Amended Tax Returns: Everything You Should Know

Amended returns provide taxpayers with the opportunity to correct errors and make necessary changes to their returns. Whether you missed out on deductions, realized errors in reported income, or need to update your filing status, Form 1040-X (or the relevant amended return form if you are a business) is the tool to set things right. Understanding when to file an amended return, what circumstances warrant it, and the potential impact on your tax situation is crucial for ensuring accurate reporting and avoiding unnecessary penalties.

So, you’ve spotted a slip-up on your tax return. We know how it goes – you’re crunching the numbers, juggling receipts, and just like that, you miss something. But guess what? It’s not game over. Far from it. Whether you missed mentioning some additional income, accidentally brushed off a deduction, or let anything else slip through the cracks, amended returns give you a way to set the record straight.

In this article, we’ll break down the nitty-gritty of amended returns and how they compare with other tax fixes like tax extensions and superseded returns.

What Are Amended Returns?

Amended tax returns are returns taxpayers file when they need to make changes or corrections to a tax return they’ve previously filed. These changes could include:

- Correcting errors

- Updating information

- Adding information that wasn’t included in the original return

Sometimes, doing this could put you in an advantaged position. Say, for instance, you didn’t claim a credit that you’re entitled to in your original return. In such a case, you would be eligible to get a refund once you file your amended return. Conversely, say you learned about some additional income you’d earned in a year after filing your tax returns. In this case, your tax liability would increase. Therefore, amended returns could have varying effects but are necessary in certain circumstances.

When Should I File an Amended Return?

Fulfilling your annual “tax duty” is a must, but what happens when you realize that your tax papers carry errors or your situation has shifted after the government has accepted your return? The IRS gives you options, the most fitting of which could be the amended return 1040-X filed to amend the individual income tax return. Here are some circumstances in which you can file an amended return:

- Change in filing status: If your marital status or filing status shifted in the relevant tax year but you selected the outdated status on your return, you can file an amended return to rectify it. Suppose you were filing under the status “married filing jointly” but separated from your partner in the tax year, you could opt to file as single or married filing separately through an amended return.

- Income corrections: Maybe you were notified of additional income after tax day, or you simply missed reporting some income on your return. An amended return is your chance to set the record straight and avoid unwanted surprises.

- Deduction and credit updates: We all want to claim every deduction and credit we’re entitled to. But sometimes, you may mistakenly claim a credit or deduction that you are not eligible to. Conversely, you may realize belatedly that you are eligible for a deduction or tax credit. This may be the result of oversight, but it could also be because a legislation was passed after you filed. In all of these cases, you can file an amended return to rectify the situation.

- Receipt of new tax documents: Sometimes, tax forms, such as W-2s or 1099s, can make an appearance after you’ve already submitted your return. In such cases, you must file an amended return.

- Changes in dependents: An amended return becomes essential if you intend to add more dependents or exclude dependents that were previously reported. Suppose you are a single parent and you mistakenly claimed your 19-year-old daughter as a dependent. During the relevant tax year, she secured a full-time job and moved out. She can no longer be claimed as a dependent; therefore, you would have to file an amended return.

- Amendment of previous tax years: It’s never too late to correct errors in past returns (unless you’re claiming a refund - which we will get to). If you find errors in returns from previous years, amended returns could give you a financial do-over.

Amended Return Forms for Businesses

| Sole Proprietorships and Single-Member LLCs | Utilize Form 1040-X for your amended return, including modifications to Schedule C. |

| Partnerships or Multi-Member LLCs | Employ Form 1065 for your amended return and check box G(5) on page 1. However, some circumstances warrant using Form 1065-X to amend your returns. It’s advisable to consult your tax expert for guidance on the appropriate form to use. |

| S Corporations | Submit an amended Form 1120-S and mark Box H(4) (Amended Return) on Page 1. |

| C Corporations | Use Form 1120X for the amendment. |

When Needn’t I File an Amended Return?

The IRS will rectify some mistakes found on a return and may even approve returns when certain necessary forms or schedules are missing. However, as stated previously, any changes to your filing status, income, deductions, credits, or tax liability for the relevant tax year warrants filing an amended return. Here are some circumstances in which you needn’t file an amended return:

- Mathematical errors: If you made mathematical/clerical errors in your return, the IRS will correct these errors and adjust your return accordingly. There’s no need to file an amended return for such errors. If it results in a higher tax liability or a refund, the IRS will inform you. However, if your amended return shows that you owe more in taxes, you must pay it at the earliest to avoid penalties and interest.

- Missing forms: If you forget to attach a form, the IRS might send you a notice about the missing information and adjust your return accordingly.

- Correspondence with the IRS: If the IRS contacts you regarding discrepancies or issues with your return and you resolve the matter through correspondence, you do not need to file an amended return. For instance, if you receive the CP 2000 notice (sent when the information on your return does not match the information the IRS receives from third parties such as banks or your employer), you don’t need to file an amended return. You can, instead, resolve it through your response to the notice.

What Is the Deadline for Filing an Amended Return?

If you want to request a refund, you must submit Form 1040-X within a period of 3 years from the day you initially filed your original return or within 2 years from the day you made the tax payment, whichever comes later. However, some special rules apply when it comes to refund claims related to matters like net operating losses, foreign tax credits, and bad debts, among others.

What If I Don’t File an Amended Return?

Usually, the IRS has the authority to select returns submitted within the past three years for an audit. If the IRS detects a significant mistake, this audit could cover more years, which, typically, doesn’t go beyond six years. Therefore, if you come across any substantial error or miss on your tax returns, as a matter of abundant precaution, it’s recommended that you file an amended return. This will help you avoid any penalties or interest and claim any refund due to you.

How to File Form 1040-X

The amended tax return procedure involves a few straightforward steps:

Gather necessary documents: For an amended Form 1040, 1040-SR, and 1040-NR return, it’s necessary to include all the required forms and schedules, just as you would if it were the original submission, even if some forms don’t need changes. Additionally, a Form 1040-X should be attached.

Similarly, for an amended Form 1040-SS/PR return, all essential forms and schedules should be included, treating it as if it were the initial submission, even if certain forms remain unchanged. However, it’s important to note that Form 1040-X should not be attached to Form 1040-SS/PR.

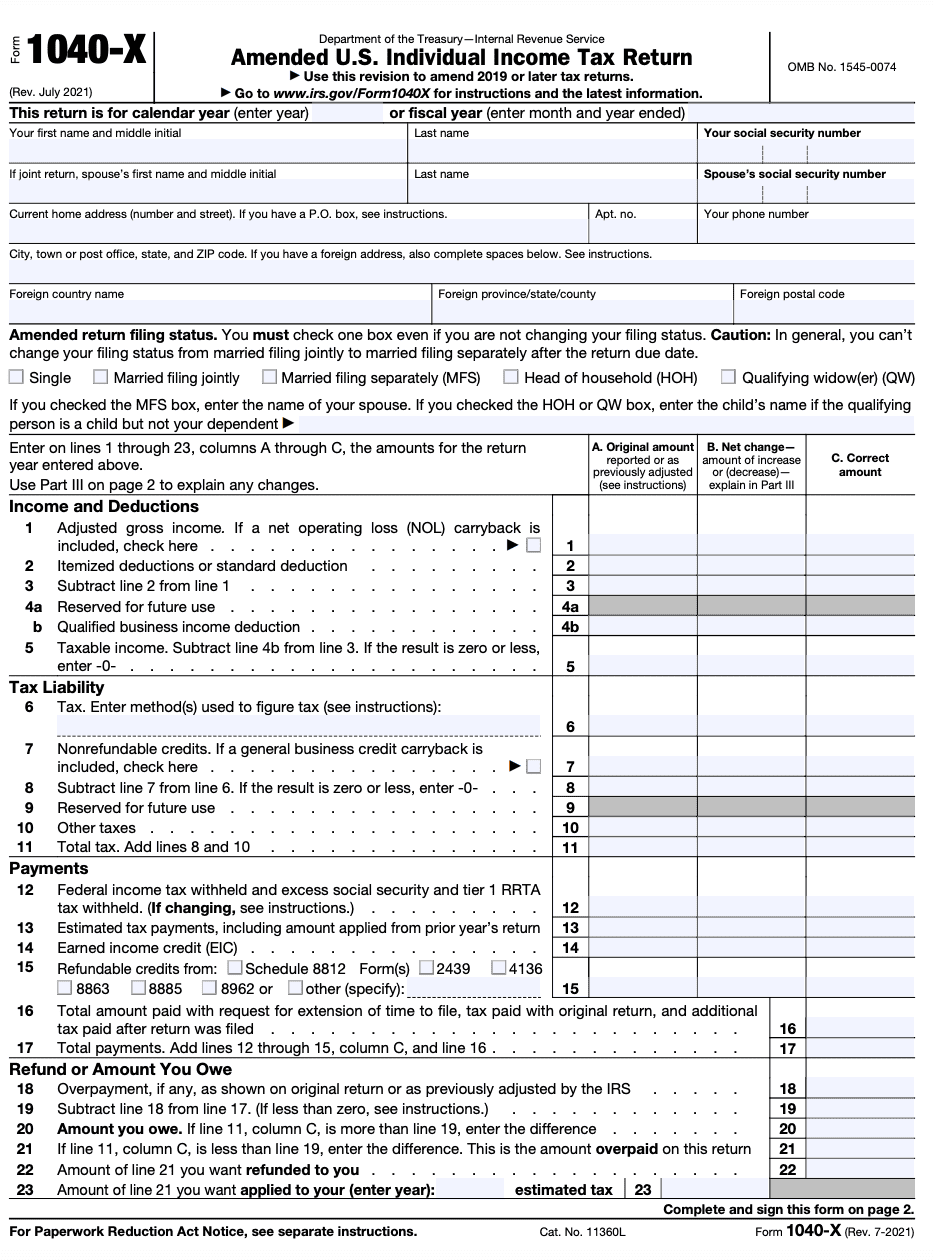

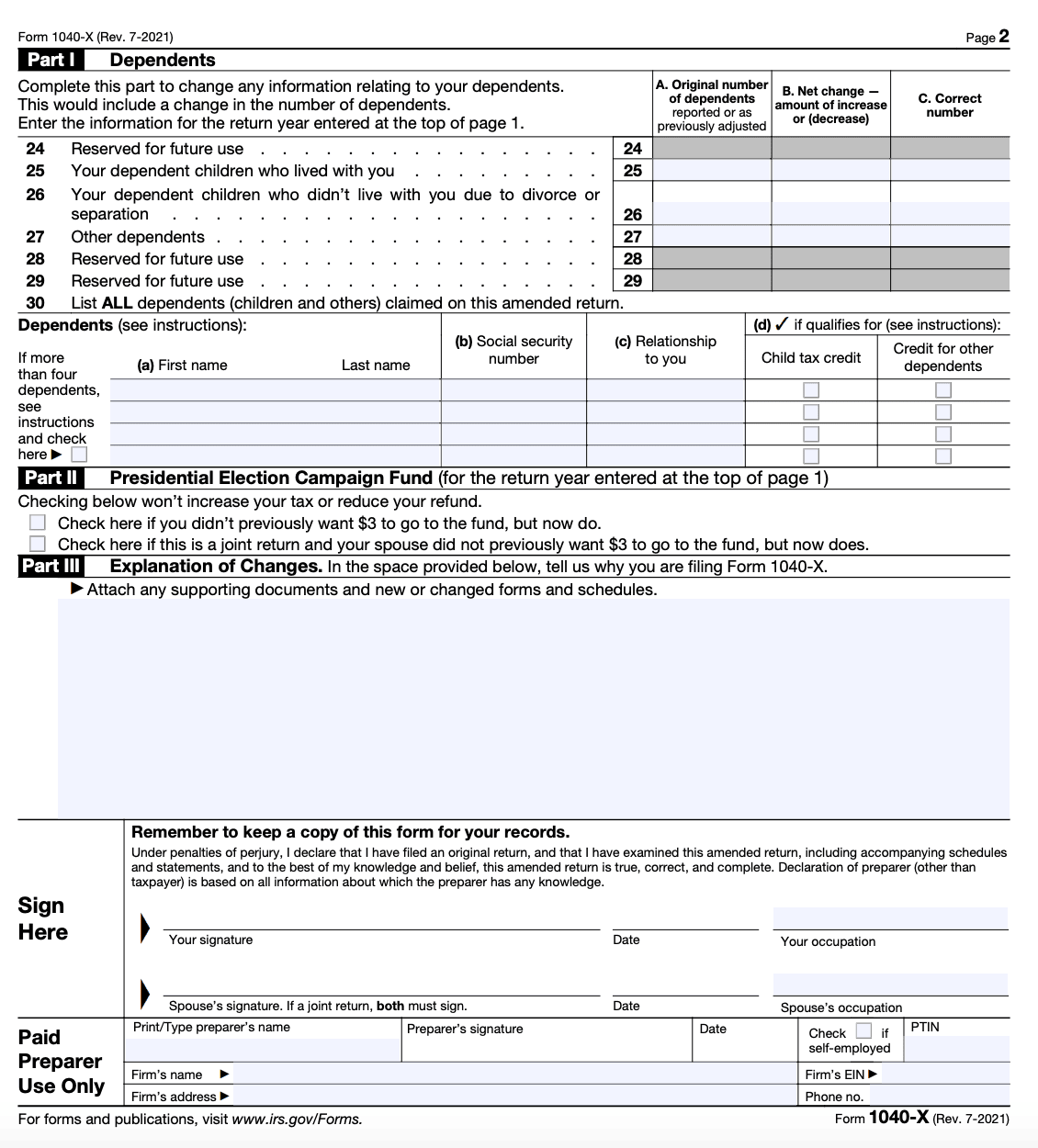

Obtain Form 1040-X: Obtain IRS Form 1040-X, which is the official form used for amending an individual income tax return. You can download this form from the IRS website or request a printed copy. Form 1040-X has three distinct columns: A, B, and C. In column A, you must note the exact figure that was initially reported in the original or last-amended tax form. Column C is where you have to enter the adjusted or accurate number. Column B captures the difference between columns A and C.

On the back of Form 1040-X, there’s a dedicated section just for you to explain the changes you’re implementing and why you’re making them. This is where you lay it all out, step by step, so the IRS understands the ins and outs of your amended return.

This brings us to filing.

Can I File It Electronically?

Well, yes and no.

From the 2019 tax year onward, the IRS permits the electronic filing of amended tax returns, provided you submitted your original return electronically and your tax software provider supports the electronic filing of amended returns.

You Must File by Paper

You need to file by paper under the following circumstances:

- For any Form 1040 and 1040-SR returns that are more than three years old, or Form 1040-NR and 1040-SS/PR returns older than 2 years, electronic amendment is not possible.

- If you’re amending a past-year return that you filed on paper, the amended return must also be filed on paper.

When filing it by paper, you must send the hard copy of the document to the IRS Service Center responsible for handling the initial tax form.

How Long Does It Take to Process?

For both paper and electronically filed amended returns, the IRS takes about 20 weeks to process. As of May 13, 2023, the IRS was handling a substantial backlog of 1.43 million Forms 1040-X. The IRS works through these submissions in the sequence they were received. It’s crucial to note that submitting the same return multiple times won’t expedite the process but could instead contribute to the growing backlog.

Where Can I Track It?

Where's My Amended Return? tool can provide you with the status of your amended returns for the current tax year and the three years immediately preceding it.

Tax Extensions vs Amended Returns

What Are Tax Extensions?

Taxpayers have the option to request an extension from the IRS to file their tax returns beyond the standard deadline. This extension, typically spanning six months, extends the filing due date from April 15 (this year, the date was April 18 for filing your 2022 returns) to October 15 (extended to October 16, 2023, this year) if the extension is filed by April 15.

Key Differences Between Tax Extensions and Amended Returns

Tax extensions and amended returns are two distinct concepts with different purposes and processes.

| Tax Extensions | Amended Returns | |

| Purpose | A tax extension allows individuals or businesses to extend the deadline for filing their tax returns. It provides additional time to gather necessary documentation, calculate taxes, and complete the tax return accurately. The extension is primarily focused on delaying the filing deadline and is filed before the return is filed. | An amended return is filed after the original tax return has been submitted and accepted by the IRS. It is used to correct errors, make changes to reported information, or claim missed deductions or credits. The purpose of an amended return is to rectify inaccuracies or gaps in the original filing. |

| Timeline | The IRS tax extension process typically extends the filing deadline by six months beyond the original due date. For example, if the regular deadline is April 15, the extended deadline would be October 15. The tax extension deadline, i.e., the deadline for filing one, is the same as the original due date. | An amended return can be filed after the original return is submitted and then processed by the IRS. There is typically no specific timeline for filing an amended return (unless a refund is being sought), but it’s recommended to do so as soon as errors are discovered or changes are needed. |

| Submission | To request a tax extension, individuals can file Form 4868 for personal returns or Form 7004 for business returns. These forms must be submitted before the original deadline and must include an estimated tax payment if taxes are owed. | An amended return is filed using Form 1040-X (to amend the individual income tax return). This form is used to correct mistakes on previously filed tax returns. It includes columns to show the original figures, the corrected figures, and the differences. |

| Reasons | Taxpayers can file a tax extension without providing a specific reason. It’s a common option for those who need more time to complete their return accurately. | Amended returns are filed when errors, omissions, or changes in circumstances are identified after the original return has been filed. Common reasons include correcting income discrepancies, claiming additional deductions or credits, or updating dependent information. These reasons need to be stated in Form 1040-X. |

| Payment | If taxes are owed, individuals requesting a tax extension are required to estimate their tax liability and make a payment with the extension request. This payment helps minimize penalties and interest. | Amending a return doesn’t necessarily involve making a payment. The focus is on correcting errors and ensuring accurate reporting. However, if additional taxes are owed as a result of the changes, they should be paid when the amended return is filed. |

| Documentation | When requesting a tax extension, individuals don’t need to provide detailed explanations or documentation. The main requirement is submitting the appropriate extension form by the due date. | Amended returns require documentation to support the changes being made. This could include updated forms, receipts, or any relevant information that validates the corrections. |

Amended vs Superseded Tax Returns

In Haggar Co. v. Helvering[^1], the US Supreme Court clarified that an amended return filed within the timeframe specified by the Internal Revenue Code of 1986 for filing returns, after the original return but before the due date, should be treated in an identical manner to the original return. A superseding return is thus a return submitted after the original return is filed but within the designated filing duration, which includes valid extensions.

Filing a superseding return to replace the original one can be a helpful choice for taxpayers, whether they’re individuals or businesses, when they face challenges they didn’t foresee when they submitted their initial returns.

Key Differences Between Amended Returns and Superseded Returns

Here’s how amended returns and superseded returns differ.

| Amended Returns | Superseded Returns | |

| Purpose | An amended return is filed to correct errors, update information, or make changes to a tax return that has already been submitted and accepted by the IRS. It is used when you need to rectify mistakes, claim missed deductions or credits, or provide accurate information that was previously omitted. | A superseded return is a corrected return filed before the original due date. It replaces the original return entirely and is used when you realize that the information provided in your original return is incorrect or incomplete. |

| Timing | Amended returns are filed after the original return has been submitted and processed by the IRS. You can typically file an amended return at any time after the original return’s filing, but it’s recommended to do so as soon as you discover the error. | Superseded returns are filed before the original return’s due date. This allows you to completely replace the original return with the corrected version. |

| Submission | Amended returns are filed using Form 1040-X. This form includes columns to show the original figures, the corrected figures, and the differences between them. You need to provide explanations for the changes made. | Superseded returns are filed using the appropriate tax form for the year you are correcting. You simply submit a new, accurate return that replaces the original. |

| Changes made | Amended returns focus on correcting specific errors or inaccuracies in the original return. You identify and correct the specific areas that need revision. | Superseded returns involve entirely replacing the original return with a corrected version. You provide all the updated and accurate information in the new return. |

Key Takeaways

- Amended tax returns allow taxpayers to fix mistakes, update information, or add missing details to a previously filed tax return.

- They are beneficial for correcting errors, updating income, deductions, or credits, and rectifying changes in filing status or dependents.

- Filing deadlines for amended returns vary based on refund claims and specific situations.

- Filing an amended return involves gathering necessary documents, completing Form 1040-X, or the relevant form, with accurate information, and explaining the changes made.

- The option to electronically file amended returns is available for returns from tax year 2019 if the original return was filed electronically, but paper filing is necessary in other cases.

Conclusion

Amended returns provide taxpayers with the opportunity to correct errors and make necessary changes to their returns. Whether you missed out on deductions, realized errors in reported income, or need to update your filing status, Form 1040-X (or the relevant amended return form if you are a business) is the tool to set things right. Understanding when to file an amended return, what circumstances warrant it, and the potential impact on your tax situation is crucial for ensuring accurate reporting and avoiding unnecessary penalties.

Related articles

How to do bookkeeping for real estate business

Keeping track of real-estate investments/businesses’ financial health helps you be profitable, receive tax benefits, and make sound financial decisions in difficult times.

Read moreFounder’s Guide to Annual Financial Planning

Learn what financial planning is, why it matters, and its key components to help your business grow better.

Read more