- IRS forms

- Form 1040-SR

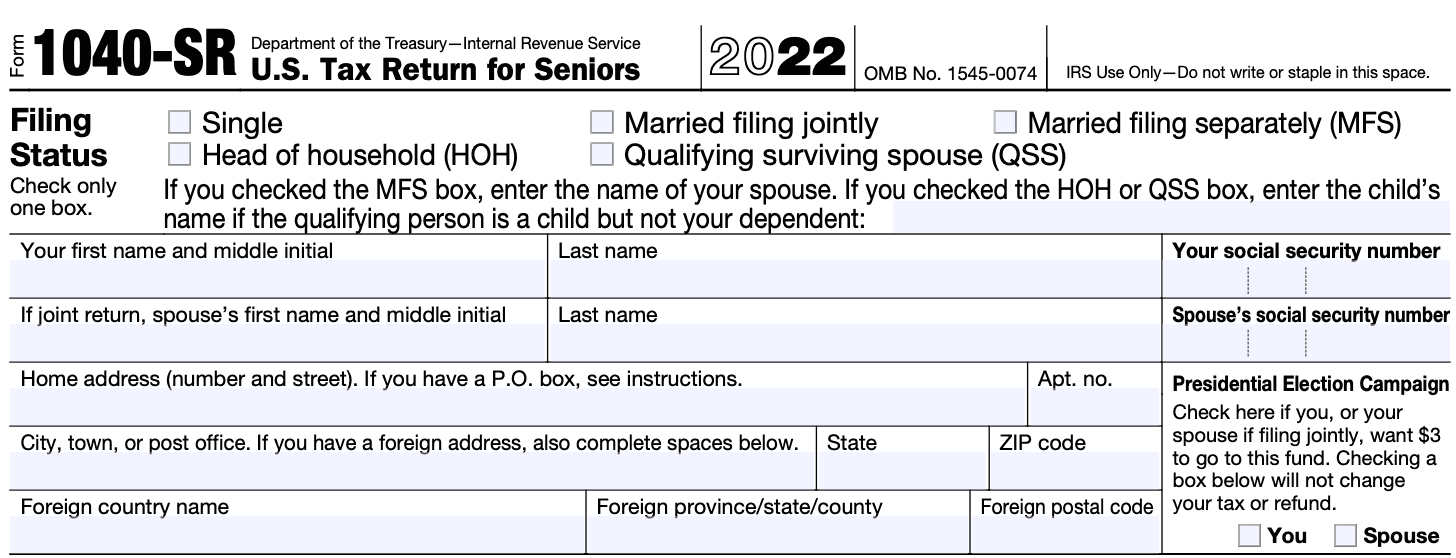

Form 1040-SR: U.S. Tax Return for Seniors

Download Form 1040-SRTax season can be a challenging time for many individuals, especially seniors who may have unique financial situations and may find the standard tax forms overwhelming. In an effort to simplify the tax filing process for older taxpayers, the Internal Revenue Service (IRS) introduced Form 1040-SR. Designed specifically for seniors, this form takes into account their needs and provides a streamlined approach to filing taxes.

Form 1040-SR is an alternative option to the traditional Form 1040 and is available to individuals aged 65 or older. It is specifically designed to cater to the needs of seniors who may have different types of income, deductions, and credits compared to younger taxpayers. The "SR" in the form's name stands for "senior."

In this blog post, we will delve into the details of Form 1040-SR and explore its benefits for senior citizens.

Purpose of Form 1040-SR

The purpose of Form 1040-SR is to provide a simpler and less complex tax filing option for older individuals who may not require all the details and schedules required in the regular Form 1040.

The key features of Form 1040-SR include:

-

Simplicity: Form 1040-SR is designed to be less complex and easier to understand compared to the standard Form 1040. It uses a larger font size and includes helpful tips and instructions tailored to senior taxpayers.

-

Standard deduction: Form 1040-SR incorporates a larger standard deduction for seniors, which can be beneficial for individuals who may not have significant itemized deductions.

-

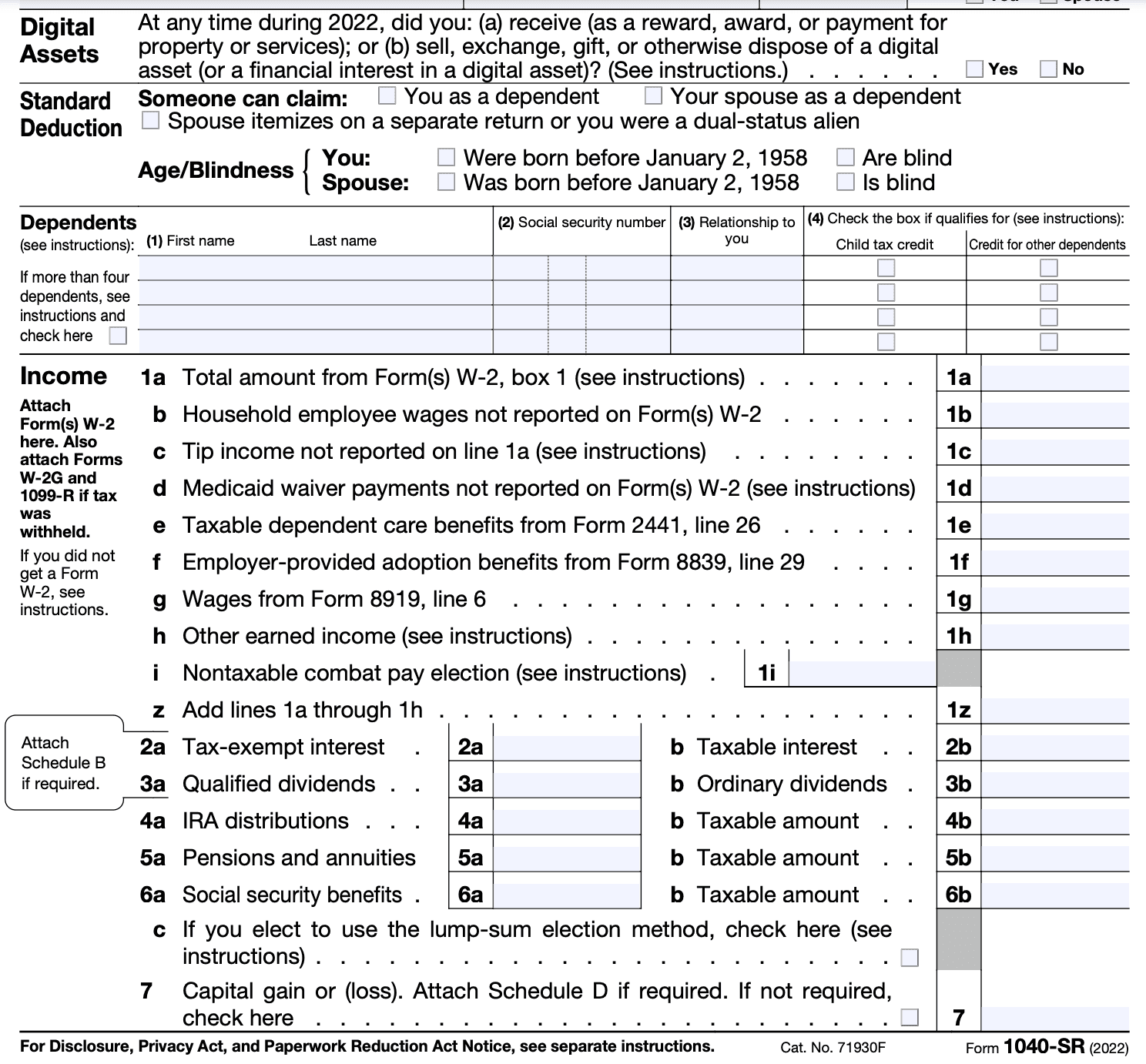

Income reporting: The form allows seniors to report various types of income, such as wages, pensions, Social Security benefits, investment income, and rental income.

-

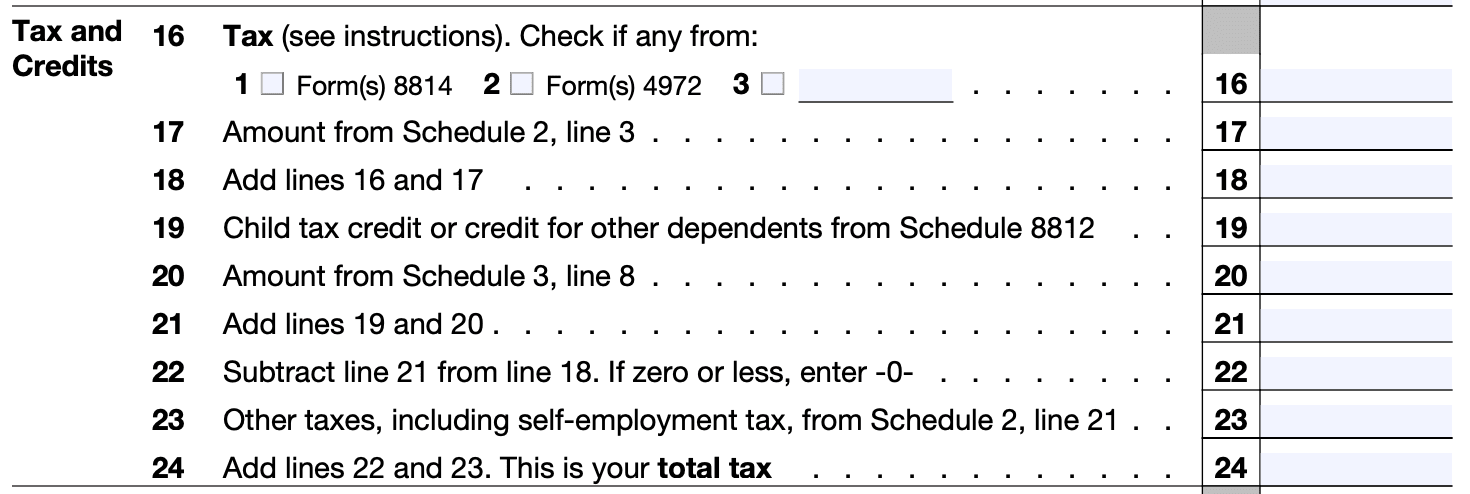

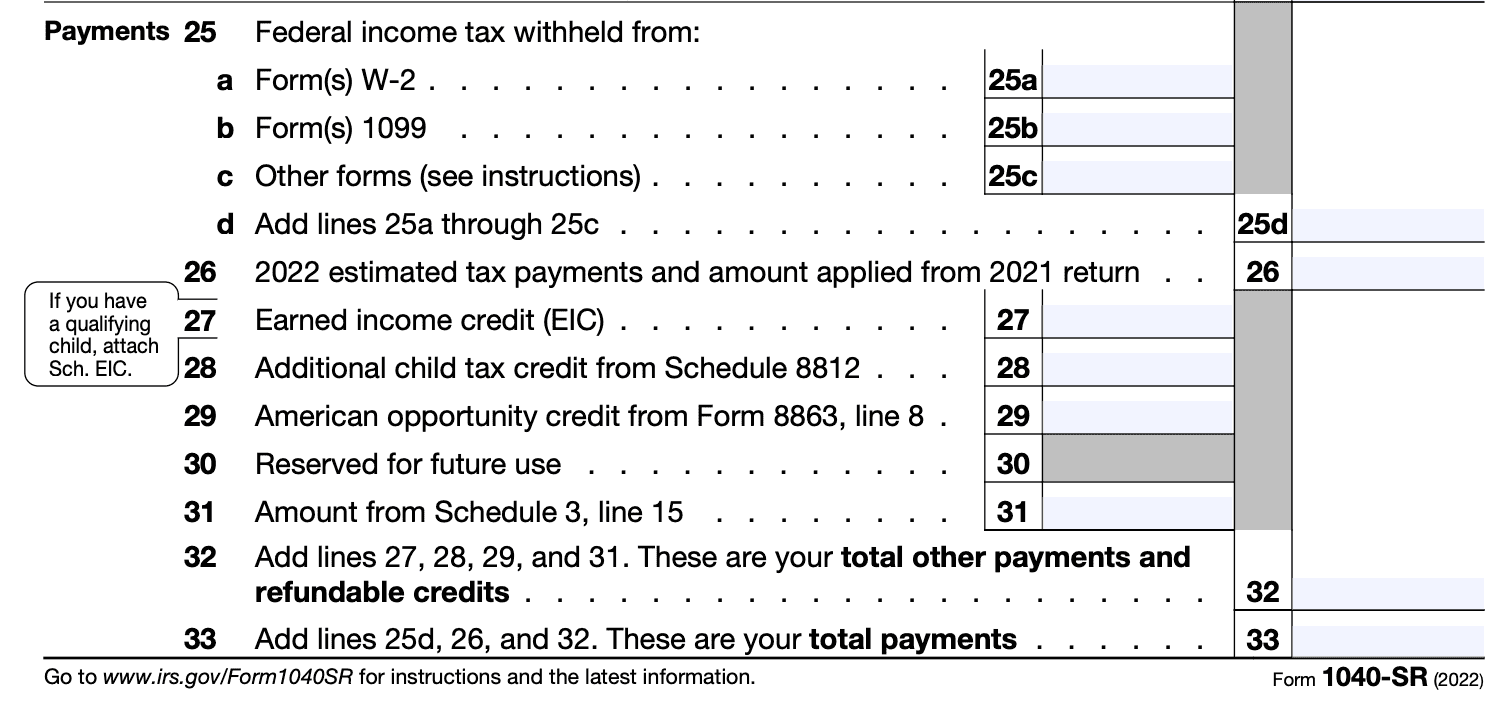

Tax credits and payments: Seniors can claim various tax credits, such as the Earned Income Credit (EIC), Child Tax Credit, and Credit for the Elderly or Disabled, if eligible. They can also report federal tax withheld, estimated tax payments, and any refundable credits.

-

Health coverage reporting: Form 1040-SR includes a section for reporting health coverage, such as Medicare Part A, Part B, or qualified health insurance coverage through the Marketplace.

It's important to note that not all seniors are required to use Form 1040-SR. They can choose to file a regular Form 1040 if they prefer or if their tax situation requires more detailed reporting. The purpose of Form 1040-SR is to provide a simplified option specifically tailored to the needs of senior taxpayers.

Benefits of Form 1040-SR

Form 1040-SR offers several benefits, which are as follows:

Larger print and readability: One of the significant advantages of Form 1040-SR is its larger print size and increased spacing, making it easier for seniors with visual impairments to read and fill out the form accurately.

**Simpler format: **Form 1040-SR uses a simplified format, making it less complex compared to other tax forms. It focuses on the most common types of income and deductions that seniors typically encounter, reducing the burden of excessive information.

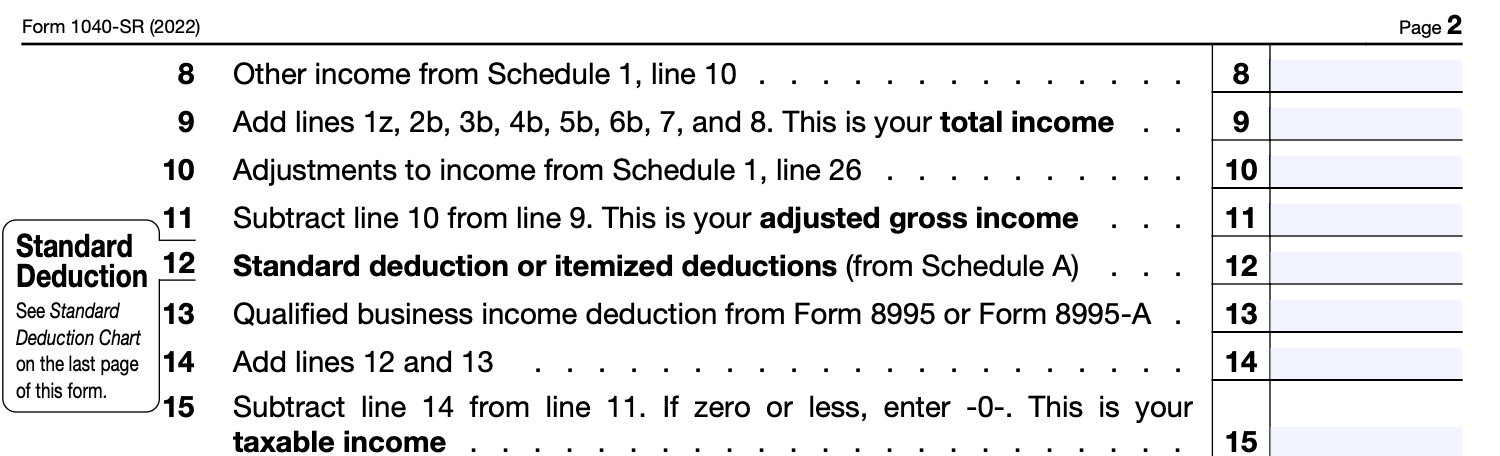

Standard deduction chart: Seniors who do not itemize their deductions can benefit from the standard deduction chart included with Form 1040-SR. This feature eliminates the need for seniors to make extensive calculations and ensures they claim the correct deduction amount based on their filing status.

Highlighted retirement income sources: The form specifically highlights common retirement income sources such as Social Security benefits, pension payments, and distributions from retirement accounts. This makes it easier for seniors to identify and report their income accurately.

Tax credit assistance: Form 1040-SR provides guidance on available tax credits that seniors may qualify for, including the Credit for the Elderly or Disabled. This feature ensures that eligible seniors can take full advantage of the credits available to them.

**Easy-to-understand instructions: **The form includes clear and concise instructions tailored to seniors' needs. These instructions guide seniors through the entire filing process, providing step-by-step explanations for each section and minimizing confusion.

Who Is Eligible To File Form 1040-SR?

The purpose of Form 1040-SR is to provide a simpler and less complex tax filing option for older individuals who may not require all the details and schedules required in the regular Form 1040.

The key features of Form 1040-SR include:

Simplicity: Form 1040-SR is designed to be less complex and easier to understand compared to the standard Form 1040. It uses a larger font size and includes helpful tips and instructions tailored to senior taxpayers.

Standard deduction: Form 1040-SR incorporates a larger standard deduction for seniors, which can be beneficial for individuals who may not have significant itemized deductions.

**Income reporting: **The form allows seniors to report various types of income, such as wages, pensions, Social Security benefits, investment income, and rental income.

Tax credits and payments: Seniors can claim various tax credits, such as the Earned Income Credit (EIC), Child Tax Credit, and Credit for the Elderly or Disabled, if eligible. They can also report federal tax withheld, estimated tax payments, and any refundable credits.

Health coverage reporting: Form 1040-SR includes a section for reporting health coverage, such as Medicare Part A, Part B, or qualified health insurance coverage through the Marketplace.

It's important to note that not all seniors are required to use Form 1040-SR. They can choose to file a regular Form 1040 if they prefer or if their tax situation requires more detailed reporting.

How To Complete Form 1040-SR: A Step-by-Step Guide

Form 1040-SR is a tax form specifically designed for seniors who are 65 years or older. It's similar to Form 1040, but with some modifications to cater to the needs of older taxpayers. Here's a step-by-step guide to help you complete Form 1040-SR:

Step 1: Gather the necessary documents

Before you start filling out Form 1040-SR, make sure you have all the relevant documents handy. This may include your W-2 forms, 1099 forms (such as 1099-INT or 1099-DIV), Social Security statements, and any other documents related to your income, deductions, and credits.

Step 2: Fill out personal information

At the top of the form, you'll find sections where you need to provide your personal information, such as your name, address, Social Security number, and filing status. Ensure that this information is accurate and up-to-date.

Step 3: Report income

Next, you'll report your income from various sources. This includes wages, salaries, pensions, Social Security benefits, dividends, interest, capital gains, and any other taxable income you may have received throughout the year. Use the corresponding lines on the form to report each type of income accurately.

Step 4: Claim deductions

Deductions help reduce your taxable income, potentially lowering your overall tax liability. If you have eligible deductions, such as medical expenses, state and local taxes, mortgage interest, or charitable contributions, you can claim them on Form 1040-SR. Make sure to follow the instructions and use the appropriate lines to report your deductions.

Step 5: Calculate taxable income

After reporting your income and deductions, calculate your taxable income by subtracting your deductions from your total income. This will give you the amount of income subject to taxation.

Step 6: Determine tax liability and credits

Using the Tax Table or the Tax Computation Worksheet provided in the instructions, determine your tax liability based on your taxable income and filing status. If you qualify for any tax credits, such as the Senior Tax Credit or the Credit for the Elderly or Disabled, make sure to include them on the appropriate lines to reduce your overall tax liability.

Step 7: Report payments and refundable credits

If you made estimated tax payments, have any withheld taxes, or qualify for refundable credits, report them on the relevant lines of Form 1040-SR. This will help reconcile your total tax liability with the amount you've already paid.

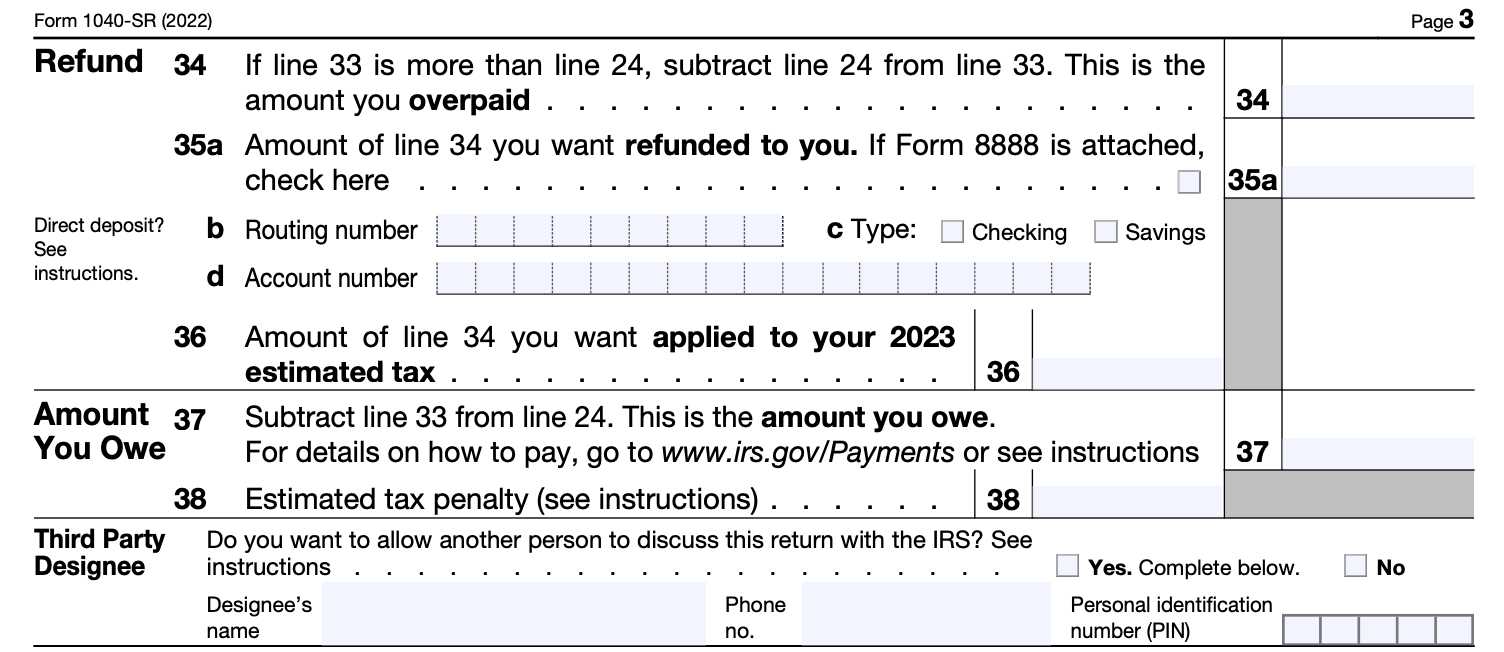

Step 8: Calculate and report the final tax liability

Subtract any payments or refundable credits from your total tax liability to determine your final tax liability or refund amount. If you owe taxes, you can include payment information on the form to settle the amount due.

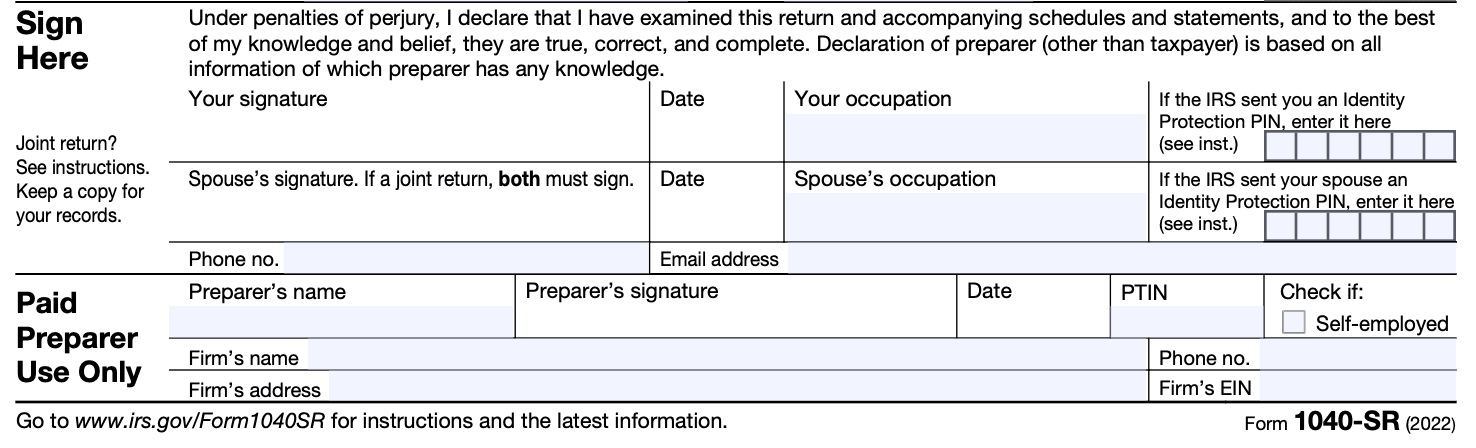

Step 9: Review and sign the form

Before submitting your completed Form 1040-SR, take the time to review all the information you've provided. Double-check for any errors or omissions that may affect your tax return. Once you're confident everything is accurate, sign and date the form.

Step 10: Keep a copy for your records

Make a copy of the completed Form 1040-SR, along with any supporting documents, for your records. It's always a good idea to have a copy of your tax return in case you need to refer to it in the future.

Special Considerations When Filing Form 1040-SR

While the majority of the information and guidelines for filing Form 1040-SR are similar to those for Form 1040, there are a few special considerations to keep in mind when filing Form 1040-SR:

Eligibility: To file Form 1040-SR, you must be at least 65 years old or older by the end of the tax year. This form is not available for individuals who are under 65, regardless of their filing status.

Standard deduction: Form 1040-SR provides larger standard deduction amounts for individuals who are 65 or older. The standard deduction for Form 1040-SR is generally higher than the standard deduction for Form 1040. Make sure to check the latest IRS instructions or consult a tax professional to determine the correct standard deduction amount based on your filing status and age.

Filing status: The same filing statuses as Form 1040 are available on Form 1040-SR, including Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child. Choose the filing status that accurately reflects your situation.

Additional income reporting: If you receive taxable retirement benefits such as pensions, annuities, or IRA distributions, you'll need to report them on Form 1040-SR. This form includes specific lines for reporting retirement income, making it easier for older taxpayers to accurately report their income.

Tax credit for the elderly or disabled: Form 1040-SR allows taxpayers to claim the Credit for the Elderly or Disabled, which provides a tax credit for certain individuals who are 65 years or older or who are permanently and totally disabled. The credit amount and eligibility requirements can be found in the IRS instructions for Form 1040-SR.

Larger print: Form 1040-SR is designed with larger font sizes and increased spacing, making it more readable for individuals with visual impairments.

How To File Form 1040-SR: Offline/Online/E-filing

To file Form 1040-SR, you have several options: filing offline (paper filing), filing online (using IRS Free File or fillable forms), or e-filing (using tax software or a tax professional). Here's a breakdown of each method:

Offline filing (paper filing)

a. Obtain the Form 1040-SR: You can download the Form 1040-SR and the corresponding instructions from the IRS website (www.irs.gov) or request them by mail.

b. Fill out the form: Follow the instructions carefully and fill out the required information on the form. Ensure that your calculations are accurate and that you've included all necessary attachments (such as W-2 forms, schedules, and supporting documents).

c. Sign and date the form: Don't forget to sign and date your completed Form 1040-SR.

d. Make a copy: Before sending your return, make a copy for your records.

e. Mail the form: Mail the completed Form 1040-SR, along with any attachments, to the appropriate IRS address. The address is based on your location and whether you are including a payment or not. Check the instructions for the correct mailing address.

Online filing

a. IRS Free File: If your income is below a certain threshold (currently $72,000 or less), you can use IRS Free File to access free tax software from various providers. This option helps you prepare and file your taxes online.

b. Fillable forms: The IRS provides electronic fillable forms on their website. You can fill in the required information electronically and then submit the form directly to the IRS.

E-filing

a. Tax software: Use commercial tax software programs (such as TurboTax, H&R Block, or TaxAct) to prepare and file your Form 1040-SR electronically. These software programs guide you through the process, perform calculations, and transmit your return securely to the IRS.

b. Tax professional: If you prefer assistance from a tax professional, they can prepare and file your return electronically on your behalf using their specialized software.

Regardless of the method you choose, it's essential to review your return for accuracy before submission. Remember to keep copies of your filed tax return and supporting documents for your records.

Common Mistakes To Avoid While Filing Form 1040-SR

When filing Form 1040-SR, which is specifically designed for seniors, it's essential to avoid common mistakes that could lead to errors or delays in processing your tax return. Here are some mistakes to avoid while filing Form 1040-SR:

Incorrect personal information: Double-check that you provide accurate personal information, including your name, Social Security number, and address. Mistakes in these details can lead to processing delays or issues with your tax return.

Math errors: Math errors are a common mistake on tax forms. Ensure that you perform all calculations correctly, including adding, subtracting, and multiplying numbers. Consider using tax software or a reliable calculator to minimize the risk of mathematical mistakes.

**Filing status errors: **Selecting the correct filing status is crucial, as it determines your tax rates and eligibility for certain deductions and credits. Review the filing status options carefully and choose the one that accurately reflects your situation.

Omitting income: Failing to report all taxable income is a significant mistake. Ensure that you include income from all sources, such as wages, self-employment income, pensions, retirement account distributions, interest, dividends, and capital gains. Refer to your tax documents (e.g., W-2s, 1099s) to ensure you report all income accurately.

Neglecting to claim deductions and credits: Be sure to take advantage of all deductions and credits you qualify for. Common deductions for seniors include medical expenses, state and local taxes, and charitable contributions. Additionally, look for credits like the Retirement Savings Contributions Credit or the Credit for the Elderly or Disabled.

**Inaccurate bank account information: **If you're requesting a direct deposit for your refund, verify that you provide the correct bank account information. A mistake in your account number or routing number can result in your refund being delayed or deposited into the wrong account.

**Not reviewing the form thoroughly: **Before submitting your Form 1040-SR, carefully review all the information you have provided. Check for any typos, missing or incomplete entries, and ensure that you have signed and dated the form where required.

Filing late or not requesting an extension: Make sure to file your Form 1040-SR by the due date, which is generally April 15th. Failing to file on time can result in penalties and interest charges. If you need more time, file for an extension using Form 4868, which gives you an additional six months to file your return (Note: An extension to file is not an extension to pay any taxes owed).

**Ignoring state tax obligations: **Remember that Form 1040-SR is for federal income tax purposes only. Depending on where you live, you may also need to file a state income tax return. Be sure to research and fulfill your state tax obligations as well.

**Not seeking professional assistance when needed: **If you have complex tax situations or are unsure about certain aspects of your tax return, it's wise to seek assistance from a tax professional or use reliable tax software. They can help ensure your Form 1040-SR is accurate and filed correctly.

By avoiding these common mistakes, you can improve the accuracy and efficiency of filing your Form 1040-SR and minimize the likelihood of encountering issues with your tax return.

Conclusion

Form 1040-SR offers a simplified and accessible tax filing option for senior citizens, taking into account their unique financial circumstances and specific needs. With its larger print, simplified format, and focused instructions, this form alleviates some of the challenges that seniors may face during tax season. By reducing complexity and providing clearer guidance, Form 1040-SR ensures that older taxpayers can fulfill their tax obligations accurately and with greater ease.

If you are a senior citizen looking to file your taxes, it is essential to consult with a tax professional or use tax preparation software to determine if Form 1040-SR is the most suitable option for your specific situation.