- IRS forms

- Schedule J (Form 1040)

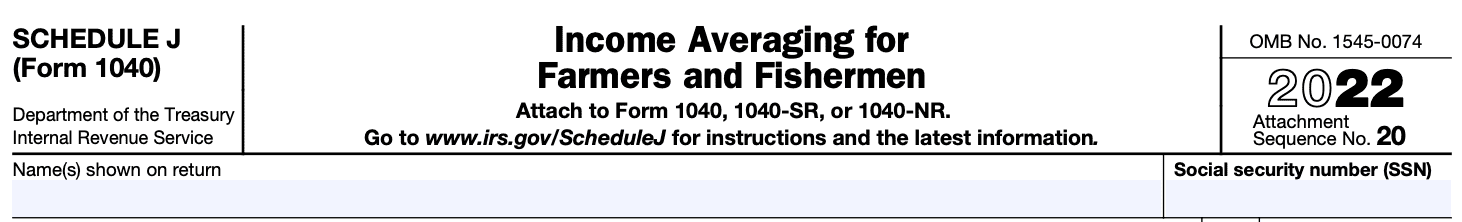

Schedule J (Form 1040): Income Averaging for Farmers and Fishermen

Download Schedule J (Form 1040)When it comes to taxation, the Internal Revenue Service (IRS) offers various provisions and forms to ensure fairness and flexibility for different professions. One such provision is Schedule J (Form 1040), which provides income averaging specifically for farmers and fishermen.

Income averaging is a tax provision designed to assist individuals whose income experiences significant fluctuations from year to year. Farmers and fishermen, in particular, often face unpredictable earnings due to factors such as weather conditions, market volatility, or irregular catch sizes. To address these challenges, the IRS introduced Schedule J as a tool to level out their tax liabilities.

In this blog post, we will delve into the details of Schedule J, exploring its purpose, eligibility requirements, and how it can benefit farmers and fishermen.

Purpose of Schedule J (Form 1040)

The purpose of Schedule J is to allow qualifying farmers and fishermen to average their income over a period of up to three years. This income averaging provision is designed to provide tax relief for individuals whose income can vary significantly from year to year due to the nature of their occupation.

By using Schedule J, farmers and fishermen can potentially lower their tax liability by spreading out their income over several years, which can help reduce the impact of high-income years on their overall tax liability. This provision recognizes the cyclical nature of farming and fishing, where income can be influenced by factors such as weather conditions, market fluctuations, or other external factors.

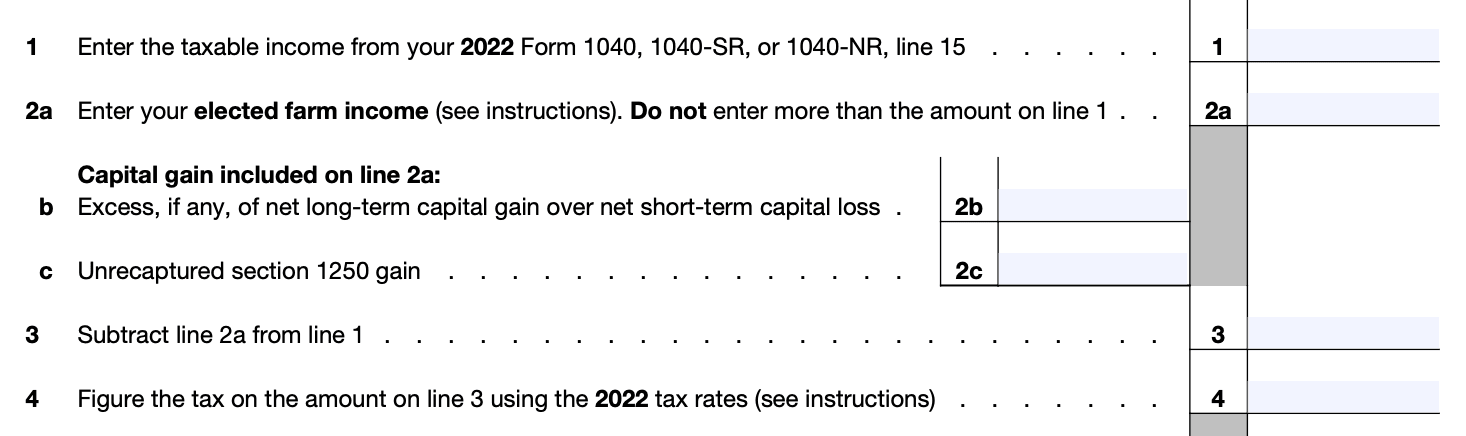

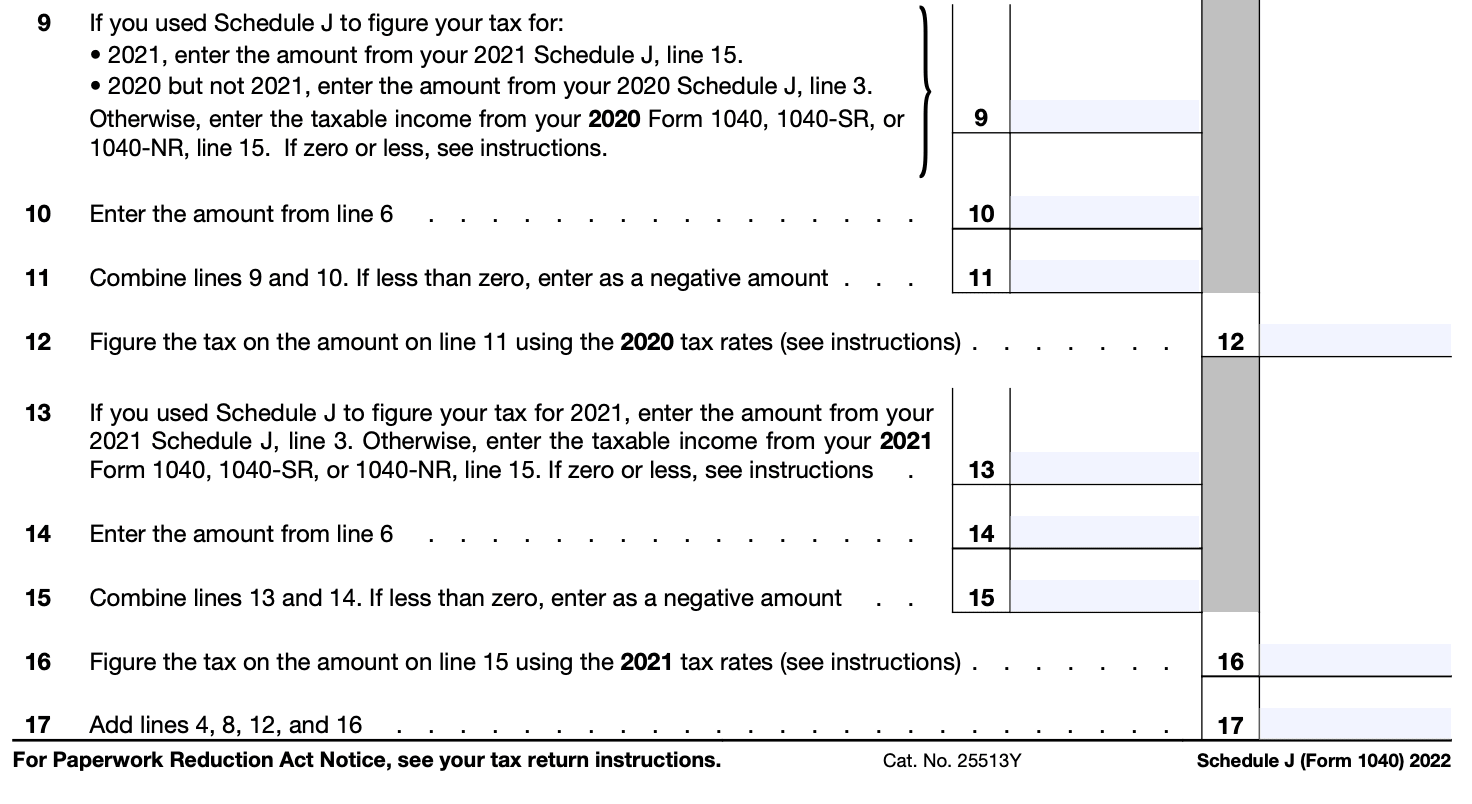

On Schedule J, taxpayers calculate their income averaging by determining the taxable income for each of the three preceding years, including the current tax year. They then calculate the average taxable income over the selected years and determine the tax liability based on the average income. The resulting tax liability is compared to the tax liability without income averaging, and the taxpayer can choose the option that results in the lower tax amount.

It's important to note that Schedule J is specifically for farmers and fishermen who meet certain criteria, and it may not be applicable to other taxpayers.

Benefits of Schedule J (Form 1040)

As of September 2021, some potential benefits of Schedule J could include:

-

Income averaging: Schedule J may provide a method for calculating your tax liability by using an income averaging method. This method could be beneficial if you have substantial fluctuations in your income from year to year.

-

Farming or fishing income: If you're engaged in farming or fishing activities, Schedule J might offer specific provisions or tax benefits related to these industries. It could help you calculate your income, deductions, and taxes related to farming or fishing activities more accurately.

-

Tax calculation adjustments: Schedule J could include adjustments to your regular tax liability calculation. These adjustments might take into account certain tax benefits, deductions, or credits that are unique to your situation.

Who Is Eligible To File Schedule J (Form 1040)?

To be eligible to file Schedule J, you must meet the following criteria:

You must have income from farming or fishing: Schedule J is specifically designed for taxpayers who have farming or fishing income as a significant portion of their total income.

You must meet the definition of a farmer or fisherman: For tax purposes, a farmer is an individual who cultivates land or operates a farm for profit. A fisherman is an individual who operates a trade or business involving the catching, taking, or harvesting of fish.

You must meet the income requirements: The IRS provides specific guidelines for determining whether you qualify as a farmer or fisherman. These guidelines consider factors such as the percentage of total income derived from farming or fishing and the total gross income.

How To Complete Schedule J (Form 1040): A Step-by-Step Guide

Form 1040 Schedule J is used to report income averaging for farmers and fishermen. It helps them calculate their tax liability by averaging their income over a period of up to three years. Here's a step-by-step guide on how to complete Schedule J:

Step 1: Obtain the necessary documents

Gather all the relevant documents, including your tax return (Form 1040), income statements, and other supporting documents related to your farming or fishing activities.

Step 2: Fill out the taxpayer information

Enter your name, Social Security number, and any other required personal information at the top of Schedule J.

Step 3: Calculate your base amount

Calculate your base amount by adding the taxable income from the current year and the two preceding years. This is the amount on which you will apply the income averaging.

Step 4: Determine the taxable income for each year

Using your tax returns for the current year and the two preceding years, identify the taxable income for each of those years.

Step 5: Allocate income to each year

Allocate your base amount to each of the three years. This is done by dividing the base amount by three.

Step 6: Calculate the tax for each year

Using the tax rates and brackets applicable for each year, calculate the tax liability for each year based on the allocated income.

Step 7: Complete Schedule J

In Part I of Schedule J, fill in the allocated amounts for each year in the designated columns. Then, in Part II, calculate the tax for each year based on the allocated income and applicable tax rates.

Step 8: Determine the income averaging benefit

Subtract the total tax for the three years from the tax that would have been owed if the income was not averaged. This is the income averaging benefit.

Step 9: Transfer the results to Form 1040

Take the income averaging benefit amount from Schedule J and transfer it to the appropriate line on Form 1040.

Step 10: Review and file

Review your completed Schedule J for accuracy and ensure that all necessary information has been entered correctly. Attach Schedule J to your Form 1040 and file your tax return by the due date.

Special Considerations When Filing Schedule J (Form 1040)

When filing Schedule J (Form 1040), which is used to report income averaging for farmers and fishermen, there are several special considerations to keep in mind. Here are some key points to consider:

Eligibility: Schedule J is specifically designed for farmers and fishermen who meet certain criteria. To qualify, you must have received at least two-thirds of your total gross income from farming or fishing activities during the preceding three years.

Income averaging: The primary purpose of Schedule J is to allow eligible farmers and fishermen to average their income over a specified period. This can help reduce the tax burden in years when income is high due to factors like weather conditions or market fluctuations.

Required documentation: It's important to maintain proper documentation of your income and expenses related to farming or fishing activities. Keep records of sales, expenses, inventory, and any other relevant financial information to support the figures reported on Schedule J.

**Computation: **Schedule J provides a worksheet to help you calculate your income averaging. It involves determining your base years, which are generally the three years immediately preceding the current tax year. The worksheet guides you through the calculations necessary to determine your income average.

Schedule J vs. regular tax calculation: When using Schedule J, your tax liability is calculated based on your average income rather than the income for the current tax year alone. This can result in a lower tax liability compared to the regular tax calculation method.

Electing income averaging: To elect income averaging, you must complete and attach Schedule J to your Form 1040. You can't use income averaging for self-employment taxes or other taxes unrelated to farming or fishing income.

Special rules and limitations: There are additional rules and limitations associated with income averaging for farmers and fishermen. These may include alternative minimum tax (AMT) considerations and restrictions on claiming certain tax credits or deductions. Review the instructions provided with Schedule J for specific details.

Professional assistance: Filing Schedule J and navigating the complexities of income averaging can be challenging. If you're uncertain about the process or have complex financial situations, it's advisable to consult a tax professional who specializes in farm or fishing tax matters.

Filing Deadlines & Extensions for Schedule J (Form 1040)

Here are the general guidelines for filing deadlines and extensions:

Original filing deadline

The original deadline for filing your federal income tax return, including Schedule J, is typically April 15th. However, if April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day. For example, if April 15th falls on a Saturday, the deadline would be pushed to the following Monday.

Extension deadline

If you need additional time to file your tax return, you can request an extension. The extension provides an extra six months to file your return, moving the deadline to October 15th. To obtain the extension, you must file Form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return," by the original filing deadline (typically April 15th). Keep in mind that an extension only applies to the filing deadline, not the payment of any taxes owed.

Estimated tax payments

Farmers and fishermen who expect to owe taxes when they file their return must make estimated tax payments. These payments are generally due by April 15th of the tax year. However, farmers and fishermen have the option to file their tax return and pay the entire balance due by March 1st to avoid making estimated tax payments. If March 1st falls on a weekend or holiday, the deadline would be extended to the next business day.

Common Mistakes To Avoid While Filing Schedule J (Form 1040)

When filing Schedule J (Form 1040), it's important to avoid certain common mistakes to ensure accurate and error-free filing. Here are some mistakes to avoid:

**Incorrectly qualifying for Schedule J: **Schedule J is specifically designed for farmers and fishermen to calculate their income tax liability using income averaging. Ensure that you meet the criteria for this schedule before filing it.

Failing to report all qualifying income: Include all income from farming or fishing activities on Schedule J. This includes income from selling crops, livestock, fish, or other related activities.

Incorrect calculation of income averaging: Schedule J allows farmers and fishermen to average their income over a three-year period to reduce tax liability. Make sure to correctly calculate the averaged income and follow the instructions provided by the IRS.

Not providing supporting documentation: Keep detailed records and supporting documents for all income and deductions claimed on Schedule J. This includes sales receipts, invoices, expense records, and any other relevant documentation. While you don't submit these documents with your tax return, you should have them available in case of an audit.

Ignoring special rules and provisions: Familiarize yourself with any special rules or provisions that may apply to your farming or fishing activities. These rules can affect how you report certain types of income or claim deductions, so it's important to understand and follow them accurately.

Forgetting to sign and date the form: Ensure that you sign and date your Schedule J and any other required forms before mailing or electronically filing your tax return. Unsigned forms may result in processing delays or even the rejection of your return.

Failing to double-check for errors: Before submitting your tax return, review your Schedule J and the entire tax return for any errors or omissions. Double-check all calculations and verify that all necessary information has been included.

Missing the deadline: Be aware of the tax filing deadline, which is typically April 15th of each year unless it falls on a weekend or holiday. Failing to file Schedule J and your tax return on time may result in penalties and interest charges.

Conclusion

Schedule J (Form 1040) provides a valuable option for farmers and fishermen to level out their income and manage their tax liabilities effectively. By averaging income over a three-year period, eligible individuals can benefit from lower tax rates and improved financial stability.

If you are engaged in farming or fishing and experience significant fluctuations in income, consulting with a tax professional or utilizing tax software can help you determine whether Schedule J is applicable to your situation.

Remember, understanding and utilizing the available tax provisions can make a substantial difference in your financial well-being as a farmer or fisherman.