- IRS forms

- Schedule 2 (Form 8849)

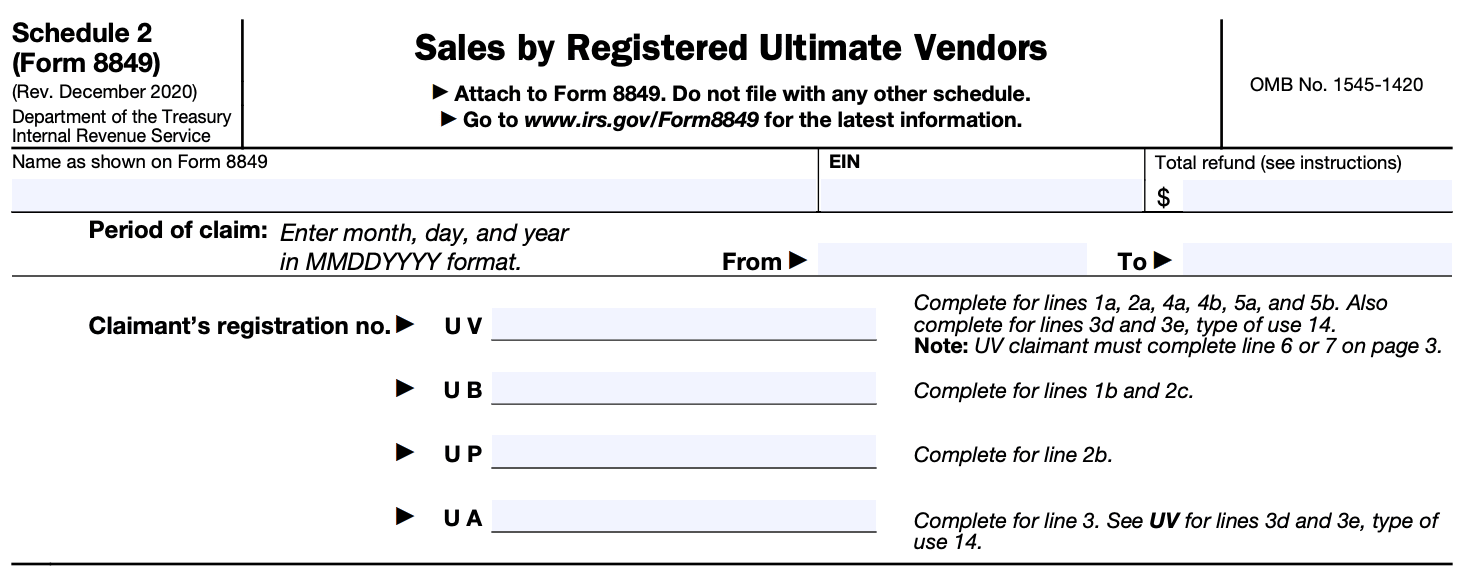

Schedule 2 (Form 8849): Sales by Registered Ultimate Vendors

Download Schedule 2 (Form 8849)As a business owner or tax professional, understanding the various tax forms and schedules can be a daunting task. One such form that often raises questions is Schedule 2 (Form 8849), specifically designed for reporting sales by registered ultimate vendors.

Schedule 2 (Form 8849) is an attachment to Form 8849, Claim for Refund of Excise Taxes. Form 8849 is used to claim refunds on certain federal excise taxes, such as those on fuels, heavy trucks, or aviation-related activities. Schedule 2 focuses specifically on sales by registered ultimate vendors.

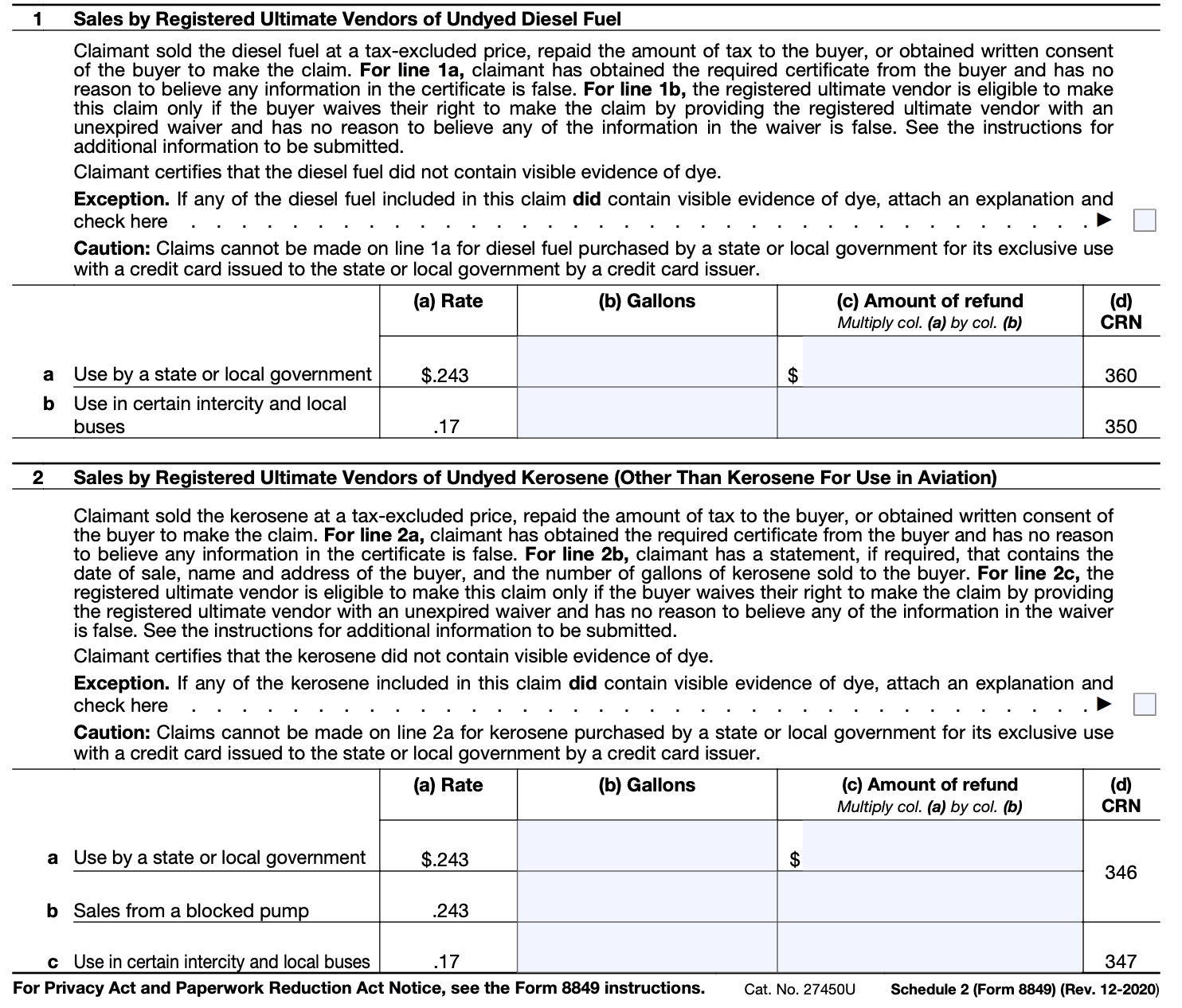

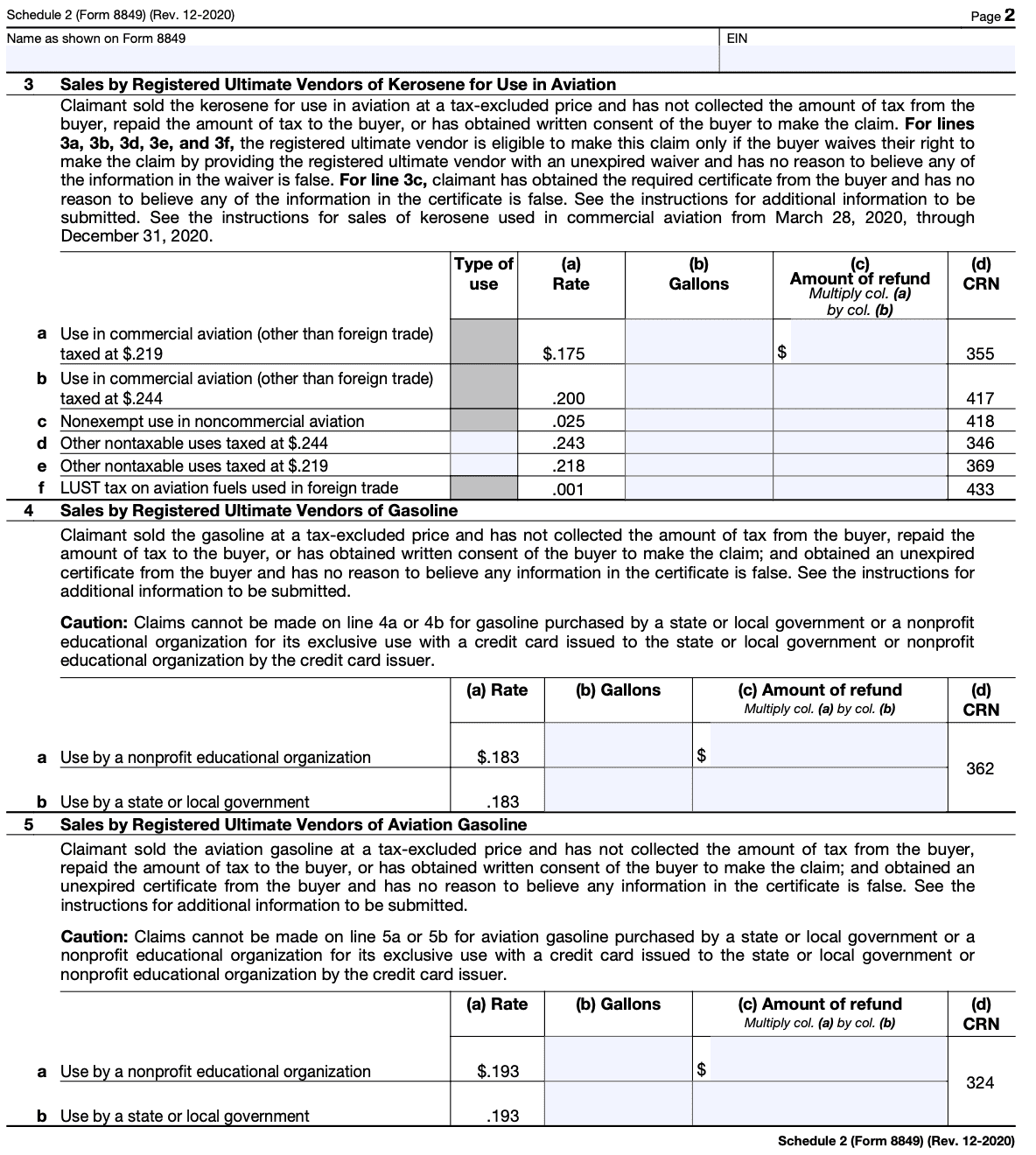

Sales by registered ultimate vendors refer to certain types of sales that are exempt from federal excise taxes. These sales occur when a registered ultimate vendor sells taxable goods or services to a buyer for further resale, use, or consumption, and the buyer is registered for the specific excise tax being claimed.

In this blog post, we will explore what the purpose of Schedule 2 is, what its significance is, and how to properly fill it out.

Purpose of Schedule 2 (Form 8849)

The term "registered ultimate vendor" refers to a person who sells taxable fuel to an end user or uses the fuel for non-taxable purposes. Generally, these vendors are not liable for the federal excise tax on fuel, but they are eligible to claim a refund or credit for the tax paid on the fuel.

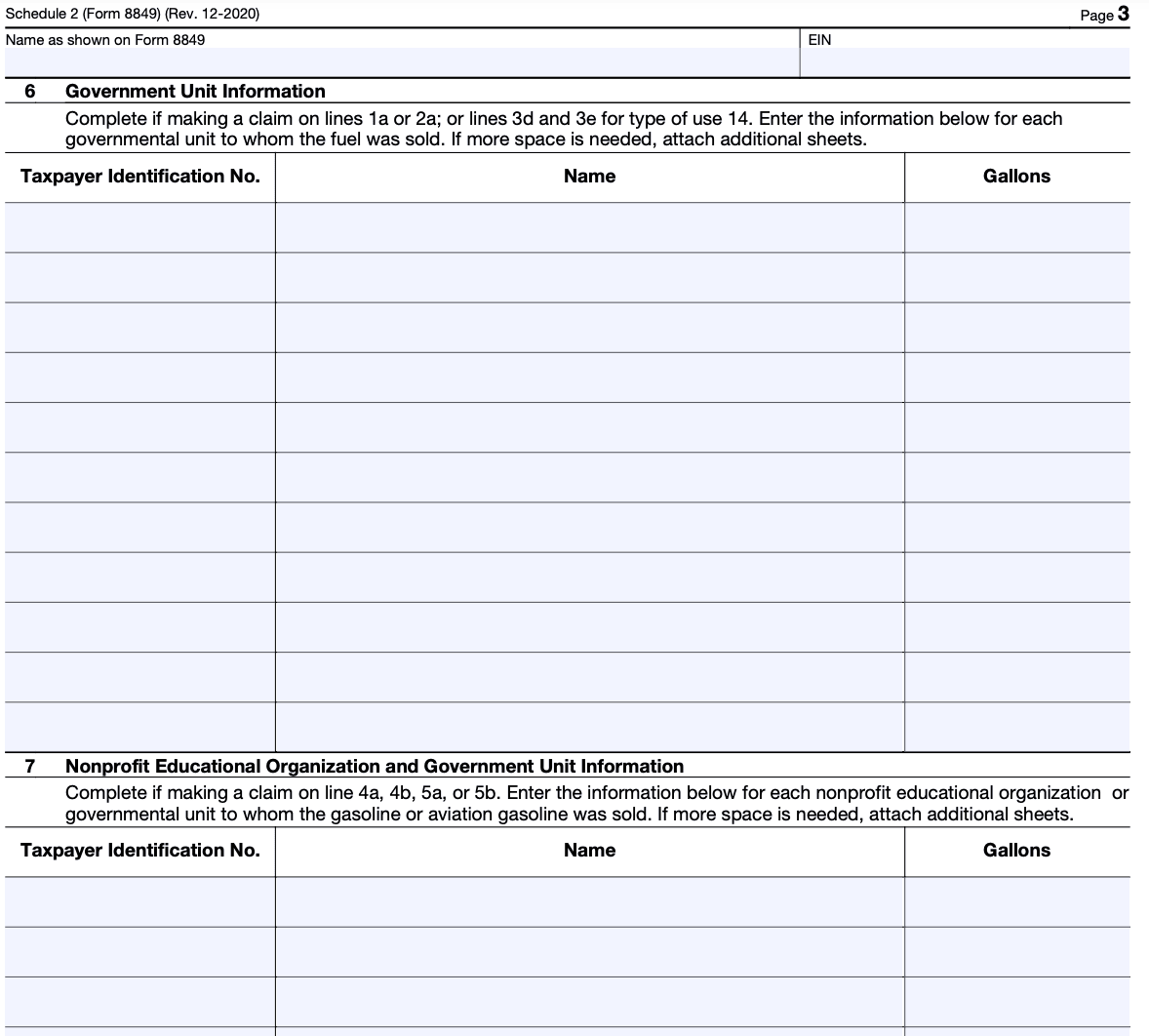

Schedule 2 is used to provide information about the sales made by registered ultimate vendors during the reporting period. The form requires details such as the name and address of the vendor, the type of fuel sold, the number of gallons sold, and the tax paid on those sales.

By completing Schedule 2 and attaching it to Form 8849, registered ultimate vendors can claim a refund or credit for the federal excise tax paid on the fuel they sold. This form helps ensure that vendors are not taxed twice on their fuel sales and allows them to recoup the tax amount paid on their sales to end users.

Benefits of Schedule 2 (Form 8849)

The benefits of Schedule 2 (Form 8849) include:

**Refunds or credits: **By completing Schedule 2, registered ultimate vendors can claim refunds or credits for the federal excise tax paid on the fuel they sold. This allows vendors to recoup the tax amount and reduce their overall tax liability.

**Avoiding double taxation: **Schedule 2 ensures that registered ultimate vendors are not taxed twice on their fuel sales. Since these vendors are not liable for the federal excise tax on fuel, claiming a refund or credit through Schedule 2 helps eliminate the potential burden of paying taxes on fuel sales that have already been taxed.

Compliance with IRS regulations: Filing Schedule 2 and Form 8849 helps registered ultimate vendors comply with IRS regulations regarding the reporting and claiming of fuel tax credits or refunds. By accurately completing the form and providing the necessary information, vendors demonstrate their adherence to tax laws and reduce the risk of penalties or audits.

**Financial savings: **The primary benefit of Schedule 2 is the potential for financial savings. By claiming a refund or credit for the federal excise tax paid on fuel sales, registered ultimate vendors can significantly reduce their operating costs and improve their profitability. These savings can be reinvested in the business or used for other purposes.

Streamlined tax processes: Schedule 2 simplifies the process of claiming fuel tax credits or refunds for registered ultimate vendors. It provides a structured format for reporting sales information, ensuring that the necessary details are provided accurately and comprehensively. This streamlines the tax filing process and reduces the chances of errors or omissions.

Who Is Eligible To File Schedule 2 (Form 8849)?

Schedule 2 (Form 8849) is typically filed by taxpayers who are eligible for specific fuel-related credits or refunds. The following entities are generally eligible to file Schedule 2:

- Registered ultimate vendors (retailers) of diesel fuel, kerosene, gasoline, aviation gasoline, or alternative fuels

- Interstate truckers who paid a federal excise tax on the purchase of certain types of fuel used in their business operations

- Owners or operators of certain buses, such as local transit buses, school buses, or qualified buses used for a private transportation function

- Government entities, including state and local governments, certain Indian tribal governments, and the District of Columbia, who paid a federal excise tax on certain types of fuel used in their operations

- Nonprofit educational organizations operating school buses that paid a federal excise tax on certain fuels

- Nonprofit volunteer fire departments that paid a (link: https://fincent.com/irs-tax-forms/form-720 text: federal excise tax) on certain fuels used for their authorized purposes

How To Complete Schedule 2 (Form 8849): A Step-by-Step Guide

Completing Schedule 2 (Form 8849) involves several steps. Here's a step-by-step guide to help you navigate the process:

Step 1: Obtain the necessary forms and instructions

Download Schedule 2 (Form 8849) and its accompanying instructions from the official IRS website (www.irs.gov) or request them by mail.

Step 2: Gather information

Collect all the relevant information needed to complete Schedule 2, such as:

- Your business name, address, and Employer Identification Number (EIN)

- Details of the fuel purchases, including dates, amounts, and types of fuel

- Supporting documentation, such as invoices, receipts, or other records, that substantiate your claims

Step 3: Determine eligibility and select the appropriate sections

Review the instructions and determine which sections of Schedule 2 apply to your situation based on your eligibility for specific fuel tax credits. For example, if you're eligible for the biodiesel or renewable diesel fuels credit, you would complete Part I of Schedule 2.

Step 4: Fill out the sections

Follow the instructions provided for each section and fill in the required information. Provide accurate data and ensure all calculations are correct. Be thorough and include any supporting documentation as required.

Step 5: Calculate the amounts

Carefully calculate the amounts you are claiming for each section. The instructions will provide guidance on how to determine the eligible credits or refunds based on the specific criteria for each section.

Step 6: Complete other necessary forms or schedules

In some cases, you may need to complete additional forms or schedules along with Schedule 2. Make sure to follow the instructions and include any required attachments.

Step 7: Review and double-check

Once you have completed Schedule 2 and any related forms, review the entire document for accuracy and completeness. Double-check all the figures and ensure that you have attached any required supporting documentation.

Step 8: Sign and submit

Sign the completed Schedule 2 and any other relevant forms. Keep a copy of the completed form and all supporting documents for your records. Submit the form by mail to the appropriate IRS address specified in the instructions.

Special Considerations When Filing Schedule 2 (Form 8849)

When filing Schedule 2 (Form 8849), there are several special considerations to keep in mind to ensure accurate and compliant completion of the form. Here are some important points to consider:

Eligibility and specific requirements: Understand the eligibility criteria and requirements for each section of Schedule 2. Ensure that you meet the qualifications for the specific fuel tax credit you are claiming and follow the instructions accordingly.

Supporting documentation: Maintain thorough and accurate records of all fuel purchases and related transactions. Keep invoices, receipts, and other supporting documentation that substantiates your claims. Attach copies of these documents to your Schedule 2 when filing. Note that different sections may have specific documentation requirements, so review the instructions carefully.

Correct tax periods: Determine the appropriate tax periods for which you are claiming credits or refunds. Make sure to enter the correct tax period information in the designated fields on Schedule 2.

Accuracy of calculations: Double-check all calculations to ensure accuracy. Follow the instructions provided for each section to calculate the eligible credits or refunds correctly. Mistakes in calculations can lead to errors and potential delays in processing your claim.

Timely filing: Pay attention to the deadlines for filing Schedule 2. Generally, Schedule 2 must be filed by the last day of the second calendar quarter following the quarter in which the fuel was used or sold. Ensure that you submit the form within the specified timeframe to avoid penalties or late filing issues.

Multiple fuel tax credits: If you are eligible for multiple fuel tax credits, determine whether you need to complete separate sections of Schedule 2 or file additional forms or schedules. Review the instructions and guidelines to ensure that you properly report and claim all applicable credits.

**Amendments and corrections: **If you need to amend or correct a previously filed Schedule 2, use the appropriate procedures outlined by the IRS. Follow the instructions for amended returns or corrections to ensure that the changes are accurately reported.

**Professional assistance: **If you are uncertain about any aspect of completing Schedule 2 (Form 8849) or if your situation is complex, consider seeking assistance from a tax professional. They can provide guidance based on your specific circumstances, help ensure compliance, and maximize your eligible credits or refunds.

Filing Deadlines & Extensions on Schedule 2 (Form 8849)

When filing Schedule 2 (Form 8849), it's important to be aware of the filing deadlines and any available extensions. Here are the key points regarding deadlines and extensions for Schedule 2:

Filing deadlines: Schedule 2 must generally be filed by the last day of the second calendar quarter following the quarter in which the fuel was used or sold. Here are the specific deadlines:

| Fuel Use Period | Deadline |

| January to March (first quarter) | July 31 |

| April to June (second quarter) | October 31 |

| July to September (third quarter) | January 31 of the following year |

| October to December (fourth quarter) | April 30 of the following year |

Extensions: The IRS allows an extension of time to file Schedule 2 under certain circumstances. To request an extension, file Form 8849 by the regular due date and check the box indicating that you are requesting an extension.

- Extension for registered ultimate vendors (retailers): Registered ultimate vendors can request an automatic three-month extension by filing Form 8849 by the regular due date. This extension is granted without any additional documentation.

- Extension for government entities: Certain government entities, such as state and local governments, Indian tribal governments, and the District of Columbia, may be eligible for a one-time automatic six-month extension by filing Form 8849 by the regular due date. This extension is granted without any additional documentation.

Penalties for late filing: Failure to file Schedule 2 by the deadline may result in penalties. The penalty amount is generally based on the number of days the return is late and can vary depending on the circumstances. It's important to file the form by the deadline or request an extension to avoid penalties.

It's essential to consult the official IRS instructions and guidelines for Schedule 2 (Form 8849) to ensure compliance with the most up-to-date deadlines and extension provisions.

Common Mistakes To Avoid While Filing Schedule 2 (Form 8849)

When filing Schedule 2 (Form 8849) for claiming certain fuel tax credits or refunds, it's important to avoid common mistakes that could delay or affect the processing of your claim. Here are some mistakes to avoid while filing Schedule 2:

- Incorrect or incomplete information: Ensure that all the required fields on Schedule 2 are filled out accurately and completely. Double-check your entries for errors or omissions, such as incorrect identification numbers or missing data.

- Using outdated forms: Always use the most recent version of Form 8849 and Schedule 2 to avoid using outdated or obsolete forms that could result in processing delays or rejection of your claim. Check the official IRS website for the latest versions.

- Filing for the wrong tax period: Make sure you are filing Schedule 2 for the correct tax period. It should correspond to the time frame for which you are claiming the fuel tax credit or refund.

- Incorrectly calculating the fuel tax credit or refund amount: Take the time to accurately calculate the amount of the credit or refund you are claiming. Check the applicable tax rates, gallons, and other relevant factors to ensure your calculations are correct.

- Failing to include required supporting documentation: Attach all necessary supporting documentation to substantiate your claim. This may include invoices, receipts, or other records that demonstrate your eligibility for the fuel tax credit or refund. Neglecting to include these documents could result in your claim being denied.

- Ignoring filing deadlines: Be aware of the deadlines for filing Schedule 2. Failing to submit your claim on time may result in penalties or the loss of your eligibility for the fuel tax credit or refund.

- Sending incomplete or illegible forms: Ensure that your Schedule 2 is legible and that all required sections are completed. Illegible or incomplete forms can cause delays and may require additional correspondence with the IRS.

- Not retaining copies for your records: Make copies of all filed documents, including Schedule 2 and any supporting documentation, for your records. This will be helpful in case any issues arise or if you need to reference your claim in the future.

- Neglecting to review and double-check your submission: Before submitting your Schedule 2, carefully review all the information provided, calculations made, and supporting documents attached. Correct any errors or discrepancies to avoid potential complications later.

Conclusion

Schedule 2 (Form 8849) simplifies the process of claiming excise tax refunds for eligible businesses. By providing a structured format for reporting specific types of excise taxes, this form streamlines the refund process, increases accuracy, and saves time and costs.

It is essential for businesses to understand the eligibility criteria, deadlines, and documentation requirements to ensure a smooth refund process. By leveraging Schedule 2 (Form 8849) effectively, businesses can navigate the complexities of excise taxes and optimize their financial operations.