- IRS forms

- Form 730

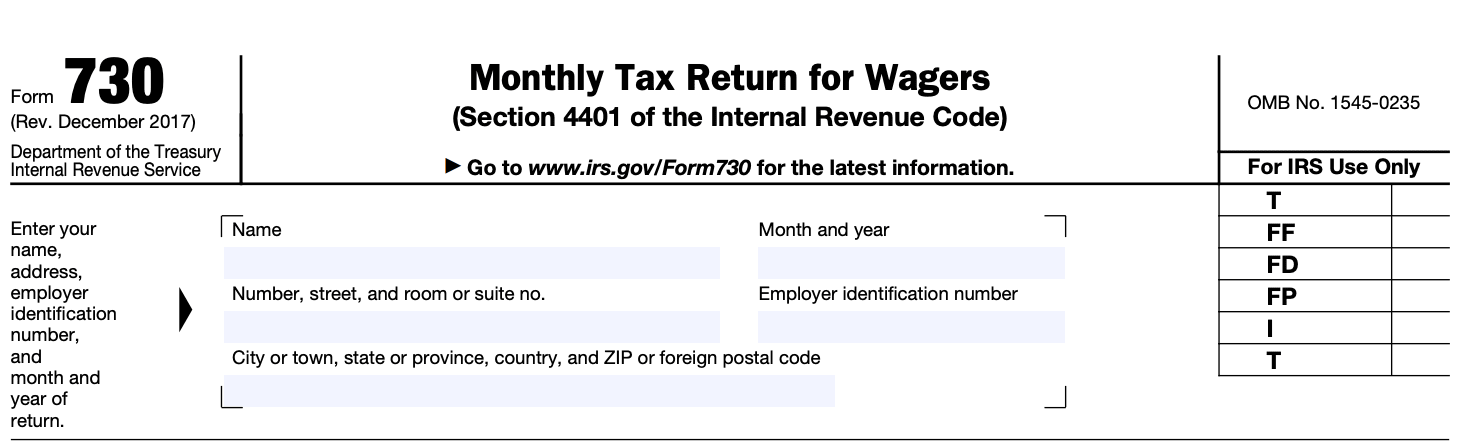

Form 730: Monthly Tax Return for Wagers

Download Form 730In the world of gambling and wagering, it's crucial for both individuals and businesses to comply with their tax obligations. The Internal Revenue Service (IRS) has specific forms designed to address the taxation of various income sources, including gambling winnings. One such form is the Form 730, also known as the Monthly Tax Return for Wagers.

Form 730 is a monthly tax return form used by businesses involved in wagering activities, including bookmakers, lottery operators, and other organizations engaged in accepting wagers. It enables these entities to report and pay the federal excise tax on wagers they have received during the month. The form is filed with the IRS and provides a mechanism for the government to collect tax revenue from the gambling industry.

In this blog post, we will delve into the details of Form 730, exploring its purpose, who needs to file it, and the important information it requires.

Purpose of Form 730

The federal excise tax on wagers is imposed on certain types of wagers, such as bets placed on horse racing, dog racing, jai alai, and lotteries. It is important to note that not all types of gambling activities are subject to this tax, and it primarily applies to specific types of wagers and establishments involved in such activities.

Form 730 is typically filed by businesses that operate in the gambling industry, including bookmakers, racetracks, off-track betting parlors, and casinos. These businesses are responsible for collecting the tax from the individuals placing wagers and then reporting and remitting the tax to the Internal Revenue Service (IRS) on a monthly basis using Form 730.

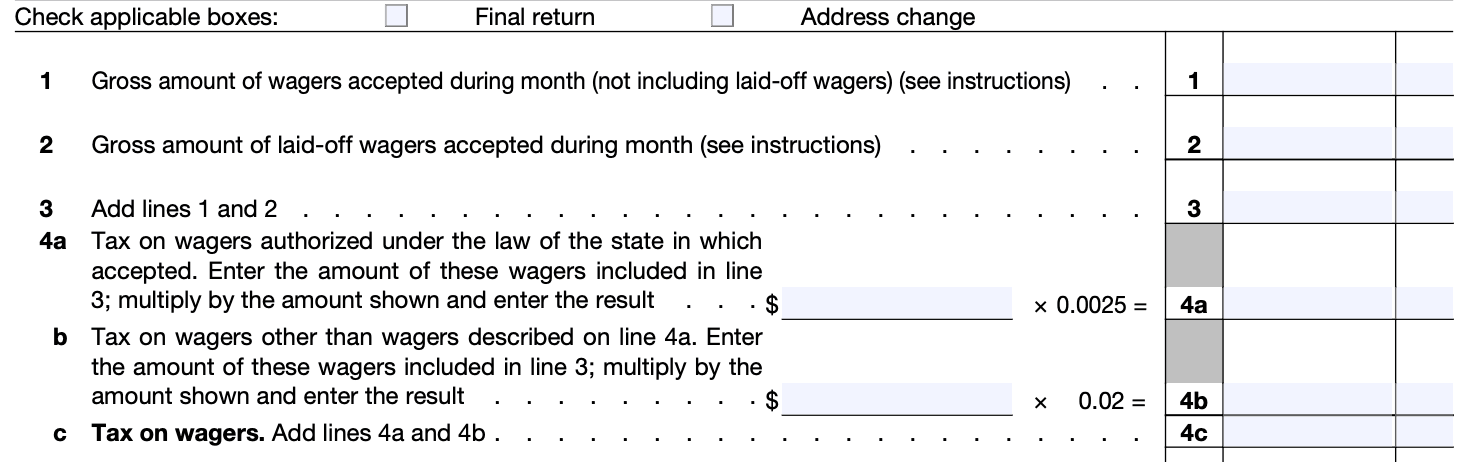

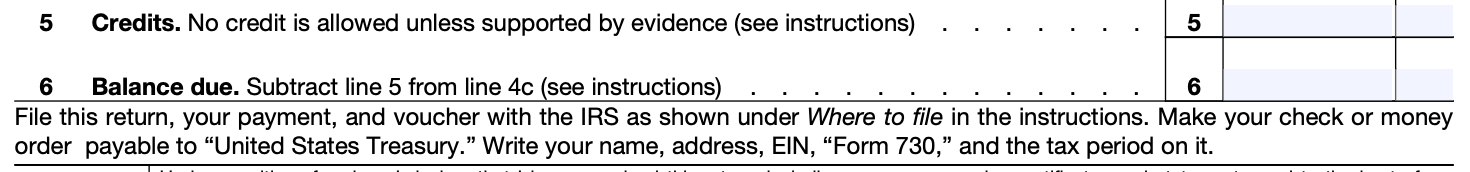

The form requires businesses to provide information about the total amount of wagers received and the corresponding tax liability. It also includes sections for reporting adjustments, credits, and any penalties or interest due. By filing Form 730, businesses fulfill their obligation to report and pay the federal excise tax on wagers and maintain compliance with the tax laws and regulations.

Benefits of Form 730

Form 730 is used to report and pay the federal excise tax on wagering. This tax is applicable to various types of gambling activities, including but not limited to sports betting, casino games, lotteries, and certain types of online gambling.

Here are some potential benefits of filing Form 730:

**Compliance with tax regulations: **By filing Form 730, you ensure that you are complying with the federal tax regulations related to wagering activities. It helps you meet your tax obligations and avoid potential penalties or legal issues that may arise from non-compliance.

Accuracy in tax reporting: The form requires you to report the details of your wagering activities, including the amount of wagers, winnings, and taxable amounts. By accurately reporting this information, you ensure that your tax liabilities are calculated correctly, leading to accurate tax filings.

**Transparency and accountability: **Filing Form 730 provides transparency and accountability regarding your wagering activities to the Internal Revenue Service (IRS). This helps maintain trust and integrity in your financial reporting, and it establishes a clear record of your taxable transactions.

Deductible expenses: While the federal excise tax on wagering is generally based on the gross amount of wagers, you may be eligible to deduct certain expenses related to your gambling activities. Filing Form 730 allows you to report these deductible expenses accurately, potentially reducing your overall tax liability.

Documentation for future references: Keeping a record of your wagering activities through Form 730 provides a documented history of your gambling transactions. This can be useful for future reference, such as when applying for loans, demonstrating financial history, or addressing any discrepancies that may arise.

Supporting documentation for losses: If you have incurred gambling losses, filing Form 730 and maintaining accurate records can serve as supporting documentation for potential deductions or offsetting winnings in future tax years. This can help mitigate the tax impact of losses over time.

Who Is Eligible To File Form 730?

Individuals or businesses engaged in certain types of gambling or wagering activities are typically required to file Form 730. Eligible filers include:

**Licensed wagering establishments: **This category includes businesses such as casinos, racetracks, off-track betting parlors, and similar establishments that are legally authorized to offer gambling or wagering services.

Pari-mutuel wagering: Individuals or businesses involved in pari-mutuel wagering, which refers to betting systems where all bets are pooled together, and the winners' share is determined by the total amount wagered.

Bookmakers: People or businesses accepting and paying off bets, usually on horse races or other sporting events, are generally required to file Form 730.

**Lottery sellers: **Individuals or businesses authorized to sell lottery tickets or participate in lottery activities may need to file this form to report and pay the applicable excise tax.

**Sweepstakes and wagering pools: **If you operate a sweepstakes, betting pool, or similar activity where wagers are made and winners are determined based on chance, you may be required to file Form 730.

How To Complete Form 730: A Step-by-Step Guide

Here is a step-by-step guide on how to complete Form 730:

Step 1: Gather necessary information

Collect all the relevant information and documents required to complete Form 730. This includes records of wagers received, winnings paid, and any adjustments or credits that apply to your business.

Step 2: Fill out the business information

At the top of the form, enter your business's name, address, Employer Identification Number (EIN), and the month and year for which you are filing the return.

Step 3: Complete Part I - tax computation

In Part I, you will calculate the tax owed based on the total wagers received during the month. Follow the instructions provided in the form to determine the taxable amount and apply the appropriate tax rate. Calculate the tax due and enter it in the designated field.

Step 4: Complete Part II - credits and payments

If you have any credits or payments to apply to the tax liability, fill out Part II. This could include any overpayments from previous periods or any other applicable credits. Subtract the total credits and payments from the tax due to determine the net amount owed.

Step 5: Complete Part III - monthly summary

In Part III, summarize the total wagers received, adjustments, credits, and payments made during the month. This section provides an overview of your business's activities for the period.

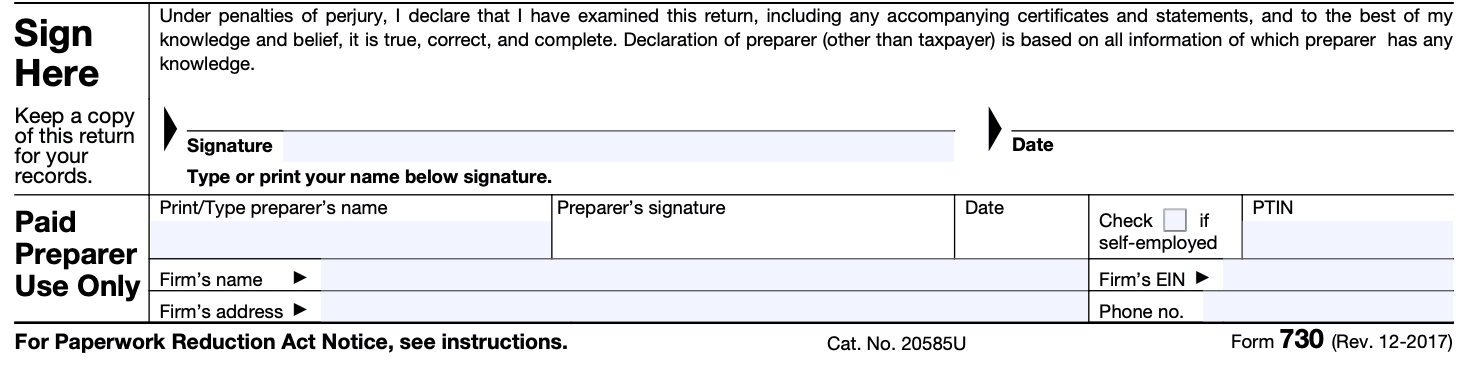

Step 6: Sign and date the form

As the responsible party, sign and date the form to certify its accuracy. If the return is prepared by someone else, such as a tax professional, they should also sign the form in the appropriate field.

Step 7: Retain a copy for your records

Make a copy of the completed Form 730 for your records before submitting it to the Internal Revenue Service (IRS). It is essential to keep a record of your tax filings for future reference or potential audits.

Step 8: Submit the form and payment

Mail the completed Form 730, along with the payment for the tax due, to the appropriate IRS address. Ensure that you are sending it to the correct location based on your business's location and the specific instructions provided by the IRS.

Special Considerations When Filing Form 730

When filing Form 730, there are several special factors to keep in mind. Here are some key considerations:

Correct filing period: Form 730 is filed monthly, and the due date for each month's return is the last day of the following month. Ensure that you file the form for the correct period and meet the filing deadline.

**Accurate reporting: **Accurately report all the required information on Form 730. This includes the total amount of wagers received during the month, the taxable amount subject to the federal excise tax, and the tax liability.

Calculate the tax liability: The federal excise tax rate for wagers may vary depending on the type of wagering activity. Make sure to calculate the tax liability correctly based on the applicable rate.

Timely payment: The tax liability reported on Form 730 should be paid in full by the due date. Include the payment along with the form when submitting it to the IRS.

Electronic filing: Generally, Form 730 must be filed electronically using the Electronic Federal Tax Payment System (EFTPS). Ensure that you are registered with EFTPS and have the necessary credentials to submit the form electronically.

**Recordkeeping: **Maintain accurate records of all wagering activities, including the total wagers received, payouts, and any other relevant documentation. These records should be retained for at least four years from the due date of Form 730.

**Consult a tax professional: **Wagering activities can involve complex tax rules and regulations. If you have any uncertainties or questions about filing Form 730, it's advisable to consult a tax professional or accountant who can provide guidance based on your specific circumstances.

Remember to review the official instructions for Form 730 provided by the Internal Revenue Service (IRS) for the most up-to-date and detailed information.

How To File Form 730: Offline/Online/E-filing

Offline filing

To file Form 730 offline, you would need to obtain a physical copy of the form from the IRS. You can order the form by calling the IRS at 1-800-TAX-FORM (1-800-829-3676) or by visiting their website . Once you have the form, you can complete it manually, following the instructions provided, and then mail it to the appropriate address as indicated in the instructions.

Online filing

The IRS offers an online filing option for certain excise tax forms, but as of my knowledge cutoff, Form 730 cannot be filed directly online. However, you can use the Electronic Federal Tax Payment System (EFTPS) to make the payment for the excise taxes owed.

E-filing

Electronic filing, or e-filing, is generally the most convenient and efficient method of filing tax forms. However, as of my knowledge cutoff, Form 730 cannot be e-filed directly. You may need to explore alternative methods for electronic filing, such as using specialized tax software or engaging the services of a tax professional who may have access to electronic filing options for Form 730.

Conclusion

Form 730 serves as a crucial tool for the IRS to collect federal excise tax from businesses and individuals involved in accepting wagers or conducting gambling activities. By requiring accurate reporting of taxable wagers and timely payment of taxes, the IRS ensures that the gambling industry contributes its fair share of revenue to the government.

If you are engaged in wagering activities, it is essential to understand your tax obligations and comply with the requirements of Form 730. Seek the assistance of a tax professional or utilize the resources provided by the IRS to ensure accurate reporting and timely payments. By doing so, you can avoid potential penalties and maintain compliance with the tax laws governing the gambling industry.

FAQs

Q1: What is Form 730?

Form 730 is a tax form used by businesses that are liable for the federal excise tax. It is known as the "Monthly Tax Return for Wagers'’ and used to report and pay the taxes on wagers and related activities.

Q2: Who needs to file Form 730?

Form 730 is typically filed by businesses engaged in certain wagering activities, such as bookmakers, lottery ticket sales agents, and operators of casinos, racetracks, or off-track betting facilities. If your business falls under one of these categories and meets the requirements for federal excise tax on wagers, you will likely need to file Form 730.

Q3: What is the purpose of filing Form 730?

The primary purpose of filing Form 730 is to report and pay the federal excise tax on wagers. The tax is levied on the amount of wagers received by the business, and the form is used to calculate the tax liability for each month and remit the payment to the Internal Revenue Service (IRS).

Q4: When is Form 730 due?

Form 730 is typically due by the last day of the month following the month in which the wagers were accepted. For example, the form for wagers accepted in January would be due by the last day of February. However, it is advisable to consult the IRS instructions or a tax professional to confirm the specific due dates, as they can sometimes change.

Q5: How do I file Form 730?

Form 730 can be filed electronically using the Electronic Federal Tax Payment System (EFTPS), which is the preferred method by the IRS. Alternatively, you can file a paper copy of the form by mail. Detailed instructions for filling out and filing the form can be found in the IRS instructions accompanying the form.

Q6: Are there any penalties for not filing Form 730?

Yes, there can be penalties for not filing Form 730 or for filing it late. The penalties may vary depending on the circumstances, but they can include monetary fines and interest charges on the unpaid tax amount. It is important to comply with the filing requirements and deadlines to avoid penalties.

Q7: Can I amend a previously filed Form 730?

Yes, if you discover an error or omission on a previously filed Form 730, you can file an amended form to correct it. Use Form 730X, Amended Monthly Tax Return for Wagers, to make the necessary corrections. Be sure to follow the instructions provided by the IRS for amending the form and include any additional tax payment if required.