- IRS forms

- Form 1099-S

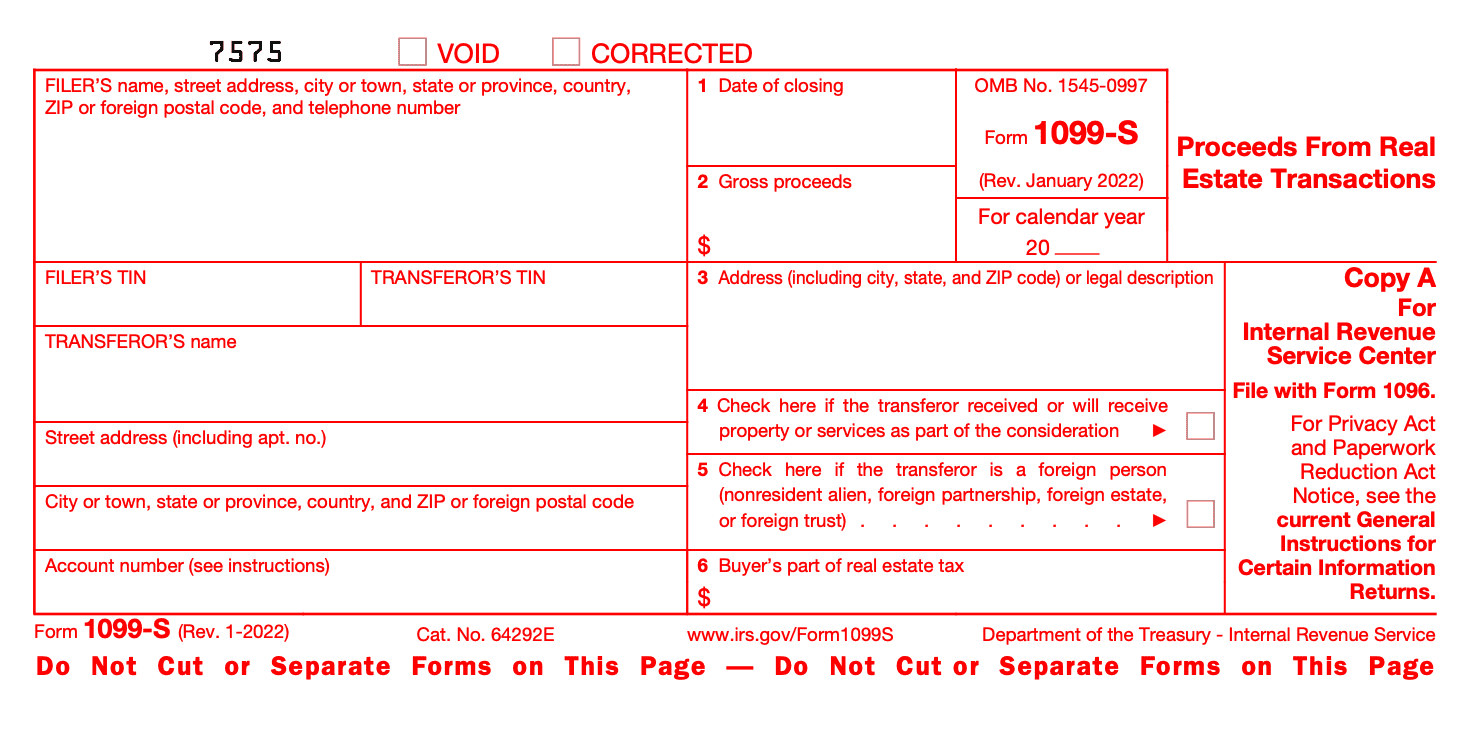

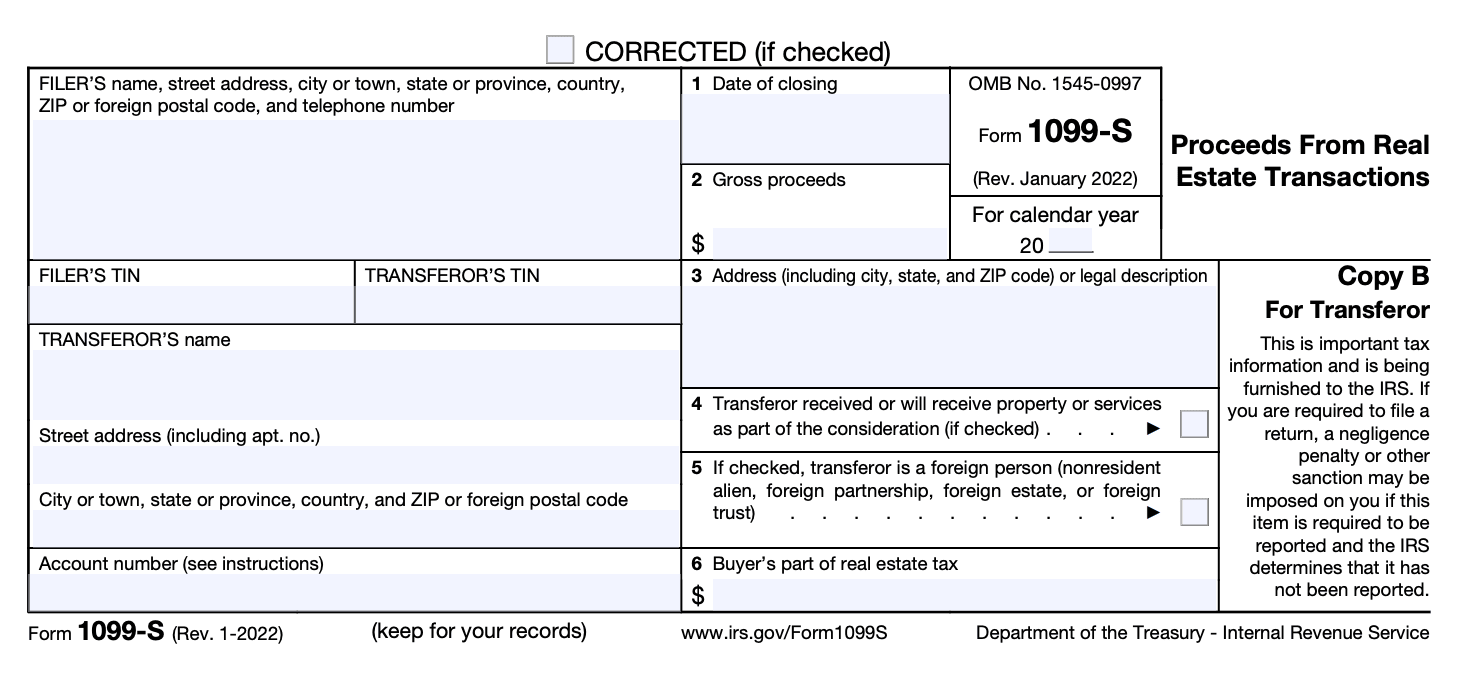

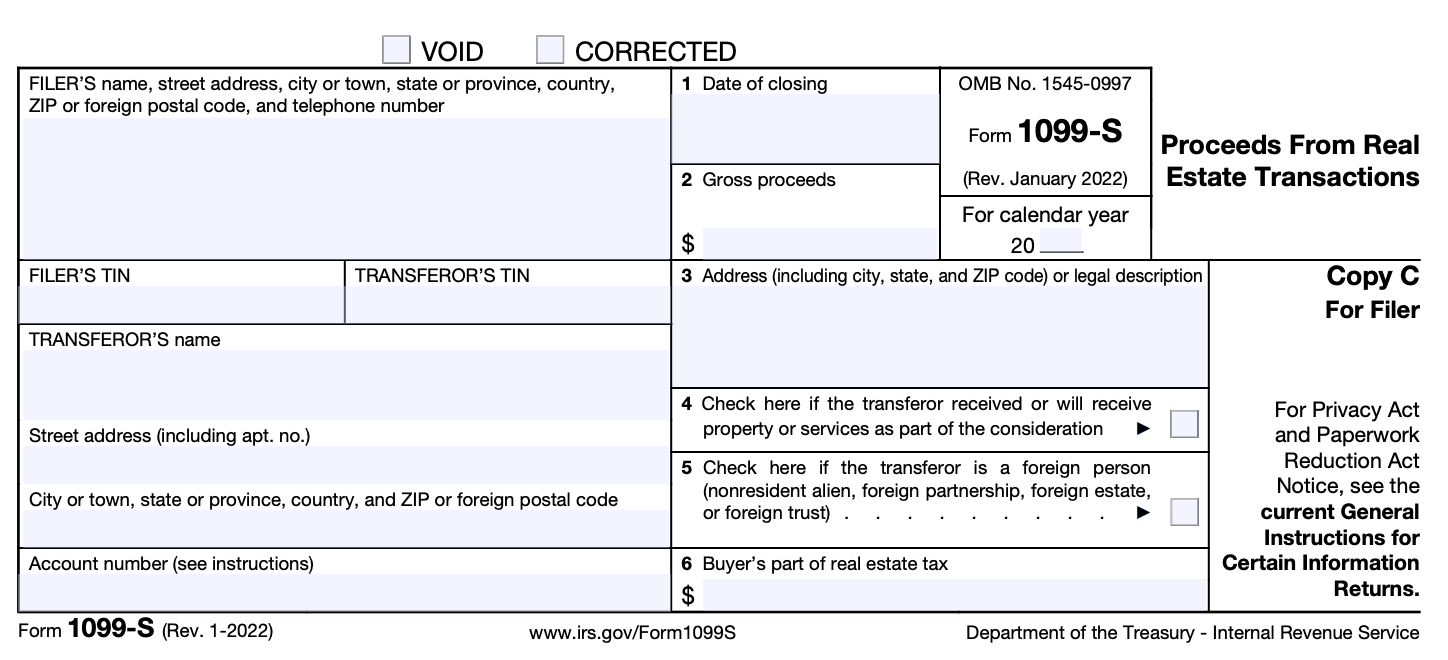

Form 1099-S: Proceeds from Real Estate Transactions

Download Form 1099-SReal estate transactions involve the buying and selling of properties, and they come with specific tax obligations. One important aspect of real estate taxation is reporting the proceeds from these transactions to the Internal Revenue Service (IRS). Form 1099-S is the document used to report the proceeds from real estate sales, providing the necessary information to ensure proper taxation.

Form 1099-S is a tax form used to report the proceeds from real estate transactions. It is typically filed by individuals or entities involved in the sale or exchange of real property. The form is required to be completed by the closing agent, which can be the escrow agent, settlement agent, or title company, responsible for the transaction. The closing agent must furnish a copy of Form 1099-S to both the seller and the IRS.

In this blog post, we will explore the key aspects of Form 1099-S and its significance in real estate transactions.

Purpose of Form 1099

The purpose of Form 1099-S is to provide information to the Internal Revenue Service (IRS) about the proceeds from real estate transactions. It is typically filed by the person or entity responsible for closing the transaction, such as the settlement agent, closing agent, or real estate attorney.

The form captures important details about the real estate transaction, including the seller's and buyer's names, addresses, and taxpayer identification numbers (TINs). It also includes information about the property, such as the address, legal description, and the gross proceeds from the sale.

Form 1099-S is important for both the IRS and the parties involved in the real estate transaction. The IRS uses the information reported on this form to ensure that taxpayers accurately report their capital gains or losses on their tax returns. It helps them verify the accuracy of the information provided by taxpayers and identify potential discrepancies.

For the parties involved in the real estate transaction, Form 1099-S serves as documentation of the sale or exchange. It provides a record of the proceeds received from the sale, which may be needed for various purposes, such as calculating capital gains taxes or reporting the transaction to state or local authorities.

Benefits of Form 1099-S

Here are some benefits of using Form 1099-S:

-

Compliance with tax regulations: The primary benefit of using Form 1099-S is to comply with the Internal Revenue Service (IRS) regulations. If you are involved in a real estate transaction as a seller, you are required to report the proceeds from the sale to the IRS using this form. Filing the form ensures that you fulfill your tax obligations and avoid penalties for non-compliance.

-

Documentation for tax purposes: Form 1099-S serves as an important documentation tool for both the seller and the IRS. By providing accurate information about the sale, including the gross proceeds, the buyer's name, and the property address, the form helps establish a clear record of the transaction. This documentation can be helpful during tax audits or when calculating capital gains or losses on the sale of real estate.

-

Facilitates accurate tax reporting: Form 1099-S provides the IRS with information about the sale or exchange of real estate, allowing them to verify that the reported proceeds match the seller's tax return. This helps maintain the integrity of the tax system and ensures that individuals accurately report their taxable income.

-

Helps prevent underreporting: Form 1099-S acts as a safeguard against underreporting of income from real estate transactions. By requiring the buyer to report the transaction to the IRS, it helps ensure that the seller cannot evade tax obligations by failing to report the sale. This helps maintain fairness and transparency in the tax system.

-

Supports tax audits and investigations: If the IRS chooses to audit a taxpayer or investigate a real estate transaction, having accurate and complete Form 1099-S records can provide evidence of the transaction details. It helps the IRS assess the taxpayer's compliance with tax laws and facilitates the resolution of any discrepancies or issues that may arise during an audit.

Who Is Eligible To File Form 1099-S?

The following individuals or entities may be eligible to file Form 1099-S:

**Real estate agents or brokers: **If you are a real estate agent or broker and participated in the sale or exchange of real estate, you may need to file Form 1099-S.

Closing agents: Closing agents, such as attorneys, title companies, or escrow agents, who are involved in the real estate transaction and handle the funds or documents related to the sale may also be required to file Form 1099-S.

**Individuals or entities selling real estate: **If you are an individual or entity selling real estate and do not use the services of a real estate agent or closing agent, you may need to file Form 1099-S yourself.

It's important to note that the requirement to file Form 1099-S may vary depending on the specific circumstances and applicable tax laws.

How To Complete Form 1099-S: A Step-by-Step Guide

Form 1099-S is used to report the sale or exchange of real estate properties. Here's a step-by-step guide on how to complete Form 1099-S:

Step 1: Gather necessary information

Before you begin filling out Form 1099-S, make sure you have all the relevant information on hand. This includes:

- Seller's information: Name, address, and taxpayer identification number (TIN) or social security number (SSN).

- Buyer's information: Name and address.

- Property information: Description of the property sold, including address, city, state, ZIP code, and legal description.

- Sales information: Date of closing, gross proceeds from the sale, and any adjustments or expenses related to the sale.

Step 2: Obtain Form 1099-S

Obtain a copy of Form 1099-S from the Internal Revenue Service (IRS) website or from an authorized vendor. The form is available in PDF format, which you can either print and fill out manually or complete electronically using appropriate software.

Step 3: Fill out the payer's information

In the top-left section of the form, provide your information as the payer. This includes your name, address, and TIN.

Step 4: Fill out the recipient's information

In the top-right section of the form, enter the seller's information as the recipient. Provide their name, address, and TIN or SSN.

Step 5: Provide property information

In the middle section of the form, enter the property information. Include the complete address, city, state, ZIP code, and legal description of the property.

Step 6: Enter sales information

In the "Sales Information" section, report the date of closing, gross proceeds from the sale, and any adjustments or expenses related to the sale. Ensure accurate reporting of the amounts, and use the designated boxes for each item.

Step 7: Complete the checkboxes and signatures

In the bottom section of the form, you'll find checkboxes related to the transaction. Check the appropriate box to indicate if the property is improved or unimproved, or if it's a sale or exchange. Also, make sure to sign and date the form in the designated areas.

Step 8: Copy and distribute

Once you've completed Form 1099-S, make a copy for your records. Distribute copies to the seller (recipient) and file Copy A with the IRS. Check the IRS instructions for specific details on mailing addresses and due dates for filing.

Step 9: File electronically (optional)

If you choose to file electronically, you can use the IRS's Filing Information Returns Electronically (FIRE) system or an approved third-party e-file provider. Electronic filing may have different deadlines, so refer to the instructions or the IRS website for the specific requirements.

Special Considerations When Filing Form 1099-S

When filing Form 1099-S, there are several special considerations that you need to keep in mind. Here are some important considerations:

Reporting thresholds: You are required to file Form 1099-S only if the transaction involves the sale or exchange of real estate for $600 or more. Transactions below this threshold generally do not need to be reported, but it's always a good practice to keep accurate records for your own reference.

**Multiple sellers or buyers: **If there are multiple sellers or buyers involved in a real estate transaction, the person responsible for closing the transaction, usually the settlement agent or the attorney, must file Form 1099-S. It is important to coordinate with all parties involved to ensure accurate reporting.

Principal residence exemption: There is an exemption for reporting the sale of a principal residence if specific conditions are met. If the property sold is the seller's primary home and certain criteria, such as ownership and use tests, are satisfied, the transaction may be exempt from reporting. However, if the transaction involves the sale of a second home, rental property, or investment property, it must be reported on Form 1099-S.

Reporting deadline: The deadline to file Form 1099-S with the IRS is typically January 31 of the year following the calendar year in which the real estate transaction occurred. You must also provide a copy of Form 1099-S to the seller(s) involved in the transaction by the same deadline.

**Accuracy and completeness: **It is crucial to ensure that all the information reported on Form 1099-S is accurate and complete. This includes the seller's and buyer's names, addresses, and taxpayer identification numbers (TINs). Any errors or omissions may lead to penalties or IRS inquiries.

State and local Reporting: In addition to filing Form 1099-S with the IRS, you may also have state and local reporting requirements. Check with the respective state and local tax authorities to determine if you need to file additional forms or provide additional information.

Form 1096: Form 1096, Annual Summary and Transmittal of U.S. Information Returns, must accompany Form 1099-S when filing with the IRS. Form 1096 summarizes the information on all the Forms 1099-S being filed.

Filing Deadlines & Extensions on Form 1099-S

Here are the general filing deadlines and extension options:

Filing deadline: The deadline for filing Form 1099-S with the IRS is typically January 31st of the year following the calendar year in which the real estate transaction occurred. For example, if the transaction took place in 2022, the form would generally be due by January 31, 2023.

Furnishing deadline: You are also required to furnish a copy of Form 1099-S to the seller by January 31st of the year following the transaction.

Automatic extension: By default, there is no automatic extension available for filing Form 1099-S. This means that if you need more time to file, you must request an extension.

Extension request: To request an extension of time to file Form 1099-S, you can file Form 8809, Application for Extension of Time To File Information Returns, with the IRS before the original due date of the form. The extension will typically be granted for up to 30 days.

It's important to remember that even with an extension, you should still furnish the copy of Form 1099-S to the seller by the original January 31st deadline.

Common Mistakes To Avoid While Filing Form 1099-S

When filing Form 1099-S, which is used to report proceeds from real estate transactions, it's important to avoid certain common mistakes to ensure accurate and compliant reporting. Here are some mistakes to avoid while filing Form 1099-S:

Incorrect taxpayer identification number (TIN): Make sure you obtain the correct taxpayer identification number (TIN) from the seller. Failure to report the correct TIN or providing an incorrect TIN can result in penalties or backup withholding requirements.

Failing to report all necessary information: Ensure that you report all required information accurately. This includes the seller's name, address, and TIN, as well as the property address, sales proceeds, and the date of closing. Check that you have correctly filled out all the relevant fields.

Using the wrong form: Ensure that you are using Form 1099-S specifically for reporting real estate transactions. Using the wrong form or not using Form 1099-S can lead to reporting errors and potential penalties.

Ignoring the filing deadlines: The deadline for filing Form 1099-S is typically January 31 of the year following the calendar year in which the transaction occurred. Make sure to file the form on time to avoid penalties for late filing.

Not providing copies to the appropriate parties: In addition to filing the form with the IRS, you must also provide a copy to the seller. Failing to provide the necessary copies to the appropriate parties can result in compliance issues and potential penalties.

Neglecting to check for accuracy: Review all the information on the Form 1099-S before submitting it. Double-check for any errors or inconsistencies that may have occurred during data entry. Accuracy is crucial to avoid complications or discrepancies.

Failing to retain records: Keep a copy of the filed Form 1099-S and any supporting documentation for your records. This is important for future reference and in case of any audits or inquiries.

Conclusion

Form 1099-S is an essential document used to report the proceeds from real estate transactions to the IRS. It ensures accurate tax reporting, compliance with IRS regulations, and provides documentation for taxpayers to report their income and expenses. The form plays a significant role in tracking capital gains and losses related to real estate sales.

By understanding the purpose and requirements of Form 1099-S, individuals and entities involved in real estate transactions can ensure compliance with tax regulations and maintain accurate financial records.