- IRS forms

- Form 990-PF

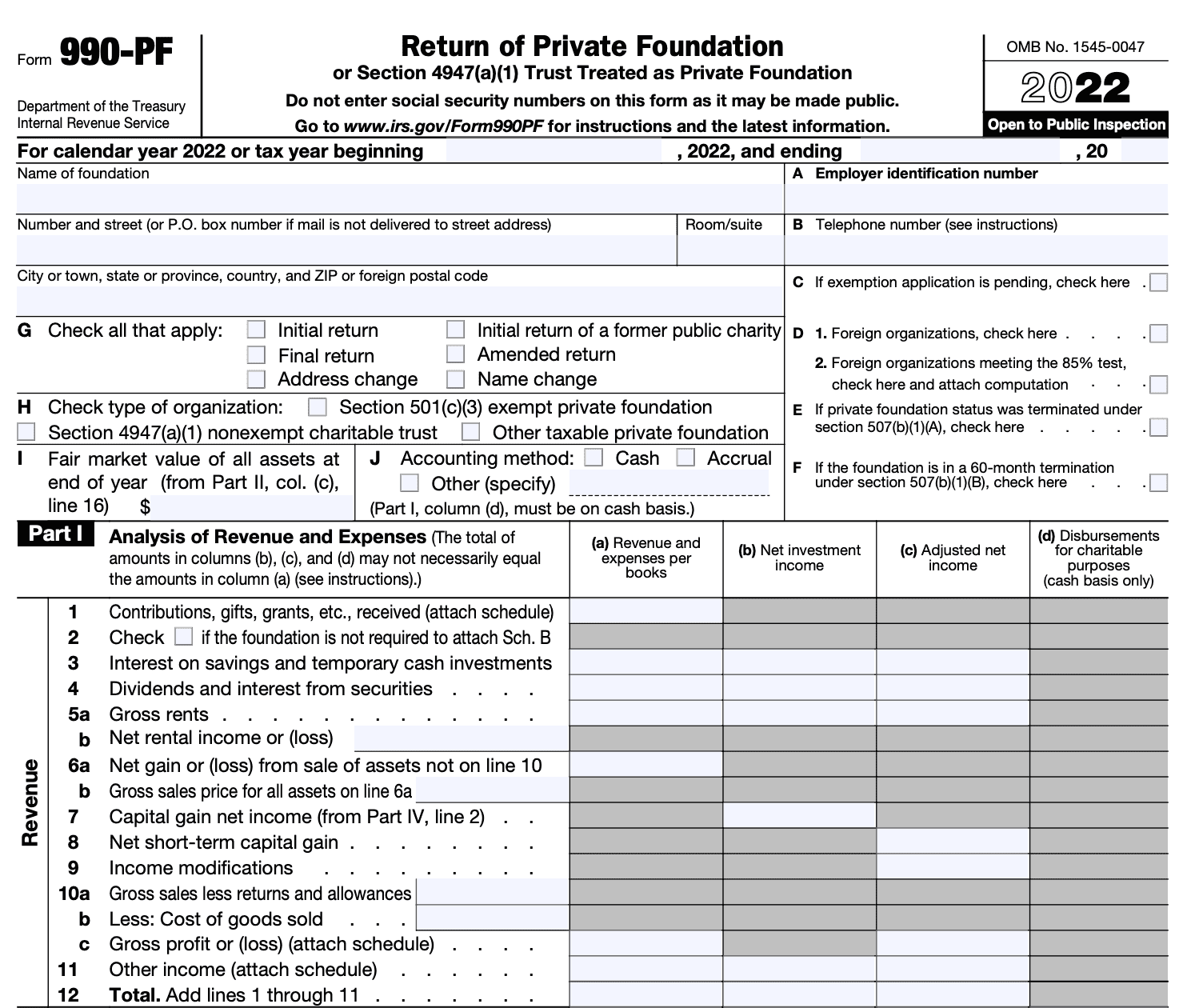

Form 990-PF: Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

Download Form 990-PFWhen it comes to charitable giving and philanthropy, private foundations and nonexempt charitable trusts play a crucial role in supporting various causes and organizations. However, their activities and financial information must be transparent and accessible to the public. This is where Form 990-PF comes into play - a comprehensive tax return document that private foundations and certain nonexempt charitable trusts must file with the IRS to maintain their tax exempt status.

In this blog, we will explore the ins and outs of Form 990-PF, shedding light on its purpose, contents, and significance.

Understanding Private Foundations / Nonexempt Charitable Trusts

Private foundations are charitable organizations established by individuals, families, or corporations to support a specific charitable cause or causes. They are separate legal entities from the donor(s) who create them, and their primary goal is to distribute funds to other charitable organizations that directly carry out charitable activities. Unlike public charities that often rely on public donations, private foundations are funded by a single source or a small group of donors.

Nonexempt charitable trusts, on the other hand, are tax exempt trusts that do not meet the requirements of public charities. As a result, they are classified as private foundations and are subject to the same regulations and reporting obligations.

Purpose of Form 990-PF

The primary purpose of Form 990-PF is to ensure transparency and accountability of private foundations, which are tax exempt organizations under section 501(c)(3) of the Internal Revenue Code.

The form collects various financial and operational details, including:

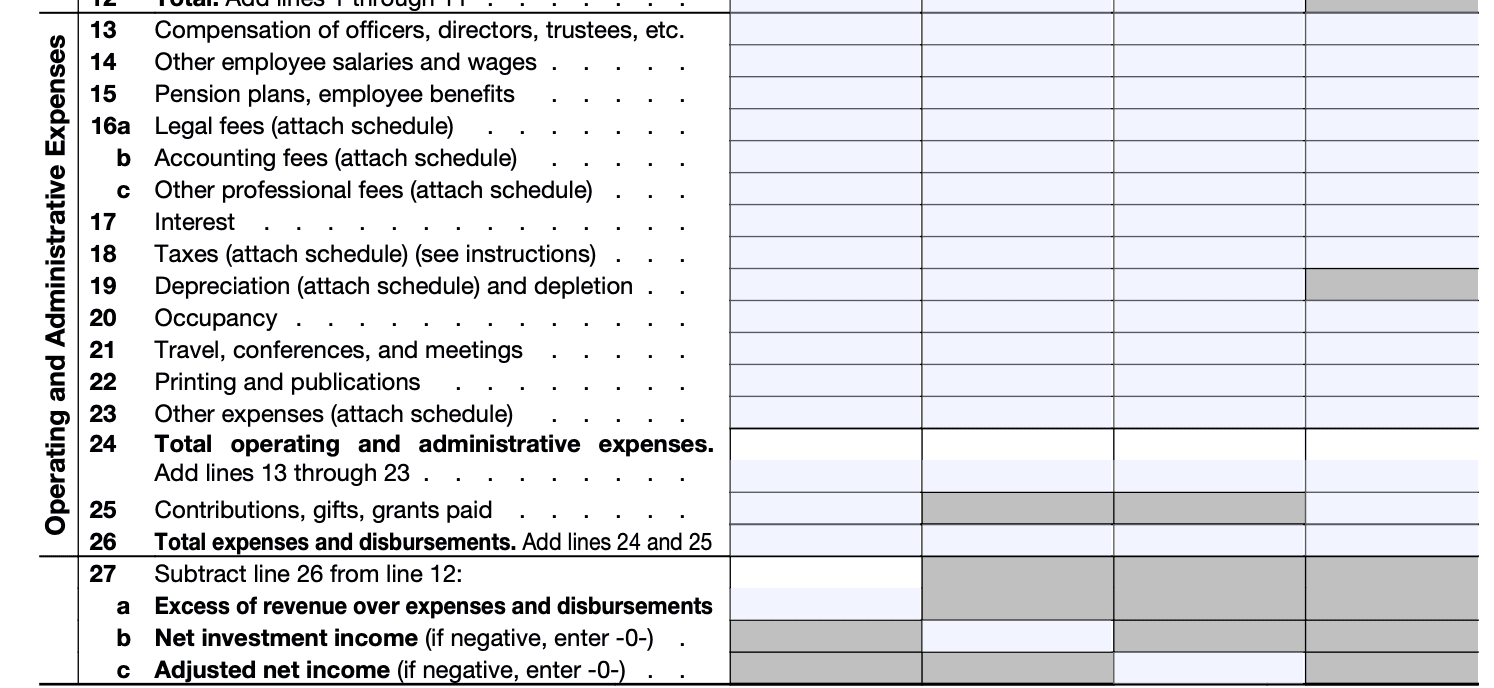

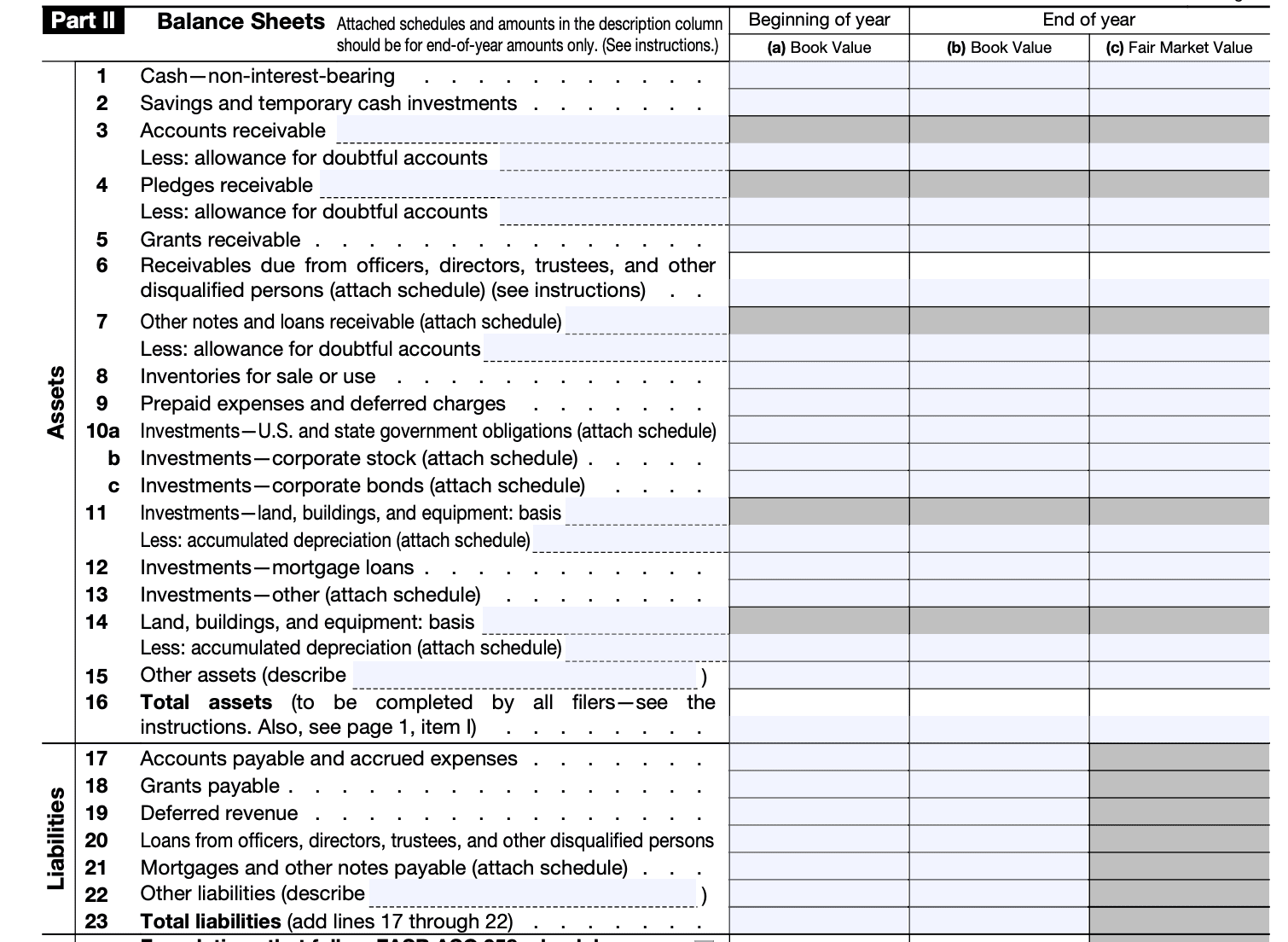

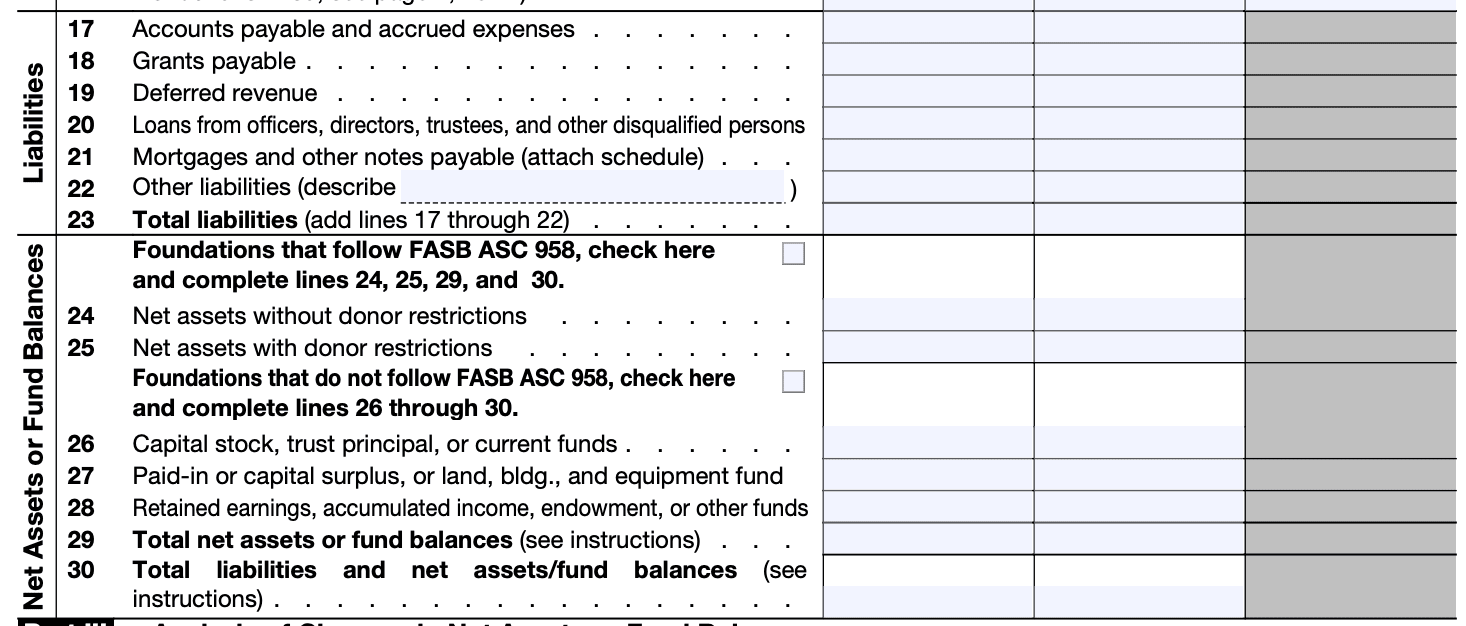

Financial information: This includes details about the foundation's income, expenses, investments, assets, and liabilities. The IRS uses this information to assess the foundation's financial health, its spending on charitable activities, and any potential abuse of tax exempt status.

Grants and contributions: The form requires the foundation to report the grants and contributions it makes to other organizations or individuals. This information helps the IRS determine if the foundation is fulfilling its charitable purposes and complying with the rules regarding grantmaking.

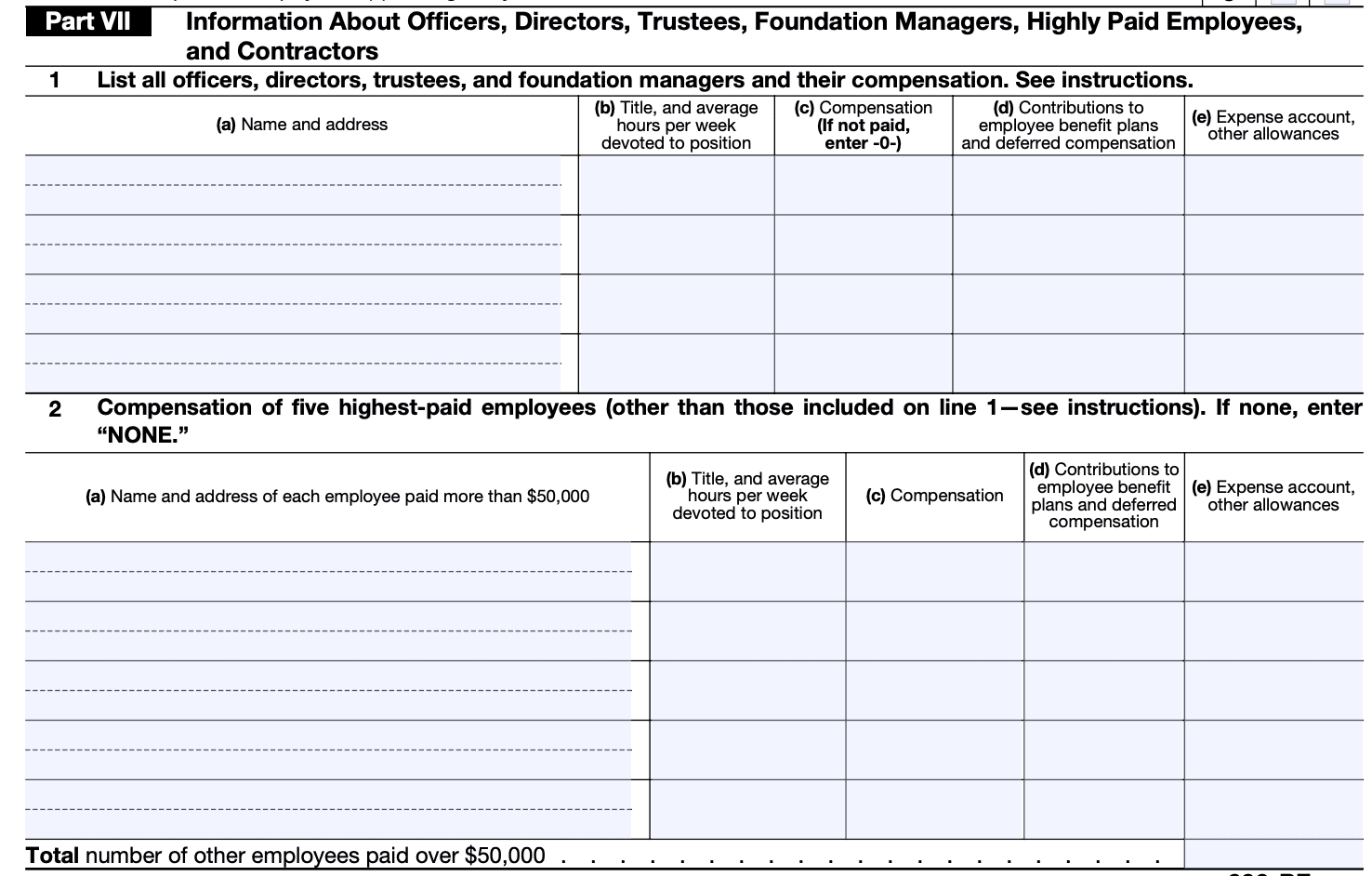

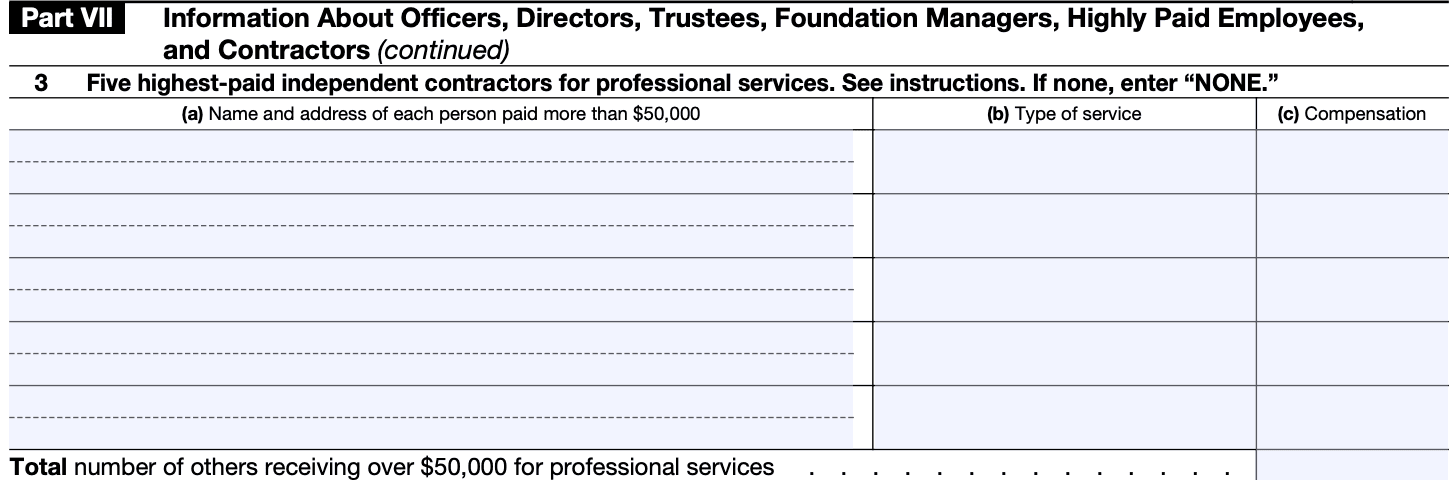

Compensation and benefits: Form 990-PF requires the disclosure of compensation and benefits paid to officers, directors, trustees, and key employees of the foundation. This ensures that excessive compensation is not being provided, which could result in private inurement and jeopardize the foundation's tax exempt status.

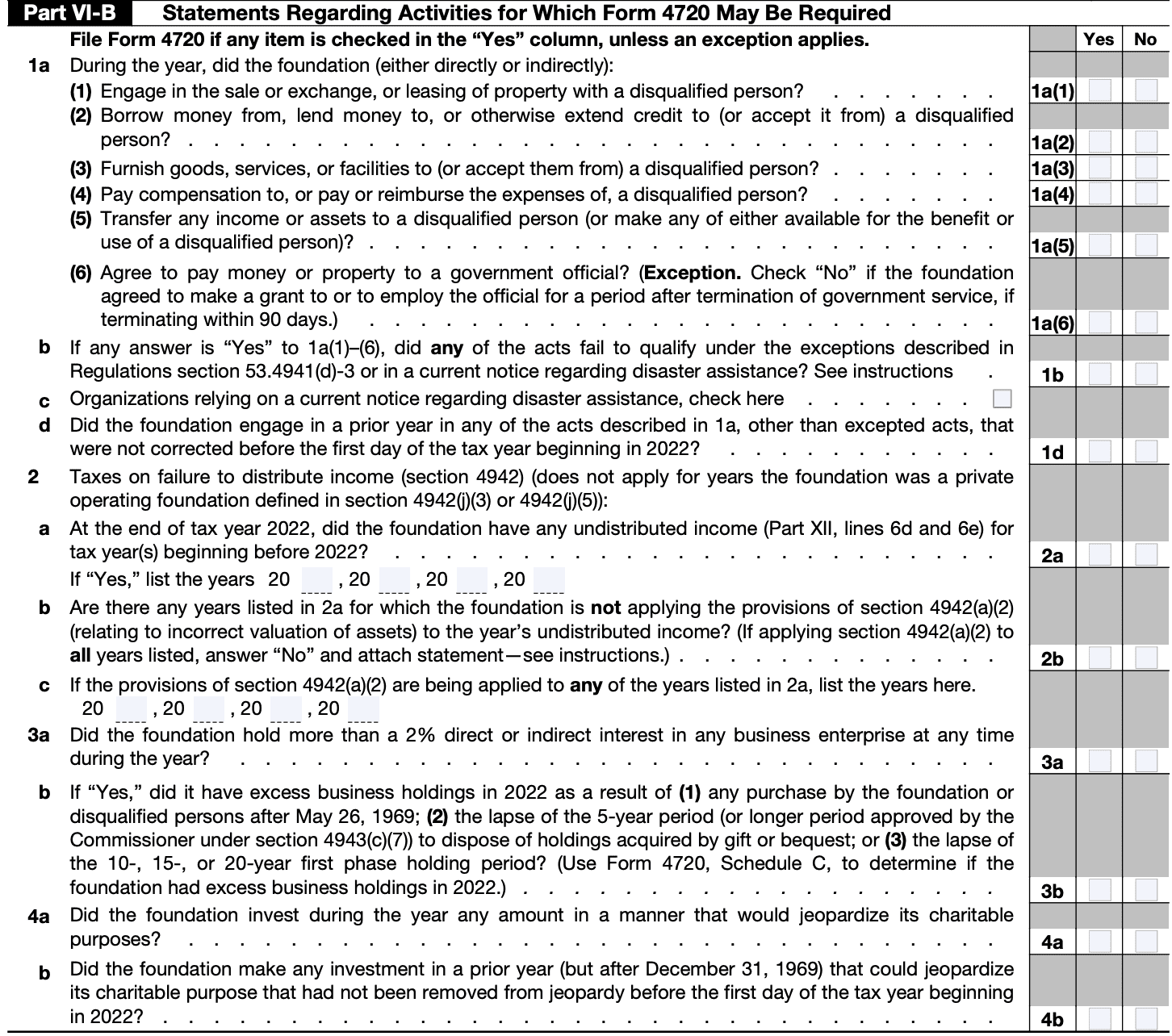

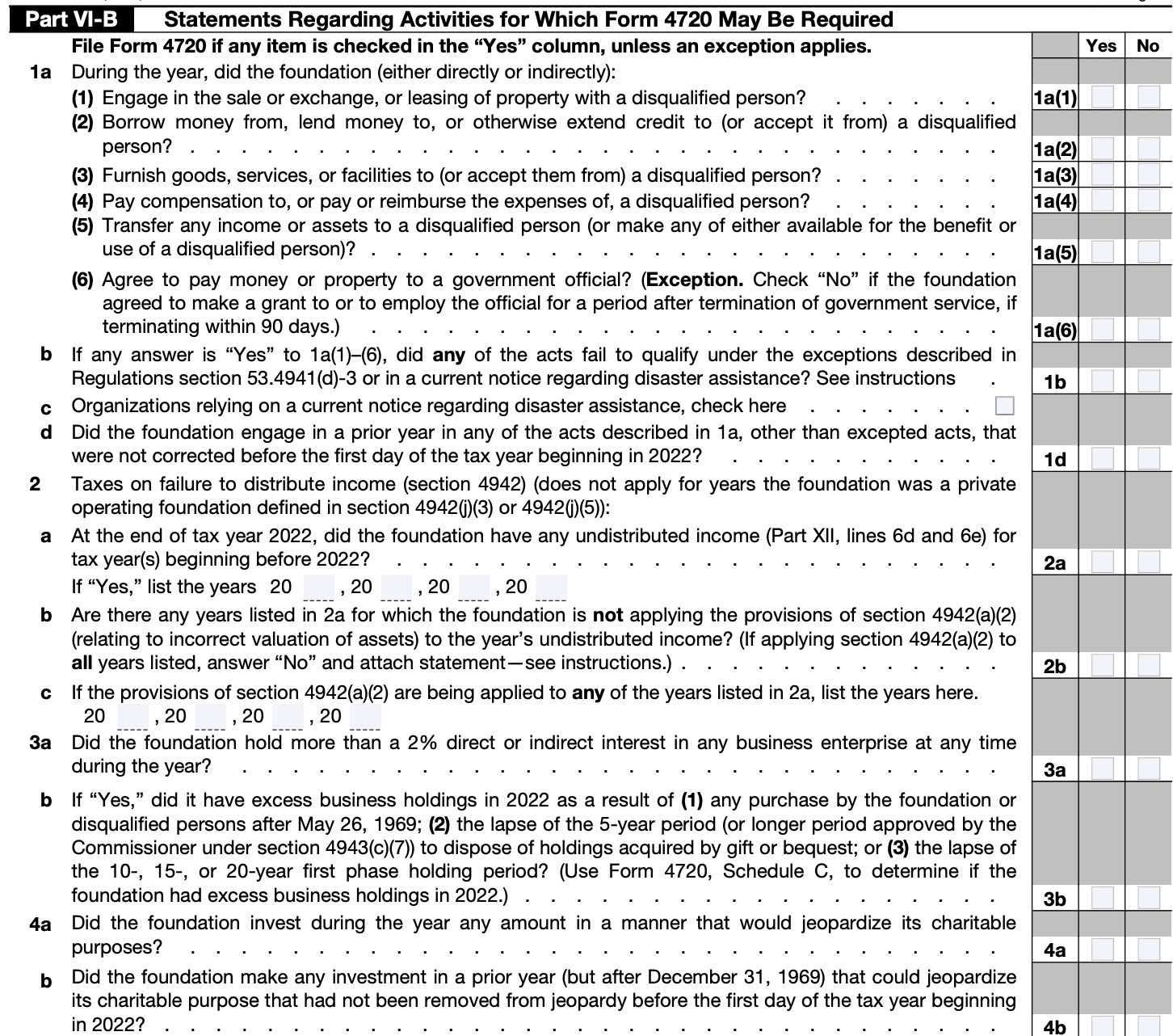

Self-dealing: Private foundations must report any transactions or relationships that may be considered "self-dealing," where the foundation engages in financial transactions with its disqualified persons (such as donors, officers, trustees, and their families). Self-dealing is generally prohibited to prevent private individuals from benefiting personally from the foundation's assets.

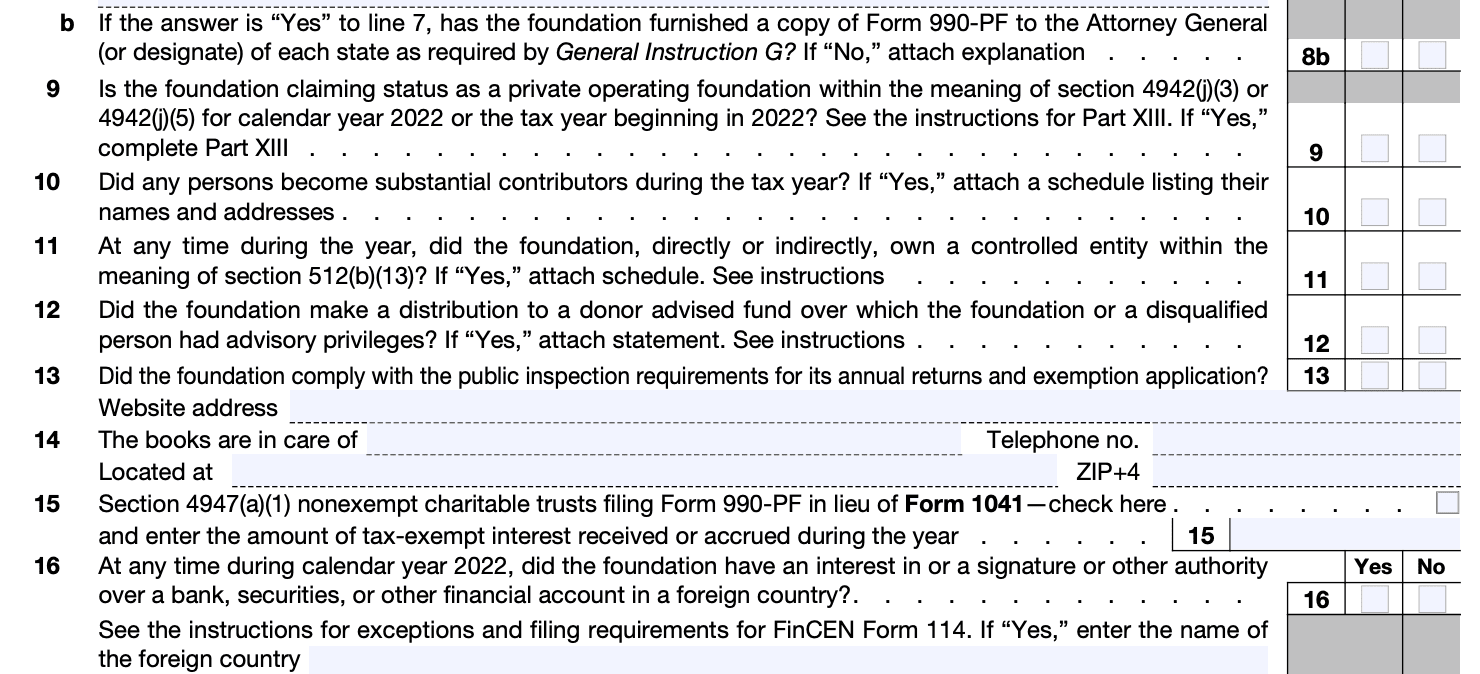

Tax compliance: The form also asks questions related to the foundation's compliance with various tax regulations and rules, ensuring that the foundation is adhering to the requirements of its tax exempt status.

Benefits of Form 990-PF

Here are some of the benefits of Form 990-PF:

- Tax-exempt status: By filing Form 990-PF, private foundations maintain their tax exempt status under section 501(c)(3) of the Internal Revenue Code. This status allows the foundation to receive tax-deductible donations from donors and, in turn, use those funds to support charitable causes.

- Transparency and accountability: Form 990-PF requires private foundations to disclose detailed financial and operational information to the public. This transparency fosters accountability and helps donors, beneficiaries, and other stakeholders to assess how the foundation operates and manages its resources.

- Grantmaking information: The form includes a section where foundations must report the grants they have made during the tax year. This information helps potential grant applicants understand the foundation's priorities and giving patterns.

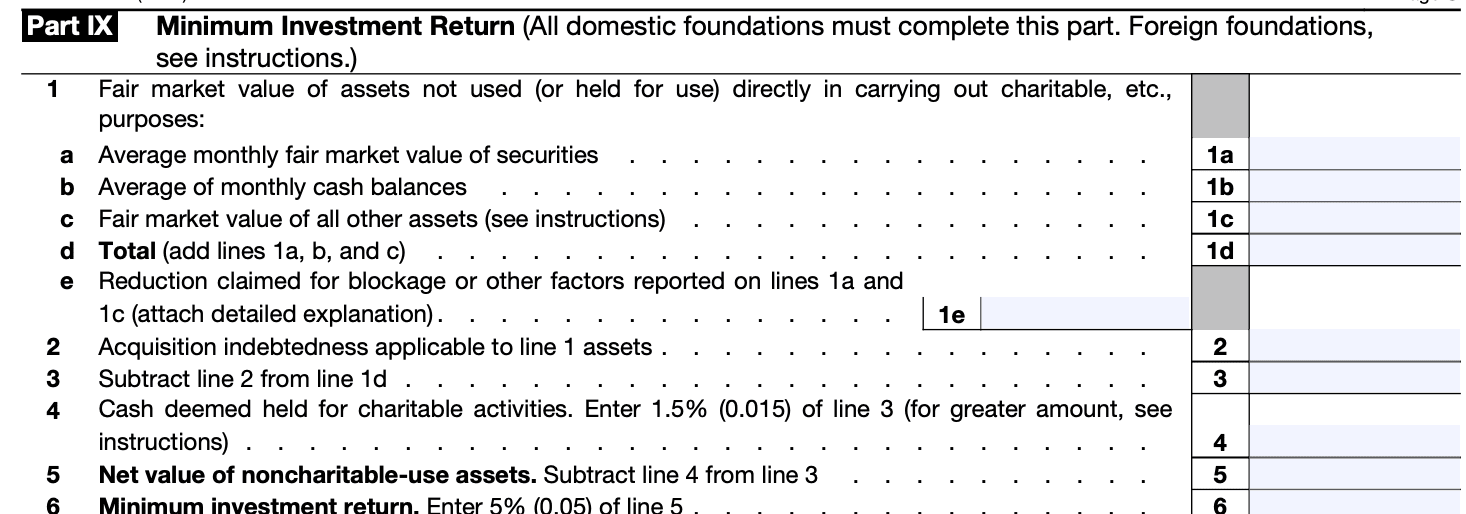

- Compliance with IRS regulations: Filing Form 990-PF ensures that the private foundation complies with IRS regulations. This includes adhering to certain payout requirements, such as distributing at least 5% of their assets' average market value each year to qualified charitable activities.

- Resource management: The form requires foundations to provide detailed information about their investments, administrative expenses, and fundraising activities. By providing this data, foundations can evaluate their resource allocation and ensure that they are managing their funds efficiently.

- Public relations and trust: A publicly available Form 990-PF allows the foundation to build trust with donors, beneficiaries, and the public. Stakeholders can see how the foundation operates, how it uses its funds, and the impact it has on the charitable causes it supports.

- Benchmarking: Form 990-PF provides valuable data that researchers, philanthropy professionals, and policymakers can use for benchmarking and understanding trends in the philanthropic sector.

- Compliance with state regulations: Filing Form 990-PF may also be required to comply with state-level reporting regulations, depending on the state in which the private foundation operates.

- Learning and improvement: Completing Form 990-PF may also benefit the private foundation itself. The process of gathering and organizing financial and operational data can prompt internal reflection and improve the foundation's management practices.

It is essential for private foundations to file Form 990-PF accurately and on time to maintain their tax exempt status and fulfill their reporting obligations.

Who Is Eligible To File Form 990-PF?

Private foundations are a specific type of tax exempt organization that is established to make grants to other organizations for charitable purposes.

To be eligible to file Form 990-PF, an organization must meet the following criteria:

Be classified as a private foundation: This means the organization's primary purpose is to make grants and operate charitable programs, rather than engaging in direct charitable activities like a public charity would.

Have tax exempt status: The private foundation must have been granted tax exempt status under Section 501(c)(3) of the Internal Revenue Code. This status is usually obtained by filing Form 1023 or Form 1023-EZ with the IRS.

Have gross income of $5,000 or more: Private foundations with gross income of $5,000 or more are required to file Form 990-PF. If the gross income is less than $5,000, the organization may be eligible to file the simpler e-Postcard (Form 990-N).

Operate in the United States: The organization must be based in the United States and subject to U.S. tax laws.

Maintain exempt status: The private foundation must maintain its tax exempt status by meeting all the requirements and restrictions imposed by the IRS.

How To File Form 990-PF: A Step-by-Step Guide

Filing Form 990-PF is a necessary requirement for private foundations in the United States. The form provides important financial and operational information about the foundation's activities and is submitted to the Internal Revenue Service (IRS).

Here's a step-by-step guide to help you file Form 990-PF:

Step 1: Gather the necessary information

Before you begin the filing process, ensure you have all the required information and documents ready.

This may include:

- Foundation's basic information (name, address, EIN/Tax ID, etc.)

- Financial statements for the tax year, including income and expenses

- Details of grants and contributions made during the year

- Information about foundation activities and expenditures

- Information on foundation board members and key personnel

- Any other relevant information about the foundation's operations

Step 2: Determine your filing deadline

The filing deadline for Form 990-PF is the 15th day of the 5th month after the close of your foundation's tax year. For example, if your foundation's tax year ends on December 31, the deadline would be May 15 of the following year. If the deadline falls on a weekend or federal holiday, it is extended to the next business day.

Step 3: Choose your filing method

Form 990-PF can be filed electronically or on paper. The IRS strongly encourages electronic filing as it streamlines the process and reduces the likelihood of errors. Electronic filing also allows for faster processing of your return.

Step 4: Obtain the Form 990-PF

You can access Form 990-PF on the IRS website (www.irs.gov) or through tax preparation software if you are using an e-file provider. Make sure you download the correct form for the tax year you are filing.

Step 5: Complete the Form 990-PF

Carefully fill out all the required sections of Form 990-PF. Some of the key sections include:

a. Part I: Summary of activities and financial information.

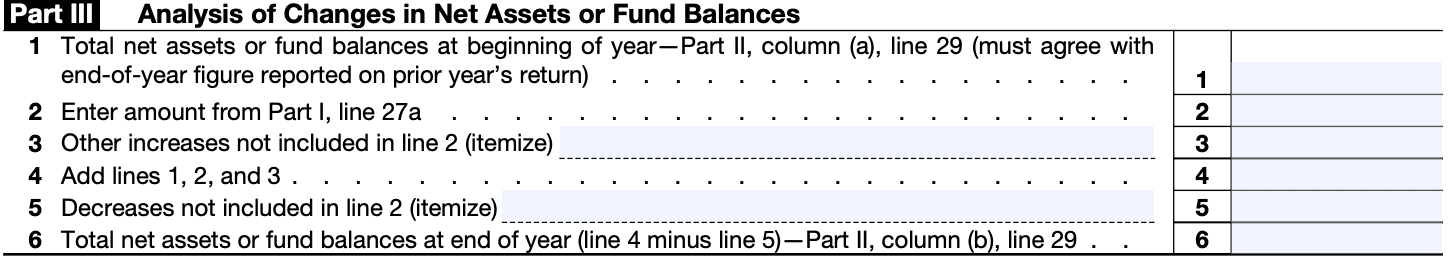

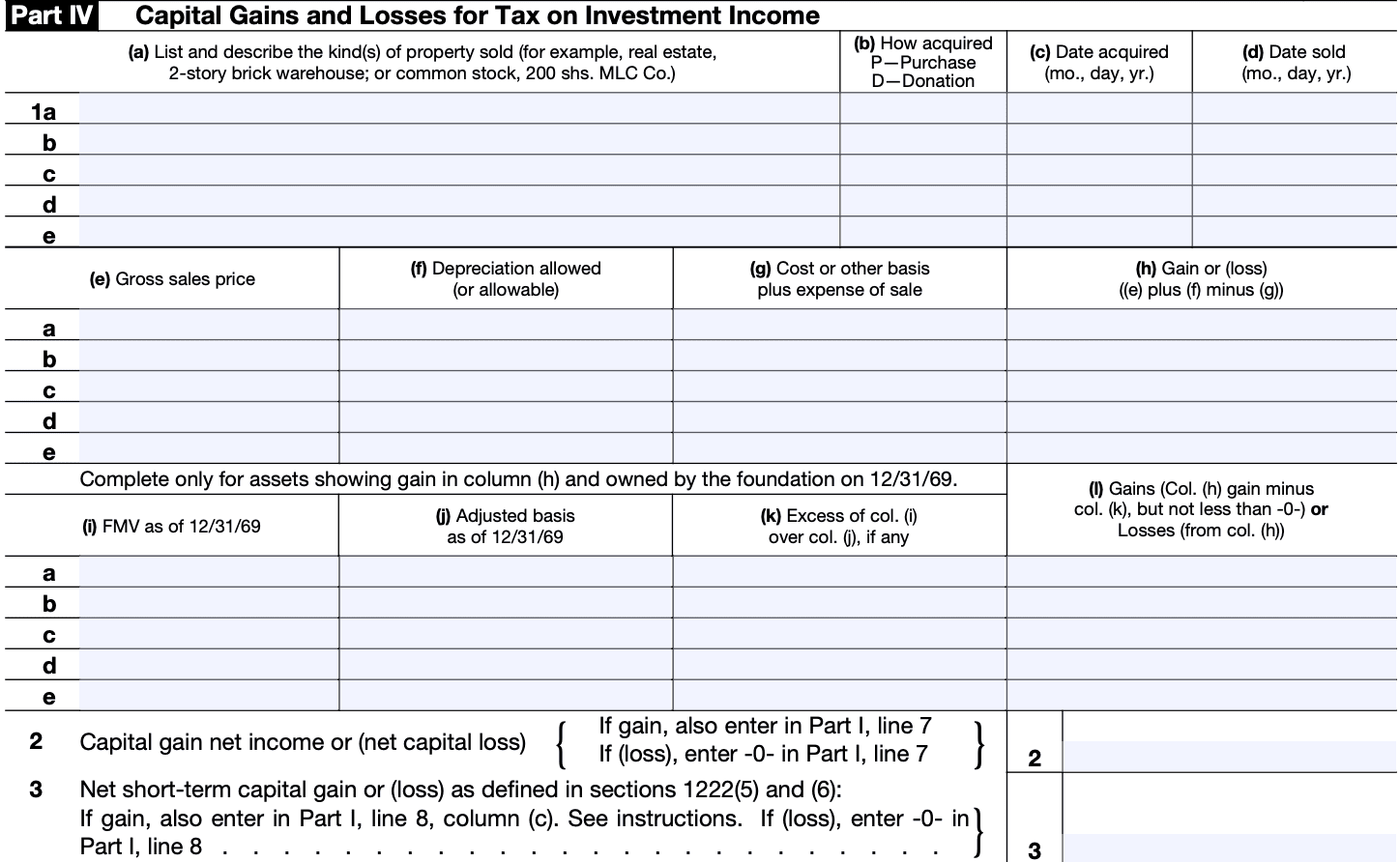

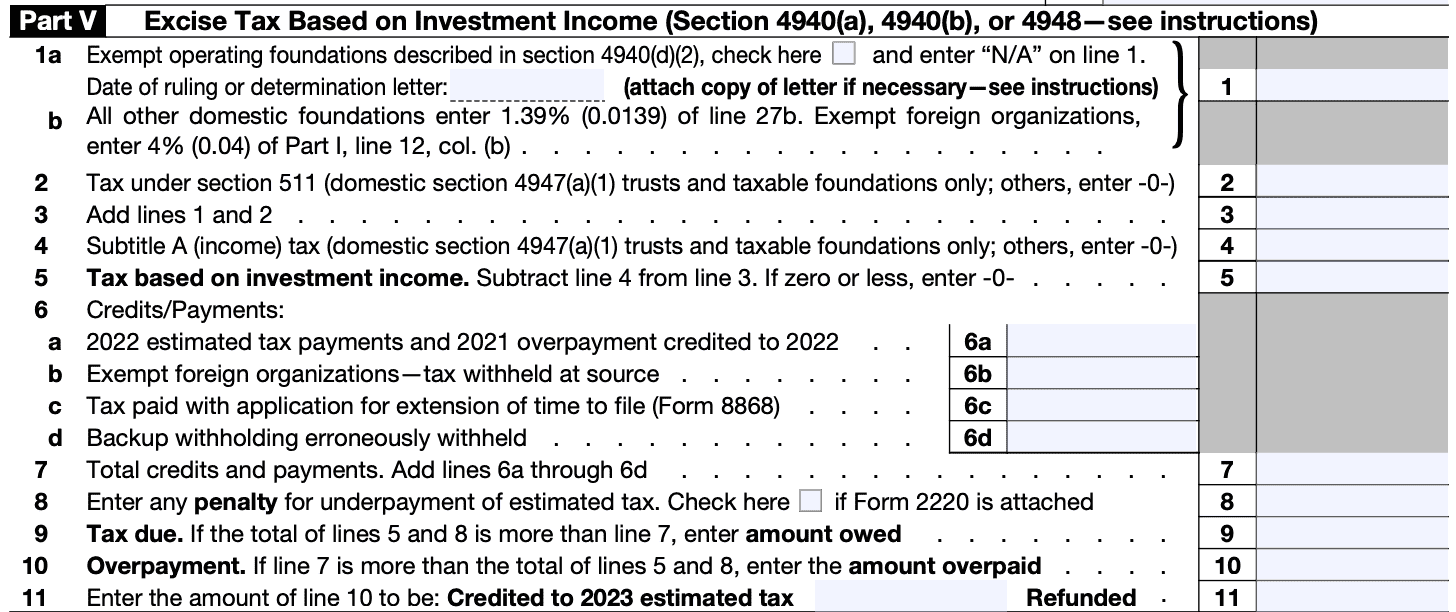

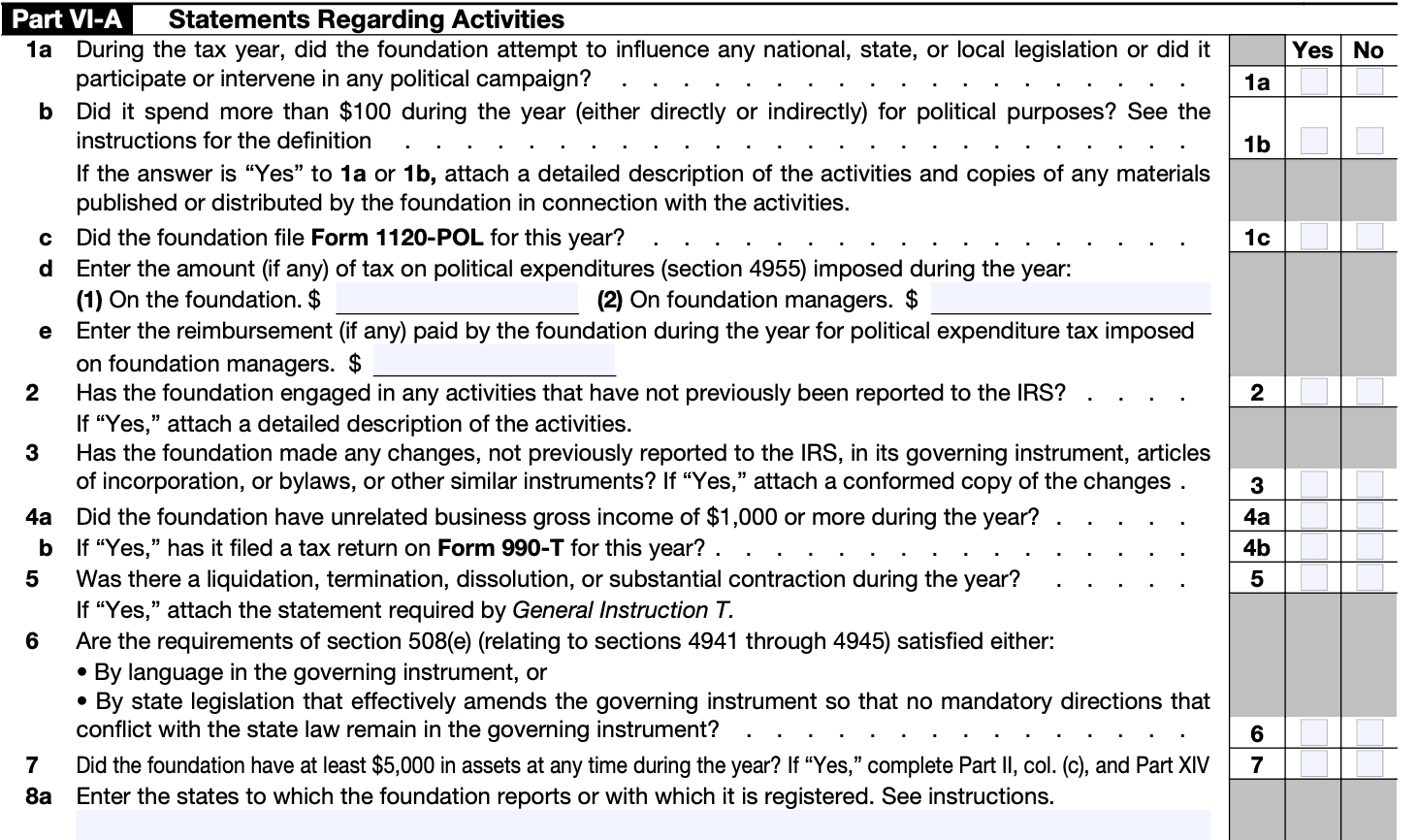

b. Part II, III, IV & V: Balance sheet information

c. Part VI: Statement of program service accomplishments

d. Part VII: Information about officers, directors, trustees, foundation managers, highly paid employees, and contractors

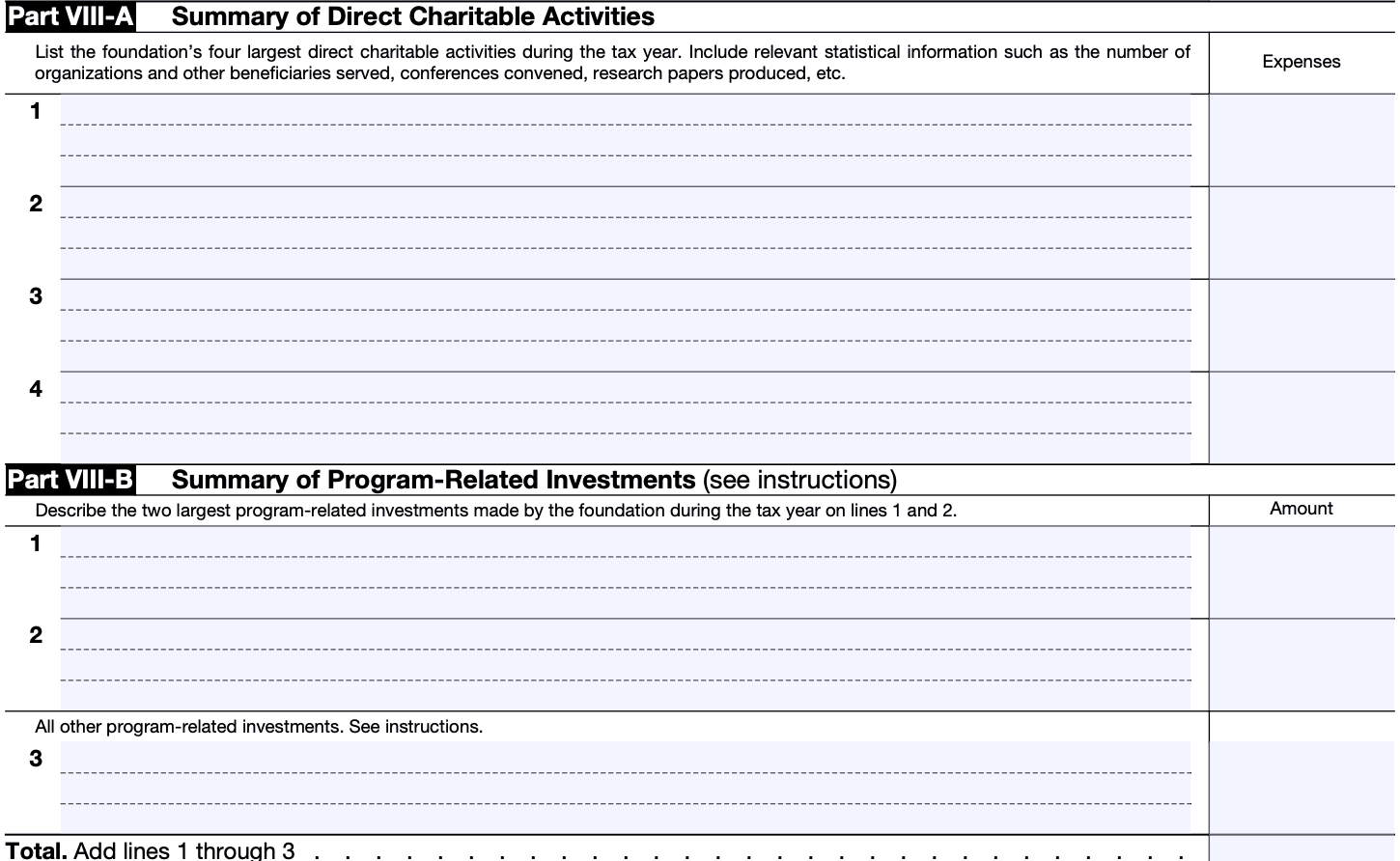

e. Complete Part VIII: Summary of activities

f. Complete Part IX: Minimum investment return

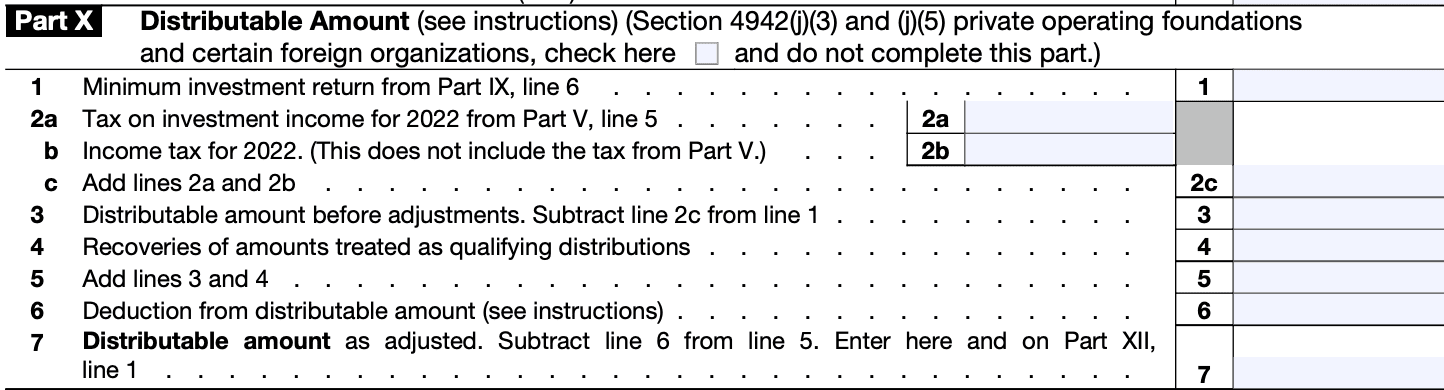

g. Complete Part X: Distributable amount

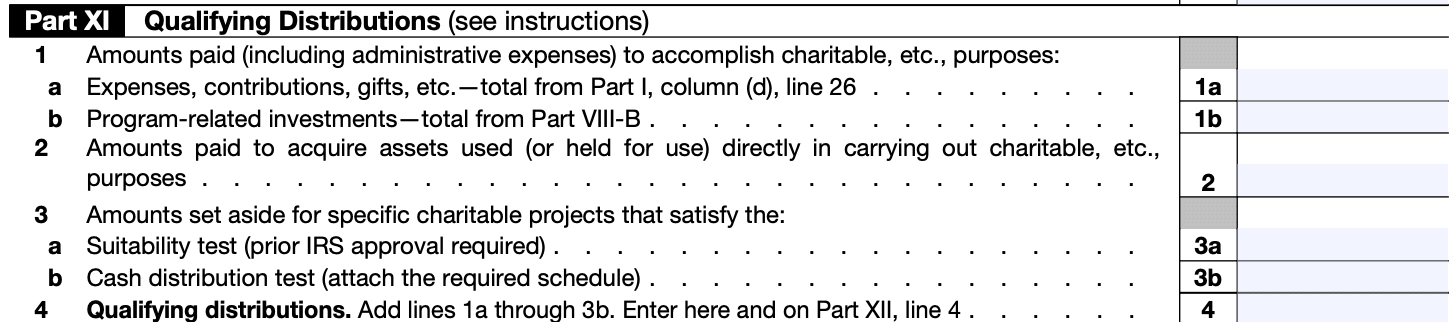

h. Complete Part XI: Qualifying distributions

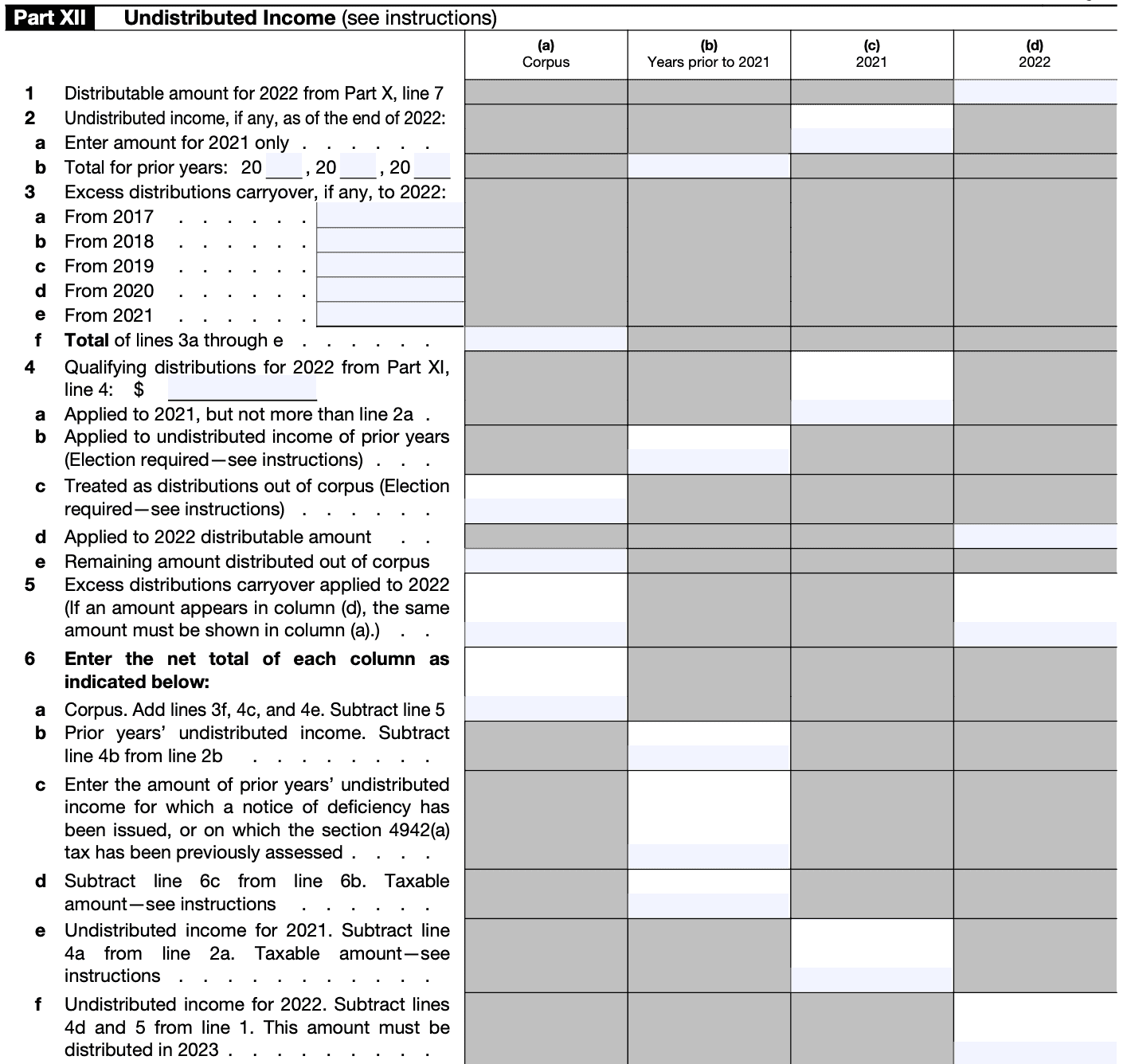

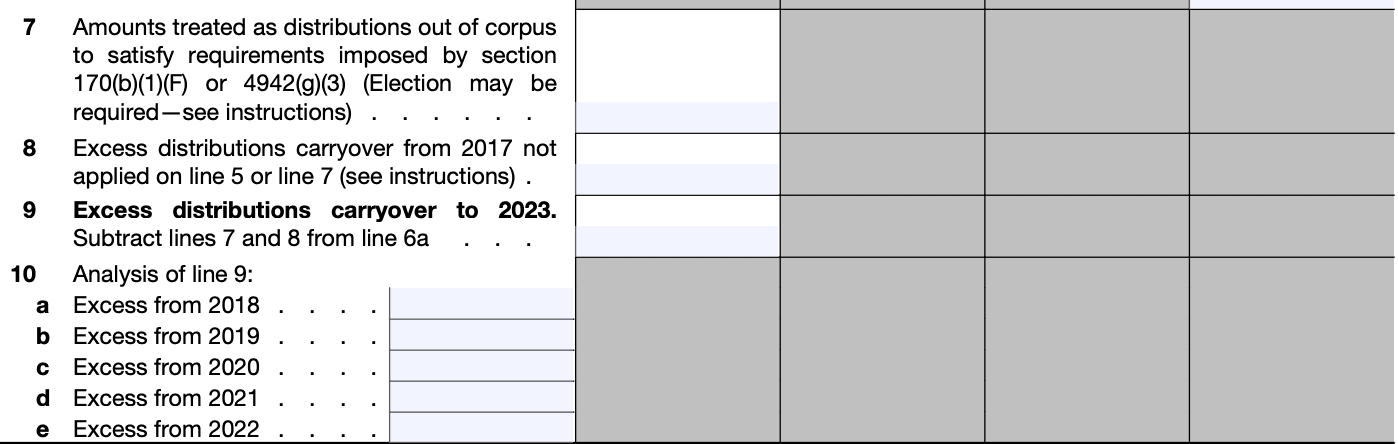

i. Complete Part XII: Undistributed income

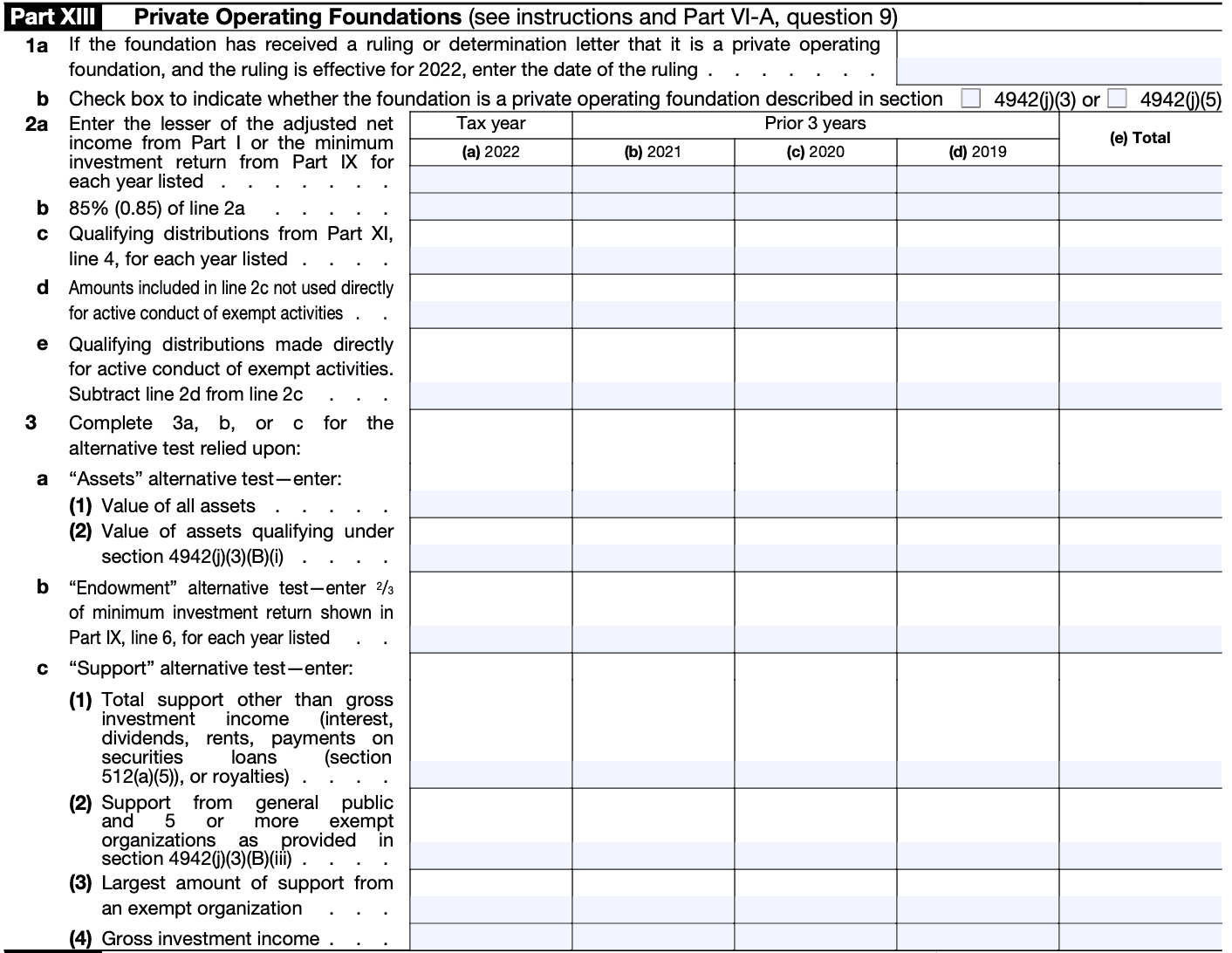

j. Complete Part XIII: Private operating foundations

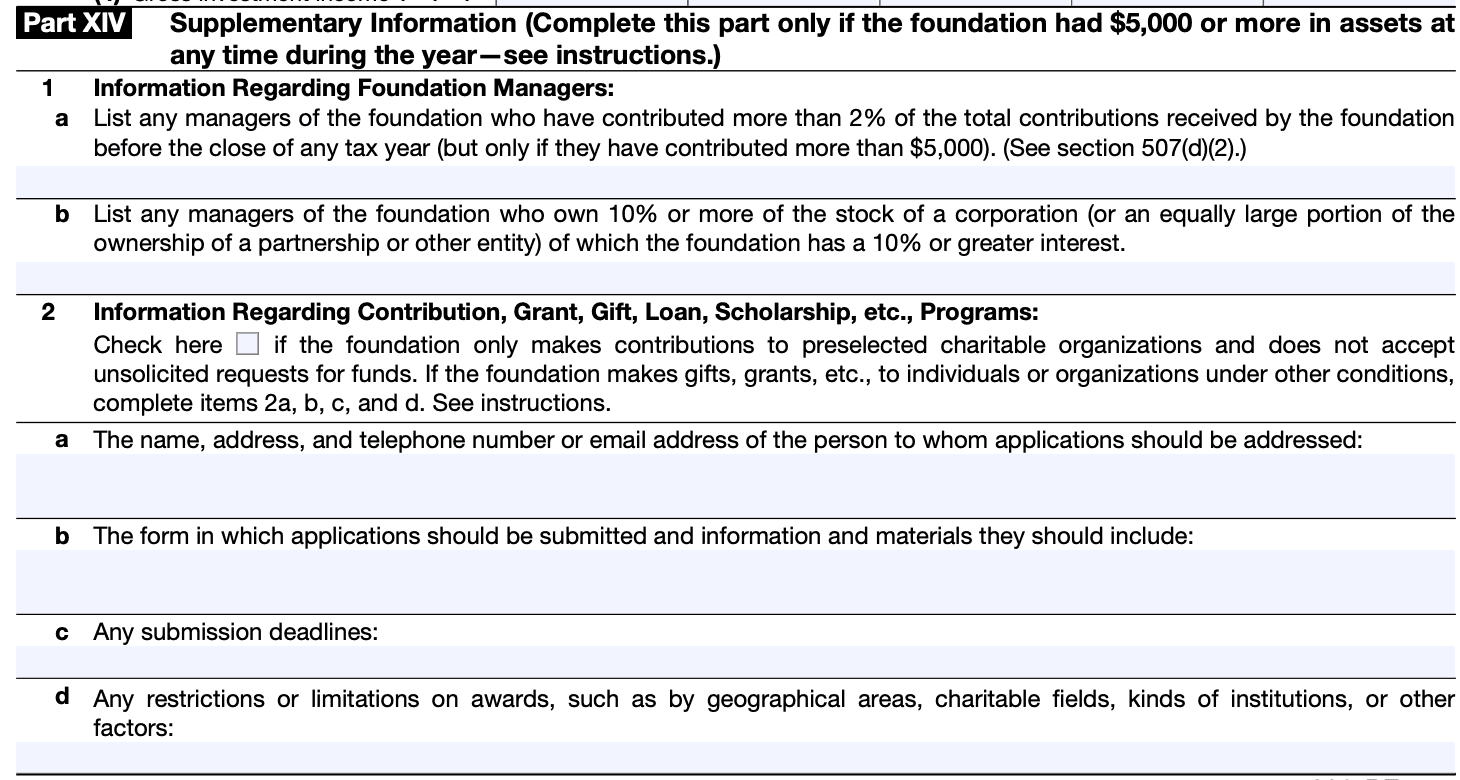

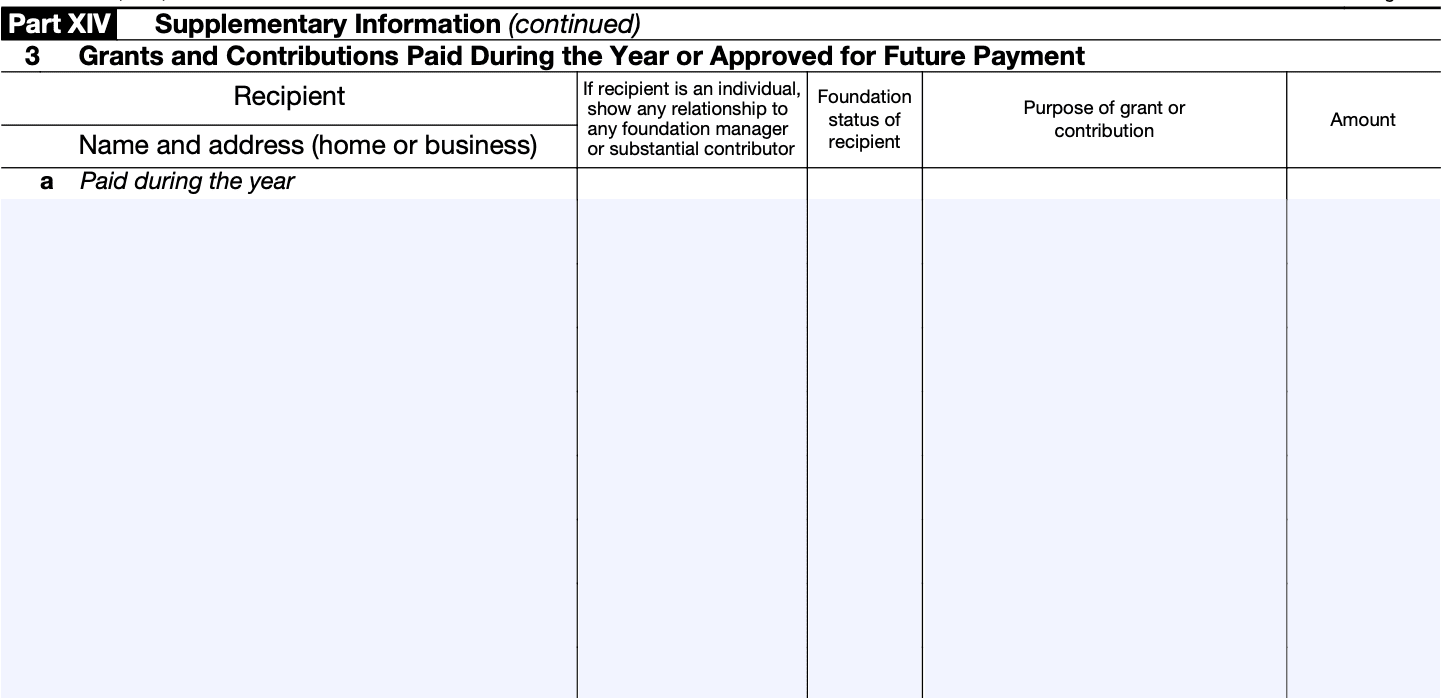

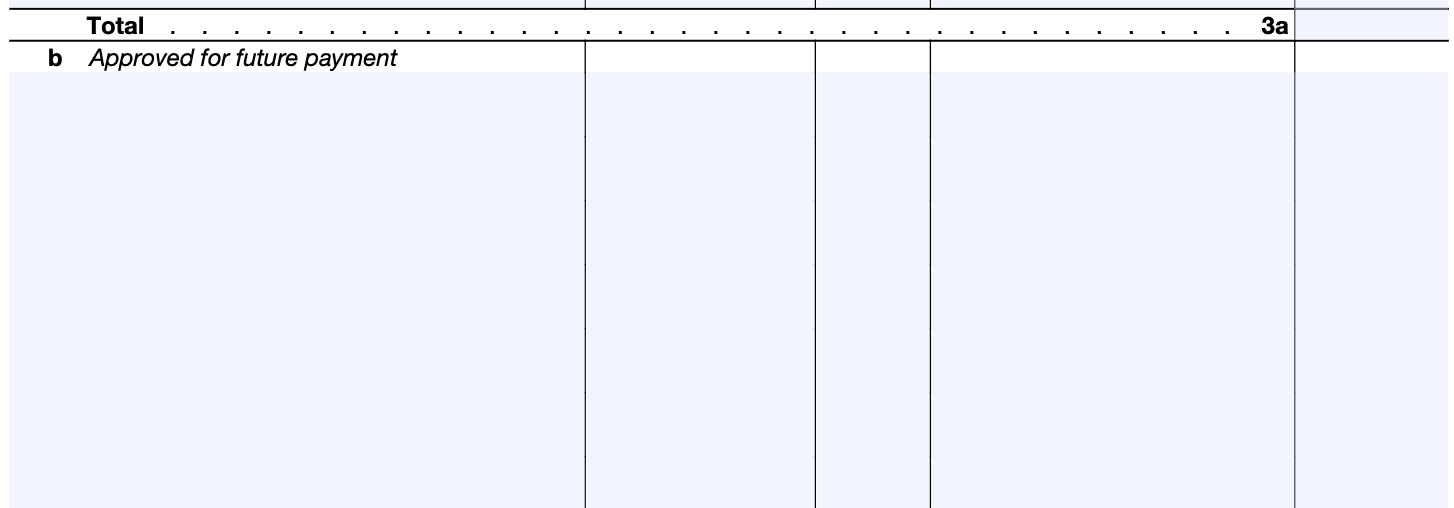

k. Complete Part XIV: Supplementary information (complete this part only if the foundation had $5,000 or more in assets.)

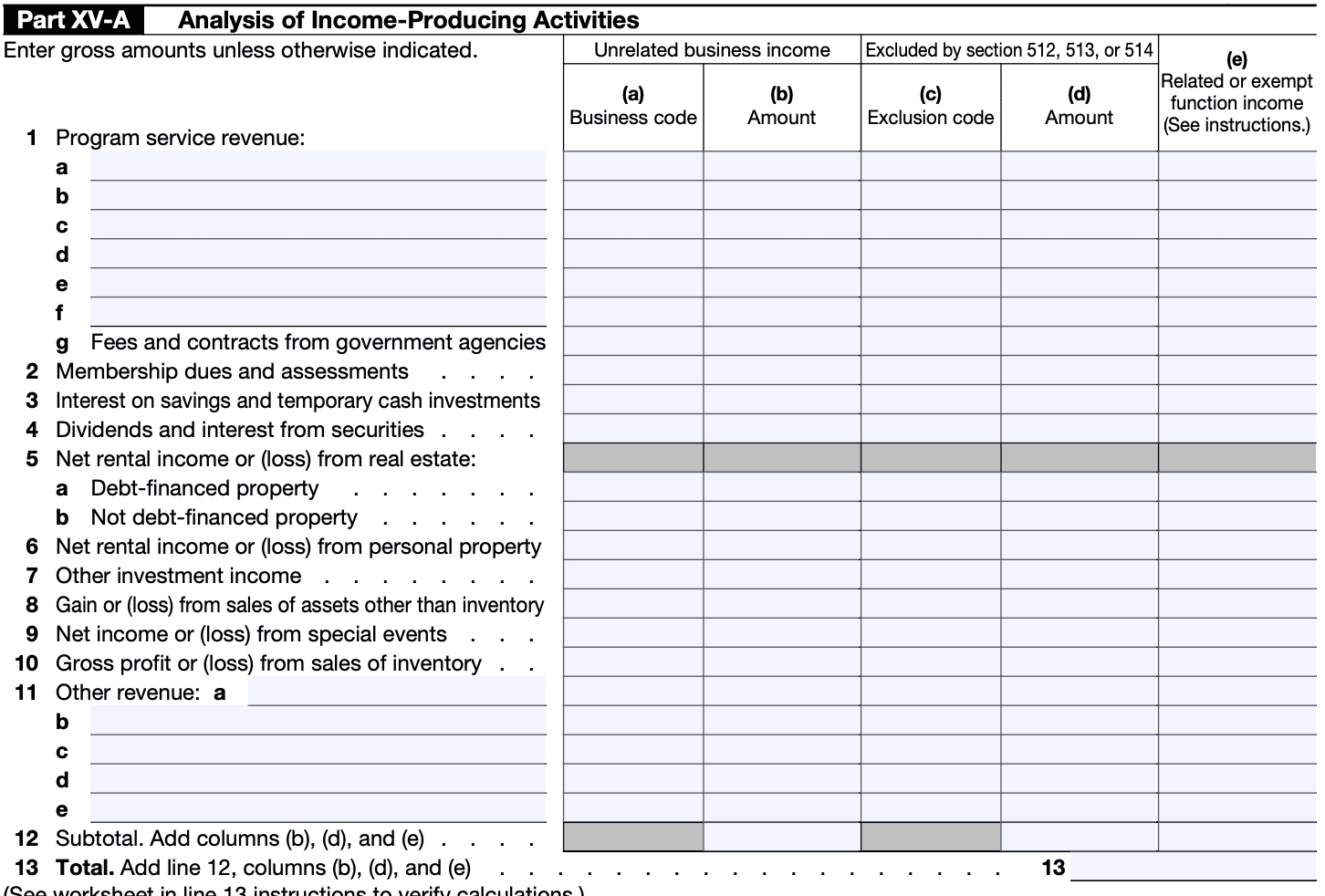

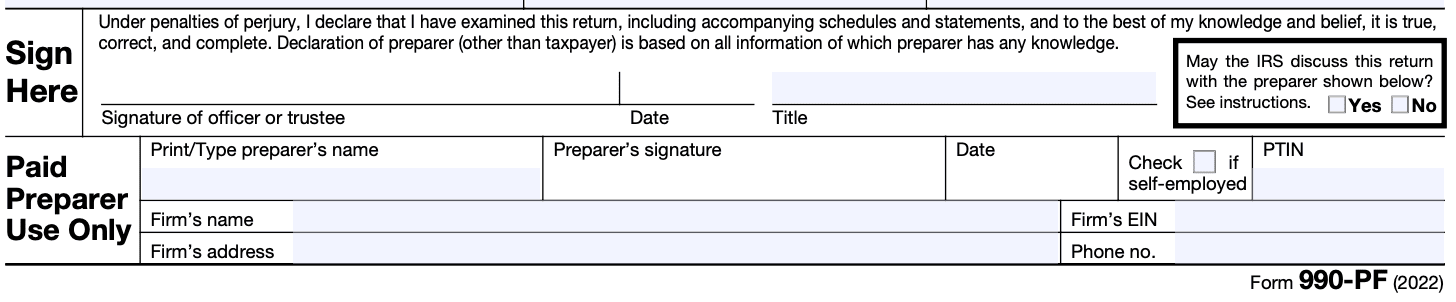

i. Complete Part XV (A & B): Analysis of income-producing activities & relationship of activities to the accomplishment of exempt purposes

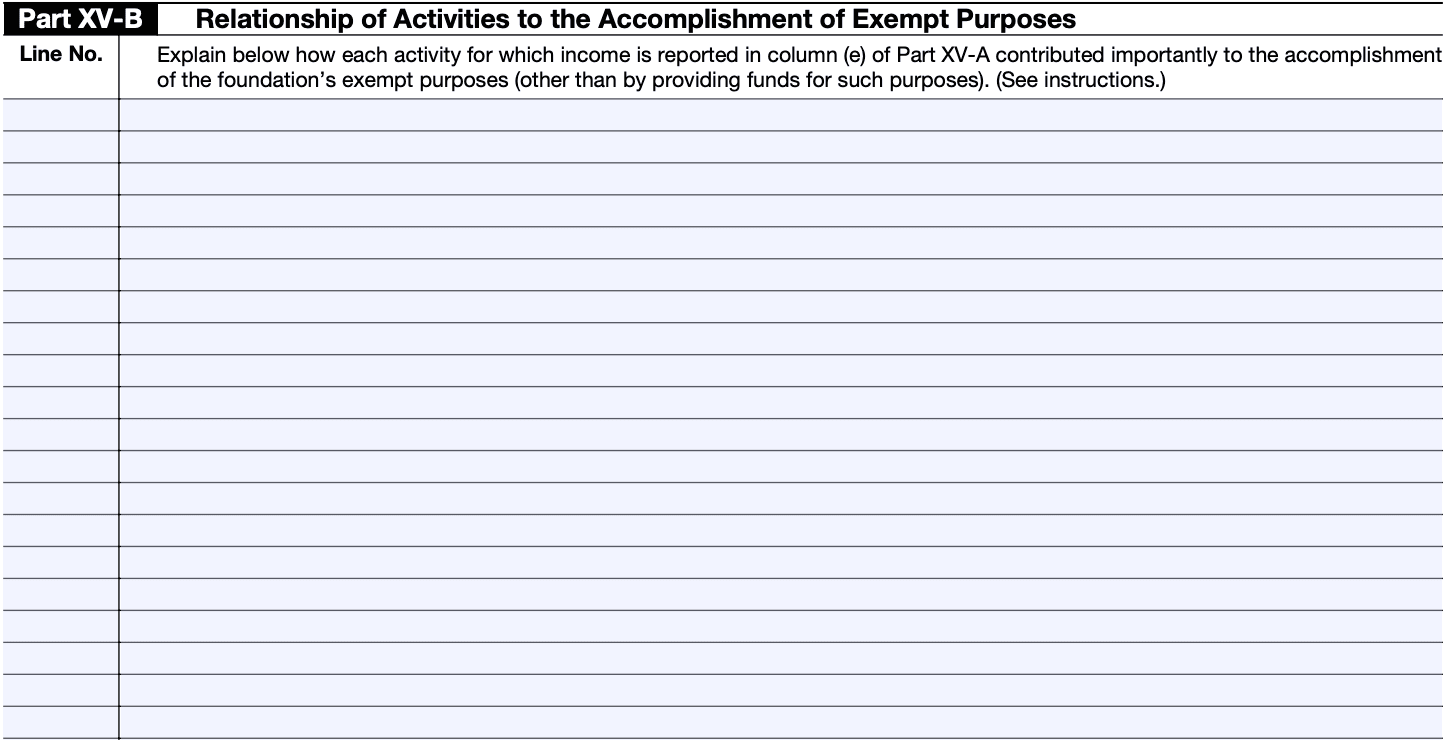

k. Complete Part XVI: Information regarding transfers to and transactions and relationships with non-charitable exempt organizations

Step 6: Review and double-check

Thoroughly review the completed form and all schedules to ensure accuracy. Check for any mistakes or omissions, as errors could lead to delays or penalties.

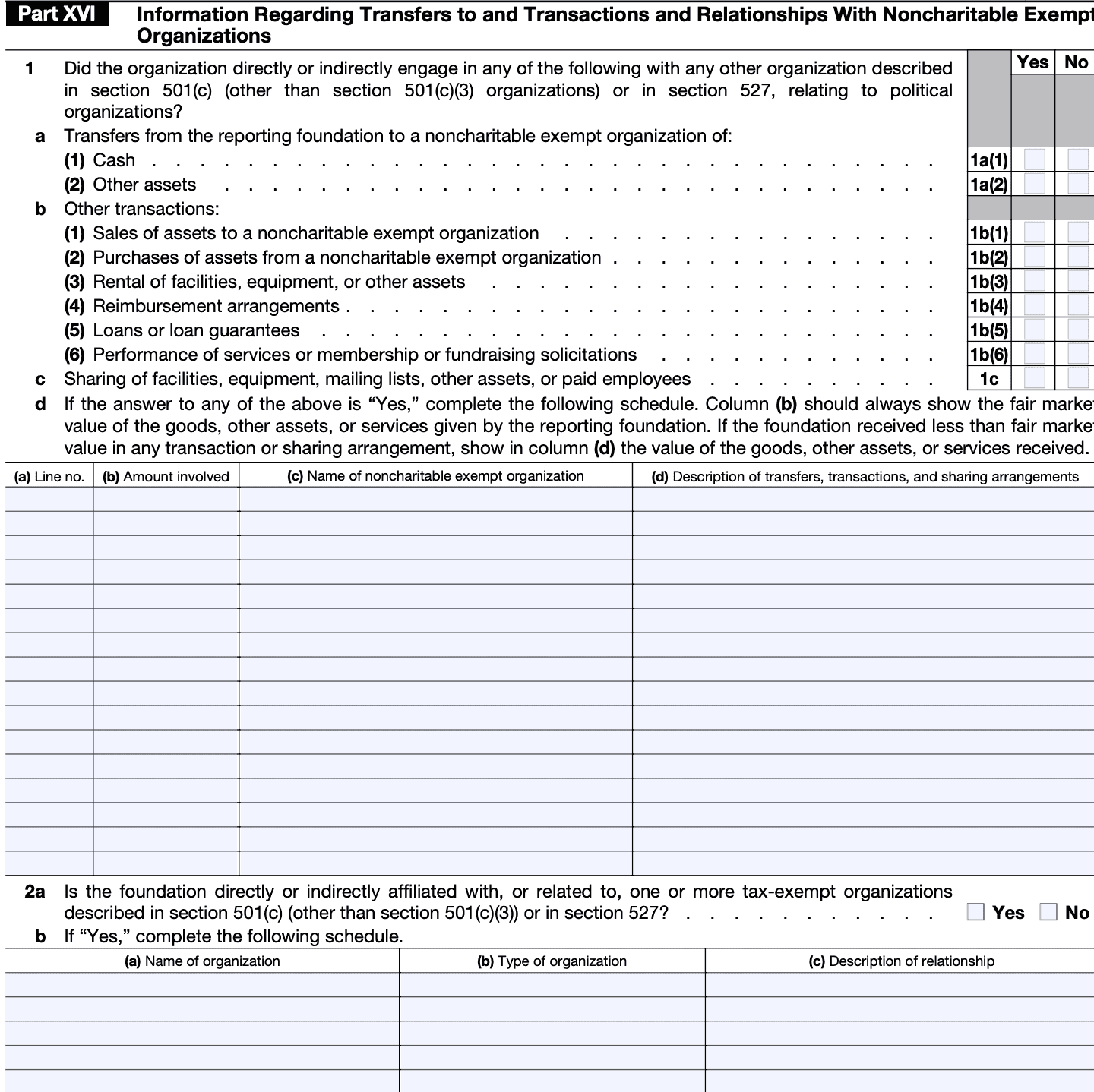

Step 7: Sign and submit the Form 990-PF

If you are filing electronically through an e-file provider, follow their instructions for submission. If filing on paper, sign the form and any required schedules and mail them to the appropriate IRS address based on your foundation's location. The mailing address can be found in the Form 990-PF instructions.

Step 8: Keep a copy for your records

Make a copy of the completed Form 990-PF and all supporting documents for your foundation's records. It is essential to retain these records for at least three years, as the IRS may request them for review or audit.

Special Considerations When Filing Form 990-PF

When filing Form 990-PF, there are several special considerations to keep in mind:

Tax exempt status: Ensure that the private foundation maintains its tax exempt status. Filing Form 990-PF is essential to maintain this status, but failure to file or filing late can result in penalties and jeopardize the foundation's tax exempt standing.

Accurate financial reporting: Provide accurate and detailed financial information. The IRS closely scrutinizes Form 990-PF, and discrepancies or inconsistencies may trigger further examination or questions.

Program-related investments: If the foundation has made program-related investments, report them properly. These are investments made primarily to achieve charitable purposes rather than to produce income, and they have specific reporting requirements.

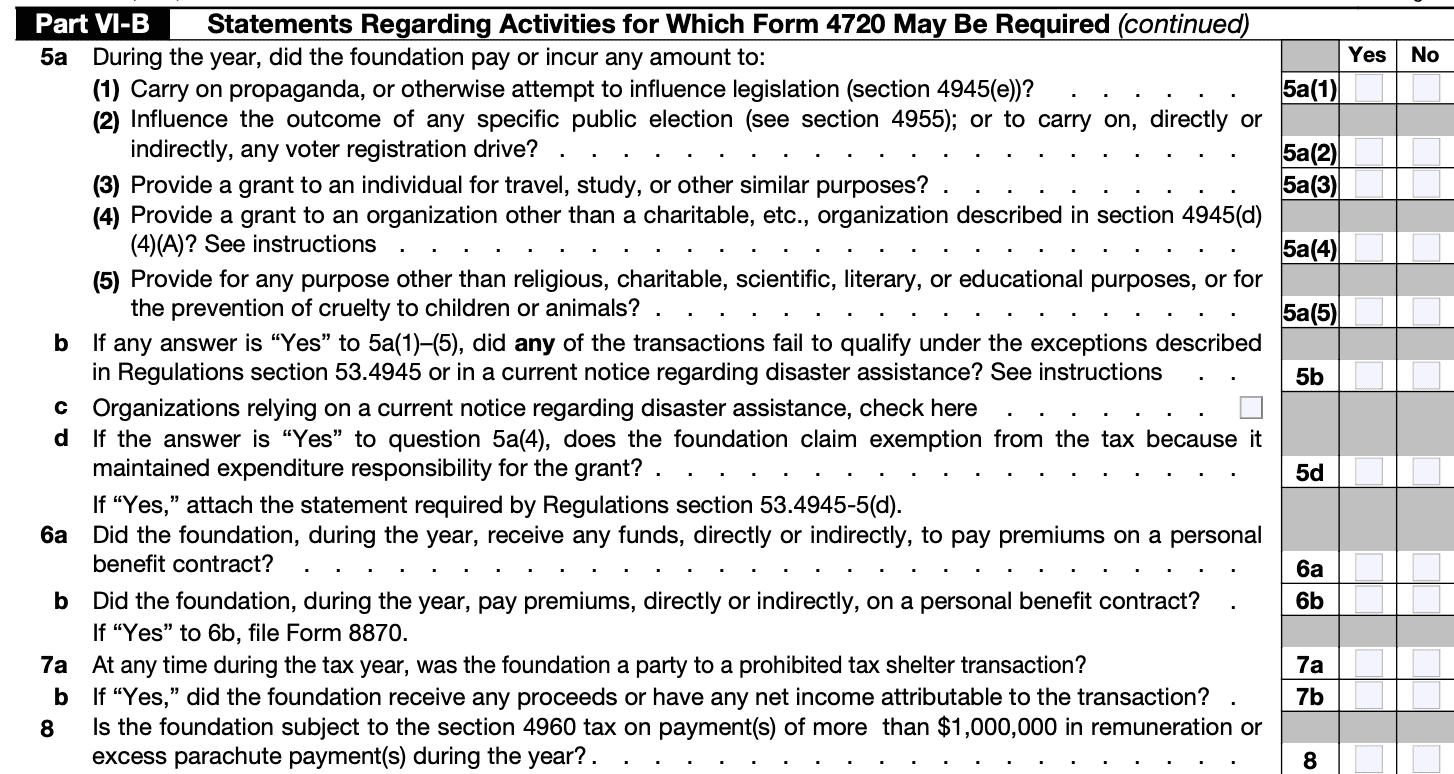

**Excise taxes: **Be aware of the excise taxes imposed on private foundations. These taxes apply to activities such as excess business holdings, jeopardizing investments, and taxable expenditures. Understanding and complying with these rules is crucial to avoid penalties.

Grant distributions: Report all grant distributions accurately, including the recipients' details and the purpose of the grants. The foundation must distribute a minimum amount for charitable purposes each year to maintain its tax exempt status.

Disqualified persons: Ensure that transactions with disqualified persons (such as foundation insiders, substantial contributors, and family members) are reported correctly and meet the IRS's requirements to avoid penalties.

Endowment reporting: For foundations with endowments, there are specific reporting requirements. Properly report the use of endowment funds and other investments.

Public disclosure: Be aware that Form 990-PF is publicly available, meaning anyone can access it. Transparency is crucial for public trust in charitable organizations.

Private foundation rules: Understand the rules and regulations that apply to private foundations, as they differ from other types of nonprofits like public charities. Private foundations have stricter regulations regarding self-dealing, grants, and investments.

Filing deadline: Make sure to file Form 990-PF on time. The filing deadline is the 15th day of the 5th month after the foundation's tax year ends, which is usually May 15 for calendar-year organizations.

How To File Form 990-PF: Offline/Online/E-filing

The filing process for Form 990-PF can be done either offline (paper filing) or online (e-filing). As of my last update in September 2021, I'll provide instructions for both methods:

Offline (paper filing)

To file Form 990-PF offline, you need to obtain a physical copy of the form, fill it out manually or using a typewriter, and then mail it to the IRS. Here's what you should do:

Step 1: Obtain the form: You can obtain Form 990-PF and its instructions from the IRS website (www.irs.gov) or by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

Step 2: Complete the form: Fill out the form carefully and accurately, providing all the required information about your foundation's finances and operations. Review the instructions to ensure you're completing the form correctly.

Step 3: Attach schedules (if applicable): Depending on your foundation's activities, you may need to attach schedules or additional documentation. Follow the instructions provided with the form to determine if any schedules apply to your foundation.

Step 4: Mail the form: Once you've completed the form and attached any required schedules, mail it to the IRS at the address specified in the instructions.

Online (E-filing)

The IRS encourages electronic filing (e-filing) for Form 990-PF, and it is mandatory for organizations with assets over a certain threshold. Here's how you can e-file Form 990-PF:

Step 1: Access the IRS website: Visit the IRS website and search for "Form 990-PF" to find the electronic filing system.

Step 2: Create an account (if needed): If you're e-filing for the first time, you'll need to create an account on the IRS website.

**Step 3: Complete the form online **: Follow the instructions provided on the IRS website to fill out Form 990-PF electronically. The online system will guide you through the process, and you'll need to enter your foundation's financial information and other required details.

Step 4: Submit the form: Once you've completed the electronic form, review it for accuracy, and then submit it electronically through the IRS website.

Step 5: Get a confirmation: You should receive an electronic confirmation that the IRS has received your Form 990-PF.

Conclusion

Form 990-PF plays a crucial role in promoting transparency, accountability, and compliance in the world of private foundations and nonexempt charitable trusts.

By requiring these organizations to disclose their financial information and grant-making activities, the IRS and the public can better understand the impact and effectiveness of their philanthropic endeavors.

As donors and beneficiaries continue to demand greater transparency from the philanthropic sector, Form 990-PF remains an essential tool in fostering trust and informed decision-making within the charitable community.