- IRS forms

- Schedule 1 (Form 1040)

Schedule 1 (Form 1040): Additional Income and Adjustments to Income

Download Schedule 1 (Form 1040)Filing taxes can be a complex process, especially when it comes to reporting additional income and making adjustments to your income. One crucial form to be aware of is Schedule 1 (Form 1040), which serves as an addendum to your individual income tax return.

What is a 1040 Schedule 1?

The 1040 Schedule 1, commonly referred to as "Additional Income and Adjustments to Income," is a crucial form used alongside the standard Form 1040 for federal income tax filings in the United States. This schedule allows taxpayers to report various additional sources of income or adjustments that might not be covered in the primary Form 1040.

Schedule 1 encompasses diverse financial elements, including:

- Additional income streams like business income, rental income, or unemployment compensation.

- Adjustments to income, incorporating deductions such as educator expenses, specific business costs, health savings account deductions, and contributions to retirement accounts, among others.

Key Takeaways

- Additional income reporting: It supplements Form 1040 by documenting extra income sources like unemployment compensation or rental income.

- Adjustments to income: This section accommodates adjustments such as educator expenses, specific business costs, and deductions, contributing to the calculation of the adjusted gross income (AGI).

- Miscellaneous untaxed income: It captures various sources of untaxed income (excluding self-employment income) like gambling winnings, jury duty pay, or cancelled debts.

- Comprehensive financial overview: By addressing additional income and adjustments, Schedule 1 offers a more holistic representation of your financial status, aiding in a precise tax assessment.

In this blog post, we will explore Schedule 1 in detail, focusing specifically on additional income and adjustments to income. Understanding these concepts and their proper reporting is essential for accurately filing your taxes and maximizing your deductions.

Purpose of Schedule 1 (Form 1040)

Schedule 1 is used when taxpayers have additional sources of income or need to make certain adjustments to their income that cannot be accommodated on the main Form 1040.

Some examples of additional income that may be reported on Schedule 1 include:

- Income from freelance work or self-employment

- Rental income from real estate or other properties

- Unemployment compensation

- Gambling winnings

- Partnership income or S corporation income

Additionally, Schedule 1 may be used to report adjustments to income. These adjustments include deductions that you may be eligible for, such as:

- Educator expenses

- Student loan interest deduction

- Health savings account (HSA) deductions

- Self-employed health insurance deduction

- Contributions to retirement plans

Please note that tax laws and forms can change over time, and new versions of Schedule 1 may be released by the IRS.

Benefits of Schedule 1 (Form 1040)

Here are some of the benefits of Schedule 1:

- Additional income reporting: Schedule 1 allows you to report additional types of income that may not be included on the main Form 1040. This includes income from sources such as rental properties, partnerships, S corporations, and royalties. By reporting all your income sources accurately, you can ensure compliance with tax laws and avoid potential penalties.

- Above-the-Line deductions: Schedule 1 provides a space for above-the-line deductions, also known as adjustments to income. These deductions are taken into account before calculating your adjusted gross income (AGI). Examples of above-the-line deductions include educator expenses, student loan interest deductions, self-employment tax, health savings account (HSA) contributions, and contributions to a traditional IRA.

- Additional tax credits: Certain tax credits, such as the additional child tax credit, the American opportunity credit, and the lifetime learning credit, are reported on Schedule 1. These credits can help reduce your overall tax liability and potentially result in a refund if you qualify.

- **Other adjustments: **Schedule 1 also covers various other adjustments to income, such as the deduction for self-employment tax, the deduction for health insurance premiums for self-employed individuals, and the deduction for contributions to a SEP, SIMPLE, or qualified retirement plan. These adjustments can help lower your taxable income and potentially reduce your tax burden.

- Foreign income and taxes: If you have foreign income or paid foreign taxes, Schedule 1 provides a section to report this information. This is important for individuals who have income from foreign sources or who may be eligible for certain foreign tax credits or exclusions.

- Partnership and S corporation income: If you are a partner in a partnership or a shareholder in an S corporation, Schedule 1 allows you to report your share of income, deductions, and credits from these entities. This ensures that your individual tax return reflects your ownership of these businesses.

Overall, Schedule 1 provides a comprehensive way to report additional income, deductions, and adjustments, allowing for a more accurate calculation of your tax liability. It helps ensure that you take advantage of all available deductions and credits, potentially reducing your tax burden or increasing your refund.

Who Is Eligible To File Schedule 1 (Form 1040)?

Here are some common situations where filing Schedule 1 may be necessary:

- You have additional income sources: If you received income from sources other than your regular job, such as self-employment income, rental income, or unemployment compensation, you would need to file Schedule 1.

- You have adjustments to income: Certain deductions and adjustments to your income require the use of Schedule 1. Examples include deductions for educator expenses, student loan interest, or contributions to a Health Savings Account (HSA).

- You have additional tax credits: Certain tax credits, such as the Additional Child Tax Credit or the Adoption Credit, may require you to file Schedule 1 to calculate the credit.

- You owe certain taxes: If you owe taxes like the self-employment tax, household employment taxes, or the individual shared responsibility payment (penalty for not having health insurance), you will need to file Schedule 1.

How To Complete Schedule 1 (Form 1040): A Step-by-Step Guide

Completing Schedule 1 (Form 1040) requires you to report additional income, deductions, and credits that are not included on the main Form 1040. Here's a step-by-step guide on how to complete Schedule 1:

Step 1: Gather the necessary documents

Collect all the relevant documents, such as W-2 forms, 1099 forms, and any other income- or expense-related documents that might affect Schedule 1.

Step 2: Fill out your personal information

Enter your name, Social Security number, and other personal details at the top of Schedule 1.

Step 3: Report additional income

If you have any additional sources of income that are not reported on Form 1040, report them on Schedule 1. Common examples include self-employment income, rental income, or unemployment compensation. Use the appropriate lines to report each type of income and provide the necessary information.

Step 4: Calculate adjustments to income

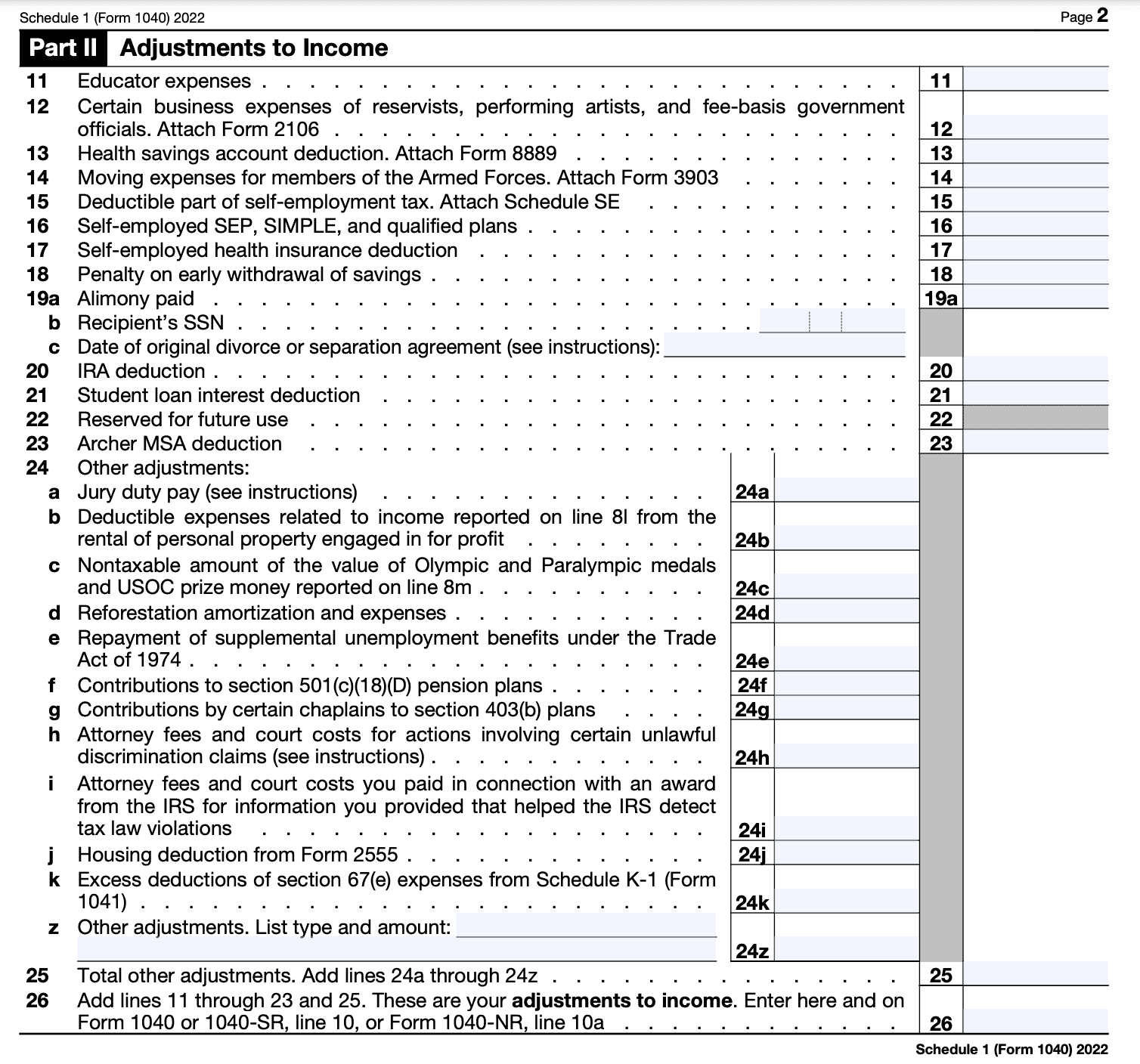

What are the Adjustments to income on Schedule 1?

These adjustments, also known as "above-the-line deductions," are subtracted from your total income to calculate your AGI.

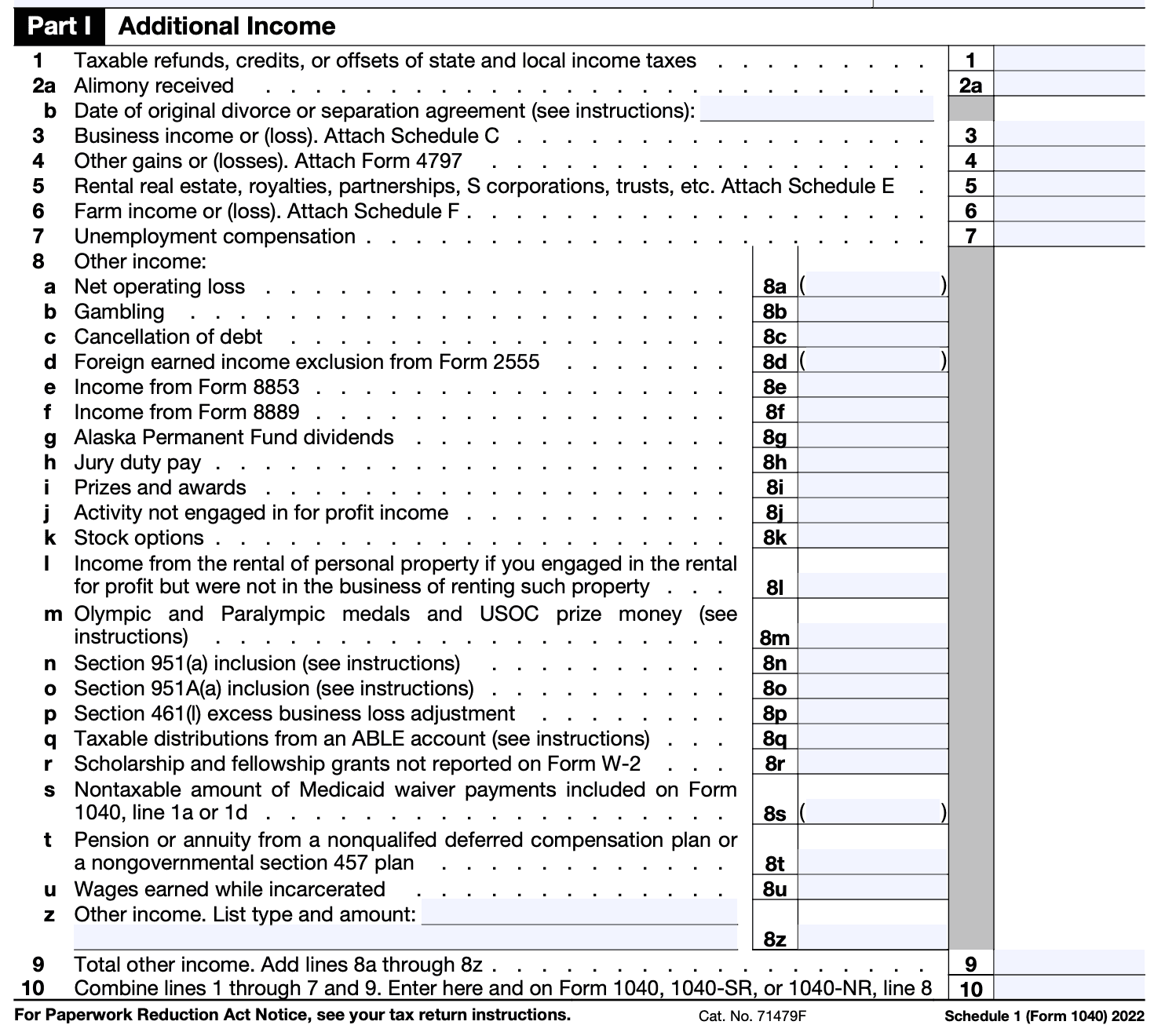

Line 1 requires reporting income from tax refunds, tax credits, or offsets for state and local taxes. Use the IRS worksheet if you received a 1099-G, and exceptions are outlined in the instructions.

Line 8 covers miscellaneous untaxed income like gambling winnings, cancelled debts, prizes and awards, etc. Don't report self-employment income here. It's split into sections 8a to 8p, with 8z for unlisted income.

Carefully review the available deductions and adjustments on Schedule 1 to see if any apply to your situation. Fill out the appropriate lines accordingly.

Step 5: Report other tax credits

Certain tax credits that are not accounted for on Form 1040 are reported on Schedule 1. Here are a few examples:

- Additional child tax credit: Report any additional child tax credit you qualify for on line 19.

- Residential energy credits: If you made energy-efficient home improvements, report the credits on line 24.

- Foreign tax credit: If you paid foreign taxes, report the credit on line 25.

Check if you're eligible for any other tax credits and report them on the appropriate lines of Schedule 1.

Step 6: Calculate other payments and refundable credits

If you make any estimated tax payments or have any refundable credits, report them on Schedule 1. Common examples include overpayment from a prior year's return, the premium tax credit, or the net premium tax credit.

Some of the adjustments to income you might find on Schedule 1 include:

- Self-Employed SEP, SIMPLE, and Qualified Plans (Line 15): Self-employed individuals can deduct contributions made to certain retirement plans, such as Simplified Employee Pension (SEP) or Savings Incentive Match Plan for Employees (SIMPLE) plans.

- Educator Expenses (Line 23): Eligible educators can deduct up to $250 for unreimbursed expenses related to classroom supplies.

- Certain Business Expenses (Line 24): Self-employed individuals or those with specific business-related expenses can claim deductions here, such as expenses for business use of your home, costs related to your business, or expenses related to being an employee.

- Health Savings Account (HSA) Deduction (Line 25): Contributions made to a Health Savings Account may be eligible for deduction.

- IRA Deduction (Line 32): Contributions made to traditional individual retirement accounts (IRAs) might be deductible, subject to income limits and other criteria.

- Student Loan Interest Deduction (Line 33): Taxpayers who paid interest on qualifying student loans during the tax year may be eligible to deduct up to a certain amount.

Step 7: Review and attach Schedule 1

Double-check all the information you entered on Schedule 1 for accuracy. Once you're confident that everything is correct, attach Schedule 1 to your Form 1040 when filing your tax return.

Remember to keep copies of all the documents and forms you submit for your records.

Special Considerations When Filing Schedule 1 (Form 1040)

Here are some important points to consider:

- Types of income: Schedule 1 is used to report various types of income, such as business income, rental income, unemployment compensation, gambling winnings, and other miscellaneous income. Make sure to accurately report all applicable sources of income.

- Adjustments to income: Schedule 1 is also used to report certain adjustments to income. These adjustments include deductions for educator expenses, student loan interest, self-employment tax, health savings account contributions, and contributions to individual retirement accounts IRAs or self-employed retirement plans, among others.

- Additional taxes: Certain taxes or penalties that are not reported directly on Form 1040 may need to be reported on Schedule 1. For example, if you owe the Additional Medicare Tax or the Net Investment Income Tax, you will report them on this schedule.

- Foreign accounts and assets: If you have foreign financial accounts or meet certain criteria for reporting foreign assets, you may need to complete Schedule 1 and attach other forms like the FBAR (Report of Foreign Bank and Financial Accounts) or Form 8938 (Statement of Specified Foreign Financial Assets).

- Health care coverage: In previous years, Schedule 1 was also used to report health care coverage exemptions. However, starting with the 2020 tax year, these exemptions are no longer applicable, as the individual mandate penalty has been eliminated.

- Other credits: Some tax credits, such as the residential energy credit or the adoption credit, may require information to be reported on Schedule 1. If you are eligible for these credits, ensure you accurately complete the necessary sections of the schedule.

Are alimony payments reported on Schedule 1?

Yes, alimony received or paid is reported on Schedule 1, if applicable.

As of last update in April 2023, the tax treatment of alimony payments underwent significant changes with the Tax Cuts and Jobs Act (TCJA) of 2017. These changes affect how alimony payments are reported on IRS Tax Schedule 1 (Form 1040).

For divorce or separation agreements executed after December 31, 2018:

- Alimony payments are not deductible by the payer.

- Recipients of alimony are not required to include these payments as taxable income.

Therefore, for these newer agreements, alimony payments are not reported on Schedule 1 by either the payer or the recipient.

However, for divorce or separation agreements executed on or before December 31, 2018, and not modified after that date to specifically adopt the TCJA rules:

- Payers of alimony can deduct these payments as an adjustment to income on Schedule 1 (Form 1040).

- Recipients of alimony are required to report these payments as additional income on Schedule 1.

How To File Schedule 1 (Form 1040): Offline/Online/E-filing

To file Schedule 1 (Form 1040), you have several options: offline paper filing, online filing, and e-filing. Here's a brief overview of each method:

Offline paper filing

- Obtain a copy of Form 1040 and Schedule 1 from the IRS website, local IRS office, or by requesting that they be mailed to you.

- Fill out the required information on both forms manually, following the instructions provided.

- Attach Schedule 1 to your completed Form 1040.

- Make a copy of the forms for your records.

- Mail the original forms to the appropriate IRS address based on your location. The address can be found in the instructions for Form 1040.

Online filing

- Use an online tax preparation software or a professional's website that supports the filing of Schedule 1.

- Enter your tax information into the software or website as prompted.

- The software will generate the necessary forms, including Schedule 1, based on your inputs.

- Review the forms for accuracy and completeness.

- Follow the instructions provided by the software or website to submit your tax return electronically.

E-filing

- E-filing is the electronic submission of your tax return directly to the IRS.

- You can e-file through IRS Free File if your income is below a certain threshold. The IRS Free File program offers free tax preparation software for eligible taxpayers.

- Alternatively, you can use commercial tax preparation software or hire a tax professional who offers e-filing services.

- Provide your tax information to the software or tax professional, and they will generate the necessary forms, including Schedule 1.

- Review the forms for accuracy and completeness.

Deadline For Submitting Form 1040 Schedule 1

The deadline to submit Schedule 1 with your Form 1040 to the IRS aligns with the standard due date for filing federal income tax returns, which is April 15th of each year.

| Tax Year | Initial Filing Deadline | Extension Deadline |

| 2023 | 15-Apr-24 | 15-Oct-24 |

| 2024 | 15-Apr-25 | 15-Oct-25 |

| 2025 | 15-Apr-26 | 15-Oct-26 |

Common Mistakes To Avoid While Filing Schedule 1 (Form 1040)

When filing Schedule 1 (Form 1040), there are several common mistakes that you should avoid to ensure accuracy and prevent potential issues with the Internal Revenue Service (IRS). Here are some mistakes to watch out for:

- Incorrect personal information: Make sure to provide accurate personal information, including your name, Social Security number, and filing status. Double-check these details before submitting your form.

- Failure to report all income: Ensure that you report all sources of income on Schedule 1. This includes income from employment, self-employment, rental properties, investments, and any other taxable income. Review your income statements (such as W-2s and 1099 forms) and ensure they are accurately reflected on Schedule 1.

- Neglecting to claim deductions and credits: Take advantage of eligible deductions and tax credits to minimize your tax liability. Common deductions include student loan interest, educator expenses, and contributions to retirement accounts. Additionally, make sure to claim applicable tax credits, such as the Child Tax Credit or the Earned Income Tax Credit.

- Failing to reconcile health coverage: If you had health insurance coverage through the Health Insurance Marketplace, ensure that you reconcile any advance payments for the premium tax credit you received. This is done on Form 8962, which is filed with your tax return. Failure to reconcile the credit accurately can result in delays or adjustments to your refund.

- Mathematical errors: Be careful when performing calculations on Schedule 1. Simple math errors, such as addition or subtraction mistakes, can lead to discrepancies on your tax return. Double-check all calculations and use tax software or a calculator if necessary.

- Missing signatures: Both you and your spouse (if applicable) must sign and date your tax return. Forgetting to sign the form can result in the IRS rejecting your filing. Ensure that all required signatures are provided before submitting your return.

- Late or missing Schedule 1: If you have any additional items to report that require Schedule 1, ensure that you include them with your Form 1040. Forgetting to attach Schedule 1 when required can lead to processing delays or inquiries from the IRS.

- Failure to retain documentation: Keep copies of all the relevant supporting documentation, such as income statements, receipts, and records of deductions and credits. This is important in case the IRS requests verification or in the event of an audit.

To minimize the chances of making these mistakes, consider using tax software or consulting a tax professional. They can provide guidance and help ensure that your Schedule 1 (Form 1040) is filed correctly.

Strategic Tax Planning with IRS Schedule 1 (Form 1040)

Taxpayers can leverage Schedule 1 for tax planning in several ways:

- Timing income and deductions: For instance, if you anticipate a higher income next year, it might be advantageous to defer certain income types or accelerate deductions into the current year.

- Retirement contributions: Increasing contributions to retirement accounts can reduce taxable income and build savings.

- Healthcare planning: Utilizing HSAs or self-employed health insurance deductions can lower taxable income while ensuring healthcare needs are met.

Conclusion

Remember, the information provided in this blog post is meant to serve as a general guide. Tax laws and regulations are subject to change, and individual circumstances may vary. It's always recommended to consult with a qualified tax professional or refer to the official IRS guidelines for the most up-to-date and personalized advice regarding your tax situation.

Frequently Asked Questions

What is Schedule 1 on the 1040 form?

Schedule 1 is an extra form alongside Form 1040 for reporting additional income sources and adjustments not covered on the main form, ensuring a thorough tax assessment.

What is 1040 tax form for?

The 1040 tax form is for individuals in the US to report yearly income, calculate taxes owed or refunds due, and detail deductions, credits, and financial data for tax purposes.

What does schedule mean on 1040?

“Schedule" refers to additional forms or attachments that provide specific details about various types of income, deductions, or credits.

What are the three types of 1040?

The three types are Form 1040EZ, Form 1040A, and Form 1040.

For most individual taxpayers, the main choice is between the standard Form 1040 or Form 1040-SR, which is specifically designed for taxpayers aged 65 and older.

Do I need to file Schedule 1 with my tax return?

You might need to file Schedule 1 if you have additional sources of income or certain adjustments, deductions, or credits to claim.

What types of income should be reported on Schedule 1?

Additional income sources, such as freelance earnings, rental income, or unemployment compensation, are typically reported on Schedule 1.

Which adjustments to income are reported on Schedule 1?

Adjustments like educator expenses, student loan interest, or contributions to retirement accounts may be included on Schedule 1.

What deductions and tax credits are claimed on Schedule 1?

Deductions like the educator expense deduction or certain credits, such as the additional child tax credit, might be claimed on this schedule.

Is Schedule 1 mandatory for every taxpayer?

No, not every taxpayer needs to file Schedule 1. Only those who have additional income, adjustments, deductions, or credits that apply should include them with their tax return.

Can Schedule 1 affect my tax refund or payment?

Yes, reporting additional income or claiming deductions or credits on Schedule 1 can impact your tax liability, potentially affecting your refund or amount owed.

What happens if I fail to include Schedule 1 when required?

Omitting Schedule 1 when necessary might result in errors in your tax return, potentially leading to additional taxes owed or delayed refunds.

Can omissions or inaccuracies on Schedule 1 lead to tax audits?

Yes, discrepancies or inaccuracies on Schedule 1 might trigger IRS inquiries or audits, which can have legal ramifications.