- IRS forms

- Form W-2

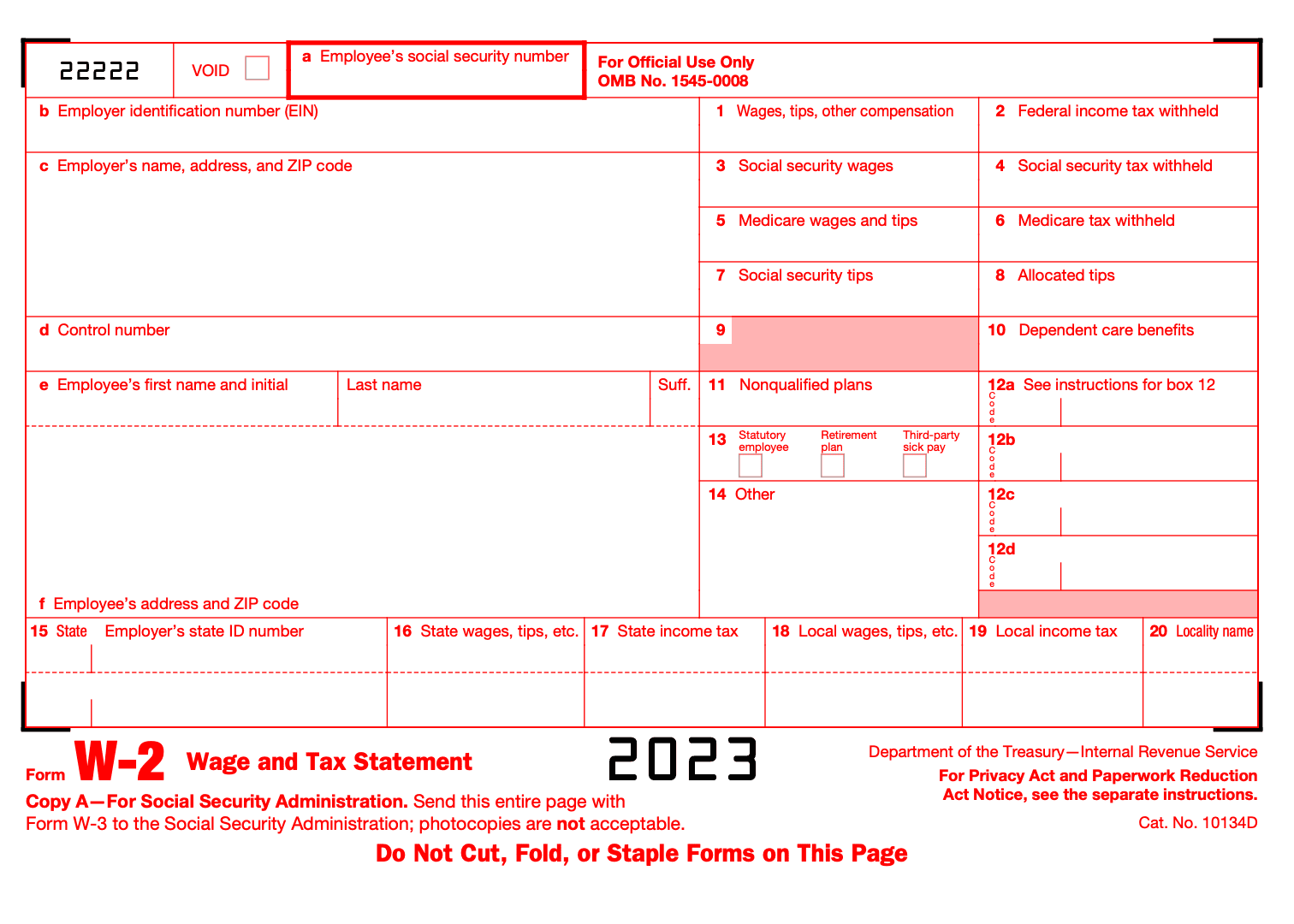

Form W-2: Wage and Tax Statement

Download Form W-2Let’s accept that paying our share of taxes is as important as creating wealth. And addressing this matter today, let’s talk about the importance of W-2 forms. If you’re a US resident, you'd be getting a W-2 form every year. Even if you only worked just one day last year, you still need to fill out a W-2 form. But what is a W-2 form, and why is it important?

In this blog post, we discuss everything you need to know about W-2 forms and how you can fill it. So grab your pay stub, and let's get started!

What Is a W-2 Form?

The IRS Form W-2, also known as the Wage and Tax Statement, is a document that an employer must send to an employee at the end of the year. It summarizes the employee's wages and taxes withheld from their paycheck throughout the year. The employee will use this information to file their income tax return.

The W-2 form has four copies:

- Copy A goes to the Social Security Administration: The Social Security Administration uses Copy A to keep track of an individual's earnings over their lifetime and determine their eligibility for benefits.

- Copy B and C go to the employee: The employee will need copy B and C to file their federal and state income tax returns, respectively.

- Copy D goes to the state tax agency: Copy D is used by the state tax agency to reconcile state taxes withheld with taxes owed.

While the W-2 form may seem like just another paperwork, it is a very important document. Employers are required by law to provide employees with a W-2 form, and employees need it to file their taxes accurately. So next time you get your W-2 form in the mail, be sure to open it up and take a look!

Purpose of Form W-2

The IRS Form W-2 serves a crucial purpose in the United States tax system. It is used to report information about an employee's annual income and tax withholding. Here are the main reasons why the W-2 form is used:

- Income reporting: The primary purpose of the W-2 form is to report the total wages and compensation earned by an employee during the tax year. This includes salary, bonuses, tips, commissions, and other forms of compensation.

- Tax withholding: The W-2 form provides detailed information about the federal, state, and local income taxes withheld from an employee's paychecks throughout the year. This helps taxpayers reconcile their tax liability with the amount already paid.

- Social Security and Medicare taxes: It reports the amounts paid into Social Security and Medicare by both the employee and the employer. This information is crucial for determining eligibility and benefits under these programs.

- Verification for taxpayers: Employees use the W-2 form to verify the accuracy of their income and tax withholdings when preparing their income tax returns. It ensures that they report the correct income and claim eligible deductions and credits.

- Filing tax returns: The IRS requires taxpayers to attach a copy of their W-2 form when filing their federal income tax returns. This helps the IRS cross-verify the income reported on the tax return with the income reported by the employer.

- Compliance and auditing: Employers use the W-2 form to demonstrate compliance with tax withholding and reporting requirements. It serves as a record of their tax obligations and is subject to auditing by tax authorities.

- State and local tax authorities: In addition to federal taxes, the W-2 form also includes information on state and local income taxes withheld. This is crucial for complying with tax obligations at multiple levels of government.

- Record-keeping: Employers and employees alike use the W-2 form as a record-keeping tool. It provides a summary of an employee's annual financial transactions with their employer, which can be useful for financial planning and budgeting.

- Economic data analysis: Government agencies and researchers use aggregated W-2 data to analyze income trends, economic conditions, and the overall tax base. This information helps shape economic policy and tax legislation.

- IRS compliance checks: The IRS uses the information on W-2 forms to identify discrepancies and potential tax evasion. This helps ensure that taxpayers are accurately reporting their income and paying their fair share of taxes.

How Do W-2 Forms Work?

Employers generally send out W-2 forms in January of each year. Employees should receive their W-2 forms by January 31st. If an employer does not provide a W-2 form, the employee can request one from the IRS.

The information on a W-2 form includes the employee's name, address, and Social Security number. It also includes the amount of money earned during the year and federal, state, and local taxes withheld. The employer's name, address, and Employer Identification Number (EIN) are also included on the form.

To complete a W-2 form, an employer will need to have several pieces of information about each employee, including their:

- Social security number,

- Date of birth, and

- Information about their dependents

The employer will also need to know how much money was earned during the year and how much was withheld for taxes.

Once all this information has been gathered, the employer will fill out the appropriate fields on the W-2 form and send it to the employee.

While most employers will take care of sending out W-2 forms to their employees, there are some cases where an employee may need to request a copy of their form. This can happen if an employer loses records or if an employee never received their original W-2 form. In these cases, an employee can contact the IRS directly to request a copy of their W-2 form. Employees can also request copies of their W-2 forms from their state tax agency or local Social Security office.

How To Complete Form W-2: A Step-by-Step Guide

Form W-2 can be completed by following these step-by-step instructions:

Step 1: Download the form

Visit the official website of the Internal Revenue Service (IRS) or use a reputable tax preparation software to download Form W-2. Ensure that you have the most up-to-date version of the form.

Step 2: Fill out the first part with your details as mentioned below.

Field A: Employee’s social security number

Enter the employee's social security number. This nine-digit number tracks an individual's earnings and calculates their benefits.

Field B: Employer identification number (EIN)

Enter the employer's EIN (Employer Identification Number). This can be found on the previous year's tax return or other correspondence from the IRS.

Field C: Employer’s name, address, and ZIP code

Enter the employee's address. This should include the street address, city, state, and ZIP code. P.O. box addresses are not accepted.

Field D: Control number

This box is mostly used for internal tracking purposes and does not need to be filled out by the employee.

Field E & F: Employee’s name, address, and Zip code

This box requires you to enter the employee's name and address here. It would help if you were sure to include the street address, city, state, and ZIP code.

Box 1: Wages, tips, other compensation

Box 1 reports the total wages, tips, and other types of compensation that the employee earned during the year. This number will be pre-filled by your employer based on their records.

Box 2: Federal income tax withheld

This field reports how much federal income tax was withheld from the employee's paychecks throughout the year. You should check this number against your records to ensure it is correct.

Box 3: Social security wages

This field reports the total wages subject to social security taxes for the year. Social security taxes fund retirement and disability benefits for US workers.

Box 4: Social security tax withheld

As with Box 2, this field reports the amount of social security taxes withheld from the employee's paychecks during the year.

Box 5: Medicare wages and tips

This box reports the number of wages and tips subject to Medicare taxes. Like Social Security, Medicare taxes fund health care benefits for American workers.

Box 6: Medicare tax withheld

As with Boxes 2 and 4, this field reports the amount of Medicare taxes withheld from the employee's paychecks during the year.

Box 7: Social security tips

This box is mostly used for tracking purposes, so the employee does not need to fill it out.

Box 8: Allocated tips

If your employer has allocated tips on your behalf, this box will be filled out. Otherwise, it would help if you left it blank.

Box 9: Advance EIC payments

This field reports any advance payments the employer made for the Earned Income Credit (EIC) on your behalf. You can leave this box blank if you do not qualify for EIC.

Box 10: Dependent care benefits

This box reports any amounts that your employer provided to you for dependent care benefits during the year. This may include childcare or elder care expenses, but it does not include health insurance premiums.

Box 11: Nonqualified plans

This box will be filled out if your employer has provided you with non-qualified retirement plans, such as a pension or annuity plan. Otherwise, you can leave it blank.

Box 12a: Deferred compensation plans

This field reports any amounts your employer has deferred on your behalf for retirement plans, such as a 401(k) or 403(b) plan.

Box 12b: Nonqualified deferred compensation plans

This box will be filled out if your employer has provided you with nonqualified deferred compensation plans. Otherwise, you can leave it blank.

Box 13: Checkboxes and Yes/No fields

This section allows you to choose a checkbox or answer "yes" or "no." The boxes listed here may vary depending on the form you are filling out. For example, you may have to check a box indicating that you are eligible for advance EIC payments or that you wish to receive an additional withholding allowance.

Box 14: Other

Depending on your employer and the form you complete, this box may be used to report information such as sick pay, union dues, non-taxable health insurance premiums, cafeteria plan benefits, etc. You will need to refer to your specific form for more details about what should be included in Box 14.

Box 15: State | Employer’s state Id number

In this box, your employer will report their state identification number and the total amount of wages they have withheld for state taxes.

Box 16: State wages, tips, etc.

Wages, tips, and other compensation from your job(s) in [state]. This includes salary, hourly wages, commissions, and tips.

Box 17: State income tax

Any state income tax details withheld from your wages will be in this box.

Box 18: Local wages, tips, etc.

Wages, tips, and other compensation from your job(s) in [local area]. This includes salary, hourly wages, commissions, and tips.

Box 19: Local income tax

If you live in a locality that imposes an income tax, you'll see that information reported in Box 19 of your W-2 form.

Box 20: Locality name

The name of the locality will be here. This information is important because it tells you how much money you owe in local taxes. The amount of tax you owe will depend on your income and the tax rate in your locality.

At the end of the year, it can be helpful to compare the amounts reported in Boxes 2 through 6 with your records to ensure everything is correct. If you notice any discrepancies, you may want to ask your employer or tax professional about resolving them. Remember that it is ultimately your responsibility to ensure that all your income is accounted for on your tax return.

- Send Copy A to the SSA; Copy 1, if required, to your state, city, or local tax department; and Copies B, C, and 2 to your employee.

- Keep a copy of Copy A, and a copy of Form W-3, with your records for at least 4 years.

- Send the whole Copy A page of Form W-2 with Form W-3 to the SSA even if one of the Forms W-2 on the page is blank or void. Do not staple Forms W-2 together or to Form W-3. File Forms W-2 either alphabetically by employees' last names or numerically by employees' SSNs.

How Can Fincent Help You Fill Out W-2 Forms?

It's a given that tax filing and filling such forms can be a complex business. To retrieve you from such essential but sidelined chores, Fincent is here to aid you in numerous ways. Have a look:

1. Automatically calculate taxable wages and withholdings

Fincent can help take the guesswork out of calculating taxable wages and withholdings. We have a sophisticated system that can automatically calculate these amounts based on the information you provide. And Fincent will also keep track of any changes in tax rates or regulations so that you always stay compliant.

2. Prepare forms for all employees

Fincent understands that dealing with financial paperwork can be a daunting task. Whether you're an individual employee or a small business owner, Fincent can help prepare the forms you need to stay compliant with the law. You can prepare all employees' tax returns, payroll, and benefits forms and offer a wide range of other financial services, such as bookkeeping, budgeting, and investment advice.

3. Print accurate forms with ease

Fincent's service is often used by businesses that need to print forms for their employees, customers, or clients. The forms can be used for various purposes, such as tax forms, employment applications, and order forms. The forms can be printed in various sizes and styles, and they can be printed on both sides.

4. File your W-2s with the IRS

W-2s are an essential part of tax season but can also be a major headache. If you're not careful, it's easy to make mistakes when filling out your W-2. And if you do make a mistake, it can cost you time and money to fix it. That's why it's important to use a professional service like Fincent.

Fincent knows the ins and outs of the W-2 process and can help ensure that your paperwork is filled out correctly. They can also file your W-2s with the IRS, so you don't have to worry about it. And if you run into any problems, we're here to help.

5. Get help when you need it

Fincent believes that financial services should be available and accessible to everyone. That's why they offer a wide range of products and services designed to meet your unique needs. From checking and savings accounts to loans and credit cards, Fincent has the right solution for you. And if you ever need help, the team is always there to provide support.

Conclusion

Assuming that you were an employee of a company during the year, your employer should have given you a W-2 form to fill out. The W-2 form is how the IRS knows how much money you made and how much taxes were withheld from your paycheck. And now that you know how to fill out a W-2 form, it's time to start.

If you need help, Fincent is here to assist you with its wide range of financial services, including tax preparation and filing. Sign up today! And talk to one of our experts to make sure you never fall behind on all this.

FAQs

Who is required to fill out a W-2 form?

Any employee receiving a regular salary or wage from an employer must fill out a W-2 form. This includes employees who work full-time or part-time and salaried and hourly workers.

How many W-2 forms do you need?

Typically, you will need one W-2 form for each employee. However, if you have a large company or work in a highly regulated industry, you may need to fill out extra W-2 forms.

When do you submit W-2 forms?

According to the IRS, you should submit your W-2 forms by January 31st. This gives the government enough time to process your taxes and avoid late fees. However, you may need to file an extension if you're self-employed or have other income sources.

How do you submit W-2 forms?

Once you have obtained your W-2 form, you can file your tax return online or by mail. If you are filing online, you must provide your Social Security number and a credit or debit card for payment. If you are filing by mail, you must complete and sign Form 1040 and enclose a check or money order for payment. You should mail your tax return to the address listed on Form 1040. Please visit the IRS website for more information on how to file your tax return.