Difference between 1099-NEC and 1099-MISC

This article offers a 1099-NEC vs. 1099-MISC breakdown and an in-depth look at both forms so that you can stay informed without losing track. Know when to file these forms, how to submit these forms, and the penalties.

On your Linkedin feed, it may seem entrepreneurs are always doing something cool and going places.

However, those who have been in the trenches know the entrepreneurial journey is not as glamorous as it appears. Some of the most critical aspects of running a business are mundane and dull. Yet these responsibilities and challenges must be taken care of, for business growth.

Knowing your taxes is one of those.

In 2020, IRS revived the form 1099 NEC for small businesses to report non-employee compensation. This form differs from 1099-MISC, which was used till 2020 to report the same.

If you run an agency/a small business (or work with freelancers), you must understand the difference between 1099 NEC and 1099 MISC, when to file these forms, how to submit these forms, and the penalties.

But keeping track of all the intricacies of tax regulations is HARD, right?

This article offers a “1099-NEC vs. 1099-MISC” breakdown and an in-depth look at both forms so that you can stay informed without losing track.

What is form 1099-NEC

As mentioned above, before 2020, 1099-MISC forms were used for reporting any payment sent to contractors and freelancers. But to keep up with the gig economy and address the tax filing deadline issue( more on that later), IRS reintroduced form 1099-NEC after 32 years.

1099-NEC is a must for each person to whom you( as a business owner) paid at least $600 for:

- Receiving service from a person who is not your employee ( Hence, you can’t include it in W 2 forms.)

- Making payments to attorneys ( this includes law firms and other legal service providers)

- Purchasing fish from someone involved in the trade and business of catching fish.

In other words, 1099-NEC is a must for freelancers ( provided they are from the US ) you work with or the legal consultants you hire. Also, if you withhold any federal income tax from any US taxpayer, you must file the 1099-NEC as well.

Form 1099 is pretty short and easy to fill. To complete it, you need to provide the following information:

- Payer’s information, including name, address, and taxpayer identification number (TIN).

- Recipient’s information, including name, address, and TIN.

- The total amount of non-employee compensation paid.

- Any federal or state income tax withheld.

Please note that you have to fill up multiple copies of 1099-NEC:

- Copy A is for IRS.

- Copy 1 goes to your state tax department.

- Copy B and Copy 2 are for the recipient.

- Copy C is yours to keep.

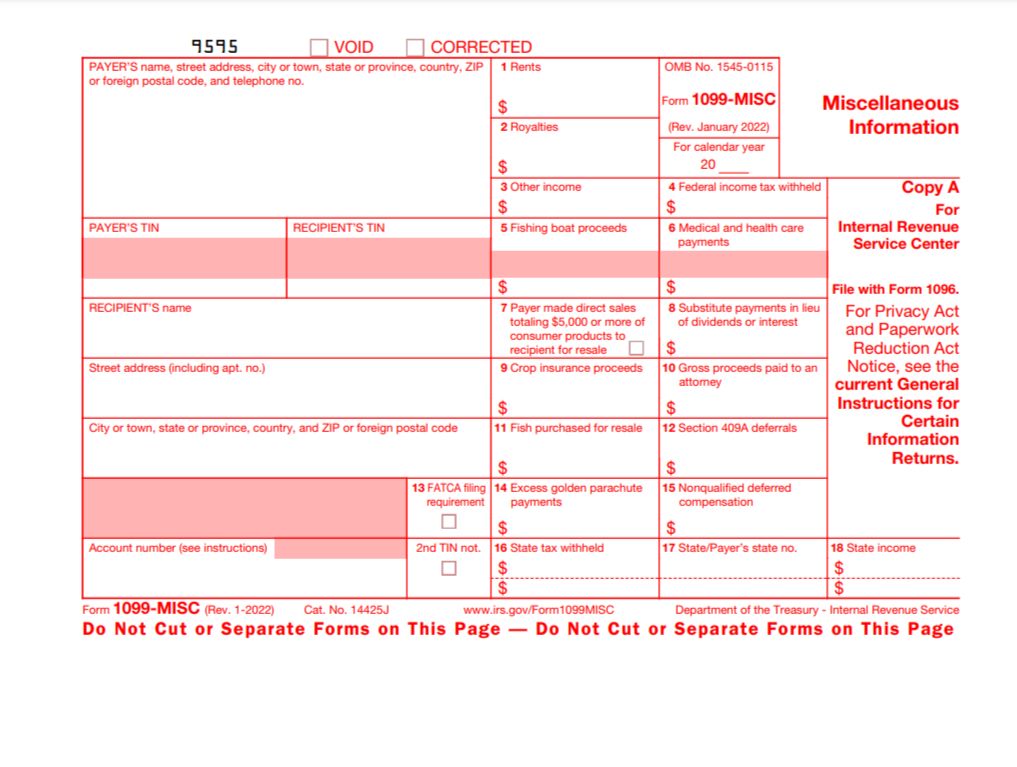

What is form 1099-MISC

1099 MISC is no longer applicable for non-employee payment situations involving independent contractors/ service providers and freelancers.

However, you need to file a 1099-MISC in the following situations, provided the amount paid exceeds $600 :

- Rents (Box 1)

- Royalties (Box 2)

- Other income (Box 3), including prizes and awards

- Federal income tax withheld (Box 4), including backup withholding

- Fishing boat proceeds (Box 5)

- Medical and health care services (Box 6)

- Substitute payments in place of dividends or interest (Box 8)

- Crop insurance proceeds (Box 9)

- Gross proceeds paid to an attorney. (Box 10. However, you should report payments to attorneys for services on Form 1099-NEC.)

- Fish purchased for resale (Box 11)

- Section 409A deferrals (Box 12)

- Excess golden parachute payments (Box 14)

- Nonqualified deferred compensation (Box 15)

In other words, you will be filing 1099-MISC for the rent you paid for your office, any cash rewards you gave away, and any medical services you opt for as a business owner.

Like its 1099 NEC counterpart, the 1099-MISC form requires the following:

- Payer’s information, including name, address, and taxpayer identification number (TIN).

- Recipient’s information, including name, address, and TIN.

- The amount of payment.

- Any federal or state income tax withheld.

Why did they introduce 1099-NEC when 1099-MISC is still relevant?

Currently, both 1099-NEC and 1099-MISC are active. Even one might have to file both at the same time. So this begs the question: why did 1099-NEC come back after 32 years?

There are two reasons behind it.

-

Filling deadline simplification: Until 2015, the deadline for the 1099-MISC form was 28th Feb. But IRS set the deadline for W-2 forms ( employee compensation from the previous year) on 31st Jan. This almost one-month gap between the two deadlines confused many taxpaying business owners.

To address this issue, Protect Americans from Tax Hikes( PATH) law was introduced, which shifted the deadline of 1099-MISC to 31st January (same as the W2 form).

There was one caveat, though:

PATH shifted the deadline for filling 1099 MISC with non-employee ( contractors and freelancers) compensation part only. The deadline for filing the forms remained 28th Feb for other situations. Two deadlines for different parts of the same tax document created some more confusion among taxpayers.

As a solution, IRS reintroduced the 1099-NEC to end this confusion and align the deadlines.

-

The rise of the gig economy:

The gig economy is slowly gaining prominence across the globe. And US economy is leading the change.

In 2022, 70.4 M Americans worked as freelancers. Based on a Statista report, the number will be 79.6M by 2025. And younger workforces( 50 % of Gen Z and 44% of millennials) also lean toward freelancing.

The skill level of this workforce varies across the board, from beginner level to expert consultant level. The degree of involvement isn’t homogenous either: Some are full-time freelancers, and some do freelancing on the side to supplement their income.

It was impossible to accommodate all that within box 7 of the previous 1099-MISC form. Hence the form 1099 NEC made a comeback.

IRS from 1099 NEC vs. 1099 MISC: what is the difference?

Now let’s address the elephant in the room “ what is the difference between a 1099 MISC and a 1099 NEC?”

Both forms report payments made to individuals and service providers who are not employees. However, the difference lies in the types of expenses each form covers.

**Non-employee compensation: **

If a business owner hires freelancers for some projects or seeks help from consultants, then the business owner is liable to submit a 1099 NEC form.

These freelancers/consultants must be

- US taxpaying citizens located in the country

- Located internationally but are US citizens

- US citizens living abroad but still performing some work in the US

Your non-employee compensation could also include benefits, fees, and commissions you pay.

Many business owners rush to fill up 1099 NEC just because they hired some contractors. But there is no need to submit a 1099 NEC if your contractor/freelancer is a citizen of another country.

In general, you don’t issue 1099 NEC forms to S corporations and C corporations. Still, there are some exceptions.

- Medical and health care payments

- Payments to an attorney/ legal service provider

- Substitute payments in lieu of dividends or tax-exempt interest

Miscellaneous compensation:

1099 MISC form covers any payment you made to non-employees that doesn’t come under 1099 NEC form regulations. If you have paid more than $600 for any of the following purposes, a 1099 -MISC is a must.

- Rent payments

- Prizes or awards

- Fishing boat proceeds

- Crop insurance proceeds

- Medical or healthcare payments

- Gross proceeds paid to attorneys

- Substitute dividends and tax-exempt interest payments

Now 1099 MISC is applicable only when payments are made in the course of your trade or business. No personal transactions are reportable.

Here is an example for your better understanding:

Suppose you hire your friend as a freelance designer. Whatever you pay him in exchange for his work should be in the 1099 MISC form. However, if you gift him a check as a birthday gift, you can’t show that expense in the 1099 MISC form.

The form also covers any compensation you pay to a deceased employee. IRS has fleshed out which payments come under 1099 MISC in this document.

How to file for 1099-NEC/ 1099-Misc and error correction

We have already touched on when you need to file 1099 NEC and 1099 MISC forms. But how to file those forms?

First, you need to collect the following details even before you actually start filling out the form.

- Your TIN ( taxpayer identification number)

- Recipient’s TIN

- Recipient’s name and address

- The amount you paid to the recipient ( The amount of non-employee compensation in case of 1099 NEC)

- Federal income tax and state tax withholding

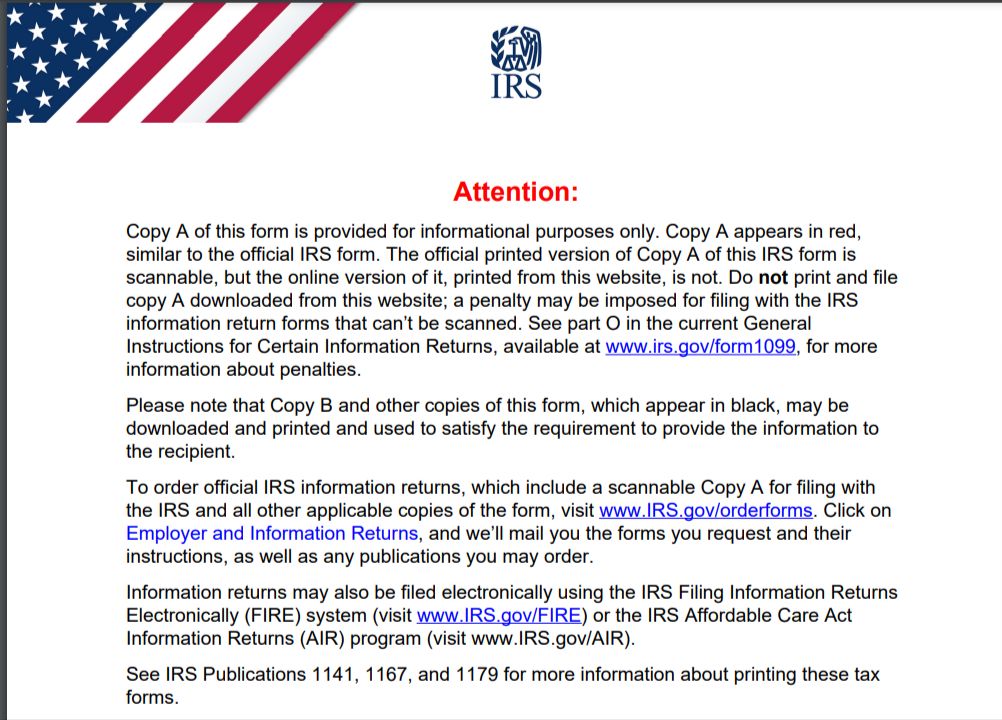

In the next step, you want to start filling out the actual form. But you can’t just download tax forms directly from the IRS website.

Online versions of 1099 NEC and 1099 MISC forms are not scannable. Therefore using downloaded forms may lead to the rejection of your tax files. You might even get slapped with a penalty if your forms can’t be scanned.

So err on the side of caution and order 1099 NEC/MISC forms on the IRS website.

The IRS encourages businesses to file forms electronically using Filing Information Returns Electronically system ( FIRE). You can, however, send your tax forms via mail. If you file 250 or more forms, you must use the electronic filing methods.

You also want to send out copies of 1099 NEC/1099 MISC to various parties as a part of the filing procedure.

-

Copy A should go for IRS. As a small business owner ( as per IRS standard), you want to submit a 1096 form along with your 1099 forms.

-

Submit Copy 1 of both 1099 NEC and 1099 MISC forms to the State Tax Department.

-

Your contractors should get Copy B so that it can be used while filing contractors’ income tax returns.

-

Save Copy C for your company’s record.

The entire procedure of filing these 1099 forms isn’t very complicated. With that said, someone might use the wrong box, unintentionally put the wrong information, complete the wrong form, or make other mistakes.

Thankfully, one can correct his/her errors. According to IRS regulations, two types of errors can be fixed:

Type 1: Type 1 error occurs when your form comes with one of the following errors:

- The incorrect amount

- An incorrect code or checkbox

- An incorrect payee name or address

- when you filed a form when one should not have been filed

To correct any type 1 error, you need to prepare a new 1099 form ( applicable for both 1099 NEC and 1099 MISC) with correct information, check the “corrected box”, and add a new 1096 form ( to send with Copy A to the IRS). Mail your corrected 1099 form and the new 1096 form to IRS, contractor, or State tax department.

Type 2: When you put the wrong TIN, name, or address of either recipient or payer, it falls under Type 2 error. This includes:

-

Wrong payer information (TIN, address, and name)

-

Wrong recipient information ( TIN, address, and name)

-

Incorrect form

To correct any type 2 error, you need two new 1099 forms. The first form will have the same information as the original incorrect one. But the amounts will be “0” in every box. Also, checking off the “corrected” box is mandatory.

The second 1099 form will contain all the appropriate information. Send these two forms along with the 1066 form to IRS and State Tax Department.

1099 NEC vs. 1099 MISC: deadline and penalties

These two 1099 forms don’t share the same deadline.

Agency owners and businesses who have paid over $600 or more to freelancers/contractors are obliged to file the 1099 NEC form by 31st January. In other words, send your 1099 NEC to both the recipient and IRS by 31st January.

For the 1099-MISC forms, you have a deadline of January 31st. However, if you put numbers in boxes 8 and 10, then the deadline is Feb 15.

If you, as a business owner, fail to file your forms by 1099 NEC or 1099MISC deadlines, you might have to pay $50 to $270 per form as a penalty. The amount of fine can vary depending on how late you file the forms. The total maximum fine for a small business can go up to $556500.

In case of intentional delay of tax filing, small businesses are subjected to a minimum penalty of $550 per form or 10% of the income reported.

Long story short, you will face a lot of trouble and a hefty fine if you fail to file your taxes within the deadline.

**Do businesses need to file both 1099 NEC and 1099 MISC forms? **

It’s possible to find yourself in situations where you wonder, “ Should I use 1099 NEC or 1099 MISC?” For instance, one of your contractors took part in a competition ( that you organized) and won a prize. Or it could be a friend from whom you rented an office place and seek legal consultation.

Sometimes you do need to file both 1099 forms, even for the same individual. In such situations, use two separate 1096 forms for each 1099 form.

Conclusion

Both 1099 MISC and 1099 NEC are for reporting non-employee payments. 1099 NEC covers your expenses for compensating your contractors. On the other hand, 1099 MISC reports your rents and any non-employee compensation that doesn't fall under 1099 NEC.

Filing these forms isn’t complicated, but there is a chance that you miss a payment or mistype any information if you do it manually. And such mistakes can get costly. That’s where applications like Fincent come in. It keeps track of your expenses and allows you to do taxes without much hassle.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more