- IRS forms

- Form 1098

Form 1098: Understand Your Reporting Obligations as a Mortgage Lender

Download Form 1098Introduction:

When it comes to taxes, there are many different forms that individuals and businesses need to file in order to report their income and expenses. One of these forms is Form 1098, also known as the Mortgage Interest Statement. This form is used by mortgage lenders to report the amount of interest paid on a mortgage loan during the tax year. In this blog post, we will provide an overview of Form 1098, who needs to file it, how to file it, and common mistakes to avoid.

What is Form 1098?

Form 1098 is a tax form used to report mortgage interest paid by the borrower to the lender. The lender is required to file this form with the Internal Revenue Service (IRS) and provide a copy to the borrower. The borrower then uses the information on Form 1098 to report the amount of mortgage interest paid on their tax return.

Who Needs to File Form 1098?

Mortgage lenders are required to file Form 1098 for any borrower who paid $600 or more in mortgage interest during the tax year. This includes banks, credit unions, and other financial institutions that provide mortgage loans.

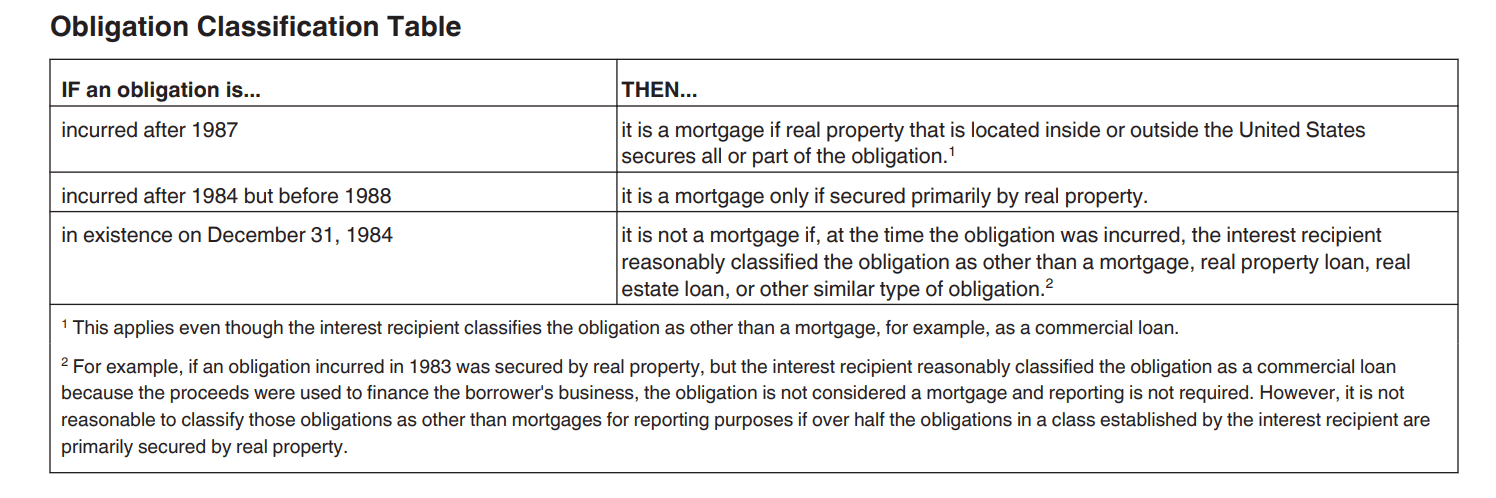

What is an Obligation Classification Table?

The obligation classification table in Form 1098 is used to report the type of mortgage interest that is being paid by the borrower. The table helps to classify the mortgage obligation as either a home acquisition debt, home equity debt, or grandfathered debt.

This information is important because it determines the eligibility for the mortgage interest deduction, which allows taxpayers to deduct the interest paid on their mortgage from their taxable income.

By providing the correct information on the obligation classification table, both the lender and borrower can ensure that they are accurately reporting the mortgage interest and avoiding any potential IRS penalties for incorrect reporting.

How to File Form 1098: Step-by-Step Guide

Step 1: Gather Information:

Mortgage lenders need to collect the borrower's name, address, and Social Security Number (SSN) or Taxpayer Identification Number (TIN), as well as the amount of mortgage interest paid during the tax year.

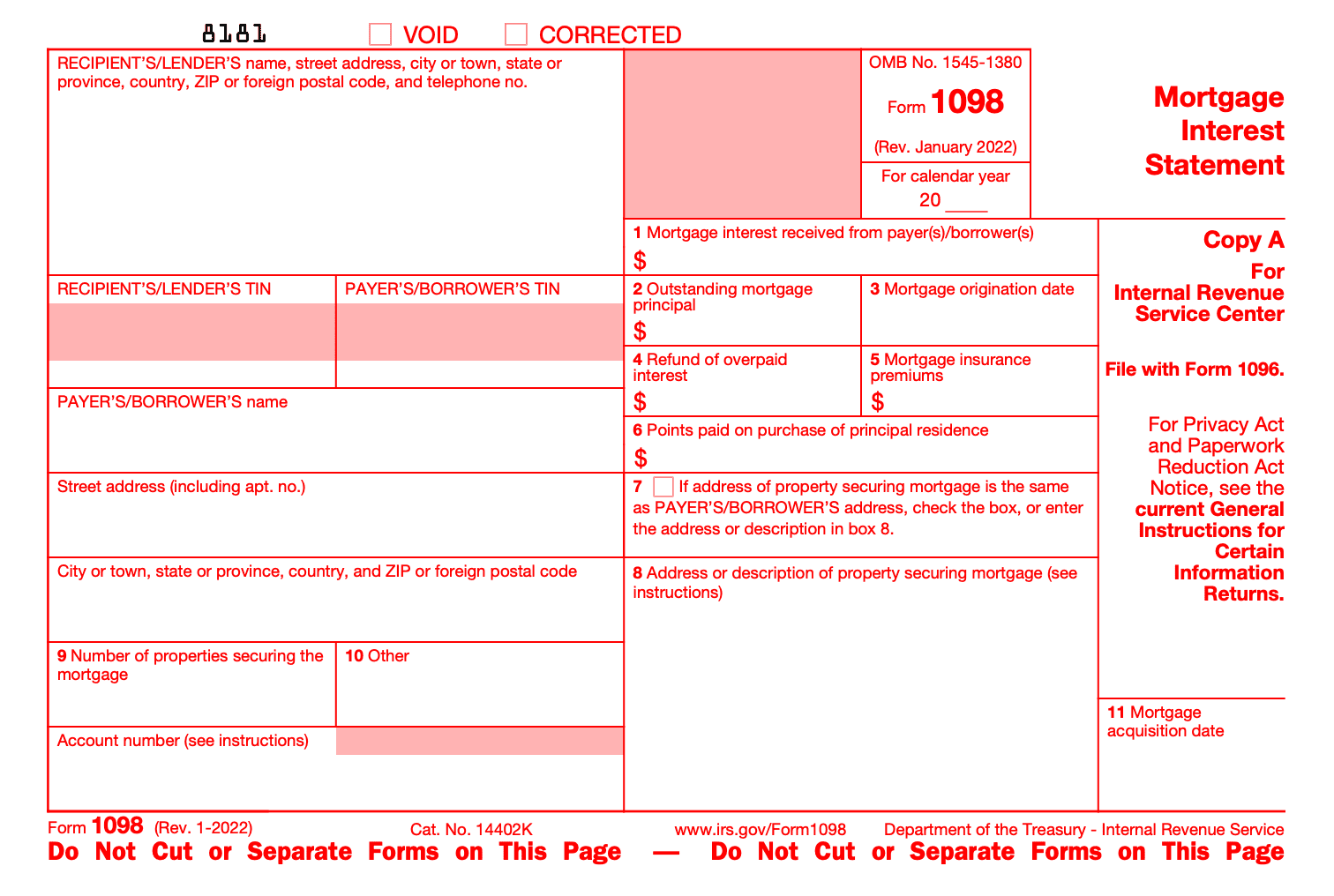

Copy A: For Internal Revenue Service Centre

This is the red copy of Form 1098, also known as the "transmittal copy." It's used to report the total interest paid on a mortgage loan to the IRS. The lender must file this copy with the IRS and send a copy to the borrower by January 31 of the year following the tax year.

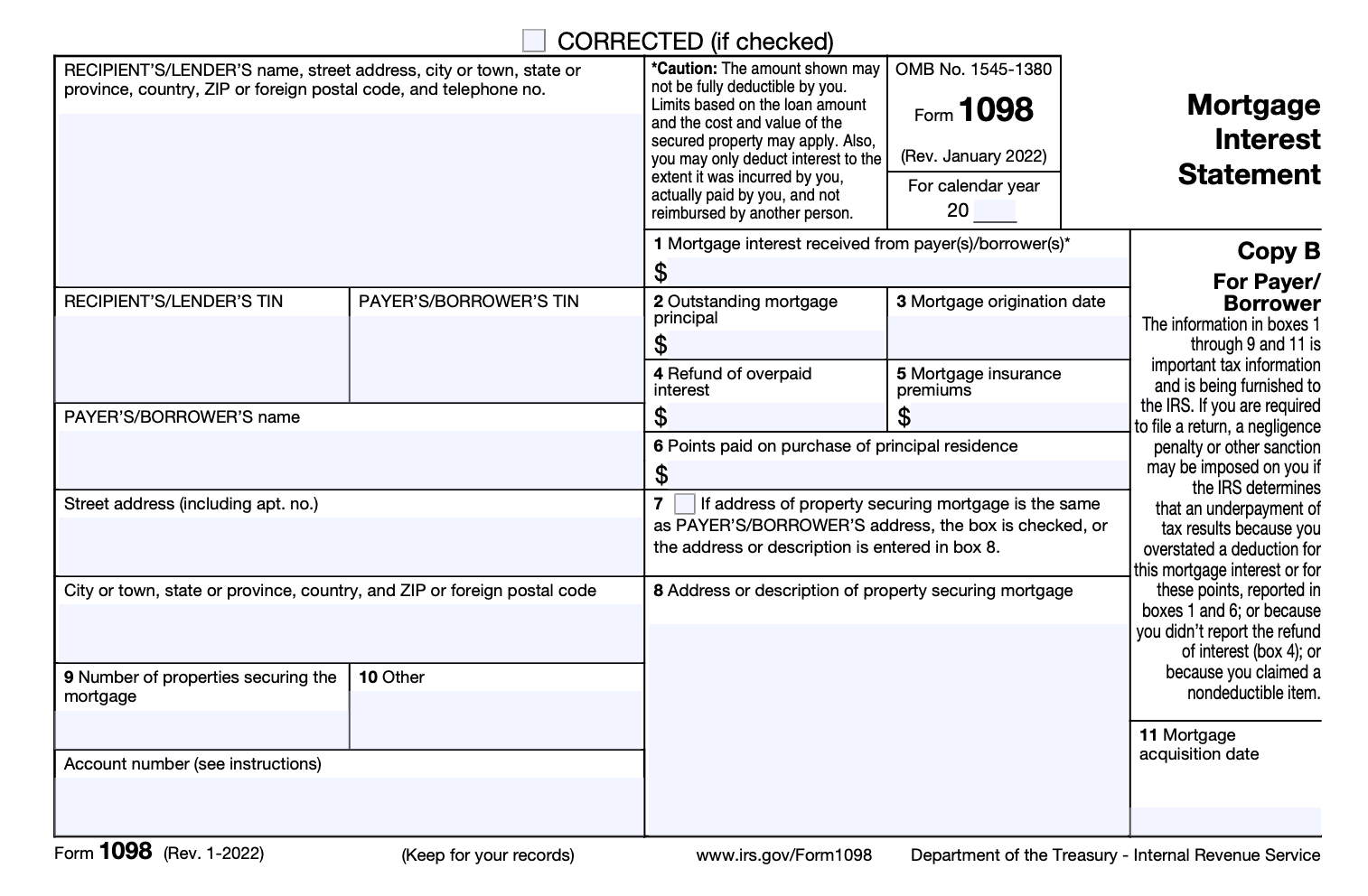

Copy B: For Payer/Borrower

This is the green copy of Form 1098, also known as the "borrower's copy." It's used to report the total interest paid on a mortgage loan to the borrower. The lender must send this copy to the borrower by January 31 of the year following the tax year.

- **Box 1: **This box reports the total amount of mortgage interest paid by the borrower during the tax year. This includes any mortgage points or mortgage insurance premiums that the borrower paid.

- Box 2: This box reports the amount of points paid by the borrower during the tax year. Points are a type of prepaid interest that a borrower can pay to reduce the interest rate on a mortgage loan.

- Box 3: This box reports the amount of mortgage insurance premiums paid by the borrower during the tax year. Mortgage insurance is required if the borrower puts less than 20% down on the home.

- Box 4: This box reports any refund of overpaid interest from a prior year.

- **Box 5: **This box reports the total amount of real estate taxes paid by the borrower during the tax year.

It's important to note that if a borrower paid more than $600 in mortgage interest during the tax year, the lender is required to send them a Form 1098. Additionally, lenders must file Copy A of Form 1098 with the IRS by February 28 (or March 31 if filed electronically) of the year following the tax year.

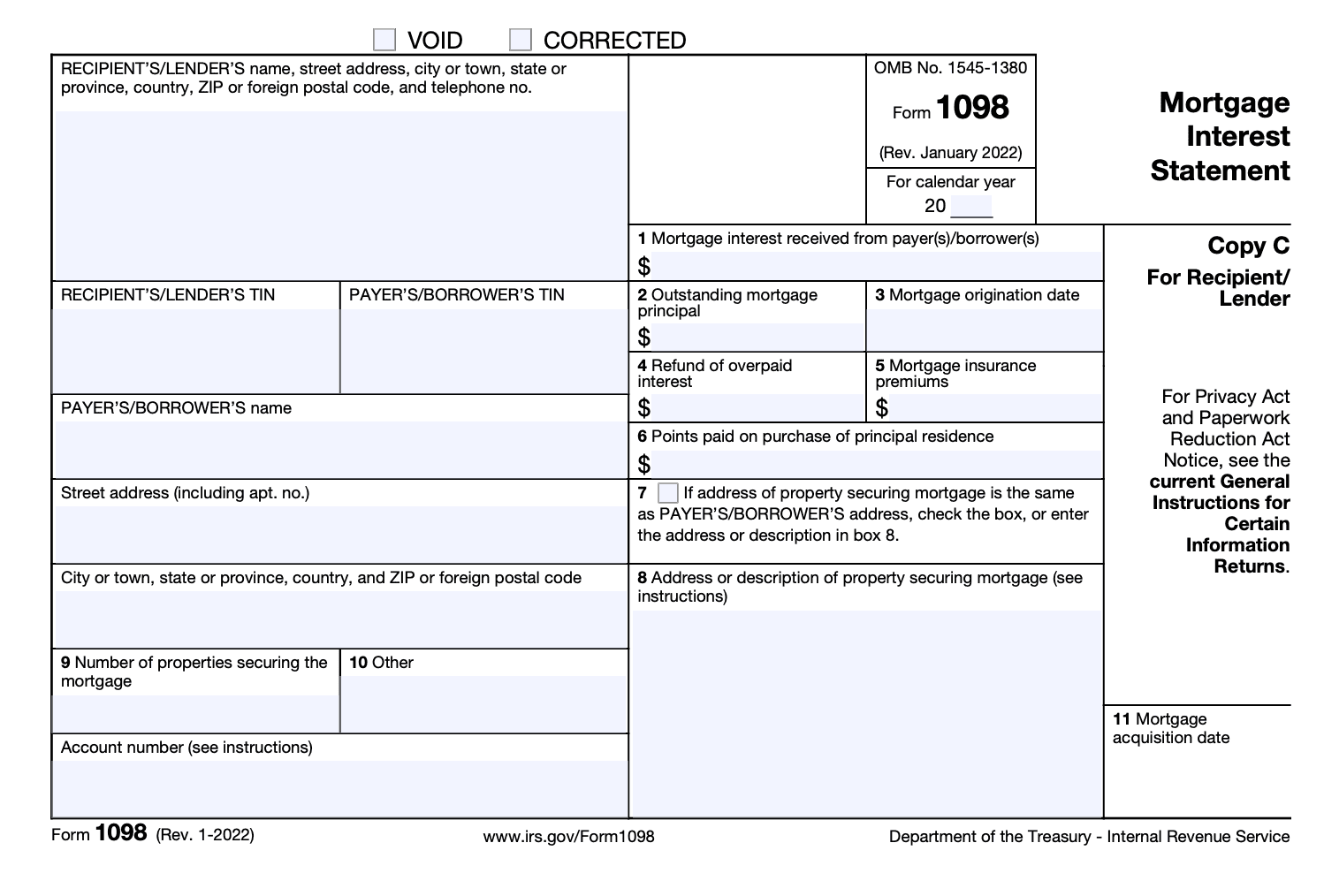

Copy C: For Recipient/ Lender

- Copy C of Form 1098 is the "Payer's Copy" intended for the payer's records.

- Copy C should include the payer's name, address, and tax identification number (TIN), as well as the borrower's name, address, and TIN.

- It should also include the amount of mortgage interest received by the lender during the tax year, any points paid on the mortgage, and the borrower's loan number.

- Copy C may include a message or note from the lender to the payer with additional information or instructions.

- Copy C should be kept by the payer for their own records as proof of mortgage interest paid and should not be sent to the borrower or the IRS.

Step2: Fill Out Form 1098

Using the information gathered, the lender must complete Form 1098, including their name, address, and TIN, along with the borrower's information and the amount of mortgage interest paid.

Step3: Send Copies:

The lender must send a copy of Form 1098 to the borrower by January 31st of the year following the tax year. The lender must also file a copy with the IRS by February 28th if filing by mail or March 31st if filing electronically.

When to File Form 1098?

As a mortgage lender, you are required to file Form 1098 annually with the IRS and provide a copy to the borrower. The deadline for filing Form 1098 is January 31st of the year following the tax year in question. For example, if you are reporting mortgage interest paid in 2022, you must file Form 1098 by January 31, 2023.

It's important to note that the deadline for providing a copy of Form 1098 to the borrower is the same as the deadline for filing with the IRS. This means that you must provide the borrower with a copy of the form by January 31st as well.

If you miss the deadline for filing Form 1098, you may be subject to penalties and interest charges. Therefore, it's important to ensure that you file the form on time and accurately report all mortgage interest paid by the borrower.

Rules for Deducting Mortgage Interest

To deduct mortgage interest on your tax return, you must be the primary borrower and make payments on the loan. Additionally, there are rules to follow.

Your total mortgage debt must be $750,000 or less (if originated after Dec. 16, 2017) or $1 million (for older mortgage debt) to qualify for the deduction.

Whether or not you need Form 1098 depends on whether or not you plan to (link: https://fincent.com/blog/itemized-deductions-how-to-reduce-your-tax-bill text: itemize your deductions) on the Schedule A Form. If you do not plan to itemize, you do not need Form 1098. However, if you plan to itemize, you will need Form 1098 from your lender to report the mortgage interest you paid.

If you meet the criteria, you would need Form 1098 to deduct the mortgage interest paid for your home loan for the current tax year. The form includes information such as the amount of mortgage interest paid and the lender's information.

If you have more than one qualified mortgage, then you will receive a separate Form 1098 for each one. This means that if you have multiple mortgages with different lenders, you will need to keep track of each Form 1098 in order to accurately report your deductions on your tax return.

Common Mistakes to Avoid When Filing:

- Failing to report all mortgage interest paid: Mortgage lenders must report all mortgage interest paid by the borrower during the tax year, including points and mortgage insurance premiums. Make sure you include all of these amounts in your report to avoid any underreporting issues.

- Incorrect borrower information: Make sure that the borrower's name, address, and social security number are correctly reported on Form 1098. Incorrect information can cause delays in processing the form and can lead to penalties for both you and the borrower.

- Reporting inaccurate mortgage interest amounts: Ensure that the mortgage interest reported on Form 1098 matches the amounts paid by the borrower. Reporting inaccurate amounts can trigger an audit by the IRS and can result in penalties and interest charges.

- Failing to provide a copy to the borrower: As mentioned earlier, mortgage lenders must provide a copy of Form 1098 to the borrower by January 31st of the year following the tax year. Failing to provide a copy can lead to penalties and interest charges.

- Not filing Form 1098 electronically: If you are required to file more than 250 Form 1098, you must file electronically. Failing to file electronically can result in penalties and interest charges. Make sure to check the IRS guidelines to determine if you meet the electronic filing requirement.

- Forgetting to sign and date the form: Form 1098 must be signed and dated by an authorized officer of the mortgage lender. Failure to sign and date the form can result in processing delays and penalties.

Exceptions to Form 1098

You are not required to file Form 1098 for mortgage interest received from entities such as corporations, partnerships, trusts, estates, associations, or companies (excluding sole proprietors), even if an individual is a co-borrower and all the trustees, beneficiaries, partners, members, or shareholders of the payer of record are individuals.

What to Do if You Encounter an Issue?

If you encounter an issue when filing Form 1098, it's important to seek assistance from a tax professional or the IRS. They can help you resolve any issues and ensure that the form is filed correctly and on time.

Conclusion:

In conclusion, Form 1098 plays a crucial role in the tax reporting process for homeowners who pay mortgage interest. It provides valuable information to both the taxpayer and the IRS, including the amount of mortgage interest paid and the lender's information.

By accurately reporting this information on your tax return, you can potentially reduce your taxable income and increase your tax refund or lower your tax liability. Failing to report mortgage interest correctly could result in penalties, so it's important to understand the rules and requirements for deducting mortgage interest.

Overall, Form 1098 simplifies the tax reporting process and ensures that taxpayers are accurately reporting their mortgage interest. It's essential for homeowners to understand how it works and how to use it to their advantage when filing their tax returns.