matters, establishing and maintaining clear lines of communication and responsibility is crucial. When it comes to fiduciary relationships, the Internal Revenue Service (IRS) has a valuable tool called Form 56: Notice Concerning Fiduciary Relationship. This form serves as a means to inform the IRS about the creation or termination of a fiduciary relationship, allowing for effective communication and accountability between fiduciaries, beneficiaries, and the IRS.

Before delving into IRS Tax Form 56, it's important to understand what a fiduciary relationship entails. A fiduciary is an individual or entity that holds a legal and ethical obligation to act in the best interests of another party. Fiduciary relationships commonly exist between trustees and beneficiaries, executors and heirs, or guardians and dependents. Fiduciaries are entrusted with managing assets, making financial decisions, and fulfilling other obligations on behalf of the beneficiaries.

In this blog post, we will explore the purpose, significance, and key aspects of Form 56.

What is the Purpose of Filing Tax Form 56?

By filing Form 56, the appointed fiduciary informs the IRS about their role and responsibilities in managing the taxpayer's affairs. The form includes information such as the name and taxpayer identification number of the individual or entity for whom the fiduciary is acting, the type of fiduciary relationship, and the fiduciary's contact information.

IRS Form 56 also allows the fiduciary to designate their authority, such as whether they have the power to receive notices and correspond with the IRS on behalf of the taxpayer. This is important because the IRS will direct communications and correspondence related to the taxpayer's affairs to the designated fiduciary.

Filing Form 56 is a legal requirement to ensure proper communication and accountability between the IRS and the appointed fiduciary, and to establish the fiduciary's authority to act on behalf of the taxpayer.

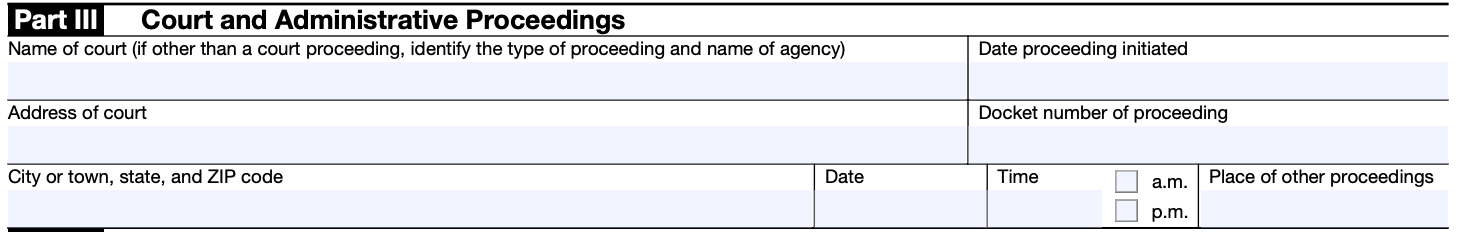

Components or Sections of Form 56

Form 56 provides important information about the fiduciary and the entity involved. The components of Form 56 include:

Identifying information

This section requires the following details:

Name, address, and (link: https://fincent.com/how-to/file-and-pay-small-business-taxes#:~:text=Taxpayer%20Identification%20Number%20(TIN),the%20most%20commonly%20used%20ones. text: taxpayer identification number (TIN)) of the entity for which the fiduciary is being appointed.

Name, address, and TIN of the fiduciary or representative being appointed.

Entity information

This section requires information about the entity for which the fiduciary is being appointed, including:

- Type of entity (e.g., estate, trust, etc.).

- Date of creation or establishment of the entity.

- Purpose or reason for the appointment of the fiduciary.

- Additional information about the entity, such as its principal address.

Fiduciary information

This section contains information about the fiduciary or representative being appointed, including:

- Relationship to the entity (e.g., executor, trustee, etc.).

- Date of appointment as fiduciary.

- Mailing address (if different from the entity's address).

- Contact information, including telephone number and email address.

- Notices and Statements: This section allows the filer to select whether the fiduciary wants to receive various tax-related notices and statements on behalf of the entity.

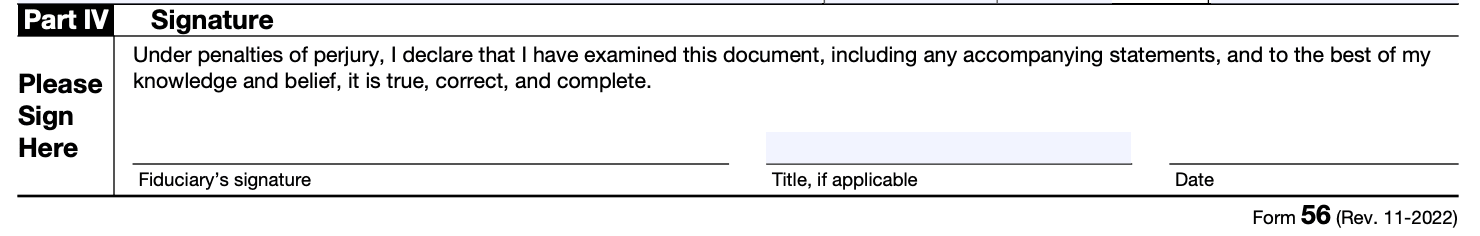

Signature and certification

The filer must sign and date the form, certifying that the information provided is true, correct, and complete to the best of their knowledge.

Benefits of Filing Form 56

Here are some benefits of filing Form 56:

-

Ensures proper tax administration: By filing Form 56, you inform the IRS about the appointment of a fiduciary, who will be responsible for handling the tax matters on behalf of the individual or entity. This helps ensure that the tax obligations are properly administered and addressed.

-

Protects the interests of the taxpayer: If an individual becomes incapacitated or is unable to handle their own tax affairs, filing Form 56 allows a trusted fiduciary to step in and manage their tax matters. This protects the interests of the taxpayer and helps ensure that their taxes are handled appropriately.

-

Facilitates communication with the IRS: When Form 56 is filed, the IRS recognizes the fiduciary as the point of contact for tax matters. This simplifies communication between the fiduciary and the IRS, allowing for efficient handling of tax-related issues, inquiries, and notifications.

-

Helps avoid penalties and compliance issues: By appointing a fiduciary and filing Form 56, you establish a clear line of responsibility for tax matters. This reduces the risk of missing deadlines, late filings, or other compliance issues that could result in penalties or legal complications.

-

Provides legal protection: Filing Form 56 creates a legal record of the fiduciary appointment, which can be important in situations where disputes or challenges may arise. It helps establish the fiduciary's authority to act on behalf of the individual or entity and protects them from unauthorized actions or claims.

-

Allows for tax refund processing: If there are any tax refunds owed to the individual or entity, the fiduciary can claim and process those refunds on their behalf after filing Form 56. This ensures that any rightful refunds are received in a timely manner.

It's worth noting that the specific benefits of filing Form 56 may vary depending on the circumstances and the nature of the fiduciary relationship.

Who Is Eligible To File Form 56?

Form 56 is typically filed by fiduciaries, such as executors, administrators, trustees, or guardians, who are responsible for managing the financial affairs of another person or entity.

Here are some situations where individuals or entities may be eligible to file Form 56:

Executors or administrators of an estate: When someone passes away, their estate may need to go through probate. The executor or administrator appointed by the court to handle the estate's affairs may file Form 56 to notify the IRS of their fiduciary role.

Trustees of a trust: If you are appointed as a trustee of a trust, whether it's a revocable living trust or an irrevocable trust, you may need to file Form 56 to inform the IRS of your fiduciary position and take responsibility for the trust's tax obligations.

**Guardians or conservators: **If you have been appointed as a guardian or conservator for a minor or incapacitated person, you may file Form 56 to establish your fiduciary relationship and handle their financial affairs.

Court-appointed representatives: In certain legal cases, the court may appoint a representative, such as a receiver or a personal representative, to manage the financial matters of an individual or entity. The court-appointed representative may file Form 56 to notify the IRS of their appointment.

It's important to note that filing Form 56 does not necessarily mean that you are required to pay taxes on behalf of the person or entity you represent. It is primarily a notification to the IRS of your fiduciary role and allows the IRS to correspond with you regarding tax matters related to the estate, trust, or individual you represent.

When Should IRS Form 56 Be Filed?

You can utilize Form 56 for the following purposes:

- Notify the IRS of the establishment or termination of a fiduciary relationship under section 6903.

- Provide notice of qualification under section 6036.

When and Where to File Form 56

Here is when and where to file form 56, notice of fiduciary relationship, should be filed as follows:

- Fiduciary Relationship: File Form 56 with the appropriate Internal Revenue Service Center when you establish or terminate a fiduciary relationship, where the person for whom you act is required to file tax returns.

- Proceedings and Assignments: If you are appointed as a receiver in a receivership proceeding or a similar fiduciary, or an assignee for the benefit of creditors, you must file Form 56 within 10 days of the appointment date with the Advisory Group Manager at the IRS area office that has jurisdiction over the person for whom you act. Additional details can be found in Pub. 4235, Collection Advisory Group Numbers and Addresses.

- Receiver or Assignee: The receiver or assignee may also file a separate Form 56 with the service center where the person for whom the fiduciary is acting is required to file tax returns to provide the notice required by section 6903.

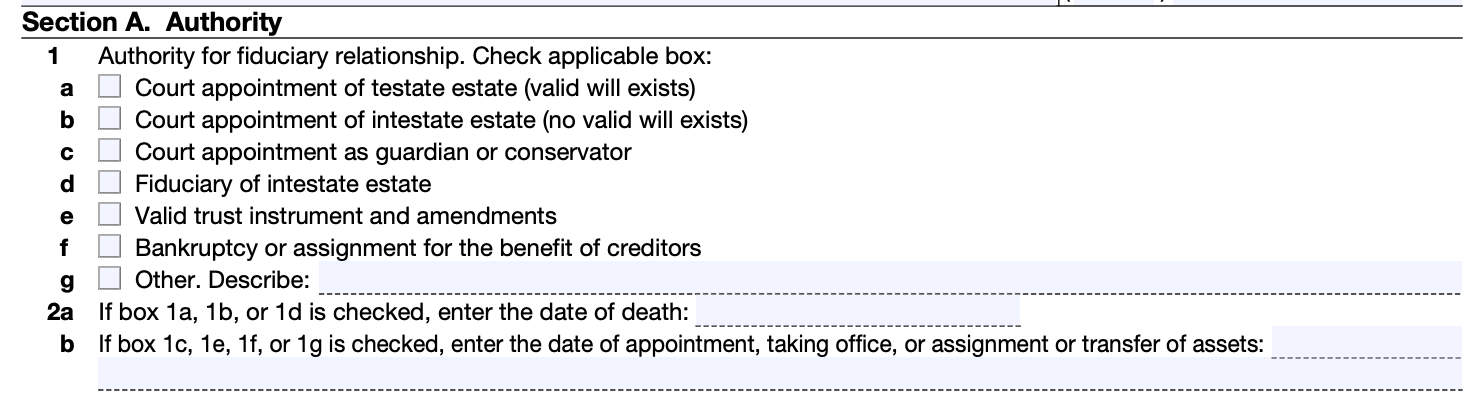

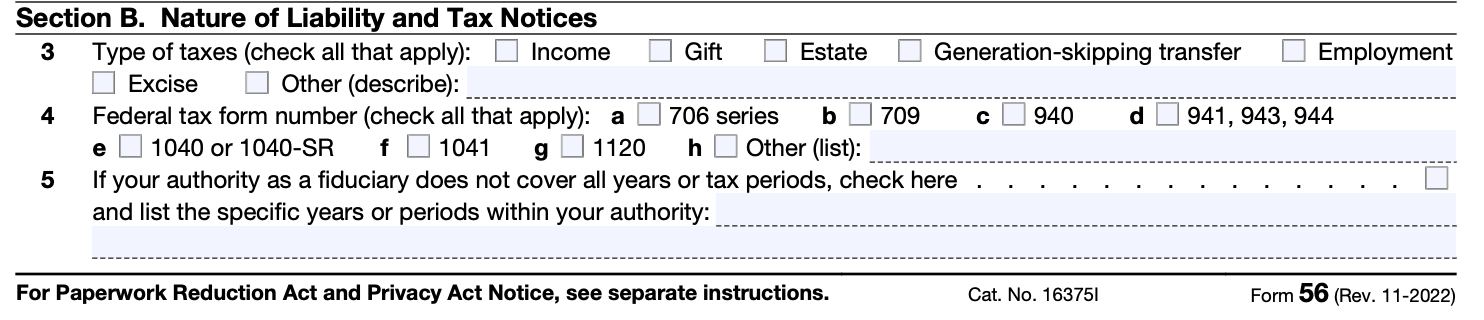

How To Complete Filing Form 56: A Step-by-Step Guide and Instructions

Here is a step-by-step guide on how to complete filing and Form 56 instructions in detail:

Step 1: Obtain the form

You can download Form 56 from the official IRS website (www.irs.gov) or request a copy by calling the IRS forms line at 1-800-829-3676.

Step 2: Read the instructions

Before filling out the form, carefully read the instructions provided with Form 56. The instructions will provide valuable information on how to complete each section correctly.

Step 3: Provide your information

Enter your personal information, including your name, address, and taxpayer identification number (Social Security Number or Employer Identification Number). If you are representing an organization, provide the organization's name and (link: https://fincent.com/glossary/employer-identification-number text: EIN).

Step 4: Identify the fiduciary

Provide information about the fiduciary relationship, such as the name of the estate, trust, or organization, and the date it was created or terminated. Indicate whether you are the fiduciary or the responsible party.

Step 5: Identify the type of fiduciary entity

Check the box that corresponds to the type of fiduciary entity (estate, trust, or other). If you selected "other," provide a brief explanation in the space provided.

Step 6: Choose the applicable codes

Check the box that indicates the reason for filing Form 56. Choose the appropriate code(s) that best describes your situation from the list provided in the instructions. If none of the codes apply, check the "Other" box and provide an explanation.

Step 7: Provide additional information

Use this section to provide any additional information that may be required based on your specific circumstances. This could include details about the fiduciary relationship, the assets involved, or any other relevant information.

Step 8: Sign and date the form

Review the completed form to ensure accuracy and completeness. Sign and date the form in the designated areas.

Step 9: Submit the form

Keep a copy of the completed Form 56 for your records. Send the original form to the appropriate IRS office based on your location. The address to which you should send the form can be found in the instructions.

Special Considerations When Filing Form 56

When filing Form 56, there are several special considerations to keep in mind. Here are some important points to consider:

Accurate and complete information: Ensure that all the information provided on Form 56 is accurate and complete. This includes details about the fiduciary, the taxpayer, the type of fiduciary relationship, and any relevant dates. Double-check the information before submitting the form to avoid any errors or delays in processing.

**Timeliness: **File Form 56 promptly after the fiduciary relationship is established or terminated. Timely filing helps the IRS maintain accurate records and ensures that the appropriate tax responsibilities are assigned to the correct parties.

Supporting documentation: In some cases, supporting documentation may be required to accompany Form 56. For example, if the fiduciary relationship is created by a court order, a copy of the order should be attached to the form. Review the instructions for Form 56 to determine if any additional documentation is necessary.

Authorized representative: If someone other than the fiduciary is completing and filing Form 56 on behalf of the fiduciary, ensure that they have the proper authorization. This can be done by completing Form 2848, Power of Attorney and Declaration of Representative, which grants authority to the representative to act on behalf of the fiduciary.

Multiple fiduciaries: If there are multiple fiduciaries for the same taxpayer, each fiduciary must file a separate Form 56. Provide accurate information for each fiduciary involved to avoid confusion or processing errors.

**Other tax forms: **Filing Form 56 does not relieve the fiduciary from other tax filing obligations. Depending on the specific circumstances, the fiduciary may still need to file other tax forms, such as Form 1041, U.S. Income Tax Return for Estates and Trusts, or Form 706, U.S. Estate (and Generation-Skipping Transfer) Tax Return. Be aware of the additional requirements and ensure compliance with all applicable tax filings.

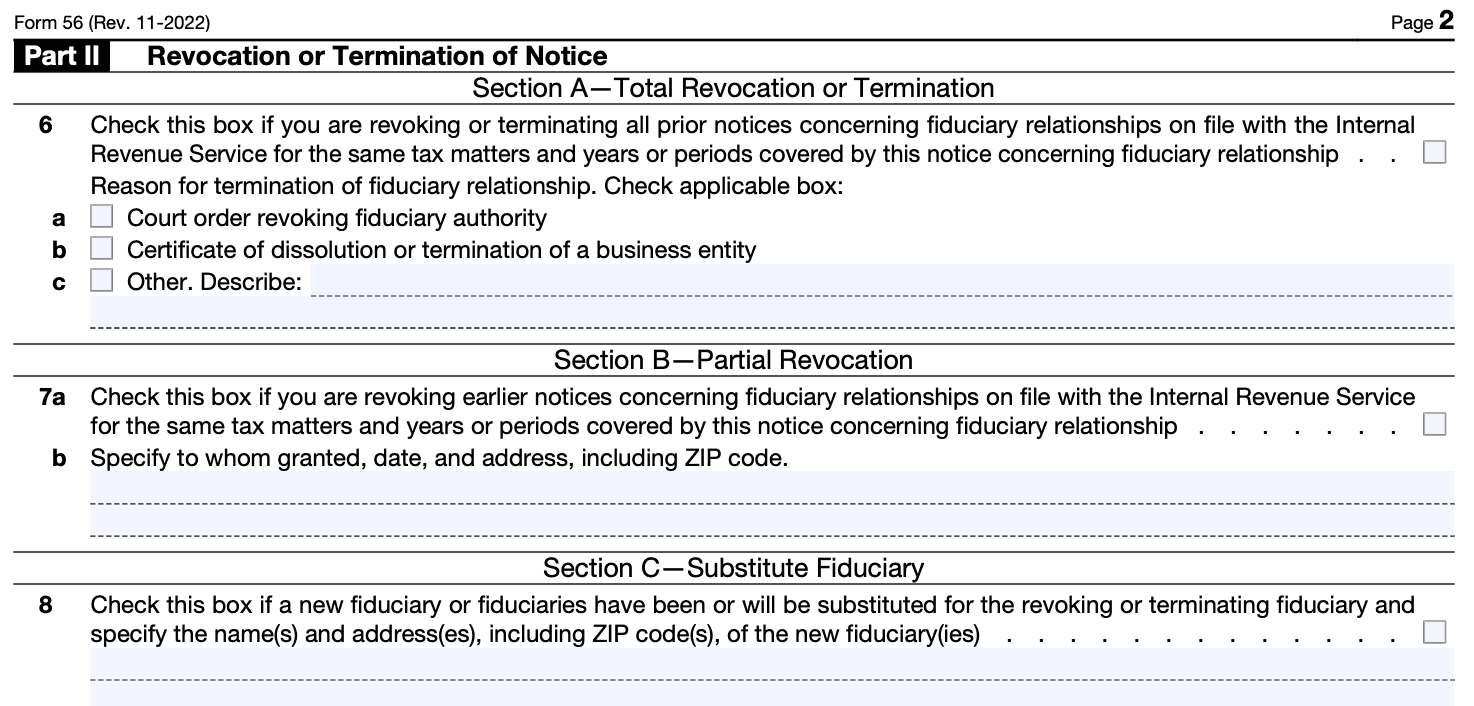

**Updates and changes: **If there are any changes to the information provided on Form 56 after filing, such as a change in address or termination of the fiduciary relationship, it is important to notify the IRS promptly. This can be done by filing an updated Form 56 or by providing written notification to the IRS.

Common Mistakes To Avoid When Filing Form 56

When filing Form 56, Notice Concerning Fiduciary Relationship, there are several common mistakes to avoid to ensure accurate and timely submission. Here are some of the key mistakes to watch out for:

**Incomplete or incorrect information: **Make sure to provide accurate and complete information on Form 56, including the name, address, and taxpayer identification number (TIN) of the fiduciary and the estate or trust.

**Failure to attach necessary documentation: **Depending on the circumstances, you may need to attach additional documentation to support your filing. For example, if you're filing on behalf of an estate, you may need to include a copy of the decedent's death certificate. Failure to include required documentation can lead to delays or rejections.

Failing to select the correct box: Form 56 provides different options to indicate the type of fiduciary relationship. Ensure that you select the appropriate box that accurately represents the relationship between the fiduciary and the estate or trust.

Late or delayed filing: Form 56 must be filed within 90 days of the fiduciary relationship being established. Failing to file the form in a timely manner can result in penalties or other complications. Therefore, it's important to be aware of the deadline and submit the form promptly.

Incorrect mailing address: Ensure that you use the correct mailing address for submitting Form 56. The address may vary depending on the location and circumstances. Refer to the instructions provided with the form or consult the IRS website for the most up-to-date information.

**Failure to notify the IRS of changes: **If there are any changes in the fiduciary relationship or the information provided on Form 56, it's crucial to notify the IRS promptly. Failure to do so may result in inaccurate records or delayed processing of your form.

Neglecting to keep copies for your records: Always make copies of the completed Form 56 and any accompanying documents before sending them to the IRS. This ensures that you have a record of what was submitted and can help resolve any potential discrepancies or issues that may arise.

Key Takeaways

Form 56: Notice Concerning Fiduciary Relationship is an essential tool for maintaining clear lines of communication and accountability within fiduciary relationships. By submitting this form, fiduciaries can establish or terminate a fiduciary relationship, allowing the IRS to administer tax matters effectively.

Transparency and communication are crucial when it comes to financial responsibilities, and Form 56 serves as a valuable means to achieve these goals. Fiduciaries should familiarize themselves with this form and ensure its proper filing to comply with IRS requirements and uphold their fiduciary obligations.