- IRS forms

- Form SS-4

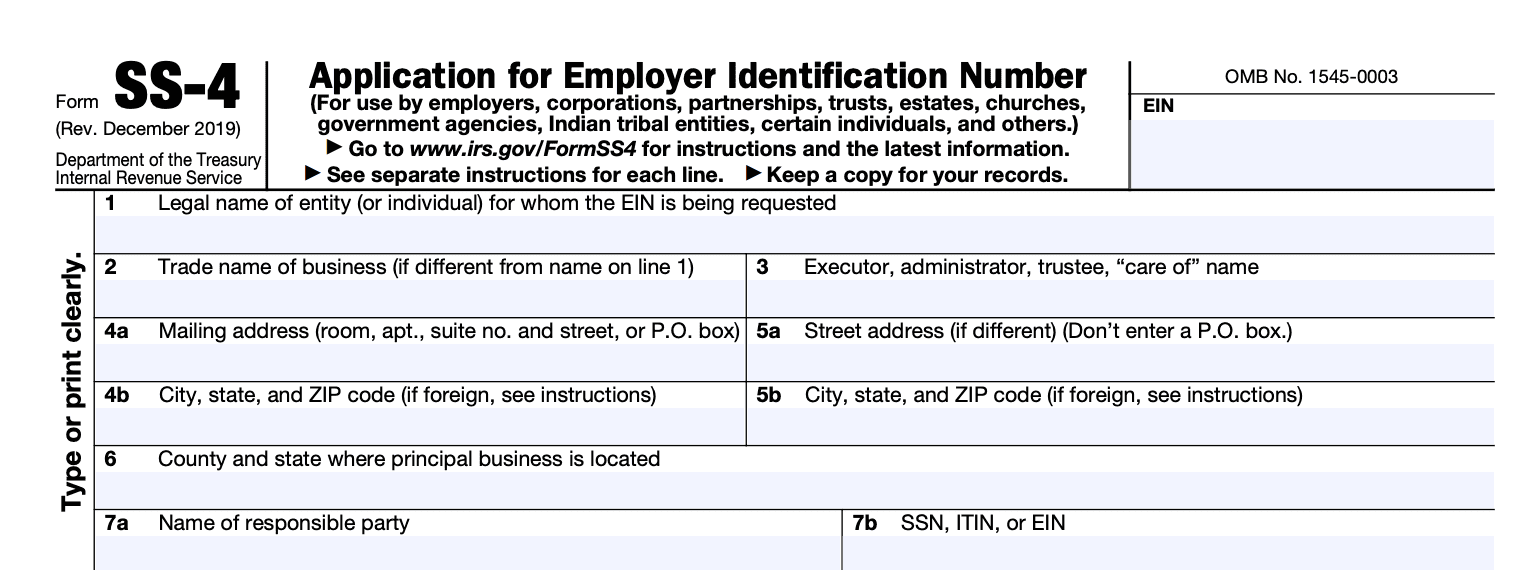

Form SS-4: Guide to Apply for an EIN

Donwload Form SS-4Introduction to Form SS-4 and Employer Identification Number (EIN)

The Internal Revenue Service (IRS) uses Form SS-4 to assign an Employer Identification Number (EIN) to a business entity. An EIN is a unique nine-digit number that identifies a business for tax purposes. This number is used to file tax returns, pay taxes, and open a business bank account.

The EIN is also called the Federal Employer Identification Number (FEIN) or the Tax Identification Number (TIN). It is assigned to businesses, non-profit organizations, estates, trusts, and partnerships.

When Do You Need an EIN?

Here are some instances when you may need an EIN, along with the corresponding instructions for each line on Form SS-4:

- **Hiring employees: ** a. Recently launched a new business and do not currently have any employees (and don't anticipate having any in the future). b. You have already hired, or plan to hire, employees (including household employees) and do not currently have an EIN.

- **Opening a business bank account:

**You have opened a bank account and require an EIN for banking purposes only. - **Changing the type of business entity:

**Want to change the type of organization, and either the legal character of the organization or its ownership has changed (e.g. incorporated a sole proprietorship or you have formed a partnership). - You have purchased a going business and do not already have an EIN.

- **Filing tax returns:

**You are a withholding agent for taxes on non-wage income paid to an alien (whether an individual, corporation, partnership, etc.) and are required to file Form 1042, the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, as an agent, broker, fiduciary, manager, tenant, or spouse. - Keogh plan:

You have created a pension plan and require an EIN for reporting purposes. - **Trusts or Estates: ** a. You are involved in certain types of organizations, such as non-profit organizations, trusts, estates, farmers' cooperatives, or REMICs. b. You have established a trust that is not a grantor trust or an IRA trust. c. You are administering an estate and need an FEIN to report estate income on Form 1041.

- **Foreigners:

**A foreign person who needs an EIN to comply with IRS withholding regulations. a. To fulfill the requirements of a Form W-8 (excluding Form W-8ECI), b. To avoid withholding on portfolio assets, or to claim tax treaty benefits. - **Applying for business licenses and permits:

**Under Rev. Proc. 80-4, 1980-1 C.B. 5817, if you are a state or local agency that acts as a tax reporting agent for public assistance recipients. - A single-member entity: a. If you're a single-member LLC/entity, you may need an EIN for Form 8832 (Entity Classification Election) or state reporting. b. Similarly, a foreign-owned U.S. disregarded entity may need an EIN for Form 5472 (Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business).

- **S-Corp:

**If you are an S corporation, you need an EIN to file Form 2553, Election by a Small Business Corporation.

Necessary Documents for IRS Form SS-4

To complete Form SS-4 (Rev. December 2019), you will need the following information and documents:

- Legal name of the business entity (the name on file with the state)

- Trade name or "doing business as" i.e., (DBA) name, if relevant

- Physical and mailing address of the business entity

- County and state where the business entity is located

- Country of incorporation, if applicable

- Name, Social Security number (SSN), and address of the "responsible party" for the business. The individual who governs, supervises, or regulates the business entity, as well as its financial resources and assets, is referred to as the responsible party.

- Type of business entity (if it’s sole proprietorship or partnership or a corporation, or LLC)

- Reason for applying (new business, change of ownership, etc.)

- Date the business entity was started or acquired

- Principal activity or product of the business entity

Methods of Filing Form SS-4

There are three methods for filing Form SS-4:

- Online application

- Mail or fax application

- Telephone application (only available to international applicants)

1. Online Application Process for Form SS-4

The most convenient and expedient method of obtaining an EIN is by utilizing the online application process. The following are the steps involved in applying for an EIN online:

- To apply for an EIN online, visit the IRS website and select the "Apply for EIN Online" option.

- Read carefully and agree to the terms and service of the IRS.

- Select the type of business entity that applies to you.

- Provide the required information, such as the legal name of your business, your Social Security number or taxpayer identification number, and your mailing address.

- Answer questions about the type of business and the reason for the application.

- Verify the information that you gave and submit the application.

- Receive your EIN immediately.

2. Applying for an FEIN by Mail or Fax

If you prefer to apply for an EIN by mail or fax, you can download Form SS-4 from the IRS website and complete it manually. Here are the steps to apply for an EIN by mail or fax:

- Download Form SS-4 from the IRS website or request a form by mail.

- Fill out the form using black ink and write legibly.

- Sign and date the form.

- Mail or fax the completed form to the appropriate IRS address or fax number.

- Wait for the IRS to process your application and send your EIN.

3. To file Form SS-4 by telephone:

This method is available only for international applicants who do not have a legal residence, principal place of business, or principal office or agency in the United States or its territories.

To file Form SS-4 by telephone, international applicants must call the IRS at 267-941-1099 between 6 a.m. and 11 p.m. (Eastern Time), Monday through Friday. They must provide all of the required information to the IRS representative during the call. The IRS representative will then assign an EIN and provide the applicant with the EIN immediately over the phone.

The following information is required when filing Form SS-4 through telephone application:

- Legal name of the applicant

- Trade name or DBA name, if applicable

- Country of the applicant’s legal residence

- Mailing address of the applicant

- Reason for applying for an EIN

- Name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the responsible party

- Type of entity (e.g., corporation, partnership, sole proprietorship)

- Date the applicant started or acquired the business or started operating as a sole proprietorship

- Closing month of the applicant’s accounting year, if applicable

- Primary business activity

- Estimated number of employees, if applicable

- Estimated first-year total sales, if applicable

- Contact name and telephone number, if different from the responsible party

Note:

- After completing the telephone application, the applicant will receive a confirmation notice of the EIN assignment by mail. It is typically within four weeks.

- If the applicant does not receive the confirmation notice within four weeks, they should call the IRS at 267-941-1099 to follow up on the application.

Completing Form SS-4: Step-by-Step Guide

Step 1: Gather the necessary information

- Collect information about your business, such as its legal name, trade name, and mailing and physical addresses.

- Know the entity's responsible party name and SSN number or taxpayer ID number.

Step 2: General Info Section

Fill out the general information section, including lines 1-7b of the form.

- Enter Your Business Information

- Legal Name

- Trade Name (if applicable)

- Trust or Estate Information (if applicable)

- Enter Your Business Address

- Mailing Address

- Physical Address (if different)

- Primary Location

- Enter Your Business Responsible Party Information

- Full Name

- Social Security Number or Taxpayer Identification Number

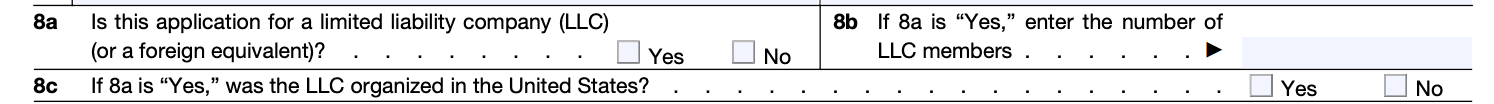

Step 3: Business Type Info Section

- Line 8a: Check the box to confirm if the entity is an LLC.

- Line 8b: Indicate the type of entity your business is, such as a sole proprietor, corporation, partnership, or trust.

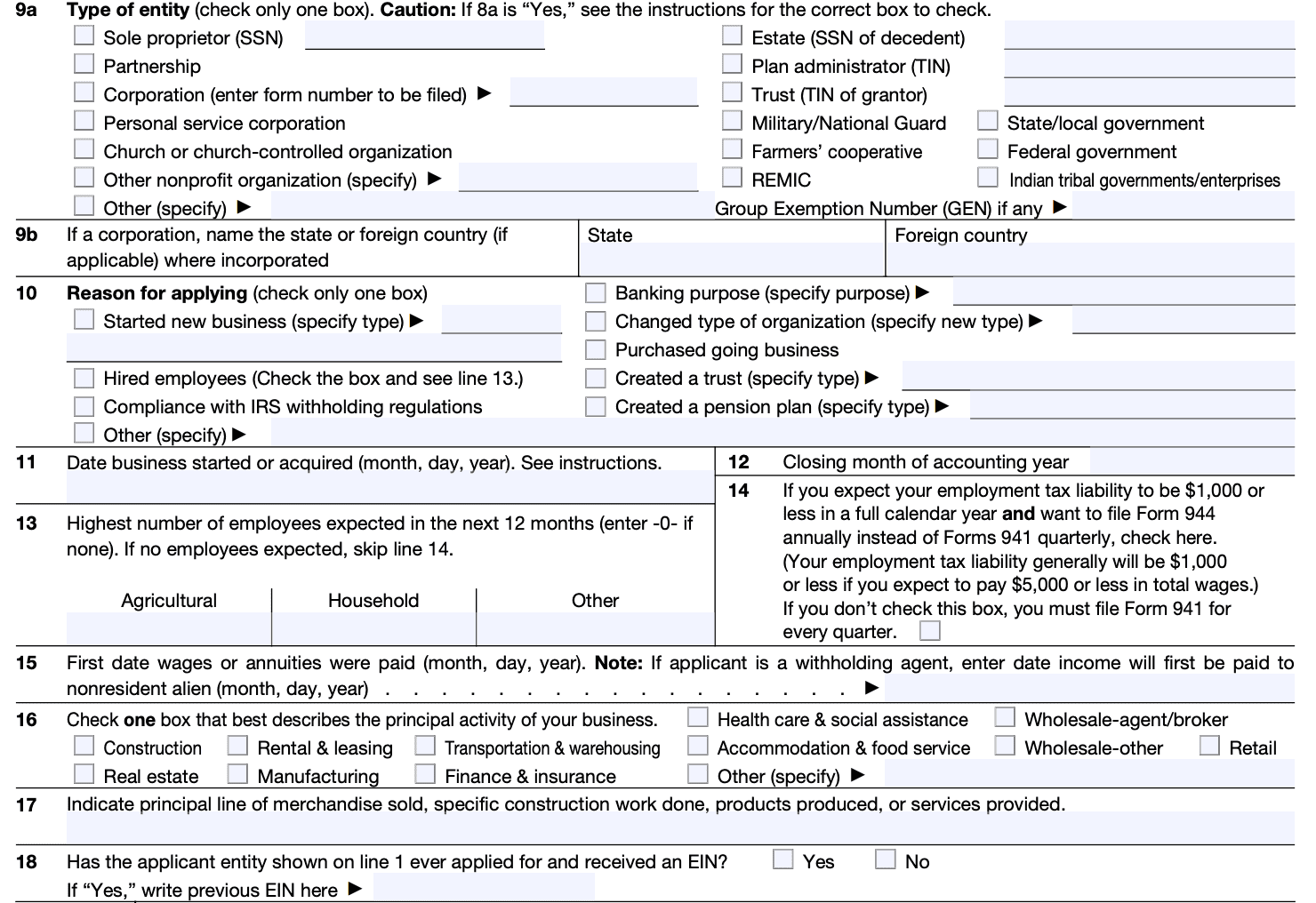

Step 4: Complete the Other Business Information Section

- Select reason for applying for an EIN

- Provide business start date and fiscal year-end

- Estimate number of employees for next 12 months

- Indicate if (link: https://fincent.com/irs-tax-forms/form-944 text: filing Form 944) and provide first wage payment date

- Describe primary business activity

- Previous EIN Application (Yes or No)

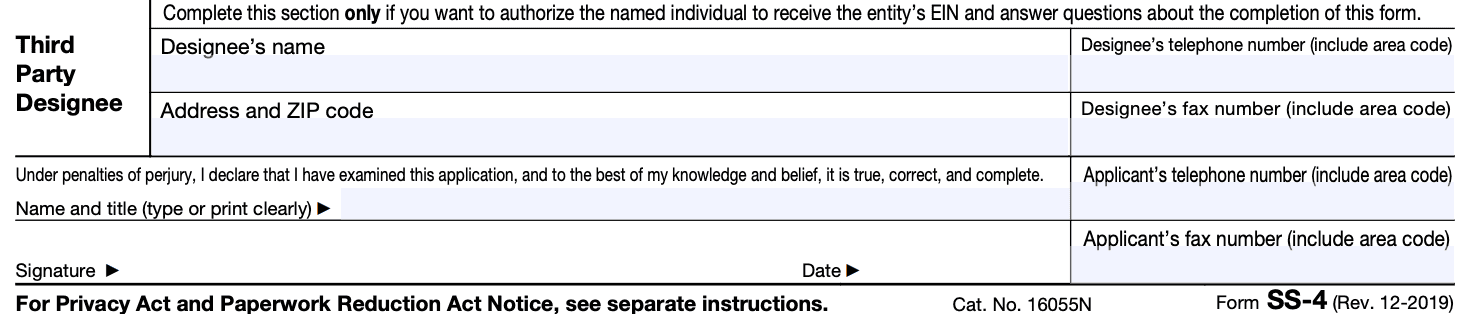

Step 5: Sign the Form

- The form must be signed by the responsible party or fiduciary, depending on the type of entity applying for an EIN.

- Ensure that the signature is valid and accurate.

Step 6: Submit Your Form SS-4

- Submit the form online, by fax, or by mail.

- Be ready with the necessary information to avoid a timeout on the online form.

- Once submitted, you will receive your EIN immediately.

What Happens After Filing Form SS-4

After filing Form SS-4, the IRS will review your application and assign an EIN. If you filed the application online, you will receive your EIN immediately. If you applied by mail, fax, or telephone, you will receive your EIN by mail within four weeks.

Common Errors to Avoid When Filing Form SS-4

Here are some common errors to avoid when filing Form SS-4:

- Missing or incomplete information: Ensure that you fill out all the required fields on the Form SS-4 application. Provide accurate and complete information, including the responsible party's name, SSN or EIN, and contact information.

- Incorrect business entity type: Select the appropriate entity type that best describes your business or organization. Common types include sole proprietorship, partnership, LLC, corporation, and nonprofit organization.

- Mismatched information: Ensure that the information provided on the Form SS-4 application matches the information on your tax returns, such as your legal name, address, and taxpayer identification number.

- Incorrect formatting: Follow the IRS's guidelines for formatting information on the Form SS-4 application, such as using proper capitalization and punctuation and avoiding special characters.

- Inconsistent signatures: Make sure that the responsible party signs and dates the Form SS-4 application and that the signature matches the name provided on the application.

- Not including a valid reason for applying: A valid reason for applying for an EIN can include starting a new business, hiring employees, or changing the legal structure of your business.

By avoiding these common errors, you can increase the likelihood of a successful and timely EIN application process.

**Double-Check and Submit Form SS-4: **Before submitting Form SS-4, it is essential to double-check all the information provided to ensure that it is accurate and complete. **Any errors or omissions can result in delays in processing your application. **Once you have verified that all the information is correct, you can submit Form SS-4 through the online application process, mail, fax, or telephone application process.

FAQs about Form SS-4 and EIN:

Q: Is there a fee to apply for an EIN?

A: No, there is no fee to apply for an EIN.

Q: What is the typical processing time for receiving an Employer Identification Number (EIN)?

A: If you apply online, you will receive your EIN immediately. If you apply by mail, fax, or telephone, it may take up to four weeks to receive your EIN.

Q: Can I use the same EIN for multiple businesses or entities?

A: No, each entity must have its own unique EIN.

Q: What happens if I need to change the information on my EIN application?

A: You can request a change to your EIN application by completing and submitting Form SS-4 with the corrected information.

Q: What would be the consequences if I lost or misplaced my EIN?

A: Yes, if you have lost or misplaced your EIN and need to retrieve it:

- Contact the IRS Business & Specialty Tax Line at 1-800-829-4933 between the hours of 7am and 7pm local time, Monday through Friday.

- An IRS representative will ask you to provide identifying information to verify your identity before providing your EIN over the phone.

- Alternatively, you can request a letter from the IRS confirming your EIN by submitting Form 4506-T (Request for Transcript of Tax Return).

This process can take several weeks to receive the letter in the mail.

Q: Is an EIN equivalent to a Social Security Number (SSN)?

A: An Employer Identification Number (EIN) and a Social Security Number (SSN) are not identical. An SSN is a nine-digit number issued to individuals for tax purposes, while an EIN is issued to businesses, organizations, and other entities for tax purposes.

Q: Is it possible for me, as a non-US citizen, to apply for an EIN?

A: Yes, international applicants can apply for an EIN using the online or telephone application process.

Q: Would an EIN be required if I operate as a sole proprietor?

A: Sole proprietors are not required to have an EIN but may choose to apply for one for tax purposes or to open a business bank account.

Q: Is it permissible to utilize my EIN in place of my SSN for personal tax-related matters?

A: No, an EIN is not a substitute for an SSN for personal tax purposes.