How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Introduction

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

And speaking of difficult times, the US real estate industry is in chaos now. A Freddie Mac report estimated US had 3.8 M fewer housing units in 2021 than existing demand. This gap in supply and demand sored prices high and left many willing buyers waiting for their chances.

However, during mid-2022, mortgage interest rates spiked, pushing many buyers to ditch their home-owning dreams. This cooling off the market forced 1 in 5 sellers to drop their asking price.

Irrespective of which way you want to go, your decision— be it selling, renting or expanding, should be based on your real estate’s financial condition, especially in this unpredictable market. And you can assess your assets’ financial standing by adopting proper real-estate bookkeeping.

In this article, we cover real estate bookkeeping in detail: what it means, its benefits and how you can do it correctly.

What is real-estate bookkeeping?

As an investor or property owner, you might get caught up in tasks like negotiating with prospects, renovating, and generating leads. It’s easy to lose track of all the transactions and receipts.

But those transactions, receipts and financial reports can reveal a lot about your real estate investment’s financial well-being. Based on those numbers, you can make crucial decisions for maximizing profits or minimizing losses.

Also, as the tax deadline closes in, many find themselves totally unprepared and on a scavenger hunt for some months-old receipts. You can avoid such a situation by following proper bookkeeping practices. It will help you have an organized list of transactions, making filing for taxes easier.

Here is a list of tasks that comes under the charter of real estate bookkeeping:

- Creating a process for invoicing tenants for monthly rent payments.

- Tracking payments made to construction companies, house builders and other parties.

- Reconciliation of bank statements and vendor invoices

- Preparing reports for annual tax filings.

- Financial statements creation

- Understanding revenue, expenses, and gains in property asset value.

- How should you manage your money for maximum profit gain?

Benefits of real estate bookkeeping

Bookkeeping is far from the most exciting part of the business. And in fact, your attention should be on more important things like filing your lead pipeline or strategize which direction you want to grow your real estate investments in. (That’s why we strongly recommend a bookkeeping software like Fincent). However, real estate bookkeeping offers three major benefits:

Sound decision-making:

If you look at real estate owners’/investors’ responses to the US housing crisis, they are all over the place. For example, 51% of all rental owners don’t want to sell in the next two years, even when prices are high. But, on the other hand, 56% of those who want to sell would not acquire any new property.

Now how do you determine what is the best action for you?

This decision comes from analyzing your income statement and cash flow. Your financial statements will reveal ways to reduce costs and increase your cash flow.

All these insights you can generate by updating your books and utilizing your bookkeeping software.

Tax filing and backup for a tax audit:

IRS wants you to disclose your income, expenses and profits during the tax filing. When you maintain your book, finding those numbers and putting them into the right boxes isn’t hard at all. Compliances and quick filings also bring some extra tax benefits, so that’s an added plus.

A decent bookkeeping software backs up documents and receipts associated with various transactions. It can save you a lot of headaches in case you get picked for IRS audits, be it by mail or in-person interview. You can quickly produce proof of any transaction during the audit.

Improve cash flow:

Here are some ways to ensure your cash flow in rental properties: 1.) raising invoices for your tenants at the right time, 2.) getting them paid in time 3.) waiting till the due date to pay vendors.

And you can accomplish those if you have a process of generating invoices, tracking those and reconciling your accounts. Proper bookkeeping practices cover all of the above-mentioned tasks.

If you are a small real estate investor, you can do it on your own. However, you can easily automate and outsource to free up your schedule.

Financial statements generated by software like Fincent can also point out which expenses affect your bottom lines significantly. Once spotted, it’s easy to improve the cash flow by putting a lease on those expenses.

Bookkeeping tips for real estate businesses

When it comes to real estate bookkeeping, some generic advice such as “cut expenses” and “hire a tax professional“ do apply. However, if you are looking for some real-estate business-specific bookkeeping best practices for real estate owners/investors, here are a few.

Don’t put all the eggs in the same basket (get different accounts) :

Many real estate investors ( especially the new ones) make the mistake of cramming all the transactions into one bank account. There are two major problems with this:

- It’s difficult to differentiate personal transactions from real estate transactions, especially if you own multiple rental properties. And when you can’t keep track of all the transactions, it will cause a big problem during tax filing. As a result, you might have to pay more taxes or get slapped with a fine.

- Mixing up personal and business transactions is regarded as commingling funds. It strips the liability protection that comes with LLC registrations. In other words, if you get sued ( and you have this commingling of funds situation going on), your personal funds will be under the fire too.

So get a separate business account for your real estate transactions. In the case of multiple properties held in separate LLCs, you need multiple accounts. Also, depending on local laws, you may want to keep security deposits in separate business accounts.

Once you separate accounts, you want to document all transactions.

And automated bookkeeping tools like Fincent come in handy here. The tool directly connects to your bank account and imports transactions to the application. You can view all transactions on the Fincent dashboard and create reports easily. It saves you hours of uploading your transactions to your bookkeeping software.

Keep copies of all receipts:

IRS has clearly mentioned on their website that you must keep records of your purchases, expenses, assets, and even entertainment and gift expenses.

Imagine how stressful it would be to look for months-old receipts just before your tax-filing deadline.

So, keep a copy of your receipts in a safe place, and make sure you specify which property the receipt is for. While you are better off scanning all of your receipts, pay attention to entertainment, travel, and gift expenses. These are the ones that frequently draw the attention of the IRS.

Any decent bookkeeping apps allow users to upload receipts and link those to bank and credit card transactions.

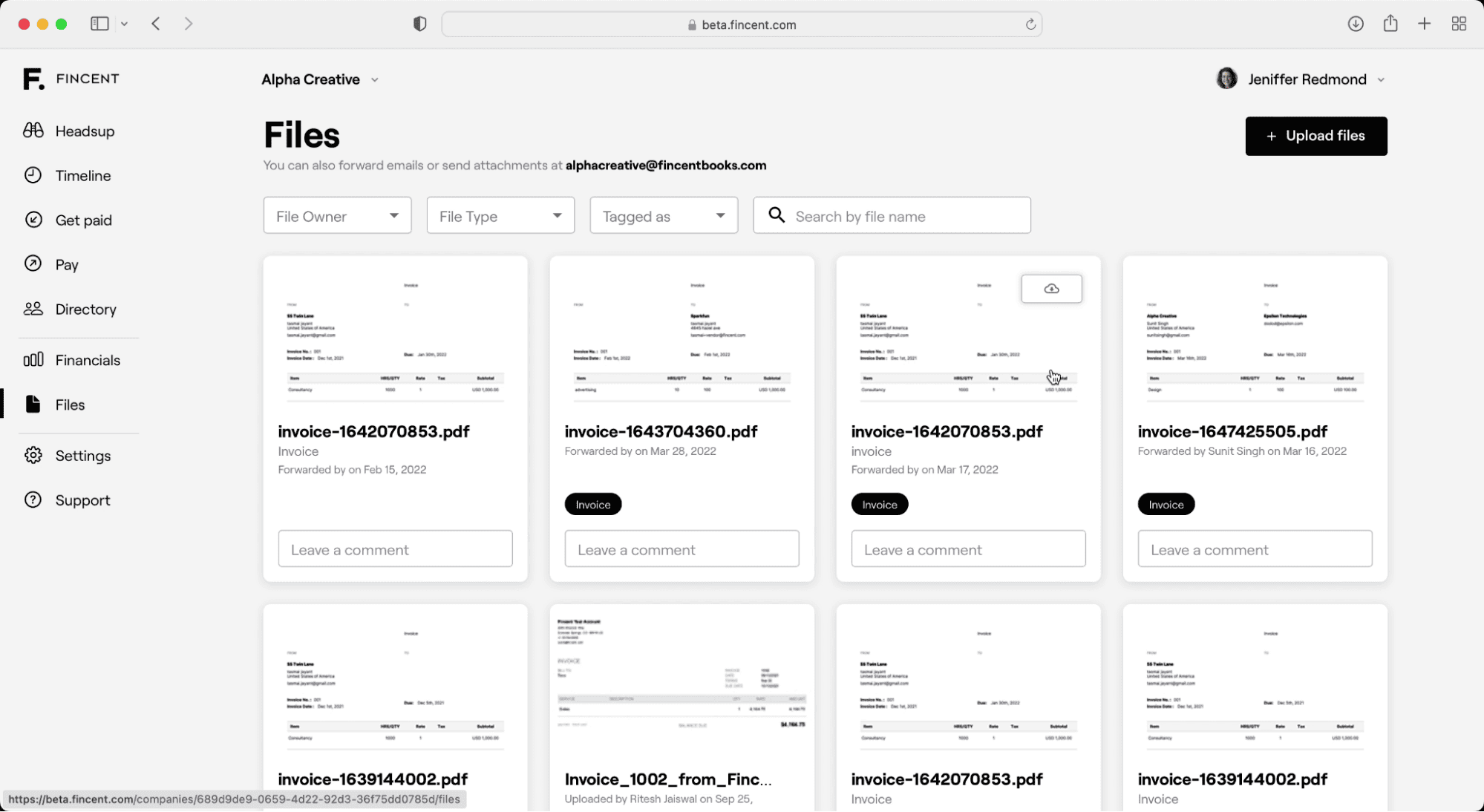

For example, the Fincent app lets you upload your receipts on the “Files” tab. You can even mark those receipts using custom tags and find them easily in future.

Categorize expenses:

One of the main goals of bookkeeping is determining your taxable income. It is calculated by subtracting your expenses from your revenue.

Revenue is the total rent you receive and/or the lump sum you get from flipping your properties. However, before you do the final calculation, you should organize your expenses based on the categories listed in Schedule E.

- Advertising

- Auto and travel

- Cleaning and maintenance

- Commissions

- Insurance

- Legal and other professional fees

- Management fees

- The mortgage interest paid to banks, etc.

- Other interest

- Repairs

- Supplies

- Taxes

- Utilities

- Depreciation expense or depletion (capital improvements)

- Other

Listing the expenses under the right category maximises your chances of tax deduction and penalty evasion.

Now the tax is an area that you shouldn’t venture into alone unless you know what you are doing. Many real estate investors and owners consult with a CPA with real estate knowledge.

However, hiring a CPA only for tax preparation is a bit overkill. CPAs can do much more than taxes; therefore, they are not cheap at all. Instead, you can hire tax preparers. They are a good option for those who don’t need other financial services.

_If you are a Fincent user, you can get access to tax experts on the platform ( for an extra fee) for categorizing your expenses and taking care of other tax responsibilities. _

Review financial statements regularly:

Sometimes, big cheques can be deceiving. You might be on the moon after making a $50k profit on a $150k property, provided you spent $10k for maintenance. However, you might miss that you did better last year when you flipped a property at $150k after purchasing it at $100K and spending $12.5K on it. The gross profitability in the first scenario is less than ( 20%) in the second one (25%).

You can’t determine the health of your business based on the size of the cheques only. That’s why regular review of your financial statements is a must.

Three main statements deserve your attention:

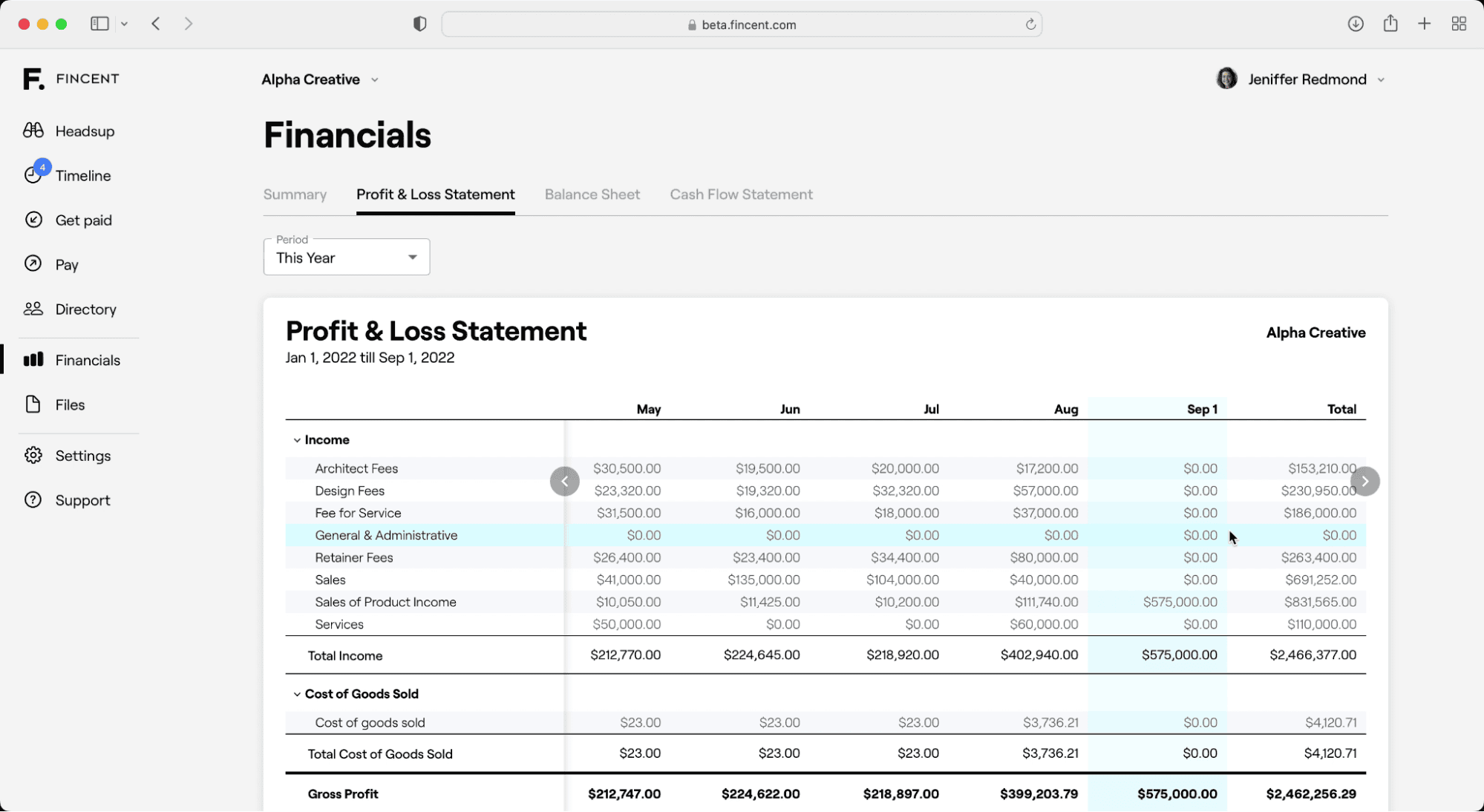

Income statement: The income statement, also known as the Profit and loss statement, discloses the expenditure, revenue, and net income of your real-estate business over a fiscal year.

**_Balance sheet: _**The balance sheet reports your business’s assets, liabilities and stakeholders’ equities at a specific time. It provides a snapshot of what your business owns and how much it owes to other parties on a given day.

Cash flow: The Cash flow statement shows the sources of cash and keeps a tab on incoming cash ( through payment, rent, revenue, funding etc.) and outgoing cash ( loan instalments, expenses, operation costs). A positive cash flow is a sign of the healthy financial state of your real-estate business. It means you can invest more money in the renovation, hiring better PMs and marketing.

You can certainly create your financial reports on an excel sheet. However, you have to manually store the data first and then do all the calculations on your own, which of course, takes a chunk out of your productive working hours.

Alternatively, use a bookkeeping application like Fincent.

Just follow Financials->balance sheet/ cash flow on the dashboard. Since all the recorded data is sorted already, the application takes a few seconds to create your financial statements.

Reconcile accounts monthly

Reconciling your accounts refers to the process of double-checking your recorded transactions to match your original ones. You want to reconcile to spot any issues, manual errors and fraudulent activities. If everything aligns, you are in good shape.

Usually, your accounting software can reconcile in real time with almost near-perfect accuracy. So if you use one, you are unlikely to find a mismatch between your recorded and real transactions.

Yet, reconciling your accounts is still highly recommended as a bookkeeping practice.

Because despite your best efforts, the following situations may occur, and reconciliation is the only to make things correct:

-

Sometimes the bank may decline the cheque deposit based on insufficient funds. It can happen if you set up auto payments and forget to maintain a specific balance on the issue date. To fix such issues, you need to pay the full amount plus a $25 returned check fee.

However, you also want to fix this on your books during reconciliation. Otherwise, if left uncorrected, that wrong entry would infiltrate into all kinds of financial statements and predictions, making them less accurate.

-

Once you issue a wrong check and the recipient has got it, there is no way to make it void. Fail to inform your bank, and the recipient might get it even cashed. In such situations, either of the two parties ( you and the recipient) end up not getting the right amount.

A quick fix is to request repayment from the receiving party and issue a correct check. Nonetheless, if you left your accounting software on its own device, this sudden “disruption” would not be recorded correctly.

In such situations, fix your books when you double-check your real transactions with recorded ones at the end of the month.

-

There can be some uncleared checks sitting in your account. If you don’t consider their status during financial reporting, you might end up with the wrong numbers. You can find these during reconciliation.

-

If any fraudulent activities or unsolicited transactions take place in your account, you can catch them during reconciliation.

Here is a step-by-step breakdown of how to reconcile your accounts:

- Get your bank record from your bank statement, or let your bookkeeping app fetch it directly from the account.

- Find the detailed record of your real-estate business transactions from your bookkeeping software or ledger.

- Check your bank deposits and withdrawals. Ensure the rent you receive, deposits and payments made to vendors are recorded. If anything is missing, fix it.

- Recheck the income and expenses recorded in your books.

- Sometimes due to various reasons like deposits in transit, outstanding checks, and banking errors, your bank records may not reflect the original state of cash flow. Adjust your records accordingly.

- Did you pay your vendors for property A from property B’s business account once? Or Did you redirect the rent of property A to property B’s account, as the latter has some cash flow issues? You want to adjust such events on records to reflect the actual state of incoming and outgoing cash flows.

- Finally, the end balance in both bank and book records should match after all the adjustments. If it doesn’t, take a second look at book entries and transactions for a clue.

Final Thoughts

A solid understanding of your real estate business’s financial condition will help you navigate this 2022 housing crisis and beyond. And this understanding forms based on the insight gained by following real estate bookkeeping best practices.

Now, if you own/ invest in a few properties, you can do your books manually on an excel sheet. However, as shown above, having an accounting/ bookkeeping application makes your job multitude easier. As you grow and add more units to your portfolio, the ROI you get from solutions like Fincent increases exponentially. So feel free to book a demo here.

Related articles

Building the Right Bookkeeping Model for Your Construction Business

Bookkeeping is the cornerstone of financial success for construction businesses. By recognizing the significance of bookkeeping, construction companies can overcome the unique challenges they face and build a strong financial infrastructure. From maintaining compliance and achieving financial visibility to optimizing project cost management and navigating cash flow fluctuations, effective bookkeeping empowers construction businesses to drive growth and profitability.

Read moreHow is Bookkeeping Different for Marketing and Advertising Agencies

By setting realistic marketing budgets, identifying tax-deductible expenses, and streamlining reconciliation and reporting processes, marketing agencies can optimize their financial management. These practices contribute to improved financial stability, better decision-making, and long-term success in the dynamic marketing industry.

Read more