- IRS forms

- Form 1096

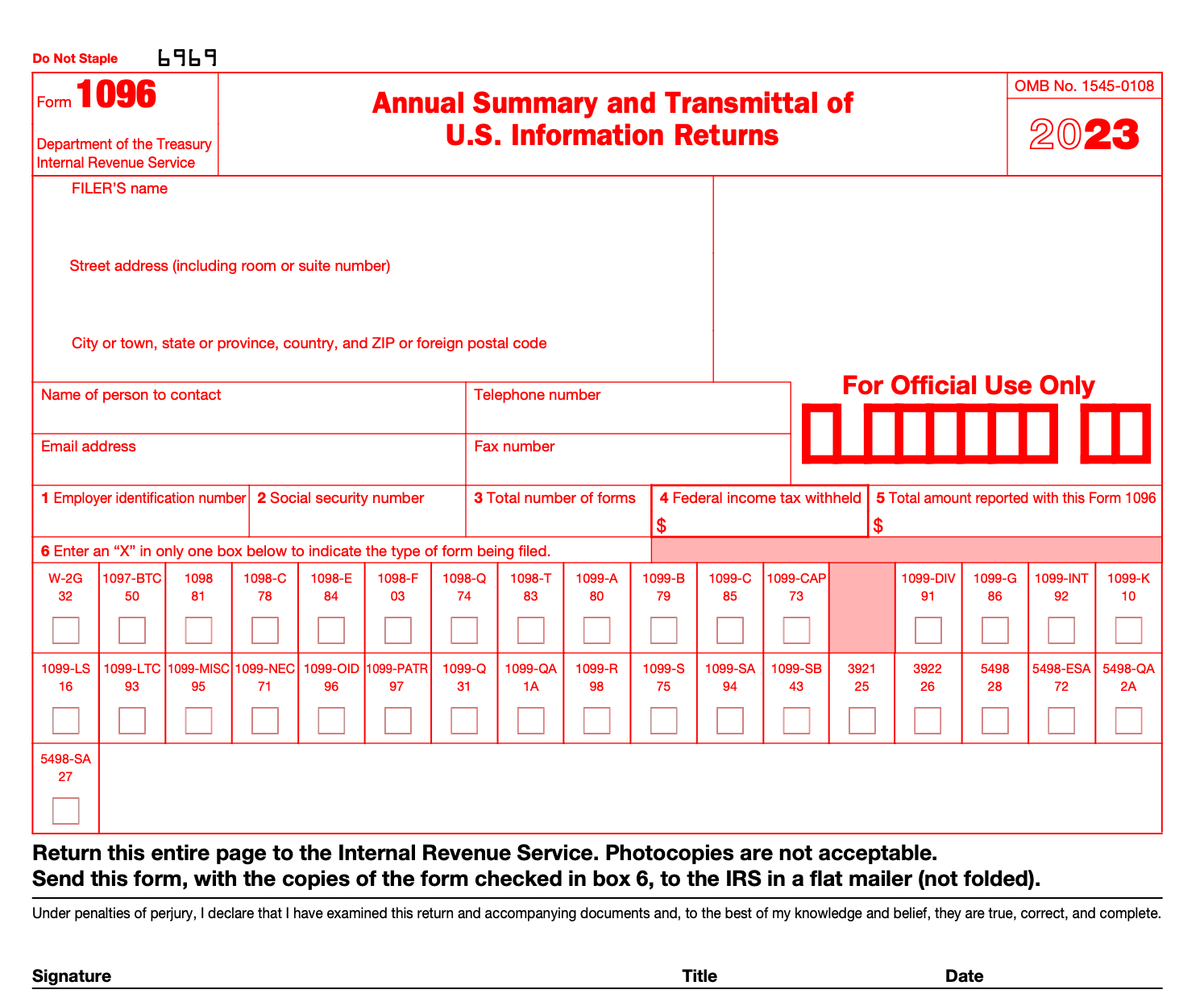

Form 1096: Annual Summary and Transmittal of U.S. Information Returns

Download Form 1096Filing taxes can be a big headache for many, considering the plethora of forms and annexures and paper copies one has to submit. Losing yourself in this maze is very likely.

Luckily, we have prepared for you a short and simple guide to maneuver your way through filing one of the most important forms: Form 1096.

Not sure what Form 1096 is or whether it pertains to your taxes? Stop worrying and begin reading. We're sure all your doubts will be cleared by the end of the article.

What Is IRS Form 1096?

Form 1096 is an information return form that summarizes the information about any payment that you've made to any recipient for tax purposes. Form 1096 is also titled "Annual Summary and Transmittal of U.S. Information Returns".

If your business has made out any one of the following forms to any recipient in the financial year, you'd have to file a Form 1096.

For instance, if your firm has worked with an independent contractor and paid them $5,000, you'd be sending them a Form 1099-NEC. Form 1096 comes in for summarizing all the Form 1099-NECs that you've paid out over the course of the financial year.

One Form 1096 can summarize only one kind of the seven Forms listed above. For instance, if you've issued seven Form 1097s and two Form 1099s, you'd be filing only two 1096 forms where one summarizes the Form 1097s and the other one Form 1099s.

Usually, small businesses only have to worry about Form 1099s that are sent to independent contractors. A 1099 form is only sent to a contractor when the payment made is upwards of $600.

Purpose of Form 1096

IRS Form 1096 serves a crucial role in tax reporting, functioning as a summary transmittal for various informational returns.

- Aggregator document: Form 1096 acts as a cover sheet, consolidating data from multiple Forms 1099, 1098, 5498, and other information returns.

- Submission to IRS: It's submitted to the IRS along with the compiled informational returns, providing a snapshot of the collective data being reported.

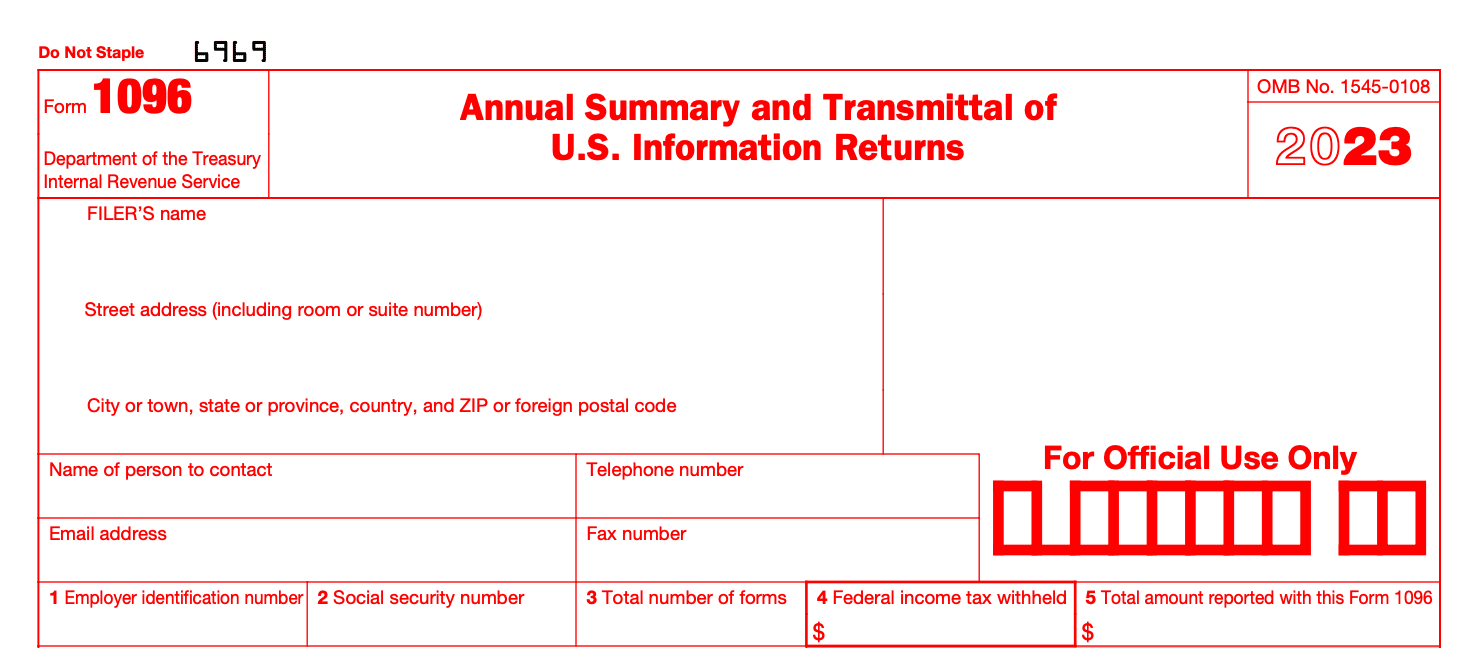

- Identification: It includes essential details such as the filer's name, address, taxpayer identification number (TIN), and the total number of forms submitted.

- Verification: It allows the IRS to cross-verify the totals reported on individual information returns, ensuring accuracy and completeness.

- IRS copy: One copy of Form 1096 is sent to the IRS, facilitating the matching of reported income with the corresponding taxpayer records.

- Record-keeping: It serves as a record for the filer, documenting the information sent to the IRS for their own reference and in case of future audits.

- Compliance: It aids in compliance with IRS regulations by providing a systematic way to report and transmit information about various types of income, interest, dividends, and other payments.

- Penalty prevention: Filing Form 1096 in a timely and accurate manner helps prevent penalties that may be imposed for incorrect or late submissions of informational returns.

- Data organization: It helps organize and categorize information returns, streamlining the process of IRS data analysis and making it more efficient.

- Facilitates analysis: It enables the IRS to analyze data trends, track taxpayer compliance, and identify any discrepancies, contributing to the overall integrity of the tax system.

Who Files Form 1096?

If at any point in time your firm has issued any one, or several, of the above forms in paper, it is necessary for you to file a Form 1096 and send it to the IRS. However, if your firm has issued these forms via e-file, it obviates the need to fill in Form 1096.

Moreover, if the total tally of the above seven forms filed by your business exceeds 250, then you can only file Form 1096 electronically. If the number is less than 250, then Form 1096 can be mailed to the IRS in paper or filed electronically as well.

How To Complete Form 1096: A Step-by-Step Guide

Form 1096 can be completed with the steps mentioned below.

It comprises a total of six numbered boxes as you can see below.

Step 1: Provide basic information

In the first four boxes, fill in basic information about your business. Remember, it is your information that these boxes require, not the business you've issued a form to.

In the first four boxes, fill in basic information about your business. Remember, it is your information that these boxes require, not the business you've issued a form to.

You can write your Social Security Number in Box 1 if you don't have an Employer Identification Number.

Step 2: Fill boxes 5 and 6

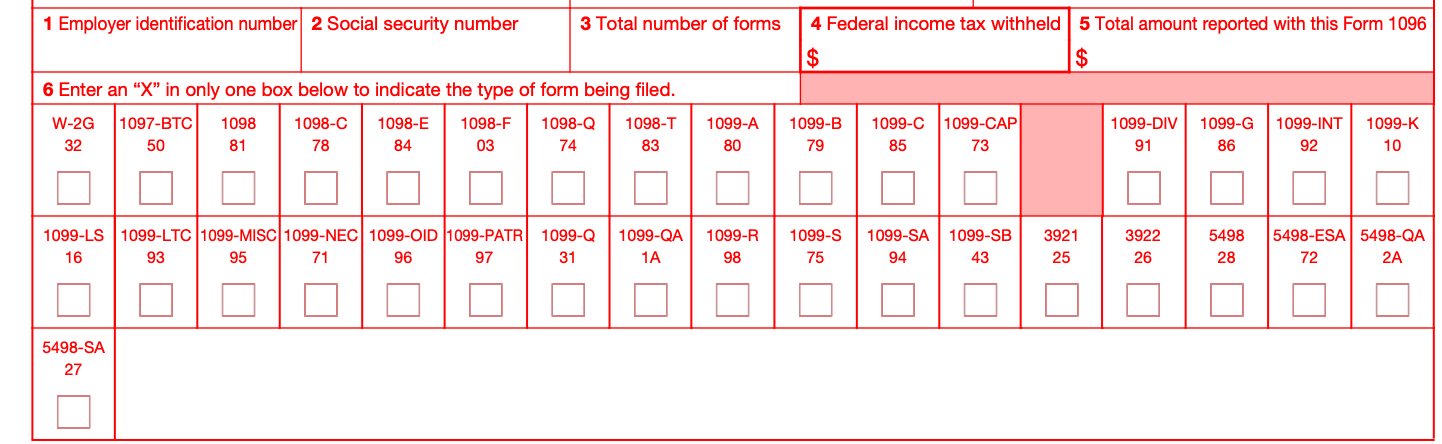

Box 6 contains a checklist for the various forms that are summarized via Form 1096. Since we've listed only seven forms that fall under its ambit, you might be confused seeing 34 boxes listed here. But there's a simple rationale behind it.

Box 6 contains a checklist for the various forms that are summarized via Form 1096. Since we've listed only seven forms that fall under its ambit, you might be confused seeing 34 boxes listed here. But there's a simple rationale behind it.

As you can see, many forms have multiple variants. Form 1120 has 6, Form 1099 has 20 variants, and Form 5498 has 4. The IRS considers each of these variants as one form.

So in effect, if you've filed a Form 1099-A and a Form 1099-MISC, you'll have to fill in two different Form 1096s summarizing each. The key here is to remember that Box 6 will contain only one tick.

Note: We urge you to fill in Box 6 first so that you remember which form's being summarized. This will avoid any error in the total amount you'll have to mention in Box 5.

Step 3: Sign and file the form

Review the completed Form 1096 for accuracy and completeness. Sign and date the form, and keep a copy for your records.

Review the completed Form 1096 for accuracy and completeness. Sign and date the form, and keep a copy for your records.

Obtaining Form 1096

If you're planning to send in your IRS Form 1096 via paper, then you'll have to pay close attention to what's being discussed in this paragraph.

You cannot print Form 1096 off of the internet, nor can you photo scan a copy of the same. The reason behind it is that the IRS scans each copy of Form 1096 it receives. They need official, original documents from the firm.

Here are some ways you can get a physical copy of Form 1096:

- You can easily mail order the various forms from the IRS from their website. Simply log on to this site, search for the required form, and place an order. The quantity limit for a particular form is set at 100.

- If a form is not in stock right now, the IRS will send it as soon as the inventory's replenished; there's no need to place an order again.

- Other sources include office supply stores as well as tax preparation software.

- Alternately, you can place an order via phone. You can dial 1800-tax-form (800-829-3676) between 7 AM and 10 PM from Monday to Friday. You should call the same line if you require more than 100 copies of any of the forms on the website.

IRS Form 2553, “Election By a Small Business Corporation,” is required to be filed with the IRS to switch a C Corporation to S Corporation status for purposes of federal taxation.

Where Should You Send Form 1096?

Form 1096, along with Copy As of paper information returns, must be posted to the nearest Internal Revenue Service office from your principal business location. You can find the exhaustive list on this page.

You can also find this information in the instructions printed on the Form 1096 PDF provided above.

What Is the Due Date to Submit Form 1096?

For the financial year 2020, the due date for submitting Form 1096 summarizing Form 1099-NEC to the IRS is February 1, 2021. Both must be submitted together.

The deadline for submitting Form 1096 for summarizing any of the other forms is March 1 if you're filing it via paper and March 31 if you're doing it electronically.

The penalty for late filing of the form progresses with time. Submitting within a month of the deadline would cost you $50, after which it doubles. On August 1, the penalty jumps to $260, and if the information is not filed intentionally, the penalty is a steep $530.

Conclusion

Form 1096 is a summary form that has to be filed if your business has issued any one of Forms 1097, 1098, 1099, 3921, 3922, 5498, or W-2G to anyone in the financial year paying them more than $600.

It's worth remembering that Form 1096 cannot be photocopied or printed off the internet; you have to place an order with the IRS for them. The usual delivery span is given as 10 business days, so order accordingly.

If you've issued the other forms by paper, you'll have to file Form 1096 by paper only.

The IRS considers the different varieties of Forms 1098, 1099, and 5498 as different forms, so you'll have to fill in a Form 1096 for each type of those forms if you've issued any. As a small business, though, your main concern would be Form 1099-NEC.

When in need of accurate financial reports for your tax returns, consult a professional bookkeeping service like Fincent. Our team takes care of money matters for you, giving you the freedom to innovate and grow your small business.