- IRS forms

- Form 1120-S

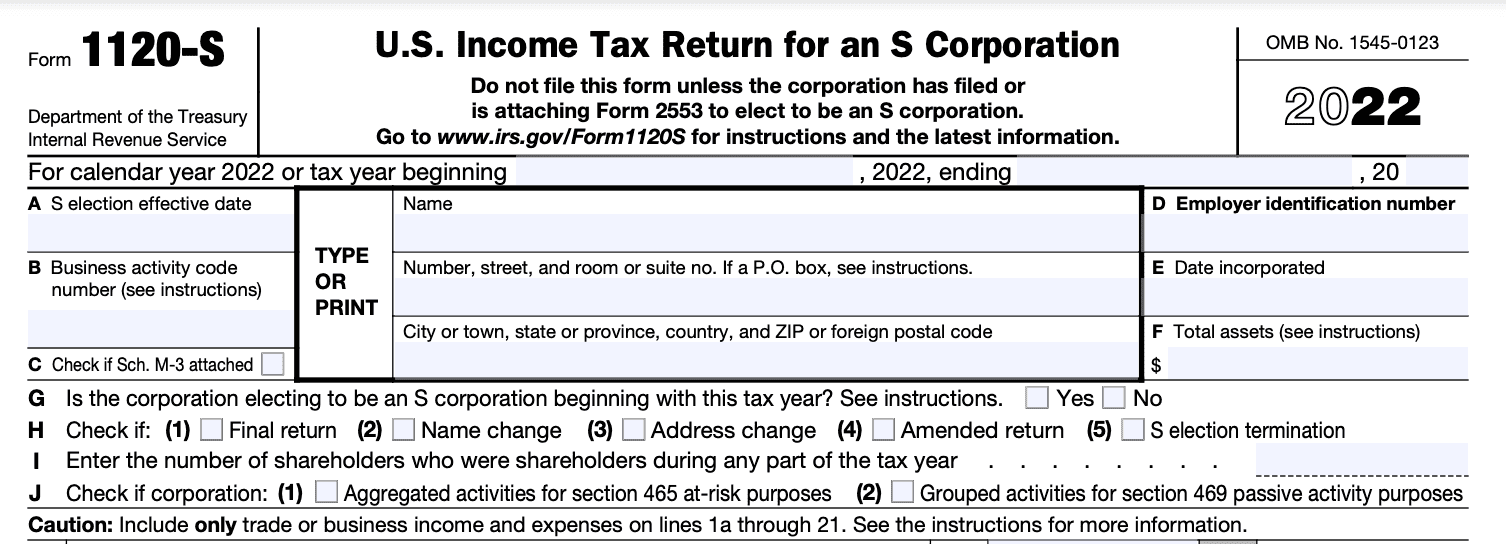

Form 1120-S: U.S. Income Tax Return for an S Corporation

Download Form 1120-SForm 1120-S is the federal income tax return form that S corporations or LLCs taxed as S corps have to file.

If you're trying to file this form on your own, chances are you will need some guidance. The form is long and complex, and the probability of messing up is high.

Follow this article to educate yourself on the purpose of Form 1120-S and how to file it so that you get it right the first time.

What Is IRS Form 1120-S?

If you're running a business in the United States, chances are you might be using form 1120 to file your tax information with the IRS. But many small businesses confuse this with Form 1120-S. The 'S' in the name stands for S corporation.

Thus, if your business is running as an S corporation, then instead of Form 1120, you'll have to fill in Form 1120-S as your company's federal income tax return.

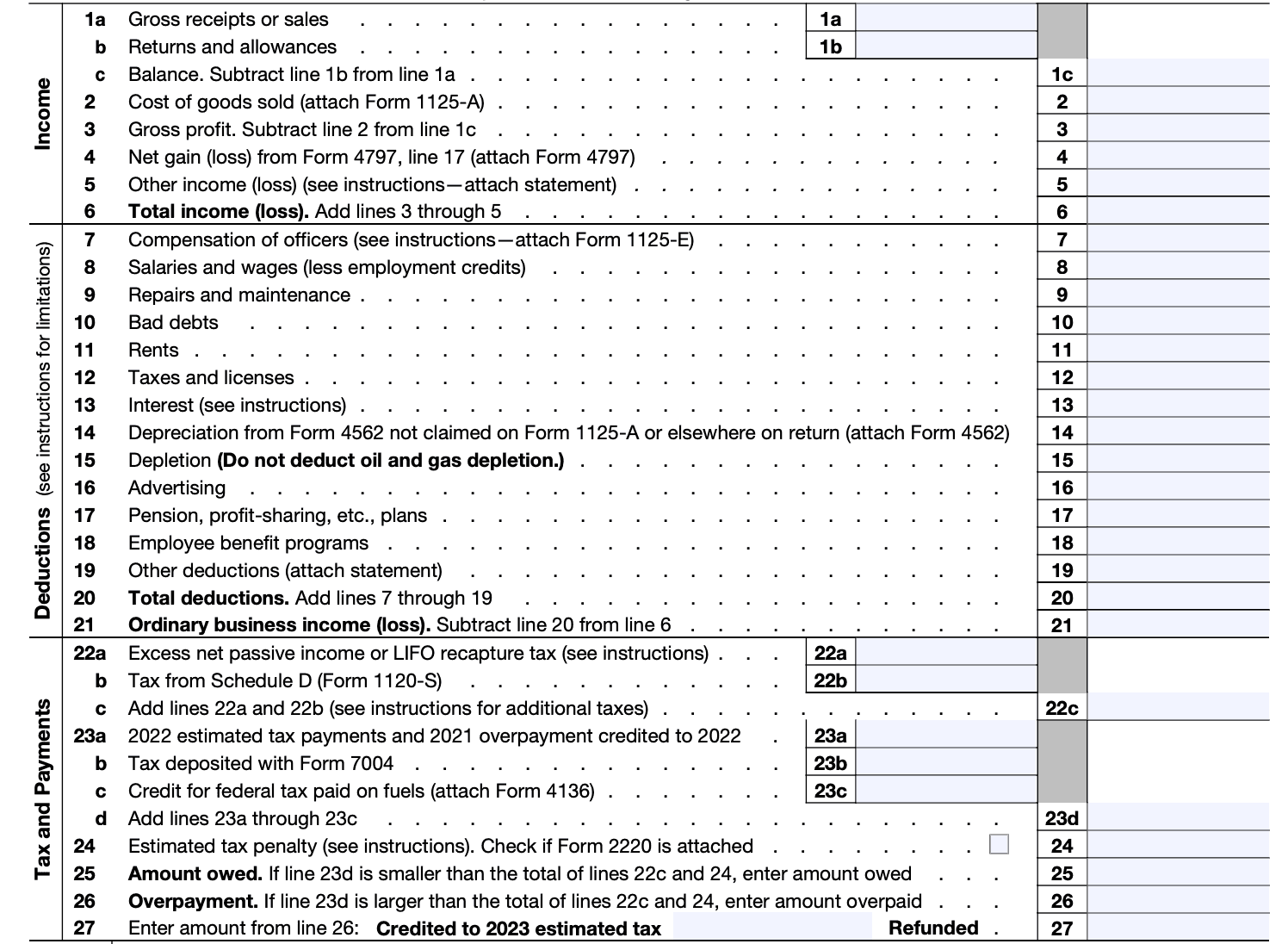

This form gives the IRS a detailed insight into the finances of your corporation, including an overview of income, deductions, and credits.

Purpose of Form 1120-S

IRS Form 1120-S serves a critical role in reporting the income, deductions, and credits of S corporations.

Income reporting: It documents the corporation's income, including sales, gross receipts, dividends, and other sources.

Tax calculation: It calculates the S corporation's taxable income and determines the applicable tax liability.

Pass-through entity: It reflects the pass-through nature of S corporations, where income, deductions, and credits flow through to shareholders.

Shareholder allocations: It details how the corporation's income, losses, deductions, and credits are allocated among individual shareholders.

Ownership information: It provides essential information about shareholders, including their names, addresses, and ownership percentages.

Tax credits: It allows for the reporting of various tax credits that the S corporation may be eligible for, reducing its overall tax liability.

Deductions: It documents deductible expenses incurred by the S corporation, reducing its taxable income.

Capital gains and losses: It reports any capital gains or losses realized by the S corporation during the tax year.

Record**-keeping**: It serves as an official record for both the S corporation and its shareholders, aiding in record-keeping and future reference.

IRS compliance: It ensures compliance with IRS regulations by providing a comprehensive overview of the S corporation's financial activities.

Distribution reporting: It records any distributions made to shareholders, distinguishing between dividends and returns of capital.

Taxpayer identification: It requires the S corporation to provide its taxpayer identification number (TIN) for identification purposes.

Final return: If the S corporation is dissolved or terminated, Form 1120-S is used to file the final tax return.

Consistency with shareholders: It helps maintain consistency between the S corporation's tax reporting and that of individual shareholders.

Avoidance of penalties: Filing Form 1120-S in a timely and accurate manner helps avoid penalties for late or incorrect reporting.

How To Complete Form 1120-S: A Step-by-Step Guide

Step 1: Gather the necessary information

Like every other tax form, the 1120-S can be quite confusing with all its boxes and blanks. Thus, it is advised that you keep all of the information in the following checklist close at hand before filing Form 1120-S.

- Date of incorporation of the firm

- List of products or services that your company offers

- Business activity code

- Employer Identification Number (EIN): This is a 9-digit unique ID that the IRS issues to businesses for identification purposes in their database. You can apply for an EIN on the IRS site or by mailing them Form SS-4.

- The date of electing the S corporation status: This date will vary based on your accounting. It will be January 1 if you follow the calendar year or the first day of your fiscal year.

- Profit and loss statement and balance sheet for the corporation

- Accounting method: Firms use either cash or accrual accounting methods, so be sure to clarify with your accountant if you have any doubts.

- Independent contract payments: If you have paid more than $600 to any independent contractor, you need to file Form 1120-S.

Step 2: Complete Part 1

Part 1 pertains to basic business information such as the date of incorporation, EIN, and the date of S corporation status election. Profit and loss information is also presented in Part 1 of the form.

Part 1 pertains to basic business information such as the date of incorporation, EIN, and the date of S corporation status election. Profit and loss information is also presented in Part 1 of the form.

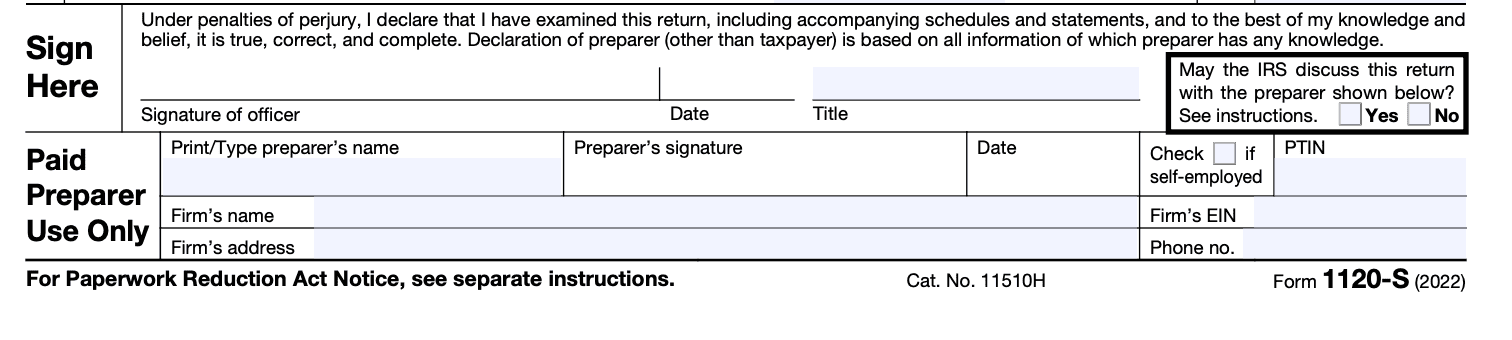

If you choose to fill out the form yourself, sign right next to the space given. If you're getting the form filled by a professional service, they too will sign the form other than just the owner.

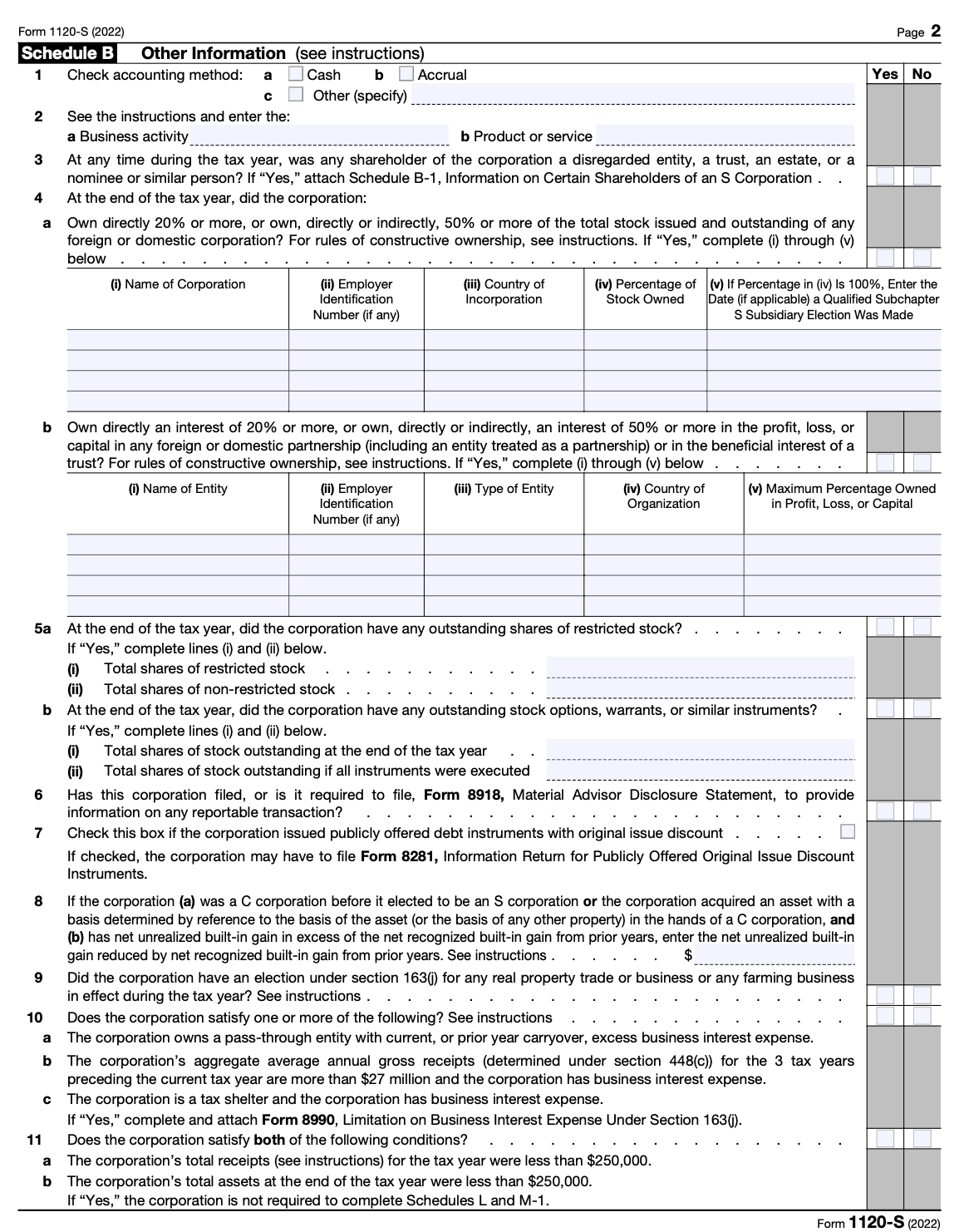

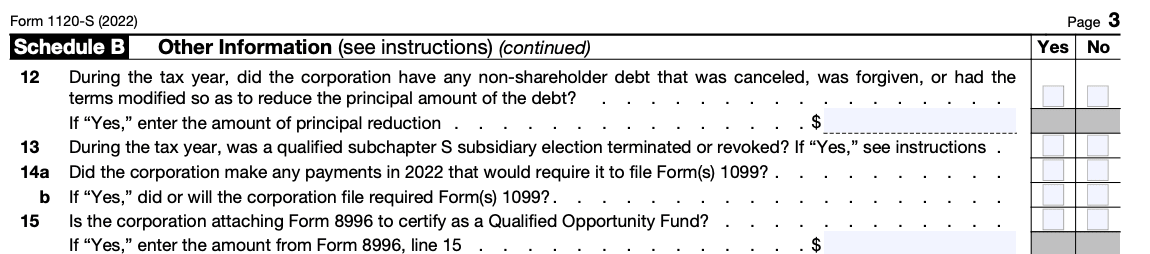

Step 3: Complete Schedule B

Schedule B is the longer part of the form. It will require you to fill out the particulars of your business, such as the products and services you offer, business activity code as well as the accounting practice your business follows.

Schedule B is the longer part of the form. It will require you to fill out the particulars of your business, such as the products and services you offer, business activity code as well as the accounting practice your business follows.

When filling in this section, you will find that some questions pertain only to particular types of businesses. Questions regarding shareholders and business payments would also need to be answered.

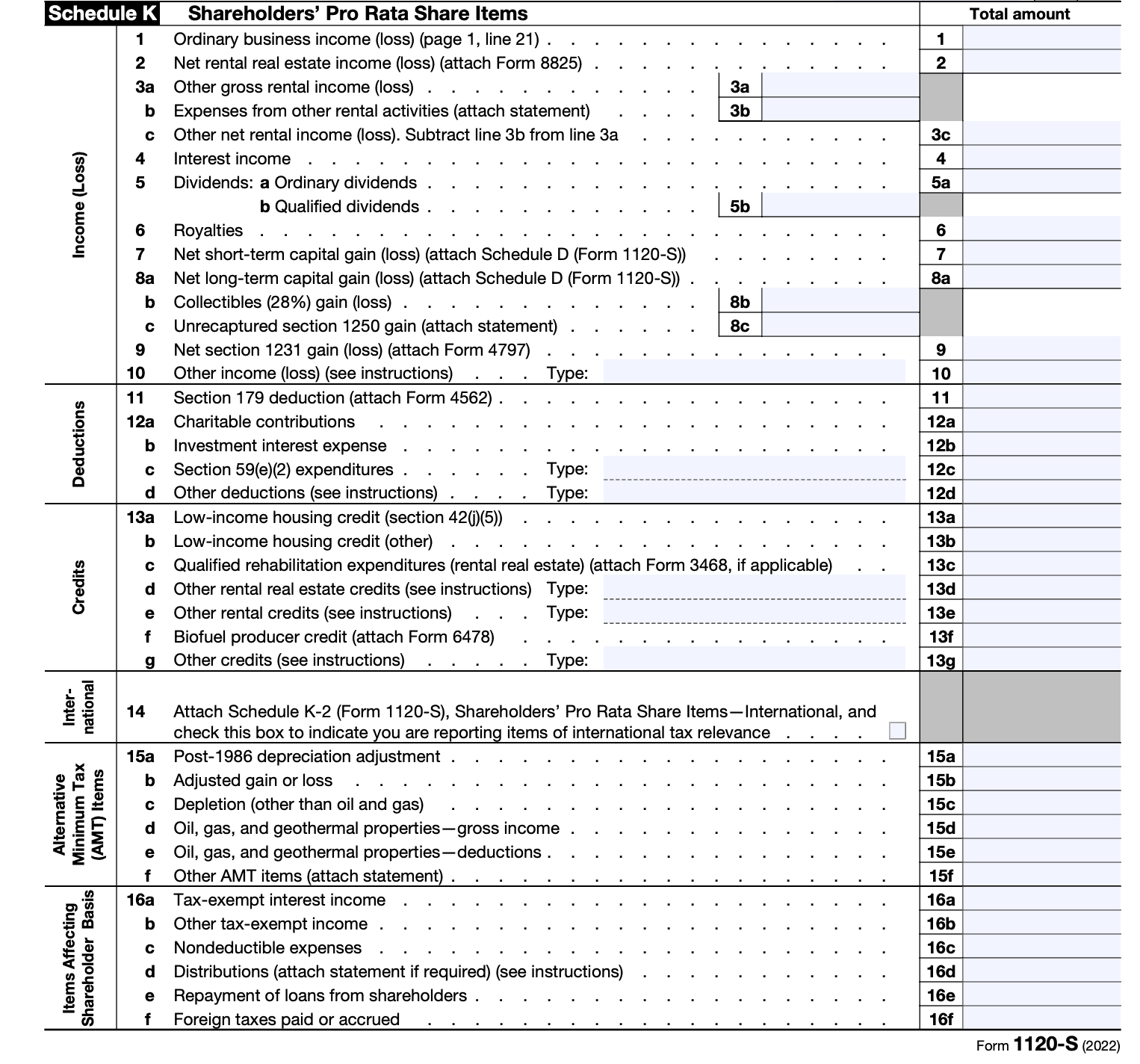

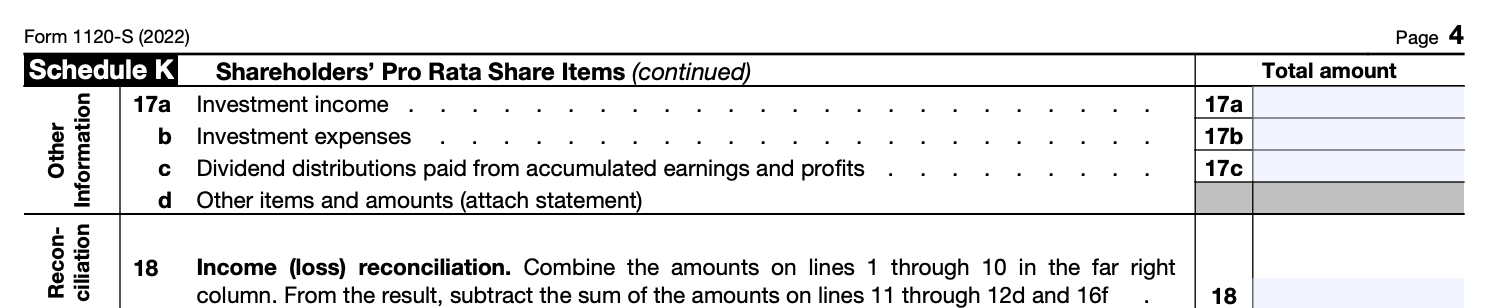

Step 4: Complete Schedule K

This Schedule summarizes the S corp's shareholders' income, tax deductions, and tax credits within the financial year.

This Schedule summarizes the S corp's shareholders' income, tax deductions, and tax credits within the financial year.

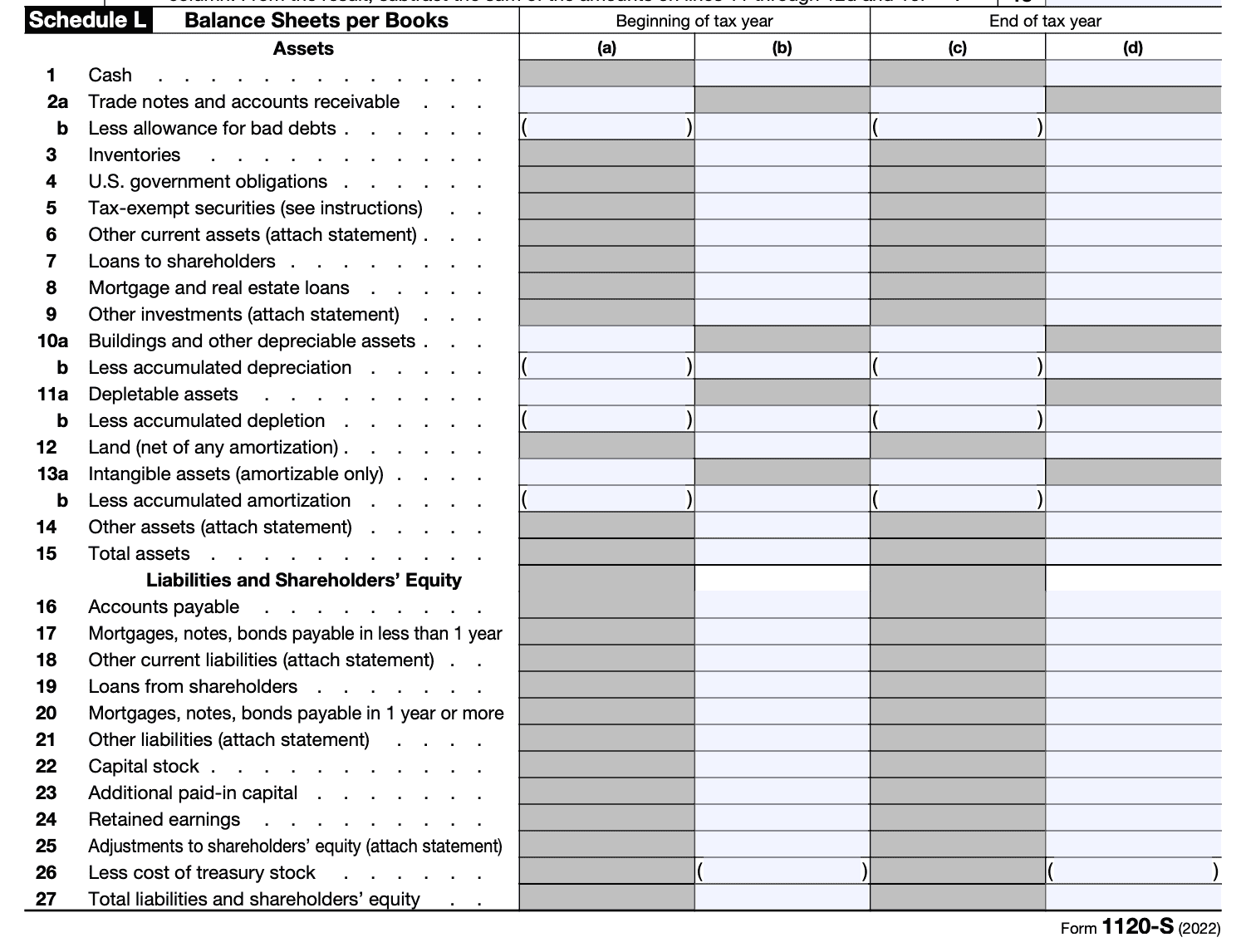

Step 5: Complete Schedule L

The filling out of Schedule L is contingent on your answers to questions 11a and 11b on Schedule B.

The filling out of Schedule L is contingent on your answers to questions 11a and 11b on Schedule B.

If the answer to both the questions was "Yes", then you can skip this section. Answering "No" for either of the questions would demand that you fill out Schedule L.

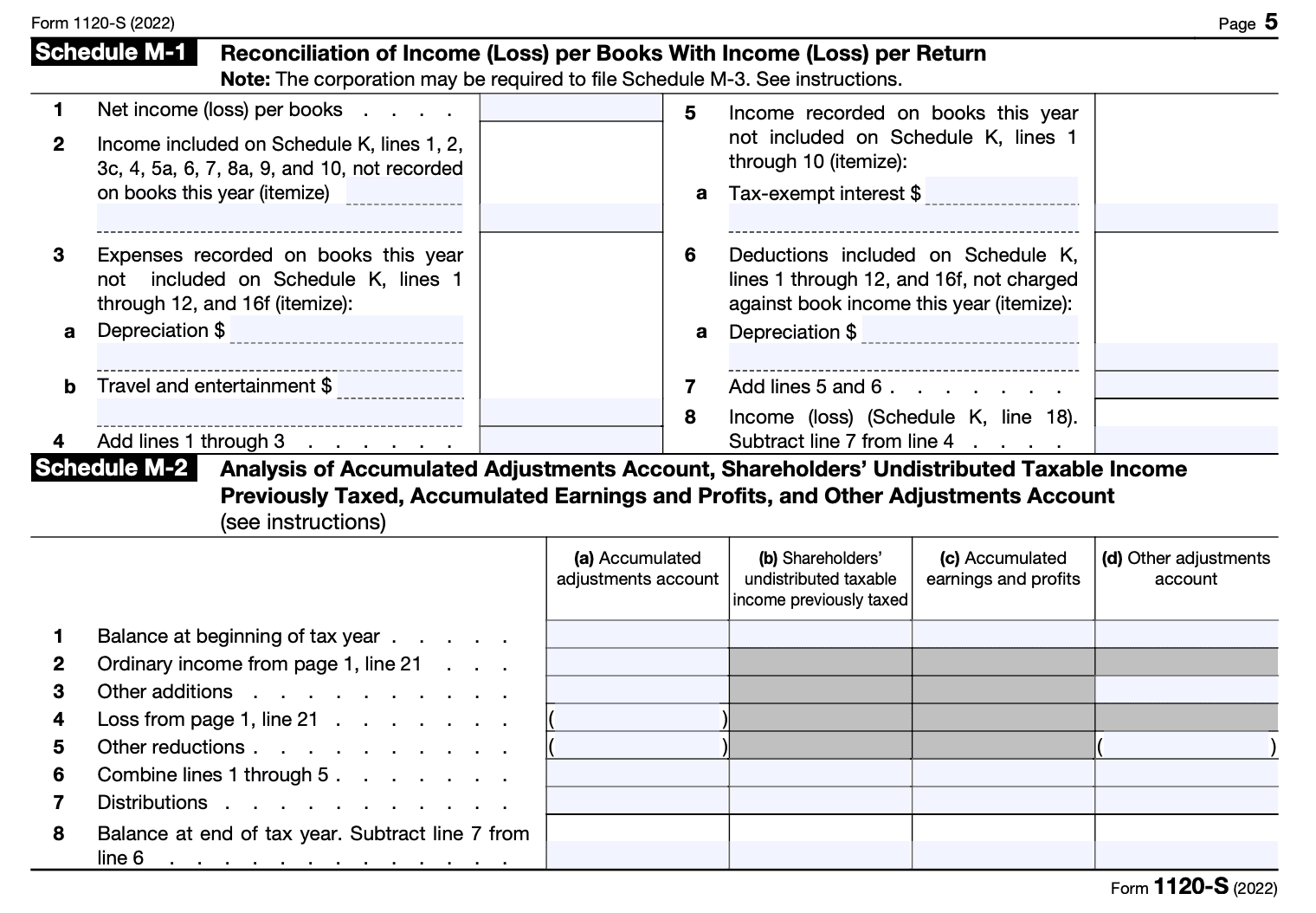

Step 6: Complete Schedule M-1 and M-2

If you had to fill out the previous schedule, you would need to fill in Schedule M-1 as well. This section balances the company's income or loss as per the accounting book with the tax return.

If you had to fill out the previous schedule, you would need to fill in Schedule M-1 as well. This section balances the company's income or loss as per the accounting book with the tax return.

If you are tracking business transactions all by yourself, you may omit certain expenses in your accounting books, leading to confusion later. A professional bookkeeping service like Fincent ensures error-free accounting so you can file your returns without worrying about mistakes.

Schedule M-2 reports the balancing profit or loss that the corporation has made after all deductions.

Step 7: Sign and file the form

Review the completed Form 1120-S for accuracy and completeness. Sign and date the form, and keep a copy for your records.

Review the completed Form 1120-S for accuracy and completeness. Sign and date the form, and keep a copy for your records.

Due Date for Form 1120-S

The due date to file the 1120-S tax form is contingent on the type of calendar the business follows. Technically, it is to be submitted by the 15th day of the third month since the end of the previous year.

For instance, if a firm follows the calendar year, its books for the particular year would close on 31st December. That allows the firm to file Form 1120-S by 15th March of the coming year.

S corporations that need more time to file Form 1120-S can apply for an extension, pushing the deadline to 16th September of the coming year.

Where To Mail Form 1120-S

Form 1120-S can either be filed electronically, using the IRS' e-file system.

Alternatively, one can also mail the form to the IRS on the basis of their business residence as well as the total assets of the firm at the end of the year. You can find the detailed guide to the right address on this page.

Conclusion

As an S corp, you must fill out several tax forms while filing your annual returns. To avoid penalties from the IRS, you need to stay on top of your taxes, and the best way to do that is to keep a constant check on your business transactions.

That's why it's helpful to employ the services of Fincent, a professional bookkeeping service made with creative professionals in mind. While you focus on your S corp, leave the bookkeeping to us to save time and money. Book a demo today.