- IRS forms

- Form 2553

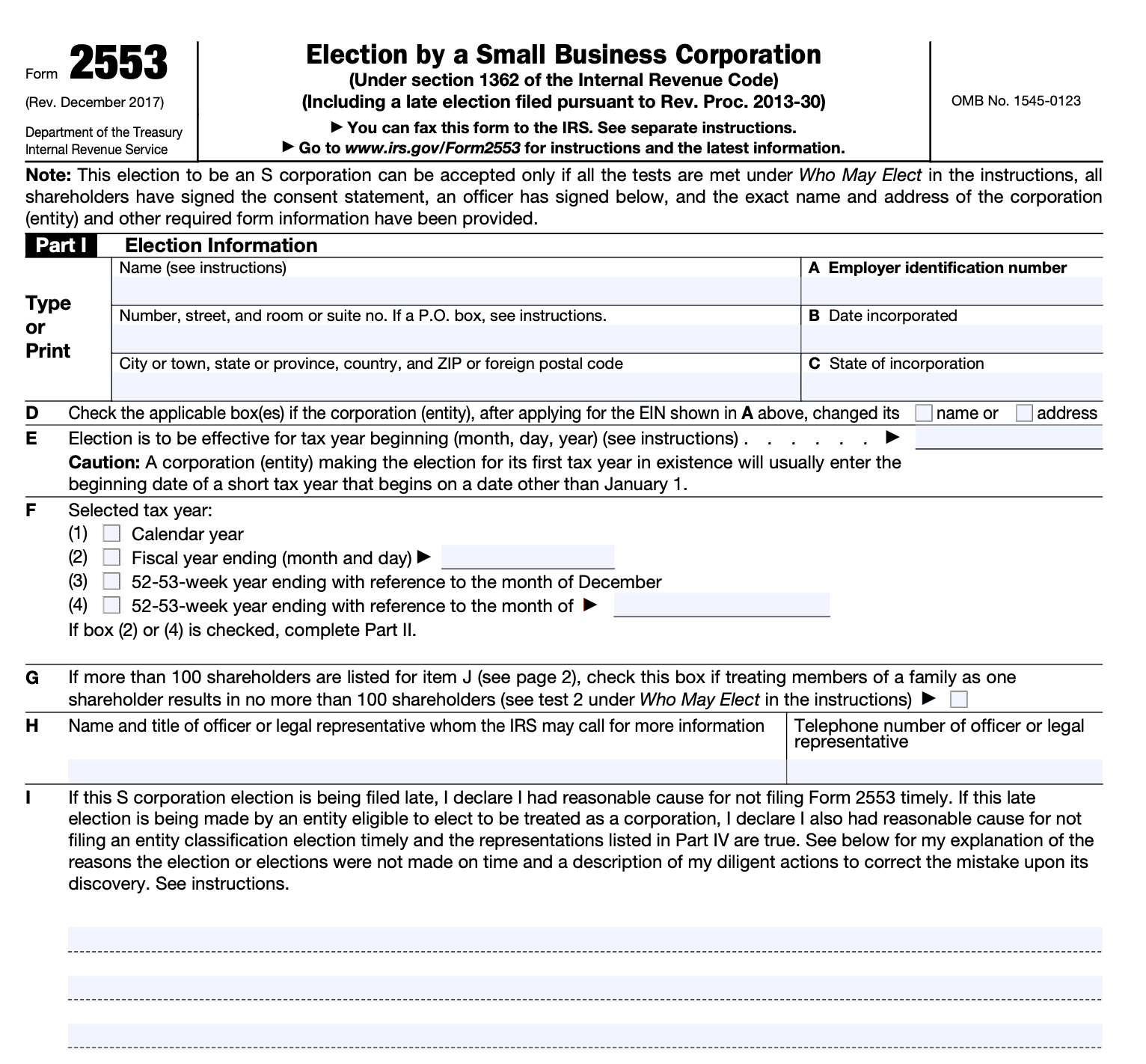

Form 2553: Election by a Small Business Corporation

Download Form 2553Tax compliance is a key part of running any business. However, if you run a smaller business, chances are taxes eat into a sizable portion of your profits. This is why tax planning is crucial for small businesses.

Special tax designations can help your small business save on taxes and help you scale up in the long run. And that's where Form 2553 comes in.

What Is IRS Tax Form 2553?

A business that files for incorporation with the IRS is designated as a C corporation by default. However, this tax designation isn’t very tax-efficient. It makes sense to have your business incorporated as an S corporation to potentially save on taxes.

IRS Form 2553 (Under section 1362) is what helps you elect to be taxed as an S corporation instead of the default C corporation status.

Who Files Form 2553?

A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to be an S corporation.

How To Complete Filing Form 2553: Step-by-Step Instructions

Once you’ve downloaded Form 2553, you can begin carefully filling in each of the four parts using the instructions mentioned below.

Step 1: Provide election information

This section requires you to provide the following information about your business:

- Name and address of the business

- State where the business was incorporated and the date of such incorporation

- (link: https://fincent.com/glossary/employer-identification-number text: Employer Identification Number (EIN))

- Names and contact information of officials in your corporation who the IRS can contact for any correspondence concerning your form

- The tax year you would like your business to be designated as an S corporation.

Under normal circumstances, Form 2553 must be filed within two months and 15 days from the beginning of the tax year for your business.

In case this period has lapsed, you can still file the form by providing information about the delay under Item I. Pay attention to Part IV of the form if this applies to you.

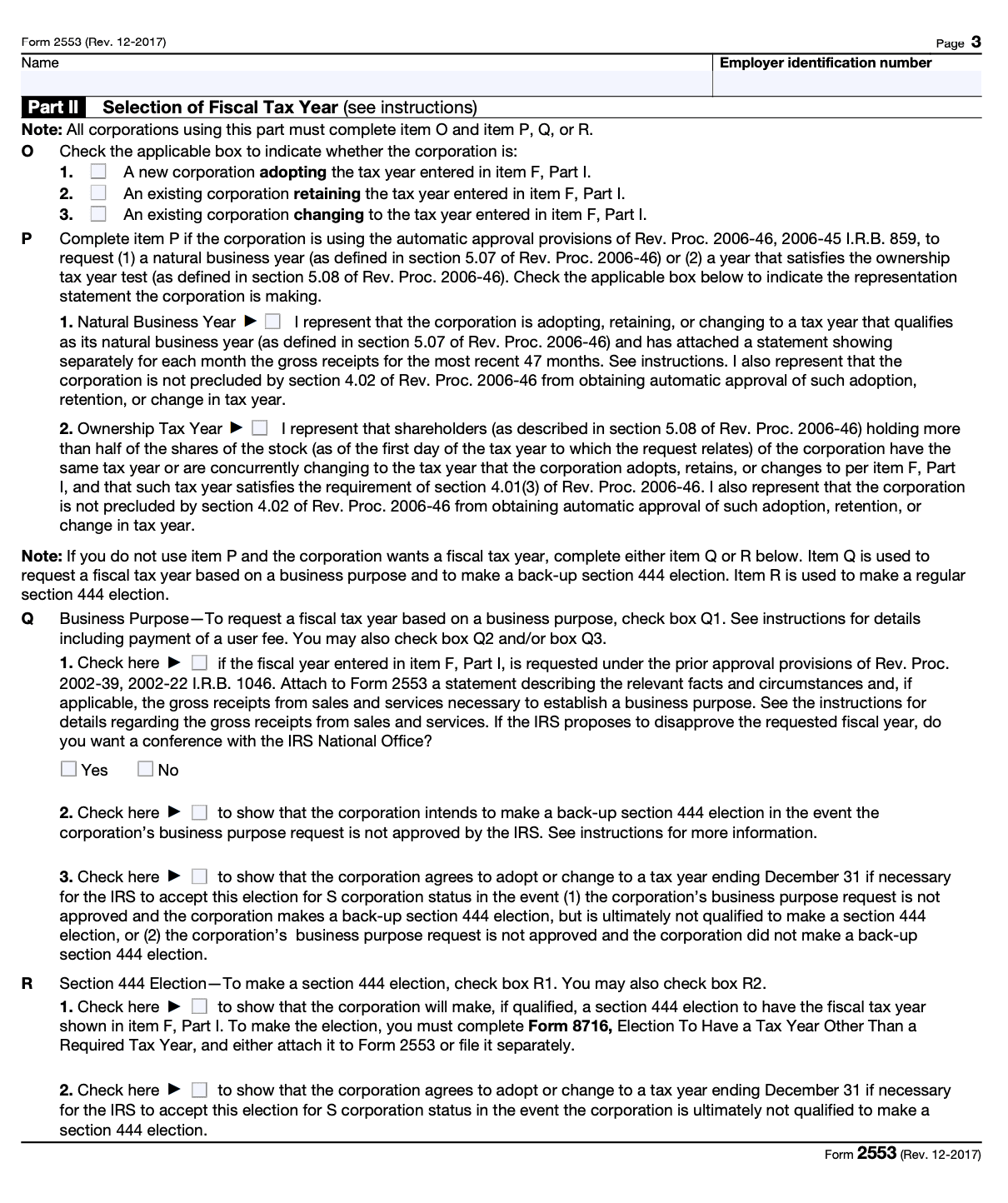

Step 2: Select the fiscal tax year

This section allows you to choose your tax year if you checked boxes (2) or (4) in Item F of Part I. You can either choose to retain your existing tax year or change it from or to the calendar year.

You may choose your natural business year or ownership tax year by completing Item P (1) or (2), respectively.

You can also request a fiscal tax year without completing item P if it is for a specific business purpose, along with a backup Section 444 election vide Item R. The business can opt for a regular Section 444 election by completing Item Q.

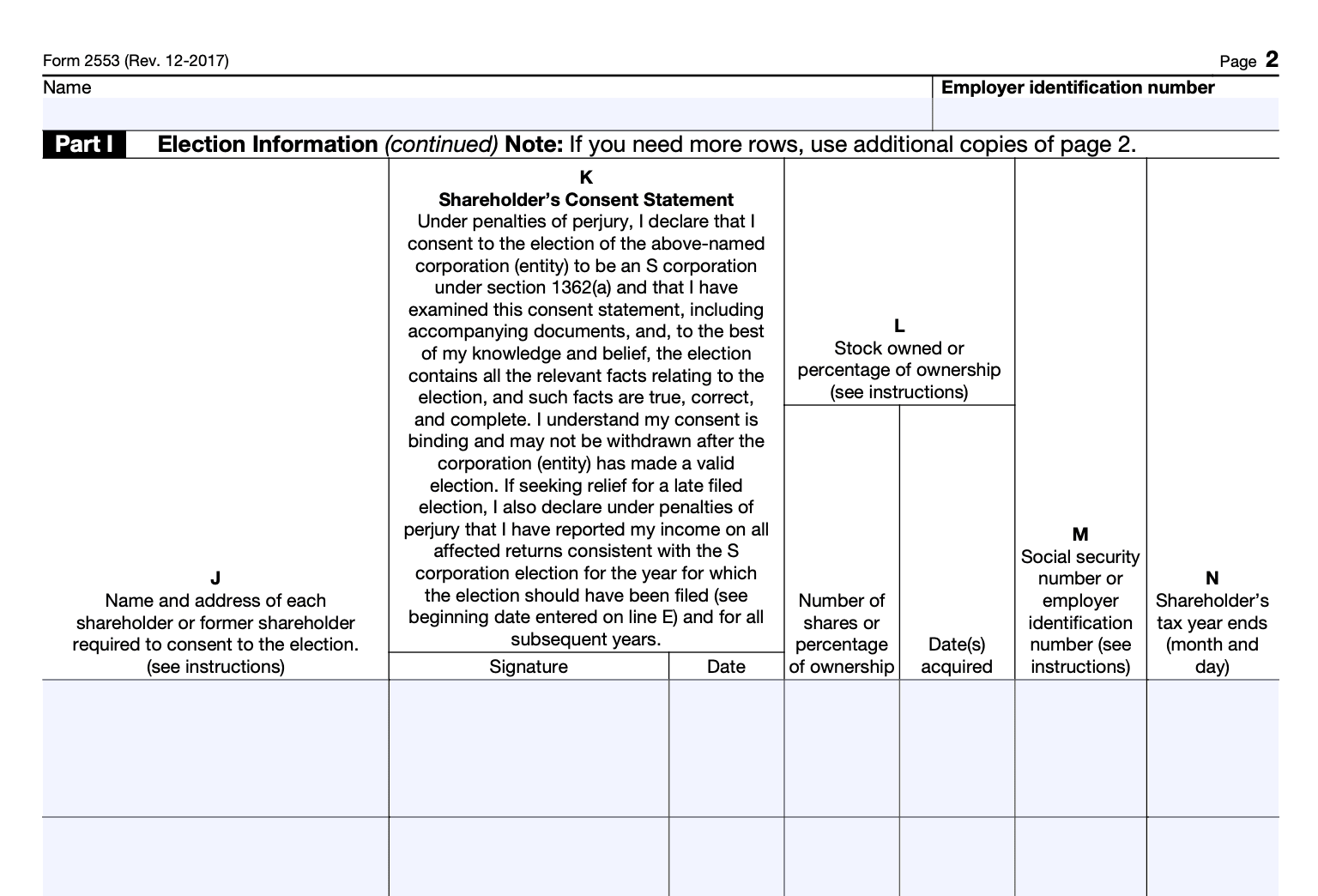

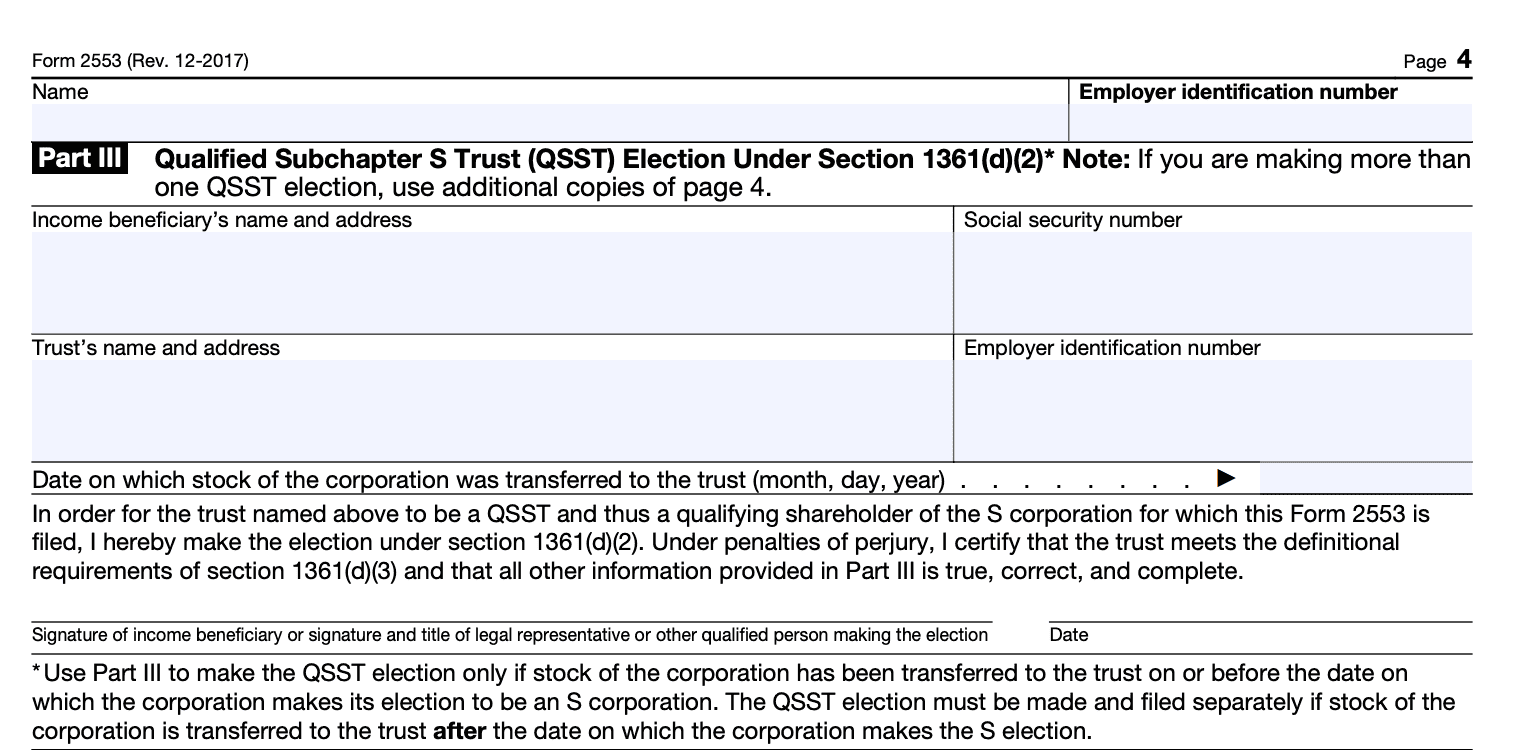

Step 3: Complete Part III, Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)

This section only applies to trusts applying for the S corporation tax designation.

If this section is relevant to your trust, fill in the following:

- Beneficiary’s name, address, and Social Security Number (SSN)

- Name and address of the trust and the EIN

Step 4: Complete Part IV, Late Corporate Classification Election Representations

This section is relevant only if you’re making your application past the deadline period, which is two months and fifteen days from the commencement of the tax year.

If your business uses the calendar year as the tax year, your deadline would be March 15 of the same year.

Step 5: Review and file the form

The IRS only allows filing Form 2553 through mail or fax.

The Department of the Treasury Internal Revenue Service Center is situated in two locations. You can send the original copy of the form to the address that corresponds with the location of your corporation's principal business, office, or agency.

What Is the Deadline to File Form 2553?

You are permitted to file Form 2553 any time of the year. The IRS has not laid down a particular date as the deadline to file the form. However, when you file the form determines how soon the IRS grants your company the S corp status.

If you want your company to elect the S corp tax status, you need to:

- Either file the form during the year preceding the tax year the election has to take effect, or

- File it within 2 months and 15 days after the beginning of the tax year the election is to take effect.

If you consider the calendar year as tax year (ending on 31st December) for your business, the last date to file the form would be 15th March, 20XX.

For example, you will need to file the form before 15th March 2022 if you want the S corp election to take effect from January 2022 retroactively. But if you file it after the 2.5-month window, your company won't be elected as an S corp until 2023.

How Often Do I Need to File Form 2553?

Form 2553 is typically filed once when a corporation or entity first elects to be treated as an S corporation. However, if the election is revoked or terminated, and the business wishes to regain S corporation status, the form must be filed again.

What Happens if I File the Form Late?

The IRS has certain provisions for granting S corp status in case of a late filing in a few scenarios. You may be eligible to file Form 2553 late if:

- The company intended to be elected as an S corporation by the intended effective date, i.e., the date entered on line E of Form 2553.

- The company has a reasonable cause to not timely file the form.

- The company and its shareholders reported their incomes per S corporation status and, in a way, consistent with the company's intention to be elected as an S corp for the same tax year - providing proof of the same.

Filing Cost for Form 2553

Filing Form 2553 itself incurs no fee unless you are requesting a special tax year by checking box Q1, which incurs a $6,200 user fee. Remember, while the IRS does not charge for the form, there could be other associated costs for professional services.

How Long Does the Processing Take and When Can I Expect to Hear Back?

The IRS is usually quick to respond with a status update on your application. You can expect to hear back from them within 60 days of filing your form. If not, you can reach out to them for an udpate.

Also, it’s advisable to understand the requirements of W2 and W4 forms for small business.

How Do I Get a Copy of My Form 2553 From the IRS?

If your business is granted the S corp status, you will need to keep a copy of your Form 2553 handy as you will need it when you file your taxes.

In an event that you lose your Form 2553, you can file a request with the IRS to get a new copy. Follow the steps below to do so:

- Call the IRS Business and Specialty Tax Line at 1-800-829-4933 during their working hours (7 AM to 7 PM in your state's time zone).

- Request for a copy of the form.

- Identify yourself with your name and role within the company, your corporation's name and address, your EIN, and your business' contact details.

If you are planning to start a small business, understand different types of startup expenses, which will help you launch successfully.

Conclusion

Filing for the S corp status comes with various tax benefits for your business. The IRS has laid down the process of filing Form 2553 in detail on its website.

Another way to maximize savings for your small creative business is to hire a professional bookkeeping service like Fincent. We handle all your accounting and money management needs so you can devote your undivided attention to creative pursuits and growing your company. Discover how our team of bookkeepers can help you make sound financial decisions.

FAQs:

Are there any separate state rules for Form 2553? Yes, state rules for S corporation election can vary. Some states recognize the federal S corporation election automatically, while others require a separate state election. It's important to consult with a tax professional or your state's tax authority for specific requirements.

What’s the difference between Form 8832 and Form 2553? Form 8832 is used by entities to elect their classification for federal tax purposes (e.g., partnership, disregarded entity, or corporation), while Form 2553 is specifically used by corporations that want to elect S corporation status.

What happens after you submit Form 2553? After submitting Form 2553, the IRS will review your election and notify you usually within 60 days whether your election to be treated as an S corporation has been accepted.

How do I know if my Form 2553 was approved? The IRS will issue a letter of determination informing you if your Form 2553 has been approved. If you haven't heard from the IRS after 60 days, you can contact them to inquire about the status of your application.

Who is required to consent to the S Corporation election on Form 2553? All shareholders must consent to the S Corporation election by signing Form 2553. Conversely, to revoke the S Corp election, consent from holders of more than 50% of the corporation's shares is required.

How do I know if I have an S Corp or a C Corp? To determine whether your business is classified as an S Corp or a C Corp, you can contact the IRS Business and Specialty Tax Line for confirmation.

Can I submit Form 2553 online? No, Form 2553 cannot be submitted online. It must be sent via mail or fax to the IRS according to the instructions provided on the form.