- IRS forms

- Form CT-1

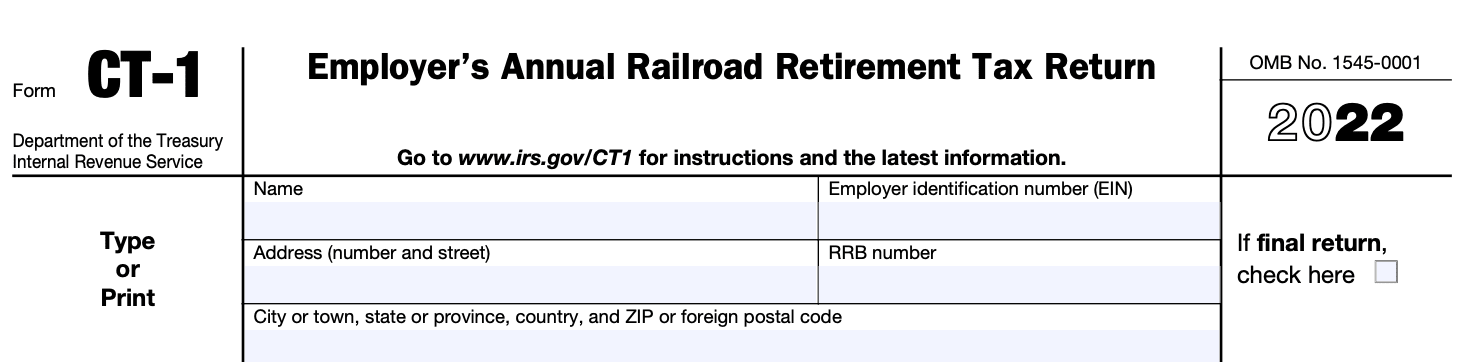

Form CT-1: Employer's Annual Railroad Retirement Tax Return

Download Form CT-1Managing payroll and tax obligations is a crucial aspect of running a business, and this includes complying with the specific tax requirements of certain industries. If you are an employer in the railroad industry, you have the responsibility of filing Form CT-1, also known as the Employer's Annual Railroad Retirement Tax Return.

The Railroad Retirement Tax Act (RRTA) imposes taxes on the compensation paid to employees in the railroad industry. This tax is separate from the Social Security and Medicare taxes that most employers are familiar with. The Railroad Retirement Tax consists of two parts: the Tier 1 tax and the Tier 2 tax.

The Tier 1 tax is equivalent to the Social Security tax for most employees. Both the employer and the employee are responsible for paying the Tier 1 tax. As an employer, you must withhold the employee's portion from their wages and contribute the employer's portion to the Railroad Retirement Board (RRB).

In this blog post, we will provide you with a comprehensive guide to help you navigate through the complexities of Form CT-1 and ensure compliance with the Internal Revenue Service (IRS).

Purpose of Form CT-1

The purpose of Form CT-1 is to report the employer's share of the taxes under the RRA. Employers in the railroad industry are required to pay taxes on behalf of their employees, similar to Social Security and Medicare taxes in the general workforce. These taxes fund the benefits provided by the Railroad Retirement Board (RRB).

Form CT-1 is filed annually by railroad employers to report their taxable compensation, calculate the tax liability, and reconcile the amount of taxes paid throughout the year. The form also includes information about the number of employees covered, the amount of wages subject to tax, and any adjustments or corrections to previous filings.

By completing Form CT-1 accurately and submitting it to the IRS and RRB, railroad employers fulfill their tax obligations and contribute to the funding of the Railroad Retirement system, ensuring that eligible railroad workers and their families receive the benefits they are entitled to under the RRA.

Benefits of Form CT-1

The benefits of Form CT-1, the Employer's Annual Railroad Retirement Tax Return, include:

-

Compliance with tax obligations: Form CT-1 enables railroad employers to fulfill their tax obligations under the Railroad Retirement Act (RRA). By accurately completing and submitting the form, employers ensure compliance with tax laws and regulations specific to the railroad industry.

-

Reporting employee contributions: Form CT-1 provides a mechanism for reporting the employer's share of taxes related to the RRA. These taxes fund the benefits provided to railroad employees and their families, such as retirement, disability, and survivor benefits. By reporting these contributions, employers contribute to the stability and sustainability of the Railroad Retirement system.

-

Calculation of tax liability: The form allows employers to calculate their tax liability accurately. By providing information about taxable compensation and applying the appropriate tax rates, employers can determine the amount of taxes they owe under the RRA. This ensures that the correct amount of taxes is paid, preventing underpayment or overpayment.

-

Reconciliation of taxes paid: Form CT-1 facilitates the reconciliation of taxes paid throughout the year. Employers can compare the total taxes paid during the tax year with the calculated tax liability on the form. This process helps identify any discrepancies and allows for adjustments or corrections, ensuring accurate reporting and reducing the likelihood of penalties or audits.

-

**Documentation for audits and record-keeping: **Form CT-1 serves as essential documentation for audits and record-keeping purposes. By maintaining a record of their tax filings, employers can easily provide the necessary information and evidence in case of inquiries from the Internal Revenue Service (IRS) or the Railroad Retirement Board (RRB)

Who Is Eligible To File Form CT-1?

The RRTA applies to certain railroad employers and their employees, including:

Class I railroad companies: This includes major railroad companies with an annual operating revenue of at least $250 million.

Class II and III railroad companies: These are smaller railroad companies with lower annual operating revenues.

Railroad industry contractors: Certain contractors providing services to railroad companies may also be subject to the RRTA.

It's important to note that Form CT-1 is not applicable to employers who are not subject to the RRTA. For employers who are not covered by the RRTA, they would generally use Form 941, the Employer's Quarterly Federal Tax Return, to report their federal income tax, Social Security tax, and Medicare tax liabilities for their employees.

How To Complete Form CT-1: A Step-by-Step Guide

Completing Form CT-1, Employer's Annual Railroad Retirement Tax Return, requires careful attention to detail. Here's a step-by-step guide to help you navigate the process:

Step 1: Obtain the necessary forms and instructions

Visit the official website of the Internal Revenue Service (IRS) at www.irs.gov and search for Form CT-1. Download the form, along with the instructions for Form CT-1.

Step 2: Provide general information

At the top of Form CT-1, enter your employer identification number (EIN), your name, and the address of your business. If any of this information has changed since your last filing, make sure to update it accordingly.

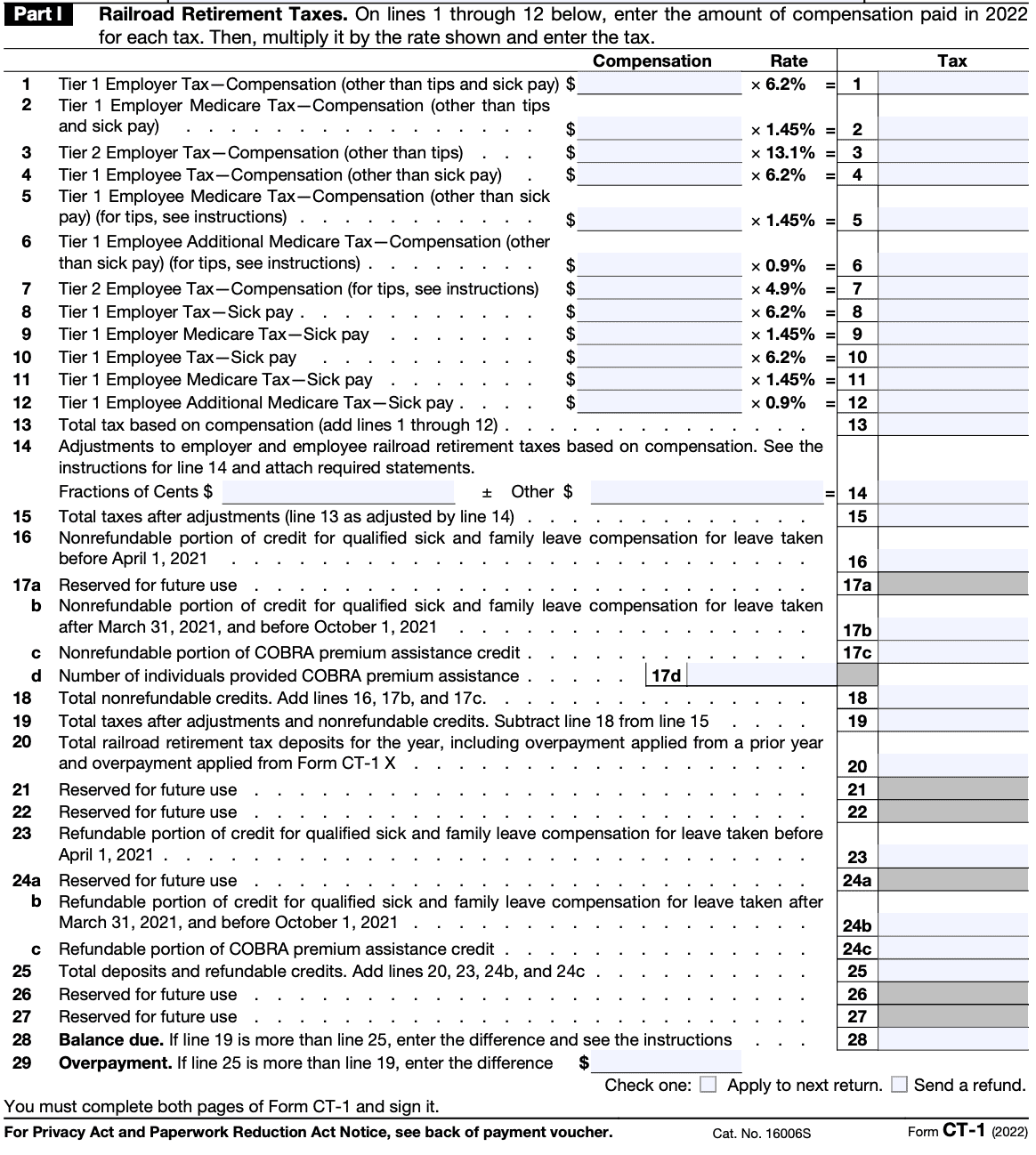

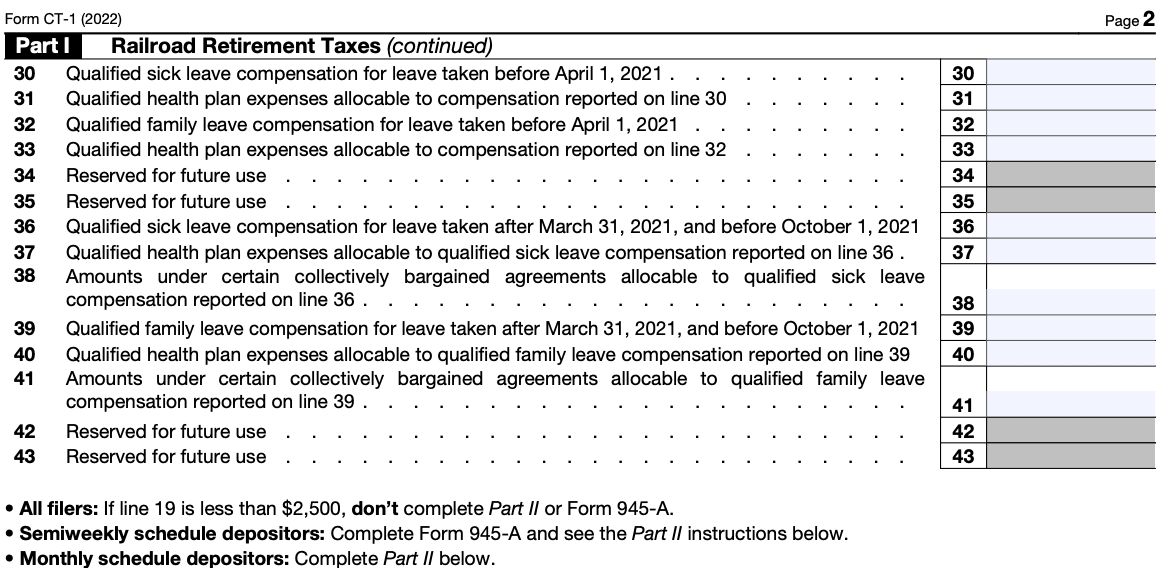

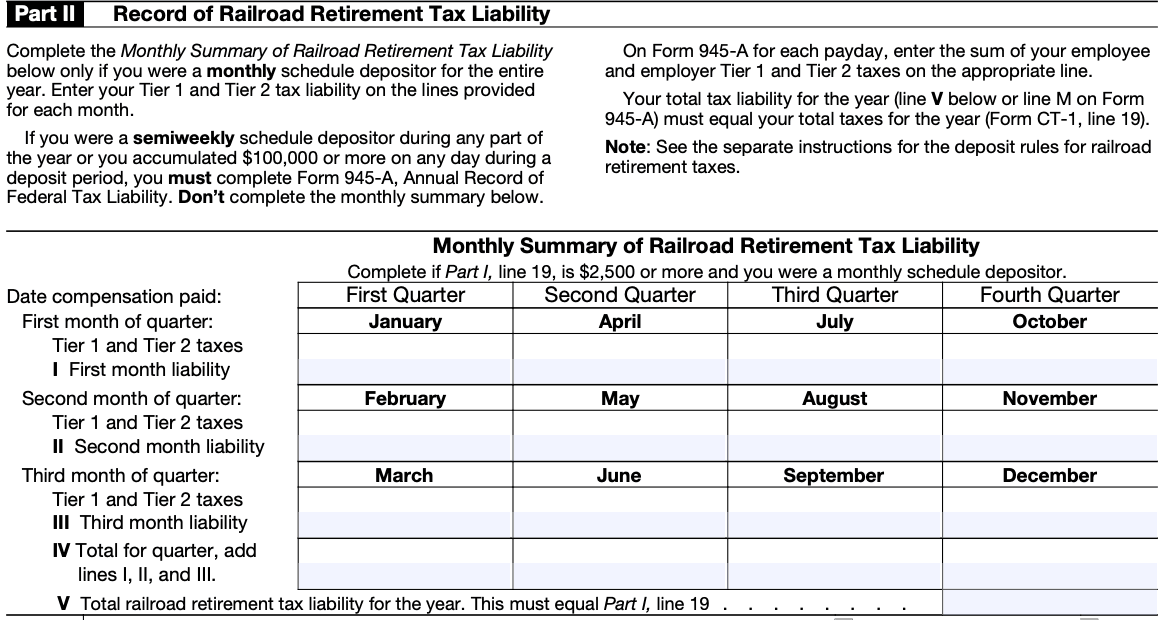

Step 3: Complete Part I - Tax Computation

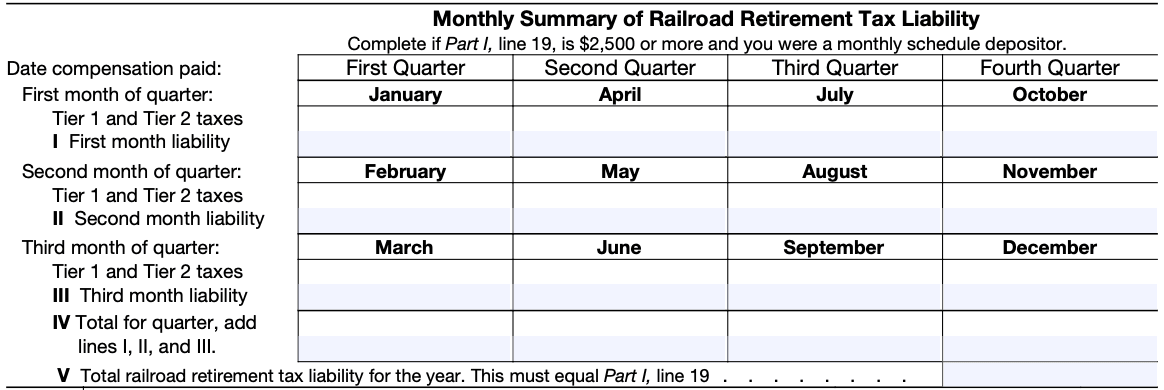

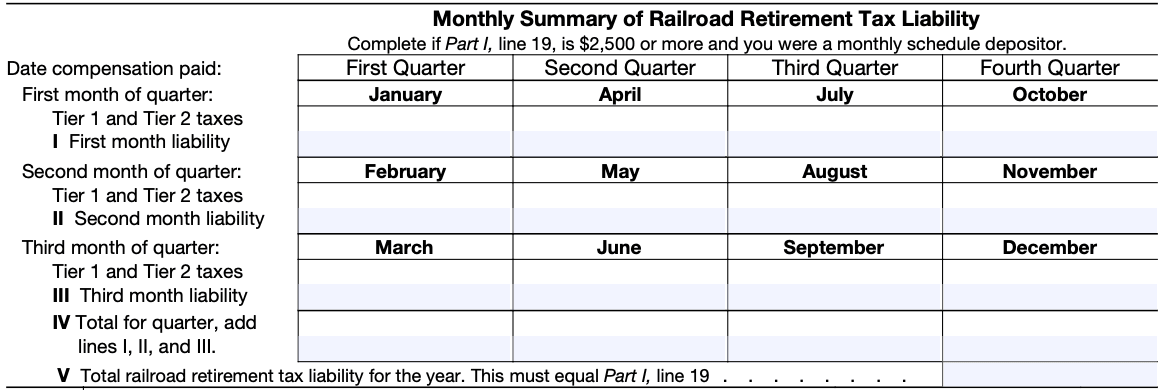

In Part I of Form CT-1, you'll calculate your tax liability. The instructions will provide you with the necessary guidelines and tax rates. Enter the relevant figures from your payroll records to calculate the total tax due.

Step 4: Complete Part II - Total Compensation Paid

In Part II, you'll report the total compensation paid to railroad employees during the tax year. This includes wages, salaries, tips, bonuses, commissions, and other forms of compensation subject to the Railroad Retirement Tax Act (RRTA).

Step 5: Complete Part III - Taxable Compensation

In Part III, you'll calculate the taxable compensation for each employee. Refer to the instructions for guidance on what types of compensation are subject to taxation. Enter the relevant figures for each employee.

Step 6: Complete Part IV - Tax Withheld

In Part IV, report the total amount of tax withheld from employees' compensation during the tax year. This includes both the employee and employer portions of the tax.

Step 7: Complete Part V - Total Tax Liability

Part V is used to calculate your total tax liability for the tax year. You'll combine the tax amounts from Parts I, III, and IV to arrive at the total tax due.

Step 8: Complete Part VI - Deposits and Payments

In Part VI, you'll report any deposits or payments made throughout the year. This includes both the tax withheld from employees' compensation and any additional payments made towards your tax liability.

Step 9: Complete Part VII - Overpayment or Balance Due

In Part VII, you'll determine if you have an overpayment or balance due. If you overpaid your tax liability, you can choose to apply the overpayment to the next tax period or request a refund. If you have a balance due, you'll need to remit the payment to the IRS.

Step 10: Sign and submit the form

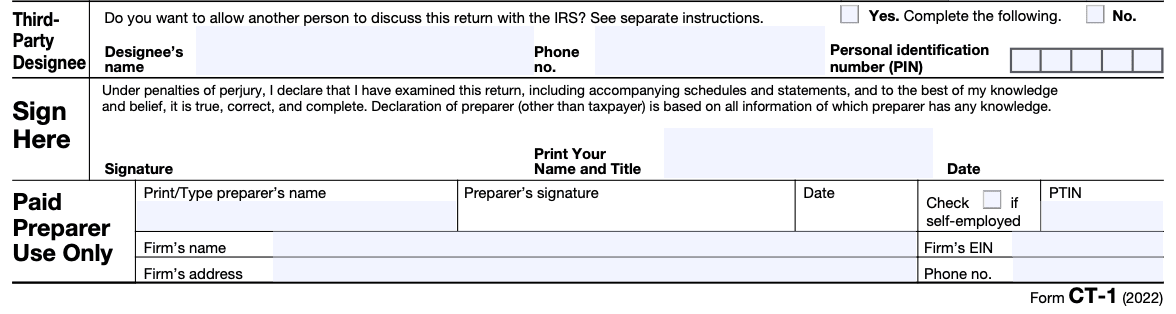

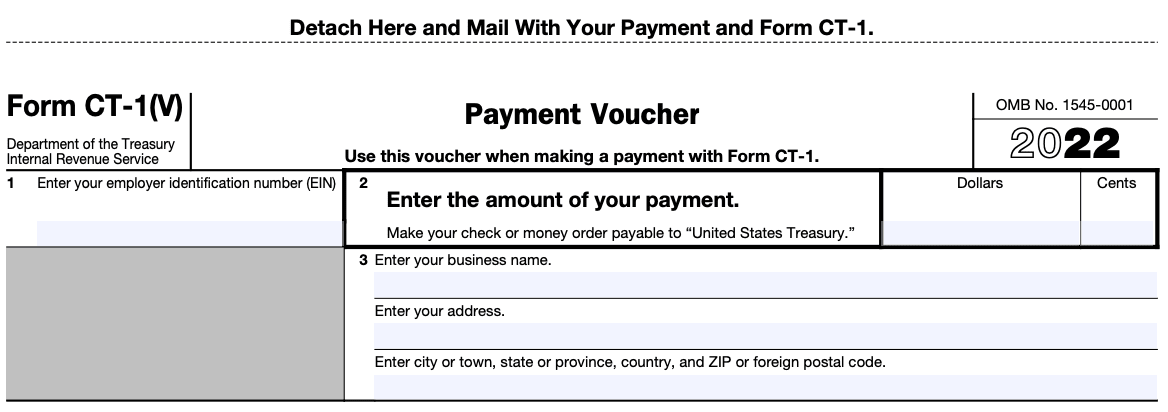

Ensure you've signed and dated the form in the appropriate section. If you have a balance due, attach a check or money order payable to the "United States Treasury" along with the completed Form CT-1. If you're expecting a refund, it's advisable to file electronically and choose direct deposit for faster processing.

###Step 11: Retain a copy

Make a copy of the completed Form CT-1 and all accompanying documentation for your records. It's crucial to keep this information for at least three years in case of any future inquiries or audits.

Remember, this step-by-step guide is a general overview, and it's important to refer to the specific instructions for Form CT-1 provided by the IRS. If you have any doubts or need further assistance, consider consulting a tax professional or reaching out to the IRS directly for clarification.

Special Considerations When Filing Form CT-1

When filing Form CT-1, Employer's Annual Railroad Retirement Tax Return, there are several special considerations that you should keep in mind. Here are some important points to consider:

Railroad Retirement Tax Act (RRTA): Form CT-1 is used for reporting and paying the employer's portion of the Railroad Retirement Tax under the RRTA. This tax is separate from Social Security and Medicare taxes and applies specifically to railroad employers.

Separate tax rates: The Railroad Retirement Tax has its own tax rates and wage bases that are different from the rates for Social Security and Medicare taxes. It's important to refer to the latest instructions for Form CT-1 to determine the correct rates and wage bases for the tax year you are filing.

**Reporting wages and tips: **You need to report all compensation subject to the Railroad Retirement Tax on Form CT-1. This includes wages, salaries, tips, bonuses, commissions, and any other forms of compensation paid to your employees during the tax year.

Employee and employer portions: Form CT-1 requires you to report both the employee's and the employer's portions of the Railroad Retirement Tax. You should accurately calculate and report both amounts based on the applicable tax rates.

Filing deadlines: Form CT-1 must be filed annually, and the deadline for filing is generally the last day of February following the tax year. However, it's crucial to verify the specific due date each year, as it may vary.

Electronic filing: The IRS encourages electronic filing for most tax forms, including Form CT-1. Electronic filing can streamline the process and help ensure accuracy. Check the IRS website for available electronic filing options.

Record-keeping: As with any tax form, it's important to maintain accurate and complete records of all relevant documents, such as payroll records, tax calculations, and any other supporting documentation. These records should be kept for at least four years.

Payment of taxes: Along with filing Form CT-1, you must remit the taxes due. The IRS provides various payment options, including electronic funds transfer (EFT), credit/debit card payments, or mailing a check or money order.

How To File Form CT-1: Offline/Online/E-Filing

The filing process for Form CT-1 can be done either offline (paper filing) or online (e-filing). Here's how you can file Form CT-1 using both methods:

Offline filing

- Obtain a copy of Form CT-1: You can download the form from the official website of the Internal Revenue Service (IRS) or request a copy by mail by calling the IRS Forms and Publications helpline.

- Fill out the form: Carefully complete all the required fields on the form, including your employer identification number (EIN), contact information, and the amounts of railroad retirement tax withheld and paid.

- Attach supporting documents: If required, attach any necessary schedules or supporting documentation to substantiate the amounts reported on Form CT-1.

- Send the form to the IRS: Once you have completed the form, mail it to the appropriate address provided in the instructions for Form CT-1. Make sure to use certified mail or a reputable courier service to ensure safe delivery.

Online/E-filing

- Access the IRS e-file system: Visit the IRS website and navigate to the e-file section. Ensure that you have the necessary credentials to log in or create a new account.

- Select the correct form: Choose Form CT-1 from the list of available forms for e-filing. The IRS e-file system will guide you through the process step by step.

- Enter the required information: Fill out the electronic form provided, entering the necessary details such as your EIN, contact information, and tax amounts withheld and paid.

- Submit the form electronically: After completing the form, review the information for accuracy and then submit it electronically through the IRS e-file system.

- Retain confirmation and payment records: Once you have successfully filed the form, keep a copy of the confirmation for your records. If you have any tax payments associated with Form CT-1, make sure to retain documentation of those payments as well.

Remember to refer to the specific instructions provided by the IRS for filing Form CT-1 to ensure compliance with the latest requirements and guidelines.

Common Mistakes To Avoid While Filing Form CT-1

When filing Form CT-1, which is used to report and pay the railroad retirement tax, it's important to avoid certain common mistakes to ensure accurate and timely filing. Here are some mistakes to avoid:

Incorrect or missing information: Ensure that all required fields on the form are filled out accurately and completely. Double-check your entries for accuracy, including the employer identification number (EIN), employee information, wages, and tax calculations.

Using outdated forms or instructions: Always use the most recent version of Form CT-1 and review the corresponding instructions provided by the IRS. Using outdated forms or following outdated instructions can lead to errors and delays in processing your tax return.

Missed deadlines: Be aware of the deadlines for filing Form CT-1. The form is typically due quarterly, and the due dates may vary depending on the tax year and the specific quarter. Failing to file by the deadline can result in penalties and interest charges.

Incorrect tax calculations: Ensure that you accurately calculate the railroad retirement tax based on the applicable rates and wage limits. Double-check your calculations to avoid underpayment or overpayment of taxes.

Failure to reconcile with Form 941: If you are also required to file Form 941, the Employer's Quarterly Federal Tax Return, make sure that the amounts reported on Form CT-1 match the corresponding figures on Form 941. Consistency between the two forms is crucial for accurate reporting.

Neglecting to include necessary attachments: Depending on your specific circumstances, you may need to include attachments or schedules along with Form CT-1. For example, if you have adjustments or corrections to prior filings, you may need to include Form CT-1-X. Be sure to review the instructions to determine if any additional forms or schedules are required.

Not retaining copies of filed forms: It is essential to keep copies of all filed forms, including Form CT-1, for your records. These copies can serve as proof of filing and can be useful in case of any discrepancies or audits.

Conclusion

Complying with the tax obligations specific to the railroad industry is vital for employers. Form CT-1, the Employer's Annual Railroad Retirement Tax Return, allows you to report and reconcile the railroad retirement taxes accurately.

By understanding the requirements and following the step-by-step guide we provided, you can navigate the process with confidence and ensure compliance with the IRS.

Remember to consult the official IRS instructions and seek professional assistance if needed to ensure accurate and timely filing of Form CT-1.