- IRS forms

- Form 706

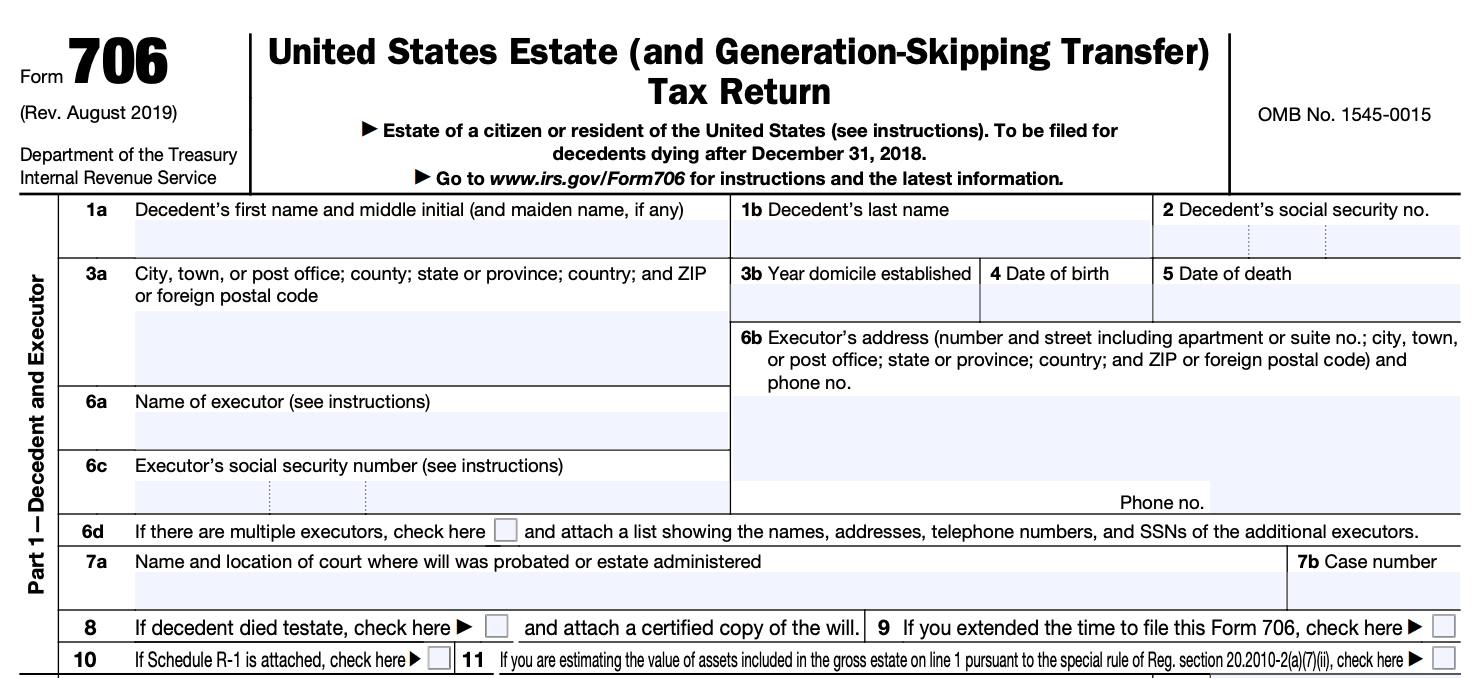

Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return

Download Form 706Managing finances and taxes can be a complex task, especially when it comes to estate planning and wealth transfer. The United States imposes an estate tax on the transfer of property upon an individual's death. The IRS requires the filing of Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, to report and calculate the estate tax liability.

Form 706 is a tax return form that must be filed by the executor or administrator of an estate when the decedent's gross estate, plus adjusted taxable gifts and specific exemptions, exceed the applicable estate tax exclusion amount. The form is used to determine the estate tax liability and report various assets, deductions, and calculations associated with the estate.

In this blog post, we will delve into the details of Form 706, its purpose, and key considerations for taxpayers.

Purpose of Form 706

The purpose of Form 706 is to calculate and report the estate tax liability when an individual passes away, and to report any generation-skipping transfers that may have occurred.

The estate tax is a tax imposed on the transfer of an individual's assets after their death. It applies to estates with a total value exceeding the estate tax exemption amount set by the IRS. Form 706 is typically filed by the executor or administrator of the deceased individual's estate.

The form requires detailed information about the assets and liabilities of the decedent, including property, investments, debts, and other financial holdings. By providing this information, the IRS can determine the value of the estate and calculate the estate tax owed, if any.

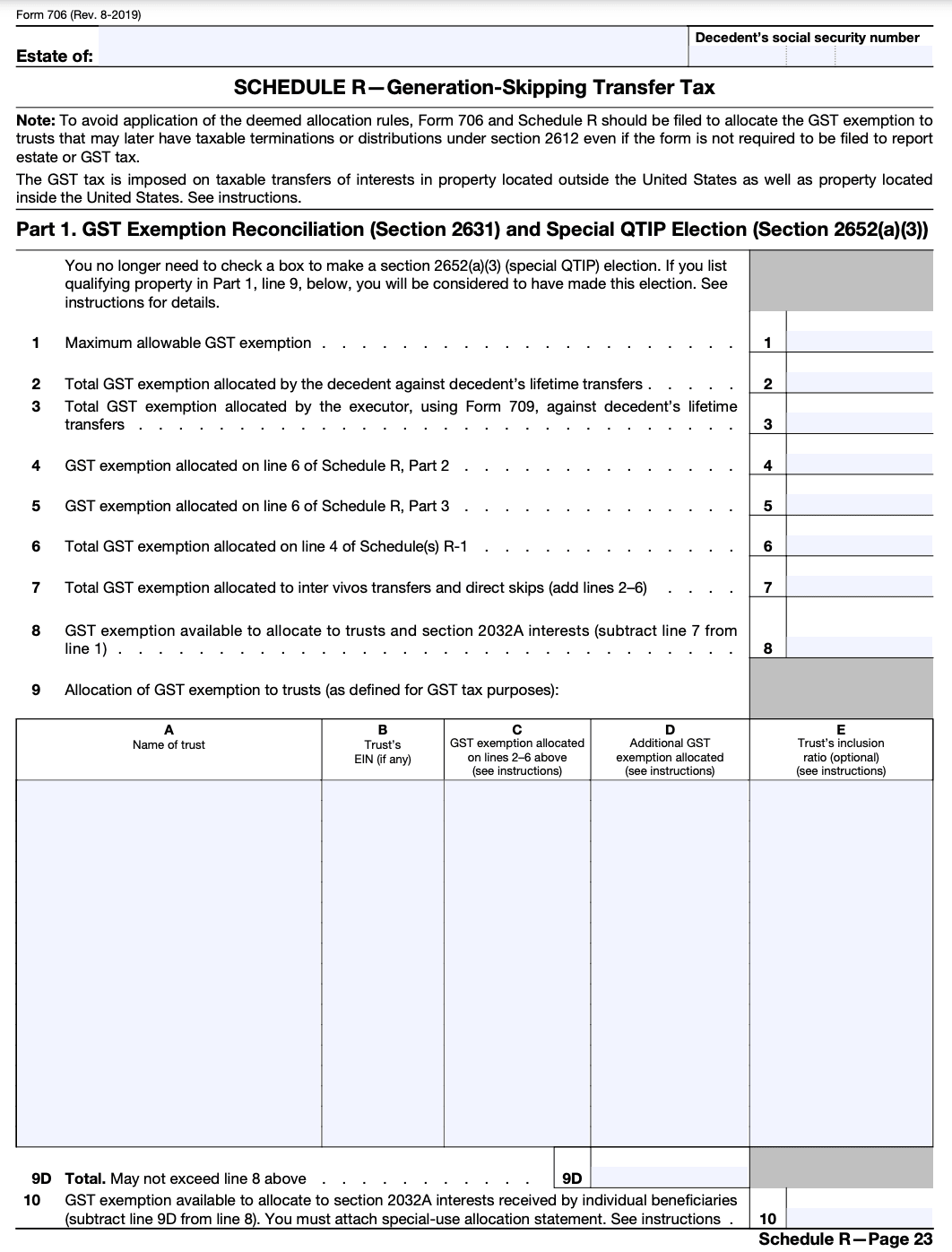

Additionally, Form 706 is used to report generation-skipping transfers, which are transfers of property that skip a generation, usually from grandparents to grandchildren, without any intervening transfers to the children. Generation-skipping transfers may be subject to an additional tax known as the generation-skipping transfer tax (GSTT).

Benefits of Form 706

While the form is primarily used for calculating and reporting estate taxes, there are several benefits to filing Form 706. Here are some of the key benefits:

- Estate tax reduction: One of the primary benefits of filing Form 706 is the opportunity to reduce the estate tax liability. By accurately reporting the value of the estate and applying various deductions, exemptions, and credits, the executor can potentially minimize the amount of estate tax owed.

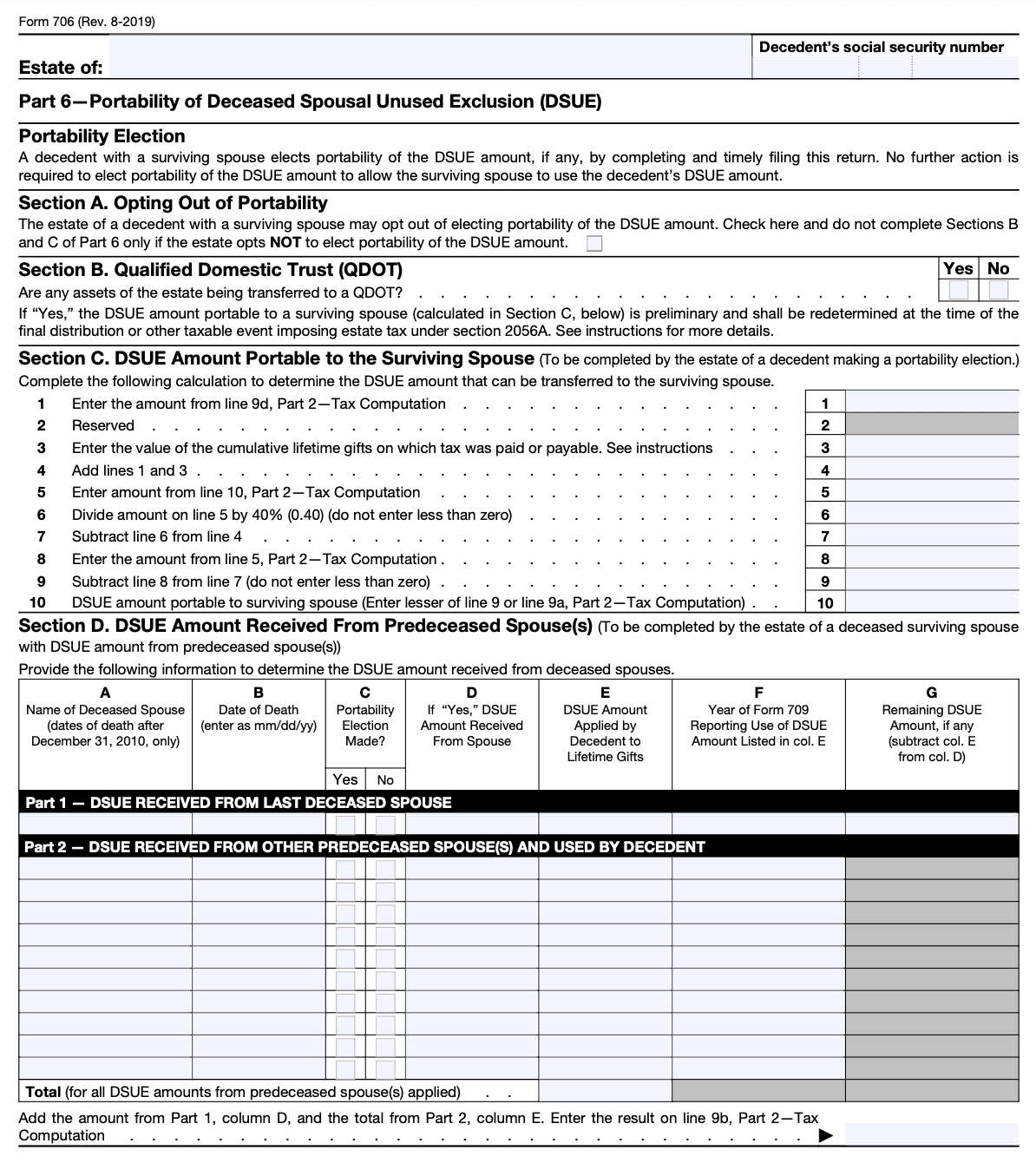

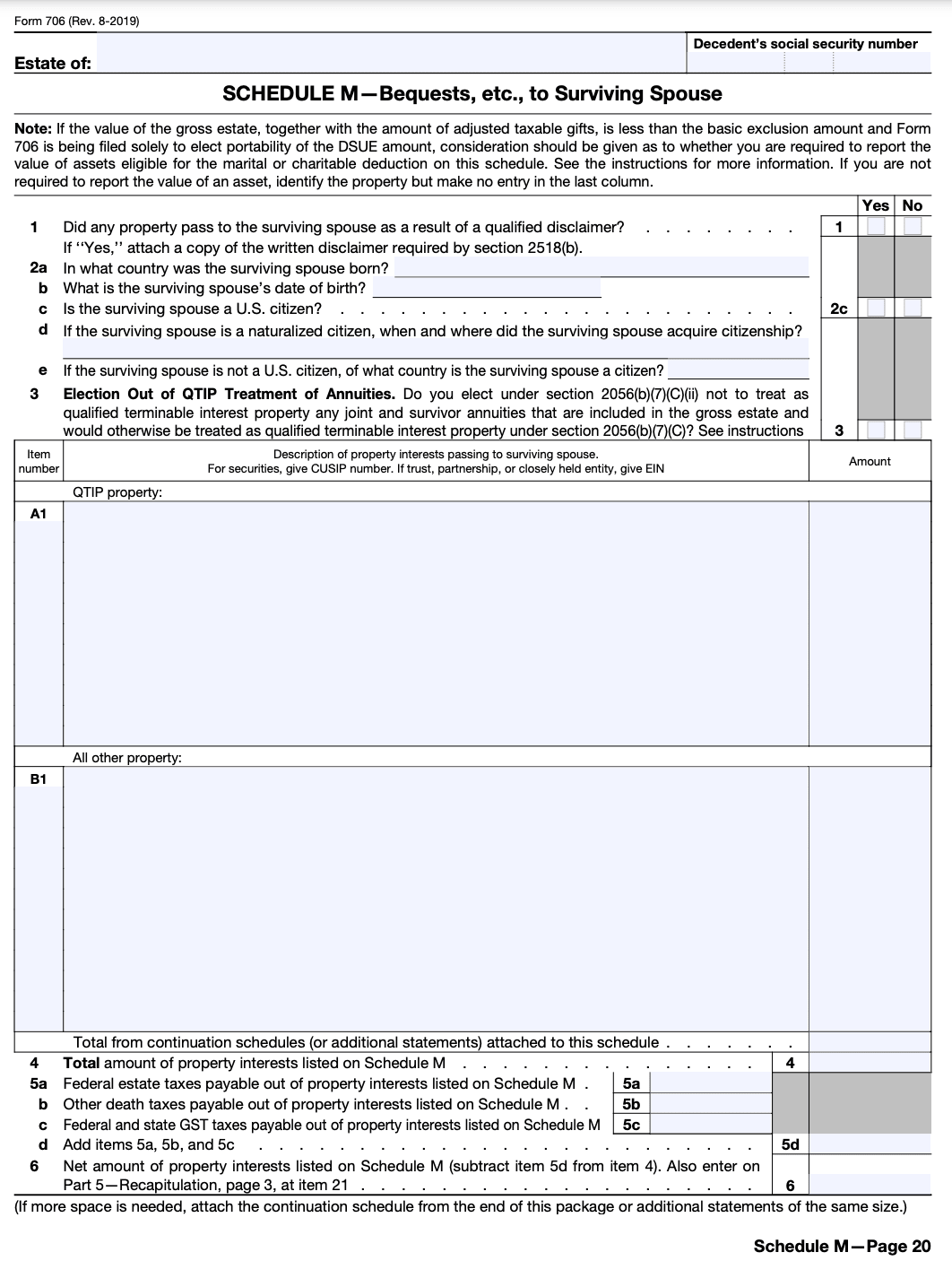

- Portability of unused exemption: Form 706 allows for the portability of the deceased spouse's unused estate tax exemption to the surviving spouse. This means that if the deceased spouse did not utilize their full estate tax exemption, the unused portion can be transferred to the surviving spouse, effectively increasing their own exemption amount.

- Basis adjustment: Filing Form 706 also allows for a stepped-up basis adjustment for assets included in the estate. This means that the value of assets at the time of the decedent's death becomes the new cost basis for the heirs or beneficiaries, potentially reducing capital gains taxes when those assets are eventually sold.

- Valuation discounts: Form 706 provides an opportunity to claim valuation discounts for certain assets, such as closely-held businesses or real estate, which can help lower the overall estate tax liability. These discounts reflect the reduced marketability or lack of control associated with these assets.

- Estate planning and administration: Even if the estate does not owe any estate taxes, filing Form 706 can still be beneficial for estate planning and administration purposes. It helps establish a clear record of the estate's assets, their values, and any transfers or distributions made, which can be useful in settling any future disputes or audits.

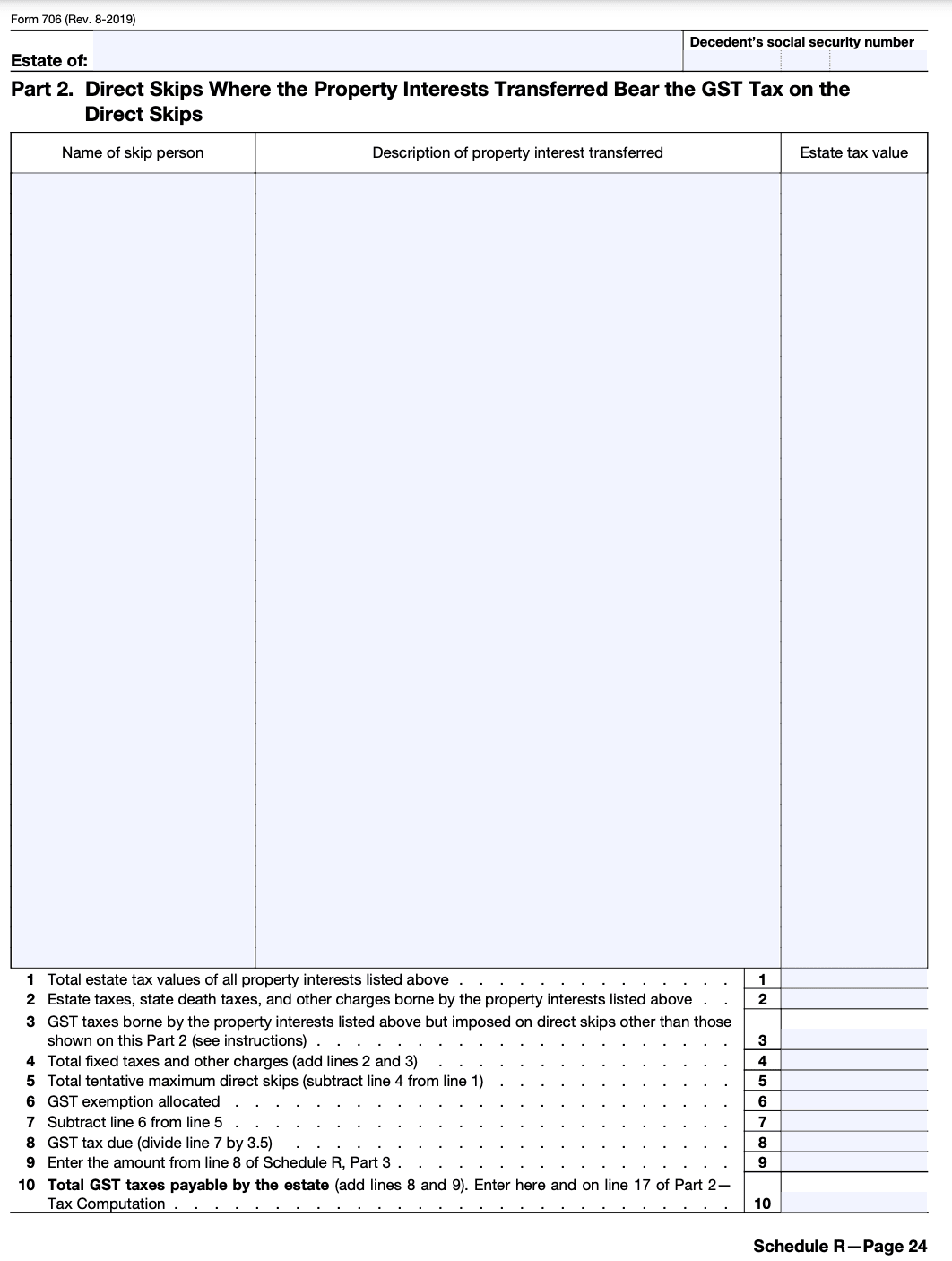

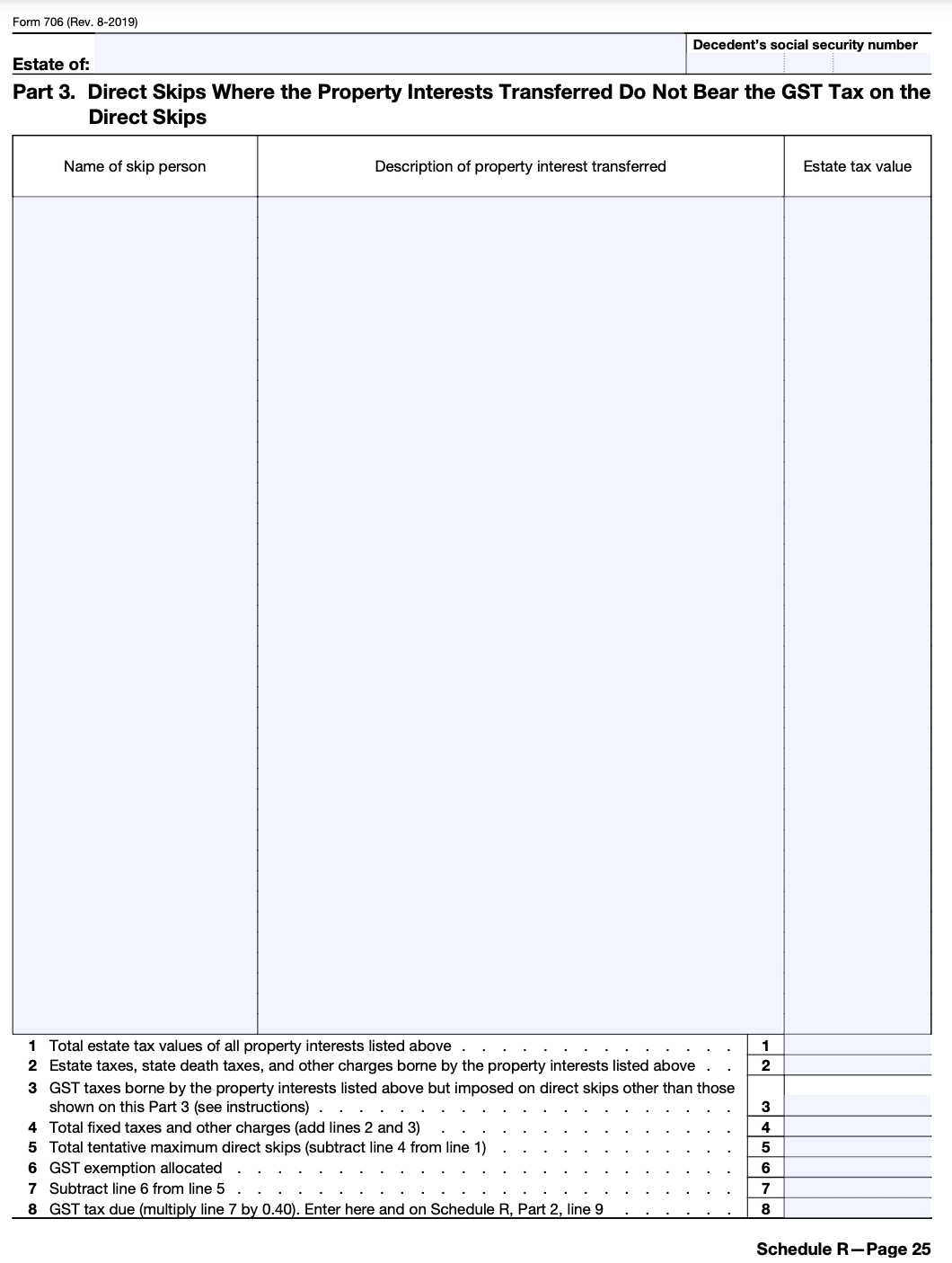

- Generation-skipping transfer tax: In addition to estate taxes, Form 706 also addresses generation-skipping transfer (GST) taxes. This tax applies when assets are transferred directly to grandchildren or more remote descendants, bypassing the children. Filing Form 706 allows for the proper calculation and reporting of GST taxes, ensuring compliance with the relevant tax laws.

Who Is Eligible To File Form 706?

The eligibility to file Form 706 depends on certain criteria:

Estate value: Form 706 is generally required to be filed if the decedent's gross estate, plus adjusted taxable gifts and specific exemptions, exceeds the applicable exclusion amount for the year of the decedent's death. The exclusion amount is subject to change based on tax laws and regulations. It is important to consult the Internal Revenue Service (IRS) or a qualified tax professional to determine the current exclusion amount.

U.S. citizen or resident alien: The decedent must have been a U.S. citizen or resident alien at the time of their death for their estate to be eligible to file Form 706. Non-U.S. citizens and non-resident aliens have different tax rules and may be subject to different reporting requirements.

Assets subject to estate tax: The estate should have assets that are subject to estate tax, such as real estate, investments, bank accounts, business interests, and other valuable assets. Certain types of assets, like life insurance proceeds, may be included in the estate for tax purposes.

How To Complete Form 706: A Step-by-Step Guide

Here is a step-by-step guide to completing Form 706:

Step 1: Gather necessary information and documents

Collect all relevant information and documentation, including:

- Basic information about the deceased person (decedent), such as their full legal name, date of death, and Social Security number.

- Information about the executor or personal representative handling the estate, including their contact information.

- A list of the decedent's assets, including bank accounts, real estate, investments, life insurance, and any other assets owned at the time of death.

- Documentation supporting the value of each asset, such as appraisals, financial statements, and deeds.

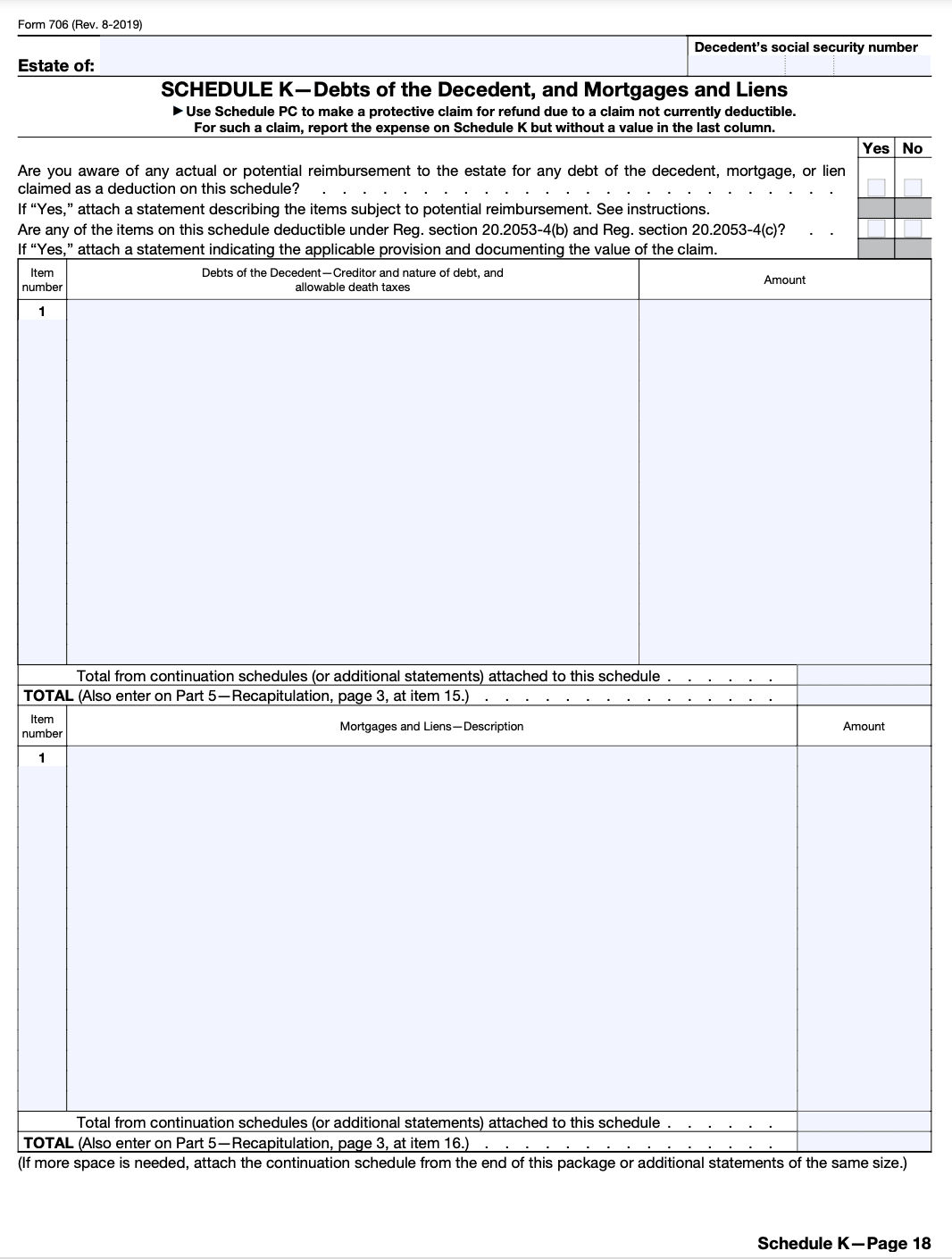

- Information on any debts, mortgages, and other liabilities of the decedent.

- Details about any previous taxable gifts made by the decedent during their lifetime.

Step 2: Complete Part 1 - Decedent and Executor Information

Provide the required information about the decedent and the executor in Part 1 of Form 706. This includes the decedent's personal details, date of death, and the executor's contact information.

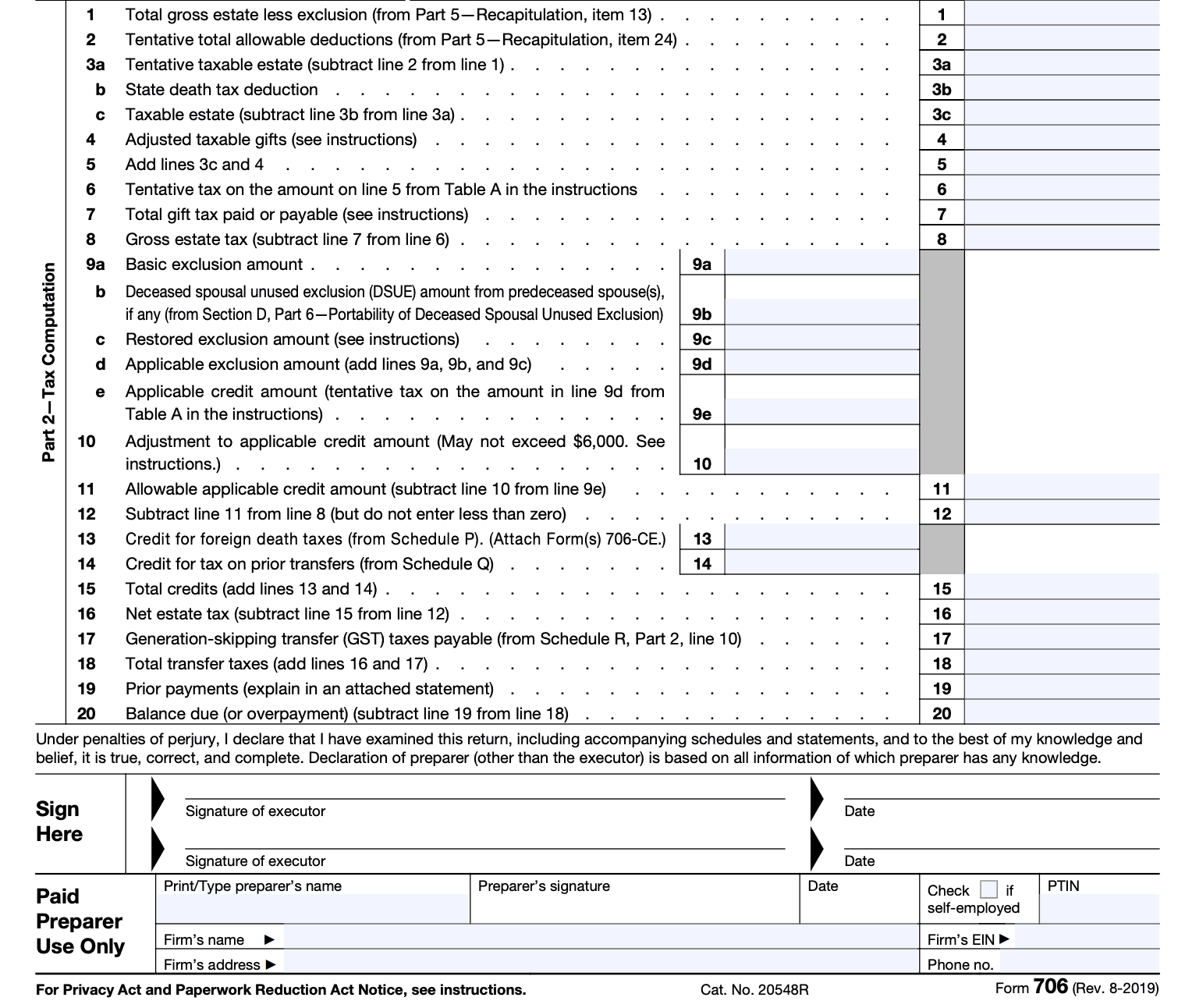

Step 3: Complete Part 2 - Tax Computation

In Part 2, calculate the tentative tax by determining the gross estate and subtracting allowable deductions. This section includes:

Determine the gross estate: Sum up the value of all the assets owned by the decedent at the time of death, including property, bank accounts, investments, and life insurance proceeds.

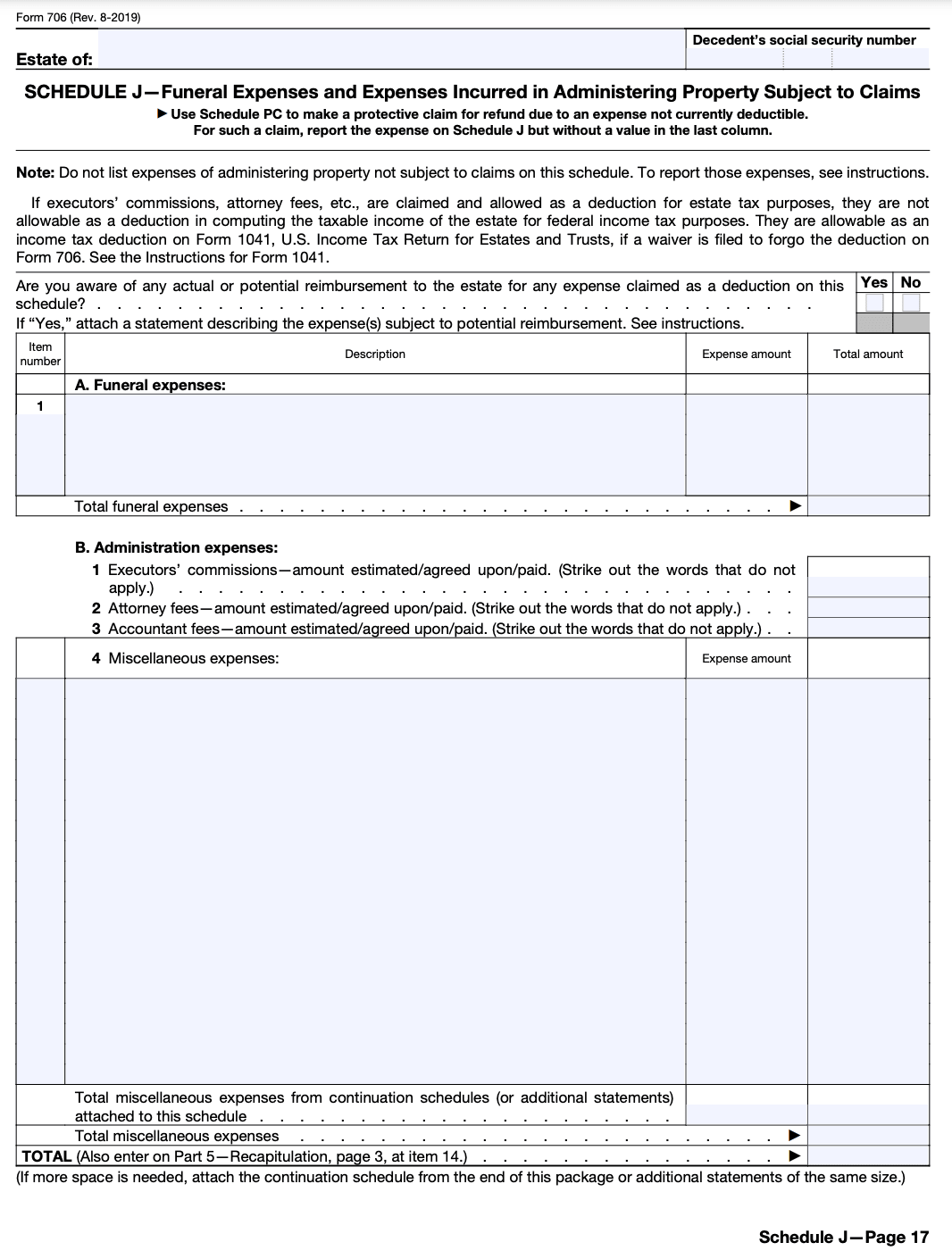

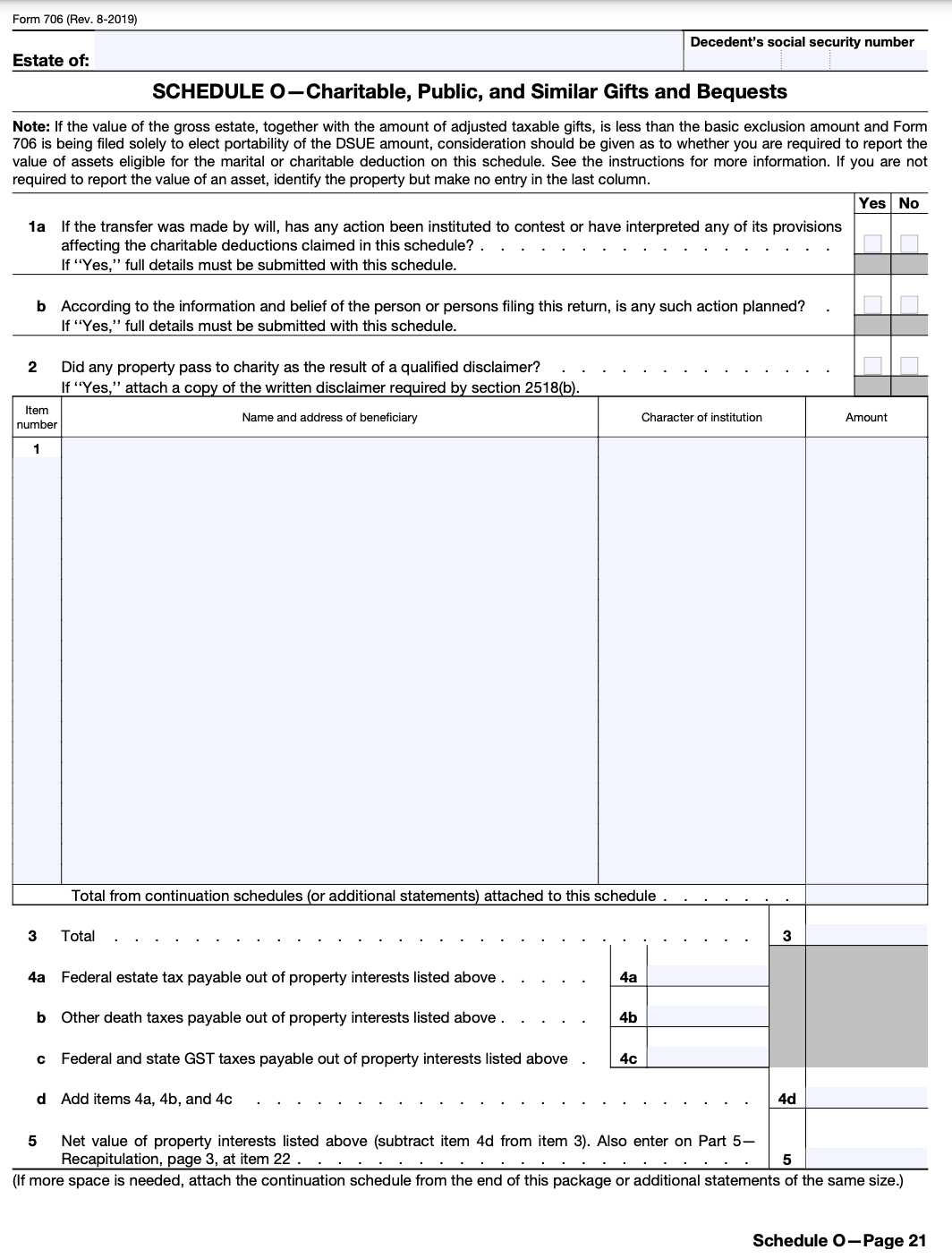

Subtract allowable deductions: Deduct expenses such as funeral and administration costs, debts, mortgages, and charitable contributions. Some deductions may require additional documentation or justification.

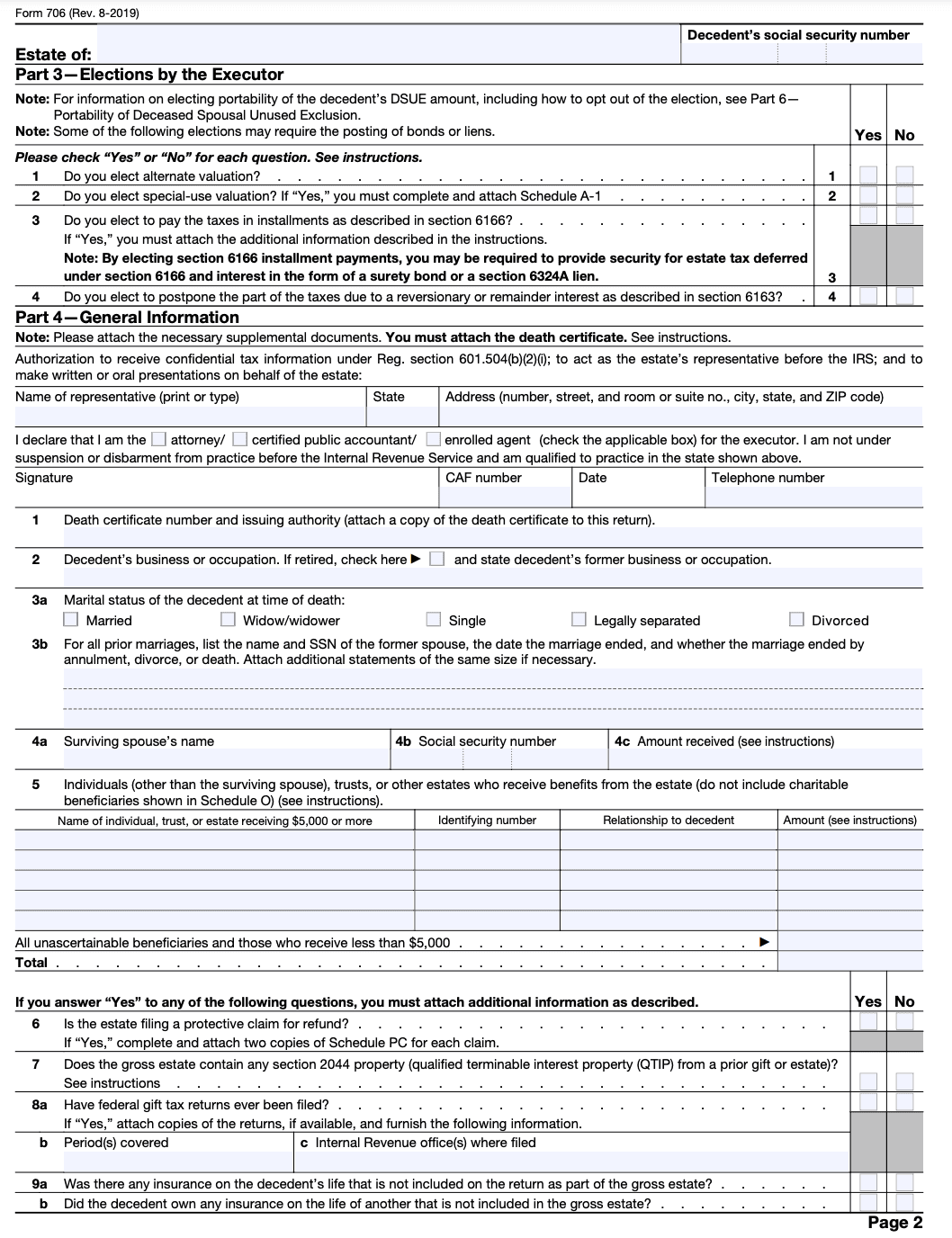

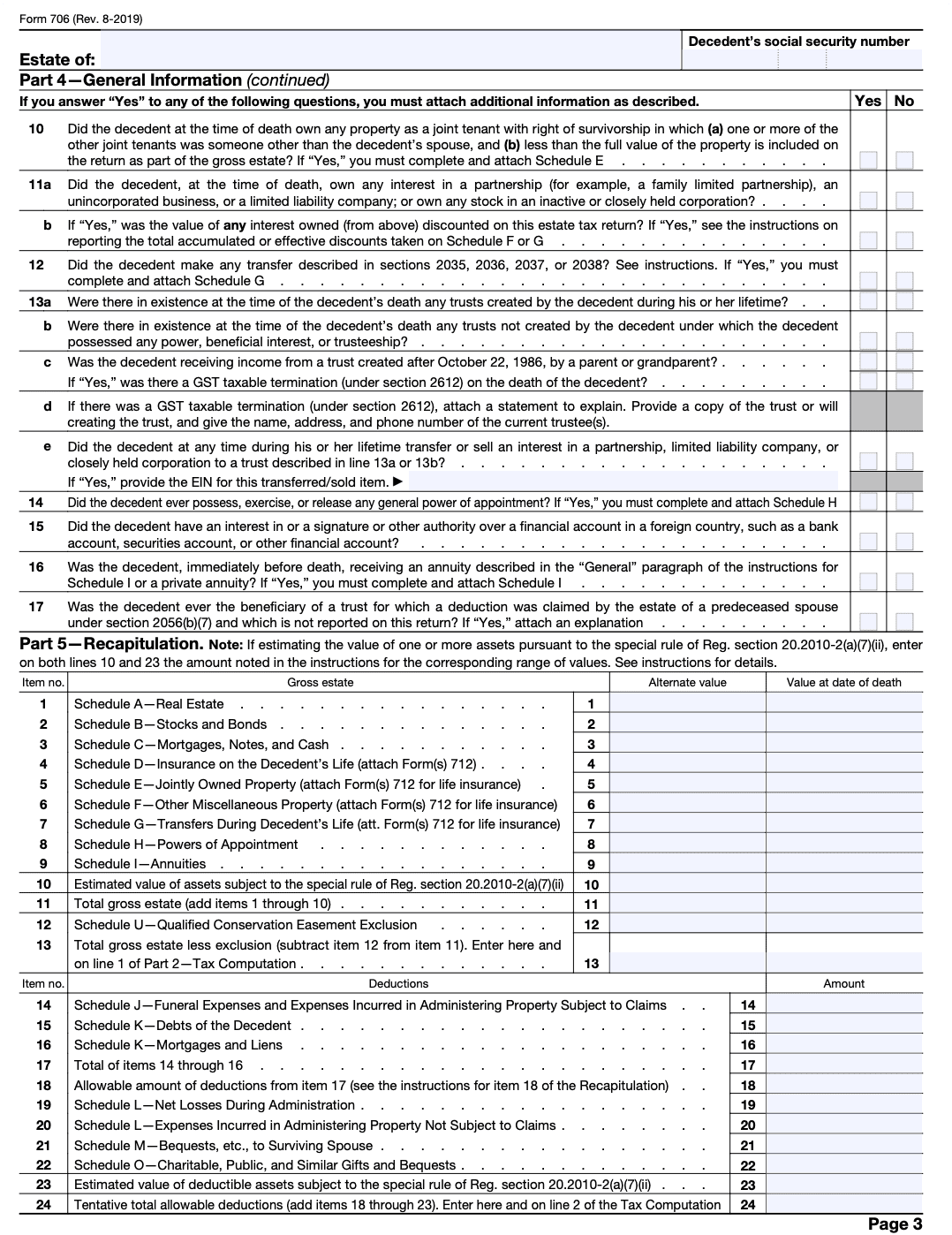

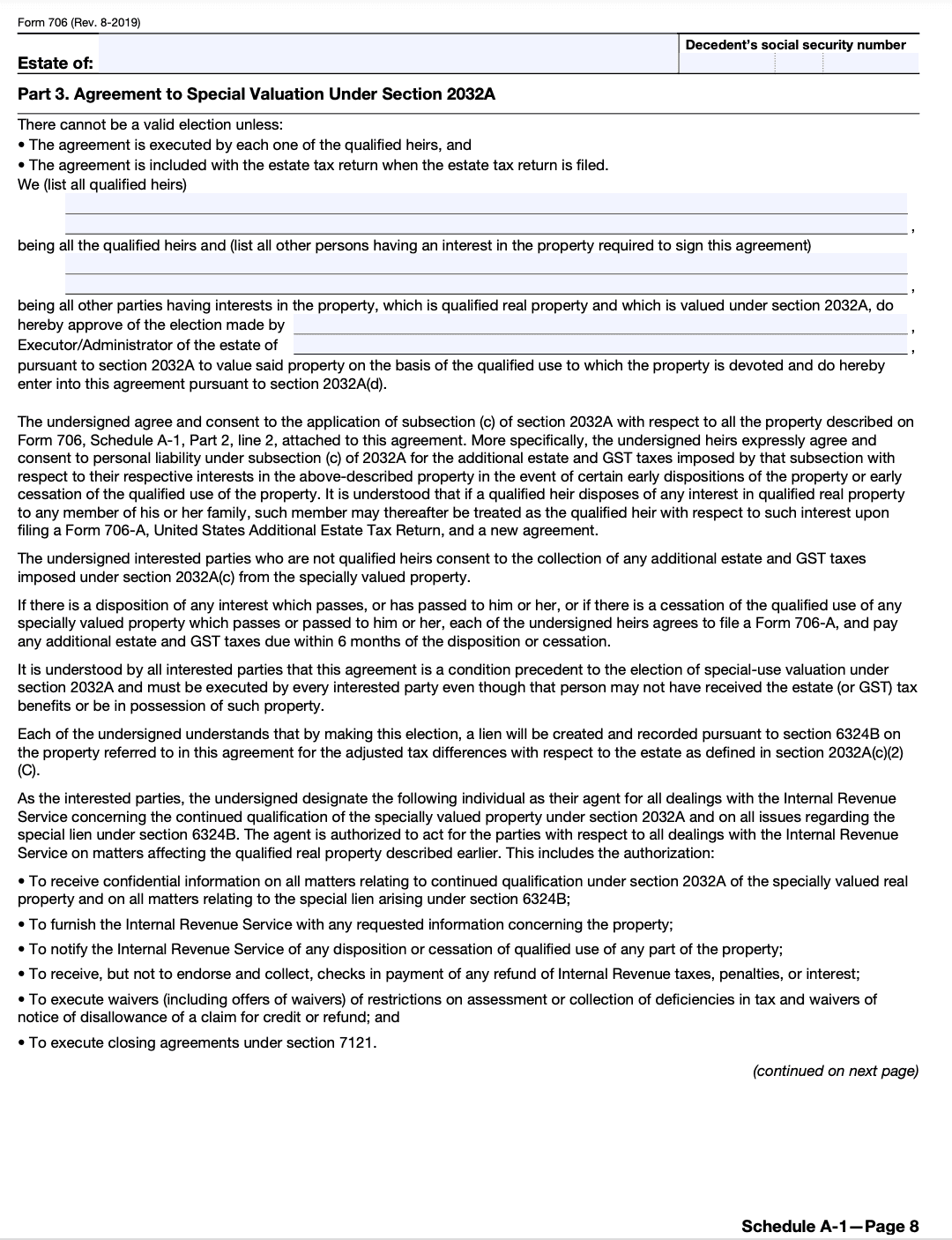

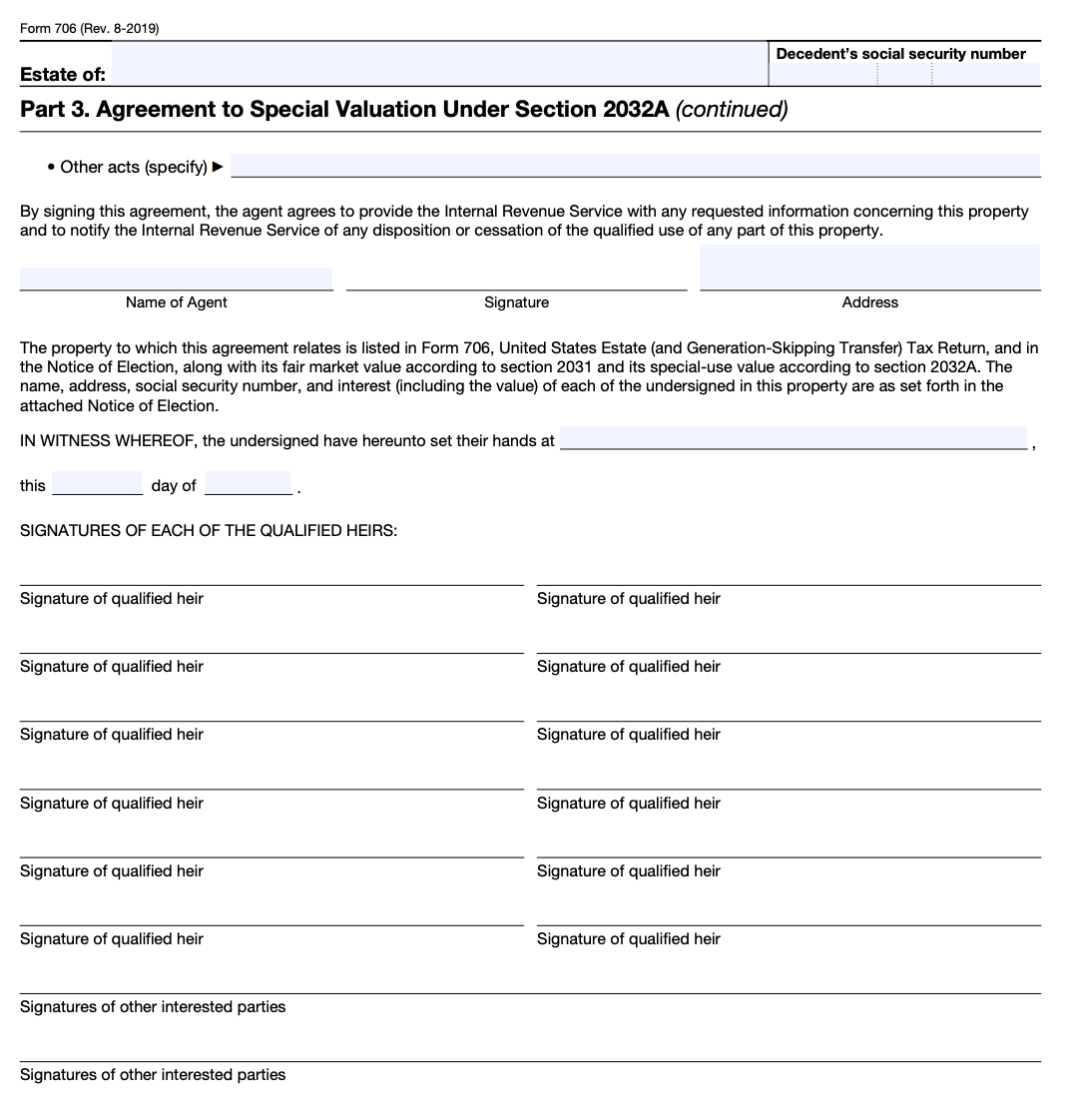

Step 4: Complete Part 3 - Recapitulation

In Part 3, summarize the estate's calculation by entering the totals from Part 2 and applying certain adjustments as instructed in the form.

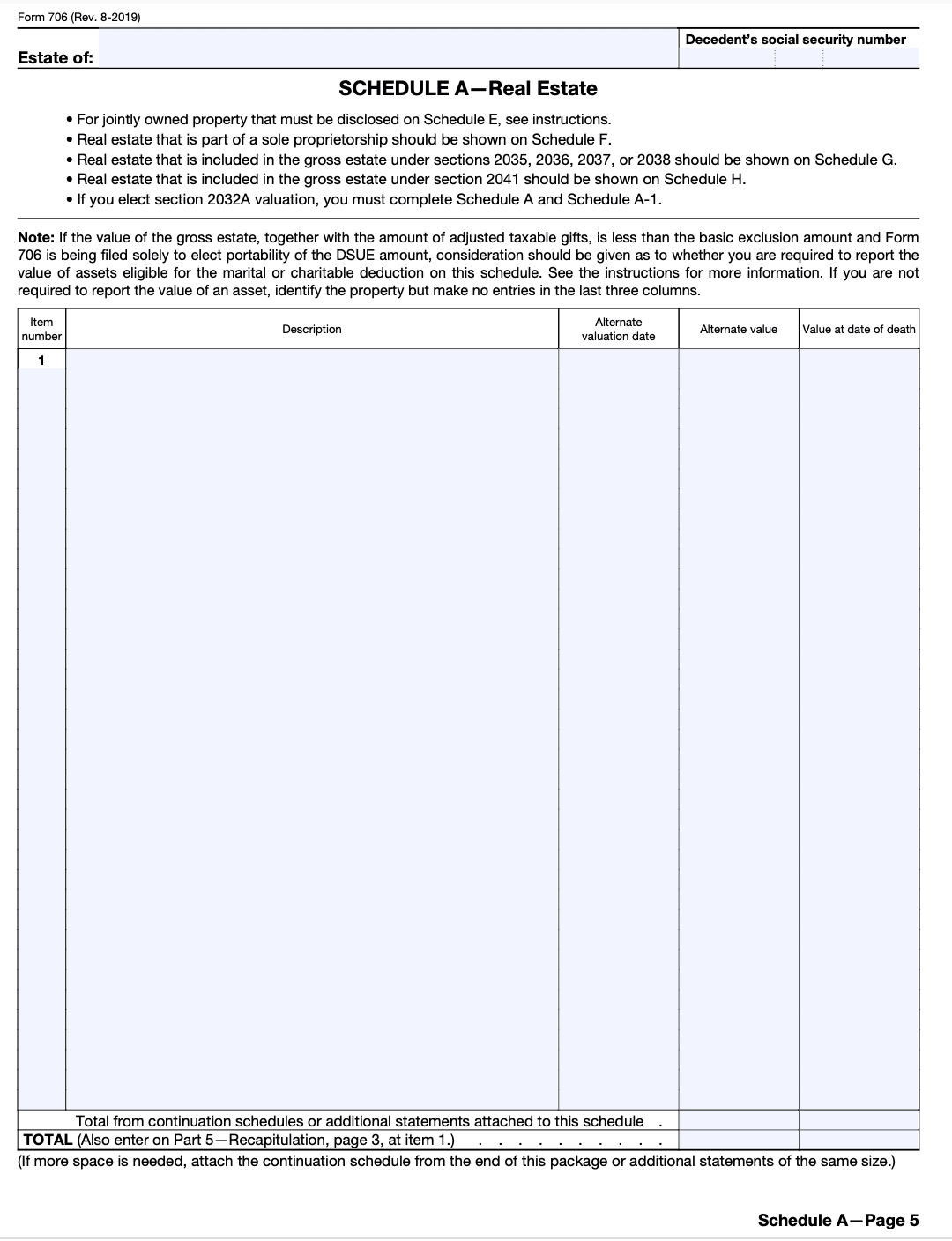

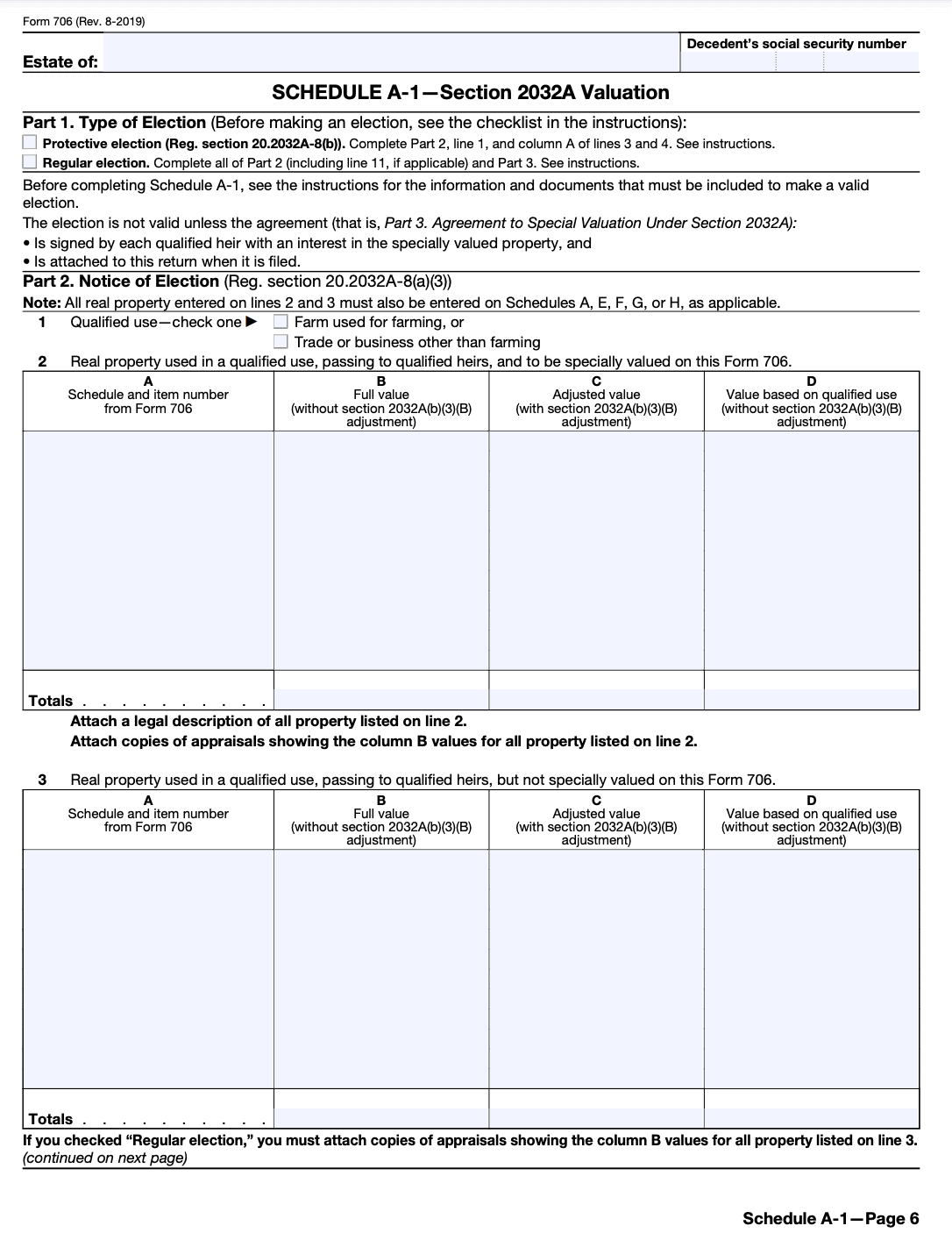

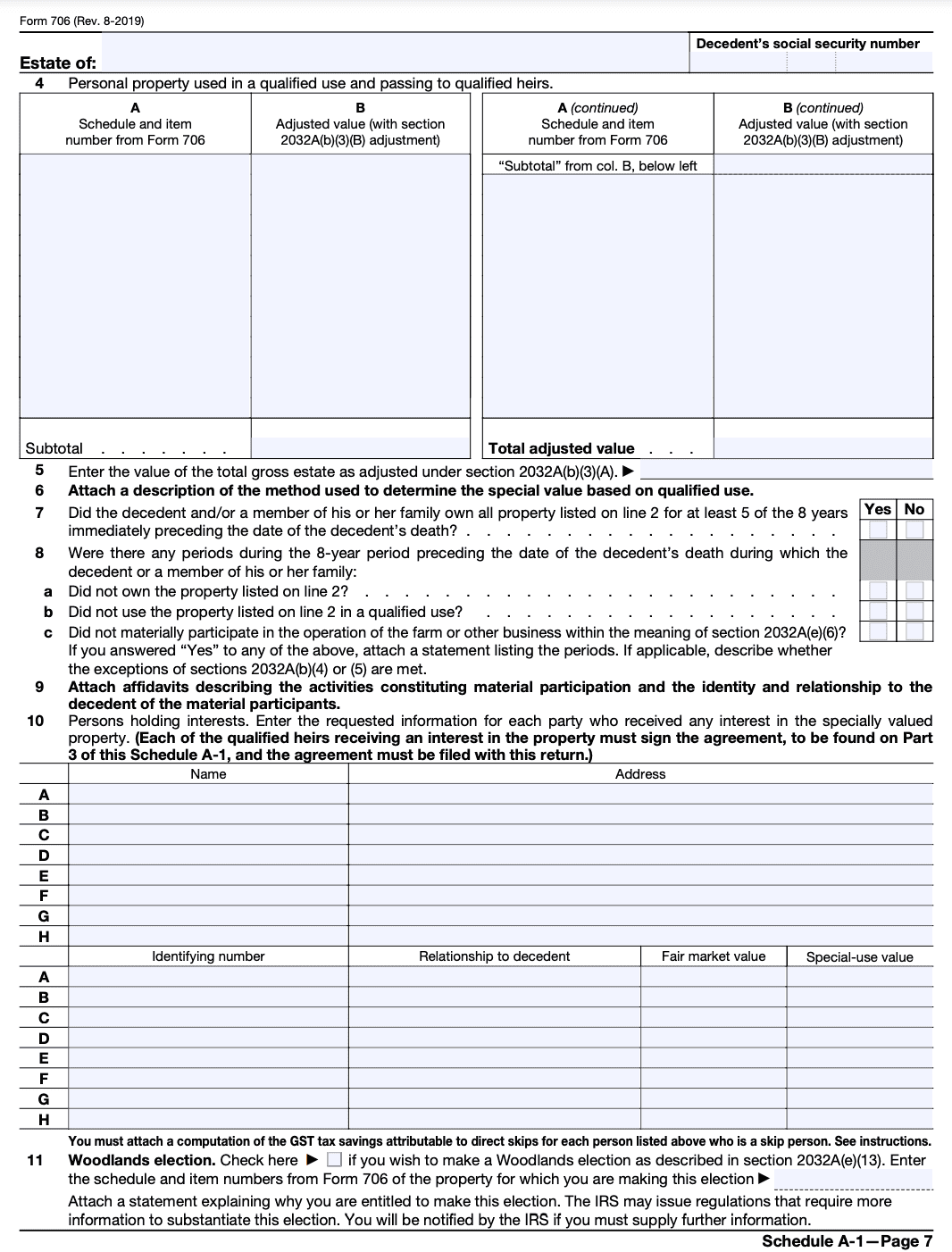

Step 5: Complete Schedule A - Real Estate

If the estate includes real estate, complete Schedule A. Provide details of each property, including its address, fair market value, and any encumbrances or mortgages.

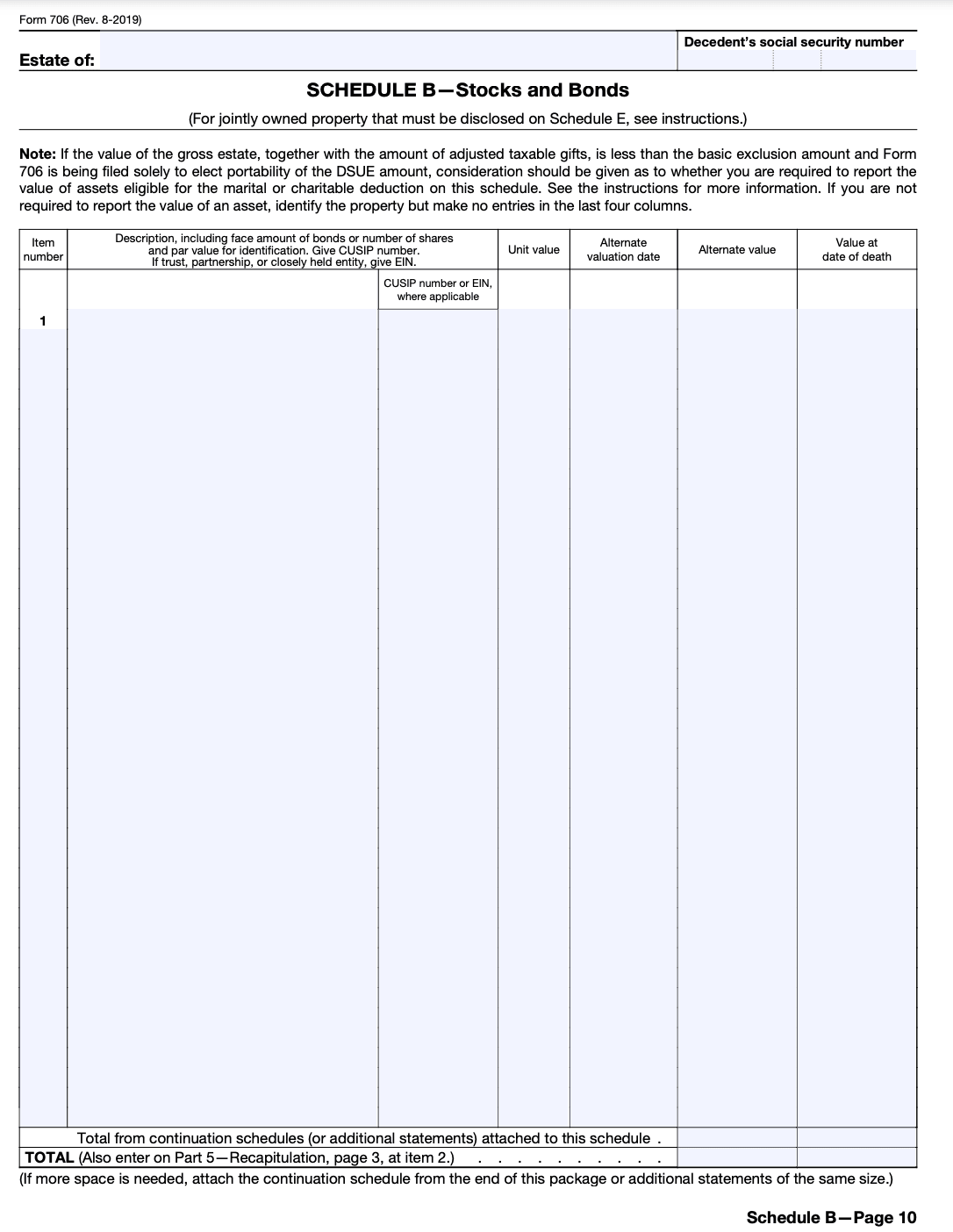

Step 6: Complete Schedule B - Stocks and Bonds

If the estate includes stocks and bonds, complete Schedule B. Provide information about each security, including the number of shares, their value, and any related debts or encumbrances.

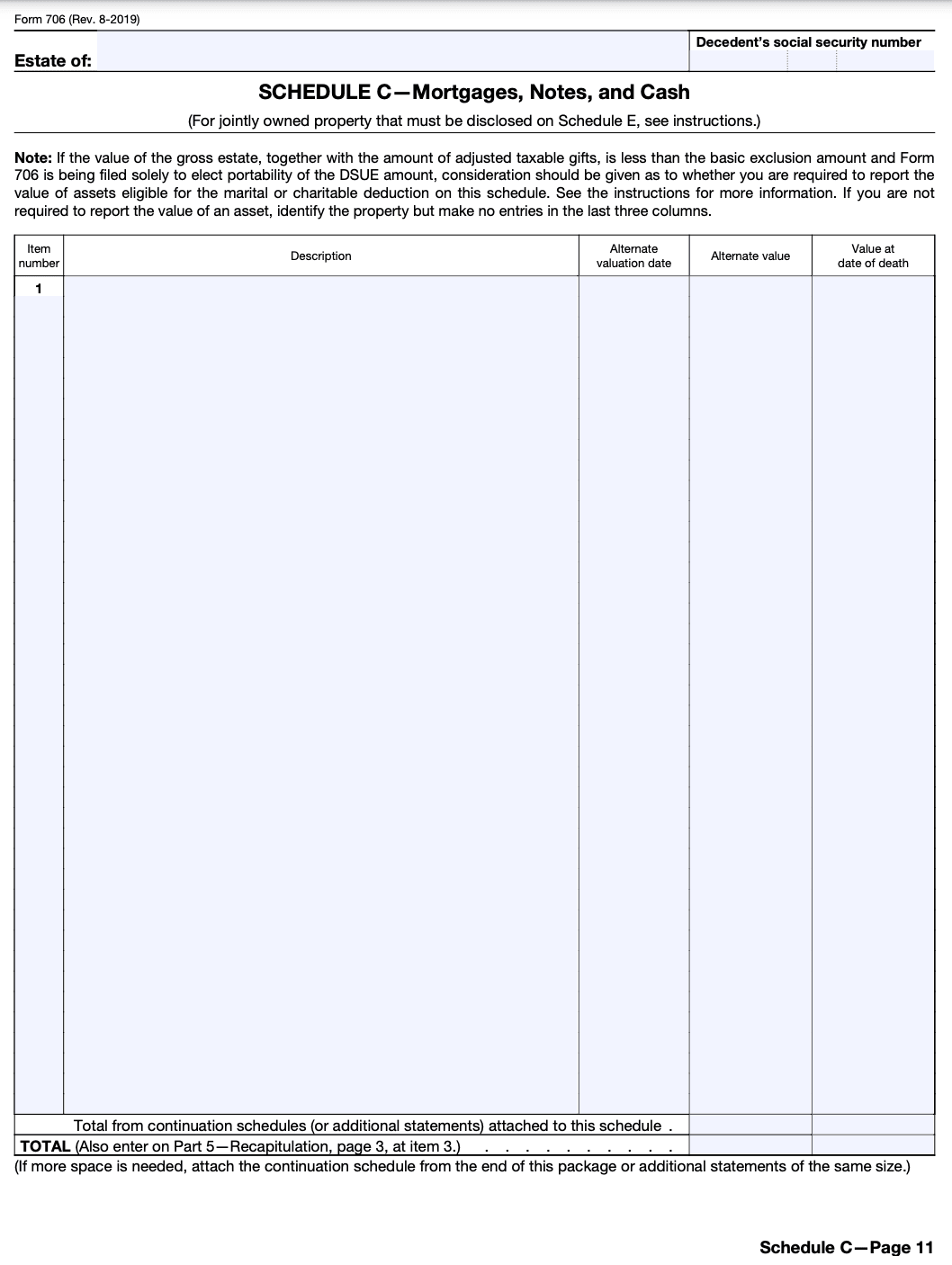

Step 7: Complete Schedule C - Mortgages, Notes, and Cash

If the estate has mortgages, notes, or cash, complete Schedule C. List each item separately, including its value, the interest rate, and the date of maturity.

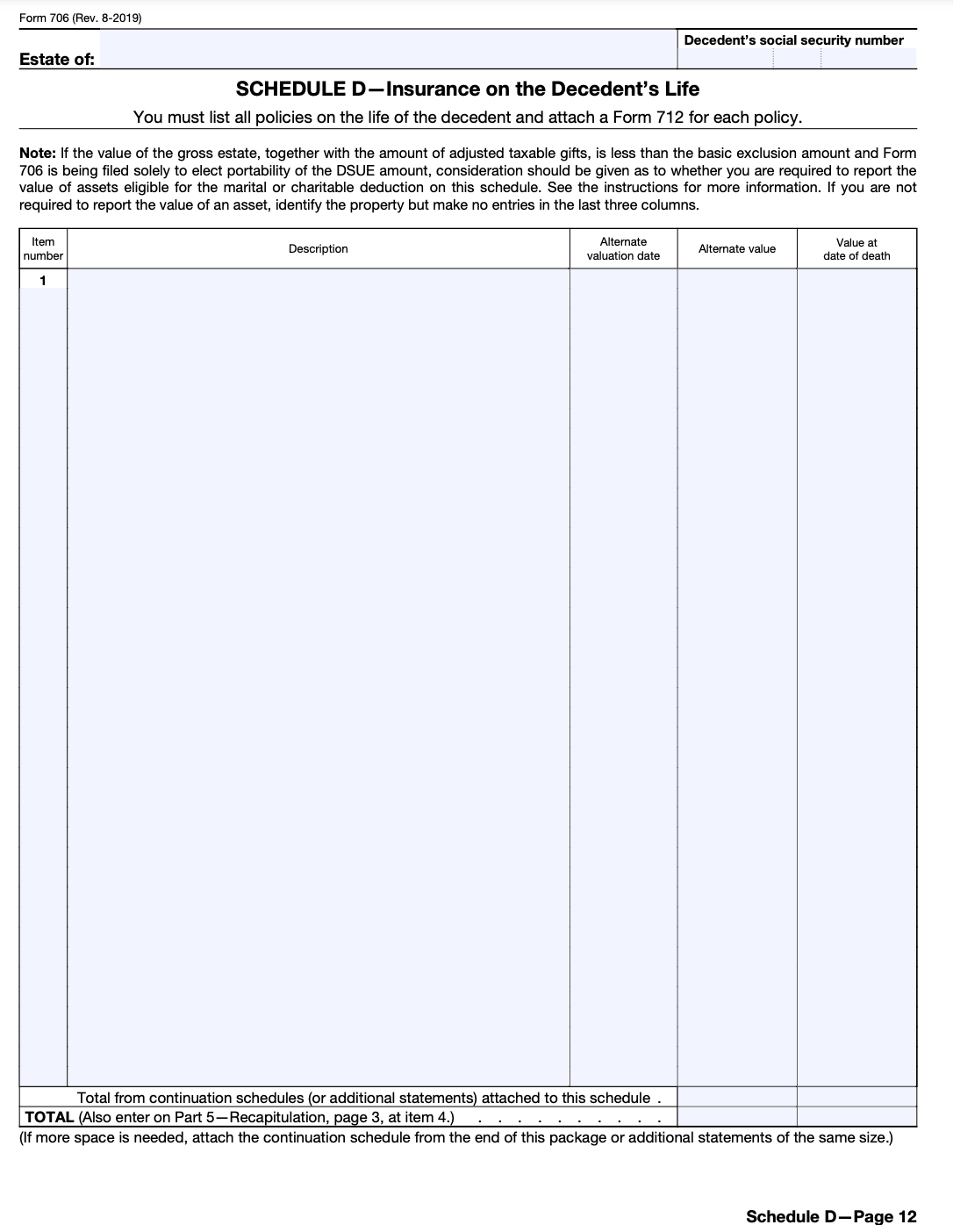

Step 8: Complete Schedule D - Insurance on the Decedent's Life

If the decedent had life insurance policies, complete Schedule D. Enter the details of each policy, including the face value and the amount payable to the estate.

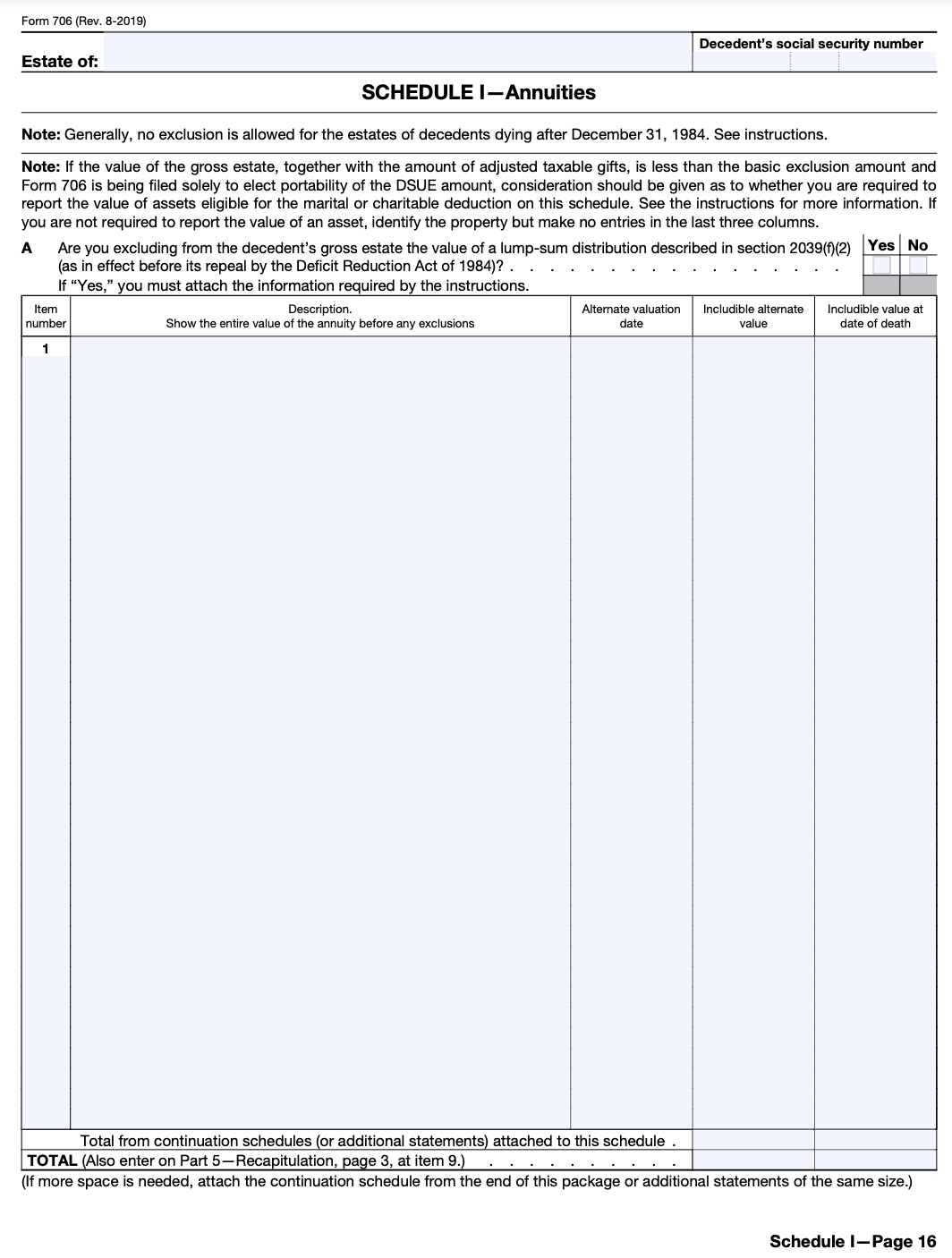

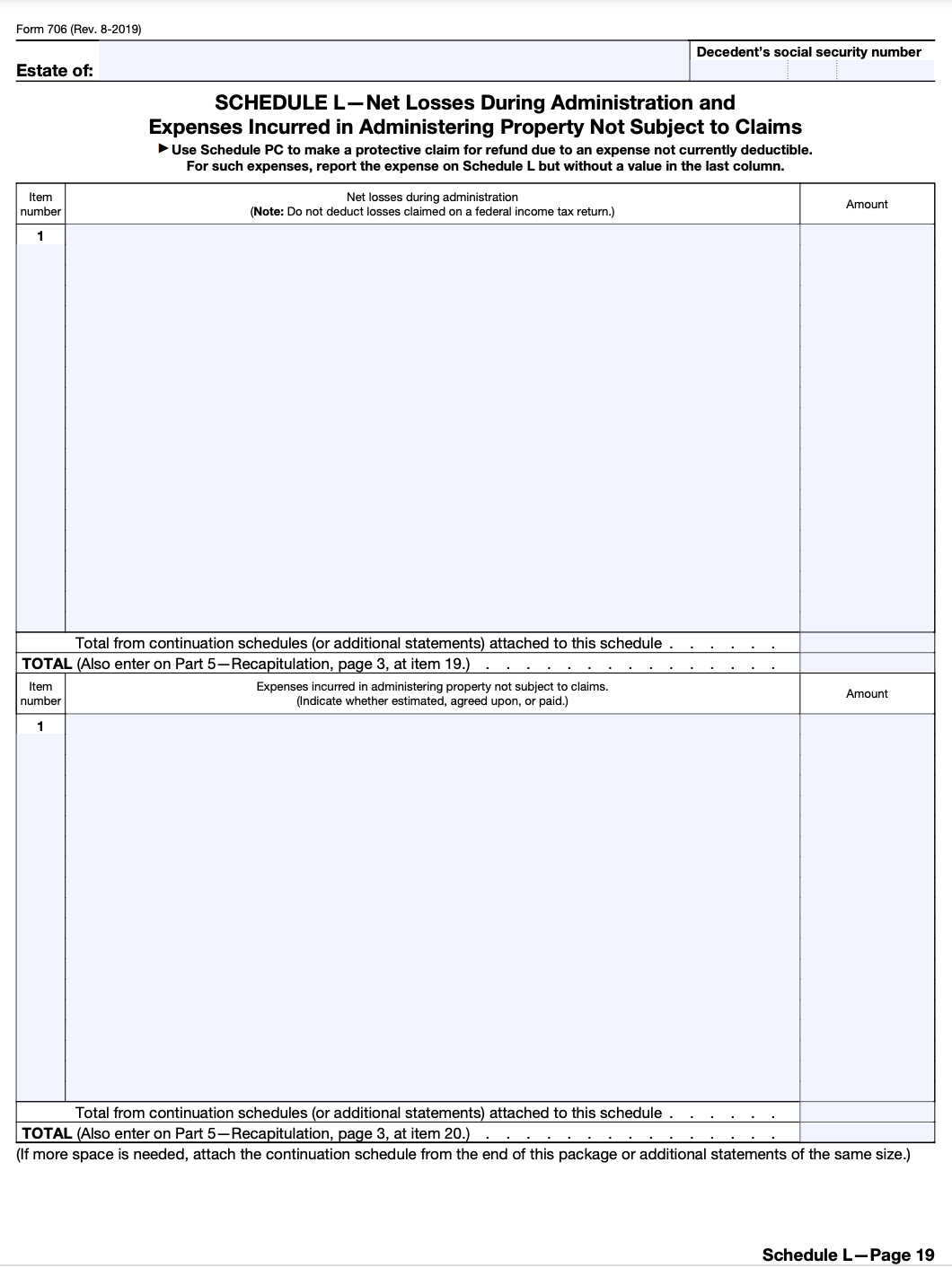

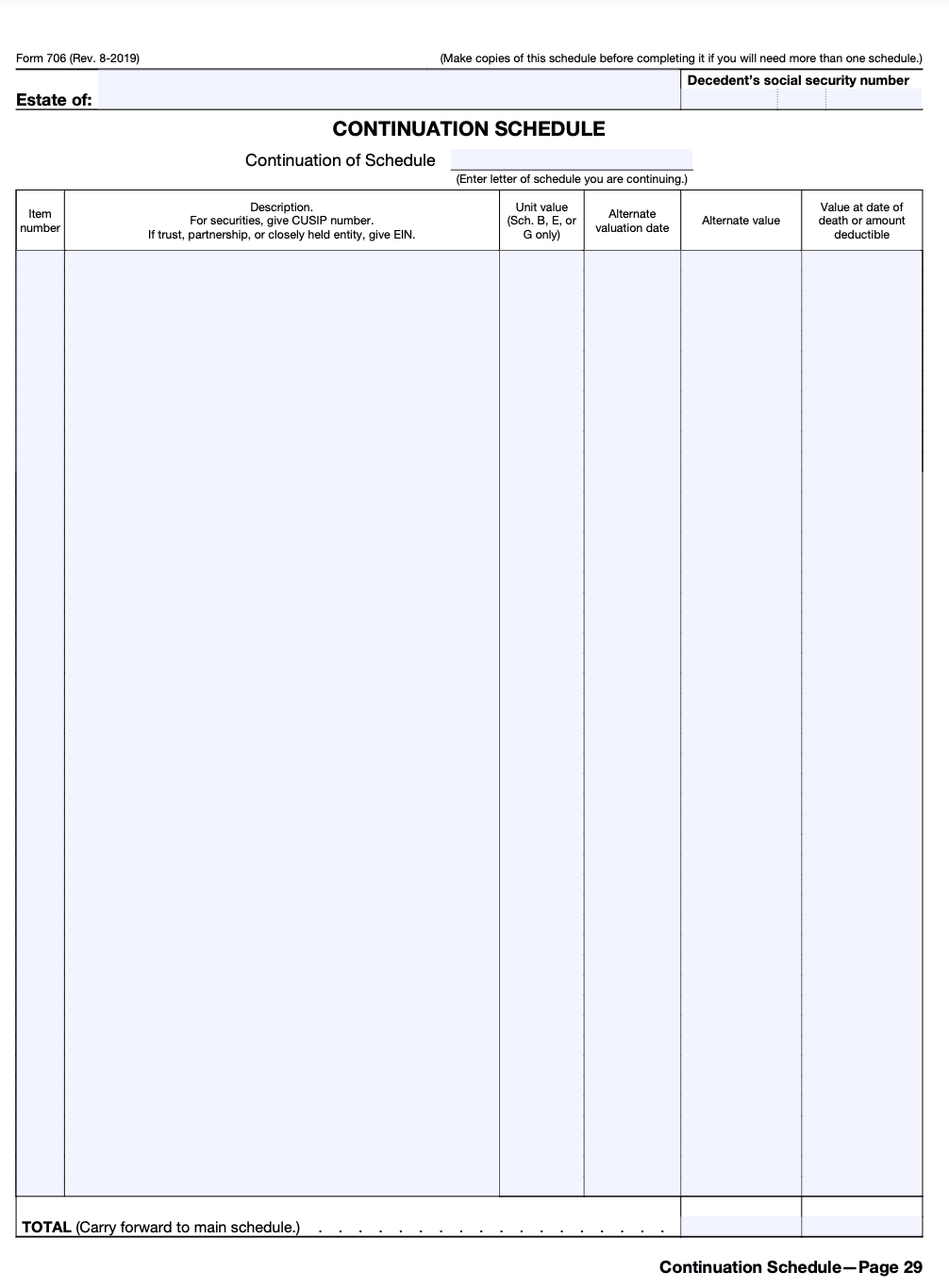

Step 9: Complete additional schedules if necessary

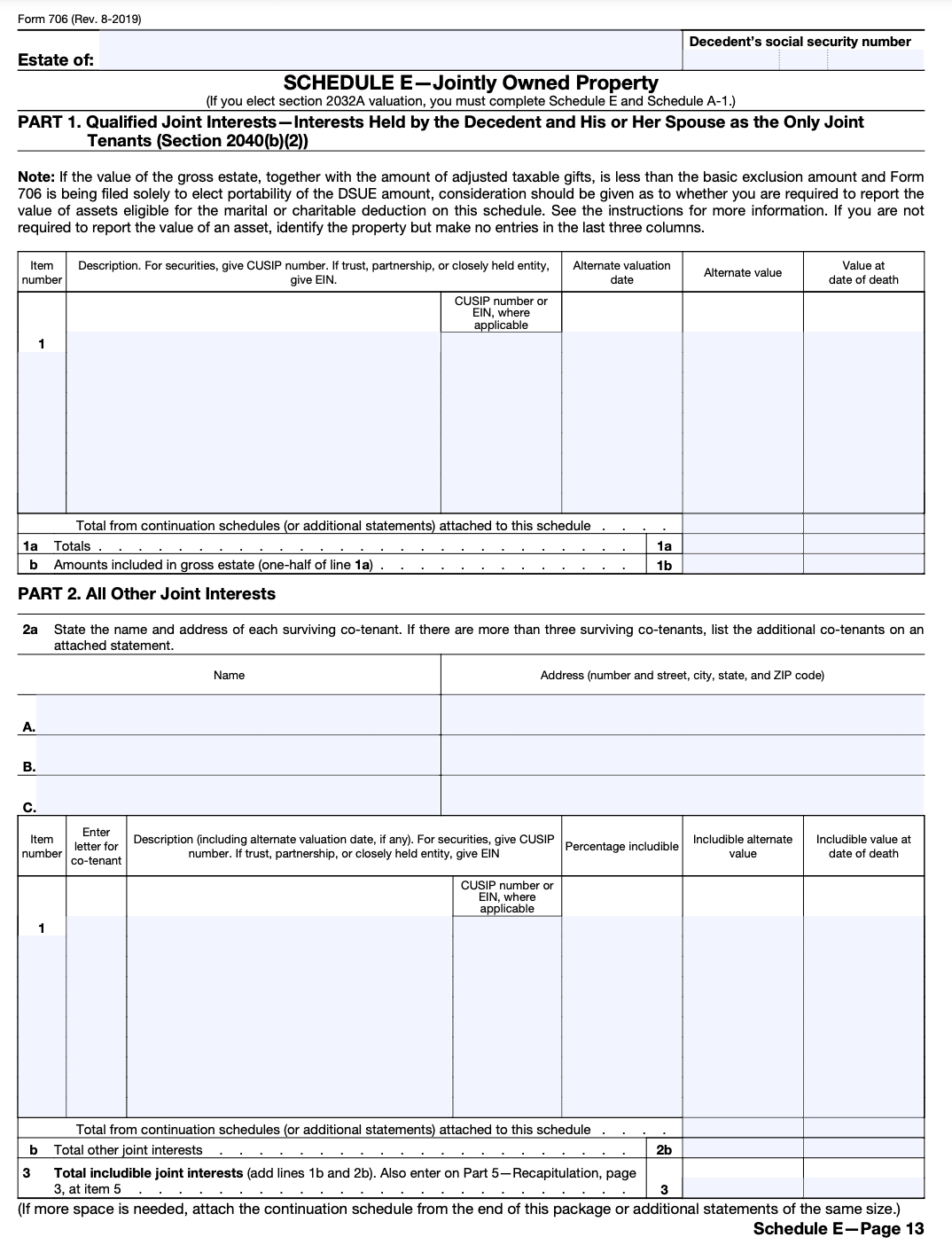

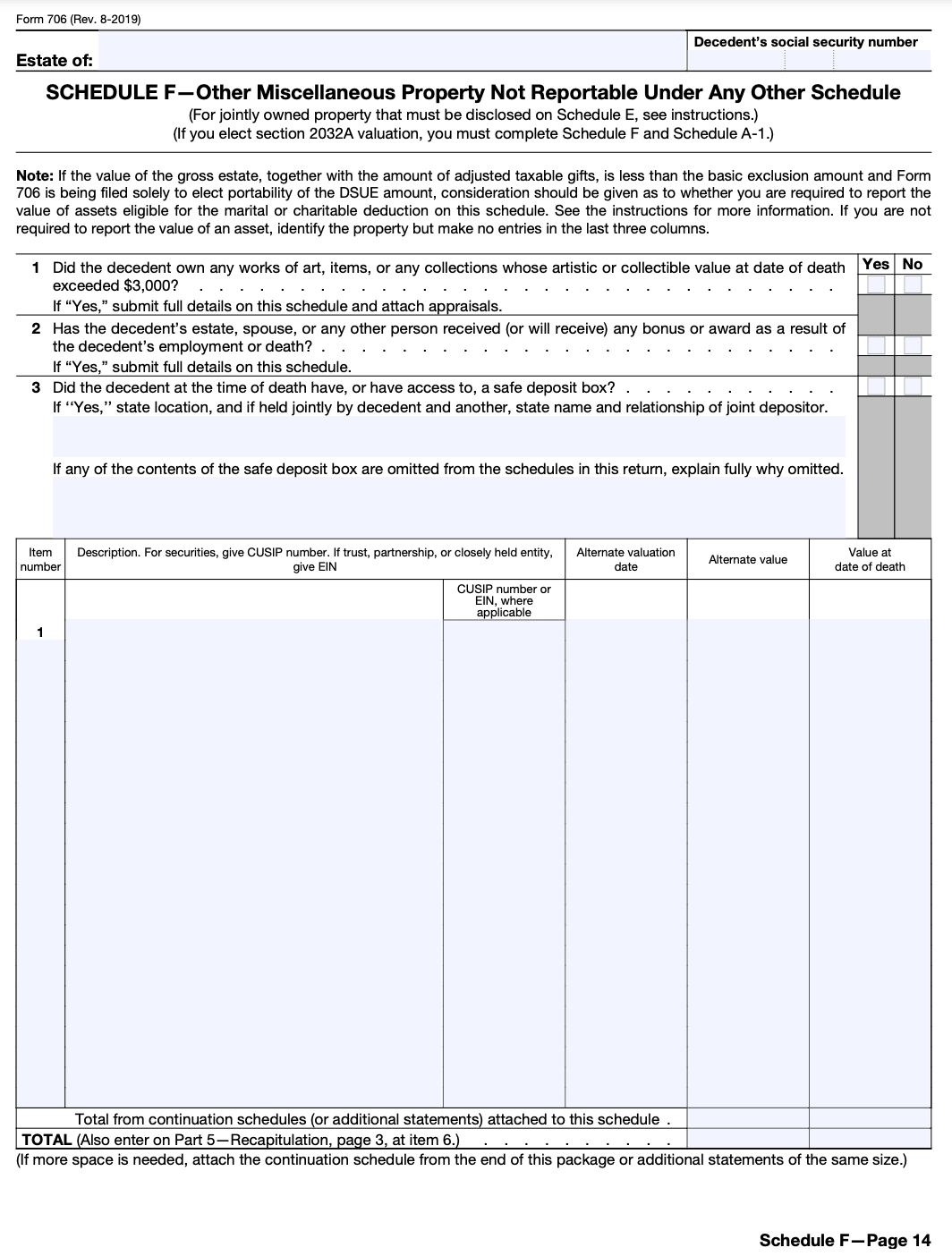

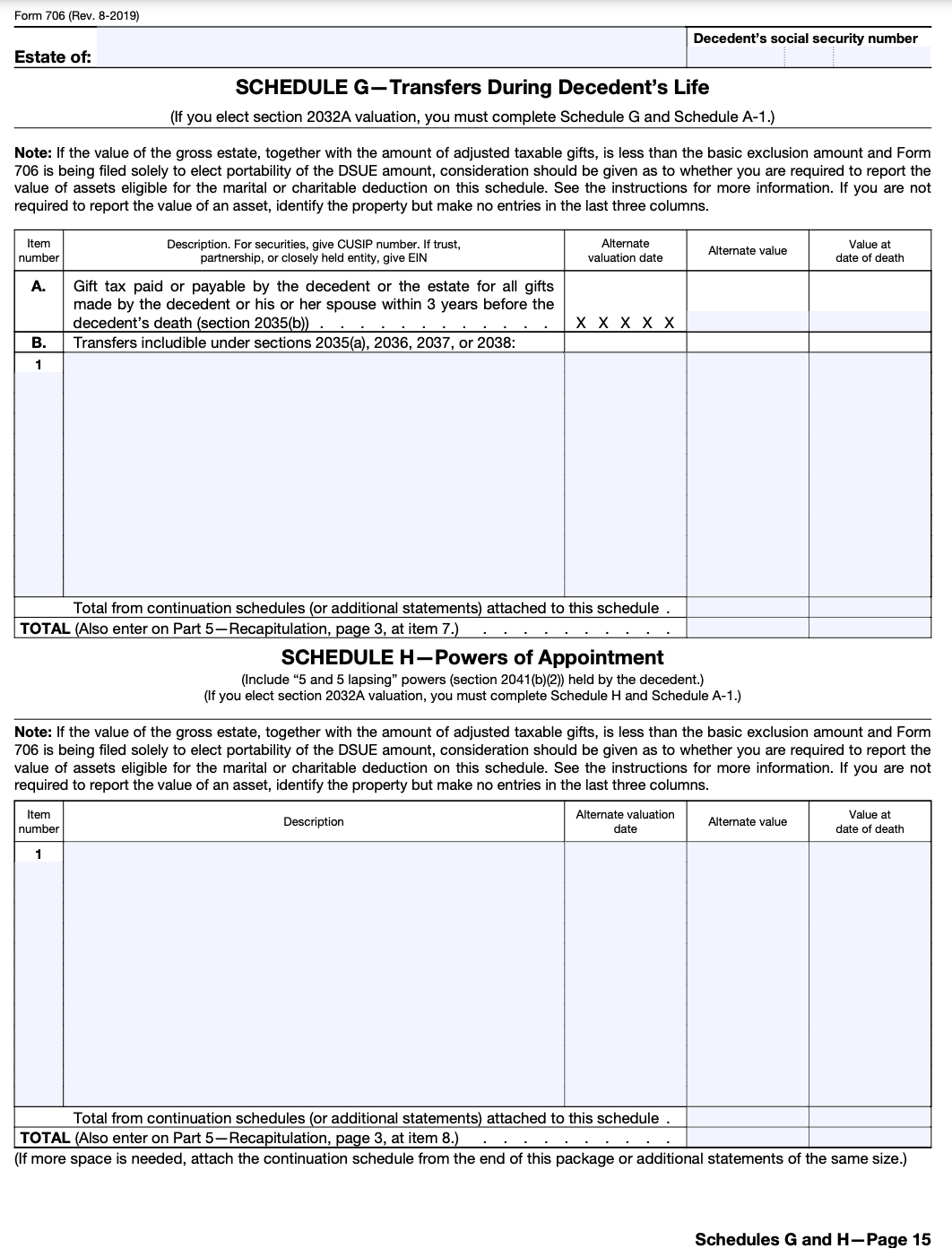

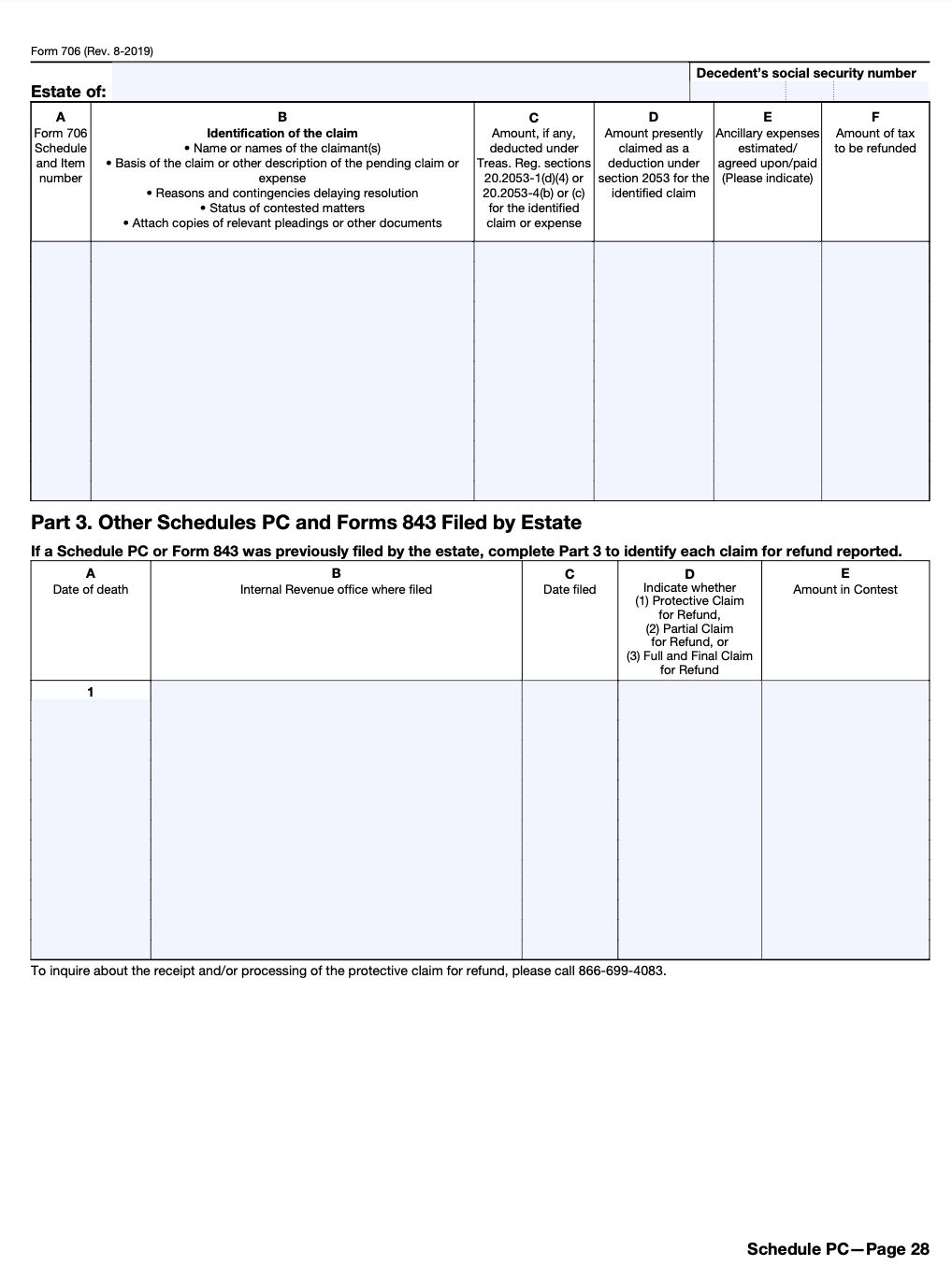

Depending on the complexity of the estate, additional schedules may be required. These can include Schedule E - Jointly Owned Property, Schedule F - Other Miscellaneous Property, and Schedule G - Transfers During Decedent's Life.

Step 10: Review and sign Form 706

Carefully review all the information provided on Form 706 and attached schedules to ensure accuracy. Once reviewed, the executor or personal representative should sign the form, certifying that the information is complete and accurate to the best of their knowledge.

Step 11: Submit Form 706

Make a copy of the completed Form 706 and all supporting documentation for your records. File the original form with the Internal Revenue Service (IRS) within nine months of the decedent's date of death. Mail the form to the appropriate address specified in the instructions for Form 706.

Special Considerations When Filing Form 706

When filing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, there are several special considerations to keep in mind. Here are some key points to consider:

Filing thresholds: Determine if you are required to file Form 706. As of my knowledge cutoff in September 2021, the filing threshold for Form 706 is generally applicable if the gross estate plus adjusted taxable gifts exceed $11.7 million (for individuals) or $23.4 million (for married couples filing jointly). However, it's important to consult the current tax laws or a tax professional for the most up-to-date information, as these thresholds may have changed.

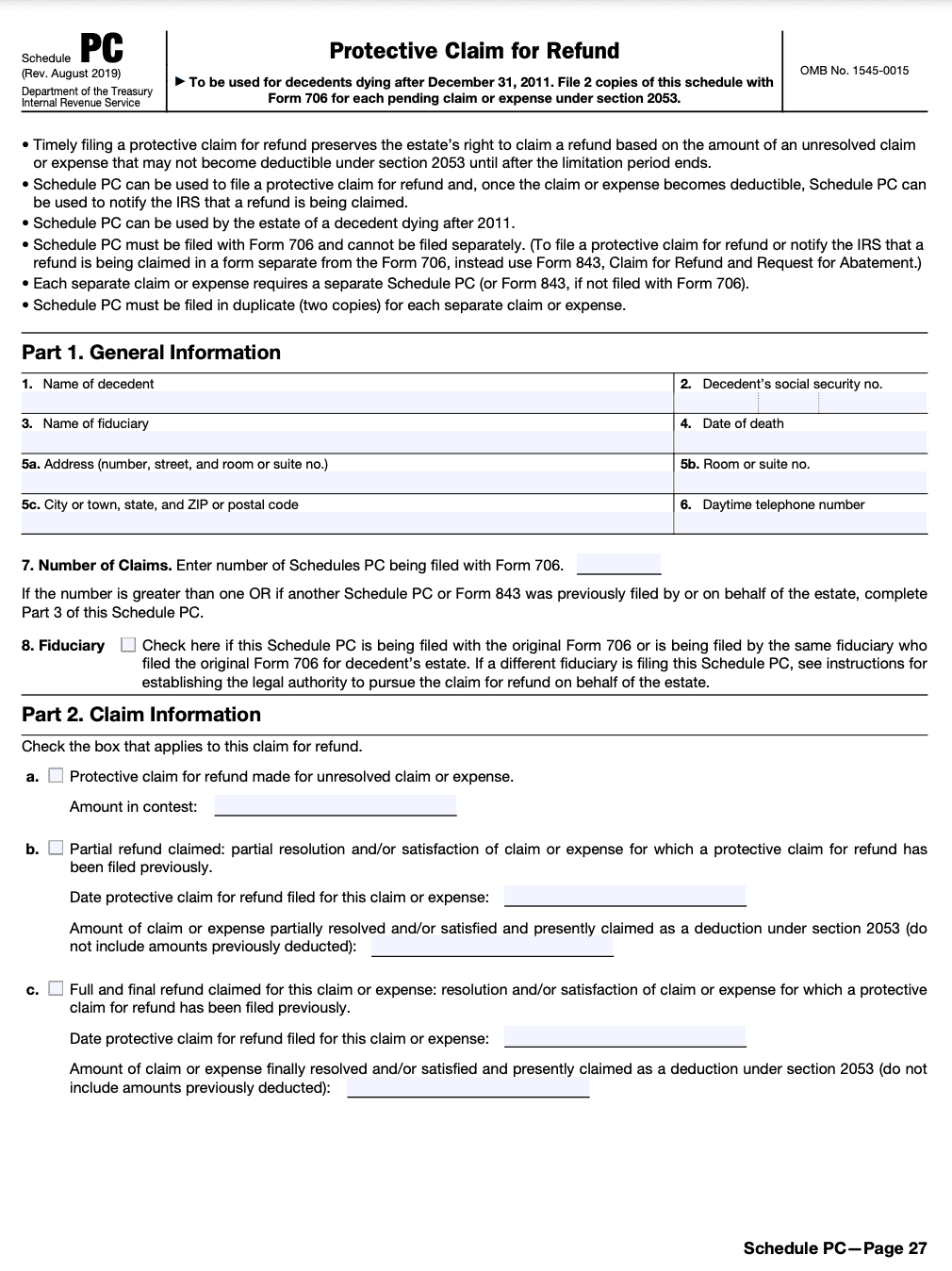

Due date: Form 706 is generally due nine months after the date of death of the decedent. However, you may request a six-month extension if needed.

Valuation of assets: Accurate valuation of assets is crucial when completing Form 706. It's important to assess the fair market value of all assets owned by the decedent at the time of their death. This includes real estate, securities, business interests, and other assets. Consult IRS guidelines or a qualified appraiser for proper valuation methods.

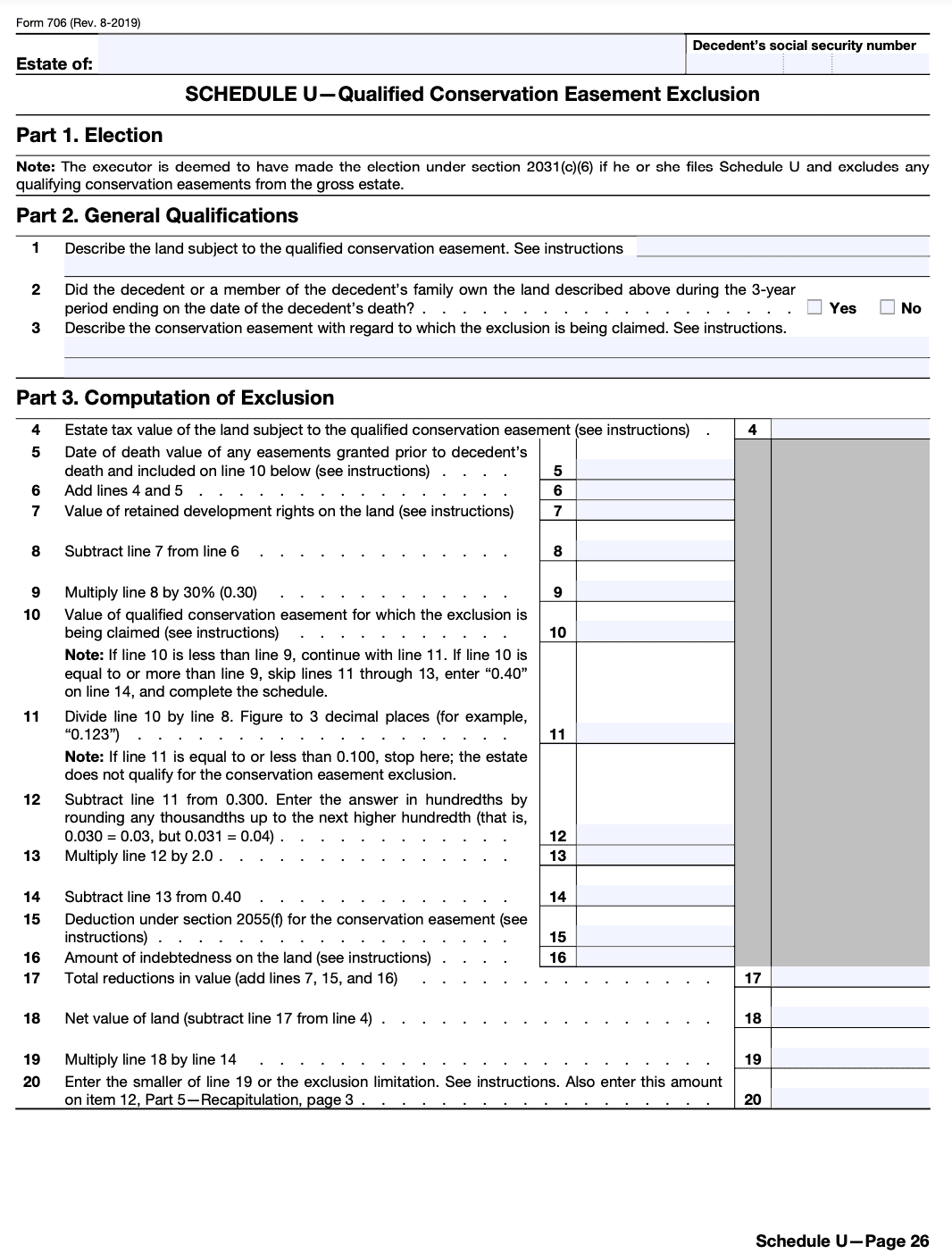

Deductions and exclusions: Familiarize yourself with available deductions and exclusions. There are various deductions and exclusions available, such as the marital deduction, charitable deductions, and the unified credit. Understanding and properly applying these provisions can significantly impact the estate tax liability.

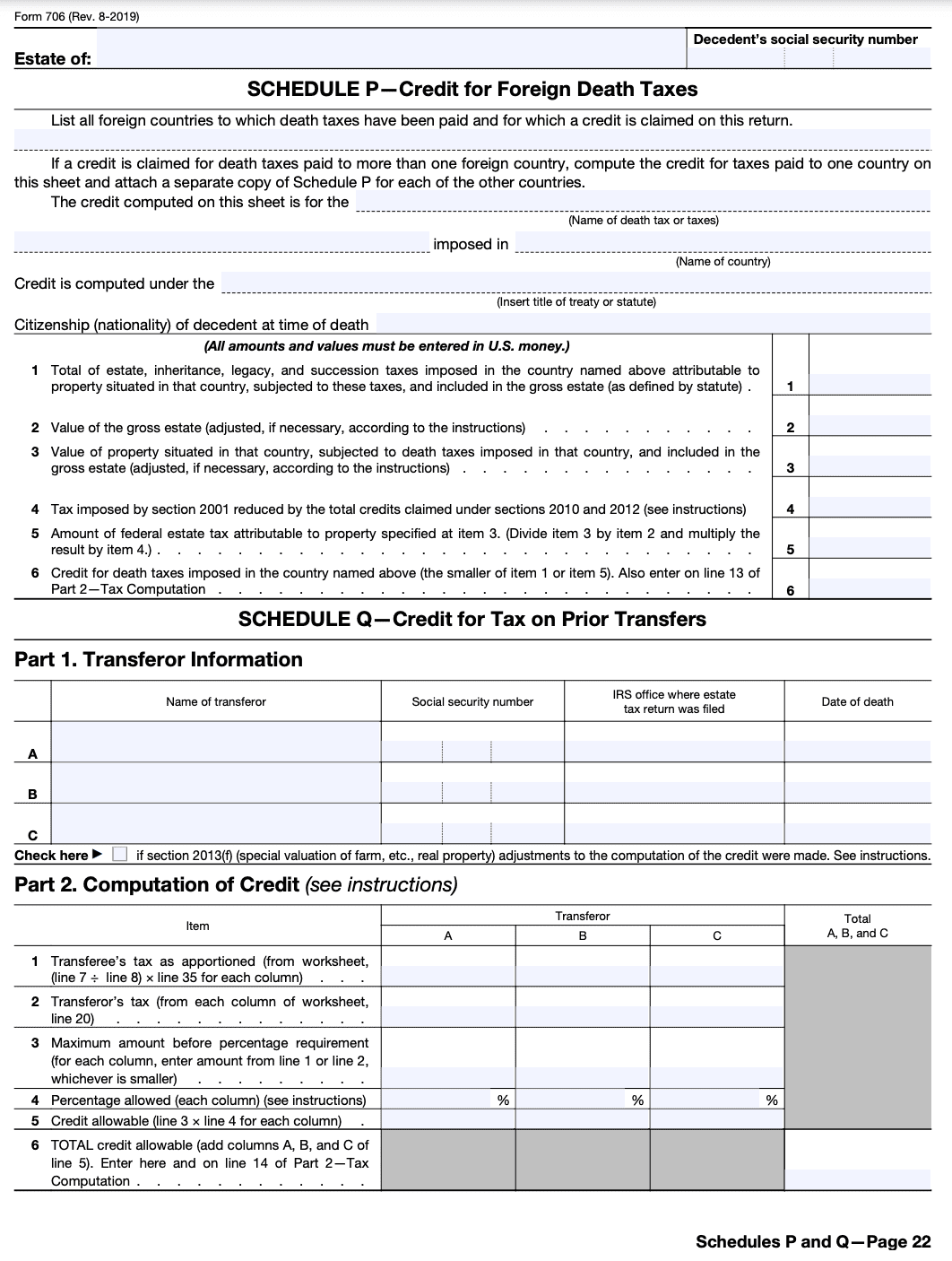

Generation-skipping transfer (GST) tax: If there are transfers to skip persons (typically grandchildren or unrelated individuals more than one generation below the decedent), it may trigger the GST tax. Special rules and reporting requirements apply in these cases. Consult tax professionals for guidance on handling GST tax issues.

Supporting documentation: Maintain accurate and detailed records to support the information reported on Form 706. This includes documentation of asset valuations, appraisals, supporting schedules, and other relevant documents. Retain these records for future reference and potential audits.

State estate taxes: In addition to federal estate tax, some states impose their own estate or inheritance taxes. Be aware of the state-specific requirements and filing obligations. Consult the appropriate state tax agency or a tax professional for guidance.

Consult a tax professional: Due to the complexity of estate tax laws and potential implications, it's advisable to consult with a qualified tax professional or estate planning attorney. They can provide personalized advice based on your specific circumstances and ensure accurate and compliant filing of Form 706.

How To File Form 706: Offline/Online/E-filing

To file Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, you have the option to file it offline or online through e-filing. Here's a breakdown of the different methods:

Offline filing

a. Obtain a physical copy of Form 706: You can download the form from the official website of the Internal Revenue Service (IRS) or request a printed copy by calling the IRS forms hotline at 1-800-TAX-FORM (1-800-829-3676).

b. Complete the form: Fill out the necessary information on Form 706 manually. Make sure to provide accurate details about the decedent's estate, assets, deductions, and any applicable taxes.

c. Attach supporting documentation: Gather and attach any required supporting documentation, such as appraisals, valuations, and relevant schedules.

d. Sign and mail the form: Once the form is complete, sign it and mail it to the appropriate IRS address based on your state. You can find the correct mailing address in the instructions accompanying Form 706.

Online filing

a. Access the IRS Modernized e-File (MeF) system: Visit the official IRS website and go to the MeF system for e-filing estate tax returns.

b. Create an account: If you don't have an account, you will need to create one by providing the necessary information.

c. Complete the form online: Follow the instructions provided by the MeF system to complete the Form 706 electronically. Enter all the required information accurately and thoroughly.

d. Attach electronic copies of supporting documentation: Scan and upload the required supporting documentation as instructed by the MeF system. Ensure that the documents are legible and in the accepted file formats.

e. Review and submit: Carefully review all the information provided on the form and the attached documents. Once you are satisfied with the accuracy, submit the form electronically through the MeF system.

E-filing through an authorized software provider

a. Use authorized tax software: Utilize IRS-authorized estate tax software to prepare and e-file Form 706. These software programs provide a guided approach and often include built-in error checks to ensure accuracy.

b. Follow the software instructions: Enter the required information as directed by the software, including details about the decedent's estate, assets, deductions, and any applicable taxes.

c. Attach electronic copies of supporting documentation: Scan and upload the necessary supporting documents as prompted by the software.

d. Review and submit: Thoroughly review the completed form and attached documents for accuracy. Once you are satisfied, follow the software's instructions to submit the form electronically.

Common Mistakes To Avoid While Filing Form 706

When filing Form 706, it's important to avoid certain common mistakes to ensure accurate reporting and compliance with tax regulations. Here are some common mistakes to avoid while filing Form 706:

Incomplete or missing information: Ensure that all required fields on the form are completed accurately. Double-check the accuracy of personal information, such as the decedent's name, date of birth, date of death, and Social Security number.

Incorrect valuation of assets: Properly value the decedent's assets as of the date of death. This includes real estate, investments, businesses, and other valuable items. Consult professionals like appraisers or accountants to determine the accurate fair market value.

Failure to report all assets: Report all assets that are includible in the decedent's estate, even if they are not subject to tax. This includes assets held jointly with rights of survivorship, life insurance policies, retirement accounts, and other assets that pass outside of probate.

Improper allocation of deductions and exemptions: Ensure that deductions and exemptions are properly allocated among the estate and any qualified transfers. Mistakes in allocation can result in underpaying or overpaying estate taxes.

Late filing or failure to request an extension: Form 706 must be filed within nine months of the decedent's date of death. If more time is needed, request an extension using Form 4768. Failure to file on time or request an extension may result in penalties and interest.

Inaccurate or missing supporting documentation: Include all necessary supporting documentation, such as appraisals, inventory lists, and relevant schedules. Inadequate or missing documentation can lead to delays in processing the return or potential audits.

Failure to report generation-skipping transfers: If there are any generation-skipping transfers (transfers to individuals at least two generations below the decedent), ensure they are properly reported on Schedule R.

Incorrect calculation of tax liability: Double-check all calculations, including the taxable estate, tax rates, deductions, and credits. Math errors can lead to incorrect tax liability and potential penalties.

Neglecting to consider state-level estate tax requirements: Different states may have their own estate tax laws and filing requirements. Be sure to understand and comply with the specific regulations of the state where the decedent resided.

Not seeking professional advice when needed: Estate tax laws can be complex, and mistakes can be costly. Consider consulting with a qualified estate tax attorney or tax professional to ensure accurate filing and to address any specific circumstances or questions.

Conclusion

Form 706 plays a vital role in the estate tax planning process, allowing the IRS to determine the accurate estate tax liability owed by a deceased individual's estate. Executors must complete the form accurately and provide all necessary information about the decedent's assets, deductions, and liabilities.

Understanding the intricacies of Form 706 can help ensure compliance with estate tax laws and avoid unnecessary penalties or disputes. Seeking professional assistance from an estate attorney or tax advisor can be beneficial in navigating the complexities of estate taxation and ensuring a smooth filing process.