- IRS forms

- Form 4797

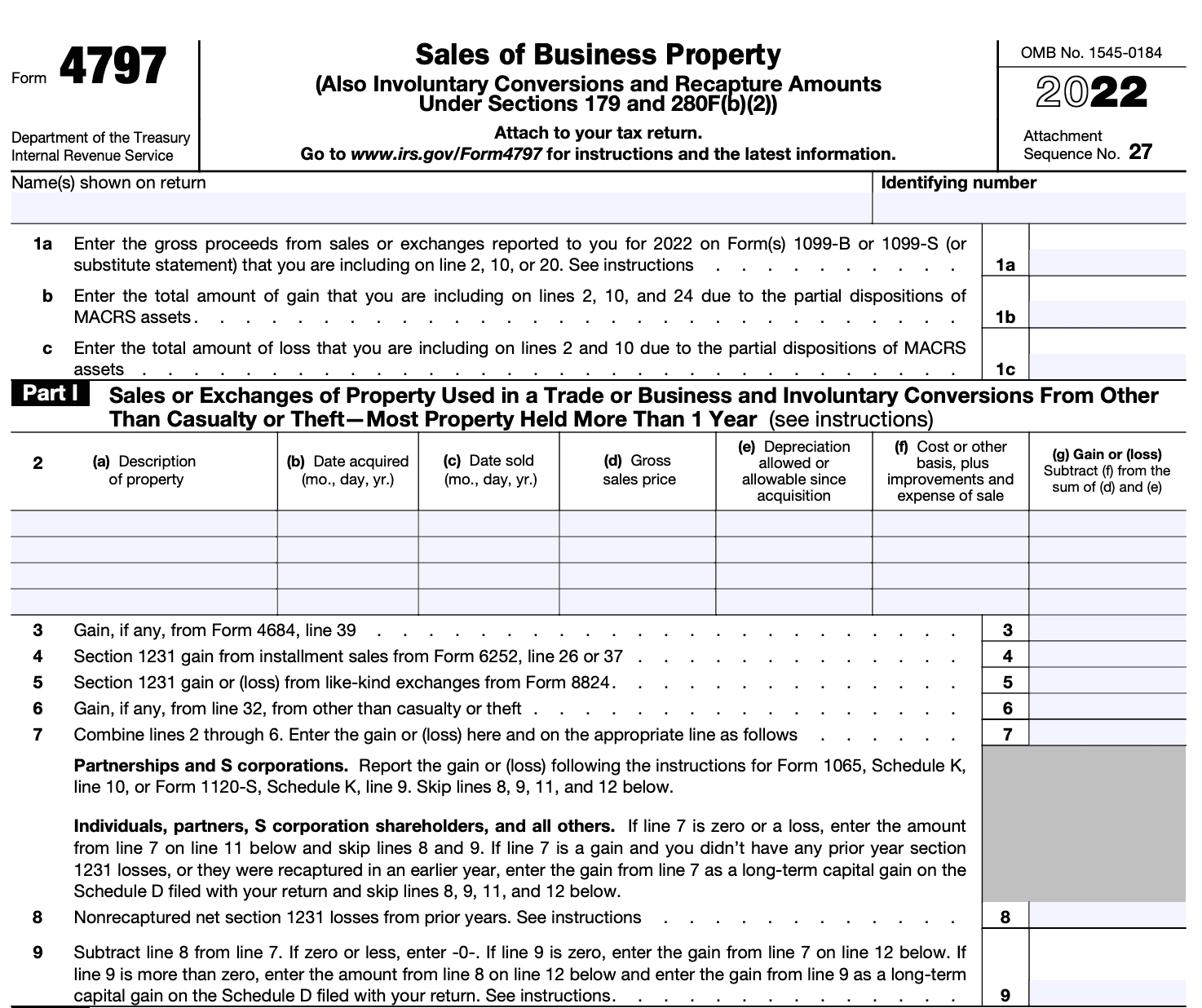

IRS Tax Form 4797: Sales of Business Property

Download Form 4797Form 4797, officially known as "Sales of Business Property," is a tax form used by individuals, partnerships, corporations, and other entities to report the sale, exchange, or disposition of certain business assets.

By using Form 4797, individuals and businesses can report and calculate the capital gains or losses from the sale of assets like real estate, machinery, equipment, and other property used in a trade or business

In this blog post, we will delve into the details of Form 4797 to understand what its purpose is, who needs to file it, and how to complete it accurately.

Key Takeaways:

- Form 4797 is used for taxpayers to categorize the property they've sold, whether it's rental property, business property, or other types of assets. This classification is essential because it determines the tax treatment of the sale.

- Rental property sales fall under the category of Section 1231 assets on Form 4797. Section 1231 assets include depreciable property used in a trade or business and real property used in a trade or business and held for more than one year.

- Form 4797 helps determine whether the gain or loss from the sale of rental property should be treated as ordinary income or capital gain.

Purpose of Form 4797

Form 4797 is a tax form used in the United States by individuals, partnerships, corporations, and other entities to report the sale or exchange of business property.

Here are the key purposes of Form 4797:

Reporting sales or exchanges: Form 4797 is used to report the details of sales, exchanges, or involuntary conversions of business property. This includes both tangible assets like buildings and equipment, as well as intangible assets like patents or copyrights.

Determining gain or loss: The form is used to calculate and report the gain or loss realized from the sale or exchange of business property. It takes into account the original cost or basis of the property, the amount received from the sale, and any depreciation or deductions claimed over the asset's useful life.

Classifying transactions: Form 4797 requires taxpayers to classify their transactions into different categories based on the nature of the property being sold. These categories include Section 1231 transactions (sales of depreciable property), capital assets, and ordinary income assets.

Tax treatment: Depending on the classification of the transaction, the tax treatment may vary. Form 4797 helps determine whether the gains or losses should be treated as ordinary income, subject to specific tax rates, or as long-term capital gains or losses, which may have different tax implications.

It's important to note that Form 4797 is used primarily for business property sales. For personal property transactions, such as the sale of a personal residence, a different form, such as Form 8949 or Schedule D, may be used.

Benefits of Form 4797

Here are some benefits of using Form 4797:

Taxation of capital gains: Form 4797 helps taxpayers accurately report and calculate capital gains or losses from the sale of business property. By properly reporting these gains or losses, individuals or businesses can ensure they are paying the correct amount of tax on these transactions.

Deductible losses: If you sell business property at a loss, you can deduct the loss on Form 4797. This loss can offset other taxable income, reducing your overall tax liability. Deductible losses can help minimize the tax impact of selling assets at a loss.

Section 1231 treatment: Form 4797 allows taxpayers to take advantage of the special tax treatment provided for Section 1231 assets. Section 1231 assets include depreciable property used in a trade or business, such as real estate and equipment. When these assets are sold at a gain, the gain can be treated as long-term capital gain, which generally results in a lower tax rate than ordinary income.

Netting of gains and losses: Form 4797 provides a mechanism for netting gains and losses from the sale of business property. If you have multiple sales of business property during the tax year, you can combine the gains and losses on the form to determine your overall net gain or loss. This netting provision can help optimize the tax consequences of multiple transactions.

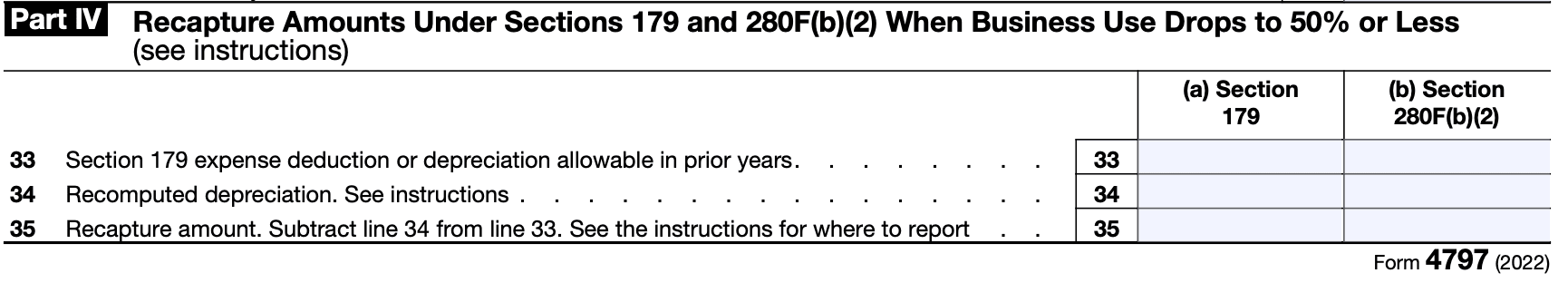

Reporting Section 179 and bonus depreciation: If you claimed Section 179 expensing or bonus depreciation on business property that is subsequently sold, Form 4797 allows you to report the recapture of these deductions. This ensures that the tax benefits received from these deductions are properly accounted for when the property is sold.

Simplified reporting: Form 4797 provides a structured format for reporting the sale of business property. By using the form, taxpayers can ensure that they include all the necessary information required by the Internal Revenue Service (IRS) and avoid potential errors or omissions in their tax filings.

Who Is Eligible To File Form 4797?

The following individuals or entities may be eligible to file Form 4797:

Sole proprietorships: Individuals who operate a business as a sole proprietor and sell or exchange business property may file Form 4797 to report the transaction.

Partnerships: Partnerships that sell or exchange business property may use Form 4797 to report the sale or exchange.

Limited liability companies (LLCs): Depending on the tax classification of an LLC, it may be treated as a partnership or a disregarded entity for tax purposes. If an LLC is classified as a partnership or has elected to be taxed as a partnership, it can use Form 4797 to report the sale or exchange of business property.

S corporations: S corporations that dispose of business property may file Form 4797 to report the sale or exchange.

C corporations: C corporations that sell or exchange business property can use Form 4797 to report the transaction.

How To Complete Form 4797: A Step-by-Step Guide with Instructions

IRS Form 4797 is a tax form used to report the sale or exchange of certain business property, such as real estate, machinery, and equipment. Here's a step-by-step guide to help you complete Form 4797 with clear cut instructions:

Step 1: Gather necessary information

Collect all the relevant information and documents related to the property sale, including the purchase price, date of purchase, sale price, date of sale, and any associated expenses.

Step 2: Understand the different parts of Form 4797

Form 4797 consists of several parts, each serving a specific purpose. Familiarize yourself with these sections:

-

Part I: This part is used to report the sale of property that is not held for sale in the ordinary course of business, such as real estate or depreciable assets.

-

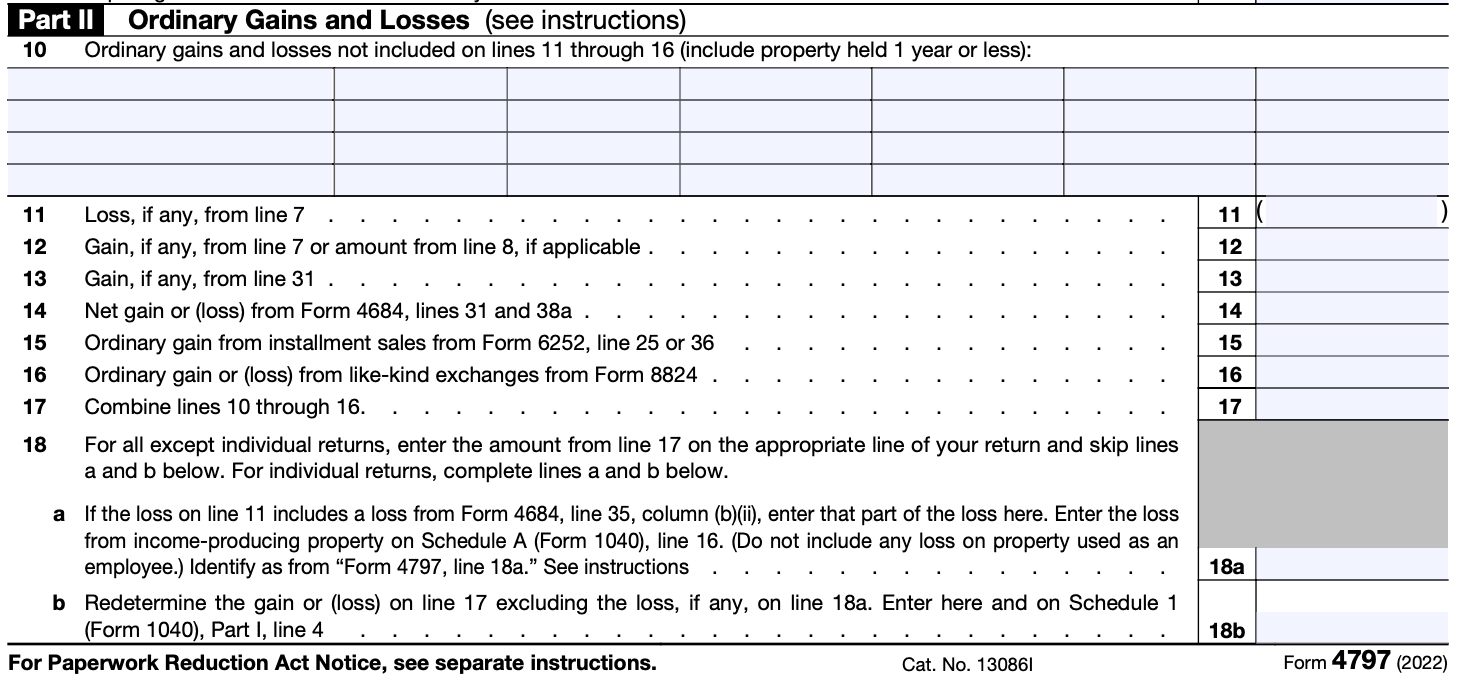

Part II: This part is used to report the sale of property used in a trade or business, such as machinery, equipment, or vehicles.

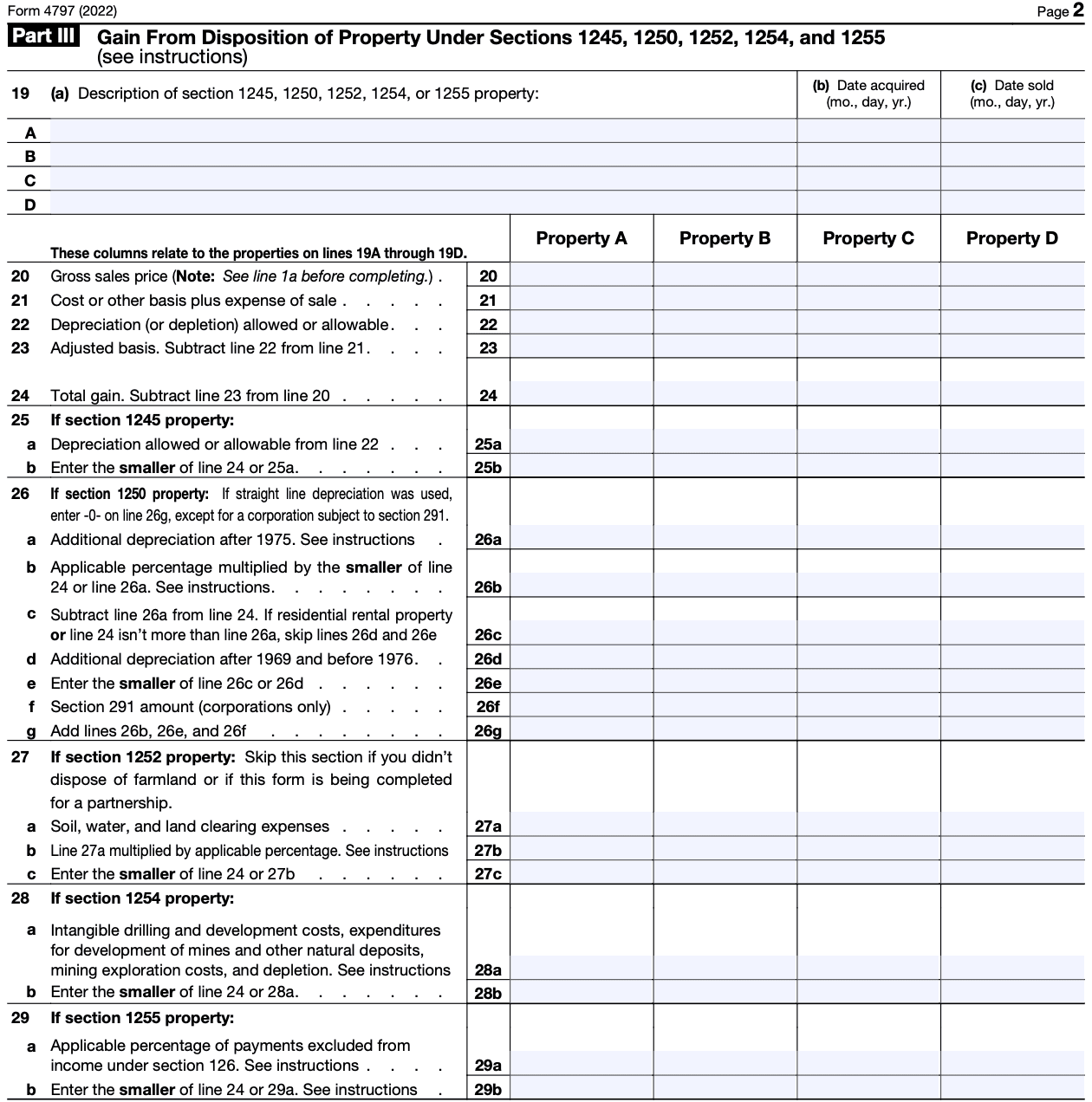

- Part III: This part is used to report involuntary conversions, such as property destroyed by a natural disaster.

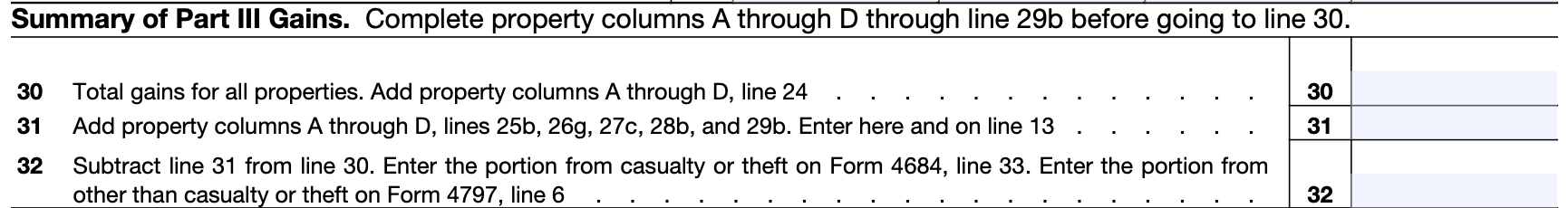

- Summary of Part III: This part is used to report gains or losses from the sale or exchange of property used in a farming business.

- Part IV: This part is used to report the recapture of certain prior-year deductions, such as depreciation recapture.

Step 3: Complete Part I or Part II

Determine whether the property you sold falls under Part I or Part II of Form 4797. Part I generally covers the sale of real estate or other non-depreciable assets, while Part II covers the sale of depreciable property used in a trade or business.

Step 4: Fill in the required information

In the appropriate part, provide the necessary details about the property sale. This typically includes the description of the property, dates of acquisition and sale, cost basis, selling price, and any expenses associated with the sale.

Step 5: Calculate the gain or loss

Calculate the gain or loss on the sale by subtracting the cost basis and associated expenses from the selling price. If there is a gain, it will be reported as a positive number, and if there is a loss, it will be reported as a negative number.

Step 6: Complete the remaining sections

Depending on the specifics of your situation, you may need to complete additional sections of Form 4797. For example, if you had an involuntary conversion (Part III) or if you are reporting gains or losses from a farming business (Summary of Part III), provide the required information in the respective sections.

Step 7: Check for accuracy and sign the form

Review the completed form carefully to ensure accuracy. Double-check all calculations and ensure that you have provided all the necessary information. Once you're confident that the form is accurate, sign and date it.

Step 8: Attach additional documentation (if required)

If there are any supporting documents required, such as a statement detailing the calculation of the gain or loss, attach them to the completed Form 4797.

Step 9: Retain a copy for your records

Make a copy of the completed Form 4797 and all supporting documents for your records. It's important to keep these documents for future reference and potential audits.

Step 10: File the IRS tax Form 4797

File the completed Form 4797 with your tax return by the applicable deadline. Ensure that you follow the instructions provided by the tax authorities regarding where to submit the form.

Special Considerations When Filing Form 4797

When filing Form 4797, there are several special considerations to keep in mind. Here are some important points:

Nature of the property: Form 4797 is specifically used to report the sale, exchange, or involuntary conversion of property used in a trade or business, as well as the sale of depreciable or amortizable property. It does not apply to the sale of personal property.

Classification of gains or losses: Different rules apply depending on whether the property sold is considered ordinary or capital. Generally, property used in a trade or business is considered ordinary, while investment property is considered capital. The classification affects how gains or losses are reported and taxed.

**Reporting depreciation: **If the property being sold was previously depreciated, you must report the depreciation deductions taken in previous years. This is done by completing Part III of Form 4797, which involves calculating the depreciation recapture amount.

Section 1231 transactions: Section 1231 of the Internal Revenue Code applies to the sale or exchange of certain business property, including real estate and depreciable assets. If you have Section 1231 transactions, you may be eligible for special tax treatment, such as the potential to offset gains with losses.

Involuntary conversions: If your property was involuntarily converted (e.g., through theft, destruction, or condemnation) and you received insurance or other compensation, you need to report the transaction on Form 4797. Different rules apply for gains or losses in involuntary conversions.

Multiple transactions: If you had multiple transactions involving the sale or exchange of business property, you must report each transaction separately on separate lines of Form 4797.

**Partner or shareholder's share: **If you are a partner in a partnership or a shareholder in an S corporation, you generally do not file Form 4797 individually. Instead, your share of the partnership's or S corporation's gains or losses is reported on your Schedule K-1, which you receive from the entity.

Filing Deadlines & Extensions on Form 4797

Form 4797 is used to report the sale, exchange, or involuntary conversion of business property, as well as the disposal of certain business assets. The filing deadline for Form 4797 is generally the same as the filing deadline for your federal income tax return, which is typically April 15 of the year following the tax year being reported.

However, if you need more time to file your tax return, you can request an extension by filing Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return). This extension will also apply to the filing of Form 4797. By filing Form 4868, you can get an additional six months to file your tax return and Form 4797. The extended deadline is usually October 15.

It's important to note that while an extension grants you more time to file your tax return, it does not extend the deadline for paying any taxes owed. If you anticipate owing taxes, it's generally recommended to estimate your tax liability and make a payment by the original deadline (April 15) to avoid penalties and interest.

Common Mistakes To Avoid While Filing Form 4797

When filing Form 4797, there are several common mistakes that you should avoid. Here are some key points to keep in mind:

- Incorrect classification: Make sure you properly classify the property being sold. Form 4797 is used for reporting the sale of various types of business property, such as real estate, equipment, and assets used in a trade or business. Ensure you select the correct property classification based on the nature of the asset being sold.

- **Inaccurate cost basis: **The cost basis of the property is crucial for determining the gain or loss on the sale. Ensure you accurately calculate the original cost basis by considering the purchase price, improvements, depreciation, and other relevant factors. Failing to include the correct cost basis can result in inaccurate tax calculations.

- Ignoring depreciation recapture: If the property being sold was previously depreciated, you may need to report depreciation recapture. Depreciation recapture is the portion of the gain that is taxed as ordinary income rather than capital gains. Ensure you properly calculate and report any depreciation recapture associated with the sale.

- Forgetting to report installment sales: If you're using the installment method to report the sale, be sure to complete the applicable sections of Form 4797. The installment method allows you to report the gain from the sale over multiple years as you receive payments, rather than recognizing the entire gain upfront.

- **Overlooking Section 1231 gains and losses: **Section 1231 gains and losses refer to gains or losses from the sale of certain business property, such as real estate and depreciable assets. These gains and losses have specific tax treatment. It's important to properly identify and report Section 1231 gains and losses on Form 4797 to ensure they are treated correctly for tax purposes.

- Omitting necessary supporting documentation: When filing Form 4797, it's crucial to include all required supporting documentation. This may include sales contracts, settlement statements, and any other relevant documentation that substantiates the transaction. Keep a copy of these documents for your records and submit the necessary attachments with your tax return.

- **Failing to seek professional assistance: **Filing Form 4797 can be complex, especially if you have multiple transactions or unique circumstances. It's advisable to seek professional assistance from a tax advisor or accountant who can guide you through the process, ensuring accuracy and compliance with tax laws.

Conclusion

Form 4797 plays a critical role in reporting gains or losses from the sale or exchange of business property. Whether you're a sole proprietor, partner in a business, or involved in corporate activities, understanding the requirements and accurately completing this form is crucial for tax compliance.

By maintaining organized records, seeking professional guidance, and staying informed about tax law changes, you can navigate the complexities of Form 4797 and ensure proper reporting on your tax return. Remember, when it comes to taxes, accuracy and compliance are key.

Frequently Asked Questions

-

Who has to fill out form 4797? If you have sold specific types of property, such as real estate or business assets, during the tax year, you'll use this form to report and calculate any gains or losses for tax purposes. It's a way to ensure you're in compliance with IRS regulations when it comes to property transactions.

-

Is Schedule D required if form 4797 is used? Form 4797 can be utilized for reporting the sale or transfer of capital assets that are not already documented on Schedule D.

-

What is the difference between Schedule D and 4797? Schedule D is primarily for reporting capital gains and losses from investment securities, while Form 4797 is for reporting gains and losses related to property used in a trade or business, such as rental property and business assets.

-

** What should I report on form 4797?** Form 4797 is used to report the sale or disposition of certain types of property, such as real estate, business assets, and investments. You should report the details of these transactions, including the date of sale, the sale price, and the original cost of the property.

-

Is the sale of rental property reported on 4797? Yes, the sale of rental property is typically reported on Form 4797. This form is used to report the sale or disposition of various types of property, including rental real estate.

-

Where should the sale of rental property be reported on 4797? The sale of rental property should be reported on Part III of Form 4797.

-

What is the passive activity adjustment 4797? The passive activity adjustment is used to calculate the tax consequences of disposing of a passive activity, such as the sale of rental property. This adjustment can result in the release of previously suspended losses, allowing you to offset them against any gain from the sale.

-

Does the sale of a second home go on form 4797? If the second home was used for rental purposes or if you previously claimed depreciation on the property, the sale should be reported on Form 4797 "Sales of Business Property." In such cases, the property is treated as a business or investment property, and Form 4797 is used to report the sale and calculate any gain or loss, as well as account for any depreciation recapture.