- IRS forms

- Form 941

Form 941: Quarterly Federal Tax Return Guide

Download Form 941Key Insights:

- (link: #what-is-form-941 text: What Is Form 941?)

- (link: #how-does-irs-form-941-look text: How Does Federal Form 941 Look?)

- (link: #who-has-to-file-form-941 text: Who Should File Form 941?)

- (link: #how-to-fill-out-form-941 text: How To Fill Out Form 941?)

- (link: #where-should-you-file-irs-form-941 text: Where Should You File IRS Form 941?)

- (link: #form-941-filing-due-dates text: Form 941 Filing Due Dates / Deadlines)

- (link: #penalties-for-the-failure-to-file text: Penalties For the Failure to File)

- (link:#covid-19-relief-measures text: COVID-19 Relief Measures)

- (link: #extension-of-tax-credits text: Form 941 Extension of Tax Credits)

- (link: #conclusion text: Conclusion)

Creative industries account for 4.01% of all US businesses. Art has a formidable business presence and is widely distributed across various communities in the region.

To make money out of creativity, managing your finances is critical. That also involves filing taxes - a nightmare for many creative professionals with no formal training or education in business and finance.

Architects, interior designers, artists, museums, event management companies, and others contribute to creative small businesses. Such occupations need a workforce to carry out tasks and help achieve company objectives. In simple terms, they have employees and employers.

Employers in creative businesses are responsible for keeping their finances on track and filing returns timely. In the US, employers are required to fill out IRS Form 941. Let's dive in and understand more about this form and how you can fill it out.

What Is Form 941?

Form 941 is an employer’s quarterly federal tax return. It is also an Internal Revenue Service tax form provided to employers in the US and a summary of total taxes withheld for the previous quarter by a business or an individual.

Running a business involves several risks. One way to tackle them is to fill out the form to obtain a clear view of the taxes you owe. Employers withhold employment taxes from their employees' salaries. They take it from federal taxes, Social Security tax, or Medicare tax and are carried forward monthly or semi-weekly.

How Does Federal Form 941 Look?

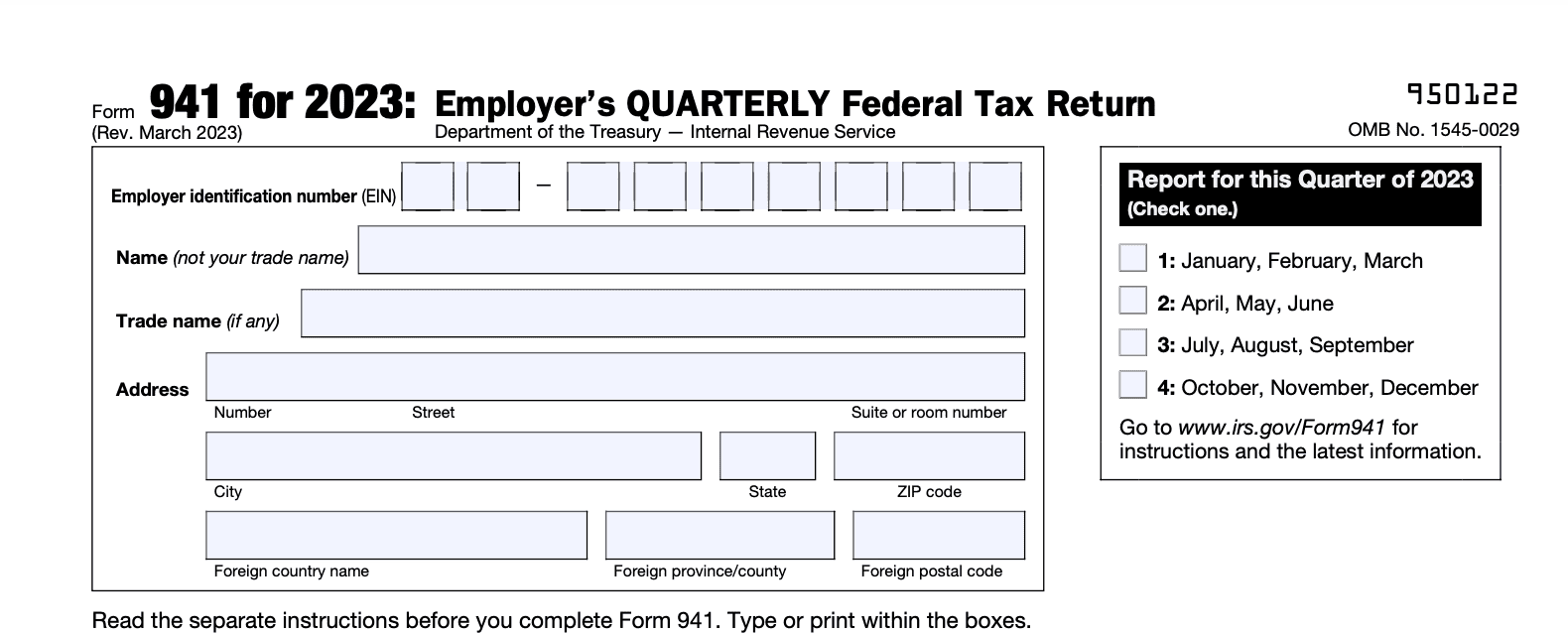

The image below shows IRS Form 941 for 2022.

Source: irs.gov

Who Has To Federal Tax File Form 941?

The businesses that typically need to file Form 941 are those that pay wages to the employees working under them. Employers use this form to report the information they withhold to the IRS, and employees aren’t liable to get a receipt for the same.

This form is used to calculate payroll amounts like the wages paid, tips reported to you by your employees, employers' and employees' share of Social Security and Medicare taxes, and so on.

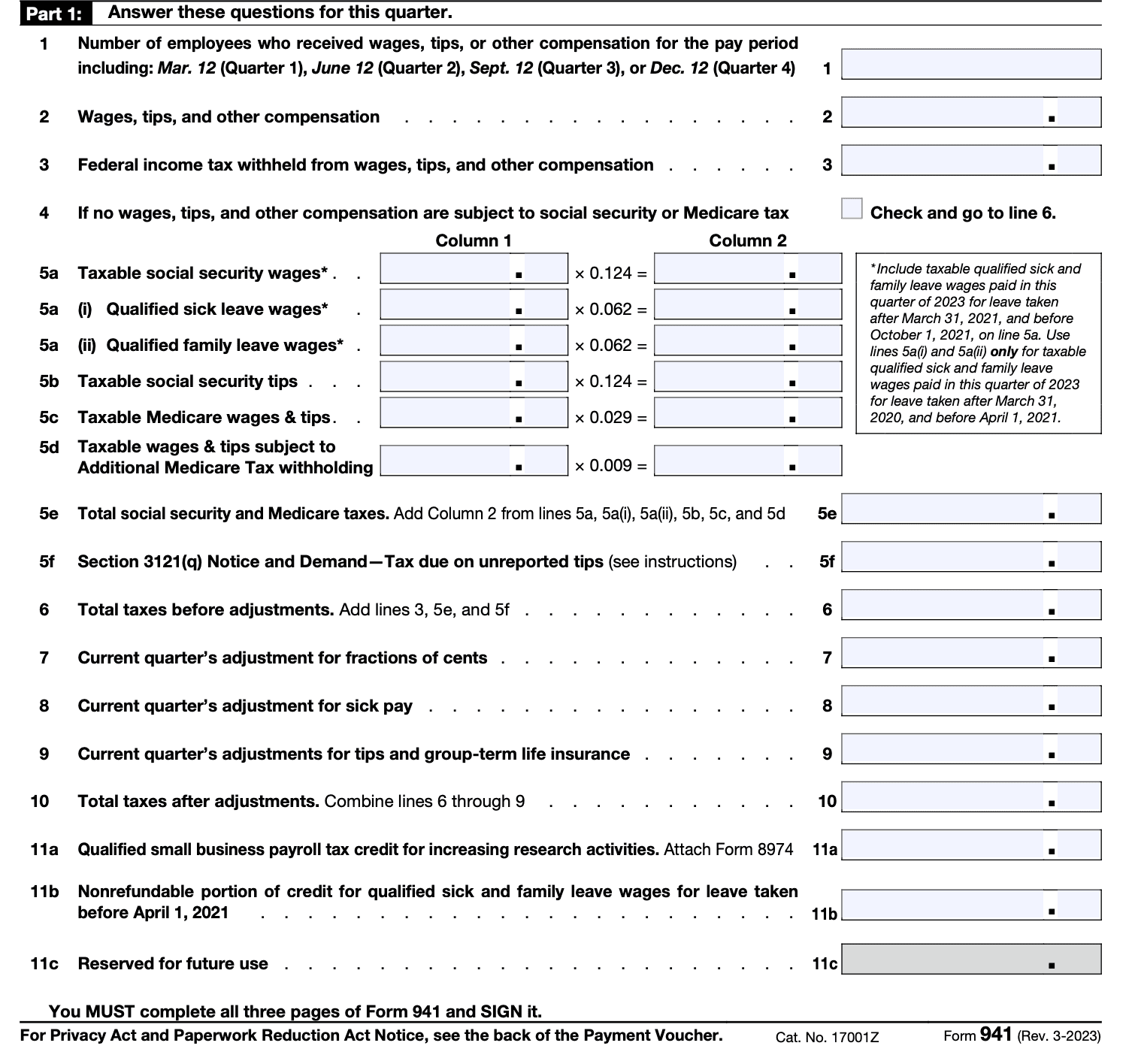

You should report the following amounts in it:

- Wages you've paid

- Tips your employees reported to you

- Federal income tax withheld

- Both the employer and the employee share of social security and Medicare taxes

- Additional Medicare Tax withheld from employees

- Current quarter's adjustments to social security and Medicare taxes for fractions of cents, sick pay, tips, and group-term life insurance

- Qualified small business payroll tax credit for increasing research activities

- Credit for qualified sick and family leave wages paid in 2023 after March 31, 2020, and before October 1, 2021.

The parameters that should not be reported are pensions, annuities, and gambling winnings. Use Form 945, Annual Return of Withheld Federal Income Tax, instead. And, to report unemployment taxes, use (link: https://fincent.com/irs-tax-forms/form-940 text: Form 940), Employer's Annual Federal Unemployment (FUTA) Tax Return.

After filing your first Form 941, you must file a return for each quarter, even if there are no taxes to report. However, there are exceptions:

- If you received notification to file Form 944, Employer's ANNUAL Federal Tax Return, file Form 944 annually instead of Form 941 quarterly.

- Seasonal employers do not have to file Form 941 for quarters in which they have no tax liability because they have paid no wages. Check the box on line 18 every quarter you file Form 941 to inform the IRS that you won't file a return for one or more quarters during the year. More information can be found in section 12 of Pub. 15.

- Employers of household employees usually don't file Form 941. Find more information in Pub. 926 and Schedule H (Form 1040).

- Employers of farm employees don't file Form 941 for wages paid for agricultural labor. For more information, see Form 943 and Pub. 51.

In simple terms, there are exceptions for employers when filling this form. This form is for seasonal employers who don't pay wages for one or two quarters, employers of household employees, and employers of agricultural employees.

How To Fill Out Form 941?

Form 941 involves several calculations, often leaving a lot of room for error. Here is a step-by-step guide to avoid committing any major mistakes while filling the form.

Form 941 consists of five parts:

Part 1 of Form 941

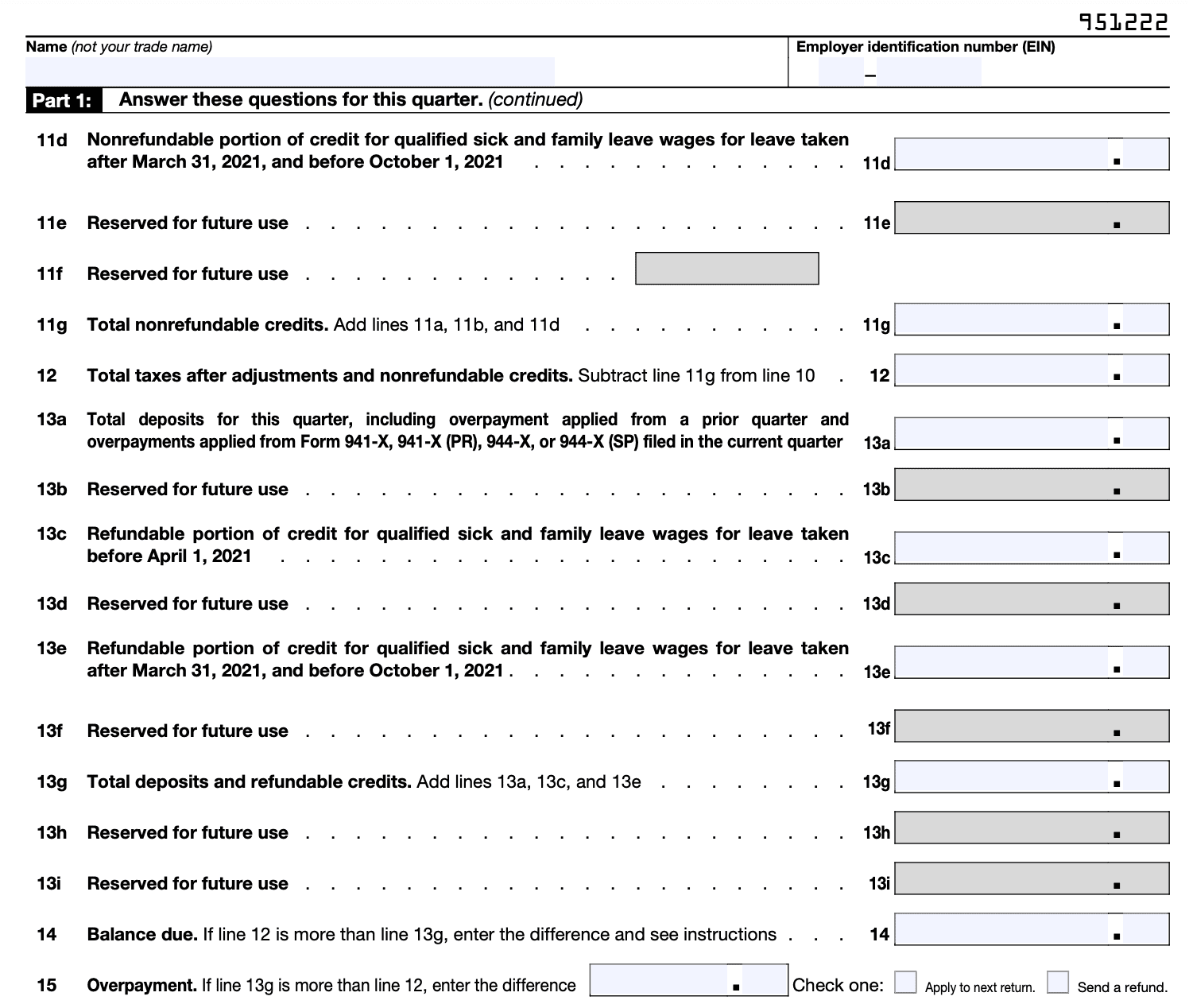

This part is meant to gather all the information to report before filling out the form. This includes basic business information, the number of employees, total wages paid for the quarter, and so on. This part also brings out whether the employer owes taxes or has overpaid.

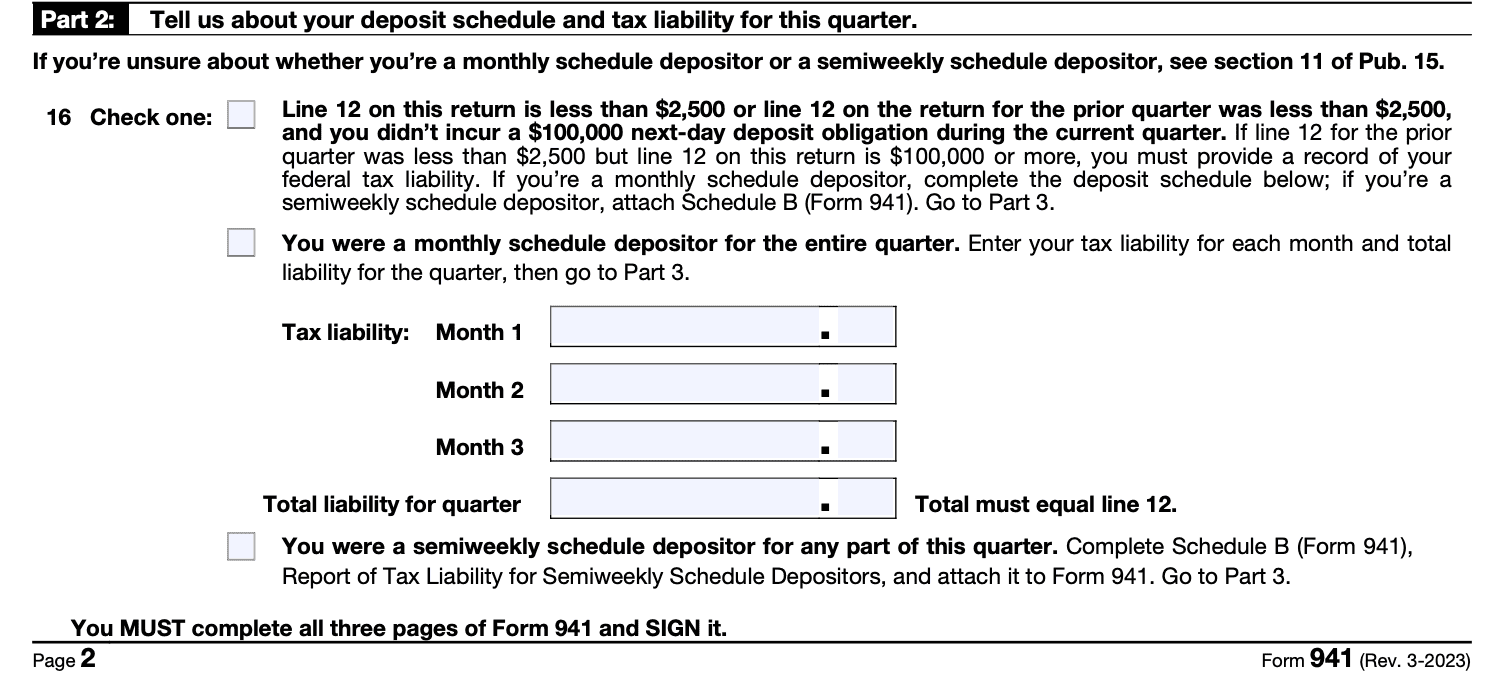

Part 2 for your deposit schedule and tax liability for this quarter.

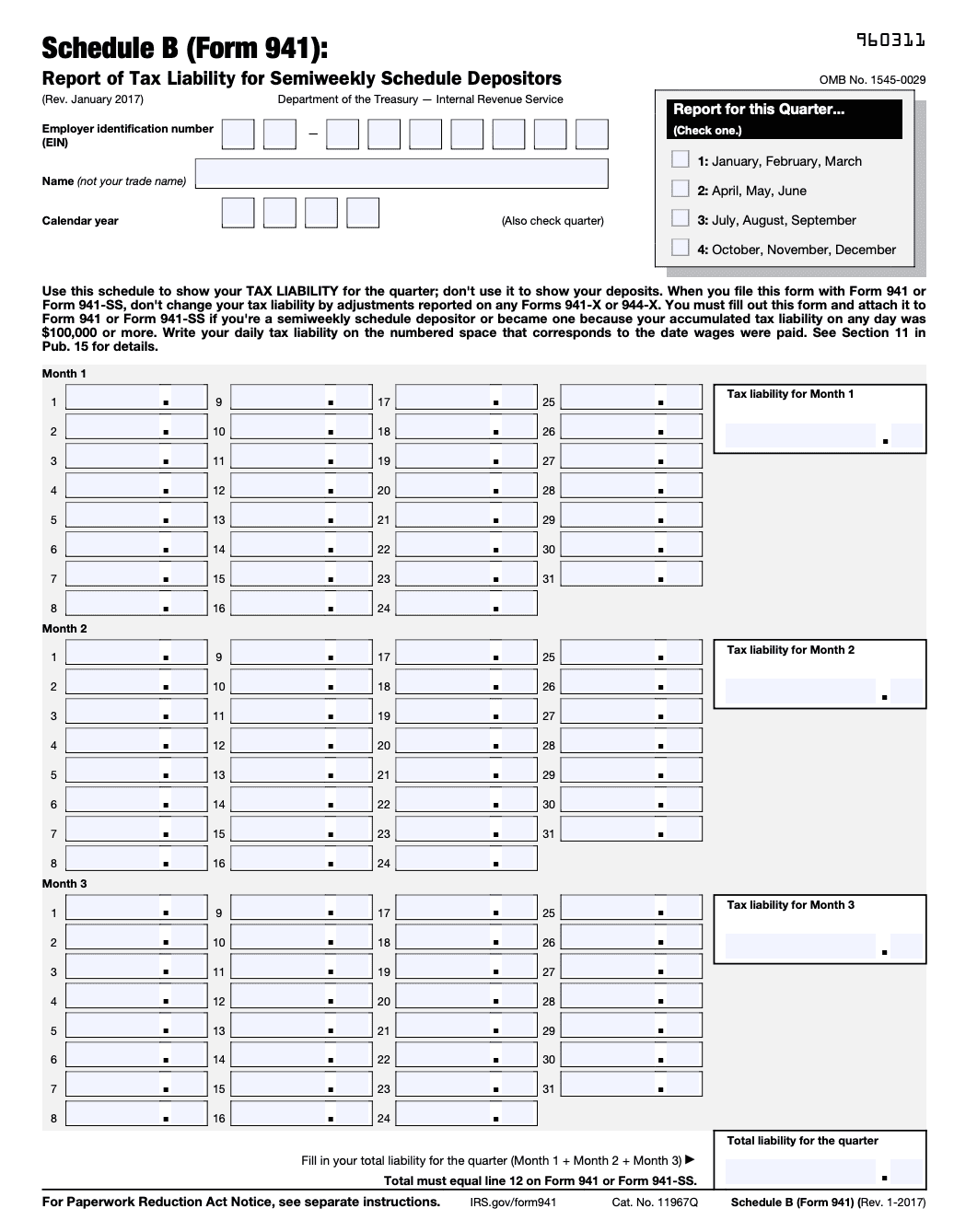

It explains the tax deposit schedule for employment taxes. It can be done either monthly or semi-weekly. As a monthly depositor, you must enter the tax liability for each month in the quarter. However, if you are a semi-weekly depositor, attach (link: https://www.irs.gov/pub/irs-pdf/f941sb.pdf text: Schedule B of Form 941).

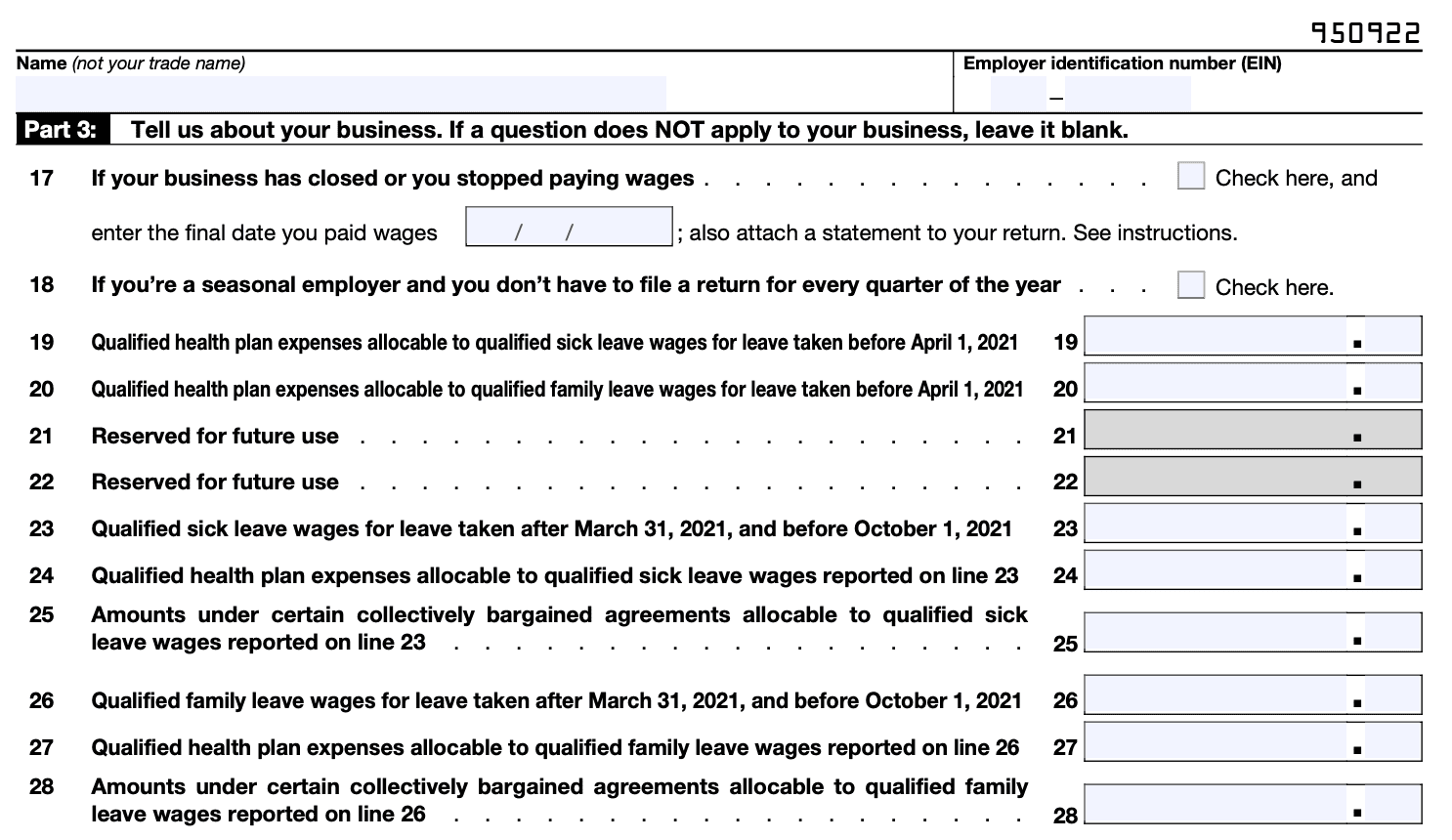

Part 3 - About your business. If a question does NOT apply to your business, leave it blank.

This part majorly asks questions about the business, such as whether the business stops paying wages or is a seasonal employer.

Part 4 - Third-party designee

This asks permission of the IRS to speak with the third-party designee. This person is someone who has been hired to prepare Form 941 or to prepare the payroll taxes. However, if you do not want to discuss with another person/third party designee, you have an option of not doing that.

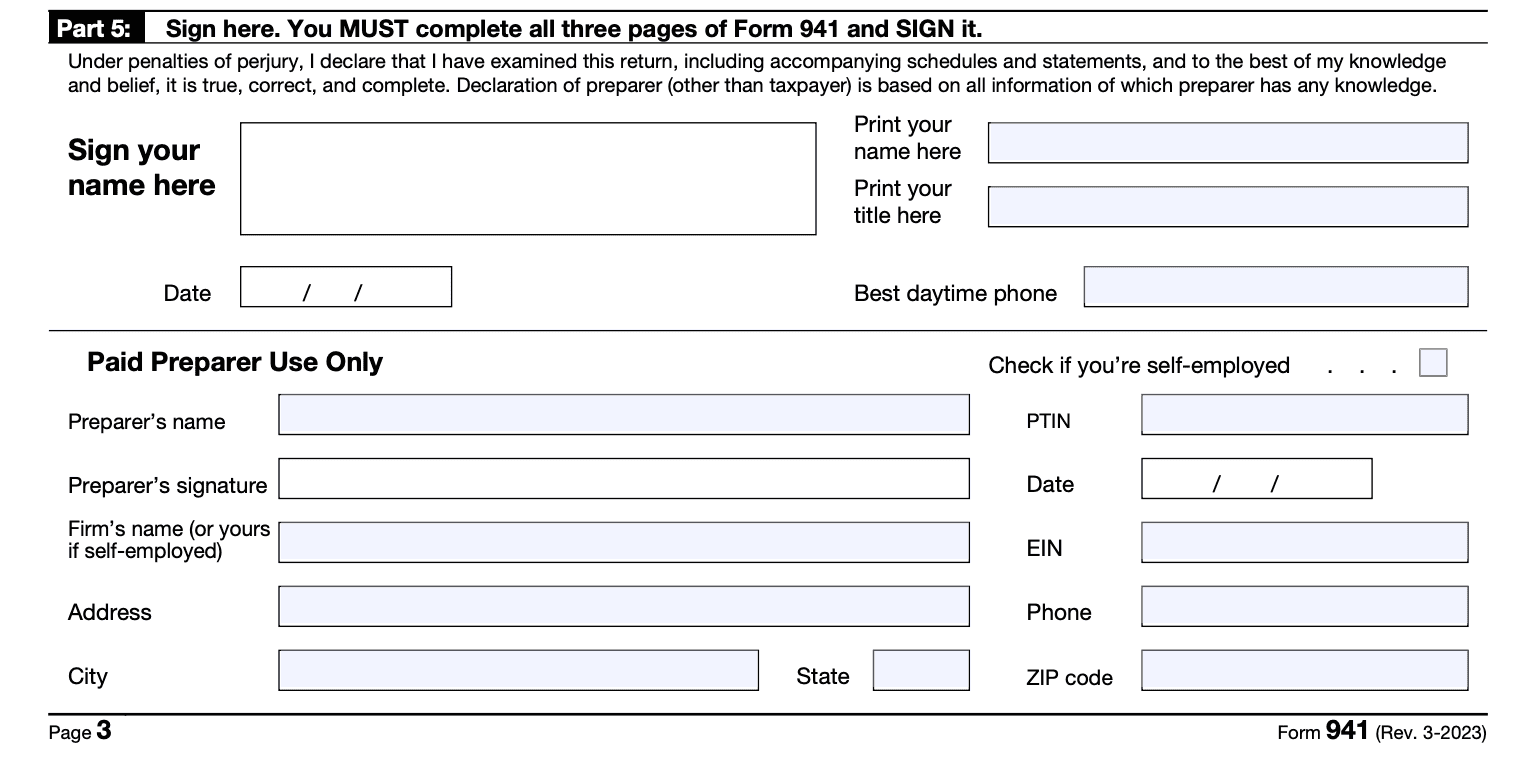

Part 5 - You MUST complete all three pages of Form 941 and SIGN it.

This step includes the signature of the employer, the date, time, and phone number. This is also the point at which you should check the form for any errors to avoid a penalty.

These are quick steps on how to fill out Form 941.

IRS Form 941 is due four times a year. So, it must be done quarterly, even if you don't have any payroll taxes to report. The due dates are as follows - April 30, July 31, October 31, and January 31.

If you report less than $50,000, then you are supposed to make monthly deposits. If you report more, you must make deposits twice a week.

Where Should You File IRS Form 941?

There are two ways by which you could file your Form 941- through mail or online.

The form 941 tax returns can be filed via mail. The address must be mentioned correctly, and the form must be postmarked by the US Postal Services on or before the due date. The returns can be sent to one of the listed addresses on the IRS website that varies according to the state your business is in.

A private delivery service will also make sure that the returns get to the IRS form 2553 on time. However, the payments are supposed to be made electronically.

Online

Form 941 can be submitted electronically using the Federal E-file. The government allows making the payment online through the Electronic Federal Tax Payment System. However, one needs to enroll to be able to do so.

Form 941 Filing Due Dates

You should file your initial Form 941 for the quarter in which you first paid wages subject to these taxes. Then, you must file for every quarter after that, every three months, even if you have no taxes to report, unless you’re a seasonal employer or filing your final return.

The following table shows when to file Form 941:

| Quarter Ends | Form 941 is Due Dates |

| March 31 | April 30 |

| June 30 | July 31 |

| September 30 | October 31 |

| December 31 | January 31 |

For instance, you must report wages you paid in the first quarter (January through March) by April 30. If you made timely deposits for the quarter, you may file Form 941 by the 10th day of the second month following the end of the quarter.

If you file Form 941 after the due date, it will be considered filed on time if the envelope is postmarked by the U.S. Postal Service on or before the due date, or sent by an IRS-designated private delivery service (PDS) on or before the due date. If you fail to comply with these guidelines, Form 941 will be considered filed when it's actually received. If a filing due date falls on a weekend or holiday, you can file on the next business day.

Penalties For the Failure to File

Form 941 for tax returns is to be filed four times a year, and the due dates have been mentioned above. Failing to file form 941 on time can lead to penalties. As you can imagine, these penalties can add up quickly. These add up to the taxes that had been due for each month or a portion for the month that is delayed.

The penalties are as follows:

- Deposits that are made 1 to 5 days late charge 2%.

- Deposits that are made 6 to 15 days late charge 5%.

- Deposits that are made 16 days or later, but ten days before the first notice from the IRS charge 10%.

- Deposits that were paid directly to the IRD or along with the tax returns charge 10%.

- Amounts that remain unpaid even after the first notice or from the day you received a notice demanding immediate payment, whichever is earlier, charge 15%.

Balancing the Year

Balancing out the year is crucial and cannot be neglected. Are you wondering how you can do this? The total amount that you report on the four Forms 941 should be equal to the total amount on the W-2 forms given to the employees, along with the W-3 form sent to the government.

COVID-19 Relief Measures

To everyone's surprise, Form 941 for 2019 had been revised in 2020 for quarters two, three, and four in respect of the COVID-19 pandemic. In this revised version, the IRS is allowed to defer payments for certain employment taxes. It is a part of two tax credits introduced due to the pandemic.

The Employee Retention Centre encourages the businesses affected during the coronavirus pandemic to keep paying their employees. This tax credit is available up to June 30, 2021. Employers can receive these tax credits after filing their tax returns by reducing their employment tax deposits.

The Sick and Family Leave tax credit ensures that the employers must give paid sick and family leaves to the employees who can't work due to the pandemic. The credit was available between April 1, 2020, and March 31, 2021. The tax credits could be taken by keeping part of employment taxes to employee wages rather than depositing them.

Form 1120 for Corporations

Use Form 1120 is used to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation

Extension of Tax Credits

The tax credits were extended from April 1, 2021, to September 30, 2021, for companies with fewer than 500 employees.

Conclusion

Small creative businesses are already under immense pressure to help boost the economy. Taking up the task of filing for returns will add to the burden.

Fincent provides industry-leading bookkeeping services to small businesses to help them focus on scaling without having to worry about their finances. You can reach out to them to ensure a stress-free future for your creative business.