- IRS forms

- Form 6252

Form 6252: Installment Sale Income

Download Form 6252For individuals engaged in the world of real estate, investments, or business, tax forms play a vital role in managing financial obligations. One such form is Form 6252, which deals with the installment sale of property. While it may sound intimidating at first, understanding this form is essential for accurately reporting taxable income and ensuring compliance with the Internal Revenue Service (IRS).

Form 6252, officially known as the "Installment Sale Income" form, is used to report income from the sale of property where the seller receives at least one payment in a tax year following the year of sale. It is applicable to individuals, partnerships, corporations, and other entities that sell property on an installment basis.

In this blog post, we'll delve into the details of Form 6252, exploring what its purpose is, who needs to file it, and how to complete it correctly.

Purpose of Form 6252

The purpose of Form 6252 is to calculate and report the taxable gain or loss from the sale of property when the seller receives payments in installments over multiple years.

When a seller chooses to finance the sale of a property and receives payments in installments, rather than receiving the full payment upfront, the transaction is considered an installment sale. This commonly occurs in real estate transactions or when selling a business.

Form 6252 is used to report the details of the installment sale, including the buyer's name and identifying information, the property sold, the terms of the installment agreement, and the income received each year. Using this form, the taxpayer can determine the portion of the installment payment that is taxable income in each tax year.

The form also helps calculate the gain or loss on the sale, based on the selling price, the seller's basis in the property, and any selling expenses incurred. The seller is required to report a portion of the gain as taxable income each year until the installment payments are completed.

It's important to note that Form 6252 is only required for sales that qualify as installment sales. Not all sales are considered installment sales, and if the entire sales price is received in the year of the sale, this form is not needed.

Benefits of Form 6252

Here are some benefits of using Form 6252:

Deferral of taxes: One of the primary benefits of Form 6252 is that it allows taxpayers to defer the recognition of taxable income. Instead of recognizing the entire gain from the sale in the year of the sale, taxpayers can spread the income over the installment period, which can be several years. This can help taxpayers manage their cash flow and potentially reduce their tax liability in the current year.

Lower tax rates: By spreading the income over multiple years, taxpayers may be able to take advantage of lower tax rates. If the installment payments are received in future years where the taxpayer falls into a lower tax bracket, it can result in overall tax savings compared to recognizing the entire gain in the year of sale at potentially higher tax rates.

Time value of money: By deferring the tax liability, taxpayers can benefit from the time value of money. They can use the funds received from the buyer to invest or earn interest during the installment period, potentially increasing their overall financial returns.

Flexibility in reporting: Form 6252 provides flexibility in reporting installment sales. Taxpayers can choose to report the installment method for any eligible sales or elect out of the installment method and recognize the entire gain in the year of sale. This flexibility allows taxpayers to optimize their tax planning based on their individual circumstances.

Adjustments for interest and depreciation: Form 6252 also allows taxpayers to adjust the installment sale basis by considering interest and depreciation. This ensures that the taxable gain is calculated accurately, taking into account any interest received on the installment payments or depreciation adjustments that may be applicable.

Partial exclusions: In certain cases, taxpayers may be eligible for partial exclusions on the gain from the sale of a primary residence under certain conditions. Form 6252 provides a mechanism to calculate the portion of the gain eligible for exclusion when an installment sale involves a principal residence.

Who Is Eligible To File Form 6252?

Form 6252 is used by individuals, partnerships, corporations, trusts, and estates to report the installment sale of property. The eligibility to file Form 6252 depends on whether an installment sale has occurred. An installment sale generally refers to a transaction where the seller receives payments for the sale of property over more than one tax year.

Here are the entities that may be eligible to file Form 6252:

**Individuals: **If an individual sells property and receives payments for the sale in installments, they may need to report the sale using Form 6252.

Partnerships: If a partnership sells property and the installment sale results in a gain, the partnership may need to report the sale using Form 6252. Each partner would then receive a Schedule K-1 (Form 1065) to report their share of the gain or loss.

**Corporations: **If a corporation sells property and receives payments in installments, the corporation may need to report the sale using Form 6252.

Trusts: If a trust sells property and receives payments in installments, the trust may need to report the sale using Form 6252. The beneficiaries of the trust would then receive a Schedule K-1 (Form 1041) to report their share of the gain or loss.

**Estates: **If an estate sells property and receives payments in installments, the estate may need to report the sale using Form 6252. Beneficiaries of the estate would receive a Schedule K-1 (Form 1041) to report their share of the gain or loss.

It's important to note that the eligibility to file Form 6252 is dependent on the specific circumstances of the sale and whether it meets the criteria for an installment sale.

How To Complete Form 6252: A Step-by-Step Guide

Here's a step-by-step guide to completing Form 6252:

Step 1: Gather necessary information

Collect all the relevant information and documents related to the installment sale. This includes the sales contract, dates of payments received, and any other details about the sale.

Step 2: Fill out the taxpayer information

At the top of Form 6252, provide your personal information, including your name, address, Social Security number, and the tax year for which you are filing the form.

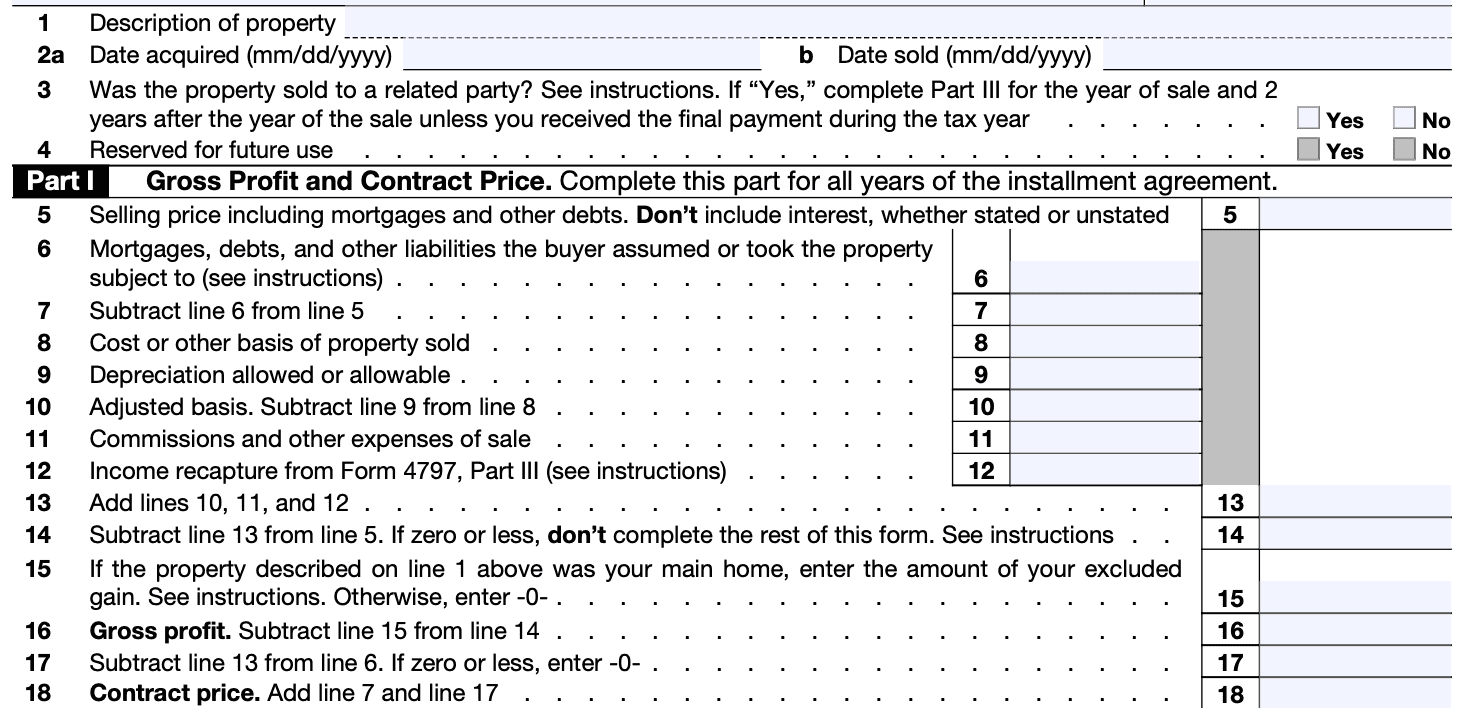

Step 3: Describe the property sold & determine gross profit

In Part I of the form, provide a detailed description of the property you sold. Include the type of property, such as real estate or equipment, and any other pertinent details that help identify the property.

Step 4: Determine the installment sale price

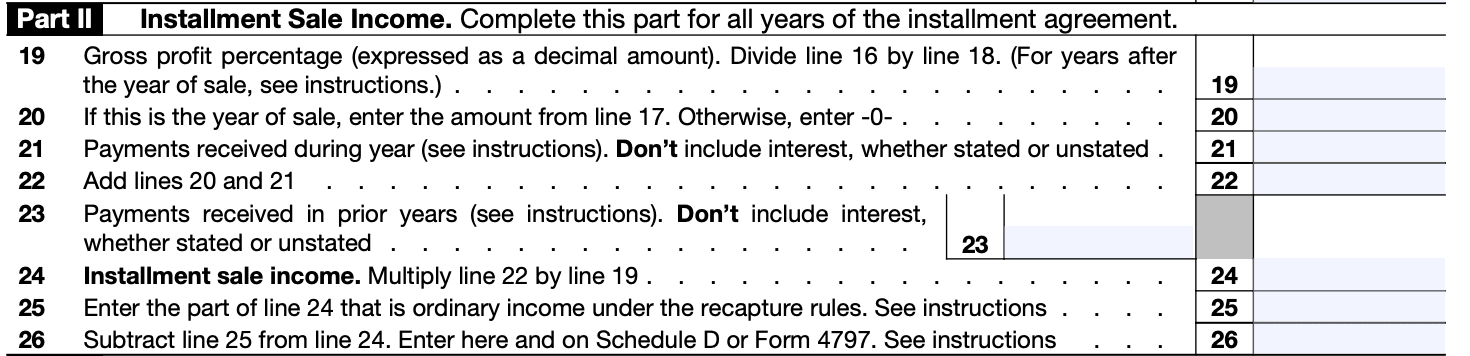

In Part II, you will need to calculate the installment sale price. This includes the total selling price, the down payment, and the amount financed.

Step 6: Calculate the installment sale income

In Part III, you will calculate the installment sale income to report on your tax return. Multiply the gross profit by the percentage of the sale price you received during the tax year. This will give you the installment sale income for the year.

Step 7: Report the installment sale income on your tax return

Once you have calculated the installment sale income, you need to report it on your tax return. Typically, you will report it on Schedule D (Form 1040) if you sold a capital asset, such as real estate. Include the information from Form 6252 in the appropriate sections of Schedule D.

Step 8: Attach supporting documents

If you received any payments during the tax year, you should attach a statement to Form 6252 that shows the computation of the installment sale income. Additionally, if you sold real estate, you may need to attach Form 4797 to report the sale of the property.

Step 9: Retain a copy for your records

Make a copy of the completed Form 6252 and all supporting documents for your records. It's important to keep these records in case of any future inquiries from the IRS.

Step 10: File the form

File Form 6252 along with your tax return by the due date. If you e-file your tax return, you can attach the form electronically. If you file a paper return, include the form and any supporting documents in your mailing.

Special Considerations When Filing Form 6252

When filing Form 6252, you should be aware of the following special considerations:

Installment sales: Form 6252 is used to report installment sales of property, which occurs when you sell property and receive at least one payment in a tax year after the year of the sale. You need to report the sale on an installment basis, recognizing a portion of the gain each year as you receive payments.

**Sales of business or rental property: **Form 6252 is generally used for the sale of business or rental property. If you sell personal-use property on an installment basis, you usually don't need to report it on this form unless you have a gain and you choose to report it.

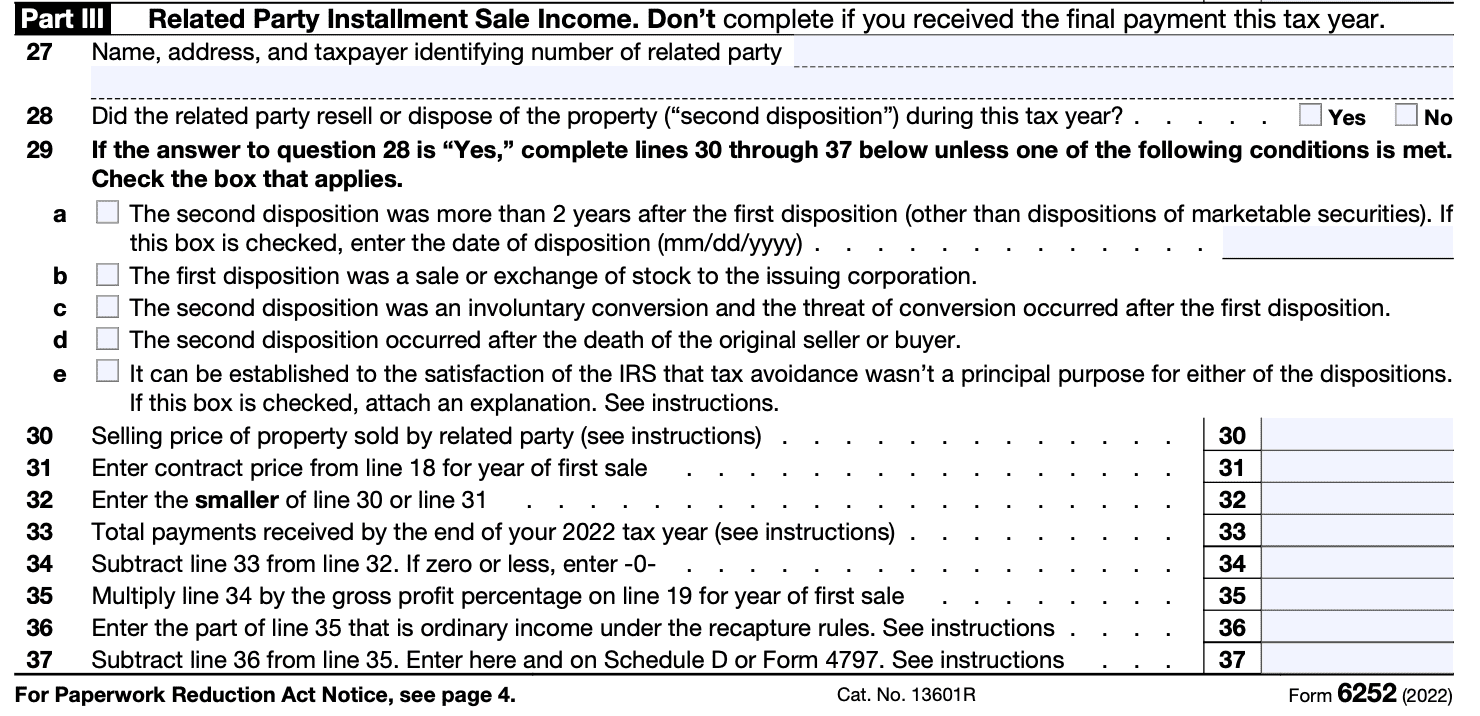

**Reporting the sale: **You must provide detailed information about the installment sale, including the buyer's name, social security number, and address. You also need to include a description of the property, the selling price, the amount of the down payment, and the terms of the installment agreement.

Gain on sale: Calculate the gain on the sale by subtracting your adjusted basis in the property from the selling price. The adjusted basis is generally the original cost of the property plus any improvements or adjustments over time.

Interest income: If you receive interest income from the installment sale, you must report it as well. The interest is generally taxable in the year you receive it.

Installment sale agreement: If you have an installment sale agreement, you may need to attach a copy of the agreement to your tax return.

Reporting depreciation recapture: If you previously claimed depreciation deductions on the property you sold, you may need to report depreciation recapture as ordinary income on Form 4797 or other applicable forms.

Form 1099-S: If the buyer used a third-party settlement organization, such as an escrow agent, to facilitate the sale, they will issue Form 1099-S, Proceeds from Real Estate Transactions, to report the sale proceeds. You should reconcile the information on Form 1099-S with your own records to ensure accuracy.

Reporting installment sale on schedule D: You may need to report the gain or loss from an installment sale on Schedule D, Capital Gains and Losses, along with Form 6252. This depends on the nature of the property sold and other factors, so consult the instructions for Schedule D to determine if it applies to your situation.

Consult a tax professional: Filing Form 6252 can be complex, especially if you have multiple installment sales or if the transaction involves unique circumstances. It's advisable to consult a tax professional or accountant who can guide you through the process and ensure compliance with tax laws.

Filing Deadlines & Extensions on Form 6252

The filing deadline for Form 6252 is generally the same as the deadline for individual income tax returns, which is April 15th of each year. However, if April 15 falls on a weekend or a holiday, the deadline is extended to the next business day.

If you need more time to file your Form 6252, you can request an extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form extends the filing deadline for your individual tax return, including any forms and schedules such as Form 6252, by six months. With the extension, the new filing deadline would be October 15.

It's important to note that an extension of time to file does not extend the deadline for paying any taxes owed. If you owe taxes, you are still required to estimate and pay the amount due by the original filing deadline (April 15) to avoid potential penalties and interest. The extension only provides additional time to submit your completed tax return.

How To File Form 6252: Offline/Online/E-filing

You can file Form 6252 either offline or online, depending on your preference and the options provided by the tax authorities in your country. Here's a general overview of how you can file Form 6252:

Offline filing

Obtain a physical copy of Form 6252: You can usually download the form from the official website of your country's tax authority or visit a local tax office to obtain a printed copy.

- Fill out the form: Complete the required information on Form 6252, including your personal details, property information, installment sale details, and calculation of gain or loss.

- Attach supporting documents: Gather any necessary supporting documents, such as sales agreements, settlement statements, and other relevant paperwork related to the installment sale.

- Submit the form: Mail the completed Form 6252, along with any supporting documents, to the designated address provided by your tax authority. Ensure you keep a copy of the filed form for your records.

Online/E-filing

- Determine if online filing is available: Check with your tax authority to see if they offer online filing options for Form 6252. Many tax authorities provide web-based platforms or software for electronic filing.

- Access the online filing system: If available, visit the official website of your tax authority and log in to the online filing system using your credentials.

- Follow the instructions: Navigate to the section for filing Form 6252 and follow the provided instructions. Enter the required information in the designated fields and review your entries carefully.

- Upload supporting documents (if required): If the online filing system allows you to attach supporting documents electronically, scan and upload any necessary files as per the system's instructions.

- Submit the form: Once you have completed all the required fields and attached any necessary documents, submit the Form 6252 electronically through the online filing system. You may receive a confirmation or acknowledgment of your submission.

Remember, the specific procedures and options for filing Form 6252 can vary depending on the tax authority of your country.

Common Mistakes To Avoid While Filing Form 6252

When filing Form 6252, it's important to be careful and avoid common mistakes that could lead to errors or potential issues with the IRS. Here are some common mistakes to avoid:

Incorrectly reporting sale details: Ensure that you accurately report the sale date, selling price, and other relevant information regarding the property sold. Mistakes in these details can lead to discrepancies and potential audits.

Ignoring reporting requirements: Form 6252 must be filed for each installment sale made during the tax year. Failure to report all relevant transactions can result in penalties and interest charges.

Incorrectly calculating installment sale income: It's essential to correctly calculate the amount of income to report for each installment sale. This involves determining the gross profit, the portion of the gain attributable to the current tax year, and any prior-year adjustments. Utilize the instructions and worksheets provided by the IRS to ensure accurate calculations.

**Neglecting to report interest: **If the installment sale includes a provision for interest, it must be reported as interest income on your tax return. Failure to report interest can lead to underreporting of income.

Not keeping track of principal payments: Ensure that you accurately track the principal payments received during the tax year. The principal portion is not taxable income but will reduce the gross profit to be reported.

**Missing the due date: **Form 6252 must be filed by the due date of your tax return, including extensions. Failing to file on time may result in penalties and interest charges.

Forgetting to attach required documentation: Depending on the circumstances, you may need to attach supporting documents, such as contracts or deeds, to substantiate the installment sale. Be sure to review the instructions for Form 6252 to determine if any additional documentation is required.

Not seeking professional guidance: If you're unsure about any aspect of reporting installment sales or Form 6252, it's recommended to consult a tax professional or seek guidance from the IRS. They can provide clarification and ensure accurate filing.

Conclusion

Form 6252 is an important tool for accurately reporting installment sale income to the IRS. Understanding its purpose, determining whether you need to file it, and completing it correctly will help you remain compliant with tax regulations.

While this blog provides a broad overview of Form 6252, it is essential to consult with a tax professional or refer to the IRS instructions to ensure accurate reporting based on your specific circumstances. Remember, accurate reporting not only helps avoid penalties but also establishes a transparent and reliable financial record.