- IRS forms

- Form 5472

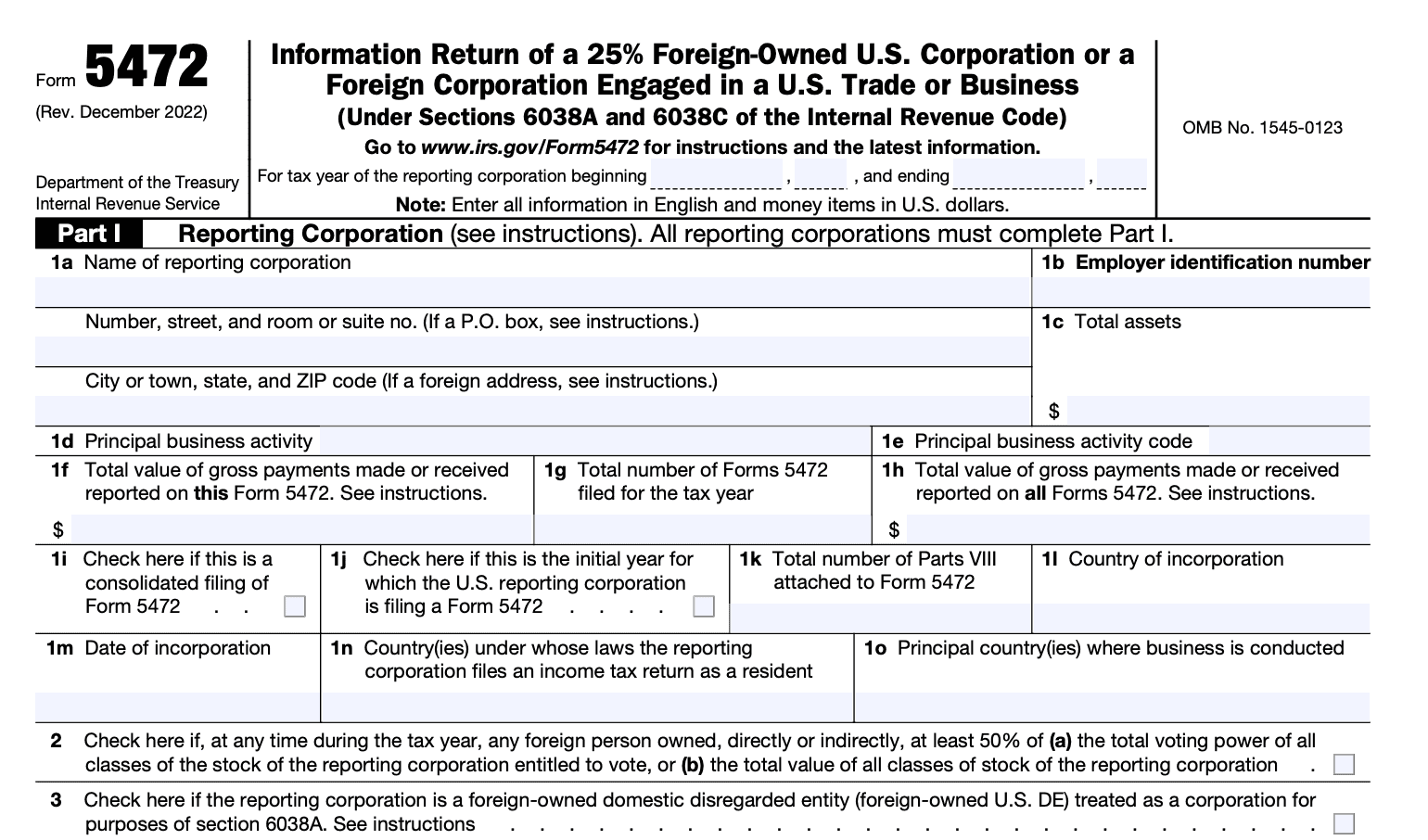

Form 5472 Filing: Guide for Foreign-Owned US Corps

Download Form 5472Introduction

Form 5472 is a requirement for foreign-owned U.S. corporations or foreign corporations that engage in U.S. trade or business. It is an information return that requires detailed reporting on the company's related parties, transactions, and other relevant financial information. This guide will help you learn how to file Form 5472 accurately, avoid common mistakes, and stay compliant.

Who needs to file Form 5472?

Form 5472 is required to be filed by foreign-owned U.S. corporations and foreign corporations doing business in the United States. A foreign-owned U.S. corporation is one where a foreign person or entity owns 25% or more of the corporation's shares. A foreign corporation is involved in U.S. trade or business when they operate in the United States. This could be either directly or through a branch or office.

Here are a few examples of entities that are required to file Form 5472:

- A foreign-owned U.S. corporation that has a U.S. branch office

- A foreign corporation that owns a U.S. subsidiary

- A foreign corporation that operates a business in the United States

Exceptions from filing IRS Form 5472

There are some exceptions to the filing requirements for certain entities. If a corporation is not doing business in the US, they don't need to file Form 5472. Similarly, if they're not owned by a foreign entity, they're also exempt.

Exceptions to filing Form 5472 are available for reporting corporations under certain circumstances. These circumstances are as follows:

- If the corporation did not engage in any reportable transactions as listed in Parts IV, V, and VI of the form.

- A U.S. person who is in control of a foreign-related corporation must file Form 5471 for the tax year. They must also report information under section 6038. To qualify for this exception, a U.S. person must complete Schedule M ((link: https://fincent.com/irs-tax-forms/form-5471 text: Form 5471)). This includes listing all reportable transactions between the reporting corporation and a related party for the tax year. However, this exception does not apply to foreign-owned U.S. disregarded entities (DEs).

- If the related corporation qualifies as a foreign sales corporation and files Form 1120-FSC. However, this exception also does not apply to foreign-owned U.S. DEs.

- The reporting corporation is a foreign corporation. It does not have a permanent establishment in the U.S. under an applicable income tax treaty. To comply with the requirement, it must timely file Form 8833.

- The reporting corporation is a foreign corporation. All of its gross income is exempt from taxation under section 883. It also complies with the reporting requirements of sections 883 and 887.

- If both the reporting corporation and the related party are not U.S. persons, as defined in section 7701(a)(30), and their transactions will not generate gross income from sources within the U.S., or income effectively connected with the conduct of a trade or business within the U.S., nor any expense, loss, or other deduction that is allocable or apportionable to such income. However, this exception does not apply to foreign-owned U.S. DEs.

Consolidated income tax returns:

It is important to recognize that a company belonging to an affiliated group can fulfill the requirements of Regulation section 1.6038A-2. They can do this by submitting a U.S. consolidated Form 5472 for a consolidated income tax return. It should be noted that no one in the group is required to file a consolidated Form 5472. This is even if other members of the group choose to file one or more Forms 5472 on a consolidated basis.

What information is required on Form 5472?

Form 5472 requires detailed reporting on the company's related parties, transactions, and other relevant financial information. Form 5472 (Rev. December 2022) is divided into several parts, each requiring specific information. Let's take a closer look at what each part entails:

Part I - Reporting Corporation:

This section requests basic identifying information, such as the corporation's name, address, (link: https://fincent.com/glossary/employer-identification-number text: EIN), and tax year.

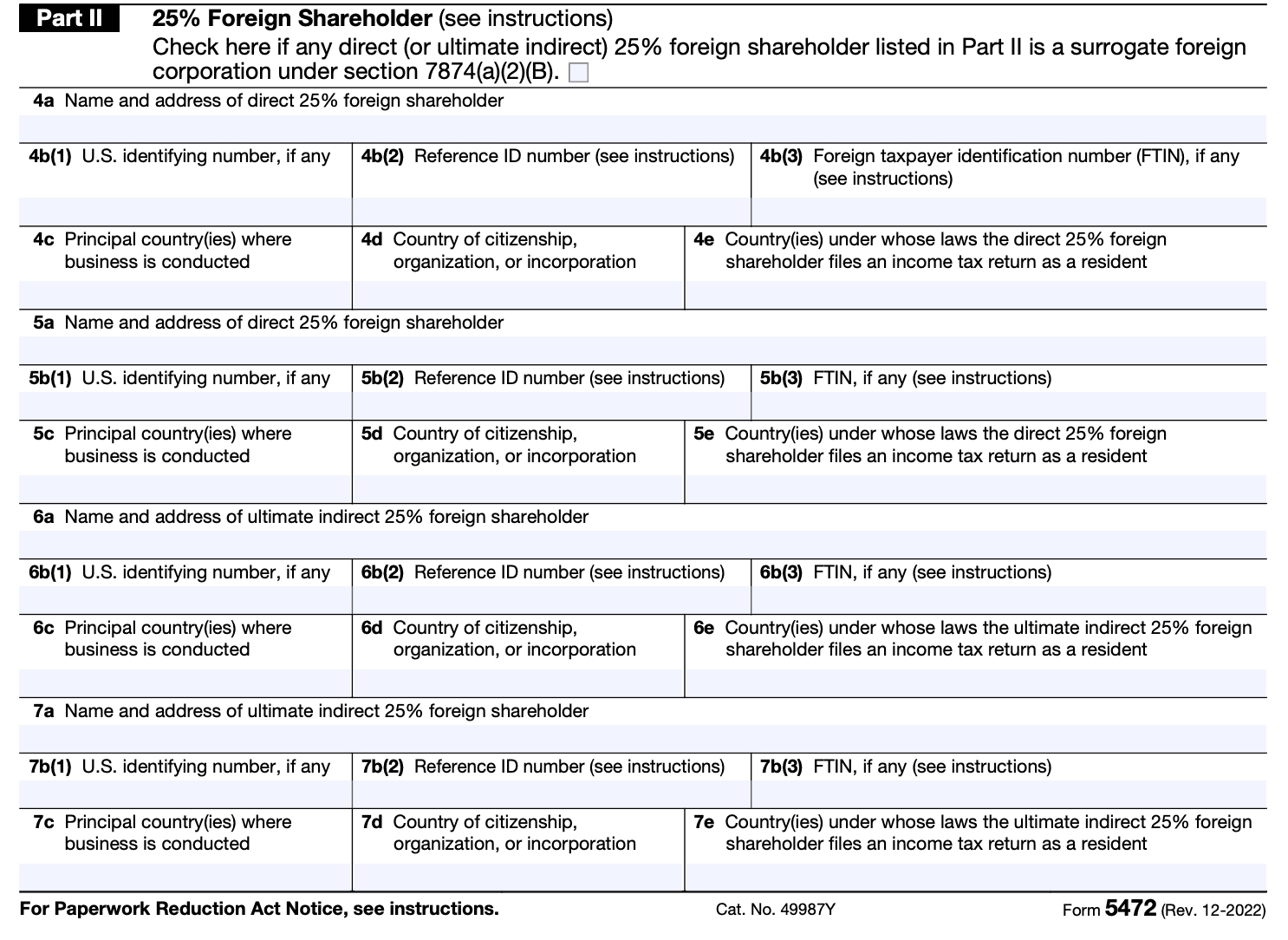

Part II - 25% Foreign Shareholder:

This section requires information on foreign owners and related parties holding at least 25% ownership, including their names, addresses, and ownership percentages.

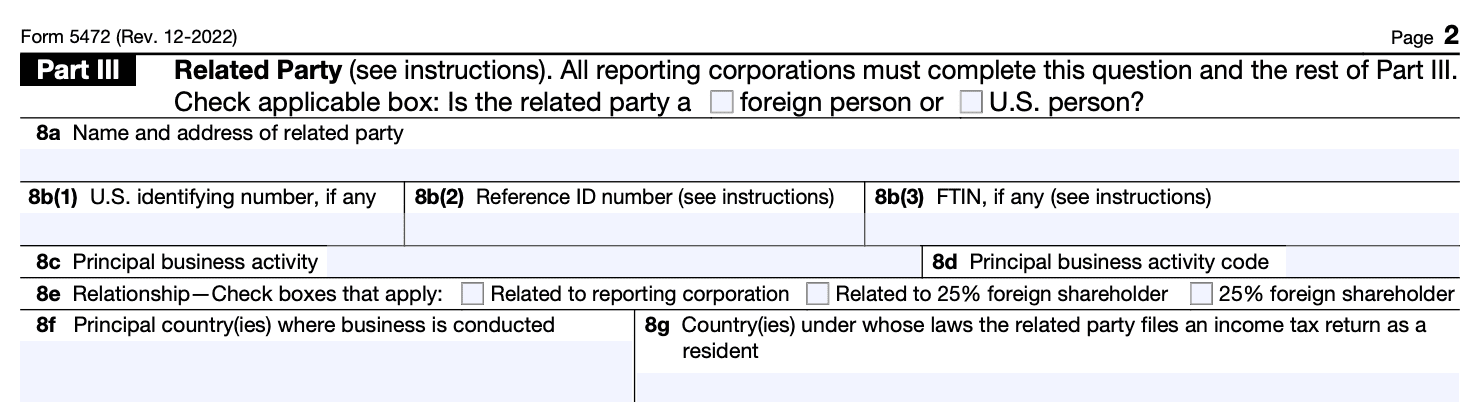

Part III - Related Party:

This section demands detailed information on reportable transactions with related parties, including transaction type, amount, and party relationship nature.

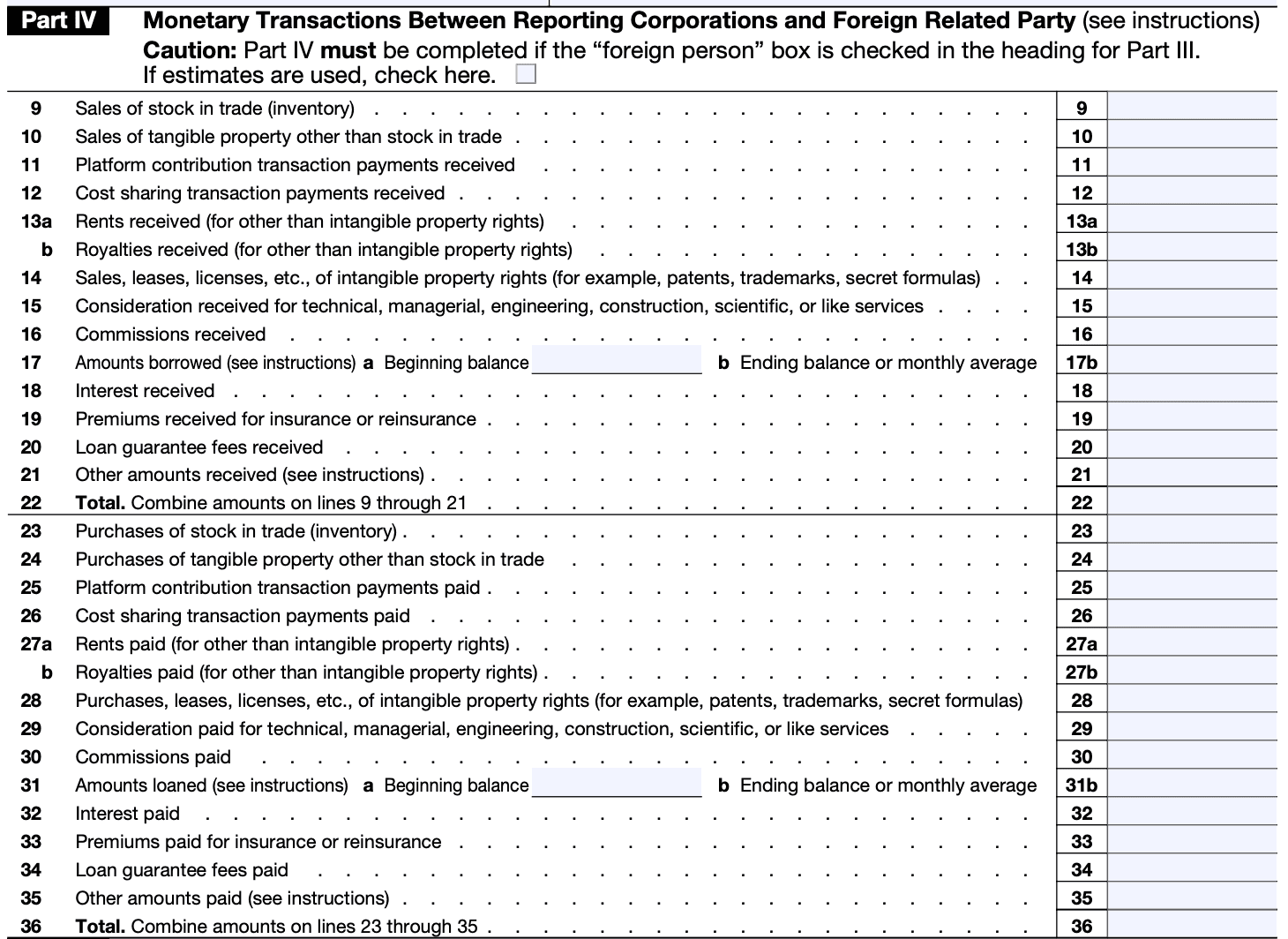

Part IV - Monetary Transactions Between Reporting Corporations and Foreign Related Party:

This section requests the reporting corporation's balance sheet, including assets, liabilities, and equity.

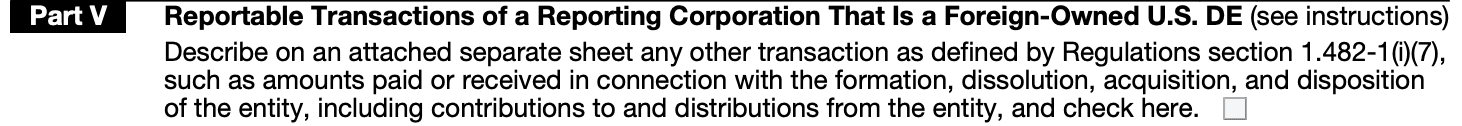

Part V - Reportable Transactions of a Reporting Corporation That Is a Foreign-Owned U.S. DE:

This section necessitates an income statement for the reporting corporation, including revenues, expenses, and net income.

Part VI - Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and the Foreign Related Party:

This section provides space for additional relevant information on the reporting corporation or its related parties.

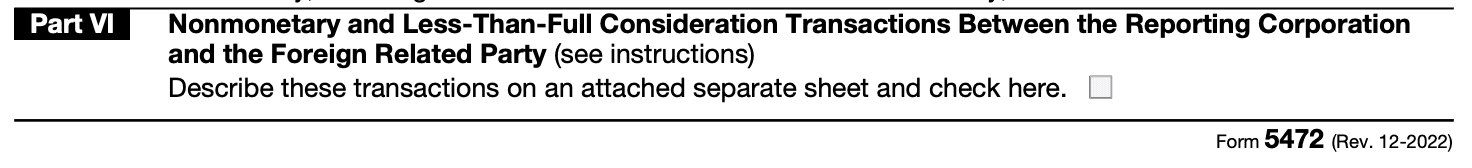

Part VII - Additional Information:

This section provides additional space for any other information that the reporting corporation feels is necessary to disclose.

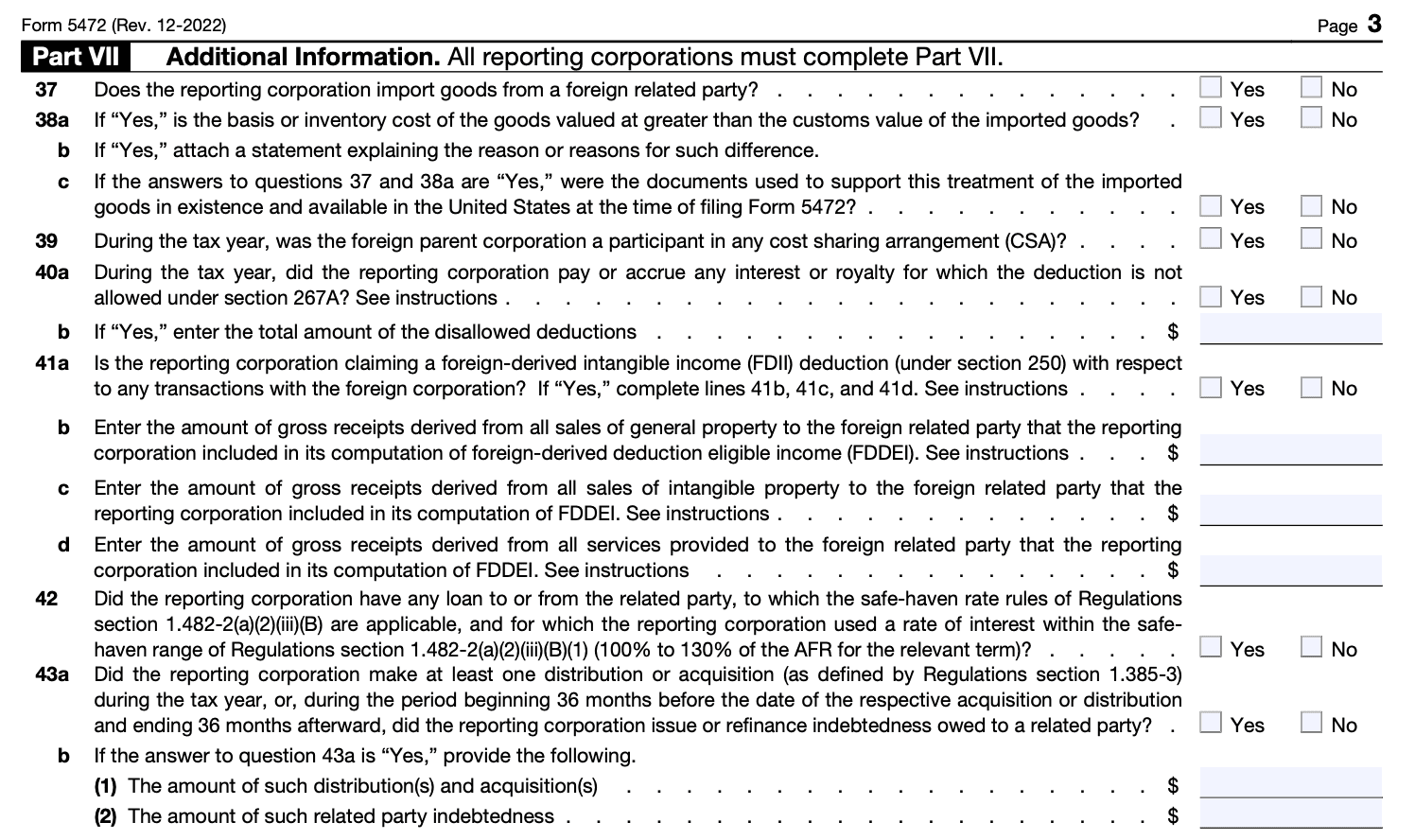

Part VIII - Cost Sharing Arrangement (CSA):

This section requests information on any cost-sharing agreements that the reporting corporation may have with related parties.

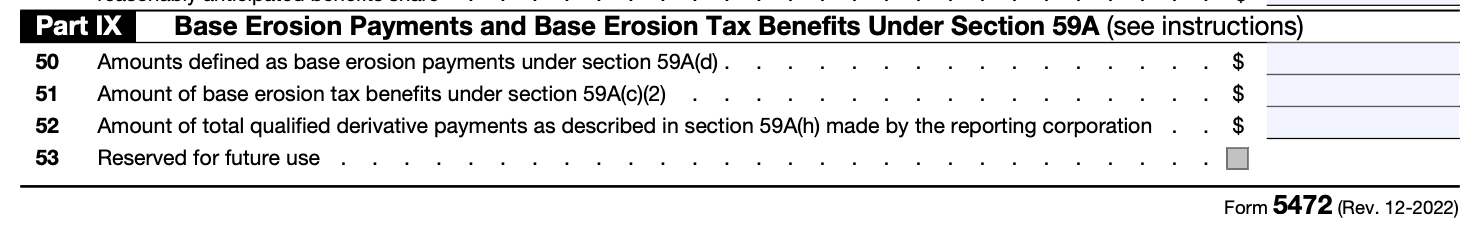

Part IX - Base Erosion Payments and Base Erosion Tax Benefits Under Section 59A:

This section requests information on base erosion payments and benefits under section 59A that the reporting corporation may have with related parties.

Reporting related-party transactions can be particularly challenging, as the rules around related-party transactions can be complex. It's important to consult with a tax professional to ensure accurate reporting of these transactions.

How to file Form 5472: Step-by-Step Guide with Instructions

Form 5472 can be filed electronically or on paper. To file electronically, you'll need to use the IRS's e-file system or a third-party software provider. If you choose to file on paper, you'll need to mail the completed form to the address listed in the form 5472 instructions.

It's important to ensure that Form 5472 is filed accurately and on time to avoid penalties and other consequences. Many foreign-owned U.S. corporations and foreign corporations engaged in U.S. trade or business choose to work with a tax professional. This is to help ensure compliance with filing Form 5472 and related tax requirements.

Here's a step-by-step guide on how to file Form 5472:

Step 1: Obtain the form

You can obtain Form 5472 from the IRS website or from a tax professional who can assist you with the filing process.

Step 2: Fill out the form

You'll need to fill out all of the required information on the form, including identifying information about the foreign owner, details about related-party transactions, and information about the U.S. corporation or trade or business engaged in the transactions.

Step 3: Attach supporting documentation

In addition to the completed form, you'll also need to attach supporting documentation to substantiate the related-party transactions. This documentation may include invoices, contracts, and other relevant financial records.

Step 4: Choose a filing method

You can file Form 5472 electronically using the IRS's e-file system or a third-party software provider, or you can file on paper by mailing the completed form and supporting documentation to the address listed in the instructions.

Step 5: File on time

- Form 5472 must be filed on or before the due date of the U.S. corporation's income tax return, including extensions. If the U.S. corporation doesn't have a tax return filing obligation, Form 5472 must be filed by the 15th day of the 6th month following the end of the U.S. corporation's tax year.

- You can file Form 5472 electronically through the IRS's Modernized e-File (MeF) system. \

Step 6: Keep copies for your records

It's important to keep a copy of the completed Form 5472 and all supporting documentation for your records in case of an IRS audit or other compliance review.

When and Where To File Form 5471?

Form 5471 is a tax form used by U.S. citizens or residents who own an interest in a foreign corporation. The form is used to report information about the corporation and the taxpayer's interest in it, including ownership, transactions, and financial information. Failure to file Form 5471 can result in significant penalties, so it's important to know when and where to file.

Filing Pro Forma Form 1120 for Foreign-Owned U.S. DEs:

- While a foreign-owned U.S. DE has no income tax return filing requirement, it will now be required to file a pro forma (link: https://fincent.com/irs-tax-forms/form-1120 text: Form 1120) with Form 5472 attached by the due date (including extensions) of that Form 1120.

- You only need to fill in the foreign-owned U.S. DE's name, address, and items B, E on the first page of Form 1120.

- The tax year for foreign-owned U.S. DE is the same as its owner's tax year for U.S. tax filing requirements.

- If the owner does not have a tax year for U.S. tax filing requirements, the tax year for foreign-owned U.S. DE is the calendar year.

Dedicated Mailing Address for Foreign-Owned U.S. DEs:

-

Foreign-owned U.S. DEs are required to use the following dedicated mailing address: _Internal Revenue Service, _

_1973 Rulon White Blvd, _

_M/S 6112 Attn: PIN Unit, _

Ogden, UT 84201.

-

Fax (300 DPI or higher) to 855-887-7737 or mail to the above address.

Extension of Time to File for Foreign-Owned U.S. DEs:

A foreign-owned U.S. disregarded entity (DE) required to file Form 5472 can request an extension of time to file by (link: https://fincent.com/irs-tax-forms/form-7004 text: filing Form 7004).

- Form 7004 can be filed to request an extension of time to file for a foreign-owned U.S. DE required to file Form 5472

- Form 7004 must be filed by the regular due date of the return

- When the code for Form 1120 need be entered on Form 7004, Part I, line 1

- Foreign-owned U.S. Disregarded Entity should be written across the top of automatic tax extension Form 7004

- The DE must fax or mail the Form 7004 to the dedicated mailing address mentioned above by the due date (excluding extensions) of the return.

**Note: **Do not use the regular filing address listed in the Instructions for Form 7004 for these entities.

Filing deadlines for Form 5472

The filing deadline for Form 5472 is the same as the deadline for the corporation's income tax return, including extensions. For calendar-year corporations, this means the filing deadline is generally April 15th, with an extension available until October 15th. However, different rules apply to fiscal-year corporations, so it's important to consult with a tax professional to determine your specific filing deadlines.

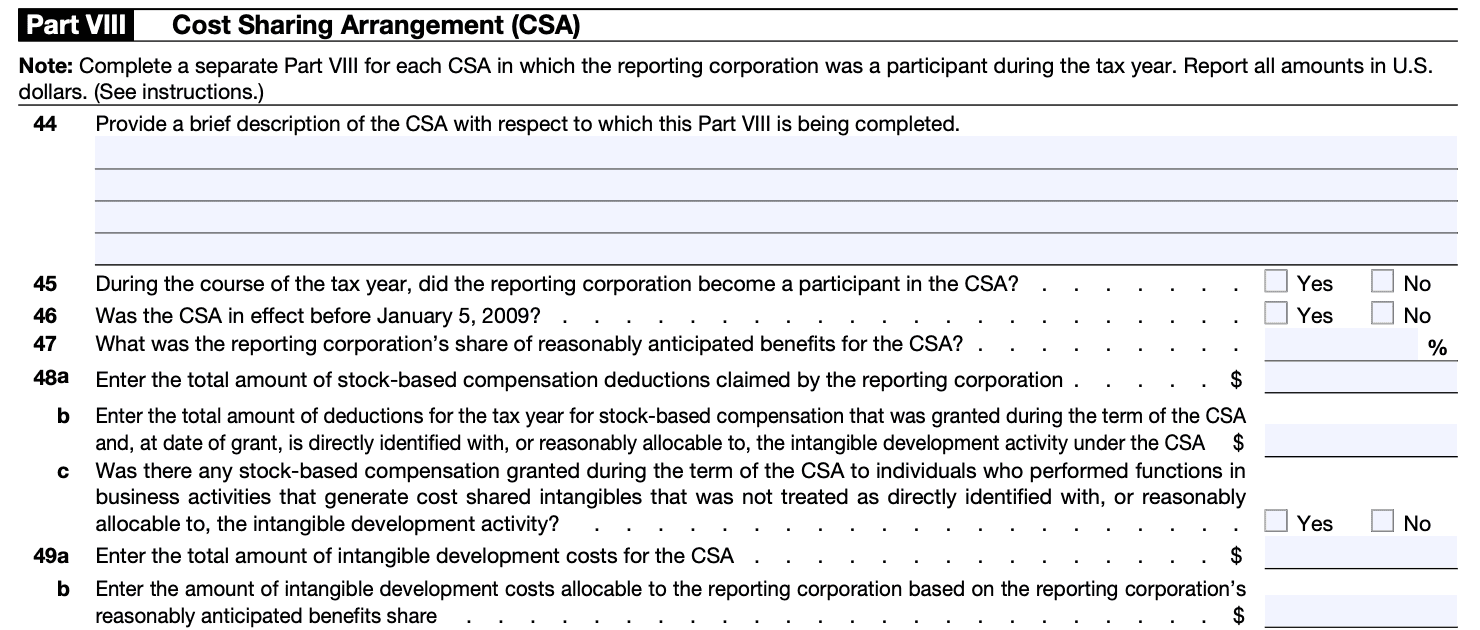

| Taxpayer Type | Tax Year End Date | Original Filing Deadline | Extended Filing Deadline |

| Calendar-year corporation | December 31 | April 15 | October 15 |

| Fiscal-year corporation: | |||

| Ending June 30 | June 30 | September 15 | April 15 (following year) |

| Ending July 31 | July 31 | September 15 | April 15 (following year) |

| Ending August 31 | August 31 | September 15 | April 15 (following year) |

| Ending September 30 | September 30 | December 15 | July 15 (following year) |

| Ending October 31 | October 31 | December 15 | July 15 (following year) |

| Ending November 30 | November 30 | December 15 | July 15 (following year) |

| Ending December 31 | December 31 | March 15 | September 15 (following year) |

Extensions are available for Form 5472, but they must be filed in a timely manner and approved by the IRS. Failure to file Form 5472 by the deadline or obtain an extension can result in significant penalties.

Penalties for not filing Form 5472

Failure to file Form 5472 on-time can result you in significant penalties.

- The penalty for failure to file is $25,000 per year, per related party, with a maximum penalty of $300,000 per year.

- Additionally, failure to file Form 5472 can result in the IRS assessing penalties for failure to maintain adequate records or failure to provide information requested by the IRS.

The IRS may also impose penalties for underpayment of taxes related to unreported related-party transactions. These penalties can add up quickly, making it important for foreign-owned U.S. corporations and foreign corporations engaged in U.S. trade or business to comply with Form 5472 filing requirements.

It's also worth noting that failure to file Form 5472 can result in the IRS denying deductions and credits related to the unreported transactions. This can lead to additional tax liabilities and a higher effective tax rate.

Conclusion

Filing Form 5472 is a critical requirement for foreign-owned U.S. corporations and foreign corporations engaged in U.S. trade or business. Failure to file can result in significant penalties and other consequences, including denial of deductions and credits and increased tax liabilities. To prevent negative outcomes, it is essential to comprehend the filing regulations.

Moreover, one should collaborate with a tax specialist to guarantee precise and prompt filing. Staying compliant with Form 5472 requirements can help reduce tax liabilities and maintain a good relationship with the IRS. This is applicable to foreign-owned U.S. corporations and foreign corporations engaged in U.S. trade or business.