- IRS forms

- Letter 6416-A

Letter 6416-A: Advance Child Tax Credit (AdvCTC) Payments

Download Letter 6416-AIn an effort to provide much-needed financial support to families, the U.S. government introduced the Advance Child Tax Credit (AdvCTC) Payments. These payments are aimed at easing the burden on parents and guardians and supporting the well-being of children. If you have children, you might have received a letter from the IRS titled "Letter 6416-A" explaining the details of these advance payments

The Advance Child Tax Credit is a part of the American Rescue Plan Act passed in March 2021. It is a temporary expansion of the Child Tax Credit (CTC) for the tax year 2021, which aims to provide financial relief to families with qualifying children. The AdvCTC allows eligible families to receive a portion of the Child Tax Credit in advance, rather than waiting until they file their tax returns for 2021.

In this blog, we'll explore the AdvCTC payments and what you need to know to make the most of this financial assistance.

Purpose of Letter 6416-A

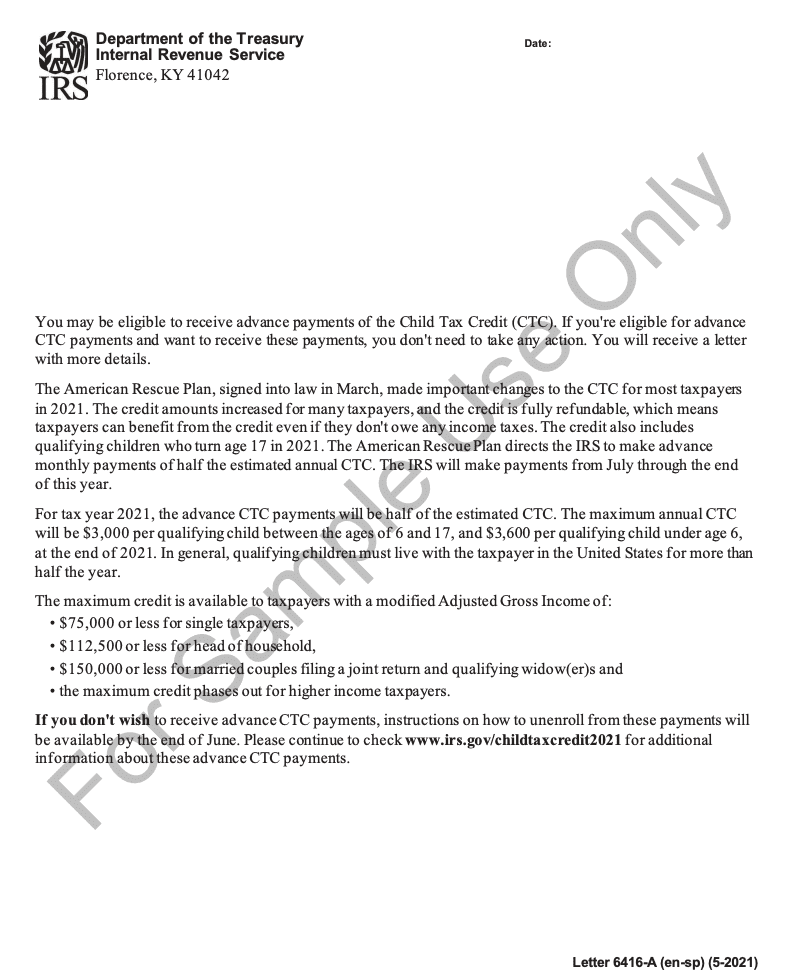

Letter 6416-A was a letter sent by the Internal Revenue Service (IRS) to taxpayers who were eligible to receive Advance Child Tax Credit (AdvCTC) payments. The purpose of this letter was to inform eligible individuals about the upcoming monthly payments they would receive as part of the Child Tax Credit program.

The Child Tax Credit is a tax benefit provided by the U.S. government to help families with qualifying children reduce their tax burden. In 2021, as part of the American Rescue Plan Act, the IRS implemented a temporary expansion of the Child Tax Credit, allowing eligible families to receive advance payments throughout the year rather than waiting until they file their tax returns.

Letter 6416-A would typically provide recipients with important information about the amount of their monthly payments, the schedule of when the payments would be made, and how the payments would be delivered (e.g., via direct deposit or by mail).

Benefits of Letter 6416-A

The AdvCTC provided eligible families with an early distribution of a portion of their 2021 Child Tax Credit in the form of monthly payments. These payments were sent out from July to December 2021.

Some potential benefits of the Advance Child Tax Credit payments include:

-

Financial assistance: The payments provided financial support to families with children, helping them cover essential expenses, such as childcare, education, and healthcare costs.

-

Monthly disbursements: Unlike the traditional Child Tax Credit, which was usually claimed when filing tax returns, the AdvCTC was distributed monthly, giving families a steady income stream to support their needs throughout the year.

-

Reducing child poverty: The AdvCTC was intended to help reduce child poverty by providing targeted support to families with lower incomes, helping lift millions of children above the poverty line.

-

Accessibility: The payments were made in advance, making the credit more accessible to families that might have found it challenging to pay for child-related expenses until they received their tax refunds.

-

Automatic enrollment: In most cases, eligible families did not need to take any action to receive the payments. The IRS automatically determined eligibility based on tax returns, Social Security Administration data, or other information available.

-

Flexibility: Families could use the funds as needed, depending on their individual circumstances and financial priorities.

Who Is Eligible To Receive Letter 6416-A?

To determine eligibility for the advance child tax credit payments, the IRS considered several factors, including but not limited to:

Dependent children: The taxpayer must have one or more qualifying children who meet the requirements of a dependent for tax purposes. Qualifying children must be under the age of 17 at the end of the tax year and have a valid Social Security number.

Age and income limits: The taxpayer must have an adjusted gross income (AGI) within the income limits set for the tax year. The income threshold may vary each year, and those with higher incomes may receive a reduced amount or may not be eligible for the credit.

Filing status: The taxpayer's filing status (e.g., single, married filing jointly, head of household) can also affect eligibility and the amount of the credit.

Residency: The taxpayer must be a U.S. citizen or a resident alien with a valid Social Security number.

Tax obligations: Generally, eligible individuals must have a tax obligation to receive the advance child tax credit payments.

Tax return filing: Typically, taxpayers must have filed their tax returns to receive the credit. However, the IRS provided a Non-Filer Sign-Up tool for individuals who did not file a tax return to register for the child tax credit.

How To Complete Letter 6416-A: A Step-by-Step Guide

Here's a general guide:

Step 1: Review the letter and understand its purpose

Carefully read through the Letter 6416-A from the IRS to understand its content and what actions are required from you. The letter will likely provide information about your eligibility for Advance Child Tax Credit payments, payment amounts, and any actions needed to update or correct your information.

Step 2: Gather the necessary information

Before responding to the letter, gather all the relevant documents and information. This may include Social Security Numbers (SSNs) for yourself, your spouse, and your qualifying children, as well as other personal and financial details the letter might request.

Step 3: Verify your eligibility

Make sure you meet the eligibility criteria for Advance Child Tax Credit payments. Generally, you must have a qualifying child, meet certain income requirements, and file a tax return. Refer to the IRS guidelines to ensure you qualify for the AdvCTC.

Step 4: Respond to the letter

Based on the instructions in the letter, complete the required response. This may involve filling out a form, providing updated information, or taking specific actions to ensure you receive or continue to receive Advance Child Tax Credit payments.

Step 5: Double-check your information

Before submitting your response, review all the provided information for accuracy and completeness. Any errors or omissions could cause delays or issues with your AdvCTC payments.

Step 6: Submit the response

Follow the instructions in the letter on how to submit your response. This might involve mailing the completed form to a specific IRS address or using an online portal if available.

Step 7: Keep a copy for your records

Make a copy of the completed response and any supporting documentation for your (link: https://fincent.com/blog/a-beginners-guide-to-record-keeping-for-small-businesses text: records). This will help you have a reference in case of any future inquiries or issues.

Step 8: Follow up if necessary

If you don't receive any acknowledgment or confirmation of your response within a reasonable time, consider contacting the IRS to verify that they received and processed your information correctly.

Special Considerations When Filing Letter 6416-A

In general, when dealing with any official document or filing, it's crucial to follow these steps:

Verify the form's purpose: Make sure you understand why you are required to file Letter 6416-A and ensure it applies to your specific situation.

Obtain the latest version: Use the most recent version of the form to avoid potential issues or delays.

Read the instructions: Thoroughly review the accompanying instructions provided with the form to understand how to fill it out correctly.

Provide accurate information: Double-check all the information you provide on the form to ensure it is accurate and up-to-date.

Attach required documentation: If the form requires supporting documents, ensure you have all the necessary paperwork ready to be submitted along with the form.

Keep copies: Make copies of the completed form and any supporting documents for your records.

**Submit the form on time: **Pay attention to the deadline for submission and ensure the form is filed before or on the due date.

Seek professional advice if needed: If you have any doubts or concerns about the form or its implications, consider seeking advice from a qualified tax professional or legal expert.

How To Receive Letter 6416-A: Offline/Online/E-filing

The process for filing and receiving Letter 6416-A can be broken down into three methods: Offline, Online, and E-filing. Let's go through each method:

Offline filing

If you received a notice or letter from the IRS and need to respond, you can choose to file your response offline. This typically involves sending your response by mail through the postal service. Here are the steps to follow:

a. Prepare your response: Read the IRS notice carefully and understand what information or documents they are requesting from you. Make sure your response is complete and accurate.

b. Make copies: Before sending your response, make copies of all the documents you are submitting. This is to keep a record for yourself in case anything gets lost in transit.

c. Get the mailing address: Find the appropriate mailing address for your response. The mailing address will be specified on the notice or letter you received from the IRS. Make sure to use the correct address to ensure your response reaches the correct department.

d. Send the response: Mail your response and supporting documents to the provided IRS address. Use certified mail or a reputable courier service to track your delivery and ensure it reaches the IRS.

Online filing

The IRS provides various online tools and resources that taxpayers can use to respond to notices electronically. To check if online filing is available for Letter 6416-A, follow these steps:

a. Visit the IRS website: Go to the official IRS website at www.irs.gov.

b. Navigate to "Respond to a Notice": Look for a section on the IRS website that allows you to respond to a notice or letter. This section may be labeled "Respond to a Letter" or similar.

c. Provide the required information: Follow the instructions and provide the necessary information as requested by the IRS through their online platform.

d. Submit your response: Upload any required documents and submit your response electronically.

E-filing

If you are required to file specific tax forms or returns along with your response to Letter 6416-A, you may be able to e-file those forms. E-filing is generally available for tax returns and certain other tax-related forms.

a. Use tax software or a tax professional: To e-file tax forms, you'll need to use IRS-approved tax software or seek the assistance of a tax professional who offers e-filing services.

b. Follow the software instructions: The tax software will guide you through the process of completing the required forms and submitting them electronically to the IRS.

Common Mistakes To Avoid While Receiving Letter 6416-A

However, in general, when dealing with official letters, especially from government agencies like the IRS, it's essential to exercise caution and take the following precautions:

Don't ignore the letter: Ignoring an official letter can lead to serious consequences. Open the letter promptly and read its contents carefully.

Verify the sender: Check if the letter is genuinely from the IRS or the appropriate agency. Scammers often send fake letters to deceive individuals into providing personal information.

Keep calm and don't panic: Receiving an official letter can be unnerving, but it's crucial to stay calm and approach the situation rationally.

Review the content thoroughly: Understand the purpose of the letter and the specific issue it addresses. If there are any technical terms or legal jargon you don't understand, seek professional advice.

Respond within the specified timeframe: If a response is required, make sure to comply with the stated deadline. Request an extension if necessary, but don't miss the deadline without proper communication.

Gather supporting documentation: If the letter is related to taxes or finances, ensure you have all the necessary documents and records to support your case.

Seek professional advice if needed: If you are unsure about how to respond or handle the situation, consider consulting a tax professional, attorney, or relevant expert.

Be cautious with personal information: If the letter requests personal information, be sure to verify the authenticity of the request before providing any sensitive data.

Keep copies of everything: Make copies of the letter, your response, and any supporting documents for your records.

Don't engage with scams: Be cautious of phishing attempts or scams that may pretend to be official letters. Do not click on suspicious links or provide personal information without verifying the source.

Conclusion

The Advance Child Tax Credit (AdvCTC) Payments have been a lifeline for many families, offering much-needed financial relief during challenging times. If you received Letter 6416-A from the IRS, it's crucial to understand the details and implications of the AdvCTC program to ensure you make the most of this support.

As you navigate the AdvCTC payments, stay informed, communicate any changes to the IRS, and plan your finances wisely to create a brighter and more secure future for your children. Remember, proper planning and timely communication can help you make the most of this valuable assistance.