- IRS forms

- Form 1041

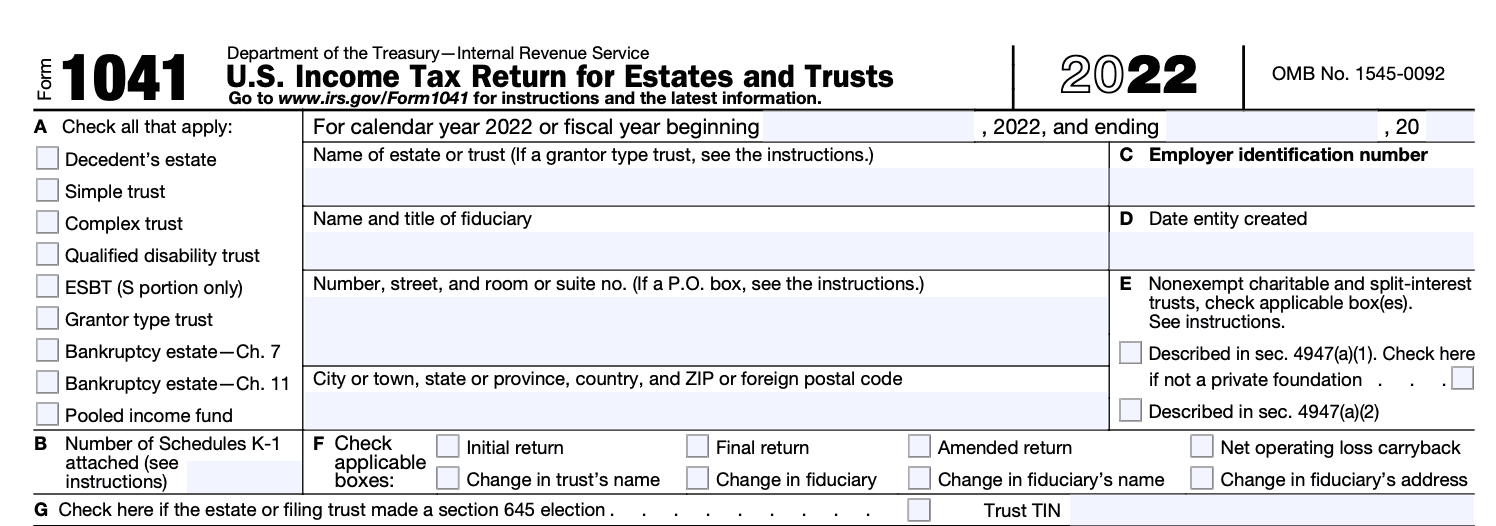

IRS Tax Form 1041 Filing Guide: Trusts and Estate Income Tax Returns

Download Form 1041Filing taxes can be a daunting task, especially for estate and trust filers. Form 1041 is a tax return filed by estates and trusts to report their income, deductions, and taxes owed to the Internal Revenue Service (IRS). This comprehensive guide will provide an overview of Form 1041 and cover everything you need to know about filing your estate and trust taxes.

What Is Form 1041?

Form 1041 is the U.S. Income Tax Return for Estates and Trusts. It is used to report the income, deductions, and taxes of estates and trusts. Estates are created when someone dies and their assets are transferred to a legal entity that manages them until they are distributed to heirs or beneficiaries. Trusts are legal entities created to manage assets for the benefit of beneficiaries.

Who Needs To File IRS Form 1041?

Estates and trusts are required to file Form 1041 if they meet certain criteria. Here's a breakdown of who needs to file:

- Estates: If a person has passed away and left property behind, an estate is created to manage that property. If the estate generates income, it must file Form 1041.

- Trusts: A trust is a legal arrangement in which one person (the trustee) manages property for the benefit of another person (the beneficiary). If the trust generates income, it must file Form 1041.

In general, an estate or trust must file Form 1041 if it has gross income of $600 or more for the tax year.

Who can file an estate income tax return?

An estate income tax return can be filed by:

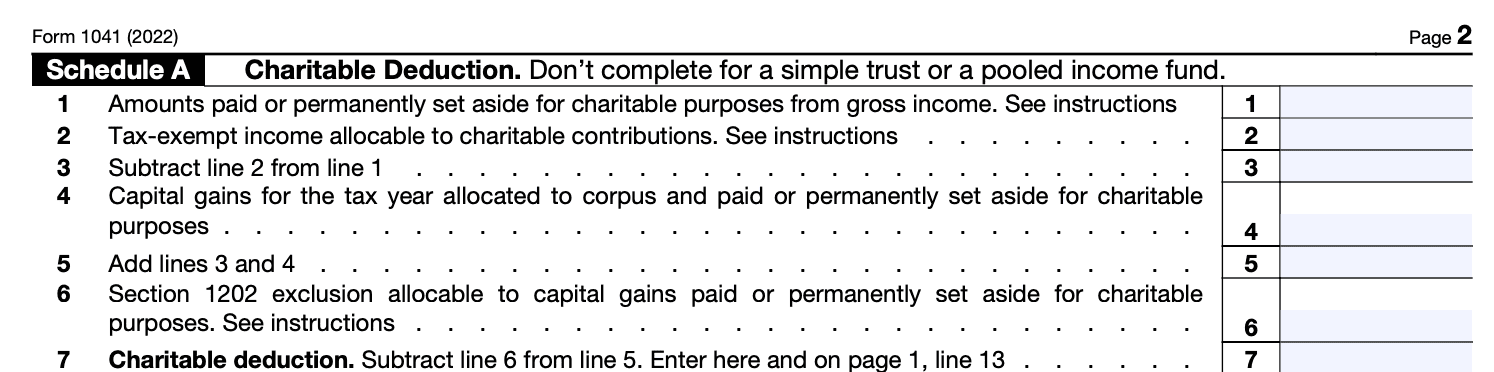

- An executor,

- An administrator,

- A personal representative, or

- Any person who is legally in charge of the deceased person’s (family member’s) property or is an appointed representative of the deceased person’s will

How To File Form 1041: Step-by-Step Instructions

Filing Form 1041 can be a complex process, and it is recommended that you seek the assistance of a tax professional. Here are the step-by-step instructions for filing Form 1041:

Step 1: Gather information

Before you can begin filling out Form 1041, you will need to gather information about the estate or trust. This includes information about the assets, income, and expenses of the estate or trust. You will also need to gather information about the beneficiaries or heirs of the estate or trust.

Step 2: Fill out Form 1041

Form 1041 has several sections that must be completed, including:

- Identification information: This section includes information about the estate or trust, such as its name, address, and tax identification number.

- Income: This section includes information about the income received by the estate or trust during the tax year, including interest, dividends, capital gains, and rental income.

- Deductions: This section includes information about the deductions that can be taken by the estate or trust, including expenses related to the administration of the estate or trust.

- Tax calculation: This section calculates the tax owed by the estate or trust.

- Beneficiary information: This section includes information about the beneficiaries or heirs of the estate or trust.

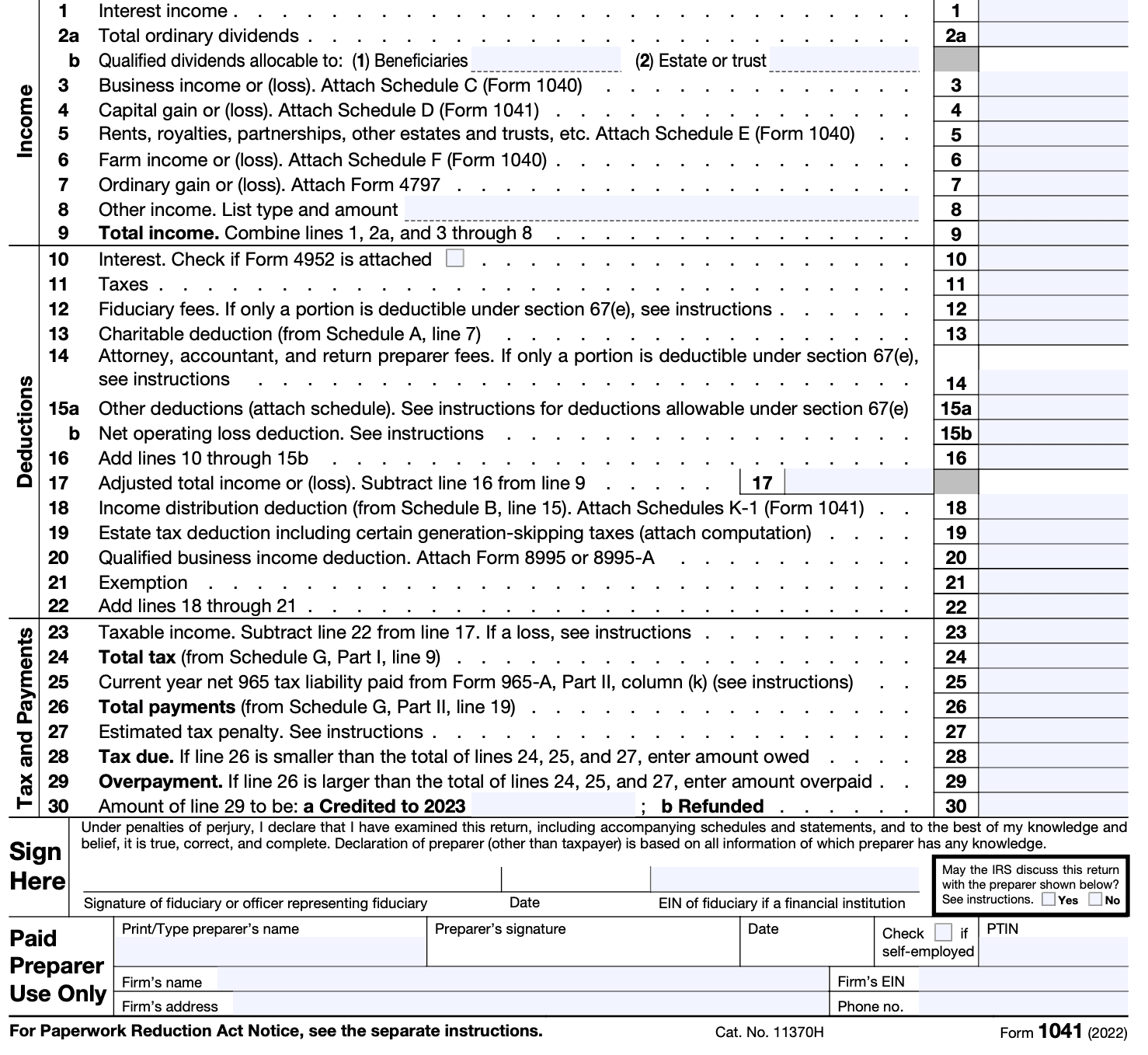

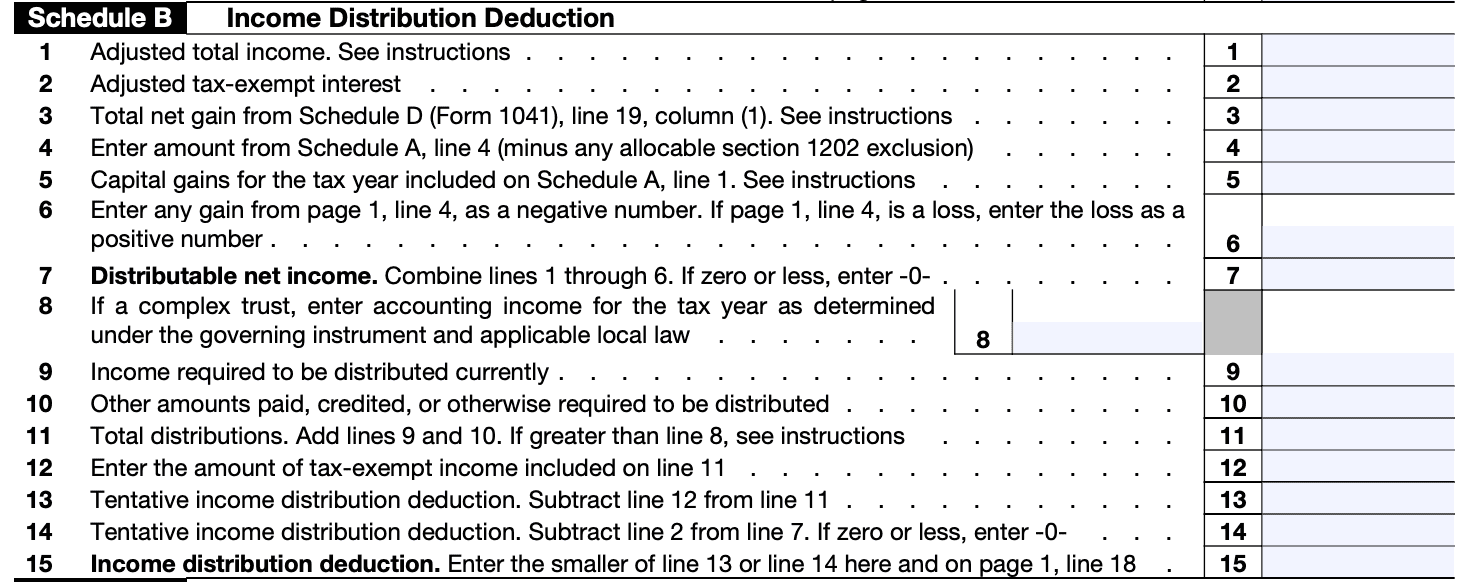

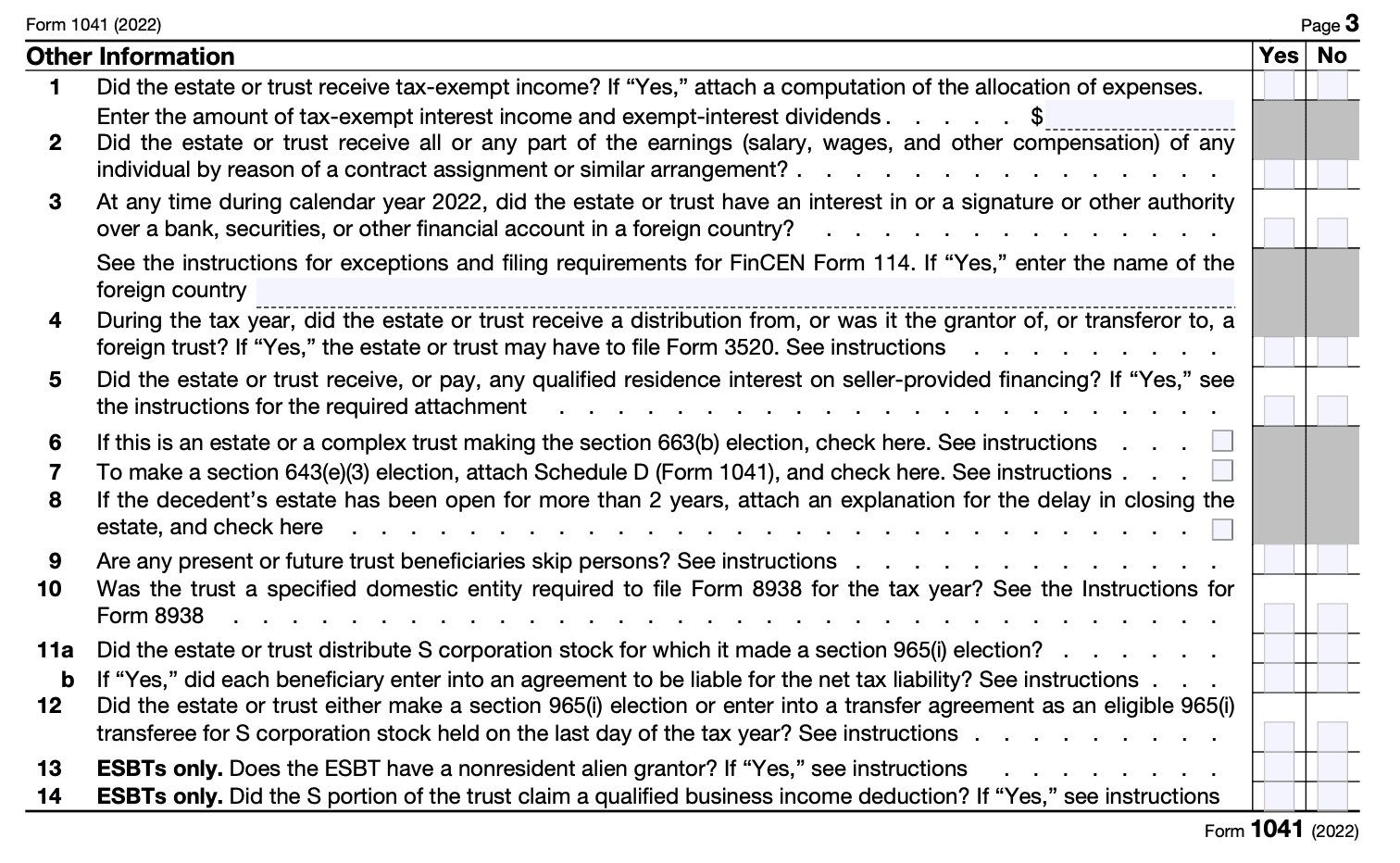

The form requires the completion of several schedules, including Schedules A, B, and G. Here's a step-by-step guide to completing each of these schedules:

Schedule A:

- Report all of the estate or trust's income received during the tax year on Line 1.

- List any deductions that the estate or trust is entitled to on Lines 2 through 15. These deductions may include expenses such as attorney fees, accountant fees, and trustee fees.

- Calculate the taxable income of the estate or trust by subtracting the total deductions listed on Line 16 from the total income listed on Line 1. This amount should be entered on Line 17.

Schedule B:

- Report all of the estate or trust's income that is subject to income tax on Line 1.

- List any deductions that the estate or trust is entitled to on Lines 2 through 14. These deductions may include expenses such as interest, taxes, and depreciation.

- Calculate the taxable income of the estate or trust by subtracting the total deductions listed on Line 15 from the total income listed on Line 1. This amount should be entered on Line 16.

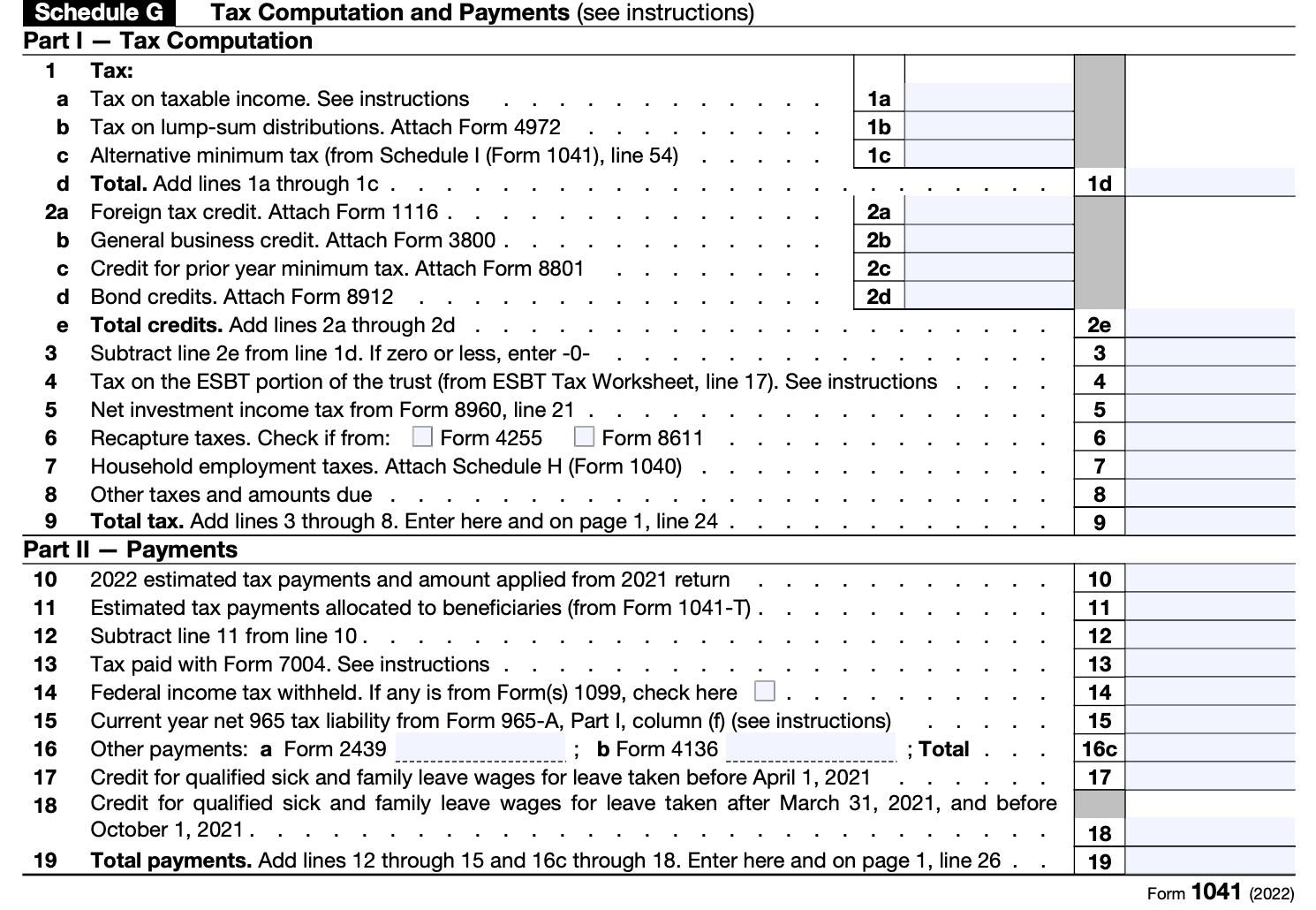

Schedule G:

- Report any tax payments made by the estate or trust during the tax year on Line 1.

- List any credits that the estate or trust is entitled to on Lines 2 through 10. These credits may include items such as foreign tax credits or the credit for tax on undistributed capital gains.

- Calculate the estate or trust's total tax liability by adding any taxes due listed on Line 11 to any credits listed on Line 12. This amount should be entered on Line 13.

- If the estate or trust made estimated tax payments during the tax year, report these payments on Lines 14 through 16.

- Calculate any remaining tax due or overpayment by subtracting Line 17 from Line 13. If the result is a negative number, this indicates an overpayment and should be entered on Line 18. If the result is a positive number, this indicates a tax due and should be entered on Line 19.

By completing Schedules A, B, and G of Form 1041, estates and trusts can accurately report their income, deductions, and tax liabilities to the IRS.

Step 3: Submit Form 1041

Once you have completed Form 1041, you will need to submit it to the IRS. The deadline for filing Form 1041 is April 15th of the year following the tax year. If you need more time to file, you can request an extension using Form 7004.

Related Schedules

| Form 1041 Schedules | What It Covers |

| Schedule D | Capital gains and losses |

| Schedule I | Income distribution deduction |

| Schedule J | Accumulated income |

| Schedule K-1 | Provides beneficiaries with their share of income, deductions, and credits |

When To File Form 1041

Form 1041 is due on the 15th day of the fourth month after the end of the tax year. For example, if the tax year ends on December 31st, the form is due on April 15th of the following year. If the due date falls on a weekend or legal holiday, the form is due on the next business day.

Estate and trust tax years can be either calendar years (January 1 to December 31) or fiscal years (a 12-month period ending on any day other than December 31). The tax year for the estate or trust is usually determined by the date of the decedent's death or the date the trust was created.

Note: When filing a deceased individual’s taxes, you need to report income from the beginning of the year to the date of death of the said individual.

Refer to the following table for further details:

| For | Due Date |

| Calendar year estates and trusts | April 15 This date was April 18 in 2023 instead of April 15 because of the Emancipation Day holiday in the District of Columbia (This applies even if you don’t live in the District of Columbia) |

| Fiscal year estates and trusts | 15th day of the fourth month following the close of the tax year For example: If an estate has a tax year ending on June 30, 2023, it will need to file Form 1041 by October 15, 2023 |

Common Mistakes To Avoid When Filing Form 1041

Filing Form 1041 can be a complicated process, and there are several common mistakes that filers should avoid:

- Failing to report all income: It is important to report all income received by the estate or trust, including interest, dividends, capital gains, and rental income.

- Failing to take all deductions: It is important to take all deductions that are allowed by law, including expenses related to the administration of the estate or trust.

- Failing to file on time: The deadline for filing Form 1041 is April 15th of the year following the tax year. Failing to file on time can result in penalties and interest charges.

- Failing to pay taxes owed: It is important to pay all taxes owed by the estate or trust on time. Failing to pay taxes

What To Do If You Encounter Issues

Filing Form 1041 can be complex and time-consuming, and it's not uncommon to encounter issues along the way. Here are a few common issues and how to address them:

- Missing or incorrect information: If you're missing information or have incorrect information, you may need to go back to the estate or trust's financial records to fill in the gaps. It's important to ensure that all information on the form is accurate and complete.

- Deadline missed: If you miss the deadline for filing Form 1041, you may be subject to penalties and interest. It's important to file the form as soon as possible to avoid additional fees.

- Disagreements between beneficiaries: If there are disagreements between beneficiaries regarding the estate or trust's financial activity, it may be necessary to seek legal advice or mediation to resolve the issue.

- IRS audit: If the IRS audits your estate or trust, it's important to respond promptly and provide all requested documentation. Seek advice from a tax professional if needed.

IRS Tax Form 1041 Deductions

Before claiming deductions on Form 1041, make sure to keep all financial documents ready. Here are some. It is common deductions and exemptions that lower the estate’s taxable income:

- $600 exemption

- Administrative expenses (i.e., court filing fees)

- Executor fees (This is deductible if the estate pays the executor for their services)

- Professional fees (i.e., accountant and lawyer costs)

- Required distributions to beneficiaries

Note: When claiming deductions or tax credits, you may need to file Schedule I, which deals specifically with the Alternative Minimum Tax (AMT) for estates.

Conclusion

Filing Form 1041 can be a complex and time-consuming process, but it's an important step in managing an estate or trust's financial activity. By following this comprehensive guide, you'll be well-equipped to complete the form accurately and on time. Remember to keep accurate financial records and seek advice from a tax professional if needed.

FAQs for Form 1041

Q: Who needs to file Form 1041?

A: Any estate or trust that has gross income of $600 or more in a tax year needs to file Form 1041.

Q: When is Form 1041 due?

A: Form 1041 is due on April 15th of the year following the tax year, unless the estate or trust has a fiscal year end, in which case the due date is the 15th day of the fourth month following the end of the fiscal year.

Q: Can Form 1041 be e-filed?

A: Yes, Form 1041 can be e-filed using tax preparation software or through a tax professional.

Q: What happens if Form 1041 is filed late?

A: If Form 1041 is filed late, the estate or trust may be subject to penalties and interest on any tax owed. The late filing penalty for Form 1041 is 5% of the tax due for each month (or part of a month) that the tax return is late; it can go up to a maximum of 25%.

Q: Can an extension be filed for Form 1041?

A: Yes, an extension can be filed for Form 1041 using Form 7004. The extension gives the estate or trust an additional 5 months to file their tax return.

Q: How long should I keep my Form 1041 records?

A: You should keep your Form 1041 records for at least 3 years from the date you filed the tax return or 2 years from the date you paid the tax, whichever is later.

Q. Are funeral expenses deductible on Form 1041?

Funeral expenses cannot be deducted on Form 1041. The IRS specifies that such expenses are only eligible for deduction on Form 706, which is a separate tax return employed by an executor to determine estate tax and compute the generation-skipping transfer tax.

Q. How do I report income from a grantor trust?

Income from a grantor trust is typically reported on the grantor's individual tax return, not on Form 1041. The trust itself does not pay taxes, but it provides information to the grantor using a Grantor Letter or Form 1041, Schedule K-1.

Q: What is a Qualified Disability Trust (QDT) and how is it treated on Form 1041?

A QDT can claim a personal exemption of $4,300 (as of 2020, adjusted for inflation). Report QDT income and deductions on Form 1041 and apply the exemption when calculating taxable income.

Q: Can I claim a net operating loss (NOL) on Form 1041?

Yes, an estate or trust can claim a net operating loss. Use Schedule A (Form 1045) to calculate the NOL and attach it to Form 1041.