- IRS forms

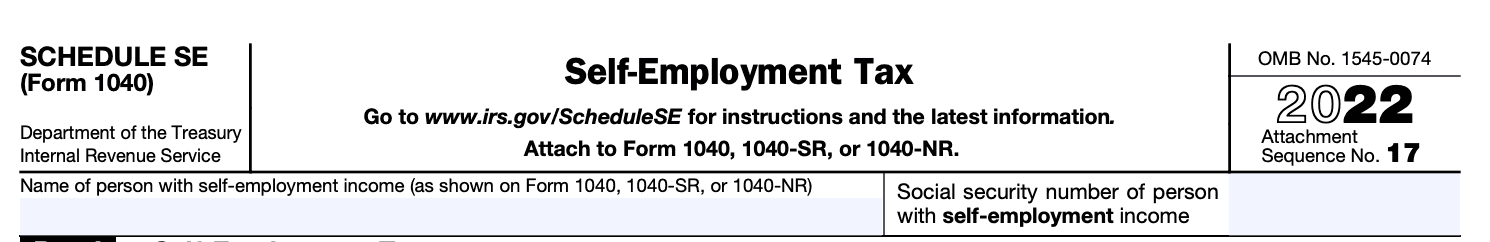

- Schedule SE (Form 1040)

Schedule SE (Form 1040): Self-Employment Tax

Download Schedule SE (Form 1040)If you're self-employed or earn income from freelance work, it's important to understand your tax obligations. One such obligation is the self-employment tax, which helps fund Social Security and Medicare programs. To report and calculate this tax, you'll need to fill out Schedule SE (Form 1040).

Self-employment tax is the way self-employed individuals pay their share of Social Security and Medicare taxes. When you work for an employer, these taxes are deducted from your paycheck automatically. However, when you're self-employed, you are responsible for paying both the employee and employer portions of these taxes.

In this blog post, we'll demystify Schedule SE and provide you with a comprehensive guide to understanding and completing this important tax form.

Purpose of Schedule SE (Form 1040)

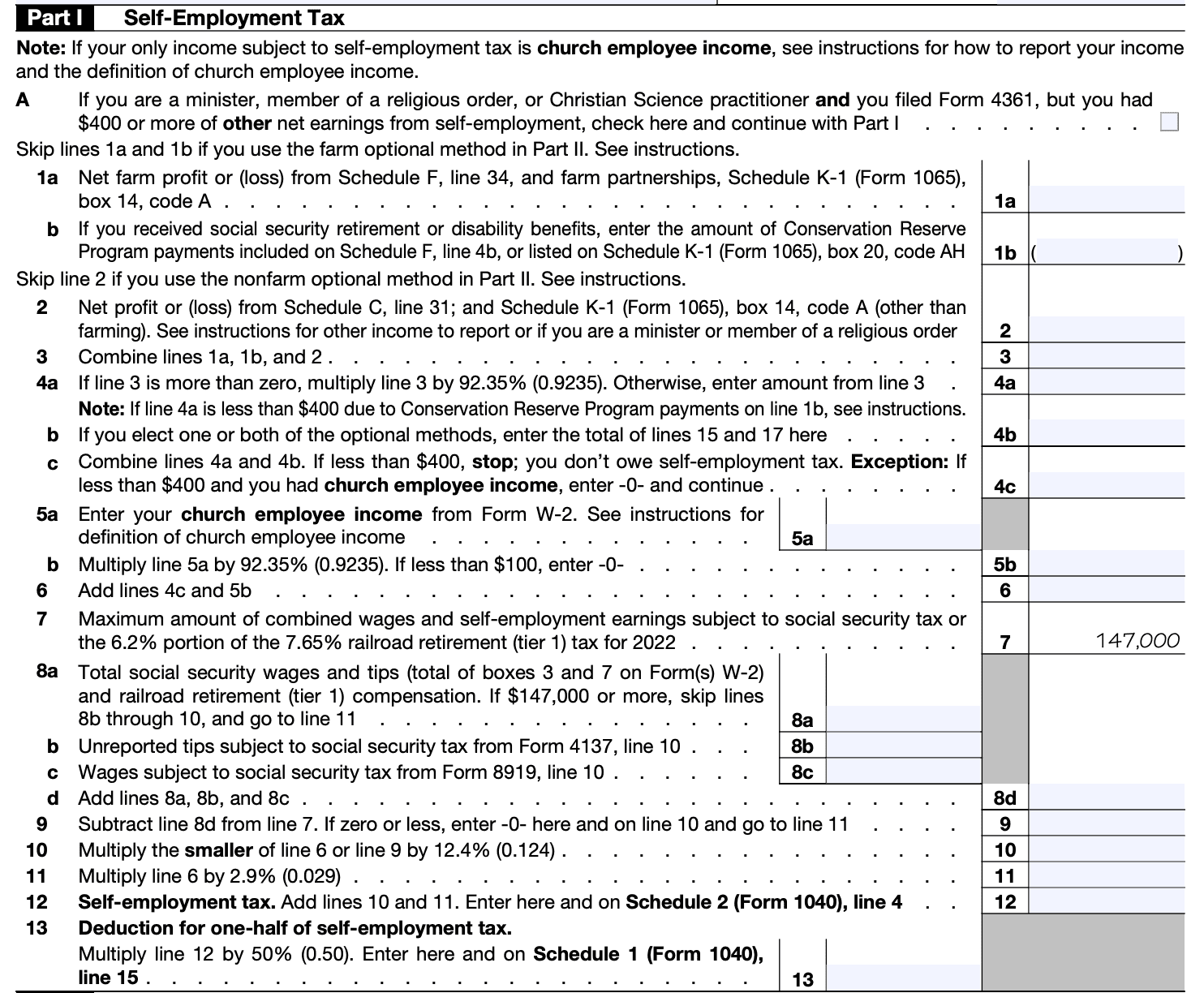

The purpose of Schedule SE is to determine the amount of self-employment tax owed by individuals who have net earnings of $400 or more from self-employment. It calculates the Social Security and Medicare taxes that self-employed individuals are responsible for paying, which are collectively referred to as self-employment tax.

When completing Schedule SE, individuals must report their net earnings from self-employment, which is the total income they earned from their self-employment activities minus any allowable business expenses and deductions. The schedule then applies the self-employment tax rate to the net earnings to calculate the amount of tax owed.

The self-employment tax rate consists of the Social Security tax rate and the Medicare tax rate. As of September 2021, the Social Security tax rate is 12.4% and is applied to the first $142,800 of net earnings. The Medicare tax rate is 2.9% and is applied to all net earnings.

Benefits of Schedule SE (Form 1040)

Here are some benefits of Schedule SE:

Calculates self-employment tax: Schedule SE helps self-employed individuals calculate their self-employment tax liability accurately. This tax is based on their net earnings from self-employment.

**Determines Social Security and Medicare contributions: **Self-employment tax consists of two components: Social Security tax and Medicare tax. Schedule SE calculates both of these contributions based on the net earnings from self-employment.

Allows for deduction of half of self-employment tax: The good news is that self-employed individuals can deduct half of the self-employment tax they owe as an adjustment to their income on Form 1040. This deduction helps reduce their overall taxable income.

Helps individuals claim the Earned Income Tax Credit (EITC): Schedule SE is also relevant for individuals who qualify for the Earned Income Tax Credit (EITC). The self-employment income reported on Schedule SE is used to determine eligibility for and calculate the amount of the EITC.

Contributions toward Social Security benefits: Paying self-employment tax contributes to your eligibility for Social Security benefits in the future. By reporting and paying self-employment tax, you are building your work credits and ensuring you qualify for benefits such as retirement, disability, and survivor benefits.

**Supports accurate tax reporting: **Schedule SE ensures that self-employed individuals accurately report their self-employment income and calculate the correct amount of self-employment tax owed. This helps maintain compliance with tax laws and reduces the risk of audits or penalties.

Who Is Eligible To File Schedule SE (Form 1040)?

Generally, if you have net earnings from self-employment of $400 or more, you are required to file Schedule SE. However, there are certain criteria that determine who is eligible to file Schedule SE. Here are the general guidelines:

Self-employed individuals: If you are self-employed and have net earnings of $400 or more from your business, you are generally required to file Schedule SE. This applies to individuals who operate as sole proprietors, independent contractors, or are in a partnership.

Church employees: If you are a minister, member of a religious order, or Christian Science practitioner, and you have received wages subject to self-employment tax of $108.28 or more, you are required to file Schedule SE.

Farming activities: If you have net earnings from self-employment as a farmer of $400 or more, you are generally required to file Schedule SE.

It's important to note that there may be exceptions and additional rules based on your specific circumstances.

How To Complete Schedule SE (Form 1040): A Step-by-Step Guide

Completing Schedule SE (Form 1040) can be done by following these step-by-step instructions:

Step 1: Gather the necessary information

Before you start filling out Schedule SE, make sure you have the following information at hand:

Your net profit or loss from self-employment (from Schedule C or Schedule C-EZ)

Your net farm profit or loss (from Schedule F)

Any other income subject to self-employment tax

Any exemptions or deductions related to self-employment tax

Step 2: Obtain Schedule SE (Form 1040)

You can obtain Schedule SE (Form 1040) from the Internal Revenue Service (IRS) website or by visiting your local IRS office.

Step 3: Understand the purpose of Schedule SE

Schedule SE is used to calculate and report your self-employment tax. Self-employment tax is the Social Security and Medicare tax for individuals who work for themselves.

Step 4: Enter your identifying information

At the top of Schedule SE, enter your name, Social Security number, and other identifying information as required.

Step 5: Calculate your net earnings from self-employment

In Part I of Schedule SE, you'll need to calculate your net earnings from self-employment. If you have multiple sources of self-employment income, you'll need to add them together to determine your total net earnings.

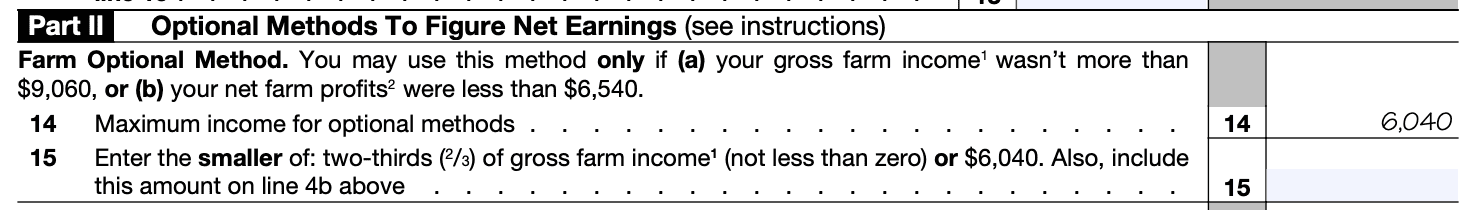

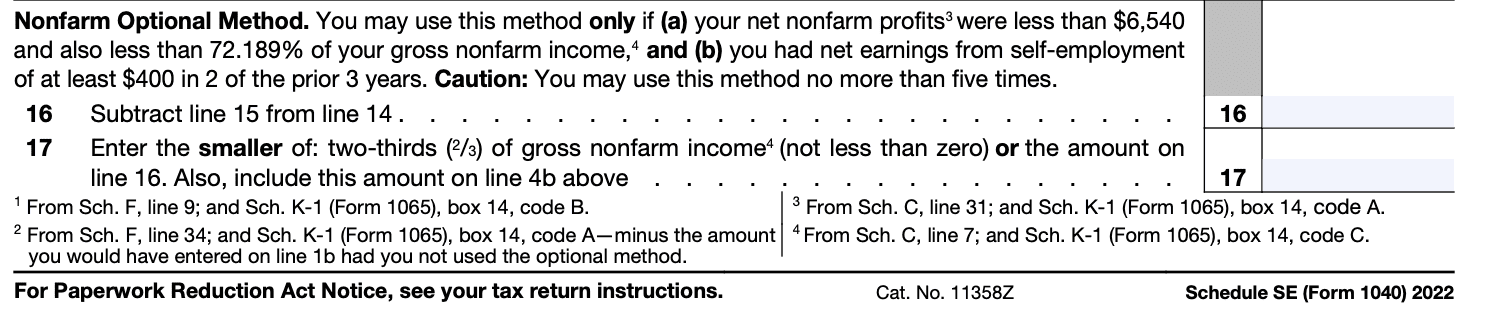

Step 6: Determine your net profit or loss from farming

If you have income from farming, you'll need to complete Part II of Schedule SE to calculate your net profit or loss from farming. If you don't have farming income, you can skip this part.

Step 7: Calculate your self-employment tax

In Part III of Schedule SE, you'll calculate your self-employment tax. The self-employment tax is calculated based on your net earnings from self-employment and any net profit or loss from farming.

Step 8: Complete the remaining sections

Continue to fill out the remaining sections of Schedule SE, following the instructions provided. Make sure to double-check your calculations and ensure that all the required information is entered accurately.

Step 9: Transfer the calculated amount to Form 1040

After completing Schedule SE, transfer the calculated self-employment tax amount to the designated line on Form 1040. Make sure to include Schedule SE with your tax return when filing.

Step 10: File your tax return

Once you have completed all the necessary forms and schedules, you can file your tax return electronically or by mail, depending on your preference and the IRS guidelines.

Special Considerations When Filing Schedule SE (Form 1040)

When filing Schedule SE (Form 1040), there are several special considerations to keep in mind. Here are some key points to consider:

**Self-employment tax: **Schedule SE is used to calculate and report self-employment tax, which consists of Social Security and Medicare taxes for self-employed individuals. Unlike employees who pay half of these taxes, self-employed individuals are responsible for paying both the employer and employee portions.

Self-employment income: Schedule SE should be filed if you had net earnings from self-employment of $400 or more during the tax year. Net earnings from self-employment generally include income from a trade or business you operate as a sole proprietor, independent contractor, or member of a partnership.

**Filing thresholds: **Even if you have self-employment income, you may not be required to file Schedule SE if your total net earnings from self-employment are below the filing thresholds. For 2022, if your net earnings are less than $400, you don't have to file Schedule SE.

Calculation method: Schedule SE provides two methods for calculating self-employment tax: the regular method and the optional method. The regular method uses the net profit from your business, while the optional method uses your gross business income. Most self-employed individuals use the regular method, but you can compare both methods to determine which is more advantageous for your situation.

**Additional medicare tax: **Schedule SE only calculates the regular Medicare tax rate. However, if your income exceeds certain thresholds, you may also be subject to the Additional Medicare Tax. The Additional Medicare Tax rate is 0.9% on earnings above $200,000 for individuals ($250,000 for married couples filing jointly). This tax is reported on Form 8959 and is not calculated on Schedule SE.

Deductions and credits: Self-employment tax is calculated on Schedule SE using your net earnings, but you may be able to deduct certain expenses related to your self-employment income. Expenses such as business supplies, home office expenses, and health insurance premiums may be deductible and can reduce your overall self-employment tax liability.

**Estimated tax payments: **If you expect to owe $1,000 or more in self-employment tax for the year, you may need to make estimated tax payments quarterly to avoid underpayment penalties. These payments are made using Form 1040-ES and should be considered to ensure accurate reporting on Schedule SE.

Filing Deadlines & Extensions for Schedule SE (Form 1040)

Here's some general information on filing deadlines and extensions as of September 2021:

Filing deadline: The filing deadline for Schedule SE is generally the same as the filing deadline for Form 1040, which is the individual income tax return. For most taxpayers, the deadline is April 15th of the following year. However, if April 15th falls on a weekend or a holiday, the deadline may be extended to the next business day.

Extension of time to file: If you need more time to complete your tax return, you can request an extension of time to file. To do so, you must file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, by the original due date of your tax return (typically April 15th). This will grant you an extension of up to six months, moving the filing deadline to October 15th.

Paying taxes owed: It's important to note that an extension of time to file does not grant an extension of time to pay any taxes owed. If you anticipate owing taxes, you should estimate and pay the amount due by the original filing deadline to avoid penalties and interest charges. Form 4868 only extends the time to file, not the time to pay.

Self-employment tax due date: Schedule SE is used to calculate self-employment tax, which is generally due at the same time as your individual income tax return. Therefore, if you have a tax liability for self-employment tax, it is typically due on the original filing deadline (April 15th), regardless of any extension.

Common Mistakes To Avoid When Filing Schedule SE (Form 1040)

When filing Schedule SE (Form 1040), it's important to avoid common mistakes to ensure accurate reporting. Here are some common mistakes to avoid:

**Incorrectly reporting self-employment income: **Ensure that you report all your self-employment income accurately. Include income from all sources, including freelance work, independent contracting, or any other self-employed activities. Review your records and 1099 forms to make sure you report the correct amount.

**Failure to calculate self-employment tax correctly: **Self-employment tax is calculated based on your net earnings from self-employment. Use the appropriate tax rate, which is currently 15.3% (12.4% for Social Security and 2.9% for Medicare). Be sure to use the correct income thresholds and exemptions.

Failing to claim the deduction for self-employment tax: You can deduct half of your self-employment tax on your Form 1040. Make sure you claim this deduction to reduce your overall tax liability.

Incorrectly classifying workers: It's crucial to correctly classify workers as either employees or independent contractors. Misclassifying workers can lead to tax penalties. Ensure you understand the criteria used by the IRS to determine worker classification and apply it correctly.

Not keeping adequate records: Maintaining detailed and accurate records is essential for self-employed individuals. Keep track of your income, expenses, and other relevant documents, such as receipts, invoices, and bank statements. Good record-keeping will help you report your income accurately and support any deductions or credits you claim.

Failing to pay estimated taxes: If you expect to owe $1,000 or more in self-employment tax for the year, you're generally required to make estimated tax payments quarterly. Failing to pay these estimated taxes or underpaying them can result in penalties and interest. Stay on top of your tax obligations and make timely payments.

Ignoring additional schedules and forms: Depending on your circumstances, you may need to complete additional schedules or forms in addition to Schedule SE. For example, if you have multiple sources of self-employment income, you may need to file multiple Schedule C forms. Be aware of the additional requirements and include all necessary forms when filing your taxes.

Conclusion

As a self-employed individual, understanding and fulfilling your tax obligations is crucial. Schedule SE (Form 1040) plays a significant role in calculating and reporting your self-employment tax liability. By carefully following the instructions and accurately completing this form, you can ensure compliance with tax regulations and avoid penalties or interest charges.

However, tax laws and regulations may change over time, so it's always advisable to consult with a tax professional or refer to the most up-to-date IRS guidelines when completing your tax forms. With a solid understanding of Schedule SE and its implications, you can confidently manage your self-employment tax responsibilities and focus on growing your business.