- IRS forms

- Schedule K-1 (Form 1041)

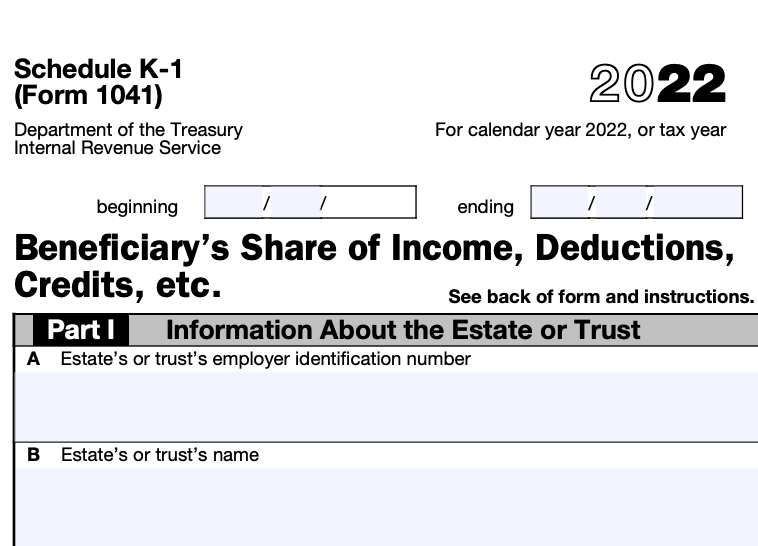

Schedule K-1 (Form 1041): Beneficiary’s Share of Income, Deductions, Credits

Download Schedule K-1 (Form 1041)Tax season can be a complex and daunting time for many individuals, especially when dealing with various tax forms. If you are a beneficiary of an estate or trust, you may come across Schedule K-1 (Form 1041).

What Is Form 1041 Schedule K-1?

Schedule K-1 (Form 1041) is an informational tax form used by estates and trusts to report income, deductions, and credits allocated to beneficiaries. The estate or trust must file Form 1041, U.S. Income Tax Return for Estates and Trusts, and provide each beneficiary with a Schedule K-1, reflecting their respective share of the estate or trust's financial activity.

In this blog post, we will delve into the details of Schedule K-1, helping you understand its purpose, sections, and how to interpret the information provided.

Purpose of Schedule K-1 (Form 1041)

The purpose of Schedule K-1 is to allocate the trust or estate's income, deductions, credits, and other items among the beneficiaries, who then report this information on their individual tax returns (Form 1040).

Here are the key purposes of Schedule K-1 (Form 1041):

Income allocation: Schedule K-1 is used to allocate the various types of income earned by the trust or estate among the beneficiaries. This includes interest, dividends, capital gains, rental income, royalties, and other types of taxable income.

Deduction allocation: Expenses and deductions incurred by the trust or estate, such as administrative expenses, attorney fees, and investment expenses, are allocated among the beneficiaries on Schedule K-1. These deductions can potentially reduce the taxable income of the beneficiaries.

Pass-through of tax items: Schedule K-1 also reports various tax items, such as tax-exempt income, foreign taxes paid, and alternative minimum tax (AMT) adjustments. These tax items are passed through to the beneficiaries, who then include them on their individual tax returns.

Reporting taxable distributions: If the trust or estate distributes income or principal to the beneficiaries during the tax year, Schedule K-1 is used to report these distributions. The beneficiaries will then include these distributions on their individual tax returns, potentially subjecting them to tax.

It's important to note that Schedule K-1 is specific to trusts and estates (such as a revocable living trust or a deceased person's estate) and is not used by partnerships or corporations.

Benefits of Schedule K-1 (Form 1041)

Here are some benefits of Schedule K-1:

- Pass-through taxation: Partnerships, S corporations, and certain trusts and estates are pass-through entities, meaning they do not pay income taxes at the entity level. Instead, the profits, losses, and deductions "pass through" to the individual beneficiaries, shareholders, or partners, who report them on their personal tax returns. Schedule K-1 helps allocate and report these items accurately to the individuals.

- Income allocation: Schedule K-1 provides detailed information about the types and amounts of income allocated to the beneficiaries, shareholders, or partners. It breaks down various categories of income, such as ordinary income, interest, dividends, capital gains, rental income, etc. This allows recipients to accurately report and pay taxes on their share of the income.

- Deduction and credit allocation: Schedule K-1 also reports deductions and credits that are passed through to the recipients. This includes items such as business expenses, rental property deductions, depreciation, foreign taxes paid, and various credits. By providing this information, Schedule K-1 ensures that beneficiaries, shareholders, or partners can claim their rightful deductions and credits on their personal tax returns.

- Tax basis tracking: Schedule K-1 includes information on the beneficiary's, shareholder's, or partner's tax basis in the entity. Tax basis represents the individual's investment in the entity and affects the taxation of distributions, sales of interests, and calculation of gains or losses. By tracking tax basis through Schedule K-1, individuals can accurately determine their tax consequences when they dispose of their interests in the entity.

- Compliance with tax laws: Schedule K-1 helps ensure compliance with tax laws by providing a clear breakdown of the entity's income, deductions, and credits. It helps recipients accurately report their share of the income and claim any applicable deductions and credits. This helps avoid potential tax audit issues and penalties due to incorrect or incomplete reporting.

- Transparency and accountability: Schedule K-1 provides transparency and accountability in the distribution of income, deductions, and credits among the entity's beneficiaries, shareholders, or partners. It allows them to understand how the entity's operations affect their individual tax situations and ensures fairness in the allocation of tax liabilities and benefits.

Who Is Eligible To File Form 1041 Schedule K-1?

Here are some common scenarios where Schedule K-1 may be required:

Estates: When an individual passes away, their estate may be created to manage and distribute their assets. If the estate generates income during the administration process, the fiduciary must file a Form 1041 and provide the beneficiaries with a Schedule K-1. The beneficiaries then use the Schedule K-1 to report their share of the estate's income on their individual tax returns.

Trusts: Various types of trusts, such as revocable trusts, irrevocable trusts, charitable trusts, or grantor trusts, may generate income or distribute funds to beneficiaries. The fiduciary of the trust must file Form 1041 and issue Schedule K-1s to the beneficiaries, who report the income or deductions on their personal tax returns.

S Corporations: In some cases, estates or trusts may be shareholders of S corporations. If this is the case, the S corporation will issue a Schedule K-1 to the estate or trust, reflecting the beneficiary's share of the S corporation's income, deductions, and credits. The fiduciary will then report this information on the estate or trust's Form 1041.

What Income Is Taxable Under IRS Form 1041 Schedule K-1?

IRS Form 1041 Schedule K-1 reports various types of income generated by a trust or estate, and not all of it is taxable. The taxable income reported on Schedule K-1 includes:

Interest income: Interest earned on investments held by the trust or estate

Dividend income: Income received from dividends on stocks or other equity investments

Rental income: Income generated from renting out properties owned by the trust or estate

Royalty income: Payments received for the use of intellectual property, such as patents or copyrights

Business Income: Profits from any business activities conducted by the trust or estate

Capital gains: Gains from the sale of assets, such as stocks, real estate, or other investments

How To Complete Schedule K-1 (Form 1041)

Completing Schedule K-1 (Form 1041) requires gathering relevant information from the trust or estate, and accurately reporting it on the form. Here are the general steps to complete Schedule K-1:

Step 1: Obtain the necessary forms

Start by obtaining Form 1041, U.S. Income Tax Return for Estates and Trusts, as well as Schedule K-1 (Form 1041). You can download these forms from the IRS website or obtain them from a tax professional.

Step 2: Gather information

Collect all the relevant information needed to complete Schedule K-1. This includes details about the trust or estate, beneficiaries, income, deductions, and credits. You'll need the trust's or estate's taxpayer identification number (TIN) as well.

Step 3: Complete the identification area

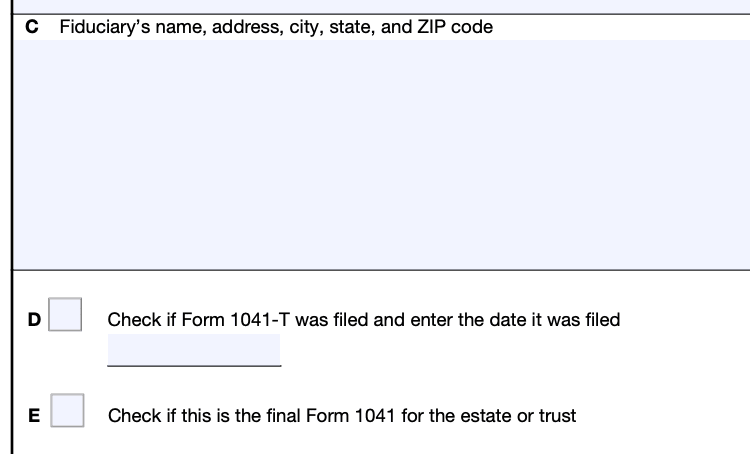

Fill out the identification area at the top of Schedule K-1. Provide the trust's or estate's name, address, TIN, and the filing year.

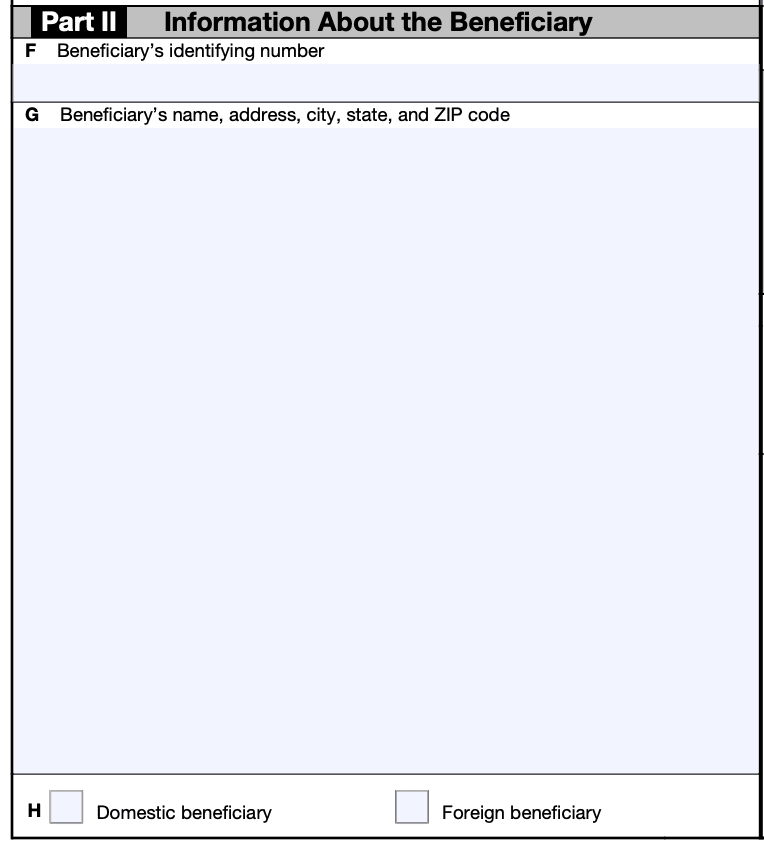

Step 4: Provide beneficiary information

In Part I of Schedule K-1, you need to report information about each beneficiary. This includes their name, address, TIN, and their share of the income, deductions, credits, and other relevant items.

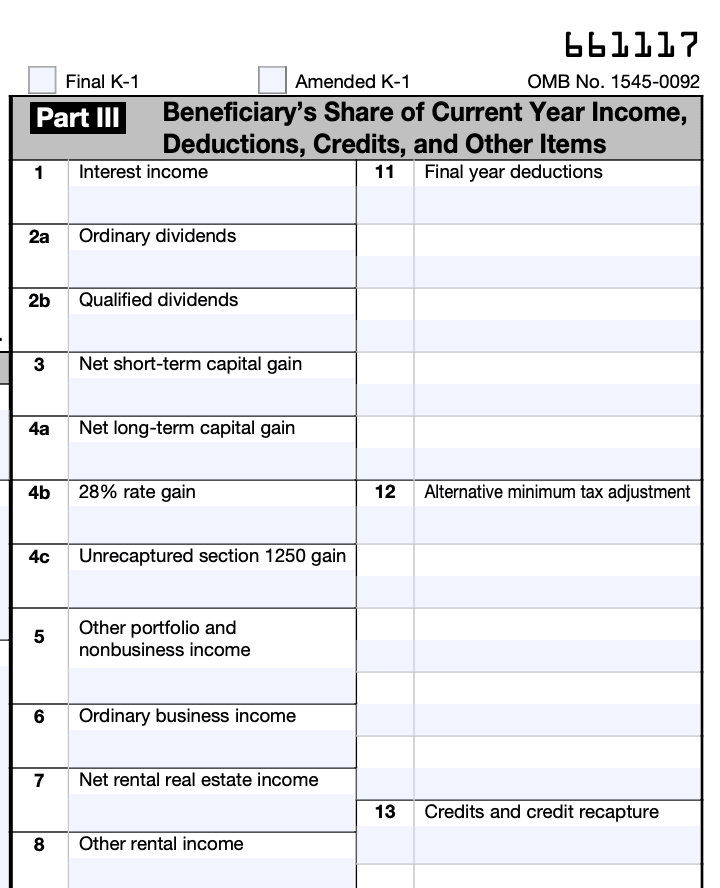

Step 5: Report income items

In Part II, report the income items allocated to the beneficiary. These may include ordinary dividends, interest income, rental income, capital gains or losses, royalties, and other types of income. Provide the necessary details and amounts for each item.

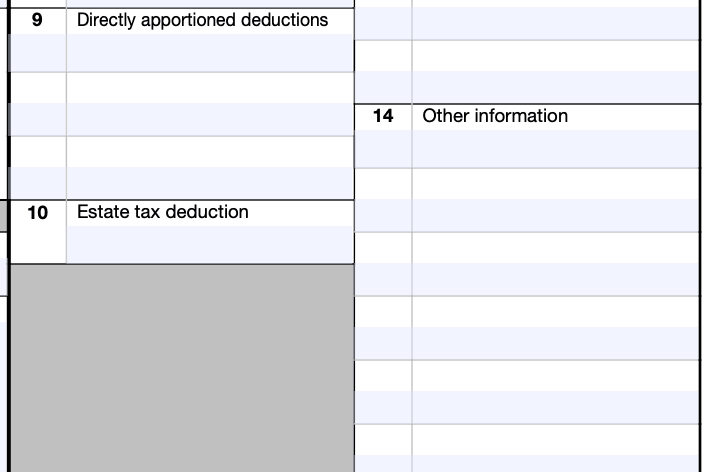

Step 6: Report deduction items

In Part III, report the deduction items allocated to the beneficiary. This includes expenses such as fiduciary fees, legal fees, accounting fees, charitable contributions, and any other deductible expenses. Provide the details and amounts for each item.

Step 7: Report tax-exempt income and other items

In Part IV, report tax-exempt income allocated to the beneficiary, if applicable. Also, report any other items, such as foreign tax paid, alternative minimum tax (AMT), or other tax-related information.

Step 8: Complete the reconciliation section

In Part V, reconcile the net income or loss of the trust or estate with the amounts allocated to the beneficiaries. This section helps ensure that the total allocated income and deductions match the trust's or estate's net income or loss.

Step 9: Sign and distribute Schedule K-1

Once you have completed Schedule K-1, sign it as the fiduciary or authorized representative of the trust or estate. Provide a copy of the Schedule K-1 to each beneficiary, and file the original with the Form 1041 when submitting the tax return.

Schedule K-1 can be complex, and the instructions may vary depending on the specific circumstances of the trust or estate. It's advisable to consult a tax professional or refer to the IRS instructions for Schedule K-1 (Form 1041) for detailed guidance specific to your situation.

When To File an Amended Schedule K-1 (Form 1041)

In case the amended return leads to alterations in income or the distribution of any income or details furnished to a beneficiary, an updated Schedule K-1 (Form 1041) must accompany the revised Form 1041 and be provided to each beneficiary. Make sure to check the “Amended K-1” box at the top of the amended Schedule K-1.

Special Considerations When Filing Schedule K-1 (Form 1041)

When filing Schedule K-1 (Form 1041), there are several special considerations to keep in mind. Here are some important points to consider:

Accurate reporting: Ensure that all the information reported on Schedule K-1 is accurate and matches the information provided to beneficiaries. This includes income, deductions, credits, and any other relevant information.

Timely filing: Schedule K-1 must be filed by the due date of the Form 1041, which is generally April 15th for calendar year filers. However, estates and trusts can request an automatic 5-month extension, which extends the due date to September 30th.

Beneficiary information: Include the correct identification information for each beneficiary, such as name, address, and taxpayer identification number (TIN), on Schedule K-1. It is important to ensure that this information is accurate and up to date.

Multiple beneficiaries: If there are multiple beneficiaries, a separate Schedule K-1 must be issued for each beneficiary, indicating their respective share of income, deductions, and credits.

Schedule K-1 distribution: Schedule K-1 must be provided to the beneficiaries in a timely manner. Generally, it should be issued to the beneficiaries by the due date of Form 1041, including extensions.

K-1 codes: Schedule K-1 includes various codes to indicate the type of income, deductions, and credits allocated to beneficiaries. It is important to use the correct codes to accurately report the information.

Alternative minimum tax (AMT): Estates and trusts may be subject to the AMT. If AMT applies, there are additional reporting requirements and calculations that need to be included on Schedule K-1.

State filing requirements: In addition to federal requirements, you may need to consider specific state filing requirements for Schedule K-1. Each state may have its own rules and regulations regarding the reporting of income, deductions, and credits for beneficiaries.

Professional assistance: Filing Schedule K-1 can be complex, especially if there are multiple beneficiaries or complex financial transactions. It is recommended to seek professional tax advice or assistance from a qualified tax professional to ensure accurate and compliant reporting.

IRS Form 1041 Schedule K-1 Deductions

IRS Form 1041 Schedule K-1, used for trusts and estates, outlines various deductions. Beneficiaries receive their share of these deductions, impacting their taxable income. Common deductions under Form 1041 Schedule K-1 include:

1. Administrative expenses:

- Legal and accounting fees related to estate administration

- Costs associated with managing and executing the trust or estate

2. Interest deductions:

- Interest paid on loans or debts incurred by the trust or estate

- Mortgage interest on property owned by the trust or estate

3. Taxes:

- State and local income taxes paid by the trust or estate

- Real estate taxes on properties held within the trust or estate

4. Trustee commissions:

- Compensation paid to the trustee for their services

- Commissions are calculated based on a percentage of the trust's assets

5. Charitable contributions:

- Deductions for donations made to qualified charitable organizations

- Ensure proper documentation for substantiating these contributions

6. Other miscellaneous deductions:

- Deductible expenses specific to the trust or estate's activities

- Any other expenses directly related to generating income for the trust or estate

Filing Deadlines and Extensions on Schedule K-1 (Form 1041)

The filing deadlines and extensions for Schedule K-1 (Form 1041) are as follows:

**Initial filing deadline: **The initial deadline for filing Schedule K-1 (Form 1041) is the same as the deadline for filing Form 1041, which is generally the 15th day of the fourth month following the end of the trust or estate's tax year. For most taxpayers, this deadline falls on April 15. However, if the 15th falls on a weekend or a legal holiday, the deadline is extended to the next business day.

**Extension deadline: **If you are unable to file Schedule K-1 by the initial deadline, you can request an extension by filing Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. This form must be filed by the initial deadline (April 15th) and will grant you a six-month extension to file Schedule K-1. The extended deadline is typically October 15.

Initial filing deadline: 15th day of the 4th month following the end of the trust or estate's tax year

Extension deadline: 6-month extension (typically October 15)

It's important to note that the extension is an extension of time to file, not an extension of time to pay any taxes owed. If you anticipate owing taxes, you should estimate the amount and make a payment by the initial deadline to avoid penalties and interest.

Common Mistakes To Avoid When Filing Schedule K-1 (Form 1041)

Here are some common errors to watch out for when filing Schedule K-1:

Incorrect or missing taxpayer identification numbers (TINs): Ensure that you provide the correct TINs for both the estate or trust and the beneficiaries. Mistakes in TINs can lead to delays and potential penalties.

Inconsistent or mismatched information: Make sure the information provided on Schedule K-1 matches the information reported on the estate or trust return (Form 1041) and the beneficiary's tax return. Inconsistencies can trigger IRS scrutiny.

Incorrect allocation of income and deductions: Ensure that income and deductions are allocated correctly among the beneficiaries based on the terms of the estate or trust agreement. Use the appropriate allocation methods and follow the guidelines provided in the instructions for Schedule K-1.

Failing to include all required information: Schedule K-1 requires detailed information about the estate or trust, as well as the beneficiaries. Double-check that you have provided all necessary details, including names, addresses, and share percentages.

Late or missing filing: Schedule K-1 must be filed with the beneficiaries' individual tax returns by the due date, including extensions. Failing to provide the K-1 on time can cause complications for the beneficiaries and may result in penalties.

Improper treatment of suspended losses: If there are suspended losses from prior years, ensure that you correctly handle them on Schedule K-1. Follow the instructions provided by the IRS to determine how these losses should be allocated or carried forward.

Neglecting to include supporting documentation: While Schedule K-1 itself is not submitted to the IRS, it's essential to retain all supporting documentation, such as financial statements, Forms 1099, and other relevant records. This documentation may be required in case of an audit or review.

Ignoring state-specific requirements: Different states may have their own rules and regulations regarding trust or estate taxation. Ensure that you understand and comply with the specific requirements of the state(s) in which the estate or trust operates.

Conclusion

Schedule K-1 (Form 1041) is a crucial document for beneficiaries of estates or trusts. It provides valuable information about their share of income, deductions, and credits, enabling them to accurately report this information on their individual tax returns.

By understanding how to interpret and use Schedule K-1, beneficiaries can fulfill their tax obligations effectively and avoid potential errors or discrepancies.

As always, it is advisable to consult with a tax professional or utilize tax software to ensure compliance with the latest tax laws and regulations.