How To Get a Tax Extension

Filing your tax returns within the deadline is one of your primary tax responsibilities. However, sometimes life happens, and you may find yourself completely unprepared and not in a position to file your taxes before the countdown ends. In such situations, wouldn’t having a few precious months to plan, reorganize, and file your taxes be great? Well, that’s what tax extension is for.

“Not filing a federal tax return can be costly — whether you end up owing more or missing out on a refund. The IRS may also impose a wide range of civil and criminal sanctions on persons who fail to file returns.” (Source: IRS publication)

Filing your tax returns within the deadline is one of your primary tax responsibilities. However, sometimes life happens, and you may find yourself completely unprepared and not in a position to file your taxes before the countdown ends.

In such situations, wouldn’t having a few precious months to plan, reorganize, and file your taxes be great? Well, that’s what tax extension is for. In the 2022 financial year alone, 19M US citizens opted for this, according to IRS data.

What Is a Tax Extension, and What Is It Not?

Every year the IRS sets a deadline for all federal tax filings (usually April 15, but in 2023, it was April 28). Your paper returns had to be properly addressed, postmarked, and sent by mail by that date. If you are an e-filer, the date and time when your return was transmitted should not be after the 18th of April.

However, taxpayers often fail to stick to deadlines for various reasons ranging from personal emergencies to being unable to collect the right tax documents. If you are in a similar situation, request a tax filing extension.

Simply put, a tax filing extension is a request for additional time to file your federal taxes with the IRS. This deadline extension you would get is 6 months (usually October 15; in 2023, it was October 18).

Sounds great, right?

Indeed it does! But with a caveat! The deadline extension you get is only applicable to tax filing, not tax payments. You need to pay your taxes by the set due date, but you can file your returns later.

Therefore, if you have trouble paying off your tax amount, you want to opt for Payment plan installments, not a tax extension.

How a Tax Extension Works

The form you use for a tax extension is 4868. Here is how filling a Form 4868 affects your tax situation:

You owe the IRS

If you can’t file your taxes in time, along with requesting an extension, you also want to estimate your taxes and pay off as much as possible.

That’s because a tax extension doesn’t protect you from a late payment fine. You will be subject to a 0.5% penalty on due taxes per month. However, if you paid 90% of your total tax liability by the deadline, you can pay the rest with your return before the extension deadline penalty-free.

To pay your tax bills, you need to make an educated guess of how much is owed. Here are a few ways to do it:

- If your income hasn’t changed that much from the last year, your current tax bill will not deviate much from the previous year’s. So, you can pay off based on that.

- You can also use the estimated tax worksheet on Form 1040 ES if there is a significant change in income.

You expect to get some refunds

What about the situations where you overpaid your taxes and are eligible for refunds? Well, the IRS will not impose a penalty if you fail to file in time. But you won’t be able to get your money back if you don’t file.

Therefore, filing on time is highly recommended. However, filing a tax extension form (Form 4868) is pretty straightforward. So, you might want to file one to err on the side of caution even when the IRS owes you money.

Who Should File for Tax Extension?

Short answer: Anyone who thinks they won’t make it by the deadline

If you are running late because some personal emergency caught you off guard, waiting for your clients to send 1099 forms, or struggling to tame and organize your unmanaged books, an extension can provide you an extra breathing space.

Otherwise, you will be facing:

- 5% of unpaid taxes for each month that a tax return is late (unless you can show the IRS some good reason)

- If your return was over 60 days late, the minimum late to file is $450 or 100% of the tax shown on the return, whichever is less.

So, yeah, being late without an extension is no fun.

However, there are some exceptions where some taxpayers can get away with late filing with an extension. They automatically receive a two-month extension for filing their taxes, whether or not they request one. These special taxpayers are:

- US citizens or "resident aliens" who are living and working abroad on the date of the tax deadline

- On-duty military members who are outside the US on the date of the tax deadline.

The regular deadline for the aforementioned taxpayers is June 15. However, they can always request an extension and push their filing deadline back to October 15.

Ways To File a Tax Extension

As mentioned above, you need Form 4868 to request your extension. Here are some ways to submit this form to the IRS.

When you make a payment to the IRS using your debit/credit card, IRS Direct Pay, or the EFTPS system to cover an educated estimate of your tax owed and indicate that it's for an extension, you'll be able to avoid the paperwork entirely.

IRS Free File

The IRS provides an opportunity for qualified taxpayers to file their Form 4868s (or any form, for that matter) via IRS free file. In case you already don’t know yet, Free File is a partnership where the IRS and some popular tax applications shook hands and agreed to offer free tax filing services to taxpayers. If your AGI is $73, 000 or less, you can file your extension form for free.

Tax software

Most tax applications support filling out Form 4868. All you need to do is follow instructions and file before the deadline. Once submitted, you will receive an electronic acknowledgment from the IRS.

Tax preparer

This is a no-brainer. If you have already hired a tax professional, you can request them to help you file Form 4868.

By mail

Last but not least, you always have good ol’ postal service on your side. You can fill out the form and send it to the IRS via snail mail. Make sure to save some proof that you mailed it.

How To Fill Form 4868

Listen, we get it - sometimes, IRS forms feel intimidating with all the hard-to-understand IRS terminology and the perceived threats of IRS penalties looming over your head.

Good news!

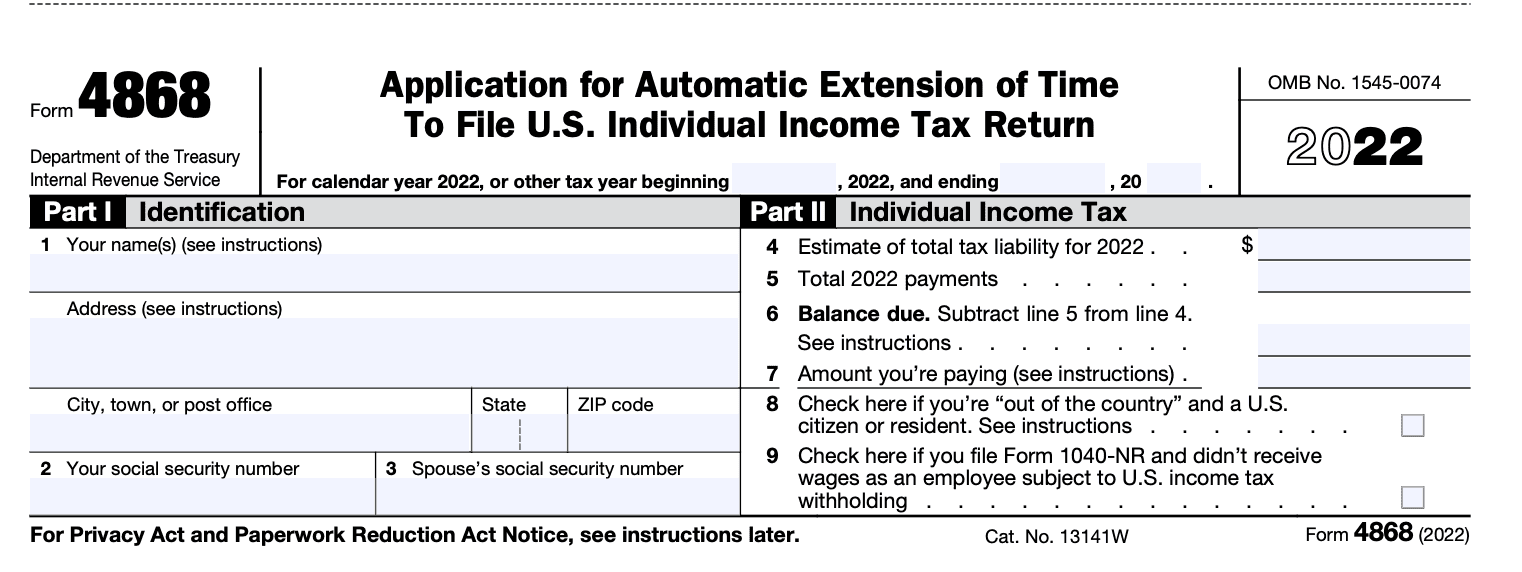

Filing a tax extension form (Form 4868) is easy and takes only two minutes. Here is a snapshot of Form 4868 for your reference.

On the left-hand side of the form, you are just required to submit general information, like your name, address, and Social Security number.

The right-hand section is where you’ll calculate your estimated individual income tax. Here is how you want to fill these sections.

Estimate of total tax liability (Part II of the form)

Here, you mention how much you are expecting to owe to the IRS. As touched above, you can use previous tax returns or estimated tax worksheet (Form 1040 ES) to find your answer. Alternatively, you can use the Fincent free income tax calculator too.

Also, if you are a small business owner or freelancer, don’t forget to get your tax write-off. On this site, we covered tax write-offs in-depth several times; you can check them out for more info.

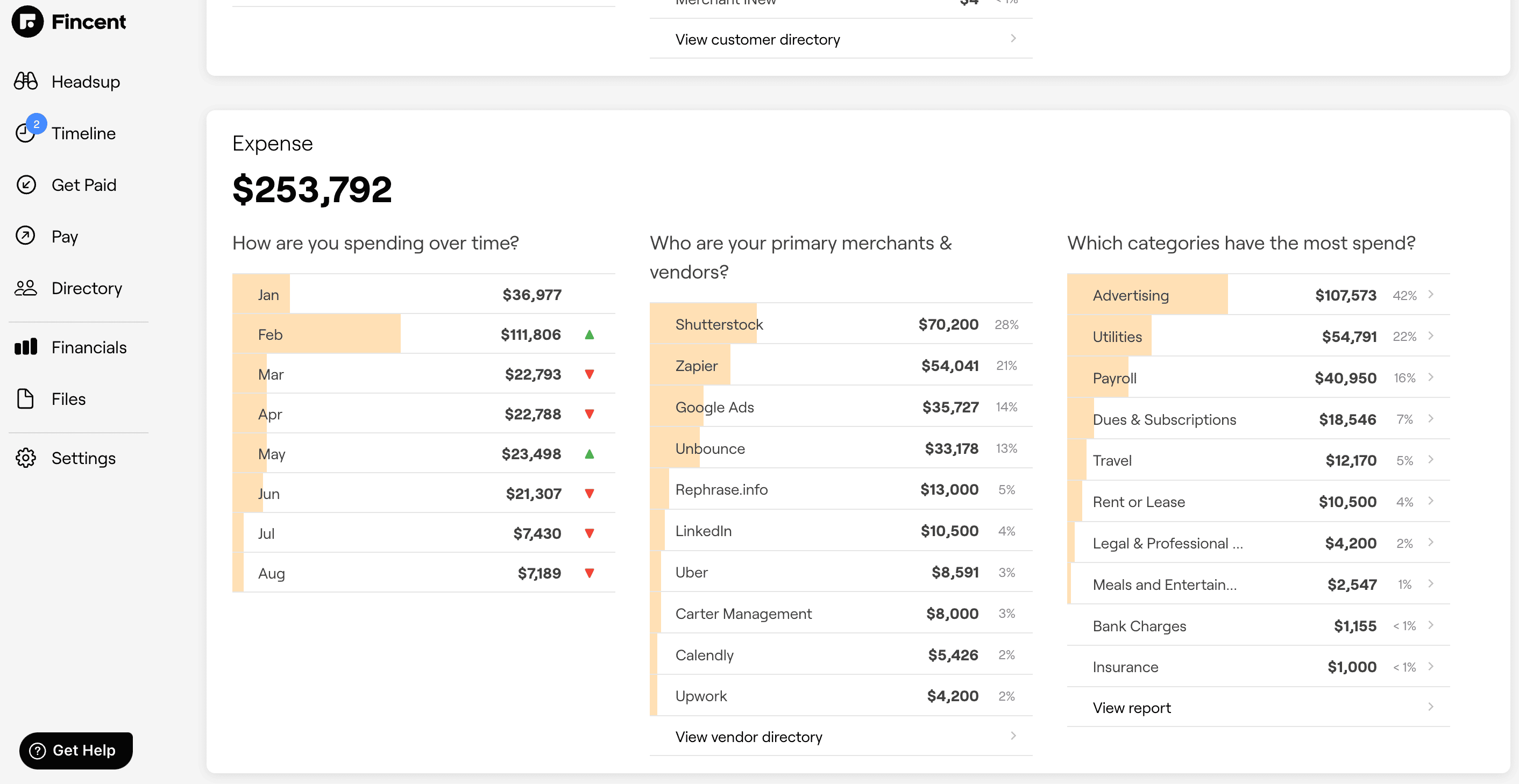

Also, using a bookkeeping solution like Fincent that automatically updates and organizes everything can be a good idea. You will have a far easier time figuring out what deductions you can claim.

Take a look at the screenshot given below. Wouldn’t it be easy to spot where your money went and claim a deduction based on that if your application offered such a clear breakdown?

Total payments made so far (Part II of the form)

You probably made some tax payments already. It could be in the form of tax withheld by your employers or quarterly payments you deposited as a 1099 worker or small business owner.

Put the amount you paid already in this box.

Balance due (Part II of the form)

Find the difference between the amounts entered in points 4 and 5 and write down the amount in point 6. If you get a negative number (meaning you will get a refund), simply enter zero.

Amount you’re paying (Part II of the form)

This is the amount you pay during your tax extension filing. Though you should clear the amount written in point 6, it is possible to get an automatic extension even if you don’t pay the whole amount.

You will be counting dollars as a penalty if you don’t pay the total amount owed. A tax extension saves you from the “Fail-to-file” penalty, not the “Fail-to-pay” one.

If the IRS owes you some refund, expect to receive it after October 15 ( Oct 16, 2023), provided you filed your tax already.

Check the box in point 8 if you’re out of the country on your regular tax due date.

Conclusion

Filing your taxes on time is crucial. However, for various reasons (within or outside of your control) things can get delayed. You are not alone; millions find themselves in that same situation.

To avoid penalties, don’t delay filing your Form 4868 and get an extension even if you can’t pay your dues completely. Once you get the extension, you will have time to reorganize and get back with an accurate tax return.

Also, an accurate tax return requires proper bookkeeping, and that’s where Fincent comes in. We already touched on how Fincent can help, right? It can easily be your affordable and reliable bookkeeping sidekick that helps you navigate through the wild west of accounting and taxes. Book a demo to learn more.

Related articles

Building the Right Bookkeeping Model for Your Construction Business

Bookkeeping is the cornerstone of financial success for construction businesses. By recognizing the significance of bookkeeping, construction companies can overcome the unique challenges they face and build a strong financial infrastructure. From maintaining compliance and achieving financial visibility to optimizing project cost management and navigating cash flow fluctuations, effective bookkeeping empowers construction businesses to drive growth and profitability.

Read moreHow is Bookkeeping Different for Marketing and Advertising Agencies

By setting realistic marketing budgets, identifying tax-deductible expenses, and streamlining reconciliation and reporting processes, marketing agencies can optimize their financial management. These practices contribute to improved financial stability, better decision-making, and long-term success in the dynamic marketing industry.

Read more