- IRS forms

- Schedule D (Form 1041)

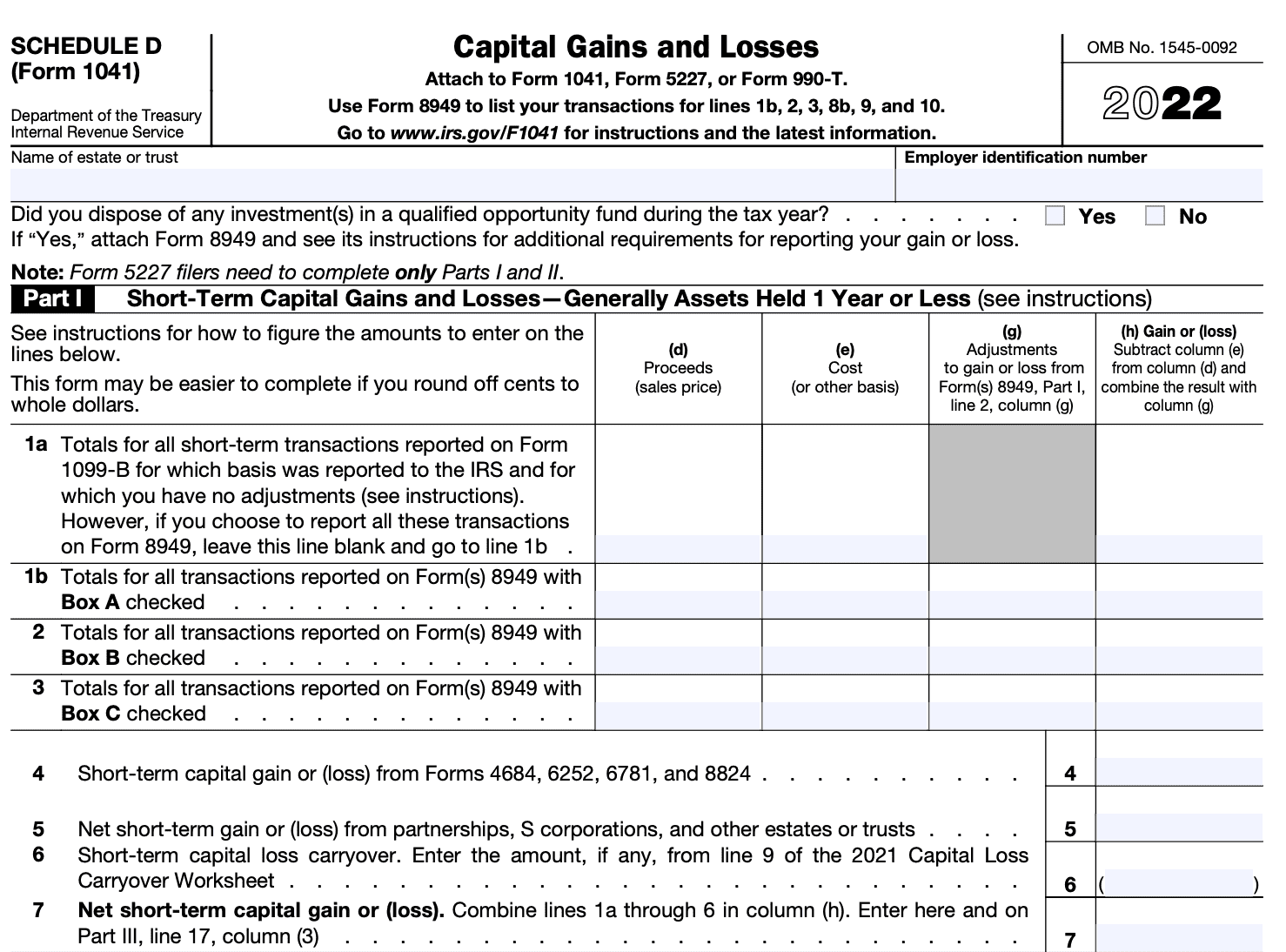

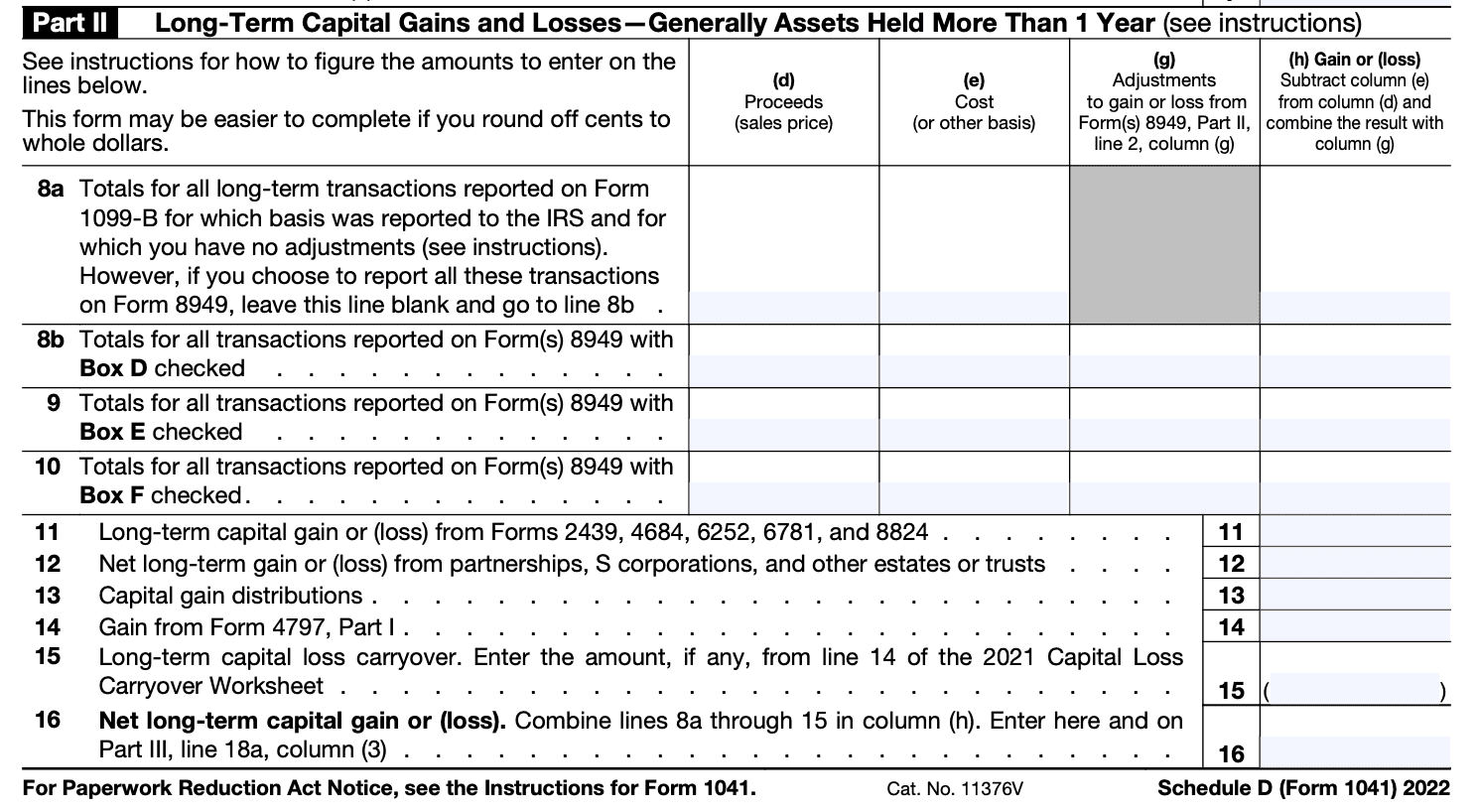

Schedule D (Form 1041): Capital Gains and Losses

Download Schedule D (Form 1041)When it comes to filing taxes for an estate or trust, Schedule D (Form 1041) plays a crucial role in reporting capital gains and losses. This form helps calculate the taxable income from investments, such as stocks, bonds, and real estate, and determines the associated tax liability. Understanding how to complete Schedule D is essential for estate executors, trustees, and tax professionals to ensure accurate reporting and compliance with the Internal Revenue Service (IRS) regulations.

Schedule D (Form 1041) is an attachment to Form 1041, which is used to report income, deductions, and taxes for estates and trusts. It specifically focuses on capital gains and losses arising from the sale or exchange of investment assets during the tax year. By completing this form, the filer calculates the net capital gain or loss and determines the taxable income.

In this blog post, we will delve into the intricacies of Schedule D (Form 1041) and provide a comprehensive overview of capital gains and losses.

Purpose of Schedule D (Form 1041)

The purpose of Schedule D is to calculate the net capital gain or loss for an estate or trust during the tax year. Capital gains or losses arise when assets, such as stocks, bonds, real estate, or other investments, are sold or disposed of. The schedule helps determine the taxable portion of these gains or losses, which are subject to specific tax rates.

On Schedule D, you would report information such as the description and sale proceeds of each asset sold, its cost or basis, and the resulting capital gain or loss. The net capital gain or loss from Schedule D is then carried over to Form 1041, where it is included in the overall taxable income calculation for the estate or trust.

It's important to note that Schedule D is not used for reporting personal capital gains and losses on individual tax returns (Form 1040). For individuals, capital gains and losses are typically reported on Schedule D (Form 1040) or on Form 8949, depending on the type of asset and the circumstances.

Benefits of Schedule D (Form 1041)

Here are some benefits of using Schedule D:

-

Capital gains and losses: Schedule D allows estates and trusts to report capital gains and losses incurred during the tax year. By reporting these gains and losses, the estate or trust can determine their taxable income and calculate the tax liability accordingly.

-

Lower tax rates for long-term capital gains: If the estate or trust has held an asset for more than one year before selling it, the resulting gain is generally considered a long-term capital gain. Long-term capital gains are subject to lower tax rates compared to short-term capital gains, which can help reduce the overall tax liability.

-

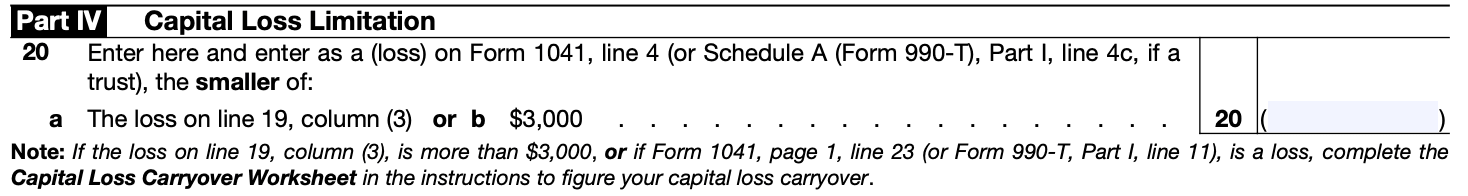

Capital loss deductions: If the estate or trust incurs capital losses during the tax year, these losses can be used to offset capital gains. If the capital losses exceed the capital gains, the excess loss can be deducted against other types of income, such as ordinary income, up to certain limits. This can help reduce the taxable income and the associated tax liability.

-

Carryover of capital losses: If the estate or trust has capital losses that cannot be fully deducted in the current year due to limitations, those losses can be carried over to future tax years. This allows the losses to be utilized in subsequent years, reducing the tax liability in those years.

-

Netting of capital gains and losses: Schedule D provides a mechanism for netting capital gains and losses. By offsetting capital gains with capital losses, the estate or trust can potentially reduce the overall tax liability. The net capital gain or loss is then transferred to the appropriate section of the estate or trust's tax return.

-

Comprehensive reporting: Schedule D requires the estate or trust to provide detailed information about each transaction involving the sale or disposition of assets, including the date of acquisition, date of sale, cost basis, sales price, and resulting gain or loss. This comprehensive reporting helps ensure accurate calculation of the taxable gains and losses.

It's important to note that while Schedule D offers these benefits, the specific tax implications and advantages will depend on the individual circumstances of the estate or trust.

Who Is Eligible To File Schedule D (Form 1041)?

The following entities are eligible to file Schedule D (Form 1041):

**Estates: **When a person passes away, their assets may be transferred to an estate. If the estate sells assets such as stocks, bonds, real estate, or other investments, it may realize capital gains or losses. In such cases, the estate would need to file Schedule D (Form 1041) to report these gains and losses.

**Trusts: **Trusts are legal entities created to hold and manage assets on behalf of beneficiaries. If a trust sells assets and realizes capital gains or losses, it would need to file Schedule D (Form 1041) to report these transactions.

It's worth noting that certain types of trusts, such as grantor trusts, are not required to file a separate income tax return. Instead, the income and deductions are reported on the individual income tax return of the grantor or beneficiaries.

How To Complete Schedule D (Form 1041): A Step-by-Step Guide

Here's a general guide on how to complete Schedule D (Form 1041):

Step 1: Gather necessary information

Collect all relevant information and documents, including:

Form 1041: U.S. Income Tax Return for Estates and Trusts

Form 1099-B: Proceeds from Broker and Barter Exchange Transactions (if applicable)

Form 8949: Sales and Other Dispositions of Capital Assets (if applicable)

Statements from financial institutions detailing capital asset transactions

Any other relevant documents related to capital asset transactions.

Step 2: Determine the classification of the estate or trust

Identify whether the estate or trust is classified as a simple trust, complex trust, or grantor trust. This classification determines how the income and deductions are reported on the return.

Step 3: Complete Part I - Short-Term Capital Gains and Losses

Report all short-term capital gains and losses on this section of Schedule D. If you have multiple transactions, you may need to attach additional sheets following the format of Form 8949.

Step 4: Complete Part II - Long-Term Capital Gains and Losses

Report all long-term capital gains and losses on this section of Schedule D. Again, use additional sheets following the format of Form 8949 if necessary.

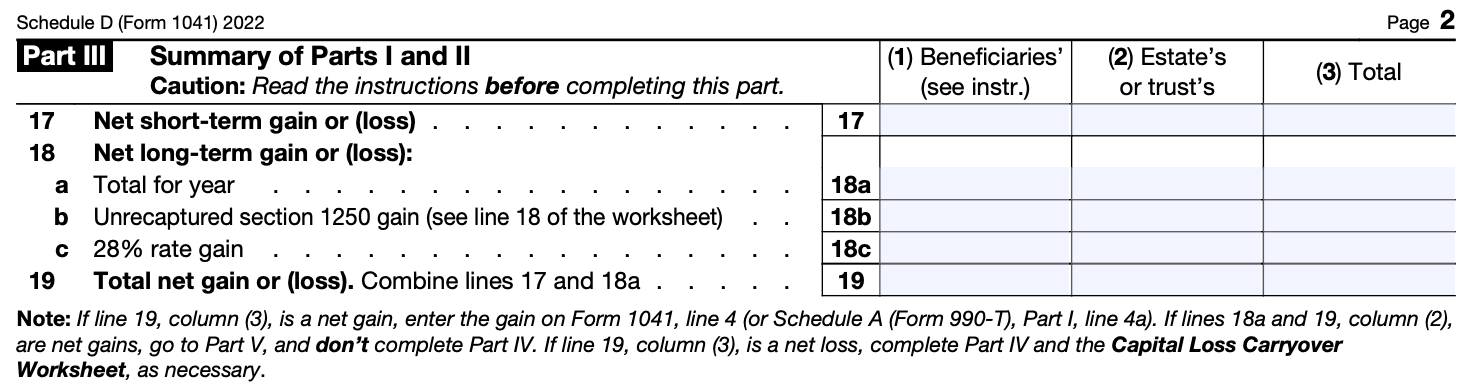

Step 5: Complete Part III - Net Capital Gain or Loss

Calculate the net capital gain or loss by subtracting the total losses from the total gains in Parts I and II.

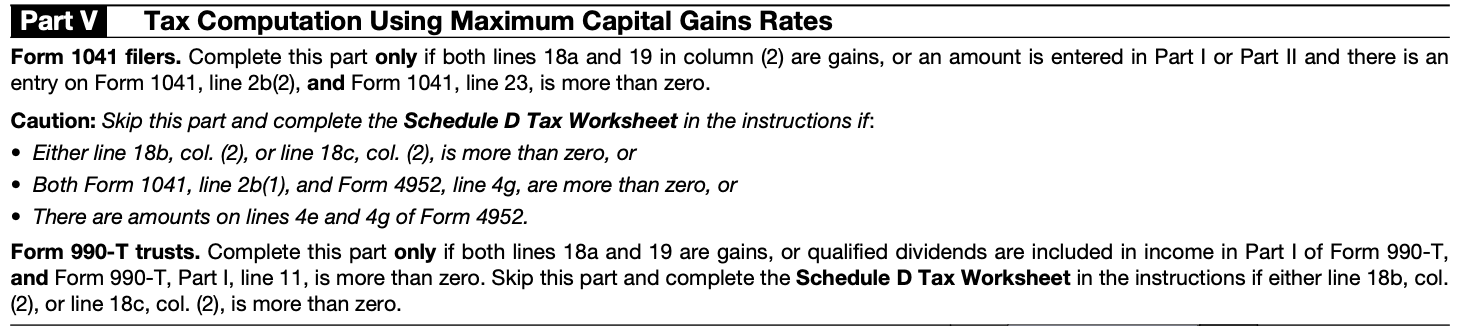

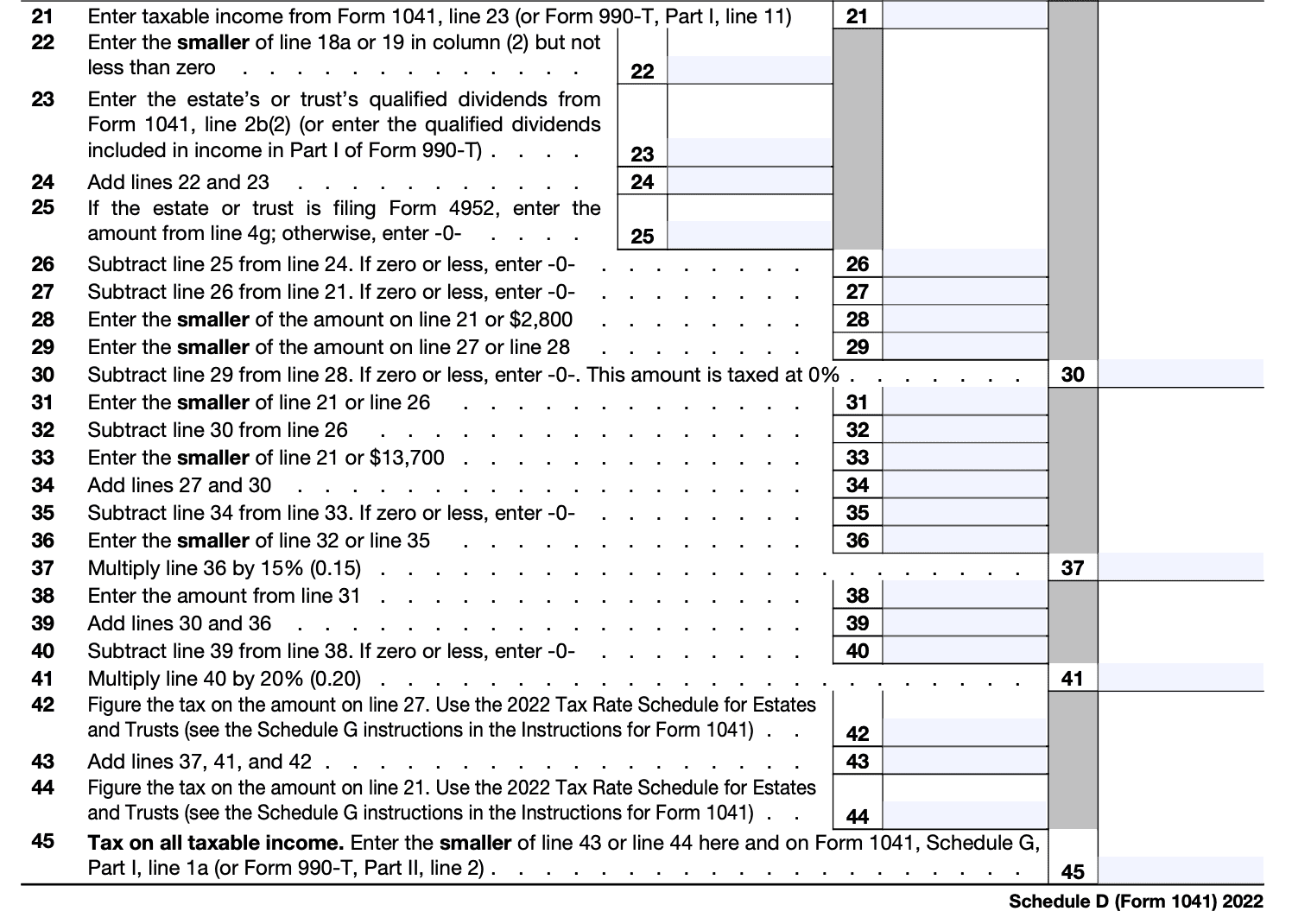

Step 6: Complete Part IV - Tax Computation using the Qualified Dividends and Capital Gain Tax Worksheet

Use the information from Part III to compute the tax using the Qualified Dividends and Capital Gain Tax Worksheet provided in the Form 1041 instructions. This worksheet takes into account the tax rates and special rules for capital gains and dividends.

Step 7: Complete Part V - Alternative Minimum Tax (AMT) Items

If applicable, complete Part V to determine any alternative minimum tax owed.

Step 8: Complete Part VI - Foreign Transactions and Tax

If the estate or trust had any foreign transactions or paid foreign taxes, report them in this section.

Step 9: Complete Part VII - Like-Kind Exchanges

If the estate or trust had any like-kind exchanges, report them in this section.

Step 10: Review and attach supporting documentation

Ensure that all calculations are accurate and double-check the information provided. Attach any required supporting documentation, such as Form 8949 or additional sheets, as applicable.

Step 11: Sign and submit

Sign and date the completed Schedule D and include it with the Form 1041 when filing your tax return. Retain a copy for your records.

Special Considerations When Filing Schedule D (Form 1041)

When filing Schedule D (Form 1041), there are several special considerations to keep in mind. Here are some important points to consider:

Reporting capital gains and losses: You need to report all capital gains and losses from the sale or exchange of assets on Schedule D. This includes both short-term and long-term gains and losses.

Cost basis: It's crucial to accurately determine the cost basis of the assets being reported. The cost basis generally refers to the original purchase price plus any adjustments such as commissions or fees. If you inherited the assets, the cost basis is usually the fair market value at the time of the decedent's death.

**Holding period: **You must classify capital gains and losses as either short-term or long-term based on the holding period of the asset. Short-term gains or losses are from assets held for one year or less, while long-term gains or losses are from assets held for more than one year.

Netting capital gains and losses: Calculate the net capital gain or loss by offsetting capital gains with capital losses. If you have both short-term and long-term gains or losses, net them separately.

**Wash sales: **Be aware of wash sales, which occur when you sell a security at a loss and repurchase the same or a substantially identical security within 30 days before or after the sale. Wash sales may require special treatment and adjustments to the cost basis.

Schedule D-1: If you have more than one capital gain or loss transaction, you may need to complete and attach Schedule D-1 to provide additional details.

Reporting requirements: Complete the appropriate sections of Schedule D, including Part I for short-term capital gains and losses and Part II for long-term capital gains and losses. Make sure to enter the correct information, such as the description of the property, dates of acquisition and sale, cost or other basis, and sales price.

Supporting documentation: Maintain proper records and documentation to support the figures reported on Schedule D. This includes brokerage statements, purchase and sale receipts, and any other relevant documents.

Carryovers: If you have capital losses that exceed your capital gains for the tax year, you may be able to carry over the excess losses to future years. Use the appropriate section of Schedule D to report any capital loss carryovers.

Final K-1 forms: If the estate or trust is distributing its assets, the beneficiaries will receive K-1 forms to report their share of the estate or trust's income, deductions, and credits. Any capital gains or losses allocated to the beneficiaries should be reported on their individual tax returns, not on Schedule D of the estate or trust.

Filing Deadlines and Extensions on Schedule D (Form 1041)

The filing deadlines and extensions for Schedule D (Form 1041) are subject to the same rules as the general Form 1041.

Under normal circumstances, the filing deadline for Form 1041 is the 15th day of the fourth month following the close of the tax year. For example, if the tax year ends on December 31, the regular filing deadline would be April 15 of the following year.

However, if the regular due date falls on a weekend or a legal holiday, the deadline is extended to the next business day. Additionally, there is a provision for a 5.5-month extension if requested. This extension allows estates and trusts to file their Form 1041 by the 15th day of the ninth month after the close of the tax year.

To request the extension, estates and trusts can file Form 7004, "Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns." By submitting Form 7004 before the regular filing deadline, estates and trusts can receive the extension automatically.

Common Mistakes To Avoid When Filing Schedule D (Form 1041)

When filing Schedule D (Form 1041), it's important to be aware of common mistakes to avoid errors and potential penalties. Here are some common mistakes to watch out for when filing Schedule D (Form 1041):

Misreporting cost basis: The cost basis of the assets being sold or transferred is crucial for calculating capital gains or losses. Ensure that you accurately report the correct cost basis for each asset, including adjustments for any splits, dividends reinvested, or other relevant events.

Failing to report all transactions: It's essential to report all relevant capital gains and losses during the tax year on Schedule D. Don't forget to include transactions such as sales, exchanges, or distributions from partnerships, stocks, bonds, or other investments.

Incorrectly classifying short-term and long-term gains/losses: Capital gains and losses are classified as either short-term or long-term based on the holding period of the asset. Short-term gains or losses arise from assets held for one year or less, while long-term gains or losses result from assets held for more than one year. Make sure to accurately classify each transaction to avoid miscalculations.

Ignoring wash sale rules: The IRS imposes wash sale rules that disallow claiming losses if you purchase a "substantially identical" security within 30 days before or after selling a security at a loss. Be aware of these rules to avoid improperly claiming losses that may not be allowed.

Failing to report carryover losses: If you have capital losses that exceed your capital gains, you can carry over the excess losses to future years to offset gains. Ensure that you correctly report any carryover losses on Schedule D and carry them forward to the appropriate tax year.

**Forgetting to attach supporting documents: **Although you don't need to submit supporting documents with your tax return, it's crucial to keep them organized and readily available in case of an audit. Ensure you have proper documentation for each transaction, including purchase and sale records, statements from brokers or financial institutions, and any other relevant paperwork.

**Not reconciling with 1099-B forms: **Brokers and financial institutions issue Form 1099-B, which reports the proceeds from sales of securities during the tax year. It's important to reconcile the information reported on Schedule D with the information provided on the 1099-B forms. Double-check for any discrepancies and make necessary adjustments.

Failing to report gifted or inherited assets correctly: If you receive assets as a gift or inheritance, there are specific rules and reporting requirements for determining the cost basis. Consult the IRS guidelines or seek professional advice to ensure you report these assets accurately.

Conclusion

Schedule D (Form 1041) is a crucial component of estate and trust tax filings, as it helps determine the capital gains and losses arising from the sale or exchange of investment assets.

By understanding how to complete this form and accurately report capital gains and losses, estate executors, trustees, and tax professionals can ensure compliance with IRS regulations and accurately calculate the taxable income.

Seeking the assistance of a tax professional is always recommended to navigate the complexities of Schedule D and ensure proper reporting of capital gains and losses for estates and trusts.