Fincent's Late Bird Offer

File an extension within 72 hours

Fincent files a tax extension for your business, for free.

Get an estimate of taxes to pay

Get a tax estimate to pay ASAP and avoid owing more to the IRS

Bring your financials up to date

Your Fincent bookkeeper classifies transactions, reconciles accounts, and prepares your financial statements.

File your taxes, minus the stress

You receive tax-ready reports for the IRS and expert filing assistance. Peace.

"Fincent revolutionized HEALiX Infrared's finances, fostering holistic wellness for all. Automation and insights drove incredible efficiency and growth. Grateful for this partnership!"

Michael Browne • HEALiX Infrared

“Fincent delivers what they promise — peace of mind. Now I can truly focus on my business without worrying about the tedium of bookkeeping.”

Noel Cabrera •

"Fincent has been amazing in taking over bookkeeping for 2 companies. I enjoy working with their software and their team has been awesome!"

Monica Snideman • Partner, End To End User Research

FAQs

Here are some common queries about our real estate bookkeeping software

Ready for your financial transformation?

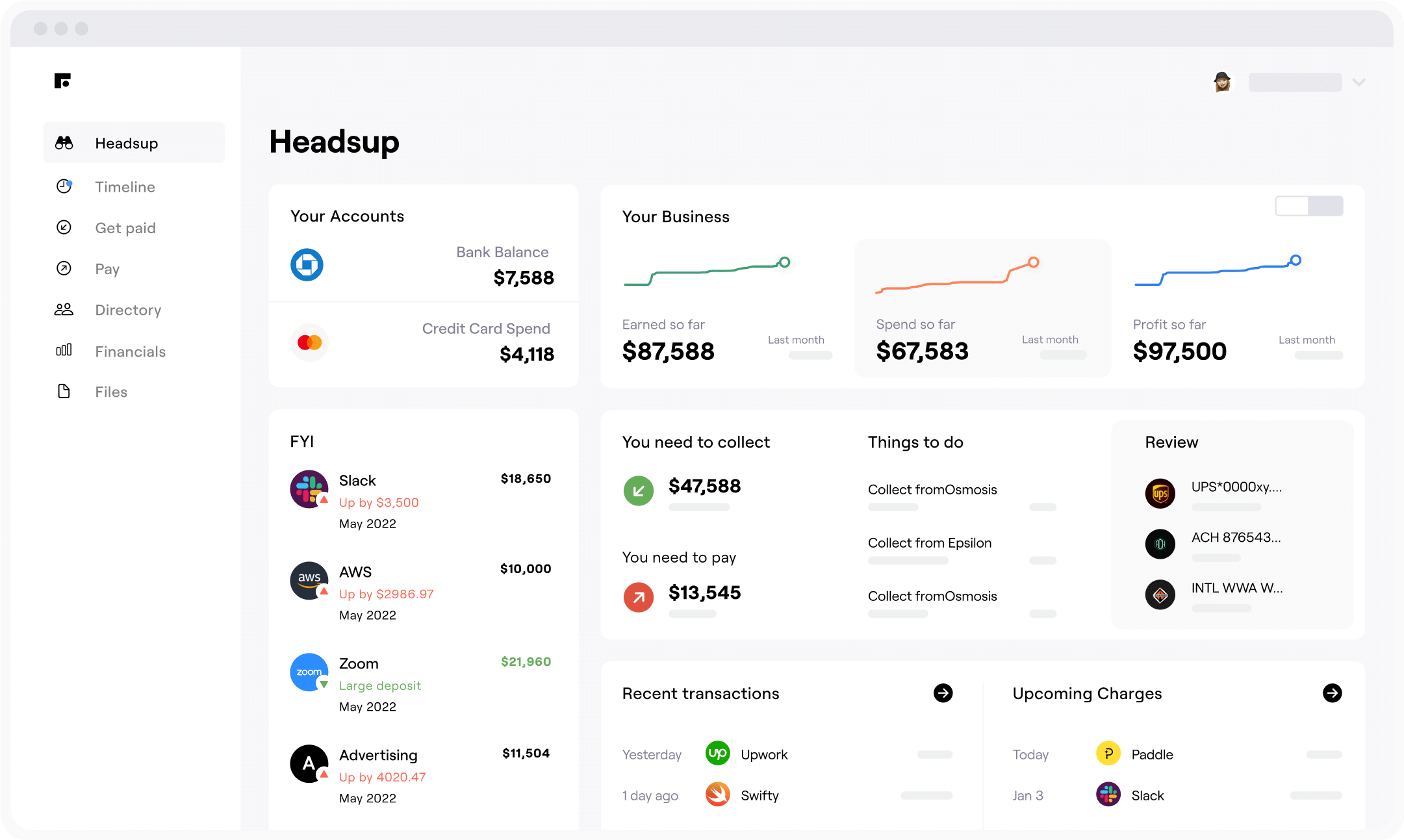

- Bookkeeping

- Tax Prep and Filing

- Invoicing and Payments