- IRS forms

- Form 2441

Tax Form 2441: Child and Dependent Care Expenses

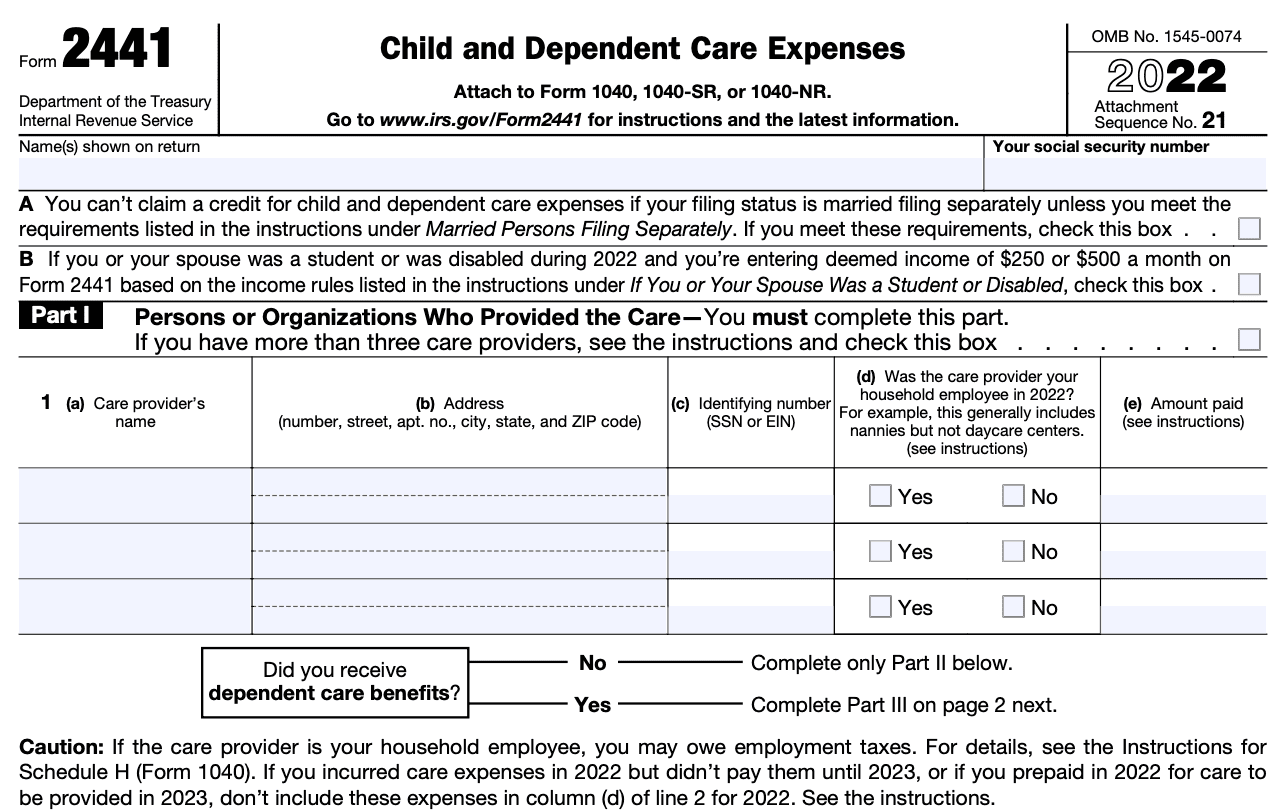

Download Form 2441Tax Form 2441, also known as "Child and Dependent Care Expenses," is a form used by taxpayers in the United States to claim a tax credit or deduction for expenses related to the care of dependents, such as children or disabled adults, while the taxpayer is working or looking for work. This form is filed along with the individual's annual income tax return.

Form 2441 requires taxpayers to provide information about the care provider, including their name, address, and taxpayer identification number or Social Security number. The form also requires details about the dependent, such as their name and Social Security number. Taxpayers must report the total amount of child and dependent care expenses paid during the tax year, as well as the amount of any dependent care benefits received from their employer or other sources.

Understanding Tax Form 2241

Tax Form 2241 is used by certain U.S. government agencies to report and pay their federal excise taxes. It is specifically used for the federal excise tax on air transportation.

Here are some key points to understand about Form 2241:

Purpose: Form 2241 is used to report and pay the taxes imposed on air transportation by certain government entities. These entities include state and local governments, Indian tribal governments, and certain international organizations.

Taxable entity: Only eligible government entities that engage in air transportation services are required to file this form. It does not apply to commercial airlines or other private entities.

Reporting period: Form 2241 is filed on a quarterly basis. The reporting periods are as follows: January to March (first quarter), April to June (second quarter), July to September (third quarter), and October to December (fourth quarter).

Tax calculation: The form provides a section to calculate the amount of federal excise tax owed based on the taxable air transportation services provided by the government entity. The tax rate may vary depending on the specific type of air transportation service.

Payment: The tax liability calculated on Form 2241 is generally paid by the government entity to the IRS using electronic funds transfer (EFT). The payment should be made by the due date of the return.

Supporting documentation: The government entity should maintain proper records and documentation to support the amounts reported on Form 2241. These records may include information about the number of flights, passenger counts, and the types of air transportation services provided.

Who Is Eligible To File Tax Form 2441?

Tax Form 2441, also known as the Child and Dependent Care Expenses, is filed by individuals who have incurred qualifying child and dependent care expenses and wish to claim the related tax credit. The form is typically filed by taxpayers in the United States who have paid for the care of a child or dependent while they were working or looking for work.

To be eligible to file Form 2441, you must meet certain criteria:

- You must have incurred qualifying expenses for the care of a child under the age of 13 or a disabled dependent of any age.

- You must have earned income during the tax year. This includes wages, salaries, tips, self-employment income, or other taxable compensation.

- You (and your spouse if filing jointly) must have paid for child or dependent care services so that you could work or actively look for work. There are exceptions for full-time students or individuals who are unable to care for themselves.

- You must have identified the care provider(s) by providing their name, address, and taxpayer identification number (TIN).

What Are the Benefits of Tax Form 2441?

Tax Form 2441, also known as the Child and Dependent Care Expenses form, is used to claim the Child and Dependent Care Credit. This credit is designed to help individuals and families offset the costs of child and dependent care expenses, allowing them to reduce their overall tax liability.

Here are some benefits of using Form 2441:

Child and dependent care credit: Form 2441 allows taxpayers to claim the Child and Dependent Care Credit, which can provide a significant tax benefit. The credit is calculated as a percentage of qualifying expenses incurred for the care of qualifying individuals, such as children under the age of 13 or dependents who are physically or mentally incapable of self-care.

Tax reduction: By claiming the Child and Dependent Care Credit on Form 2441, taxpayers can reduce their overall tax liability. The credit directly reduces the amount of taxes owed, which can result in a lower tax bill or a larger tax refund.

Eligible expenses: Form 2441 allows taxpayers to report various eligible expenses related to child and dependent care. These expenses may include costs incurred for the care of children, such as daycare, nursery school, or summer camp fees. It can also cover expenses for the care of disabled or elderly dependents, including nursing home fees or expenses for in-home caregivers.

**Work-related expense deduction: **In addition to the credit, Form 2441 also allows taxpayers to claim a deduction for work-related expenses related to child and dependent care. This deduction allows individuals to reduce their taxable income by the amount spent on eligible care expenses, subject to certain limits.

Financial relief: Form 2441 provides financial relief to families who incur significant child and dependent care expenses. By claiming the credit or deduction, taxpayers can receive financial assistance to offset a portion of these costs, making it more affordable to work or seek employment while ensuring the well-being and care of their dependents.

Completing Tax Form 2441: A Step-by-Step Guide

Completing Tax Form 2441, also known as the Child and Dependent Care Expenses form, is an important part of filing your taxes if you've incurred expenses for child or dependent care. Here's a step-by-step guide to help you complete this form:

Step 1: Gather necessary information

Before you start filling out the form, gather all the relevant information you'll need. This includes:

- Your personal information (name, address, Social Security Number)

- Information about your spouse, if applicable

- Information about the child or dependent care provider (name, address, and Employer Identification Number or Social Security Number)

Step 2: Download or obtain Form 2441

You can download the Form 2441 from the official IRS website (irs.gov) or obtain a printed copy from a local IRS office or post office. Ensure that you have the latest version of the form.

Step 3: Provide personal information

Start by entering your personal information at the top of the form, including your name, address, and Social Security Number. If you're married and filing jointly, provide the same information for your spouse.

Step 4: Enter care provider information

In Part I of Form 2441, provide the name, address, and Employer Identification Number or Social Security Number of each care provider. If the care provider is an individual, you'll need their Social Security Number.

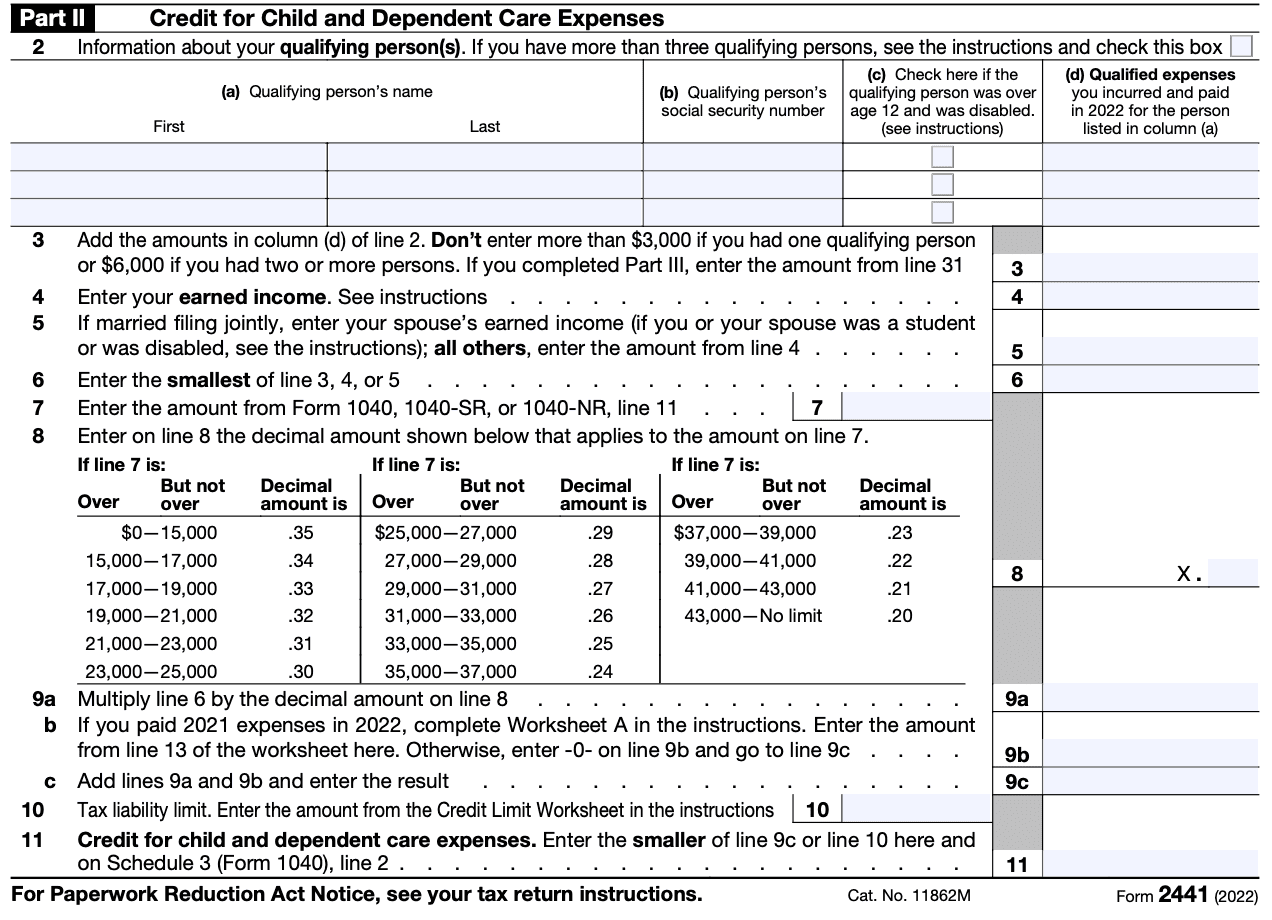

Step 5: Calculate care expenses

In Part II, you'll calculate the total expenses you incurred for child or dependent care. This includes both the expenses for qualified care and any expenses reimbursed through a flexible spending account or similar benefits. You'll need to provide the total expenses for each child or dependent.

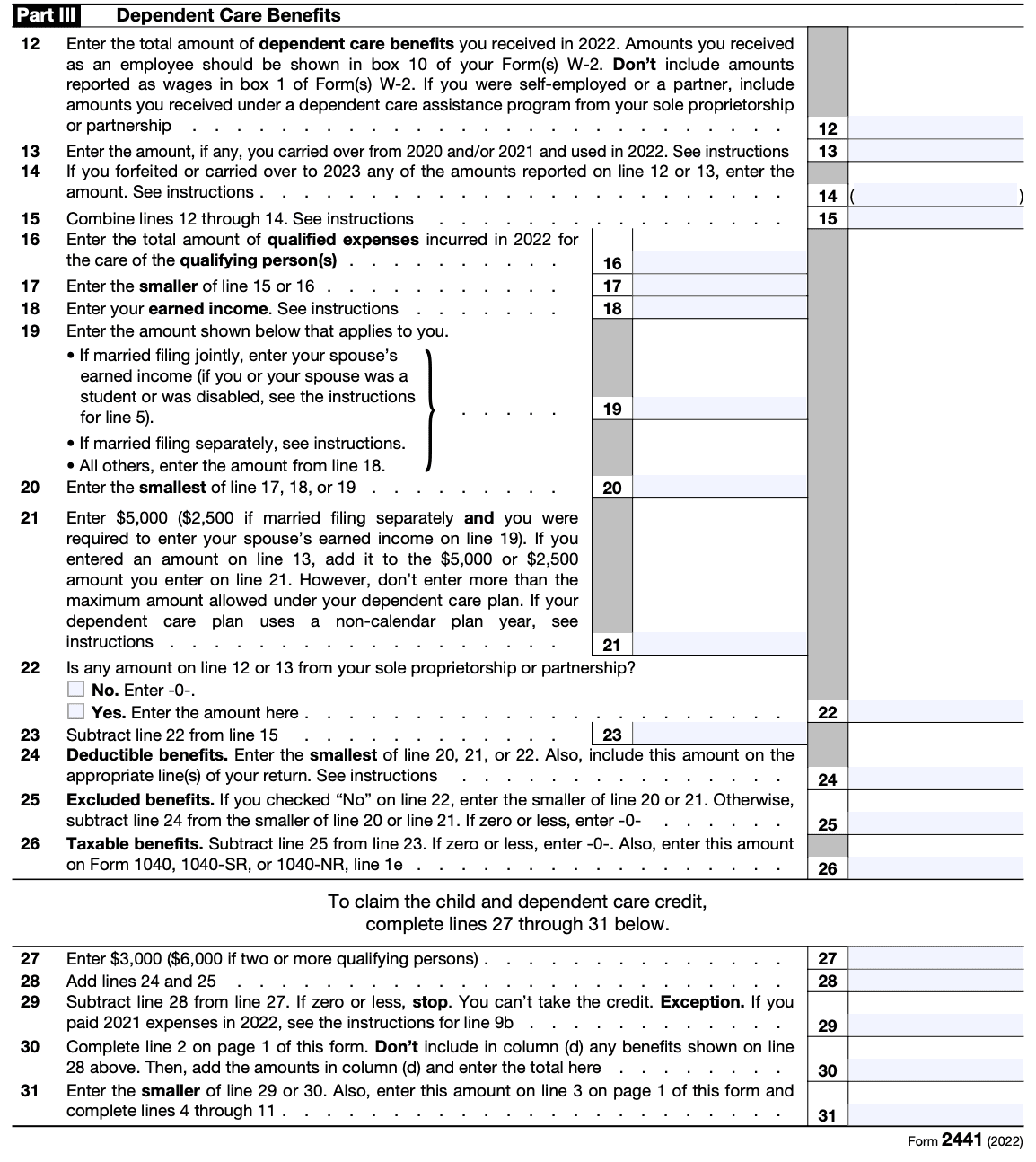

Step 6: Determine the applicable limits

In Part III, you'll calculate the applicable limits for claiming the child and dependent care credit. These limits depend on your income and are outlined in the instructions accompanying the form. Follow the instructions carefully to calculate the correct limits.

Step 7: Calculate the credit

In Part IV, you'll calculate the credit amount based on the information provided in the previous sections. Use the worksheet provided in the instructions to determine the credit amount based on your eligible expenses and income.

Step 8: Transfer the credit amount

Once you've determined the credit amount, transfer it to the appropriate line on your Form 1040 or 1040A (whichever form you're using). Follow the instructions provided on those forms to ensure the credit is applied correctly.

Step 9: Attach supporting documents (if required)

Depending on your circumstances, you may need to attach additional documents to support your claims, such as receipts or statements from the care providers. Review the instructions for Form 2441 to determine if any additional documentation is required.

Step 10: Review and submit

Before submitting your tax return, review Form 2441 and all other forms for accuracy and completeness. Double-check that you've entered all the information correctly and attached any necessary supporting documents. Sign and date the forms as required.

It's worth noting that this guide provides a general overview of completing Form 2441, but everyone's tax situation may be unique. If you have specific questions or concerns, it's recommended to consult with a tax professional or refer to the IRS Instructions for Form 2441.

Tax Form 2441: Types/Schedules/Deductions

There are other additional components dictating the calculation of Tax Form 2441. Here are some key elements of Form 2441:

Types of expenses: The form covers expenses incurred for the care of a qualifying individual. This includes payments made to child care centers, babysitters, nannies, day camps, and similar providers. Expenses for overnight camps or schooling costs are not eligible.

Schedules: Form 2441 consists of two parts: Part I and Part II.

Part I: This section is used to calculate the allowable expenses and credit for the care of one qualifying individual or two or more qualifying individuals.

Part II: This section is used to report the information about the care provider(s), such as their name, address, and taxpayer identification number (TIN).

Deductions: The form allows taxpayers to deduct a portion of their qualifying expenses based on their income. The allowable expenses are subject to a limit, and the credit is calculated based on a percentage of the allowable expenses.

Additional information: Taxpayers may need to attach additional documentation, such as receipts or statements from care providers, to support their claim for the Child and Dependent Care Expenses credit.

Filing Deadlines & Extensions on Tax Form 2441

The filing deadline and extensions for Form 2441, specifically for the Child and Dependent Care Expenses credit, generally follow the same rules as the individual income tax return filing deadlines. Here are the usual deadlines and extensions:

Filing deadline

The regular due date for filing Form 2441 is typically April 15 of the following year. For example, if you're filing your 2022 tax return, the deadline would be April 15, 2023. However, if the regular deadline falls on a weekend or a holiday, the due date may be extended to the next business day.

Extension deadline

If you need more time to file your tax return, you can request an extension. For Form 2441, the extension deadline is generally October 15. To obtain the extension, you must file Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," by the original due date of your return (usually April 15). This will grant you an additional six months to file your tax return, including Form 2441.

It's important to note that an extension of time to file your return does not grant an extension of time to pay any taxes owed. If you anticipate owing taxes, you should make an estimated payment by the original due date to avoid potential penalties and interest.

Methodologies for Filing Tax Form 2441

The method of filing this form can vary depending on whether you want to file offline (paper form), online, or e-file your taxes. Here's a general guide on each method:

Offline/Paper filing

a. Obtain Form 2441: You can download Form 2441 from the official IRS website (www.irs.gov) or request a copy by calling the IRS.

b. Fill out the form: Follow the instructions provided with the form to complete all the required information accurately. Ensure that you have all the necessary supporting documents, such as receipts and documentation of child care expenses.

c. Mail the form: Once you've filled out the form, sign and date it. Make a copy for your records and mail the original form to the appropriate IRS address, which can be found in the instructions accompanying the form. It's recommended to use certified mail or a similar service to track your submission.

Online filing

a. Use tax preparation software: Many tax preparation software programs, both free and paid, allow you to complete your tax return online. Choose a reputable software provider that supports Form 2441.

b. Enter the required information: Follow the software's instructions to enter the necessary details and complete Form 2441. The software will guide you through the process and perform necessary calculations.

c. Submit your return: Once you've completed the form and reviewed your entire tax return, you can submit it electronically through the software. The software will provide instructions on how to e-file your return securely.

E-filing

a. Engage a tax professional or authorized e-file provider: If you prefer to have assistance with your taxes, you can consult a tax professional or use an authorized e-file provider.

b. Provide necessary information: Provide all the required information and supporting documents to the tax professional or e-file provider. Make sure to mention that you want to claim the Child and Dependent Care Expenses credit using Form 2441.

c. Review and sign: Once the tax professional or e-file provider has prepared your return, carefully review the information and sign the necessary documents to authorize e-filing.

d. Transmit your return: The tax professional or e-file provider will electronically transmit your tax return to the IRS on your behalf.

Common Mistakes To Avoid While Filing Tax Form 2441

When filing Tax Form 2441, it's important to be aware of common mistakes to avoid. Here are some of the common errors people make while filing Tax Form 2441:

-

Incorrect or missing information: Ensure that all the required fields on Form 2441 are accurately filled out. Double-check your personal details, such as your name, Social Security number, and address. Any errors or missing information could lead to delays or complications with your tax return.

-

Ineligible expenses: Ensure that you are claiming expenses that are eligible, such as child care or daycare expenses for children under the age of 13, expenses for a disabled spouse or dependent, and summer day camp costs.

-

Incorrect calculations: Math errors can easily occur when calculating the credit. Use the instructions provided with Form 2441 or consult a tax professional to accurately calculate the credit based on your qualifying expenses and income.

-

Failure to report the care provider's information: You must provide the name, address, and taxpayer identification number (TIN) of the care provider on Form 2441. If this information is missing or incorrect, it may result in delays or rejection of your claim.

-

Ignoring income limits: The Child and Dependent Care Expenses Credit has income limits. If your income exceeds the specified limits, you may not be eligible for the credit or may receive a reduced amount. Make sure to review the income limits and adjust your claim accordingly.

-

Filing under the wrong status: If you're married, ensure that you are filing your tax return using the correct filing status (married filing jointly or married filing separately). The filing status can impact your eligibility for the credit and the amount you can claim.

-

Failure to keep proper documentation: It's essential to keep all supporting documentation related to your child and dependent care expenses. This includes receipts, invoices, and records of payments made to care providers.

Conclusion

Form 2441 serves as a valuable tool for taxpayers who incur child and dependent care expenses. By claiming the Child and Dependent Care Expenses credit, eligible individuals can reduce their tax liability and alleviate some of the financial burdens associated with caring for their children or dependents. However, it is advisable to consult a tax professional or refer to the official IRS guidelines to ensure accurate completion of Form 2441 and compliance with all eligibility requirements.