Tax Extension Guide: Deadlines, Forms, and Qualifying Criteria

Whether you're aiming for a bit of extra breathing space to ensure your finances are perfectly organized or life's unexpected twists have left you dealing with matters other than taxes, tax extensions are here to offer assistance. So, let's explore the ins and outs of how to get a tax extension and how they can help make return filing less daunting.

If, for any reason, you've found yourself in a last-minute frenzy just before tax day, frantically searching for misplaced receipts and questioning why you didn't take care of this sooner – you're not alone. The good news? The IRS has a lifeline for you. Tax extensions are your escape hatch – your “get out of tax day stress” card. And it's not a solitary journey – every year, likely millions of Americans file for tax extensions.

So, whether you're aiming for a bit of extra breathing space to ensure your finances are perfectly organized or life's unexpected twists have left you dealing with matters other than taxes, tax extensions are here to offer assistance. So, let's explore the ins and outs of how to get a tax extension and how they can help make return filing less daunting.

What Is Tax Day?

Tax day is the deadline for filing federal income tax returns. It falls on April 15 each year, unless it coincides with a weekend or a holiday. On this day, individual taxpayers are required to submit their completed tax returns to the Internal Revenue Service (IRS), reflecting their income, deductions, credits, and other relevant financial information for the previous calendar year.

Should You File a Return?

The answer to this hinges on several factors:

- Your total income

- Your filing status

- Your age

- Your dependency status

Even if your earnings fall below the required filing threshold set by the IRS (meaning you need not file a return), it might be beneficial for you to file one, as doing so could lead to a refund. This could be relevant in the following situations:

- Your pay had federal income tax withheld from it.

- You made estimated tax payments.

- You meet the criteria for claiming tax credits like the earned income tax credit or child tax credit.

What Are Tax Extensions?

Taxpayers can submit applications to the IRS seeking an extension to file their returns beyond the standard tax filing deadline. This extension typically extends the deadline from April 15 (this year, the date was April 18 for filing your 2022 returns) by six months. Therefore, if a request for a tax extension was filed by April 18, 2023, the deadline for filing taxes would be extended to October 16, 2023.

Why Should I File for a Tax Extension?

Well, you don’t need a specific reason or justification to file an extension, especially considering the IRS doesn’t demand one. You could opt to file for an extension in any of the following circumstances:

- Life's unexpected twists: Health issues or family emergencies can disrupt careful tax preparation, making an extension a valuable solution for those facing unforeseen challenges.

- Complex financial scenarios: Intricate financial situations often require additional time to ensure accurate reporting and compliance.

- Business challenges: Businesses dealing with intricate financial transactions, mergers, or acquisitions find extensions vital in facilitating thorough and precise tax filings.

- Avoiding rushed submissions: The pressure of meeting the standard tax deadline can lead to hurried submissions and errors. Extensions provide breathing room to avoid these mistakes.

- Error-free returns: Tax extensions serve as a lifeline for those who require extra time to ensure meticulous and error-free tax returns. This promotes full compliance and accurate reporting.

Failing To File Returns: Consequences

Another (rather compelling, one might say) reason for filing tax extensions is the negative effects of not filing your returns on time: the “failure to file” penalty and the interest charged on the unpaid amount.

The calculation of the penalty depends on the delay in submitting the tax return and the outstanding tax amount as of the initial payment deadline (not the extended one, even if you got an extension). Unpaid tax refers to the overall tax obligation indicated on your return, minus payments made through:

- Withholding

- Estimated tax payments

- Eligible refundable credits

This late-file penalty is determined as follows:

- The penalty equals 5% of your unpaid taxes for each month or portion of a month your tax return is overdue. However, the penalty does not exceed 25% of your unpaid taxes.

- If the failure to file penalty and the failure to pay penalty (i.e., the penalty levied if you fail to pay your taxes before or by tax day) are applied in the same month, the failure to file penalty decreases by the failure to pay penalty amount for that month. This results in a combined penalty of 5% for each month or portion of a month your return was delayed.

- After 5 months without payment, the failure to file penalty reaches its limit. Yet, the failure to pay penalty persists until the tax is settled, up to a maximum of 25% of the unpaid tax by the due date.

- For returns delayed by over 60 days in 2023, the minimum failure to file penalty is $450 or 100% of the tax on the return, whichever is less.

How Do Tax Extensions Work?

The benefits of tax extensions are many, but the main one is that tax extensions lengthen the filing deadline, giving you more time to gather the necessary records you need to file your returns, among other things.

However, importantly, they don't extend the timeline for settling your tax liabilities. What does this mean? Well, while you get an extension for filing your tax return, it remains imperative that you a) estimate and b) settle any owed taxes by the original deadline to sidestep any potential penalties (the failure to pay penalty) and interest.

Therefore, do note that an inability to pay is not a good reason to file an extension. If you find that you are unable to pay, what you can do is opt for one of the IRS’s payment plans, which enable you to pay off your tax balance over an extended period. You can enter into an installment agreement, which allows you to pay off your tax in installments every month until your entire obligation is cleared.

How Do I File for an Extension?

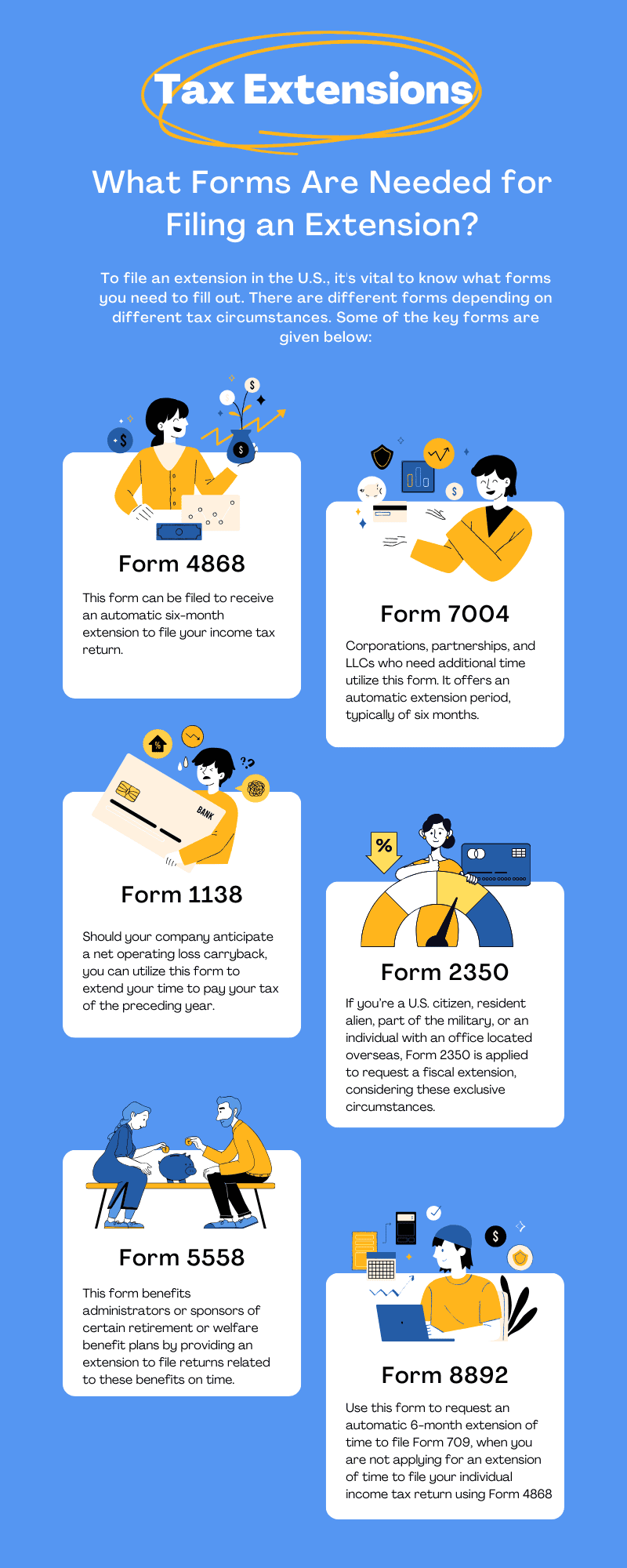

If you are an individual taxpayer, you need to submit Form 4868. Businesses and corporations generally file Form 7004.

Form 4868

This form is applicable when an extension is required for the following returns:

- Form 1040: US Individual Tax Return

- Form 1040-SR: US Tax Return for Seniors

- Form 1040-NR: US Nonresident Alien Income Tax Return

- Form 1040-PR: Self-Employment Tax Return-Puerto Rico

- Form 1040-SS: US Self-Employment Tax Return

Do I have to give reasons for requesting an extension?

Well, no. There's no necessity to state a reason for seeking an extension (especially considering this form spans half a page). You only need to fill out two sections:

- In Part I - Identification: Your name, address, Social Security number, and, if relevant, your spouse's Social Security number

- In Part II - Individual Income Tax: An honest estimate of your projected final taxes, factoring in the total tax payments you've already settled during the year

If you estimate that you owe taxes, it's essential that you settle the balance along with the form.

Tax Extension: Process

Here’s how you can file Form 4868:

- Obtain the form: Download Form 4868, Application for Automatic Extension of Time to File US Individual Income Tax Return.

- Provide the required information: Complete the necessary sections of the form, including your personal or business details, tax identification number, estimated tax liability, and any payments you've already made. Double-check this information to ensure it is accurate, matches IRS records, and is up to date.

- Choose a filing method: Decide how you want to file the tax extension request. You can typically file electronically using tax software, through an authorized e-file provider, or by mailing a paper form. Here are your options if you choose to file online:

- The IRS’s collaboration with the nonprofit group Free File Alliance offers individuals with an adjusted gross income below $73,000 access to no-cost, tax preparation software through IRS Free File. When it comes to filing a tax extension, anyone, regardless of income can utilize the platform for that purpose.

- IRS e-file is the electronic filing system offered by the IRS. It lets you electronically submit your tax forms. Using e-file, you can secure an extension for filing your tax return by electronically submitting Form 4868 through IRS e-file independently, utilizing either no-cost or paid tax software, or seeking assistance from a tax professional who is adept at using it.

- Mail paper form: If using a paper form, fill it out accurately, sign it, and mail it to the appropriate IRS address. Make sure to use certified mail for proof of delivery.

- Estimate and pay any owed taxes: If you owe taxes, estimate the amount and include payment with your extension request. This minimizes the risk of penalties and interest.

- Receive confirmation: If you e-file, you'll receive an acknowledgment or confirmation of your extension request. If you mail a paper form, consider sending it well before the deadline to ensure it's received on time and you have time to make any corrections, if required.

- Meet the extended deadline: Your tax extension will grant you additional time (usually around six months) beyond the original due date. Use this time to accurately prepare your tax return.

Paying an estimate

Alternatively, if you pay the IRS all or part of your estimated taxes (before or by tax day) by scheduling a payment with the IRS’s Direct Pay using the Electronic Federal Tax Payment System (EFTPS) or your credit/debit card, you won’t have to file a separate extension form. However, while paying, you must select the indicator that states that the payment is for an extension. Upon doing this, you will get a confirmation number for your records, and you needn’t file a separate application for an extension.

Can it get rejected?

Well, sometimes. To prevent this from happening, make sure there are no spelling errors or calculation errors and that you provide up-to-date information (your address, surnames, etc.) that matches IRS records. The IRS usually gives you time to remedy these errors, and you will be intimated by mail if your application is rejected. This is also another reason to file for an extension well in advance and not too close to tax day.

Tax extensions for businesses

Like with Form 4868, Form 7004 grants businesses a six-month extension from the original due date of the return (which is based on the business structure and fiscal year). For example, if the original due date is March 15, the extended due date would be September 15. Like the 4868, it should be filed by the day that the tax return is due and does not come with an extension to pay.

Filing for an extension gives businesses additional months to compile their financial information and complete their tax documentation accurately. Form 7004 is typically used for various business tax returns, such as corporate income tax returns (Form 1120), partnership tax returns (Form 1065), and certain trusts' income tax returns (Form 1041).

State Tax Extensions

Individual income taxes are imposed by forty-three states and the District of Columbia. Every state has its unique criteria for tax extensions. While a few states, such as Alabama and California, automatically grant all taxpayers a six-month extension, others necessitate the completion of a form on or before your initial return deadline. Some, like Wisconsin and Illinois, give you a six-month extension if your federal tax-filing extension was approved.

Also, state income tax deadlines usually mirror the federal due date, although there are exceptions. In Virginia, for instance, taxpayers have until May 1 to submit their state returns.

Since these provisions differ across states, consult your state’s tax authority to see what the deadlines and procedures are.

Special Cases and Considerations

For those living abroad

If you're a US citizen or a resident alien and your return's typical due date falls on the regular deadline:

- You can receive an automatic 2-month extension to file your return and pay federal income tax.

- This applies if you live outside the United States and Puerto Rico, with your primary business location or duty post also outside these territories, or if you're in military or naval service stationed outside the United States and Puerto Rico.

- When using a calendar year, the typical return due date is April 15, and the automatically extended due date would be June 15. In cases where the due date lands on a Saturday, Sunday, or legal holiday, the deadline shifts to the next business day.

Remember, even if you qualify for an extension, any unpaid tax after the regular due date will accrue interest. To apply this 2-month extension automatically, you need to include a statement with your return that clarifies which of the two circumstances mentioned earlier made you eligible for the extension.

For those in combat zones

If you fall into either of the following two scenarios, your due date for filing tax returns and making tax payments will automatically be extended:

- If you are deployed in military service in a combat zone or have qualifying service outside a combat zone

- If you are on armed forces deployment beyond the US while engaged in a contingency operation, away from your permanent duty station

For these individuals, the deadline for both filing and tax payment is extended by 180 days after the following:

- The final day of being in a combat zone, participating in a contingency operation, or performing qualifying service outside of the combat zone

- The final day of continuous qualified hospitalization due to a service injury from a combat zone, contingency operation, or while performing qualifying service outside the combat zone

For those in disaster zones

Usually, the IRS provides tax-related relief to areas declared by the Federal Emergency Management Agency (FEMA) as being disaster stricken. Counties in some states (Alabama, Arkansas, California, Florida, etc.) have had their federal tax deadlines extended in 2023.

So, individuals and businesses residing or operating in such counties that are acknowledged by the IRS qualify for this relief. Also, if your tax preparer resides in the impacted county or your essential documents for filing your returns were situated within the disaster-stricken region, you could also meet the criteria.

Late Payment vs. Late Filing

Late payment and late filing are two separate aspects of tax compliance. Late payment refers to a situation where you don't submit the owed taxes by the established deadline, leading to potential penalties and interest on the unpaid amount. On the other hand, late filing involves not submitting your complete tax return by the due date. This can also result in penalties, even if you've paid your taxes on time. Essentially, late payment focuses on the money you owe, while late filing centers on the submission of the required documentation.

If an extension is granted, is it still necessary to pay taxes by the original deadline?

Yes, even if an extension is granted, it's important to pay the estimated taxes you owe by the original tax deadline. While the extension offers additional time to file your complete tax return, it doesn't extend the deadline for settling any tax liabilities. If you don't pay the owed taxes by the original due date, you might incur penalties and interest on the unpaid amount, despite an extension. Any amount that you pay over your actual tax liability will be refunded to you. Also, if a refund is due to you, there will be no failure to file penalty if you fail to file your return by the deadline.

Key Takeaways

- Tax extensions are a lifeline for taxpayers facing last-minute rushes before the tax-filing deadline. By granting them, the IRS provides extra time (usually six months) for filing tax returns beyond the deadline.

- The failure to file penalty is a consequence of submitting tax returns late or failing to submit them.

- Tax extensions extend the filing deadline but not the deadline for settling tax liabilities. Estimated taxes must be paid by the original deadline to avoid penalties and interest.

- Form 4868 is used by individual taxpayers seeking extensions, while businesses generally use Form 7004 for the same purpose.

- State tax extension requirements vary, with some states automatically granting extensions and others requiring extension forms to be submitted.

- Specific situations, such as living abroad or being in a combat zone, can also impact tax deadlines and extensions.

- Late payment and late filing are distinct aspects of tax compliance, each with its consequences.

If you missed the tax extension bus this season, don’t worry. Make sure to file your return and pay your taxes as soon as you can. And keep in mind, armed with the knowledge of tax extensions, you are now better-equipped to deal with the 2024 tax season.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more